Global66 Detailed ReviewRates, Fees, Limits, Safety and More

Last updated: February 14, 2025

What is Global66? An introduction

Global66 is the leading financial technology company in Latam specializing in international money transfers, multi-currency accounts, and cross-border financial solutions. Its mission is to simplify global finances by empowering individuals and businesses to connect seamlessly across borders.

Clients can send or receive funds from anywhere in the world, open local named accounts in the US/EU/UK/MX and spend with their debit card.

Global66's Mission is to empower individuals and businesses to connect seamlessly across borders.

The company is dedicated to providing transparent, efficient, and cost-effective financial solutions, enabling users to take full control of their global financial needs.

By redefining how people and businesses interact with their finances on a global scale, Global66 delivers tools that are accessible, transparent, and designed for the modern world. Whether it's sending money to loved ones, managing international travel expenses, or supporting the financial needs of a global business, Global66 provides the ideal financial solution.

Global66 company information

Global66 aims to simplify cross-border transactions, empowering individuals and businesses to access financial services with transparency, speed, and competitive rates.

To achieve this, Global66 is building a seamless, user-centric platform designed to adapt to the needs of each customer. Global66's goal is to become a trusted partner in managing and transferring money across borders, making international payments as straightforward as local ones.

Global66 supports customers at every stage of their financial journey, offering tools for efficient money management, fast and secure transfers, and multi-currency accounts. This personalized approach ensures customers can save time and money while enjoying an intuitive and secure experience.

Global66 by the numbers

The below data and statistics help put Global66's financial and customer reach and impact in perspective.

- Founders: Cristobal Forno and Tomas Bercovich.

- Headquarters: Santiago, Chile.

- Founded: 2018.

- Customer base: More than 2 million personal and business customers.

- 25 million website sessions a year.

- 15 million app sessions a year.

- Countries served: Argentina, Chile, Colombia, Ecuador, Peru, Mexico.

- Currencies supported: 9 currencies including USD, MXN, EUR, COP, ARS, CLP, PEN, BRL and GBP.

Global66 is a leading financial services company providing international money transfers and multi-currency accounts in Latin America with more than 2 million customers and about 40 million sessions across their website and mobile app.

What services does Global66 provide?

Global66 provides numerous useful financial services related to international money transfers; these are listed below.

- International Money Transfers: Quick and transparent international money transfers with competitive exchange rates, no hidden fees, and fast processing times. Transactions can be made to more than 70 destinations in multiple currencies.

- Multi-Currency Accounts: Manage your finances globally with multi-currency accounts that allow you to hold, exchange, and use up to 8 different currencies that include USD, EUR, GBP, BRL, COP, ARG, PEN, MX, CLP. This feature is perfect for frequent travelers, expatriates, or businesses dealing with international clients.

- 11% Annual Yield on COP Balances: Earn a competitive annual return on your Colombian Peso balances, helping you grow your savings.

- 6% Annual Yield on USD Balances: Generate income on your US Dollar holdings with an attractive annual yield. These interest rates are designed to maximize the value of your funds while maintaining flexibility.

- Prepaid Card: Access your funds with a prepaid card that allows you to pay in multiple currencies without additional conversion fees.

- SWIFT Transfers (USD): Easily transfer funds internationally to any bank account using the SWIFT network.

- Local Banking options in the USA, Europe, UK and Mexico: Open named accounts issued locally to your name in order to receive and send payments.

From international money transfers at competitive exchange rates and low fees to multi-currency accounts to earning interest on your CLP and USD balances, Global66 offers a wide variety of useful services for immigrants and expats in Latin America.

Which countries does Global66 operate in?

Global66 is active in various Latin American countries, providing fast and economical international money transfers as well as multi-currency accounts to residents of various countries in the region.

Where can I send money from with Global66?

Global66 currently allows residents of the following countries to open accounts and access its services:

- Argentina

- Chile

- Colombia

- Ecuador

- Mexico

- Peru

The company is continuously working to expand into new regions, and those whose countries are not yet supported are encouraged to check back regularly for updates.

Where can I send money to with Global66?

Global66 supports sending money to over 70 countries across the Americas, Europe, and Asia.

Transfers are available in a variety of currencies, including USD, EUR, GBP, BRL, COP, ARG, PEN, MX, CLP and others.

