Airwallex Detailed ReviewRates, Fees, Limits, Safety and More

Last updated: May June 08, 2024

What is Airwallex? An introduction

Airwallex is a leading global financial platform for modern businesses, offering trusted solutions for global payments, treasury and expense management, and embedded finance.

With its proprietary infrastructure, Airwallex removes the friction from global payments and financial operations, allowing businesses of all sizes to unlock new opportunities and grow beyond borders.

Founded in Melbourne, Australia, Airwallex powers over 100,000 businesses globally and is trusted by brands such as Brex, Rippling, Navan, Qantas, SHEIN and many more.

Airwallex company information

Airwallex's founding story is very interesting and inspiring, something that all business owners can find some parallels in.

In 2015, a few fellow entrepreneurs launched a cafe in Melbourne, Australia. At the surface, they were making and selling great coffee, but one of the reasons for launching their new business was a desire to learn more about how to sustain and grow local businesses with a hyper growth mindset and a global scaling ambition.

It did not take them too long to build a smooth and reliable supply chain that was optimized for operational costs. The process of getting there helped them discover problems that existed in various areas - these aspects provided them insights into the problems that Airwallex would aim to solve later.

For example, the team had to make recurring purchases worth USD 10,000 to buy items like coffee cups, lunch boxes and other paper goods from China. To pay their overseas suppliers, they used an international payments company that charged 4.5 percent of the transfer amount. This was a very high cost of international remittances. Not to say that the time it took to move the money internationally was also long.

Faced with these challenges - expensive and slow international money transfers - they felt that something better was possible. And that is how Airwallex was born, with a driving motive of building a cost-effective and efficient financial infrastructure that met the needs of international businesses.

Jack Zhang (CEO), and the other co-founders believe modern businesses need to be borderless from day one both to build the business with the best resources available and to be able to grow without boundaries.

Airwallex is built to provide a financial operating system and payments network for globally-native businesses without the limitations of traditional institutions. It is worth noting that the same transfer they made back in 2015 would cost someone just a 0.5 percent fee on Airwallex today.

Airwallex was born to simplify cross border payments for international businesses. The founders opened a cafe in Melbourne, Australia to deeply understand the inherent friction points involved in international payments.

Today, Airwallex has built out one of the most powerful payments and financial infrastructure. Airwallex's customers leverage their platform to simplify their finance, from collections to payouts, streamline multi-currency management and optimize cost savings – the most comprehensive end-to-end solution of any fintech.

In addition, Airwallex's large enterprise customers have the ability to integrate their customizable API into their backend and build offerings using the technology.

To grow and thrive, businesses must have the tools to be borderless from day one. Airwallex wants to be core to enabling their journey.

Airwallex by the numbers

The below statistics help to understand the magnitude of Airwallex's financial impact and customer reach. We have partitioned this statistical information into various sections below.

Corporate Statistics

- Revenue (incl. Interest income on client funds) increased 82% YoY in Q1 2024

- Transaction Volume increased 68% YoY in Q1 2024

- Turned cash flow positive in 2023

- Annual Transaction Volume (run rate) of approx. USD 90 Billion

- Over 100,000 business customers

Infrastructure and Platform Statistics

- Payment processing with all major schemes like Visa, MasterCard and Amex, and 160+ local payments methods

- Able to collect payments in 180+ currencies in 180+ countries

- Open domestic and foreign currency accounts within minutes and accept currencies in over 60 countries

- Open accounts with local bank details in 23+ currencies in 60+ countries

- FX Engine trades 60+ currencies at interbank rates, saving up to 80% on FX fees

- Payout to over 150 countries, with 120 countries leveraging local rails for 90% of transactions

- Approximately 85% of funds arrive within a few hours/same day

- Approximately 50% of transactions are instant

- Issue multi-currency cards in 40 markets

- 60+ licenses and permits globally

People, Growth and Investment Statistics

- Around 1,500 people globally, across 23 locations

- Adding approximately 300 people in 2024

- Raised more than USD 900 Million

- USD 5.6 Billion valuation (Series E2 raise in Oct 2022)

- Investors include: Sequoia, DST Global, Greenoaks Capital, Salesforce Ventures, Lone Pine Capital, Square Peg Capital and 1835i Ventures (ANZ Bank)

Airwallex operates at a massive, global scale to empower more than 100,000 businesses worldwide by providing cost-effective, quick and convenient international business payments and money transfers.

What services does Airwallex provide?

Airwallex's full-featured business accounts give you everything you need to power and simplify your global payments and financial operations. Instantly tap into leading global coverage, world class security, seamless onboarding, award winning customer support, and integrations with other popular platforms like Xero, Amazon, and Shopify.

Here are some of the key features of the Airwallex business account:

- 60+ countries where you can open local currency accounts

- 180+ countries from which you can accept payments

- 150+ countries to which you can make transfers

- 70% global transfers arrive within the same day

Within Airwallex Business Account, your business can leverage these additional products:

- Global Accounts: Open local currency accounts with local bank details around the world in minutes

- FX & Transfers: Make international transfers to 150+ countries at interbank rates

- Payment Links & Plugins: Accept payments worldwide - no coding required

- Borderless Cards: Issue multi-currency corporate cards instantly

- Bill Pay: Automate your domestic and international bill pay workflows

- Expense Management: Gain more control and visibility of expenses

- Software Integration: Automatically sync transactions with your accounting system

The Airwallex business account comes with a comprehensive suite of products and services to help drive your business forward. Key capabilities include international transfers and payments, global and local accounts, cards, bill pay and numerous useful integrations.

Which countries does Airwallex operate in?

Airwallex operates at a global scale and numerous countries and currencies are supported by their platform. This includes hundreds of the world's nations and numerous popular currencies.

At the current point in time, Airwallex is only able to process account applications for businesses registered in the following countries:

- Australia

- Canada

- Hong Kong SAR

- Lithuania

- Malaysia

- Netherlands

- New Zealand

- Singapore

- United Kingdom

- United States of America

If you do not see the country your business is registered in on the above list, Airwallex unfortunately will not be able to onboard you right now.

