GME Remittance Detailed ReviewRates, Fees, Limits, Safety and More

Last updated: November 20, 2022

What is GME Remittance? An introduction

GME Remittance company information

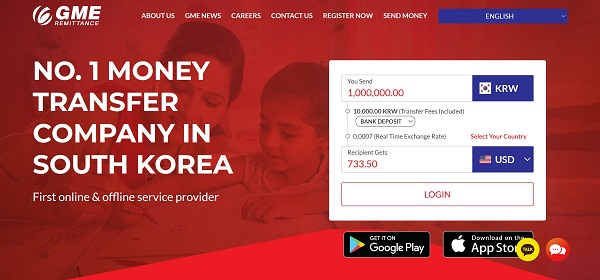

GME Remittance was established in 2016, and has grown to become the No. 1 money transfer company within South Korea in just a few years. Since its inception, GME Remittance has grown by leaps and bounds, and now supports international money transfers to over 200 countries worldwide.

In 2020, GME Remittance facilitated international remittances worth more than KRW 1 trillion (equivalent to USD 1 billion). This amount grew to USD 1.4 billion in 2021, and the company has a goal of hitting USD 2 billion remittance volume on its platform in 2022.

With the most remittance market share in South Korea, GME Remittance is the first non-bank private remittance service provider in South Korea that is fully licenses and regulated by the Ministry of Strategy and Finance in South Korea. Compliance with the strict guidelines of the Ministry of Strategy and Finance enables GME Remittance to provide very robust and secure systems to its customers.

GME Remittance by the numbers

The massive scale of GME Remittance's money transfer and related products becomes evident once we look at the below statistics:

- No. 1 remittance market share in South Korea

- More than 200 thousand customers

- USD 1.4 billion worth remittances sent in 2021

- Send money to over 200 countries worldwide

- More than 12 branches within South Korea

- 6 years' experience in international money transfer business

- First non-bank licensed money transfer company in South Korea

GME Remittance is the premier remittance company in South Korea that enables you to send money to over 200 countries all over the world.

GME Remittance provides both online as well as offline services so you can send money with them online using their website or mobile apps, or by visiting one of their branches located within South Korea.

What services does GME Remittance provide?

GME Remittance provides a gamut of services related to money and currency exchange. Below are GME's primary services available to you as a customer:

- International money transfers

- International mobile top-ups

- Mobile coupons

- ATM Cash payouts

- Easy loans

- Fast Remit

- Mobile wallet services

- Local transfers within South Korea

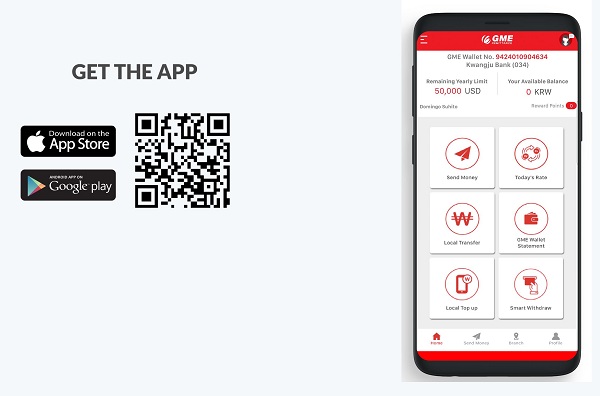

The below graphic represents GME's services in a pictorial way.

As you can see, you can achieve a lot with GME's many financial products and services regardless of whether you are living within South Korea, or are an overseas South Korean resident.

GME provides a lot of useful services for overseas South Koreas as well as local residents.

Which countries does GME Remittance operate in?

With GME Remittance, you can send money from South Korea to many global destinations. See below for more details about GME Remittance's global corridor coverage.

Where can I send money from with GME Remittance?

GME Remittance is based out of South Korea and enables residents and immigrants based out of South Korea to send money overseas. As the first non-bank private money transfer company that is fully licensed by the Ministry of Strategy and Finance in South Korea, GME has quickly grown to be the No. 1 remittance company within South Korea.

Where can I send money to with GME Remittance?

With GME Remittance, you can send money to more than 200 global destinations all over the world. This is a very comprehensive coverage which lets you send money from South Korea to virtually anywhere in the world.

The below graphic shows GME Remittance's worldwide coverage in terms of the world's map.

With GME Remittance, you can send money from South Korea to over 200 destinations worldwide.

How much money can I send with GME Remittance?

If you send money overseas with GME Remittance, there are some transfer limits that apply. Currently, you can send up to USD 5,000 equivalent per transaction using GME Remittance.

There is also an annual limit of USD 50,000 USD that will apply. You should plan your international money transfers with GME Remittance keeping these transfer limits in mind.

You can send up to USD 5,000 per transaction, and USD 50,000 per year with GME Remittance.

Please note that there can be other limitations from GME Remittance's partners that may lower the transfer limits. Additionally, different countries may have compliance and regulatory rules in place which may further lower the amount of money you can send to those countries.

The GME Remittance website or mobile app will let you know your transfer limit when you try to initiate an international money transfer.

How good is GME Remittance's service?

GME Remittance has more than 200 thousand customers, so we trust that their product is high quality. One reliable way to validate this is to check GME Remittance's ratings and reviews on some popular review platforms.

What do users have to say about GME Remittance?

Let us examine what other remittance customers say about GME Remittance's money transfer services; below are their ratings and reviews on some popular review^ platforms:

- GME Remittance does not have many reviews on Trustpilot; currently Trustpilot is rated average with a 3.7/5.0 rating on Trustpilot and has only 1 review

- On the Google Play Store, GME Remittance's Android app is rated 3.1/5.0 with 4.66k reviews and 100k+ downloads

- On the Apple App Store, GME Remittance's iOS app is rated 4.7/5.0 with 1.2k ratings

^Ratings on various platforms as on November 20, 2022

GME Remittance has excellent ratings on the Apple App Store; Google Play reviews are a mixed bag though.

In general, customers seems to like GME Remittance's money transfer services as evidenced by their excellent iOS app ratings. However, if you are an Android user, you may run into some issues; if this happens, reach out to GME Remittance's helpful customer service team for assistance.

Does GME Remittance have a mobile app?

GME Remittance does have a mobile app that is available on both the Apple App Store for iOS devices as well as the Google Play Store for Android devices.

Download the GME Remittance mobile app to send money with them from the comfort of your home or office without having to go into a physical branch to start your transfer.