In addition to regional coverage, Global66 allows users to send money in USD to any country worldwide using the secure and reliable SWIFT network. This feature provides seamless access to international banking systems and ensures efficient and secure cross-border transfers.

With Global66, you can send money from Latin America to more than 70 countries worldwide. Additionally, you can send money in USD to anywhere in the world using SWIFT bank transfers.

What are Global66's fees and exchange rates?

Global66 offers competitive fees and exchange rates, ensuring that customers can transfer money internationally and manage their finances without hidden costs. Transparency is at the core of their pricing, so you always know what you are paying and how much your recipient will receive.

Here is additional information about Global66's exchange rates:

- Mid-Market Exchange Rates: Global66 uses mid-market exchange rates for currency conversions, ensuring you get a fair and competitive rate.

- Low FX Markup: Global66's foreign exchange markup is among the lowest in the market, helping you save more compared to traditional banks or other services.

When it comes to transfer fees, here is some useful information that you should be aware of:

- Transparent Fees: Global66 shows all fees upfront at the time of the transaction. No hidden costs, ensuring peace of mind.

- Low Fees for Transfers: For most countries, transfer fees are minimal and fixed. Fees may vary depending on the amount, currency, and destination.

- Free Internal Transfers: Transfers between Global66 accounts are free, regardless of the currency.

- Additional Fee Information for SWIFT Transfers: A small additional fee may apply for SWIFT-based transactions, depending on the bank's intermediary charges.

Before confirming any transaction, Global66 provides a detailed breakdown of:

- The exact exchange rate applied.

- The transfer fee for the transaction.

- The total payout amount to the recipient.

You can preview these details using the online calculator on the Global66 website or directly in the Global66 app.

Global66 is very transparent about both the exchange rate and transfer fee that will be applied to your international money transfer with them.

Are Global66 exchange rates good?

Global66 offers some of the most competitive exchange rates in the industry, staying close to the real mid-market rate.

By choosing Global66, you avoid the high fees and markups typically charged by traditional banks and other providers. They are typically 50% cheaper than traditional brick and mortar remittance companies.

That said, we always suggest to our readers to always shop around and see what other remittance service providers are offering. More information will help you best choose a partner to send money with. When you compare money transfer providers, the chances of your getting the most benefit on your international money transfers increase significantly.

Whilst you can compare remittance companies manually, a quick and convenient way to do so is to rely on RemitFinder's online money transfer comparison engine. RemitFinder compares umpteen providers side-by-side to give you accurate and updated information about exchange rates and deals.

Is Global66 a cheap way to send money overseas?

Global66 is not just affordable, it's also transparent and reliable. With competitive exchange rates, clear fee structures, and cost-saving opportunities, it is an excellent choice for sending money overseas.

For users who take advantage of its features, it often proves to be one of the cheapest and most efficient options available.

How do I avoid Global66 fees?

Global66 is designed to offer transparent and competitive fees for international money transfers. However, there are smart strategies you can use to minimize or even avoid fees entirely, ensuring more of your money reaches your recipient.

Here are some smart options and creative ways to minimize or avoid Global66 fees:

- Encourage your recipient to sign up with Global66: Transfers between Global66 accounts are completely free. If your recipient has a Global66 account, you can send money instantly without incurring any fees.

- Take advantage of the referral program: If someone shares their referral link with you, you can enjoy 30 days of fee-free transactions after signing up. This is an excellent way to try out Global66's services at no cost. Similarly, you can share your own referral link to invite others and unlock additional benefits.

- Promotions: Keep an eye out for Global66's promotions and special offers. Occasionally, they provide discounted or zero-fee transfers to new or existing users, helping you save even more.

- Leverage multi-currency accounts: By holding balances in currencies like USD, EUR, or COP within your Global66 multi-currency account, you can avoid frequent currency conversion fees when making transfers.

By following the above strategies, you can minimize or eliminate fees on your Global66 transactions and ensure the maximum amount of your money reaches your recipient.

How much money can I send with Global66?

Global66 offers flexible transfer limits designed to accommodate a wide range of personal and business needs. These limits are transactional, meaning that you can make multiple transfers within these limits if necessary.

Local Payout Transfer Limits:

- Minimum Amount: USD 20 (except Argentina: USD 10).

- Maximum Amount: Between USD 500,000 and USD 1,000,000.