Airwallex's capabilities are mapped out corresponding to the respective Airwallex onboarding entity as per the table below.

| Country | Airwallex Entity |

|---|---|

| Australia | Australia |

| Austria | Netherlands |

| Belgium | Netherlands |

| Bulgaria | Lithuania |

| Cayman Islands | Hong Kong SAR |

| China | Hong Kong SAR |

| Croatia | Lithuania |

| Cyprus | Netherlands |

| Czech Republic | Lithuania |

| Denmark | Netherlands |

| Estonia | Lithuania |

| Finland | Netherlands |

| France | Netherlands |

| Germany | Netherlands |

| Greece | Netherlands |

| Hong Kong SAR | Hong Kong SAR |

| Hungary | Lithuania |

| Iceland | Netherlands |

| Ireland | Netherlands |

| Israel | United Kingdom |

| Italy | Netherlands |

| Republic of Korea | Hong Kong SAR |

| Latvia | Lithuania |

| Liechtenstein | Netherlands |

| Lithuania | Lithuania |

| Luxembourg | Netherlands |

| Macao SAR | Hong Kong SAR |

| Malaysia | Malaysia |

| Malta | Netherlands |

| Marshall Islands | Hong Kong SAR |

| Mexico | United States of America |

| Netherlands | Netherlands |

| New Zealand | New Zealand |

| Norway | Netherlands |

| Poland | Lithuania |

| Portugal | Netherlands |

| Puerto Rico | Hong Kong SAR |

| Romania | Lithuania |

| Seychelles | Hong Kong SAR |

| Singapore | Singapore |

| Slovakia | Lithuania |

| Slovenia | Lithuania |

| Spain | Netherlands |

| Sweden | Netherlands |

| Switzerland | United Kingdom |

| Taiwan | Hong Kong SAR |

| Thailand | Hong Kong SAR |

| United Arab Emirates* | United Kingdom |

| United Kingdom | United Kingdom |

| United States of America | United States of America |

| Virgin Islands, British | Hong Kong SAR |

| Virgin Islands, US | Hong Kong SAR |

* Not supported at the moment except for exemption approved for certain platform clients

Where can I send money from with Airwallex?

Using Airwallex, you can send money from more than 150 countries. Note that your business must be registered in one of the countries where Airwallex has an entity.

Where can I send money to with Airwallex?

Airwallex allows you to send money to more than 180 countries.

With more than 150 sending countries and 180+ receiving countries, Airwallex supports international business transfers between more than 27,000 country combinations.

You can send money from 150 countries to 180 global destinations with Airwallex. Your business account must be registered in the countries where Airwallex entities are hosted; these include Australia, Canada, Hong Kong SAR, Lithuania, Malaysia, Netherlands, New Zealand, Singapore, United Kingdom and United States of America.

What are Airwallex's fees and exchange rates?

One of the best things about Airwallex when it comes to their exchange rates and fees is the complete transparency that the company provides. Below is the exchange rate that you will get with Airwallex:

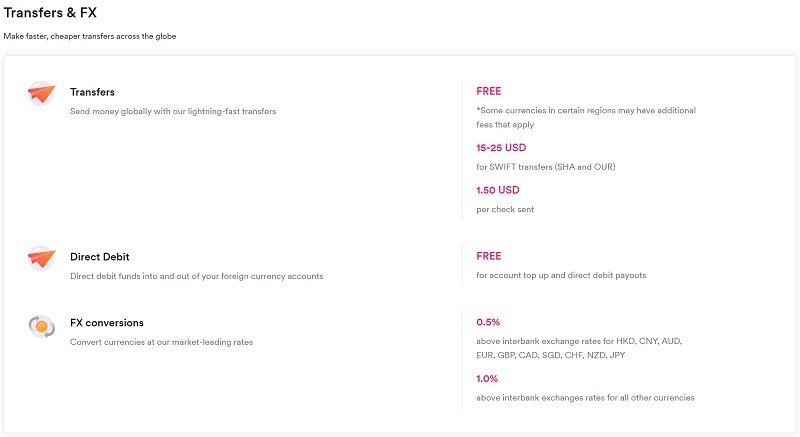

- For transfers done in AUD, CAD, CNY, CHF, EUR, GBP, HKD, JPY, NZD and SGD, the exchange rate will be 0.5% lower than the interbank exchange rate.

- For all other currencies, the exchange rate will be 1.0% lower than the interbank exchange rate.

Airwallex charges a fixed FX markup of 0.5% for AUD, CAD, CNY, CHF, EUR, GBP, HKD, JPY, NZD and SGD transfers, and 1.0% for all other currencies. Due to this transparent pricing, you can rest assured that there are no hidden charges you will have to pay with Airwallex.

When it comes to transfer fees, Airwallex has the same level of openness and transparency. You can expect to pay the below fees on your international business payments and transfers done with Airwallex:

- Many transfers are free.

- Depending on the country and currency transferred as well as payment method chosen, there may be fees applied.

- SWIFT transfers from the US cost between USD 15-25.

- Paper checks cost USD 1.50 per check.

- Direct debits in and out of foreign currency accounts are free.

The below graphic from Airwallex summarizes their exchange rates and fees in international money transfers in a pictorial manner.

Are Airwallex exchange rates good?

Airwallex provides highly competitive exchange rates with very transparent FX markup.

Airwallex offers FX rates that are competitive with other currency exchange services, typically adding a small markup between 0.5% and 1.0% (depending on the currency the transfer is made in) on top of the interbank rate.

Airwallex's exchange rates are much better than those offered by traditional banks, which can add significant FX markups anywhere from 2% to 6% on foreign exchange. In this way, Airwallex is a highly cost-effective manner for businesses to make international payments and money transfers.

If you are a business that needs to make international transfers and payments, we highly recommend that you always check what other remittance service providers are offering. The more data and information you have, the better the decision you can make.

It is a good idea to always compare money transfer companies. When money transfer operators compete for your business, you win. This is especially true for business payments that can be both high value as well as recurring.

You can always compare remittance companies yourself by doing manual searches, but it can be very time intensive to do so. A better and faster option is to utilize RemitFinder's online international remittance comparison platform. RemitFinder compares many money transfer companies in an easy to consume format so you can pick the best deal to maximize the reach of your hard-earned money.

Is Airwallex a cheap way to send money overseas?

Most businesses use their bank or PayPal to send money overseas and make international payments. Both of those options come with high fees and bad exchange rates. Banks, for example, can charge an FX markup from 2% all the way up to 6%. Plus, you have to pay high fees that can range anywhere from USD 25-50.

Compared to all these options, Airwallex charges a fixed FX markup between 0.5-1.0%, depending on the source currency of your international transfer. In that way, Airwallex is certainly a cost-effective way to make overseas FX payments.

How do I avoid Airwallex fees?

