MoneyMatch Detailed ReviewRates, Fees, Limits, Safety and More

Last updated: August 14, 2022

What is MoneyMatch? An introduction

MoneyMatch company information

MoneyMatch Sdn Bhd is a Malaysian start-up headquartered in Kuala Lumpur, Malaysia. Founded in 2015, MoneyMatch was accepted into one of Malaysia's most reputable Accelerator programs, the Cyberview Living Labs Accelerator in collaboration with tech accelerator Watchtower and Friends (WTF), in the same year.

MoneyMatch graduated from the program in 2017 and it officially launched its international transfer platform. In doing so, MoneyMatch was among the first batch of fintech start-ups enrolled into the Central Bank of Malaysia's Financial Technology Regulatory Sandbox Framework launched by Bank Negara Malaysia. The company successfully graduated in 2019 and obtained a Class B remittance license under the Money Service Business division of the Central Bank of Malaysia.

MoneyMatch went on to become the first Malaysian-born company to launch a fully electronic know-your-customer (eKYC) onboarding process through its mobile application. This paved the way for an end-to-end digital platform that empowers convenient, secure and transparent cross-border transactions, versatile enough to be used by individuals and corporations around the world.

MoneyMatch is redefining the financial ecosystem to enable seamless, instant and low-cost cross-border money transfers. The company's award-winning digital transfer platform allows customers to send money to over 110 countries and across 40 currencies to serve individuals, businesses of all sizes, and enterprises, locally and globally. Since its inception, MoneyMatch has transacted a total volume exceeding MYR 3.5 Billion as of March 2022 and is set to further expand its product offerings into other financial sectors.

MoneyMatch lets you send money to more than 110 countries in over 40 global currencies, and has handled more than MYR 3.5 Billion in money transfers.

MoneyMatch's tagline, 'Rethinking Finance', seeks to encourage conducting financial transactions via innovative and unconventional means.

MoneyMatch by the numbers

Below are some statistics that help capture MoneyMatch's business and impact in a numeric fashion:

- Founded in 2015

- Launched international remittance platform in 2017

- Allows sending money to more than 110 countries

- Supports sending to 40 global currencies

- Facilitated money transfers worth MYR 3.5 Billion as of March 2022

- More than 28,000 registered users

What services does MoneyMatch provide?

MoneyMatch provides the below products and services geared towards both individual and business customers:

- International money transfers for individuals

- International money transfers for businesses

- A variety of insurance products for small to medium enterprises (SMEs)

Starting as a P2P (peer-to-peer) exchange platform that enabled the buying and selling of currency for travelers, MoneyMatch today is an award-winning digital transfer platform enabling digital and financial inclusion, allowing its customers to seamlessly make international payments at a significantly lower cost.

Lower transaction fees and cost-efficient foreign exchange rates translate into improved profitability and gains that customers can use to power growth and expansion. Over the years of operating within the payments space, MoneyMatch developed its strategic niche within the B2B (business-to-business) payments space, and this has proven to be valuable as the company's bespoke solutions center around the idea of relieving the operational and financial burdens of small and medium enterprises (SMEs).

MoneyMatch serves commercial customers in various business operations, and is expanding its offerings to include shariah-compliant financing, corporate insurance and fund transfer to e-wallets abroad, all to ease the administrative burdens of SMEs.

MoneyMatch aims to provide international payments as well as insurance products to individual as well as SME customers.

MoneyMatch's philosophy inspires a drive to democratize the financial services ecosystem through a genuinely advantageous product which is efficient and convenient for the benefit of users.

Which countries does MoneyMatch operate in?

MoneyMatch started in Malaysia, but over time, they have expanded into additional markets. Today, MoneyMatch operates in multiple countries; let us see below the countries and currencies that they support.

Where can I send money from with MoneyMatch?

With MoneyMatch, you can send money from Australia, Brunei and Malaysia. This means customers in those countries can send their money transfers in the following 3 currencies:

- Australian Dollar (AUD)

- Brunei Dollar (BND)

- Malaysian Ringgit (MYR)

Where can I send money to with MoneyMatch?

MoneyMatch allows you to send money to over 110 countries worldwide and across 40 currencies.

MoneyMatch's supported destination countries are spread across all major continents of the world. For all of the receiving countries, you can send money in the native currency of that country. So, for example, if you were sending money from Malaysia to India, your recipient will get paid in India Rupees (INR).