SWIFT Transfers in USD Limits:

- Minimum Amount: USD 20.

- Maximum Amount: USD 500,000.

Pay In Transfer Limits:

- Minimum Amount: USD 3.

- Maximum Amount:

- Argentina, Chile, Colombia, Mexico: USD 500,000.

- Ecuador: USD 100,000.

- Peru: USD 250,000.

- USA, SEPA, and United Kingdom: USD 1,000,000.

Using Global66, you can send fairly large amounts of money transfers internationally. Limits vary based on the type of transfer as well as destination country.

All transfer limits, fees, and estimated delivery times are shown upfront before confirming a transaction. For large amounts, additional verification may be required to comply with anti-money laundering (AML) and know-your-customer (KYC) regulations.

How long does it take for Global66 to send money overseas?

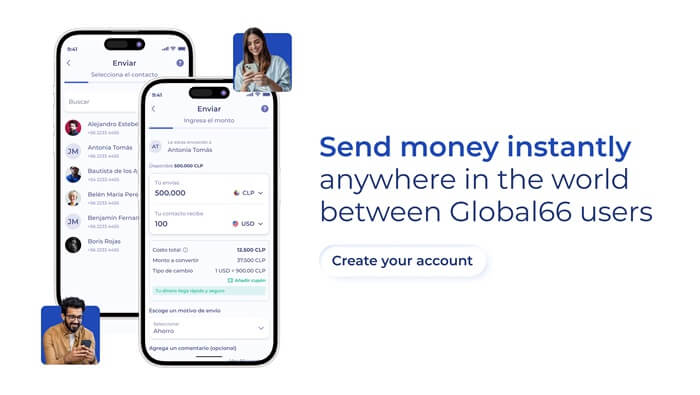

Global66 is known for its speed and reliability, offering two main options for international money transfers: remittances to third-party bank accounts and Peer to Peer transfers between Global66 users. Transactions can be initiated 24/7, allowing you to send money any day of the week, at any time.

P2P Transfers (Peer-to-Peer): Funds are transferred instantly between Global66 users without any fees.

Remittances to Third-Party Bank Accounts: While most transactions are processed quickly, in some cases, transfers to third-party bank accounts may take up to 48 hours, depending on the recipient's banking institution.

Instant Transfers:

- Europe

- Mexico

- Argentina

- United Kingdom

- Brazil

Same day transfers

- United States

- Colombia

- Costa Rica

- Ecuador

- India

- Dominican Republic

- Peru

- Australia

- Bolivia

- Canada

- Chile

- Paraguay

- Uruguay

Global66 is a fast way to send money abroad. P2P transfers amongst Global66 users are processed instantly. Many other transactions finish instantly as well, or within the same day.

How can I pay for my Global66 money transfer?

To be able to complete an international money transfer, you first need to send your funds in local currency to the money transfer company you choose. The mechanism to pay for your remittance transaction is called a payment method.

Global66 supports the following payment methods:

- Bank transfer: Global66 will open a deposit account in your name in the country of your choice (Chile, Colombia, Argentina, Mexico, Peru, US, EU, UK) where funds can be transferred in order to pay. In order to provide the best possible experience, Global66 will allow deposits through alternative methods such as PSE in Colombia.

- Balance from Multi-Currency Account: If you have a multi-currency account with Global66, you can pay directly from your account balance in USD, EUR, or other currencies. This option avoids additional fees and simplifies the payment process.

- Referral Credits: Credits earned through Global66's referral program can be applied to cover fees or partially fund your transfer.

- No Cash Deposits: Global66 does not accept cash payments. Transactions must be funded electronically.

You can pay for your Global66 international money transfer in a variety of convenient ways that include bank transfers, using funds in the multi-currency account as well as referral credits.

Which payment method should I use to pay for my Global66 money transfer?

All of Global66's payment methods - bank transfer, multi-currency account and referral credits - are easy and convenient ways to pay for your Global66 international remittances. You can choose amongst these based on your convenience and preference.

How can my recipient get paid with Global66?

The method you choose to credit your overseas receiver is generally called a delivery method.

Global66 offers flexible and reliable delivery methods to ensure your recipient receives their money quickly and conveniently. The available delivery options depend on the destination country, but they are designed to provide seamless payouts for both individuals and businesses.