At this time, there is no way to avoid Airwallex fees. The good news is that fees are low and shared transparently. You can, therefore, plan your transfer keeping the fees in mind.

There are no hidden fees with Airwallex.

The other important thing to remember is that Airwallex fees, if any, are always paid by the sender and not the recipient. The only exception to this is incoming wire transfer fee is the sender chooses a SWIFT transfer. Here is the breakdown:

- Airwallex fees are paid by the sender: If you are using your Airwallex business account to send money overseas, you will have to pay the fees associated with the transaction. This will generally include the FX markup and any associated transfer fees that can vary based on the transfer method chosen.

- Airwallex recipients pay no fees: If you are the recipient of an Airwallex international money transfer, you will generally pay no fees and will receive the full amount sent by the sender. The only exception to this would be incoming wire transfer fees or potential intermediary bank fees changed for SWIFT transfers. These SWIFT fees vary by banks and generally range from USD 25 to USD 50 per transfer.

As is obvious from the above, we recommend avoiding SWIFT transfers due to the associated fees. In many cases, Airwallex offers local payment methods to completely avoid SWIFT transfer fees paid by the recipient.

If you are an Airwallex sender, check with your recipient to see if they accept local payment methods supported by Airwallex. If they do, use such local payment methods to avoid additional SWIFT fees.

How much money can I send with Airwallex?

Airwallex's transfer limits vary depending on a few factors that include the transfer method, recipient type and account configuration. In many cases, there are no limits to how much money you can send abroad with Airwallex.

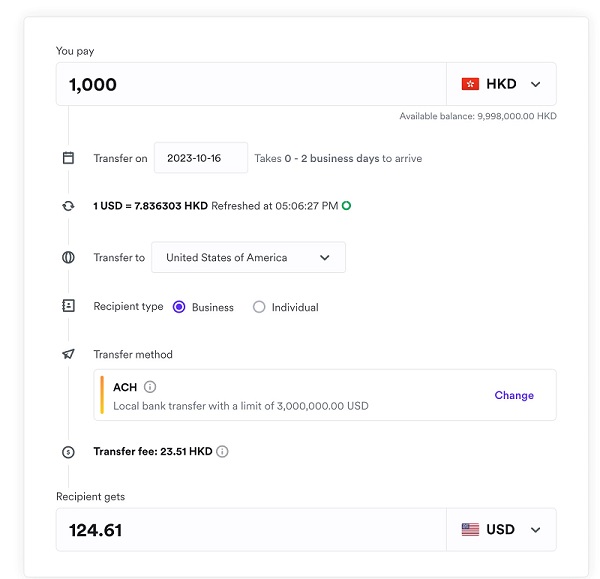

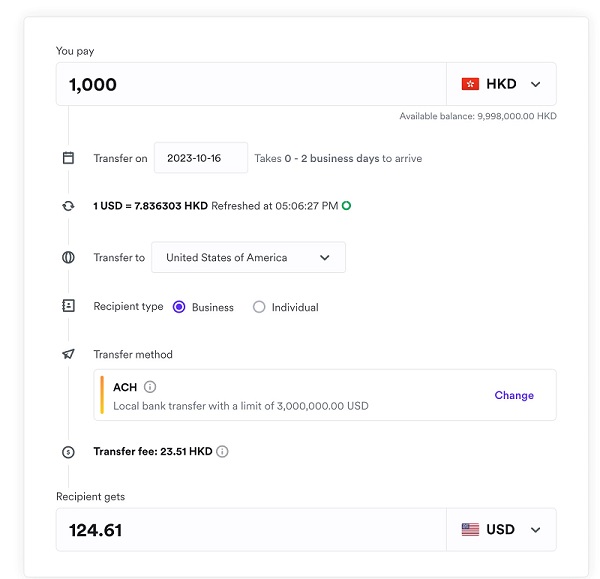

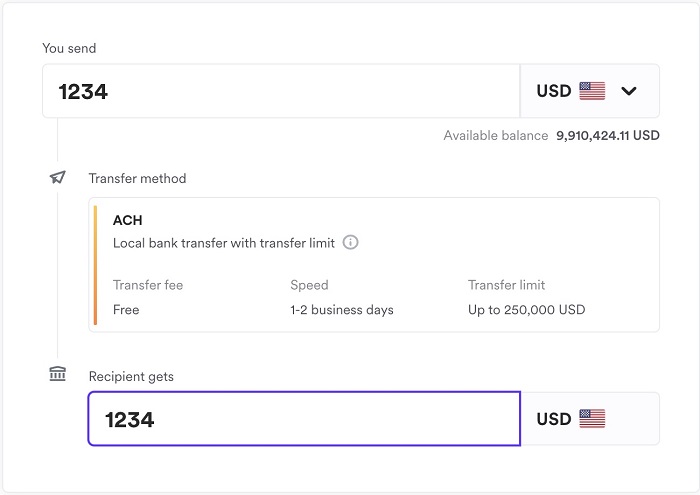

If there is a limit, or none, you will be able to view that information when you create your new international transfer with Airwallex. The below screenshot shows an example of how this will look like.

Most Airwallex international money transfers can be sent without any upper limits. In certain cases, limits may apply and will be shared when you create a new transfer.

To learn more about Airwallex transfer limits, you can refer to their Payout Network1 guide. Simply select your country or region to see various payment methods supported by Airwallex and associated transfer limits, if any.

How long does it take for Airwallex to send money overseas?

The speed of your international money transfers with Airwallex depends on a few factors that include the selected payment and delivery method, recipient location, and transfer date. Most Airwallex transfers finish between 0 and 3 business days.

Some Airwallex transfers can finish on the same day. In the worst case scenario, your money will reach the overseas destination in up to 3 business days.

The good news is that Airwallex shows you how long your transfer will take when you create a new money transfer with them. The below screenshot shows how this looks.

Airwallex's Payout Network1 guide is a good resource to learn more about the time it can take your international money transfer to complete. Choose your source country or region to see the transfer times for various supported payment methods in your country or region.

A best practice that we recommend is to always go with local transfers and payment methods if possible. This is because local transfers are always cheaper as well as quicker as compared to SWIFT transactions.

Always check with your recipient to see if they can accept the payment in a local payment method, and if they can, use that to save time and money on your international payment.

Are there any Airwallex coupon codes or promotions I can use?

Yes, there are several Airwallex deals and promotions that RemitFinder users can take advantage of; these are as below.

- United States business users who sign up with Airwallex can get up to USD 500 bonus.

