DolEx Detailed ReviewRates, Fees, Limits, Safety and More

Last updated: April 25, 2022

What is DolEx? An introduction

DolEx Dollar Express company information

DolEx, short for DolEx Dollar Express, is a Financial Services company with more than 20 years' experience, and with global operations in many countries.

DolEx provides a wide range of financial products to its customers that include local and international remittances, check cashing, making payments and sending money orders.

DolEx has a widespread network that includes over 3,000 retail agents as well as 500 retail stores. This helps amplify the reach of DolEx's services to consumers who can find convenient DolEx locations nearby to use their services. In North America, DolEx has presence in 30 US states, Puerto Rico and US Virgin Islands.

Additionally, DolEx also has a very extensive network of more than 125,000 payout locations spread across about 20 countries they operate in. These include Central and South America, Mexico, the Philippines and the Caribbean.

DolEx's mission is to enhance the reach of financial services and related products to underserved communities by relying on technology and innovation.

DolEx has more than 20 years' experience in various financial services that include local and international remittances, payments, money orders and check cashing.

What services does DolEx provide?

DolEx provides a wide variety of financial services to its customers across multiple distribution channels. For example, you can send both local as well as international remittances with DolEx.

Below, we list the full spectrum of DolEx financial products available to you.

- Money transfers or remittances - both local as well as international. You can send money with DolEx either online or visiting on of their retail locations.

- Personal loans - get cash when you need it the most. You can get a personal loan with DolEx anywhere from USD 300 to USD 10,000.

- Check cashing - cash your checks at DolEx locations near you.

- Bill pay - pay your bills on time. DolEx supports more than 10,000 merchants and companies that include banks, phone companies, public utilities and many more.

- Money orders - a great alternative to sending cash or dealing with checks.

- Tax preparation - finish your tax filing on time (only available in New York, USA).

- Telephony services - all your connectivity needs in one place. DolEx provides support for pinless, domestic as well as international mobile top-ups.

DolEx provides a range of useful financial services that include remittances, loans, bill pay, check cashing, money orders and more.

Which countries does DolEx operate in?

DolEx allows you to send money locally within the US as well as to about 16 countries spread across Latin America.

Where can I send money from with DolEx?

With DolEx, you can send money from the US to several Latin American countries.

Where can I send money to with DolEx?

DolEx allows you to send both local as well as international remittances. Below, we provide information about their coverage for both types.

- Local money transfers - Within the US

- International money transfers - From US to about 16 countries

Below are the countries where you can send international money transfers to using DolEx.

- Bolivia

- Brazil

- Chile

- Columbia

- Costa Rica

- Dominican Republic

- Ecuador

- Guatemala

- Honduras

- Haiti

- Mexico

- Nicaragua

- Panama

- Peru

- Paraguay

- El Salvador

You can send money via DolEx within the US as well as to 16 Latin American countries.

DolEx provides two convenient ways to help you send money with them - online or by visiting one of their retail locations.

Are DolEx exchange rates good?

Is DolEx a cheap way to send and receive money?

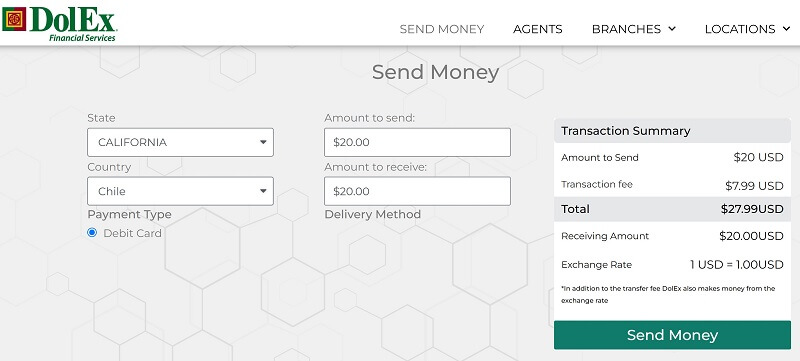

To see if DolEx exchange rates and fees are competitive, you can visit their website. Simply choose your destination country and punch in the amount you want to send, and DolEx will show you exactly how much your recipient will get.

How to send money with DolEx

If you want to eliminate the hassle of manually searching exchange rates, you can use RemitFinder's online remittance comparison engine to automate your search. RemitFinder compares numerous money transfer companies and present easy to digest results to you in a simple view.

If you compare various money transfer companies, you are better informed to make the best decisions for your international remittances. Additionally, you may also be able to save even more money by taking advantages of deals, promotions and offers that are available from time to time.

How much money can I send with DolEx?

DolEx does not enforce any limits on the amount of money you can send.

DolEx may, however, ask you to provide additional identification information as well as documentation related to the source of funds. This is needed to ensure your safety and compliance with legal and regulatory requirements.

There is no limit to the amount of money you can send with DolEx.

How long does it take for DolEx to send money overseas?

DolEx money transfers can be available as soon as within minutes. In general, it can take up to one business day for DolEx to process your money transfer.

Transfer speed depends upon the delivery method you choose as well as on the recipient's country.