Global66 supports the following delivery methods:

- Direct Bank Transfer: Send money directly to your recipient's bank account in their local currency. Simply add their bank details (account number, SWIFT code, or IBAN) during the transfer process.

- Global66 Multi-Currency Account: If your recipient has a Global66 account, they can receive the money directly into their multi-currency wallet. This is the fastest and most convenient option, allowing them to hold and manage funds in up to 8 different currencies.

Global66 allows you to send money to your recipient directly in their overseas bank account, or into their Global66 multi-currency account if they have an account with Global66.

Which delivery method should I use for my Global66 money transfer?

Global66 offers several delivery methods, allowing you to choose the option that best suits your recipient's needs for speed, convenience, and flexibility.

For Speed and Convenience: If your recipient has a Global66 account, transferring directly to their multi-currency wallet is the fastest option.

For Traditional Transfers: Direct bank transfers are widely available and suitable for most recipients.

Are there any Global66 coupon codes or promotions I can use?

Yes, Global66 offers a variety of promotions and exclusive benefits to help you save on your international money transfers. These initiatives are designed to reward both new and loyal users while enhancing their financial experience with Global66.

Here are some useful Global66 promotions:

- Fee-Free Transfers: RemitFinder users enjoy 30 days of fee-free transfers when signing up with Global66 through RemitFinder. Periodic promotions may waive transfer fees for specific destinations or currencies.

- Referral Program: Share your referral link with friends and family to earn credits that can be used to cover fees on future transactions.

- Exclusive Seasonal Offers: Discounts and rewards during holidays or special events, such as cashback or reduced fees for select transfer corridors.

- Exclusive Partnership Promotions with RemitFinder: Global66 collaborates with RemitFinder to bring you exclusive deals from time to time.

- Global66 Passport Program: Members gain access to tailored benefits, premium support, and personalized offers that enhance their experience with Global66.

If Global66 runs any offers or promotions in the future, we will add them on this page. Check this Global66 review periodically to ensure that you do not miss out on any future deals.

Whilst you can check for Global66 deals and discounts manually, doing so is time consuming. A better way is to sign up for the RemitFinder daily exchange rate alert. Our daily alert is totally free of cost; we will keep you posted on exchange rates and latest offers from many money transfer companies.

How can I find Global66 near me?

Global66 operates entirely online, providing a seamless and convenient way to manage your international money transfers and financial products. As a result, there are no physical locations, branches, or agent offices to visit. Designed to bring the world of global finances to your fingertips, eliminating the need for physical branches while providing exceptional service and security.

Here are 2 easy ways you can access Global66:

- Website: Visit the Global66 website to create an account, send money, or explore available financial services.

- Mobile App: Download the Global66 app, available for both Android and iPhone.

What is the best way to find a Global66 Sending Location near me?

Global66 is an online company so there are no sending locations to go to. Simply login online to start your international money transfer with them.

What is the best way to find an Global66 Payment Location overseas?

Since Global66 deposits money into your recipient's overseas bank account, there is no need for your receiver to go to a payment location in their home country.

Is Global66 a safe way to send money abroad?

Established as a trusted financial technology company, Global66 combines cutting-edge security measures with robust regulatory compliance to protect its users and their funds.

Global66 has many measures in place to ensure the safety and security of their customers' funds and personal information. Below, we present some of these.

- Identity Verification (KYC): Strict KYC guidelines ensure only authorized individuals can access accounts, enhancing security and ensuring compliance with international Anti-Money Laundering (AML) regulations.

- Three Layers of Security:

- Static PIN: A user-created PIN adds an extra layer of protection for transactions.

- Biometric Authentication: Optional two-factor authentication using fingerprint or face ID enhances account security.

- One-Time Password (OTP): Required for sensitive actions like logging in or adding new beneficiaries.

- Fraud Detection: Advanced automated systems monitor and flag suspicious activities, enabling swift intervention to protect funds.

- ISO 27.001 Certification: Certified under the globally recognized ISO 27.001 standard, demonstrating a strong commitment to information security and data protection.

- Regulatory Supervision: Operates under the Unidad de Análisis Financiero (UAF) and complies with strict regulations, including the PLAFT system, to prevent illicit activities and ensure transparency.

Global66 implements a variety of security measures to keep your account and information safe with them.

Can I trust Global66?