- New Airwallex users in United Kingdom and EU can earn 10% cashback.

- You can earn 10% cashback in Australia for signing up for a new Airwallex business account.

- If you sign up from Singapore, you can earn 3% cashback for qualifying spending.

- New Hong Kong business users can earn 1% cashback and up to 5000 Asia Miles after signing up.

New RemitFinder business users from several countries can take advantage of attractive Airwallex deals to earn bonus, cashback and other rewards.

If Airwallex adds additional offers or promotions in the future, we will add them on this Airwallex detailed review. Check this Airwallex review from time to time to ensure that you do not miss out on upcoming promotions.

That said, it will be time consuming to check for Airwallex offers and discounts manually. Plus, you may simply forget to check back and miss out on good deals. A more efficient and surer method is to register up for the RemitFinder exchange rate alert. You will pay nothing as the daily alert is totally free, and we will keep you ensure that you stay in the know about the best exchange rates and deals from various companies.

How can I find Airwallex near me?

Airwallex is a fully digital company and there are no offices or locations that you need to go to. Simply use your phone or computer to sign up and start using your Airwallex business account.

Online businesses can optimize their operations better and can save on the overhead of branches and offices. This helps them pass on some of the savings to their customers.

Airwallex is no exception to this as you get bank beating exchange rates and low fees on your international business payments and transfers.

What is the best way to find a Airwallex Sending Location near me?

Since Airwallex is totally online, there is no need to go to an office or branch to send money overseas. You can transact online using the Airwallex website or mobile app.

What is the best way to find an Airwallex Payment Location overseas?

Your overseas recipient will receive the funds electronically if you send money to them using Airwallex. Therefore, there is no need for the recipient of an Airwallex transfer to go to a physical location to collect the funds that you send to them.

Is Airwallex a safe way to send money abroad?

As a global financial ecosystem that empowers more than 100,000 businesses worldwide, Airwallex endeavors to take security and safety of money as well as private information very seriously. Here are some ways in which Airwallex tries to protect its customers and their systems:

- Airwallex holds user funds with leading global financial institutions who are fully regulated and monitored by various regulatory and compliance bodies.

- Airwallex safeguards user funds in compliance with local regulations in all the countries it operates in. For example, in Australia, Airwallex arranges for major APRA-regulated banks to provide bank guarantees covering the entire wallet balance to protect user funds (similar information is available for other countries on their website).

- Airwallex implements advanced security controls and infrastructure that are monitored 24/7 to secure transactions and funds.

- Airwallex meets the highest international security standards like PCI DSS, SOC1, and SOC2 compliance, in addition to local regulatory requirements.

- Airwallex is a licensed and regulated financial technology company in various countries including Australia, where it holds an Australian Financial Services License and is regulated by ASIC, RBA, and AUSTRAC.

- Airwallex incorporates robust security features like identity verification, passcode/password protection, real-time card controls, and is covered by the Financial Services Compensation Scheme in certain regions.

Airwallex implements numerous security standards and protocols, and follows many industry best practices to ensure the safety and security of your money and information.

Can I trust Airwallex?

Another important area that we always encourage our readers to inspect is a financial institution's legal and regulatory status in the countries they operate in. When it comes to Airwallex, here is some useful information related to their compliance and legal status:

- In the United States, Airwallex US, LLC (NMLS #1928093) is a licensed money transmitter in most US states. For some of its banking and payment services, Airwallex also partners with Evolve Bank & Trust (member FDIC). Additionally, Airwallex partners with the Community Federal Savings Bank, Member FDIC, for the Airwallex Borderless Card which is issued pursuant to a license from VISA U.S.A. Inc.

- In the United Kingdom, Airwallex UK Ltd is a Financial Conduct Authority (FCA) regulated and licensed electronic money institution as per the Electronic Money Regulations 2011 (license number 900876).

- For its Singapore operations, Airwallex Singapore Pte. Ltd. is licensed and regulated by the Monetary Authority of Singapore (MAS) as a Major Payment Institution (license number PS20200541).

- In New Zealand, Airwallex New Zealand Ltd is registered on the New Zealand Financial Service Provider Register as a Financial Service Provider (NZ FSPR number FSP1001602).

- For its European business, Airwallex Netherlands B.V. is licensed as an electronic money institution (elektronischgeldinstelling) and is supervised by the Dutch Central Bank (De Nederlandsche Bank) (Relation number R179622).

- In Malaysia, Airwallex Malaysia Sdn Bhd is regulated by Bank Negara Malaysia (license number 00318) and licensed in Malaysia as a MSB Class B (remittance business only) licensee.

- In Australia, Airwallex Pty Ltd is licensed by the Australian Securities and Investments Commission (ASIC) with Australian Financial Services License (AFSL) number 487221.

- In Canada, Airwallex Canada International Payments Ltd is regulated by the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) and is registered as a Money Service Business (MSB) with registration number M19395067. Airwallex Canada International Payments Ltd is also registered in the state of Québec by the Revenu Québec and is licensed as a Money Services Business (license number 14460).

- To operate in China, Guangzhou Shangwutong Network Technology Co., Ltd. is licensed as a payment company with permission to conduct internet payment services under a license issued by the People's Bank of China (license number Z2025844000016).

- In Hong Kong, Airwallex Hong Kong Ltd is licensed by the Hong Kong Customs and Excise Department as a Money Service Operator with license number 16-09-01929.

- In Lithuania, AWX Lithuania, UAB (Republic of Lithuania code of legal entity no. 305697289) is licensed in Lithuania as an electronic money institution with license no. 88, issued on 6 October 2021 by the Bank of Lithuania (Lietuvos Bankas, the BoL).

Airwallex is regulated and authorized by financial and regulatory authorities in every country it operates in. This ensures that Airwallex maintains the highest financial and security standards as part of its compliance with legal, compliance and regulatory requirements.

How good is Airwallex's service?

Airwallex is a practical and effective platform for international payments that provides competitive foreign exchange rates and low transfer fees. With its easy account opening process and many useful integrations with other software and payment gateways, it seems like a great fit for international business payments.

That said, another good way to check if a product or service is good or not is to see what other customers are saying about it. We will look into Airwallex's customer feedback and reviews to see if they are happy with Airwallex or not.

What do users have to say about Airwallex?

Let us check Airwallex's ratings and reviews^ on some popular review platforms and major mobile app stores to see what other customers think about their product. Here is some information on Airwallex from such popular review sites.

