Key Currency Detailed ReviewRates, Fees, Limits, Safety and More

Last updated: August 12, 2023

What is Key Currency? An introduction

Key Currency company information

Key Currency is a money transfer specialist with a human touch. Unlike banks and apps, Key Currency gives their customers a personal service. They discuss all aspects of the money transfer process including help getting started, setting up your beneficiaries, discussing exchange rates and the right time to carry out your transfer.

Key Currency provides a one-to-one service so when a customer calls, they always speak to the same person. It saves a lot of time and hassle as you will not get passed around to a different person every time and have to explain who you are and what you are looking to do.

Key Currency was started in 2014 with its head office located in Truro, Cornwall, which you might think is unusual for a financial business.

But it comes with advantages. As Key Currency has lower operating overheads than the big banks and London-based currency brokers, they can pass on those savings to you; their customers. Ultimately, Key Currency customers come to them for value for money and great service.

Another differentiating feature of Key Currency is that they are an independent, privately-owned currency broker. Their directors own and run the business. That means the way they operate is fundamentally different.

These days, most other money transfer companies are distancing themselves from their customers. What you end up with is a business run by spreadsheets. Customers become account numbers. And staff become headcount. Its why things go wrong and customers end up disappointed.

Key Currency provides a strong focus on customer service by dedicating an account manager to every single customer to ensure smooth processing of their money transfers and remittances.

Key Currency works by making sure they have good people with experience and enthusiasm for what they do. Their directors are sat within the business and take a hands-on and personalized approach to their customers and staff.

Key Currency by the numbers

Here are some interesting statistics about Key Currency that help put some perspective around their money transfer operations and scale.

- 780,000 site visitors a year

- 40,000 customers since inception

- 39 currencies available to transfer from and to

- 9 years in the currency business

What services does Key Currency provide?

Key Currency predominantly serves private customers by providing international money transfers and remittance services.

Their one-to-one service is a key attraction of their overall product offering. They do not pass you round from person to person, and help you through the entire process and work with you to achieve a better exchange rate.

Key Currency provides international money transfers with a focus on one-to-one personalized service for their customers.

Which countries does Key Currency operate in?

Key Currency is headquartered in the UK and has offices throughout Spain and in Australia. Using their international remittance services, you can send money to and from several global destinations.

Where can I send money from with Key Currency?

With Key Currency, you can send money from any of the below countries:

- Australia

- Austria

- Belgium

- Canada

- China

- Costa Rica

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Georgia

- Germany

- Greece

- Guernsey

- Hong Kong

- Hungary

- Ireland

- Isle of Man

- Italy

- Japan

- Jersey

- Liechtenstein

- Lithuania

- Luxembourg

- Macedonia

- Malaysia

- Maldives

- Monaco

- Netherlands

- New Zealand

- Norway

- Poland

- Portugal

- Puerto Rico

- Qatar

- Romania

- Singapore

- Slovakia

- Slovenia

- South Africa

- South Korea

- Spain

- Sweden

- Switzerland

- Taiwan

- United Arab Emirates

- United Kingdom

- United States

- Uruguay

- US Virgin Islands

Where can I send money to with Key Currency?

With Key Currency, you can send money to any of the below global destinations:

- Australia

- Austria

- Belgium

- Canada

- China

- Costa Rica

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Georgia

- Germany

- Greece

- Guernsey

- Hong Kong

- Hungary

- Ireland

- Isle of Man

- Italy

- Japan

- Jersey

- Liechtenstein

- Lithuania

- Luxembourg

- Macedonia

- Malaysia

- Maldives

- Monaco

- Netherlands

- New Zealand

- Norway

- Poland

- Portugal

- Puerto Rico

- Qatar

- Romania

- Singapore

- Slovakia

- Slovenia

- South Africa

- South Korea

- Spain

- Sweden

- Switzerland

- Taiwan

- United Arab Emirates

- United Kingdom

- United States

- Uruguay

- US Virgin Islands

In this way, Key Currency supports about 5700 country combinations to send and receive money internationally.