Global66 is a trusted financial platform that meets stringent regulatory and security standards. Its certifications, memberships, and transparency make it a reliable option for managing international money transfers.

A major aspect of trusting a financial institution entails inspecting their legal and regulatory status in the countries of their operation. When it comes to Global66, we notice the below pertinent information.

- Regulatory Oversight:

- Crime Prevention Certification: Global66 is certified under the Crime Prevention Model, reinforcing its commitment to ethical practices and fraud prevention.

- Membership in Fintech Associations: Fintech Chile, Fintech Perú, and Fintech Colombia: These memberships ensure adherence to best practices and innovative standards in financial technology.

- Secure and Transparent Operations:

- Clear Costs: Global66 displays all fees and exchange rates upfront, ensuring no hidden charges.

- External Audits: Regular external audits validate compliance with international financial standards.

- Responsive Customer Support: Provides accessible support via WhatsApp, help center, and social media to assist with any queries or concerns, ensuring confidence in every transaction.

Global66 is a regulated financial institution in all countries of operation and adheres with strict regulatory standards and guidelines.

How good is Global66's service?

Global66 has quickly grown into a leading financial technology company, offering reliable and user-friendly services for international money transfers. With a focus on security, transparency, and customer satisfaction, consistently delivers high-quality service to its users.

Here are some areas where Global66's service excels:

- Transparency: Provides upfront information on fees, exchange rates, and expected delivery times, eliminating hidden charges and surprises.

- Competitive Exchange Rates: Users benefit from rates close to the mid-market rate, ensuring better value compared to traditional banks.

- Multi-Currency Accounts: Manage and transfer money in up to eight currencies, adding flexibility for global transactions.

- Fast and Reliable Transfers: Many transactions are completed within 24 hours, making Global66 a fast solution for international money transfers.

- Accessibility: Available through a mobile app (iOS and Android) and web platform, provides a seamless experience from anywhere.

- On Trustpilot, Global66 is rated 4.7/5.0 with about 10,000 reviews, highlighting user trust and positive experiences.

- On the Google Play Store, Global66 is rated 4.7/5.0 with nearly 18,300 reviews and more than 1 million downloads, showcasing the app's ease of use and reliability.

- On the Apple App Store, Global66 is rated 4.7/5.0 with about 355 ratings, emphasizing its seamless performance on iOS devices

- Competitive exchange rates and transparent fees.

- Fast and flexible international money transfer options.

- Flexible payment and delivery options.

- High transfer limits that permit sending large amounts.

- A secure platform with multi-layered security features and regulatory compliance.

- Highly performant service with great customer ratings and reviews.

- Low Fees: Transparent pricing ensures no hidden costs.

- Multi-Currency Accounts: Convenient for managing funds in different currencies.

- Fast Delivery: Most Global66 transfers are completed instantly or on the same day.

- Secure Platform: Features like ISO 27.001 certification and three layers of security make Global66 highly safe.

- Excellent Customer Support: Responsive teams are available via WhatsApp, help center, and social media to assist with any questions or concerns.

- 24/7 Accessibility: Operate at any time, any day, ensuring convenience and speed whenever needed.

- Highly Rated by Customers: Consistently excellent evaluations highlight Global66's reliability, speed, and user-friendly platform.

- Peer-to-Peer Transfers (P2P): These are instant and free transfers you can make to other Global66 users. If your recipient has a Global66 account, this is the fastest and most cost-efficient option, as funds are delivered immediately.

- Bank Transfers: For recipients who do not have a Global66 account, you can send money directly to their bank account in over 70 supported countries. Transfers to destinations like Europe, Mexico, and Argentina are instant, while transfers to other countries, including the US, Peru, and Brazil, are typically completed in under 24 hours.

- SWIFT Transfers (USD): Additionally, with SWIFT transfers in USD, you can send dollars to any bank worldwide, providing global reach and flexibility for international financial needs.

- Mobile app: Easily manage your transfers from your iOS or Android device. The app offers a user-friendly interface, allowing you to send money, track transactions, and manage multi-currency accounts anytime, anywhere.

- Website: If you prefer using a desktop or laptop, the web platform provides a seamless experience to initiate and manage transfers with the same functionality and security as the mobile app.