For some countries, MoneyMatch also allows you to send money in a non-native currency like the US Dollar (USD). For example, if you were sending money from Malaysia to Australia with MoneyMatch, you have the option to send both Australian Dollars as well as US Dollars to your overseas recipient in Australia.

For some destinations, MoneyMatch allows you to send money in the non-native currency as well. For example, you can send USD to your recipient in Australia.

With support for 3 source countries and 110 destination countries, MoneyMatch enables you to send money across 330 global country combinations. In terms of currencies, this comes out to be 120 currency corridors.

You can send money amongst 330 global country pairs and 120 currency pairs with MoneyMatch.

How much money can I send with MoneyMatch?

As a regulated entity, MoneyMatch only executes transfers that fit within the limits set by the Central Bank of Malaysia. The daily limit for personal accounts is within MYR 500 to MYR 30,000. However, MoneyMatch offers reduced transfer limits for certain currencies.

For example, when sending to the US, the minimum limit is MYR 150, while the same for transferring money to India, Japan and Sri Lanka is only MYR 1.

You can send up to MYR 30,000 every day with MoneyMatch. Minimum amounts vary by currency and range from MYR 1 to MYR 500.

You can check the revised minimum transfer limits that MoneyMatch enforces by following their page dedicated to transaction limits for various currencies.

How long does it take for MoneyMatch to send money overseas?

Once your transfer is verified and accepted by MoneyMatch for processing, it typically takes 1-2 working days for it to complete and for your funds to reach the recipient. Orders with full payment and completed documentation placed after MoneyMatch's operational cut-off time (2 PM MYT GMT+8) will be processed on the next working day.

MoneyMatch specializes in sending money overseas fast. Most of their transfers finish within 1-2 working days.

Note that there may be factors outside of MoneyMatch's control like bank holidays or cut off times that may cause delays to your money transfer.

How can I pay for my MoneyMatch money transfer?

In the global remittance space, a payment method is defined as the way you pay for your money transfer with a provider you send money with. In other words, a payment method signifies how you fund your transaction.

MoneyMatch supports several payment methods depending on the country you send money from; we list these below:

- Australia: Manual transfer via Bank Transfer

- Brunei: Manual transfer via Bank Transfer or Cheque

- Malaysia: FPX (default and preferred payment option), or DuitNow, or Bank Transfer (including Instant Transfer, IBG, or Over the counter)

MoneyMatch support a variety of flexible ways to pay for your money transfer with them.

FPX is an online payment gateway prevalent in Malaysia, and is operated by PayNet. FPX offers convenience and ease of use for customers as it is linked to their bank account. Merchants also benefit by getting instant credit as FPX is connected to various banking networks. Due to all these advantages, FPX is the default and preferred payment method for your MoneyMatch remittances done from Malaysia.

How can my recipient get paid with MoneyMatch?

A delivery method is the recipient side equivalent of the payment method, and implies how your recipient will receive the money you send to them.

MoneyMatch supports the following delivery methods:

- Bank account transfer: available in all countries

- Cash pickup: available in some countries only

- Mobile wallet credit: available in some countries only

MoneyMatch lets you pay your recipient in a variety of ways; these include bank transfers, and in some countries, cash pickup and mobile wallet.

MoneyMatch supports cash pickup at an agent location for the below countries and currencies:

- BDT in Bangladesh: Mutual Trust Bank

- IDR in Indonesia: Pos Indonesia & Post office

- LKR in Sri Lanka: Cargills Banks and Food City Stores

- NPR in Nepal: EsewaRemit and Everest Bank Branch & Agents

- PKR in Pakistan: Bank of Punjab Agents

- PHP in Malaysia: Cebuana Lhuillier, M Lhuillier

- USD in Cambodia: AMK Microfinance and Agents, True Money - Alfamart & Alfamidi convenience stores, Wing Network (Wing Bank)

- VND in Vietnam: FinFan Agents

When it comes to digital wallet credits, MoneyMatch supports quite a few countries where you can pay your recipient with a direct e-wallet transfer. Below are couple examples:

- China: Alipay digital wallet

- Philippines: Coins, GCash, GrabPay, PayMaya

Make sure you check MoneyMatch's country specific guides for a complete list of delivery methods supported in your recipient's country.

How can I find MoneyMatch near me?