Below is a list of supported currencies that you can buy and sell using the Key Currency FX platform:

- GBP

- EUR

- USD

- AED

- AUD

- CAD

- CHF

- DKK

- HKD

- NOK

- PLN

- SAR

- SEK

- SGD

- ZAR

- NZD

- THB

- JPY

- HUF

- CZK

Key Currency supports about 5700 country combinations to send and receive money in more than 20 global currencies.

What are Key Currency's fees and exchange rates?

Key Currency provides highly competitive exchanges rates on their international money transfers.

You will generally see them in the top few options on RemitFinder, thereby showing that their exchange rates are good. This is great as your money goes farther by putting in more funds in your overseas recipient's pocket.

Key Currency is also happy to beat genuine quotes from other providers, thereby offering you a better exchange rate for your international remittances.

Note that Key Currency exchange rates are dependent on transaction size. In general, the more money you send in a single transaction, the better the exchange rate that you will get.

Finally, one of the best parts about Key Currency is that there are no transfer fees regardless of transfer size.

Key Currency provides highly competitive exchange rates and charges 0 transfer fees regardless of the transaction size.

Are Key Currency exchange rates good?

Yes, Key Currency exchange rates are highly competitive and they aim to offer great value for money with personalized service – something few other providers can do.

That said, we always suggest to our customers that they compare providers and see what other money transfer companies are offering before choosing a company to send money with. Comparing money transfer providers will help you to get the most optimal return on your international remittances.

The easiest way to compare various remittance service providers is to use RemitFinder's online remittance comparison engine. Simply enter your from and to country, and the amount you want to send, and RemitFinder will show you exchange rates from umpteen remittance companies. An easy-to-follow comparison format will help you choose the best company for your money transfer needs.

Is Key Currency a cheap way to send money overseas?

Yes; unlike banks and other money transfer apps, Key Currency does not charge any fees, thereby reducing the cost for their customers.

Key Currency will quote you an exchange rate and that includes the cost of their service. Not other charges are added. That way you can know exactly how much money you will receive.

How do I avoid Key Currency fees?

There are no transfer fees when you send money with Key Currency. They are one of the few providers to charge no fees regardless of trade size.

How much money can I send with Key Currency?

Key Currency has no limits on the amount of money you can send overseas with them in a single transaction.

As long as Key Currency can verify the customer as per their compliance procedures, they do not limit the amount you can send abroad using their money transfer services.

How long does it take for Key Currency to send money overseas?

The speed of your money transfer with Key Currency generally depends on the destination. Most payments reach the destination bank account in 1-3 working days.

How can I pay for my Key Currency money transfer?

When you send money abroad, the way you choose to fund your remittance transaction is called a payment method.

Key Currency accepts payment via bank transfer. This means that you will need to provide funds in the source currency to Key Currency via a local bank transfer in your country.

Which payment method should I use to pay for my Key Currency money transfer?

You can pay for your Key Currency money transfer via a local bank transfer in your source currency. Simply wire or direct debit your funds to Key Currency and they will take care of your international money transfer.

How can my recipient get paid with Key Currency?

A delivery method in an international money transfer transaction is how you choose to payout the money to your overseas recipient.

Key Currency sends your funds via the international banking network. You just need to provide them with your destination bank account details and the funds will be credited to your overseas recipient's bank account directly.

Which delivery method should I use for my Key Currency money transfer?

Key Currency supports bank transfers as their preferred delivery option. When you start your money transfer with them, simply provide the bank information for your overseas recipient.

Are there any Key Currency coupon codes or promotions I can use?

Key Currency generally does not offer promotional codes or coupons. This is because their aim is to provide all customers with great value for money.

In case that changes and Key Currency provides any promotions in the future, we will add them on this page. Make sure to check this review from time to time to stay updated with any potential Key Currency offers and discounts.

Another great way of staying up to date with offers and discounts from money transfer companies is by registering for the RemitFinder daily exchange rate alert. It is completely free of cost, and we will keep you posted about the latest exchange rates and offers from numerous money transfer providers.

How can I find Key Currency near me?

Key Currency generally speaks to all of their customers and sends all the trade documentation via email.

If you wish to work with someone in person, you can visit their offices in the UK or Spain. That said, it is normally a lot more convenient to speak to a member of their team on +44 01872 487 500.