- Step 1: Decide if you want to send your next money transfer with Global66. With the recent explosion of money transfer operators, it may seem daunting to even choose who to go with. One helpful way to reach a decision is to compare various money transfer companies using RemitFinder's real-time money transfer comparison platform. RemitFinder does all the heavy lifting to assist you to easily compare the relative strengths and weaknesses of many remittance companies side by side. This can really help you to narrow down the choices that meet your selection criteria and therefore, help you to select who to go with.

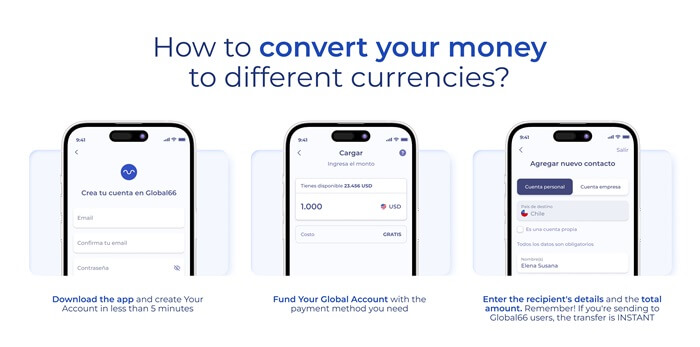

- Step 2: Sign up or log in to your Global66 account. Once you have determined that Global66 is your preferred partner to send money abroad, sign up and log in to your Global66 account through the mobile app or website.

- Step 3: Load funds into your Global66 account. Ensure your account has the necessary balance for the amount you want to send. You can fund your account via a simple bank transfer.

- Step 4: Initiate a new money transfer. Access the "Send" section in the app or platform.

- Step 5: Select type of transfer. Choose the type of transfer: between Global66 contacts, international transfer, or domestic transfer.

- Step 6: Enter transfer amount. Enter the amount you wish to send.

- Step 7: Add recipient details. Select or add the recipient by providing their details, such as name and bank account information.

- Step 8: Review and submit transfer. Review all transaction details to ensure accuracy and confirm the payment to complete the transfer.

- Expatriates, Digital Nomads, and Freelancers: Effortlessly manage cross-border financial needs, from income transfers to settling abroad.

- Investments Abroad: Send funds securely for major investments or purchases in international markets.

- Personal Transfers: Move money between your accounts in different countries and currencies.

- Business Transactions: Pay international suppliers or business partners efficiently.

- Large Value Transfers: Send substantial amounts for major purchases or investments overseas.

- Bank Account: If the sender transfers money to your Global66 account from a bank, a Global66 account number is required to complete the transaction.

- Global66 Account-to-Account Transfers: Between Global66 users, money can be transferred instantly across multiple currencies without requiring a specific account number. This makes it seamless and convenient for users within the platform.

- Referral Program: Invite friends and family to join Global66 using your referral link. Both you and your referred users can enjoy benefits, such as fee-free transfers, credits for future transactions and up to USD 50 in cash prize.

- Global66 Passport Program: For loyal users, Global66 offers the Passport Program, providing tailored benefits such as premium support, personalized offers, and exclusive financial perks.

- Ambassador Program: Join the Global66 Ambassador Program to help promote the platform and earn additional rewards. Ambassadors can receive special incentives for representing and sharing the benefits of Global66.

- WhatsApp Support: Contact the Global66 support team directly through WhatsApp for quick and convenient help.

- Social Media: Global66 is active on social media platforms, allowing users to get assistance or updates through direct messages.

- FAQs: A detailed FAQ section is available on the Global66 website and app addresses common questions and providing clear solutions.

- Help Center: Use the Global66 Help Center to create a support ticket for more complex inquiries. This ensures your case is tracked and handled efficiently by the customer support team.

- Recipient Account Closed: If the recipient's account is no longer active, the transfer will fail, and the funds will be automatically credited back to your Global66 account.

- Incorrect Recipient Details: If the provided account details do not match an existing account, the transfer will not go through, and the funds will be refunded within a few business days. In cases where the incorrect details match an account, additional steps may be required to recover the funds, involving the recipient's bank and Global66.

- Duplicate Transfers: If you accidentally submit the same transfer twice, you can request the recipient to return the duplicate amount.

- Withdraw Funds: Ensure your account balance is zero by withdrawing all funds. This includes balances in any currencies stored in your Global66 account.

