KOHO Detailed ReviewRates, Fees, Limits, Safety and More

Last updated: December 08, 2025

What is KOHO? An introduction

KOHO is a Canadian financial app that lets you send money abroad with competitive rates, no hidden fees, and fast delivery.

KOHO company information

Based in Canada, KOHO lets members send money to 190+ countries using a prepaid Mastercard and a simple mobile app. Transfers and spending updates appear in real time, and the app includes easy tools to track your money.

KOHO is not a bank, but it works with trusted financial institutions to keep member funds secure.

KOHO by the numbers

The below statistics help put KOHO's financial and customer reach and impact in perspective.

- 2+ million members in Canada

- 11+ years in business

- 250 employees

- Launched international money transfers in 2025, to 190+ countries

KOHO is a financial app in Canada that lets you send money overseas to more than 190 countries across the world.

What services does KOHO provide?

KOHO gives you a simple all-in-one money app with:

- A prepaid Mastercard for everyday spending — no credit checks, no foreign transaction fees.

- Fast, low-cost international money transfers to 190+ countries.

- Cash back (up to 2% on groceries, transit, dining + extra rewards with partner merchants).

- High-interest savings up to 3.5% on your balance.

- Smart budgeting tools to track spending and stay on top of your money.

- Credit-building options (rent reporting, secured credit, and more).

- Flexible borrowing (cash advances up to $250 and credit lines up to $15,000).

- Travel perks like a prepaid travel card, eSIM, and optional travel insurance.

KOHO is a financial super app that provides many services like a prepaid card for spending, international money transfers and a host of financial tools to save, budget and build credit.

Which countries does KOHO operate in?

KOHO currently operates exclusively in Canada. Only residents of Canada can open and use a KOHO account.

Where can I send money from with KOHO?

At this time, you can only send money from Canada.

Where can I send money to with KOHO?

KOHO's international money transfer service allows members to send money to India, USA, Mexico, Philippines and 190+ countries in all.

You can send money with KOHO from Canada to more than 190 countries across the world.

What are KOHO's fees and exchange rates?

KOHO offers one of the lowest exchange rates available for the Philippines, India, Pakistan, USA, Mexico and EU, and competitive rates for other countries*.

>*Rates compared to standard rates provided by major banks, excluding promotional, special, and limited-time offers.

Are KOHO exchange rates good?

KOHO uses the live exchange rate for every International Money Transfer and a transfer fee, and no hidden fees.

That said, we always suggest to our readers to always shop around and see what other remittance service providers are offering. More information will help you best choose a partner to send money with. When you compare money transfer providers, the chances of your getting the most benefit on your international money transfers increase significantly.

Whilst you can compare remittance companies manually, a quick and convenient way to do so is to rely on RemitFinder's online money transfer comparison engine. RemitFinder compares umpteen providers side-by-side to give you accurate and updated information about exchange rates and deals.

Is KOHO a cheap way to send money overseas?

KOHO offers fast and secure International Money Transfers with no hidden markups or fees.

How do I avoid KOHO fees?

There are no hidden fees with KOHO, and you can reduce or eliminate certain fees with KOHO by:

- Comparing transfer methods: Some payout types may cost less than others. For example, bank transfer may be cheaper than cash pickup.

- Sending larger, less frequent transfers to reduce total fee impact.

- Checking FX timing: Rates can fluctuate, and sending when the CAD is stronger may save you money.

How much money can I send with KOHO?

You can send up to $5,000 CAD daily, and up to $15,000 CAD monthly*.

*Account specific limits and restrictions may apply.

KOHO allows you to send up to CAD 5,000 every day, and CAD 15,000 every month via international money transfers.

How long does it take for KOHO to send money overseas?

It depends on where you are sending money, but most transfers to countries like the Philippines, India, and Pakistan, arrive in minutes to a few hours.

Other destinations usually take 1-2 business days.

KOHO always shows you the estimated arrival time before you transfer.

Most KOHO money transfers finish with a few hours, with the rest taking up to 2 business days.