MoneyMatch lets you send money online with their mobile app or website, and does not have branch offices or agent locations. Therefore, there is no need to be stuck in traffic or stand in lines in offices to make your money transfers with them.

Simply use their website or app to make your transactions 24x7 from anywhere you want.

Is MoneyMatch a safe way to send money abroad?

Money transfer companies have to obtain licenses from global regulatory and financial institutions to operate their business. This ensures that they implement numerous security guidelines and best practices. MoneyMatch is no different - they seem to take security and safety pretty seriously.

Based on our observations, below are some measures that MoneyMatch implements to keep your money and private information safe at all times.

- MoneyMatch has drafted their security policies according to the strictest adherence to local regulations wherever they operate, thus ensuring the safety of everyone involved.

- MoneyMatch implements bank level anti-phishing login features to make it harder for unauthorized access to your account with them.

- MoneyMatch ensures strict Know Your Customer (KYC) compliance, and has implemented a highly secure verification procedure which they call the electronic-KYC (e-KYC).

- MoneyMatch is strictly regulated by the Central Bank of Malaysia and licensed as a Remittance business (class B).

- MoneyMatch does not share your personal data for any other reasons unrelated to your transactions, and has many security measures and procedures in place to help protect your account from any unauthorized access.

- MoneyMatch processes and stores any data, information or documents you provide to them securely and privately.

- MoneyMatch helps customers protect against online fraud by publishing helpful guides to protect yourself from fraud.

MoneyMatch implements several security features to ensure your account is not accessed in an unauthorized fashion.

What is e-KYC and how does MoneyMatch use it to verify my identity?

KYC stands for Know Your Customer, and is a global banking and financial standard for financial institutions to securely identify you and your identity. The KYC process generally necessitates you to provide legal documentation like government issued photo identification to prove your identity. This helps your financial institution ensure that it is really you who is opening and operating your account, and not a fraudulent person impersonating you.

e-KYC or Electronic-KYC is the electronic way to do KYC. In this case, you provide your identity proofs electronically, the financial institution also does their due diligence and verification online. The biggest advantage of e-KYC is that you do not have to go to physical branches or offices to show your documents. Plus, it's cheaper for the financial institution as they can validate documents digitally.

MoneyMatch uses e-KYC, which is a verification process that is conducted digitally via the MoneyMatch App on your mobile device. This process can be completed anytime and anywhere with an internet connection, thereby offering you convenience and ease of use.

Can I trust MoneyMatch?

As a trusted money transmitter with operations in multiple countries for the last few years, MoneyMatch fully complies with strict rules and regulations enforced by global financial institutions. They are, in fact, licensed and authorized to handle payments and transfer money in every country they operate in.

Below is some information about MoneyMatch's licenses and authorization to handle payments in various countries.

- MoneyMatch operates as a full licensee under the Money Service Business (Class B Remittance license, Membership no. 0499) division of the Central Bank of Malaysia.

- MoneyMatch has been selected to receive a digital banking license in Malaysia under the Islamic Financial Services Act 2013 (IFSA), subject to meeting all relevant regulatory conditions.

- MoneyMatch is registered under Australia's financial regulator, AUSTRAC, as a remittance network provider and an independent remittance dealer (Registration Number 100585019-001).

- MoneyMatch is an approved participant of the Brunei Darussalam Central Bank (BDCB) FinTech Regulatory Sandbox.

- MoneyMatch operates as a Money Service Operator licensee of the Hong Kong Customs and Excise Department.

- MoneyMatch is a certified FinTech under the Singapore FinTech Association (SFA).

You can read up further on MoneyMatch's licensing and compliance with the relevant financial regulators in your country by visiting the MoneyMatch website for your country.

Given our analysis presented above, we observe that MoneyMatch definitely prioritizes the security of your money and confidential information you provide to them. They are also regulated by several global financial and regulatory institutions, and comply with their rules and guidelines.

Given MoneyMatch's focus on security and their licensing with global financial institutions, your money and information should be safe with them.

How good is MoneyMatch's service?

Having facilitated more than MYR 3.5 Billion worth of international money transfers for over 28,000 customers, MoneyMatch's remittance service should certainly be top class. A company does not get to such numbers without a great service.

A further way to validate whether MoneyMatch's service is good or not would be to see what other customers like you think about their service.

What do users have to say about MoneyMatch?

Let us see how other customers rate MoneyMatch's money transfer product on some popular rating and review^ platforms.