- Check Pending Transactions: Verify that there are no pending transfers, charges, or unresolved issues in your account.

- Contact Support: Reach out to Global66 customer support through WhatsApp, help center, or the Help Center to request account deletion.

- Follow the Instructions: The support team will guide you through the final steps to confirm your identity and process your account closure securely.

- Global Supervision: Registered and supervised by the Unidad de Análisis Financiero (UAF) in Chile, ensuring adherence to anti-money laundering (AML) regulations. Complies with the PLAFT system to prevent illicit activities and promote financial transparency.

- Certifications: ISO 27.001 Certified: Demonstrates Global66's commitment to safeguarding customer information with globally recognized standards for information security management. Certified with the Crime Prevention Model, further emphasizing its dedication to secure operations and compliance.

- Memberships: Active member of Fintech Chile, Fintech Perú, and Fintech Colombia, reinforcing its standing as a trusted fintech leader in Latin America.

- Audits: Subject to regular external audits to validate operational integrity and compliance with international best practices.

Another reliable way to check if a service is good or not is to see what other customers have to say about it. We will do the same to see if Global66's customers are happy with their service or not.

What do users have to say about Global66?

In this section, we look into Global66's ratings and reviews^ on popular review platforms and major mobile app stores to see what users think about their service.

^Ratings on various platforms as on February 13, 2025

Global66 has excellent reviews and ratings on Trustpilot as well as mobile app stores. Users seem to like Global66's international money transfer service.

Have you used Global66 yet? If so, please consider leaving a review on RemitFinder so other users can benefit from your expertise and experience.

Is Global66 the best choice for me?

Given our detailed analysis of Global66 international money transfer service and related aspects, it is clear that Global66 has many strengths. Here are some areas where we find Global66 standing tall in the international remittance use case:

RemitFinder likes Global66 for providing competitive exchange rates, fast and affordable transfers, flexible payment and delivery methods, high transfer limits and a reliable service that is well-liked by customers.

Global66 is a great platform for entrepreneurs, digital nomads, freelancers, and travelers, offering a reliable solution for anyone navigating global financial needs with flexibility, ease, and convenience. The platform is available to operate anytime, 24/7, allowing large transfer amounts, ensuring you can manage your finances whenever you need, supported by responsive online customer support.

Designed to provide a seamless experience, Global66 can be your go-to platform for managing global finances effectively and securely.

What are the best reasons to use Global66?

Global66 stands out as a top choice for international money transfers and global financial management due to its combination of speed, transparency, flexibility, and security.

Based on the in-depth analysis that we have conducted on Global66's remittance service in prior sections of this review, we notice that it can be a great fit for many international money transfer scenarios.

Here are some reasons why Global66 can prove to be a reliable ally for your next overseas funds transfer.

Global66's strengths and advantages make it a very good choice for many money transfer scenarios for remitting money out of Africa.

What type of transfers can I make with Global66?

Global66 supports multiple types of international money transfers to suit your needs or those of your recipient. These options provide flexibility, speed, and cost-effective solutions.

You can make the below types of international money transfers with Global66:

Global66 empowers you to send various types of international money transfers that include P2P transfers, bank transfers as well as USD SWIFT transfers.

What are various ways to send money with Global66?

You can place your Global66 international money transfer orders in a variety of ways that include the below options:

How to send and receive money with Global66?

It is quick and easy to send money internationally with Global66. In fact, the whole flow from start to finish can be completed on any of Global66's channels to send money with in just a few minutes. Check out the section below for the exact steps needed to do an overseas money transfer with Global66.

Step by step guide to send money with Global66

With Global66, sending money overseas takes only a few clicks. Here are the steps you need to undertake to finish an end-to-end money transfer with Global66:

The below image captures the overall steps to send an international money transfer with Global66 in an easy to understand infographic.

It is quick and easy to send an international remittance using Global66.

How can Global66 help me send money?

Global66 provides a wide range of tools and resources to help you send money internationally with ease and confidence. Whether you're making your first transfer or managing regular transactions, Global66 offers a secure and user-friendly platform to meet your needs.

With Global66, you can send money overseas for various reasons, such as:

The reasons to send money internationally with Global66 are diverse, but choosing a platform that maximizes the value of your hard-earned money while ensuring the safety of your funds and personal information is essential.

Do I need a Global66 account to receive money?