How can I pay for my KOHO money transfer?

To be able to complete an international money transfer, you first need to send your funds in local currency to the money transfer company you choose. The mechanism to pay for your remittance transaction is called a payment method.

You will need to fund your KOHO wallet to pay for your money transfers. The good news is that it is very easy to add funds to your KOHO wallet; here are a few easy methods to add money to your KOHO wallet.

- e-Transfers

- Debit Card

- Direct Deposit

- Cash Deposit

You will need to add money to your KOHO wallet to fund your international money transfers. KOHO provides many convenient ways to fund your KOHO wallet.

Which payment method should I use to pay for my KOHO money transfer?

We generally recommend direct deposit to fund your KOHO wallet since it is usually free within Canada. This way, you can avoid any potential fees to load your KOHO wallet.

How can my recipient get paid with KOHO?

The method you choose to credit your overseas receiver is generally called a delivery method.

KOHO recipients typically receive funds by direct bank deposit, with other payout options available in certain countries if needed.

Which delivery method should I use for my KOHO money transfer?

We recommend using direct bank deposit as it usually comes with the lowest possible fees. Plus, your recipient gets the money directly into their local bank account in their country.

Are there any KOHO coupon codes or promotions I can use?

KOHO does not currently offer international money transfer specific promo codes. Any active offers will appear in the app.

One attractive way to earn cash awards is by referring your friends to KOHO.

If you refer a friend to KOHO and they sign up and make a purchase of at least CAD 20 within 30 days of signing up, you can earn up to CAD 100 cash award if you are on a KOHO paid plan. If you are not on a KOHO plan, you will get CAD 20 cash award.

To refer your friends to KOHO, simply get your unique referral code from the KOHO app and share it with your friends.

If KOHO runs any offers or promotions in the future, we will add them on this page. Check this KOHO review periodically to ensure that you do not miss out on any future deals.

Whilst you can check for KOHO deals and discounts manually, doing so is time consuming. A better way is to sign up for the RemitFinder daily exchange rate alert. Our daily alert is totally free of cost; we will keep you posted on exchange rates and latest offers from many money transfer companies.

How can I find KOHO near me?

KOHO is an online app so there are no branch offices or agent locations to go to. Simply use KOHO on your mobile phone or computer for 24x7 access.

What is the best way to find a KOHO Sending Location near me?

You do not need to go to a KOHO location as KOHO is available online on your phone and computer.

What is the best way to find an KOHO Payment Location overseas?

KOHO recipients typically receive money directly into their bank account so there is no need to go to a local payment location to pick up cash.

Is KOHO a safe way to send money abroad?

KOHO has many measures in place to ensure the safety and security of their customers' funds and personal information.

KOHO uses standard cybersecurity tools like encryption, firewalls, and 24/7 monitoring to help keep your account and international money transfers safe. All data sent through the app is encrypted, and sensitive information stored by KOHO uses AES-256 protection to prevent unauthorized access.

KOHO also partners with regulated, CDIC-member banks to hold funds, offers Mastercard Zero Liability protection, and uses secure login tools like biometrics and two-factor verification.

The company follows Canadian regulations through FINTRAC registration and independent audits such as SOC 2 and PCI DSS.

Together, these measures help protect your money, your data, and your account activity when using KOHO.

Can I trust KOHO?

KOHO is considered generally reliable from a security and regulatory perspective. It partners with federally regulated, CDIC-member financial institutions to hold member funds, and it follows Canadian requirements for fraud monitoring, data protection, and financial compliance.

Keep in mind, KOHO is not a traditional bank, so it is important for members to understand how its structure works, when CDIC coverage applies, and that international money transfers are not covered by deposit insurance.

As with any financial service or third-party transfer service, you should review fees, timelines, and policies to ensure it fits your needs.

KOHO implements a variety of security practices and protocols in a bid to keep your money and information safe with them.

How good is KOHO's service?

KOHO is highly rated by users, with a 4.8/5 score on the iOS App Store (82,000+ ratings).