- On Trustpilot, Airwallex is rated Average with 3.6/5.0 rating and 1124 reviews

- On the Google Play Store, Airwallex is rated 3.5/5.0 with 187 reviews and more than 50K downloads

- On the Apple App Store, Airwallex is rated 2.8/5.0 with 15 ratings

^Ratings on various platforms as on June 08, 2024

Airwallex has mixed ratings on Trustpilot and popular mobile app stores. There are relatively less reviews on the Apple App Store.

On the positive side, here are some strong areas that users have highlighted about Airwallex:

- Practical and effective platform for international payments and managing global finances

- Responsive and helpful customer service

- Cost-effective payment gateway with competitive foreign exchange rates

- Seamless and easy-to-use interface

- Useful features like unlimited virtual cards for expense management

- Robust platform capable of handling various financial needs

Have you used Airwallex yet? If so, please consider leaving a review on RemitFinder so other users can benefit from your expertise and experience.

Is Airwallex the best choice for me?

We have looked into Airwallex's international money transfer service and related products in detail, and it is evident that there are quite a few areas in which Airwallex is strong. Here are some spectrums in which we see Airwallex providing a strategic advantage to its global business customers:

- Global Reach and Multi-Currency Capabilities: Airwallex allows you to open multi-currency accounts with local bank details in over 22 currencies. You can make transfers to over 150 countries and accept payments globally. This makes Airwallex suitable for businesses with international operations or global ambitions.

- Cost-Effective Cross-Border Payments: Airwallex offers competitive foreign exchange rates, typically around 0.5-1% markup. There are no monthly fees, and it provides cost-saving features like multi-currency wallets and virtual debit cards. This can help reduce costs for cross-border transactions and foreign exchange conversions.

- Quick International Transfers: Airwallex international money transfers finish processing in 0-3 days, making it a quick way for businesses to send money overseas and make international payments.

- Excellent Support For Local Payment Methods: One of the challenges that businesses have traditionally faced has been the lack of local payments which forces them to send money overseas using SWIFT network which is expensive and slow. Airwallex provides access to hundreds of local payment methods across the world - this makes your international business transfers quick and cheap.

- Integrated Global Financial Platform: Airwallex provides an all-in-one platform for global payments, treasury management, expense control, and embedded finance solutions through its APIs. This integrated approach can streamline international financial operations for businesses.

- Security and Compliance: Airwallex is a licensed and regulated fintech company that implements robust security measures like PCI DSS, SOC1, and SOC2 compliance. It adheres to local regulations in various countries where it operates, ensuring safety of funds and transactions.

- Many Practical Features: Airwallex has numerous useful features like unlimited virtual cards for expense management, seamless integration with other software and payment gateways and a user-friendly interface praised by many customers.

RemitFinder likes Airwallex for providing comprehensive global country and currency coverage, fast and cost-effective international payments, strong support for local payment methods, many useful integrations and platform features, and a highly secure financial and payments platform.

Given all the advantages above, it is no surprise that Airwallex is trusted by more than 100,000 businesses worldwide.

What are the best reasons to use Airwallex?

Airwallex's many strengths lend it to be a potentially great choice for many international money transfer and payments needs that today's global businesses have.

Given our detailed analysis of Airwallex's financial platform and particularly its international money transfer service, we notice that it can be a very good fit for many international business payment and money transfer scenarios.

If you are a business that sends and receives international money transfers, here are some common use cases where Airwallex can be a reliable partner to meet your needs.

- If you have customers, suppliers, partners and vendors spread throughout the world, Airwallex may be a great fit given its global reach and strong coverage of many popular currencies. Using Airwallex, you can send money internationally to over 150 countries as well as accept payments from hundreds of countries.

- Airwallex is very transparent about its FX markup as well as fees. This gives you complete visibility into how much of your hard-earned money will reach your recipient. There are no hidden fees and you can easily plan your payments and transfers with full knowledge of everything.

- International money transfer speed has been a traditional concern for many businesses. The good news is that Airwallex transfers finish within 0-3 business days. This means that you can send payments and money transfers quickly and never miss payment deadlines.

- One of the popular ways to send money abroad, especially for businesses, has been SWIFT. The problems with international wire transfers sent via SWIFT are high fees and slow speed. Airwallex solves both of those issues by providing access to hundreds of local payment methods. This means less money lost for your business for your international money transfers.

- In today's world, technology runs everything. Along with that come the risks of cybersecurity breaches, hacks and online fraud. With Airwallex, you can rest assured that your money as well as private information are in safe hands. This is because Airwallex is fully regulated in every country it operates in, and adheres to the latest security protocols, processes and best practices.

- Businesses need many capabilities to run smoothly - in addition to payments, there are other needs like accounting, payroll, taxation, auditing, etc. Airwallex provides numerous platform integrations so you can maximize automation and decrease manual work and data copying.

Airwallex's many strengths and advantages make it an attractive choice for many international money transfer and payment requirements that businesses have from time to time.

These are just some of the few reasons why Airwallex could be a great ally in your next international business money transfer.

What type of transfers can I make with Airwallex?

There are many types of money transfers that you can execute with Airwallex to ensure all your business payment needs are met.

Here are the types of money transfers and payments that Airwallex supports:

- Domestic Transfers

- Open local currency accounts in over 22 currencies and make domestic transfers within those countries using local payment rails.

- For example, you can open a USD account and make domestic USD transfers within the US, or open an SGD account and make local SGD transfers within Singapore.

- These domestic transfers bypass the SWIFT network, making them faster and cheaper than international wire transfers.

- International Transfers

- Make high-speed international transfers to over 150 countries in 60+ currencies.

- Most international transfers arrive within 1 business day, much faster than traditional bank transfers.

- Access competitive foreign exchange rates with typical markups of only 0.5-1%.

- Batch Transfers

- Send batch payments of up to 1,000 recipients across countries and currencies in one go.

- Use dynamic templates to streamline batch transfer workflows.

- Set up approval workflows and user permissions for better control.

- Payment Links

- Generate reusable or one-time payment links to receive online payments globally.

- Accept payments via popular methods like credit cards, digital wallets (WeChat Pay, GrabPay, etc.).

You can send several types of payments with Airwallex like domestic transfers, international transfers, batch transfers and payment links. Each transfer type comes with distinct advantages over traditional payment types.

What are various ways to send money with Airwallex?

You can send money international using Airwallex using any of the below options:

- Using the Airwallex website

- Using the Airwallex mobile app (both Android and iOS)

Note that Airwallex is an online only company so there are no physical offices or branch locations to go to.