- MoneyMatch is not yet rated on Trustpilot; be the first one to write a review for them.

- MoneyMatch is also not yet rated on the Google Play Store.

- On the Apple App Store, MoneyMatch's iOS app has a rating of 2.0/5.0 with about only 7 ratings.

^Ratings on various platforms as on August 14, 2022

MoneyMatch does not have many ratings yet on popular review platforms. Given their customer base and remittance volume, we expect their product to work well.

Is MoneyMatch the best choice for me?

MoneyMatch is a strong fintech startup that is rapidly expanding in the international money transfer ecosystem. Their product offering is definitely compelling enough for you to given them a serious consideration for your next money transfer. That said, we always recommend you compare them with other remittance service providers to evaluate if could be your choice for your next money transfer.

Given our detailed look at MoneyMatch's product and services, and many other aspects that we have presented, we find them strong in the below areas.

- Secure platform that keeps your money and information safe: MoneyMatch implements robust security measures as per regulator guidelines with anti-phishing login features in addition to a highly secure verification procedure for you to transfer money with them with confidence.

- Competitive exchange rates: MoneyMatch provides competitive foreign exchange rates that help you maximize the amount of money your overseas recipient gets.

- Transparent, low fees: MoneyMatch charges a flat service fee and has no hidden charges so that you are assured of transparency in pricing at all times.

- Fast money transfers: Most MoneyMatch money transfers complete within 1-2 business days. This means you can rely on them to send money overseas quickly.

- Good service quality: MoneyMatch provides a fast, convenient and high-quality service with their end-to-end digital solutions accessible via their website or mobile apps.

- Adherence to local needs: MoneyMatch's multilingual platform enables a hassle-free and user-friendly experience that caters to local needs.

RemitFinder likes MoneyMatch for providing competitive rates, low fees, quick transfers and a secure money transfer platform.

What are the best reasons to use MoneyMatch?

In today's globally connected economy, there could be a number of reasons why you may need to transfer money overseas. For instance, you may be an expat living overseas and need to support your family back home in your country with finances. Or you are making business transfers to a partner you work with. For various money transfer needs you may have, MoneyMatch could be a potential good fit.

Since we have looked at the relative strengths and weaknesses of MoneyMatch in our detailed review, we are able to see money transfer scenarios where they might be your best choice. In the section below, we outline some much remittance use cases where we believe MoneyMatch could be a great partner to help you with your transactions.

- If you need to send money overseas quickly, MoneyMatch can be your partner of choice. Most of their international remittances finish within 1-2 business days. You can consider them if your overseas recipient needs to access money quickly for urgent needs.

- MoneyMatch has a strong coverage of international currencies and destination countries that span almost all major regions of the world. Depending on where you and your recipient live, they could be a good choice for your next money transfer.

- Your money transfers with MoneyMatch are safe and secure. MoneyMatch takes the security of your funds and confidential information seriously, and you can rest assured that you are in safe hands with them. When sending money overseas, you do not want to be nervous about safety and security.

- The exchange rates you get with MoneyMatch are fairly competitive, so you can get a better return for your money. Additionally, MoneyMatch charges fixed, low fees and no hidden charges, so you always know upfront what your most transfer will cost.

- If your recipient does not have a bank account, you can still rely on MoneyMatch to execute your money transfer. This is because MoneyMatch also supports cash pickup and mobile wallet credit as possible delivery methods. These are, however, not available in all countries so check before you send money.

- MoneyMatch has fairly flexible sending limits (MYR 30,000 daily from Malaysia, for example). This means you can use their service for sending larger sums over time. This can be handy for money transfers meant to purchase property, or for bigger investments.

MoneyMatch can be a great fit for many money transfer use cases that you may have.

What type of transfers can I make with MoneyMatch?

You can make the following 2 types of money transfers with MoneyMatch:

- Personal transfers: If you need to pay friends and family and operate as an individual, choose MoneyMatch's personal money transfer service.

- Business transfers: If you are a business or corporation, you can create a business account with MoneyMatch, and rely on their international payments network to send and receive money from customers as well as partners alike.

There are differences between personal as well as business transfers with MoneyMatch that you should be aware of. For example, the transfer limits for both personal and business accounts are different, and are listed below:

- Personal transfers have an upper limit of MYR 30,000 every day.

- For businesses that are Sole Proprietorships, the upper limit is MYR 50,000 per day.