International Money Transfer via KOHO offers fast delivery, competitive FX rates with no hidden markups, and real-time tracking in the app. Transfers are handled through regulated financial partners, giving users a secure and reliable way to send money to 190+ countries.

One of the most reliable ways to check if a service is good or not is to see what other customers have to say about it. We will do the same to see if KOHO's customers are happy with their service or not.

What do users have to say about KOHO?

In this section, we look into KOHO's ratings and reviews^ on popular review platforms and major mobile app stores to see what users think about their service.

- On Trustpilot, KOHO is rated 1.4/5.0 with 497 reviews

- On the Google Play Store, KOHO is rated 4.7/5.0 with 71.5K reviews and more than 1 million downloads

- On the Apple App Store, KOHO is rated 4.8/5.0 with 82K ratings

^Ratings on various platforms as on December 06, 2025

KOHO has excellent ratings and reviews on both Google Play and Apple Store for its mobile apps. Mobile users seem to like KOHO. Trustpilot reviews, however, are on the lower side.

Have you used KOHO yet? If so, please consider leaving a review on RemitFinder so other users can benefit from your expertise and experience.

Is KOHO the best choice for me?

Given our detailed analysis of KOHO international money transfer service and related aspects, it is clear that KOHO has many strengths. Here are some areas where we find KOHO standing tall in the international remittance use case:

- 190+ countries supported: With service in India, USA, Mexico, Philippines and 190+ countries, KOHO offers its members a wide range of global destinations.

- Competitive exchange rates: KOHO uses live exchange rates, which offers better value compared to other services that add extra markups.

- No markups or hidden fees: With KOHO, the price you see is the price you pay, so more of your money arrives at its destination.

- Quick delivery times: Many transfers arrive in under 30 minutes, and you can track the status in real time through the KOHO app.

- Other useful financial services: KOHO is a financial super app that provides you many more services in addition to international money transfers. Some of these include a prepaid Mastercard, cash back on spending, interest on savings balance, and many useful budgeting tools.

- Generous sending limit: With KOHO, you can send up to CAD 5,000 daily and CAD 15,000 monthly. This allows you to send higher amounts if needed.

- Flexible payment methods: With KOHO, you pay for your money transfer with your KOHO wallet, which you can fund in many flexible ways that include e-transfer, debit card, direct deposit and even cash.

RemitFinder likes KOHO for providing comprehensive corridor support, competitive exchange rates, fast transfers, higher sending limits, flexible payment methods and numerous other financial products and services in the KOHO platform.

KOHO is a strong choice if you want to send money abroad quickly and affordably.

You can transfer to 190+ countries with no hidden fees, competitive exchange rates, and delivery that often arrives within 30 minutes. Everything happens in the KOHO app, giving you a simple, secure way to move money to family, friends, or services overseas.

What are the best reasons to use KOHO?

KOHO's key advantages make it a very good choice for quite a few international money transfer use cases. Based on the in-depth analysis that we have conducted on KOHO's remittance service in prior sections of this review, we notice that it can be a great fit for many international money transfer scenarios.

Here are some examples where KOHO can prove to be a reliable ally for your next overseas funds transfer.

- If you are a Canadian resident who wishes to send money abroad, KOHO might be a strong fit as it has coverage for more than 190 countries all over the world.

- KOHO is a financial super app that helps you spend, send, save and track your money. If you want to consolidate your financial needs in a single app, KOHO is a very good fit.

- Most KOHO money transfers finish in less than 30 minutes. This makes KOHO a great fit for scenarios when you need to rush money to someone for urgent needs.

- KOHO lets you fund your account in many flexible ways. This makes it convenient for you to get money into your KOHO account easily and quickly.

- If you are worried about security and safety, the good news is that KOHO implements numerous security best practices and safety protocols in a bid to keep your money and information safe.

- If you wish to send larger amounts to overseas recipients, KOHO might be a good partner to lean on. Currently, you can send CAD 5,000 daily and CAD 15,000 monthly.

KOHO's strengths and advantages make it a very good choice for many money transfer scenarios for remitting money abroad from Canada.