How to send and receive money with Airwallex?

Sending money internationally with Airwallex is quick and easy. The whole end-to-end process of sending money with Airwallex - either through their website or the mobile app - takes only a few simple steps and can finished in just a few minutes. We share the steps you will need to undertake an international money transfer with Airwallex in the next section.

Step by step guide to send money with Airwallex

Sending money abroad with Airwallex is quick and easy, and takes only a few clicks. Below are the steps needed to place an international money transfer order with Airwallex:

- Step 1: Determine if Airwallex is your choice for your next business money transfer. Nowadays, there are numerous choices to send money abroad. Given this, it may seem hard to even decide who to go with. An easy way to narrow down choices is to compare money transfer companies using RemitFinder's real-time international remittance comparison platform. RemitFinder has hundreds of money transfer companies with accurate and updated exchange rates. You can compare many remittance companies side by side on various factors like exchange rates, transfer limits, ratings and reviews, etc. All this information can help you narrow down the company you want to go with.

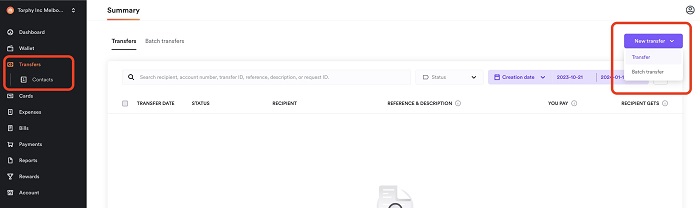

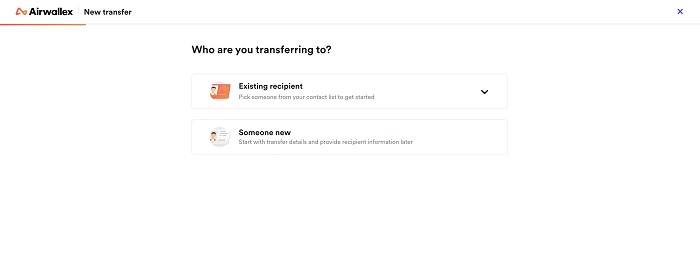

- Step 2: Navigate to Airwallex transfers page to start a new money transfer. Once you have registered for your new Airwallex business account, navigate to the Transfers page in the sidebar and click on the New Transfer button. You can also go to the Wallet page and click on the New Transfer button.

- Step 3: Select your overseas recipient. If you wish to send money to an existing contact, click on Existing Recipient and select an existing beneficiary. Otherwise, you can also create a new recipient by clicking on the Someone New button.

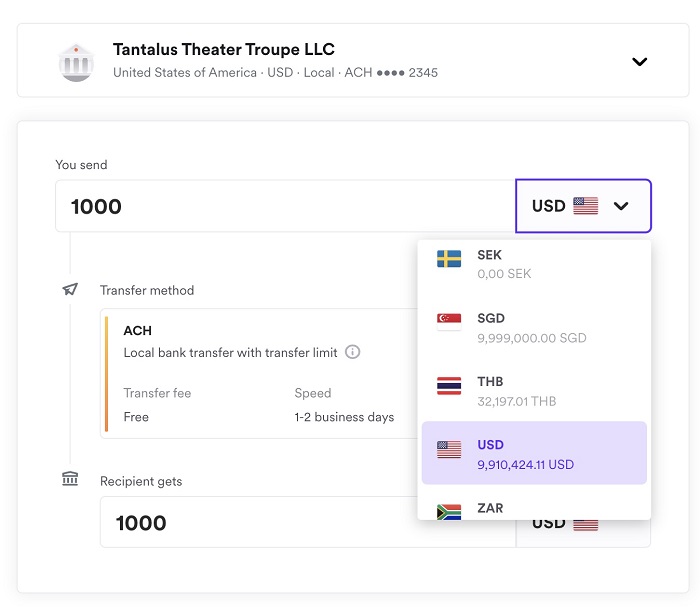

- Step 4: Select payment method and funding account. The next step in the process is to select the account you will use to fund your new Airwallex money transfer. Simply click on the wallet you want to use under the You Send section dropdown to choose your desired payment account.

- Step 5: Select amount and transfer method. Enter the amount you want to send by either entering the amount into the You Send or Recipient Gets fields; Airwallex will calculate the other corresponding amount based on the exchange rate and transfer fees. In addition, select your transfer method - local or SWIFT. One or both options will be shown based on destination country, source currency and bank account.

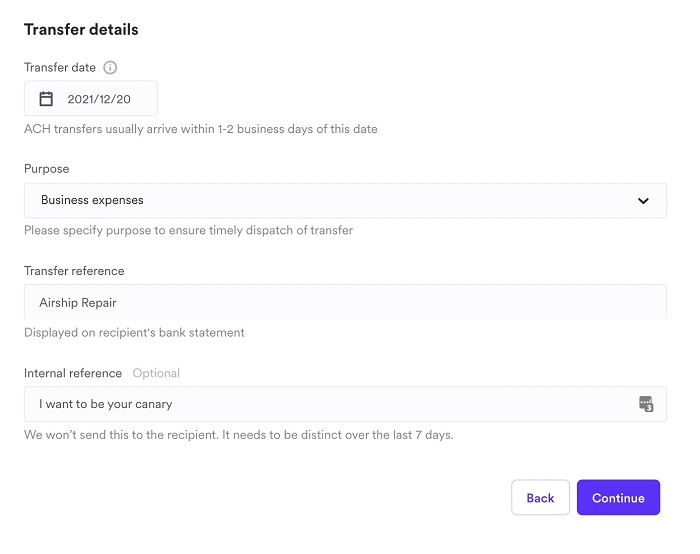

- Step 6: Add additional details for the transfer. Next, you have the opportunity to add additional data to your money transfer. For example, you can enter transfer date to schedule your payment, transfer purpose to choose a payment category, transfer reference that shows up on the beneficiary's bank account and optionally, an internal reference field for your accounting or auditing purposes.