- For businesses that are Limited Companies (e.g., Sdn. Bhd., Pte. Ltd.), the daily upper limit is MYR 10,000,000 for B2B transfers and MYR 50,000 for B2C transfers.

Make sure to research and understand other aspects of personal and business transfers before you embark of making your first transaction with MoneyMatch.

What are various ways to send money with MoneyMatch?

It is quick and easy to send money internationally with MoneyMatch. To execute your money transfers within minutes from the convenience of your home or office and without going into any branch or office, use any of the methods we outline below. MoneyMatch services are fully online, so you do not have the option to walk into an office or agent location.

- Online using the MoneyMatch Website: You can create an account on the MoneyMatch website, and easily send money to both individuals and businesses. The registration as well as money transfer flows are easy to follow so we recommend you give them a try.

- Via the MoneyMatch mobile app: MoneyMatch has mobile apps for both Android as well as iOS devices available on the respective app stores for both mobile platforms. All functionality available on the website is also available on the mobile app, and it is a great option to do your money transfers.

How to send and receive money with MoneyMatch?

With MoneyMatch, you have 2 options to send money; you can either use their website or the mobile app. Both ways are functionally the same, so it all depends on your preference. Whether you choose the app or the website, it is quick and easy to send money overseas with MoneyMatch.

In the following section, we will provide a step by step guide to help you send money with MoneyMatch.

Step by step guide to send money with MoneyMatch

Below we present the steps you need to take to send your first money transfer with MoneyMatch. It is quick and should only take a few minutes.

Note that the below steps are specific to the MoneyMatch mobile app; the flow on their website is identical so you can follow this guide for both the app as well as the website.

- Step 1: Decide if you want to send money with MoneyMatch. The first and most important aspect of an international money transfer is to decide which company you want to go with. Before making a choice, we strongly recommend you compare various remittance companies with each other and look at their pros and cons. RemitFinder is an easy way to do so. You can see exchange rates and related information from numerous providers in a single, easy to understand view.

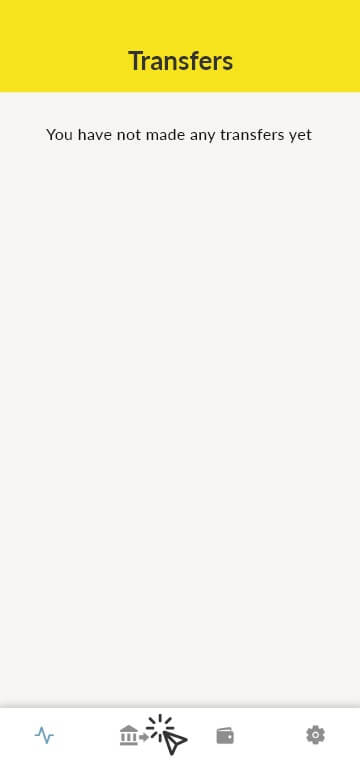

- Step 2: Create a new money transfer request. Select the option to make a New Transfer within MoneyMatch. Note that you must be signed in into your MoneyMatch account to make your transfer. If you do not currently have an account with MoneyMatch, go ahead and register an account. It's pretty quick and easy to do so. Note that for first time registrations, you will need to provide documentation for KYC (know your customer) compliance. Once you have finished the registration flow, login into your MoneyMatch account to make your first money transfer.

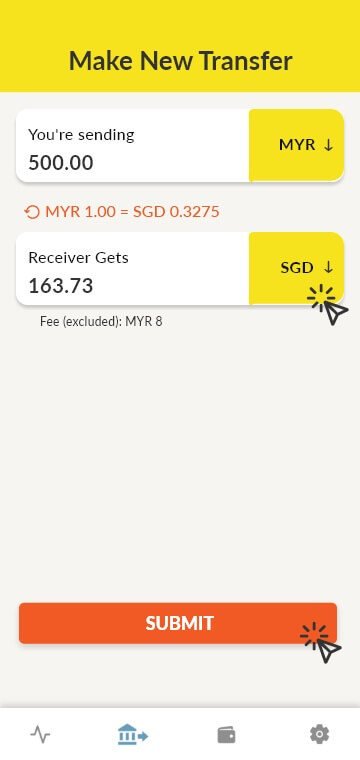

- Step 3: Select the destination currency and amount. Choose your destination currency for your overseas recipient and the transfer amount. Most of the times, this will be the native currency in your recipient's country. For example, choose SGD for transfers to Singapore.