Key Currency is available online 24x7 to create an account, and someone will assist you during business hours with your money transfer. There is generally no need to go to Key Currency's office.

What is the best way to find a Key Currency Sending Location near me?

Since Key Currency is an online money transfer company, there is no need to look for any branches or offices near you to send international remittances with them. You can send money with Key Currency anytime by starting a transfer via their website.

What is the best way to find a Key Currency Payment Location overseas?

Since Key Currency moves funds abroad digitally by relying on the international banking network, your recipient does not need to go to any physical location to pick up the money you send to them. Funds will simply be credited directly into the overseas bank account of your recipient.

Is Key Currency a safe way to send money abroad?

As Key Currency deals with peoples' hard-earned money, they know trust and transparency are incredibly important. Below are some methods that Key Currency employs to make it safe to transact on their system:

- Key Currency implements Know Your Customer (KYC) guidelines when you sign up with them. As part of the KYC verification process, you will need to provide your full name, address, and relevant photo identification. Based on all this data, Key Currency does a verification check for you. This ensures that you are transacting on your behalf and no one else is trying to create an account for you.

- Key Currency uses SSL certificates to ensure their website is secure and data is protected.

- Key Currency implements account safeguarding whereby customer funds are kept separate from Key Currency's own funds. This ensures that your money is safe in case Key Currency becomes insolvent.

- Key Currency has been in the international money transfer service for more than 9 years and has served tens of thousands of customers. A long history of money transfers helps validate the security of their platform.

Key Currency implements various security practices to try to keep your money and information safe and secure.

Can I trust Key Currency?

A big part of being able to trust a money transfer company is to check if they are regulated by popular financial watchdog institutions and comply with regulatory standards. When we checked Key Currency's legal and regulatory information, we notice the below:

- Key Currency Limited is a registered company in England and Wales with company registration no. 09603083.

- Key Currency Limited is authorized and regulated by the Financial Conduct Authority (FCA) as an Authorized Payment Institution (Financial Services Register no. 753989).

- Key Currency SL, a subsidiary of Key Currency Limited, is registered with the Bank of Spain (registration no. 6912).

- For its US services, Key Currency partners with The Currency Cloud Inc. which is registered with FinCEN (MSB Registration Number: 31000206794359).

Key Currency is a regulated and authorized company in various countries they operate in. Their payment partners like The Currency Cloud are also registered and regulated companies.

How good is Key Currency's service?

Key Currency provides an award-wining service, having won 8 industry awards since inception. A vital part of their service is that you can speak to the same person every time you call. Continuity of service makes them a great option.

What do users have to say about Key Currency?

Another good way to check if a service is good or not is to see what other customers have to say about it. Let us check and see if customers are happy with Key Currency or not by looking at their ratings and reviews^ on popular platforms to see what users think about their service.

- Key Currency is rated Excellent on Trustpilot with a 4.9/5.0 rating and has almost 1600 reviews

^Ratings on various platforms as on August 12, 2023

Key Currency has an excellent Trustpilot rating of 4.9 with almost 1600 reviews. Customers seem to like Key Currency's money transfer services.

Have you used Key Currency yet? If so, please consider leaving a review on RemitFinder so other users can benefit from your expertise and experience.

Is Key Currency the best choice for me?

There are quite a few benefits to use Key Currency to send money internationally. Given our in-depth analysis of Key Currency's money transfer service, we find it to be strong in the below aspects:

- Wide corridor coverage: Key Currency provides money transfers between about 5700 country combinations. This ensures a wide coverage that you may be able to take advantage of for your next money transfer.

- Competitive exchange rates: Key Currency offers highly competitive exchange rates. The rate gets even more better if you send higher value transfers.

- 0 transfer fees: Key Currency does not charge any fees on their international money transfers regardless of the amount you send. This will help you save even more money and maximize the amount your overseas recipient gets.

- No transfer limits: With Key Currency, there is no limit to the amount of money you can send overseas. Note that there may be legal or compliance limits for some countries, but Key Currency does not enforce any upper limits on money transfers.

- Fast money transfers: Most Key Currency money transfers will finish within 1-3 business days since they rely on the international banking networks.

- Great customer feedback: Key Currency has excellent ratings on Trustpilot. This suggests that their money transfer service is well liked by customers.