What type of transfers can I make with KOHO?

KOHO supports three main types of transfers:

- International money transfers: Send money from Canada to over 190 countries through KOHO's remittance partners.

- Interac e-Transfers within Canada: You can send or receive money from most Canadian bank accounts.

- KOHO-to-KOHO transfers: Instant transfers between KOHO users.

Through a KOHO account, members can also make purchases and bill payments.

KOHO lets you send international money transfers, Interac e-Transfers within Canada as well as instant transfers to other KOHO users.

What are various ways to send money with KOHO?

You can place your KOHO international money transfer orders in a variety of ways that include the below options:

- KOHO website

- KOHO Android app for Android devices

- KOHO iOS app for Apple devices

How to send and receive money with KOHO?

It is quick and easy to send money internationally with KOHO. In fact, the whole flow from start to finish can be completed on any of KOHO's channels to send money with in just a few minutes. Check out the section below for the exact steps needed to do an overseas money transfer with KOHO.

Step by step guide to send money with KOHO

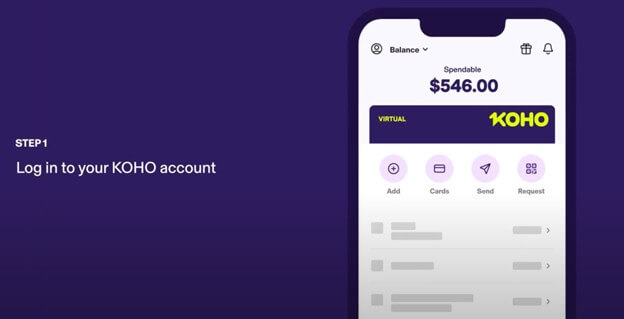

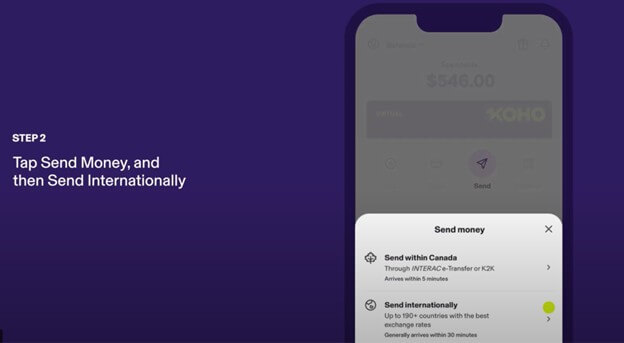

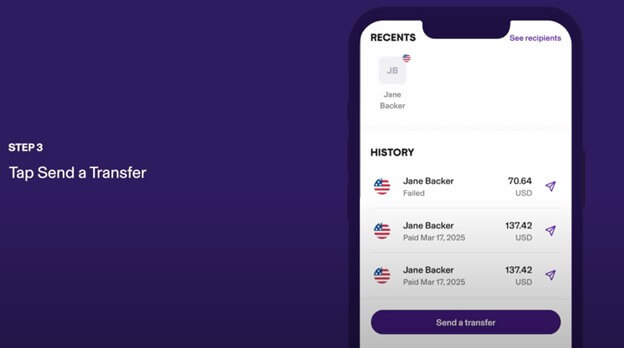

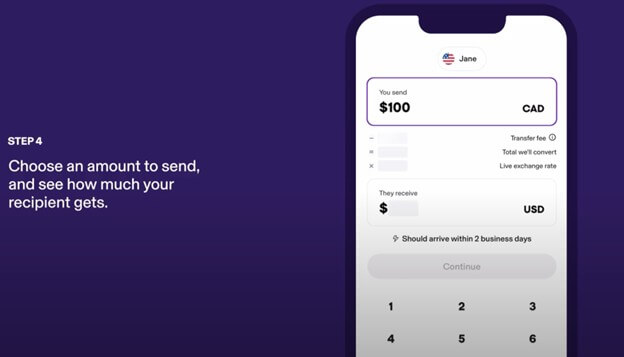

With KOHO, sending money overseas takes only a few clicks. Here are the steps you need to undertake to finish an end-to-end money transfer with KOHO:

- Step 1: Decide if you want to send your next money transfer with KOHO. With the recent explosion of money transfer operators, it may seem daunting to even choose who to go with. One helpful way to reach a decision is to compare various money transfer companies using RemitFinder's real-time money transfer comparison platform. RemitFinder does all the heavy lifting to assist you to easily compare the relative strengths and weaknesses of many remittance companies side by side. This can really help you to narrow down the choices that meet your selection criteria and therefore, help you to select who to go with.

- Step 2: Log in into your KOHO account. Once you have decided that you want to use KOHO for your next international money transfers, create your KOHO account and log in.

- Step 3: Access send money option. Tap Send Money, then tap Send internationally.

- Step 4: Start a new money transfer. Now tap, "Send a transfer" to start a new international money transfer.

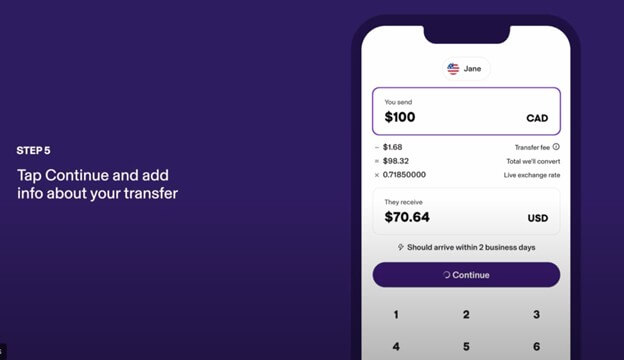

- Step 5: Enter transfer amount. Enter how much money you wish to send. The KOHO app will show you how much your recipient gets.

- Step 6: Click on Continue. Tap on Continue to progress to the next step.

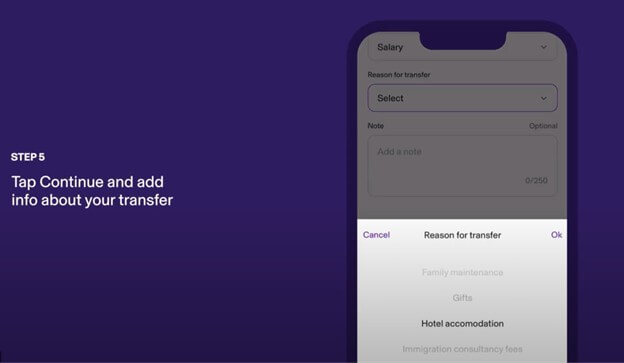

- Step 7: Add info about your transfer. Next, select a reason for your money transfer.

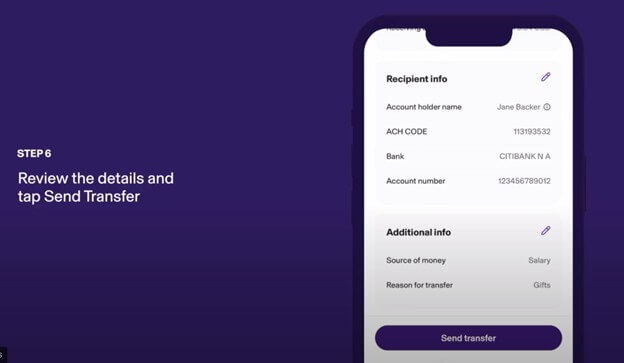

- Step 8: Review and send transfer. Now, review the details to ensure everything looks OK. If you need to make any changes, do so and once you are satisfied with everything, click on "Send transfer".