No, you do not need a Global66 account to receive money abroad.

Global66 enables you to receive money through the following methods:

The recipient of a Global66 money transfer does not need a Global66 account to access the funds. That said, transfers amongst Global66 users are instant; this makes it advantageous for the recipient to have a Global66 account as well.

Does Global66 have a mobile app?

Yes, Global66 offers a mobile app for both Android and iOS devices, available for download on the Google Play Store and the App Store. The app is designed to make managing international money transfers and financial services simple, secure, and accessible anytime, anywhere.

The Global66 mobile app is highly rated by users, with a 4.7/5.0 rating on the Google Play Store from nearly 20,000 reviews and a 4.7/5.0 rating on the Apple App Store.

These ratings highlight its ease of use, competitive exchange rates, and robust security features. The app has also been downloaded more than 1.2 million times in the last year, reflecting its growing popularity among individuals and businesses worldwide.

How do I track my Global66 transfer?

If you want to check the status of a transfer made through Global66, you can view the transaction details in your account's transaction history.

Global66 also provides updates at every stage of the process by sending email notifications to keep you informed about your transfer's progress.

Finally, if you have any questions or concerns about your transfer, the Global66 support team is available via WhatsApp, help center, or social media to assist you.

Can I use Global66 for international bank transfers?

You can use Global66 for international bank transfers by funding your transaction through your local bank account and having the funds delivered directly to your recipient's overseas bank account. This allows you to effectively simulate a traditional international bank transfer with the added benefits of competitive rates and lower fees.

International bank transfers through Global66 offer significant savings compared to traditional banks, which often have higher fees and less favorable exchange rates. Additionally, while Global66 has transactional limits per transfer, you can complete multiple transactions, making it an excellent option for both small and large transfers.

Is Global66 online better than sending money in-person in stores?

Yes, Global66 online is significantly more convenient than sending money in-person at physical stores or agent locations. As an online-first platform, Global66 is available 24/7, allowing you to send money anytime and from anywhere with an internet connection.

Unlike in-person transfers, which often require travel, waiting in line, and operating within business hours, Global66's online platform ensures a seamless, fast, and secure experience.

If you prefer to pay for your transfer with cash, you would need to consider a provider that supports in-person cash payments. However, Global66's focus on digital convenience makes it an excellent choice for users who value flexibility and efficiency.

Global66 money transfers operate digitally and there is no need to go to branch offices or agent locations to send money with them.

Does Global66 have a rewards program?

Yes, Global66 offers a comprehensive rewards program to provide additional benefits for its users. Here's how you can take advantage of it:

These programs are designed to enhance your experience with Global66, making it more rewarding to manage your global financial needs. Stay informed about the latest rewards and opportunities through the Global66 app, website, or social media channels.

What customer support options are available with Global66?

Global66 provides multiple customer support options to ensure users receive assistance whenever needed. These options include:

With these flexible support channels, Global66 ensures users can get assistance promptly and efficiently, making global financial management stress-free.

You can get in touch with the Global66 customer support team in a variety of convenient ways.

Can I cancel my Global66 transfer?

Once a transfer with Global66 has been submitted and is being processed, it generally cannot be reversed. To avoid the need for cancellation, it is crucial to carefully review all details before confirming the transaction.

That said, there are specific scenarios where a cancellation might be possible:

If you need assistance with a cancellation or recovery, contact the Global66 customer support promptly through WhatsApp, or social media. They will review your case and provide guidance on the next steps.

Finally, always double-check all transaction details to minimize the risk of errors or the need for cancellations.

How do I delete my Global66 account?

If you wish to delete your Global66 account, follow these steps to ensure a smooth and secure process:

Global66 may retain certain data for a specific period as required by legal and regulatory requirements, such as compliance with Anti-Money Laundering (AML) regulations. If you may need the service in the future, consider keeping your account active, as re-registering could take time.

Before deleting your account, it is a good idea to download a backup of your transaction history for reference in case you need to access past records later.

Additional Information

Legal and Regulatory Compliance

Global66 operates under strict legal and regulatory standards to ensure safe and compliant financial transactions for its users. Below are some key details about its compliance framework:

By adhering to these stringent legal and regulatory frameworks, Global66 ensures the safety and security of user funds and data across its services. For more information, refer to the terms and conditions available on the official website.