DolEx moves your money overseas quickly - from within minutes to 1 business day.

There are certain circumstances that can introduce delays; these can include some of the below.

- Bank holidays or processing cut off times

- Additional documentation needed by source or destination financial institutions

- Errors in recipient information

How can my recipient get paid with DolEx?

With DolEx, there are 3 convenient ways in which you can choose your recipient to get the funds; these are as below.

- Bank transfer

- Cash pickup - available at 125,000 convenient payment locations worldwide in more than 20 countries

- Home delivery - only available in the Dominican Republic and the Philippines

DolEx support 3 convenient payout methods - bank deposit, cash pickup and home delivery (Dominican Republic and Philippines only).

Note that domestic DolEx money transfers are always paid out with cash.

Are there any DolEx coupon codes or promotions I can use?

DolEx does seem to have deals and offers that they float from time to time. You can periodically their the DolEx promotions page on their website to see which deals are active at any given time.

Is DolEx safe?

DolEx claims that they take the security and safety of your money as well as confidential information very seriously. They indicate that they implement the below security best practices to ensure your safety at all times.

- Compliance with legal and regulatory requirements

- Implementation of effective know your customer (KYC) and client identification techniques

- Educating and training employees and agents on security

- Investment in automated transaction monitoring with technological solutions

- Monitoring risks and threats continuously

- Detecting and reporting issues proactively whenever they occur

- Taking anti money laundering (AML) seriously and implementing controls and processes to prevent money laundering

DolEx's 20 years of successful financial services background couples with their focus on security indicates that your money and information should be safe with them.

Can I trust DolEx?

As a multinational financial company, DolEx is fully regulated by various financial organizations and bodies. Additionally, DolEx is licensed to operate in every country as well as US states that they operate in.

Below, we provide some licensing, regulatory and compliance information about DolEx.

- DolEx is registered with the Financial Crimes Enforcement Network (FinCEN) and is classified as a Money Services Business (MSB) as well as a Financial Institution

- DolEx complies with anti-money laundering (AML) and the Bank Secrecy Act (BSA)

- DolEx Dollar Express is a licensed lender in California (License #60DBO-85686)

- DolEx Dollar Express is registered in Connecticut (unique identifier NMLS# 910812)

- DolEx Dollar Express is licensed by the Georgia Department of Banking and Finance (Payment Instruments Lic. No. 18547 and Check Cashing Lic. No. 32962)

- DolEx is part of the Nationwide Multistate Licensing System and Registry (NMLS# 910812)

- DolEx Dollar Express is an authorized foreign transmittal agency and check seller in Massachusetts (FT910812 / CS0112 / NMLS#910812)

- DolEx Dollar Express is regulated by the New York State Department of Financial Services (MT103625)

DolEx provides detailed information on various licenses and registrations they hold in the countries and states they operate in. Be sure to check DolEx's latest legal and compliance information in your area.

Why should I use DolEx?

With a 20 year old proven track record in handling money and providing financial services to its customers, DolEx is an experienced company that provides several advantages.

Below, we list some reasons why you may want to consider DolEx for your next money transfer or other financial needs.

- DolEx operates in 17 countries across North and Latin Americas

- DolEx has more than 500 retail stores and 3,000 retail agents in its partner network

- DolEx has over 125,000 payout locations spread across 20 countries

- DolEx allows you to send local remittances within the US, as well as international money transfers

- DolEx provides a wide variety of financial services and could be a one stop shop for many of your financial needs

- DolEx possesses more than 20 years' experience in the financial services industry

- DolEx is fully licensed and regulated in every country and US state where it operates in

DolEx provides numerous financial services and could be a go to provider for many financial needs.

How can I find DolEx near me?

Given DolEx's wide partner network with thousands of branches and retail outlets, the chances that you have DolEx locations near you are pretty decent.

Before we explain how to find a nearby DolEx branch, let's first see what type of branches are available to you.

With DolEx, there are 2 types of branches or locations that you can search for. Both have difference purposes w.r.t. the services they provide, and below we list the differences between them.

- DolEx branches - These are dedicated branch offices where numerous DolEx services (like remittances, money transfers, check cashing, loans, tax preparation, etc.) are offered. Note that not all services may be available at every branch location. DolEx has 3,000 retail agents and 500 retail stores that make up its branches.

- DolEx payout locations - These are locations where your recipient can receive funds or pick up money that you send to them. DolEx has 125,000 payout locations worldwide in 20 countries.

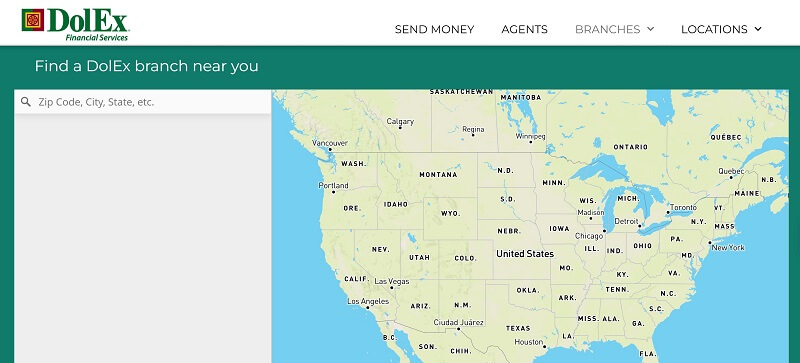

What is the best way to find DolEx branch near me?