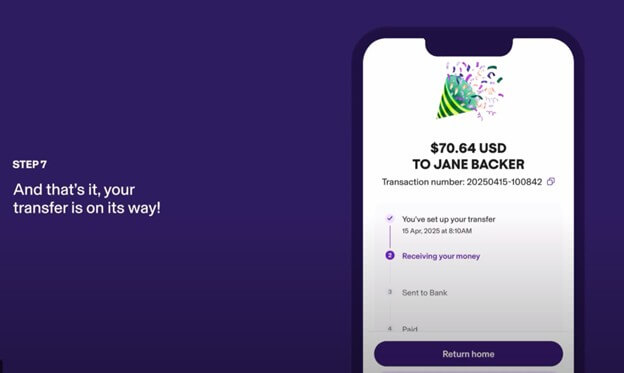

- Step 9: Money transfer initiated. Your transfer is on its way. KOHO will keep you posted on the status on your money transfer.

It is quick and easy to send money internationally with KOHO. The whole process only takes a few clicks and is easy to follow.

How can KOHO help me send money?

KOHO supports several transfer types:

- International money transfers / remittances: Send money abroad from Canada to 190+ countries worldwide.

- Domestic transfers within Canada using Interac e-Transfer: Send or receive money to/from other Canadian bank accounts via email or phone number.

- Instant transfers to other KOHO members: KOHO-to-KOHO, or "K2K" member-to-member transfers.

Do I need a KOHO account to receive money?

No, your overseas recipient does not need a KOHO account to receive the money you send to them. This is because your recipient will simply receive the money in their local bank account.

KOHO members in Canada cannot accept international money transfers at this time. Members are able to receive money in Canada via Interac e-Transfer.

Does KOHO have a mobile app?

Yes, KOHO is a mobile-first service, and all international money transfers can be sent quickly and securely through the KOHO app.

The app makes it easy to check fees upfront, track your transfer in real time, and manage your account from anywhere.

How do I track my KOHO transfer?

KOHO provides real-time tracking for international transfers; as soon as you send, you can monitor the status through the app.

Can I use KOHO for international bank transfers?

Yes. To send a transfer, you will need an eligible KOHO plan, a funded account, and a completed photo-ID verification. Once verified, you can send money directly from the KOHO app to bank accounts in 190+ countries.

Is KOHO online better than sending money in-person in stores?

For many people, KOHO is more convenient than sending money in person.

You can transfer directly from your phone without travel or wait times, and KOHO shows fees and exchange rates upfront so you always know the cost before you send.

Whether it is better depends on your needs, but the digital experience is often faster and more transparent than traditional in-store services.

KOHO is a mobile first financial app, and you can send money directly through their mobile app. You do not need to go into stores or agent locations to send money with KOHO.

Does KOHO have a rewards program?

If you refer a friend to KOHO and you can earn up to $100, while your friend gets 3 free months of the Everything plan. The more people you invite, the more you can earn.

KOHO also offers cash back on everyday spending of up to 2% on groceries, transit, dining + extra rewards with partner merchants).

What customer support options are available with KOHO?

In case you need any help with your KOHO money transfer, or have any other general questions, you can contact the KOHO customer support team.

KOHO offers support directly through the app and via its website, so members can get help with money transfers, account questions, or general issues quickly and without needing to call or visit a branch.

Can I cancel my KOHO transfer?

KOHO does not guarantee cancellation of international money transfers once you confirm and send your money transfer.

Before sending, it is, therefore, recommended that you review the rate, fees and delivery; but once sent, funds leave your account and cannot be refunded.

How do I delete my KOHO account?

To close your KOHO account, you need to ensure their account balance is $0 and then connect with customer service on the app.

Additional Information

Legal and Regulatory Compliance

KOHO is not a traditional bank, but it follows Canada's financial rules by working with federally regulated, CDIC-member institutions that hold customer funds in trust. Eligible deposits may be protected up to $100,000 through those partner banks.

KOHO uses industry-standard security, encryption, and fraud monitoring to protect accounts, and because it issues a prepaid Mastercard, it must also follow Mastercard's rules as well as Canadian AML and FINTRAC requirements. To learn more about KOHO, visit their website.

Awards, Prizes and News

KOHO was ranked #2 in Deloitte's 2025 Technology Fast 50, an annual program that recognizes Canada's fastest-growing and most innovative tech companies, marking KOHO's third year in a row on the list.