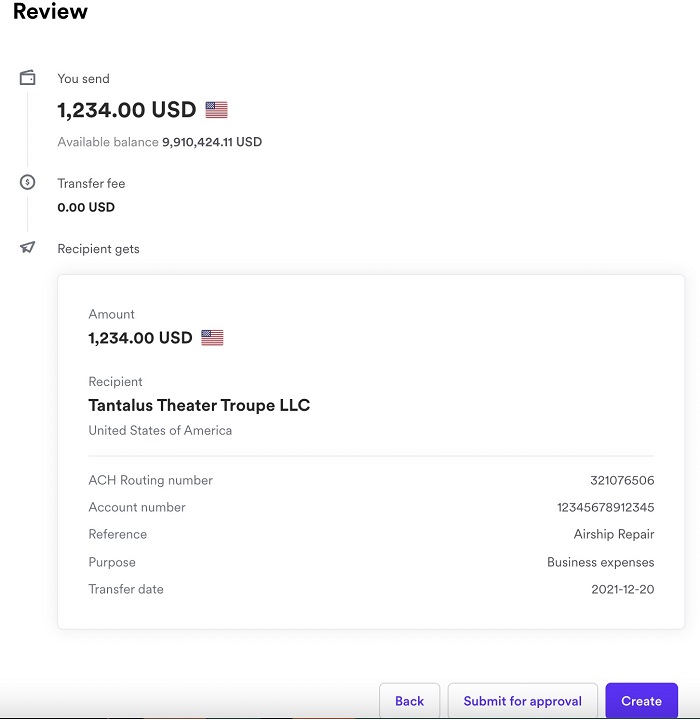

- Step 7: Review and confirm payment details. On the next screen, you are presented with a summary of your transfer with all the details entered in prior screens. Make sure to check everything for accuracy and once you are satisfied, submit your transfer for approval, if needed, or click on Create button to submit your money transfer to Airwallex for processing.

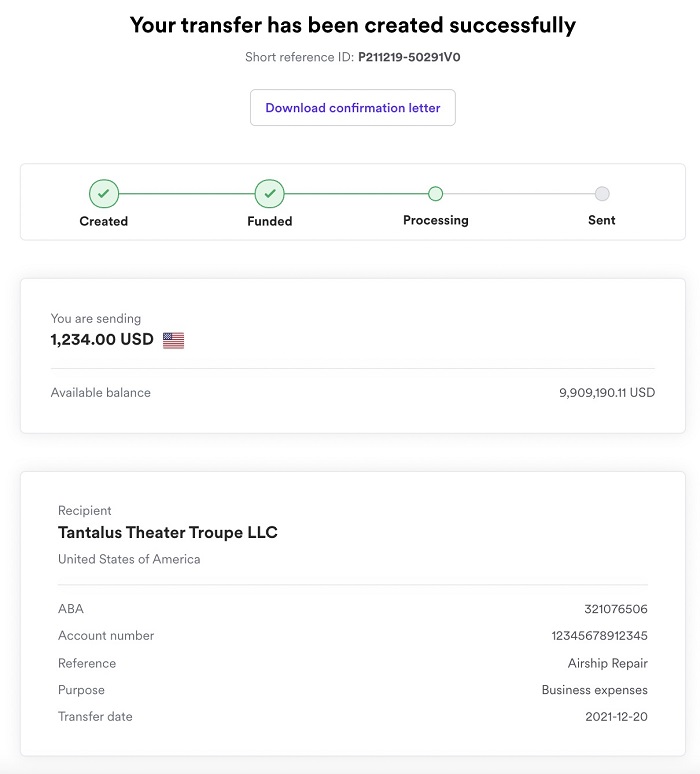

- Step 8: Transfer created successfully. After you submit your transfer, Airwallex will show you a payment confirmation screen showing that your payment has been successfully submitted to the system. You will also get a confirmation email and given the option to download your payment receipt as well.

From this point on, you are done and Airwallex will work on your international money transfer.

It is quick and easy to send money internationally with Airwallex. The whole process takes only a few steps and can be completed in just a few minutes.

How can Airwallex help me send money?

There are several useful resources to help you send money with Airwallex.

First and foremost, check out our step by step guide to send money with Airwallex in an earlier section. The process is very intuitive and easy, and you should be able to complete your first international business transfer with Airwallex quickly.

Next, Airwallex has a detailed help section on their website that covers numerous topics from account setup, sending transfers and many other services that the platform provides.

Finally, if you get stuck or have questions, you can always contact the Airwallex customer support team. Look for customer support options in a following section below.

Do I need a Airwallex account to receive money?

No, you do not need an Airwallex account to receive money sent via an international money transfer to you.

This is because the sender would have chosen either SWTIFT or a local payment method to send you the funds. In either case, there is no need for you to have an Airwallex account just to receive the money.

Of course, if you have a need to send international business payments, you can open your own Airwallex account.

Does Airwallex have a mobile app?

Airwallex does have a mobile app that you can use to send money internationally with. The app is available for both Android and iOS devices from the respective app stores.

How do I track my Airwallex transfer?

Airwallex provides multiple ways to track your international money transfer with them as below:

- Real-Time Transfer Tracking: Airwallex provides real-time tracking of your transfers through their platform. Once you initiate a transfer, you can track its progress with live updates until the funds are delivered to the recipient.

- Transfer Status Updates: You will receive email and/or in-app notifications from Airwallex regarding the status of your transfer at different stages - when it is initiated, processed, and delivered.

- Unique Transfer Reference: Each transfer you make with Airwallex is assigned a unique reference number. You can use this reference number to track the specific transfer details and status through Airwallex's platform or by contacting their customer support.

- UETR Code for SWIFT Transfers: If your transfer goes through the SWIFT network, Airwallex will provide you with a UETR (Unique End-to-End Transaction Reference) code. This code can be used to track cross-border SWIFT transfers on third-party tracking platforms like TrackMySwift.com.

Airwallex provides a comprehensive transaction tracking system that includes real-time updates, unique transaction reference numbers and UETR numbers for SWIFT transfers.

Can I use Airwallex for international bank transfers?

Yes, you can use Airwallex for international bank transfers.

Simply choose to fund your transfer using your bank account and pay your recipient directly into their bank account. By doing this, you would achieve the same goal as a bank to bank transfer, albeit without paying exorbitant fees and getting poor exchange rates offered by traditional banks.

Is Airwallex online better than sending money in-person in stores?

Airwallex is an online only money transfer and financial company and there are no offices, branches or agent locations to go to. In that sense, Airwallex is accessible and available 24x7 via your computer or mobile phone.

Airwallex is a fully digital platform and there is no need to go into an office or branch to do business with them. You can use the platform online using your phone or computer.

Does Airwallex have a rewards program?

At this time, Airwallex does not have a rewards program. If that changes in the future, we will update this review with that information.