RemitFinder likes Key Currency for providing a wide corridor coverage, competitive exchange rates, 0 transfer fees and having excellent Trustpilot ratings and reviews.

What are the best reasons to use Key Currency?

Key Currency's strengths make it a very good option many international remittance use cases and scenarios. Given our detailed analysis of Key Currency's money transfer service in this review, we find it to be a good fit for many international money transfer needs.

Below, we present some examples where Key Currency may be a good partner for your next overseas money transfer.

- If you wish to pay no transfer fees on your international money transfers, Key Currency can be a great choice since their transfers are totally free. This is regardless of the amount of money you send with them.

- If you want to get highly competitive exchange rates for your overseas funds transfers, you can take advantage of Key Currency. The more money you send with them, the better the exchange rate that you get.

- If you want to deal with a trusted provider that has been in the business for a while, Key Currency can be a good choice. They have been around for more than 9 years and have excellent Trustpilot ratings.

- If you wish to send large amounts of money abroad in a single transaction, Key Currency can help since they do not enforce any upper limits on how much money you can send with them. This is a great fit for cases like overseas property purchase or paying off a loan or making investments, etc.

- In case you prefer to only deal with bank transfers and deposits, Key Currency is ideal since they only accept bank payments and pay recipients directly into their bank accounts as well.

Key Currency can be a good partner for many popular international money transfer needs and scenarios.

Key Currency offers the best of both worlds - great service and great rates. Banks will charge you an arm and a leg for non-personalized service. Even though you can try to do everything yourself by using an app, you can get guidance and help from a money transfer expert by using Key Currency.

What type of transfers can I make with Key Currency?

With Key Currency, you can make international money transfers amongst 5700 country combinations and more than 20 global currencies. You will need to pay for your transfer via a bank account and your overseas recipient will also be credited directly into their bank account.

What are various ways to send money with Key Currency?

You can send money from one bank to another with Key Currency, albeit at great exchange rates and without paying any fees.

How to send and receive money with Key Currency?

Sending money abroad with Key Currency is quick and easy. The whole process can be finished in just a few steps, and the best part is that you will always have access to a dedicated account manager to ensure a smooth transaction.

In the next section, we will list out a step-by-step process to send money with Key Currency.

Step by step guide to send money with Key Currency

Below is an easy-to-follow step-by-step guide that you can use to send money abroad with Key Currency quickly and easily.

- Step 1: Decide if you want to go with Key Currency for your international money transfer. Since there are numerous money transfer companies that you can use to send money overseas, the process of deciding which company to use may seem daunting at first. To take the hassle out of comparing various money transfer companies, you can rely on RemitFinder's online remittance comparison platform. Once you select your source and destination countries and the transfer amount, RemitFinder compares many remittance providers side by side. You can use this information to narrow down your choices and decide which company to go with.

- Step 2: Register an account with Key Currency. Once you have decided that you wish to use Key Currency for your next money transfer, simply register a new account with them. You can register online as well as over the phone. It is quick and easy, and there is no obligation to trade with Key Currency.

- Step 3: Get an exchange rate quote. Simply let Key Currency know which currency pairs you wish to trade as well as the transfer amount, and you will be provided with a quote for your transaction. If you are happy with the quoted amount, you can proceed forward with the money transfer.

- Step 4: Send your funds to Key Currency. Once you are satisfied with the quote provided by Key Currency, simply send your money to a segregated client account via a bank transfer. Your account manager will provide all the details related to where to send the funds to.

- Step 5: Key Currency will send your funds overseas. Once Key Currency receives your payment, they will work on the currency conversion and send your funds out to the recipient's bank account in their local currency.

It is quick and easy to send money abroad using Key Currency. Your dedicated account manager is always there to help you along the whole process.

The below infographic captures the end-to-end money transfer process with Key Currency in a picture format.

How can Key Currency help me send money?

One of the best aspects of Key Currency is that they offer personal help and assistance for your international money transfer from start to finish.

Your dedicated Key Currency account manager will help you along on every step of the complete transaction. You can ask them questions at any time and get all the help you need to finish your transaction.

Do I need a Key Currency account to receive money?