To find a DolEx branch close to you, you can use the online DolEx branch locator. Simply punch in your zip code, city or state and search.

How to find the nearest DolEx branch

Another convenient way you can find the nearest DolEx branch is by calling their customer support team at 1-800-892-0210. Once you talk to a DolEx support representative, they will help located the closest DolEx branch you can go to.

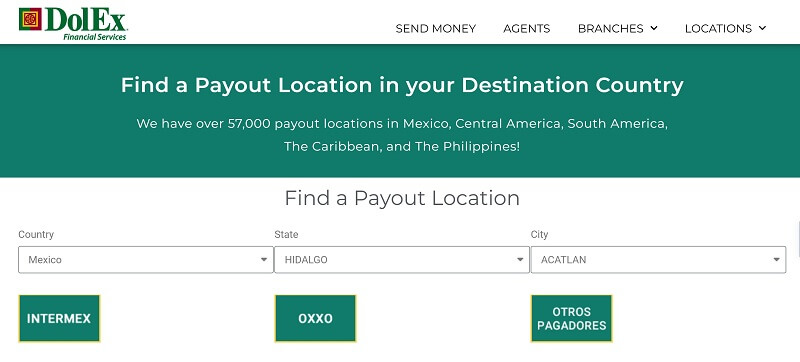

What is the best way to find DolEx payout location overseas?

If you send money overseas with DolEx, and choose pickup at an agent location, you definitely want to choose a payout location that is closest to your recipient.

To pick the most convenient payout location in your receiver's country, use the DolEx payout locator search on their website. Choose your recipient's country, state and city, and DolEx will provide you a list of locations where your receiver can pick up the funds.

Below is an example search whereby we looked up DolEx payout locations in the city of Acatlan located in Mexico's Hidalgo state.

How to find a convenient DolEx payout location overseas

If you want to see the actual payout location address, phone number and operating hours, simply click on one the search result boxes to see more information.

How to find a DolEx payout location address

DolEx has a widespread network of branches as well as overseas payout locations so both you and your recipient can find a convenient, nearby DolEx location.

Is DolEx the best option for me to send money to Latin American countries?

DolEx is a well-established financial services company with a deep, 20 years plus experience in their business domain.

They also offer a wide variety of financial products as well as a very strongly connected partner and agent network. These can definitely be very attractive factors to consider using DolEx for your next money transfer to any of the 16 destinations they support in North, South and Latin Americas.

Before you decide to send money with DolEx, you should compare other options as well to ensure you can make the best choice.

How to send and receive money with DolEx?

Once you decide that DolEx is the right choice for your next local or international money transfer, it is actually pretty easy to send money with them. You can use any of the below convenient ways to send money with DolEx.

- Online via the DolEx website

- Visiting a DolEx branch and sending money in-person

- Calling DolEx customer support for assistance with your transfer

Does DolEx have a mobile app?

DolEx does not have a mobile app at this time. This means you have to either use their website for your money transfers, or you can locate a DolEx branch near you and go there to do your transactions.

What customer support options are available with DolEx?

If you need to contact DolEx customer support, you can do so by calling their Customer Service team at 1-800-892-0210.

DolEx's support team work from 7:00 AM to 11:00 PM CST every day of the week.

Can I cancel my DolEx transfer?

If you wish to cancel your DolEx transfer, call their customer support team at 1-800-892-0210, and a DolEx support representative will assist you.

Note that DolEx cannot cancel your money transfer if the funds were already credited to the recipient's bank account or picked up as cash at a DolEx money transfer location.

Additional Information

Legal and Regulatory Compliance

DolEx is licensed with and regulated by various financial institutions, and holds licenses in numerous US states; below we list some pertinent information.

- DolEx is registered with the Financial Crimes Enforcement Network (FinCEN) and is classified as a Money Services Business (MSB) as well as a Financial Institution

- DolEx complies with anti-money laundering (AML) and the Bank Secrecy Act (BSA)

- DolEx Dollar Express is a licensed lender in California (License #60DBO-85686)

- DolEx Dollar Express is registered in Connecticut (unique identifier NMLS# 910812)

- DolEx Dollar Express is licensed by the Georgia Department of Banking and Finance (Payment Instruments Lic. No. 18547 and Check Cashing Lic. No. 32962)

- DolEx is part of the Nationwide Multistate Licensing System and Registry (NMLS# 910812)

- DolEx Dollar Express is an authorized foreign transmittal agency and check seller in Massachusetts (FT910812 / CS0112 / NMLS#910812)

- DolEx Dollar Express is regulated by the New York State Department of Financial Services (MT103625)

Further information about DolEx's legal and regulatory compliance is available on their website.