What customer support options are available with Airwallex?

If you run into any problems with your Airwallex business account, or have any questions, you can get in touch with the Airwallex customer support team.

There are several convenient ways to get in touch with Airwallex customer support team; we list them below.

- Phone Support: Airwallex provides toll-free customer support numbers for different regions as below:

- United States: +1 (855) 932-3331 8:00-18:00 PDT/PST

- Australia: +61 1 3329 9, +61 1 3858 0915

- China: +86 400 866 3888 from 9:00-18:00 CST

- United Kingdom: +44 808 196 7574

- Singapore: +65 3129 4178

- Canada: +1 (855) 292-1315 from 8:00-18:00 PDT/PST

- Email Support: Customers can email Airwallex for various inquiries as below:

- General inquiries: sales@airwallex.com

- Legal matters: legal@airwallex.com

- Media/Press: press@airwallex.com

- Data protection: dataprotection@airwallex.com

- Online Support Form: Airwallex has an online support form on their website where customers can submit requests and inquiries.

- Office Locations: Airwallex has physical office locations in multiple countries like Australia, China, UK, US, Singapore, etc. where customers can visit for in-person support if needed.

- Live Chat: In app mobile chat is also available in the Airwallex mobile app to easily reach their customer support team.

Airwallex has several easy ways to content their customer support team. Available channels include phone, email, online webform, in-app chat and in-office support in office locations.

Can I cancel my Airwallex transfer?

If you need to cancel your Airwallex transfer, it may be possible to do so. The cancelation process and options available depend on the status of the transfer. Here are the key points regarding canceling Airwallex transfers:

- If the transfer is still processing:

- If the status of your transfer is 'processing' or 'in-review', you can contact Airwallex customer support to request a cancellation.

- Provide the payment short reference (e.g. P20240129-ABCDEFG) to help them locate the transfer quickly.

- Airwallex will assess the transfer and advise you on the cancellation status.

- If the transfer has been dispatched:

- Once a transfer is dispatched, Airwallex depends on the cooperation of the recipient's bank to process cancellation requests.

- If you made a mistake with the recipient's account details, the transfer may fail and be returned to your Airwallex account automatically after some time.

- If sent to the wrong recipient, you should first try to contact them directly to request a refund.

- Initiating a payment recall:

- If unable to retrieve funds from the incorrect recipient, you can request Airwallex to initiate a payment recall through their banking partners.

- However, payment recalls are not guaranteed to be successful as they require cooperation from all involved banks.

- There may be fees charged by Airwallex's banking partners for initiating a payment recall.

- The recall process can take 4-6+ weeks to complete.

As a best practice, we recommend that you contact Airwallex customer support as soon as possible if you think you need to cancel a transfer. This will ensure that the support team can try to halt the pending transfer soonest possible, ideally before the funds have been dispatched to the recipient.

How do I delete my Airwallex account?

If you wish to delete your Airwallex account, contact their customer support team and they will assist with your request.

Make sure to keep a copy of your transaction history for future reference purposes. Once your account is deleted, you will lose all access to past transactions and other data.

Additional Information

Legal and Regulatory Compliance

Various Airwallex entities across the globe are registered with their local regulatory authorities as per below:

- United States: Airwallex US, LLC (NMLS #1928093) is a licensed money transmitter in most US states.

- United Kingdom: Airwallex UK Ltd (license number 900876) is regulated and licensed by Financial Conduct Authority (FCA).

- Singapore: Airwallex Singapore Pte. Ltd. (license number PS20200541) is licensed and regulated by the Monetary Authority of Singapore (MAS).

- Australia: Airwallex Pty Ltd (AFSL number 487221) is licensed by the Australian Securities and Investments Commission (ASIC).

- Europe: Airwallex Netherlands B.V. (Relation number R179622) is supervised by the Dutch Central Bank (De Nederlandsche Bank).

- Canada: Airwallex Canada International Payments Ltd (registration number M19395067) is regulated by the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC).

- Lithuania: AWX Lithuania, UAB (Republic of Lithuania code of legal entity no. 305697289) is licensed by the Bank of Lithuania (Lietuvos Bankas, the BoL).

- Hong Kong: Airwallex Hong Kong Ltd (license number 16-09-01929) is licensed by the Hong Kong Customs and Excise Department.

- New Zealand: Airwallex New Zealand Ltd (NZ FSPR number FSP1001602) is registered on the New Zealand Financial Service Provider Register.

- Malaysia: Airwallex Malaysia Sdn Bhd (license number 00318) is regulated by Bank Negara Malaysia.

- China: Guangzhou Shangwutong Network Technology Co., Ltd. (license number Z2025844000016) is licensed by the People's Bank of China.

Awards, Prizes and News

Here are some awards and accolades that Airwallex has won as well as some other related highlights:

- Asia FinTech Awards 2022: FinTech of the Year.

- University of Melbourne Endeavour Awards 2022: Airwallex Awarded for Customer-Centric Technology.

- CNBC-Statista's World's Top Fintech Companies 2023.

- Airwallex announced plans to launch a new AUD 20,000 scholarship for a future master's student at the University of Melbourne's School of Engineering in 2020.

References:

1. Airwallex payout network guide

Deals

Reviews

As a small business owner juggling international transactions, I’ve tried my fair share of services, and Airwallex has been a breath of fresh air. Here’s why it’s worth a look: The exchange rates are super competitive. Maybe not always the absolute best, but they’re definitely in the top 3 compared to what’s out there in the retail market. Every cent counts when you’re running a business, and Airwallex helps me stretch my dollars further. Blazing-Fast Transfers: Say goodbye to waiting days for your money to arrive. With Airwallex, the transfer is done in moments. It’s ridiculously fast compared to traditional banks, which makes a world of difference when cash flow is tight, or payments need to be made ASAP. One feature that’s genuinely useful is their multi-currency wallet. You can hold foreign currencies without forcing an exchange, which is a game-changer if you’re dealing with international clients. It’s like having a little e-wallet for your business, and it gives you the flexibility to exchange when the rates are good. On the downside, getting your account up and running does take a bit of effort since you need to go through a verification process. It’s standard for B2B services, so it’s not a dealbreaker, but it’s something to keep in mind if you’re in a rush to get started. If you’re running a small business with international payments, Airwallex is a no-brainer. It’s fast, affordable, and genuinely helpful with its multi-currency wallet feature. Sure, the sign-up process isn’t instant, but once you’re in, it’s smooth sailing.