Your overseas recipient does not need a Key Currency account to receive the money you send to them via Key Currency's international money transfer service.

Key Currency specializes in international money transfers. These are bank-to-bank payments, so all you need to do is to provide the details of the bank you wish to send the money to, and Key Currency will take care of the rest.

Does Key Currency have a mobile app?

No, Key Currency does not have a mobile app.

Most Key Currency trades are conducted over the phone with a dedicated currency broker who can assist you at every stage of your transfer. They do all the hard work for you, taking the time and hassle away from international money transfers.

How do I track my Key Currency transfer?

Tracking your Key Currency money transfer is very simple and easy. Key Currency will keep you informed at every stage of your transfer both via email and phone.

Can I use Key Currency for international bank transfers?

Yes, you can do international bank transfers using Key Currency. In fact, Key Currency specializes in international bank transfers and that is what they do day-in and day-out.

Simply pay for your Key Currency money transfer via a bank transfer, and provide your overseas recipient's bank details so they can get paid via a direct bank deposit.

In this way, you would end up making an international bank transfer with Key Currency, but at competitive exchange rates and without paying any fees.

Key Currency bank-to-bank transfers happen at competitive exchange rates and no fees thereby making them much better than international wire transfers with banks.

Is Key Currency online better than sending money in-person in stores?

Key Currency does not offer cash remittance transactions that are generally done in-person at stores and agent locations.

With Key Currency, you can only send money online or via the phone by engaging with your account manager.

Does Key Currency have a rewards program?

Key Currency generally does not run any special offers or rewards program. They simply try to just look after all their customers rather than run promotional offers.

What customer support options are available with Key Currency?

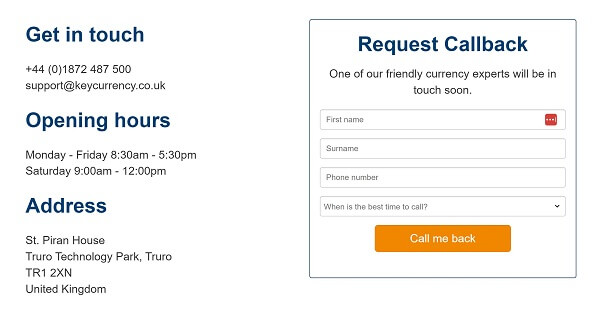

If you need any assistance or have questions, you can get in touch with the Key Currency customer support team in various ways as listed below:

- By calling +44 (0)1872 487 500 over the phone.

- By emailing support@keycurrency.co.uk.

- By filling up a webform on Key Currency website Contact page.

All these options to contact Key Currency customer support team look like the below.

Note that Key Currency customer support is available between 8:30 AM to 5:30 PM Monday-Friday, and 9:00 AM to 12 PM on Saturdays. All times are BST.

You can get in touch with the Key Currency customer support team in a variety of ways that include phone, email, and website contact form.

Can I cancel my Key Currency transfer?

If you think you made mistake in your Key Currency money transfer, contact the Key Currency customer service team immediately. They will the best path forward to try to help you cancel your transaction.

Also, the stage your money transfer is in is important. For Key Currency to be able to successfully cancel your transfer, you must inform them before they buy the destination currency in the wholesale market.

How do I delete my Key Currency account?

If you wish to delete your Key Currency account, get in touch their customer service team. Someone will get back to you to help with your account deletion request.

Before you cancel your Key Currency account, we recommend that you make a backup of your transaction history. Since you will lose access to your Key Currency account after deletion, this will be useful in case you need to reference your money transfers in the future.

Additional Information

Legal and Regulatory Compliance

Below is Key Currency's regulatory and compliance information for various countries they operate in:

- Key Currency Limited is a registered company in England and Wales with company registration no. 09603083.

- Key Currency Limited is authorized and regulated by the Financial Conduct Authority (FCA) as an Authorized Payment Institution (Financial Services Register no. 753989).

- Key Currency SL, a subsidiary of Key Currency Limited, is registered with the Bank of Spain (registration no. 6912).

- For its US services, Key Currency partners with The Currency Cloud Inc. which is registered with FinCEN (MSB Registration Number: 31000206794359).

Deals

Reviews

This is a good app.