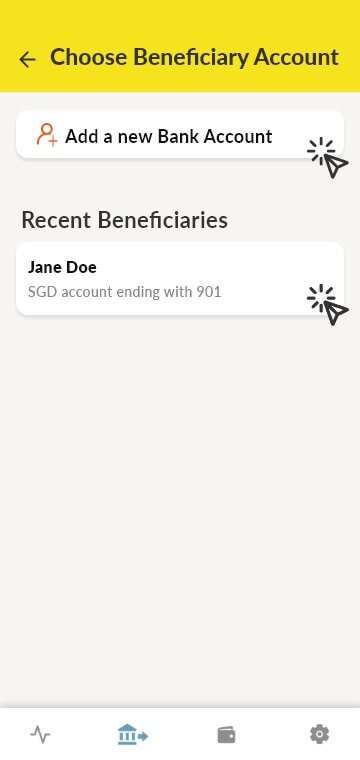

- Step 4: Enter your recipient's information. Enter name, address and other necessary information about your recipient. The information may vary based on the delivery method you choose. For example, you will need to enter bank account information for bank transfers, while mobile wallet credit will require the receiver's phone number or digital wallet account number. If you have sent money to your recipient before, simply choose them from the list of existing recipients.

- Step 5: Choose how to pay for your money transfer. Select how you want to fund your money transfer. For example, you can enter your bank information here to choose to pay with your bank account. If you have sent transfers before, your prior payment methods will be listed and you can simply select one from the list.

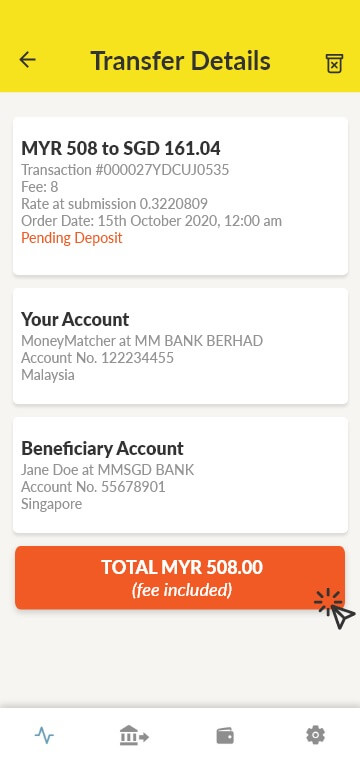

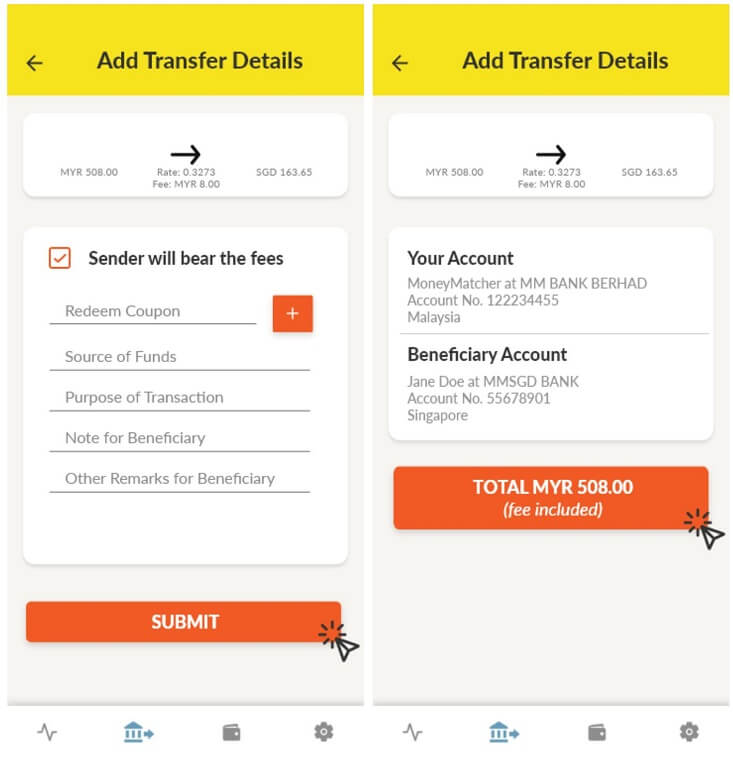

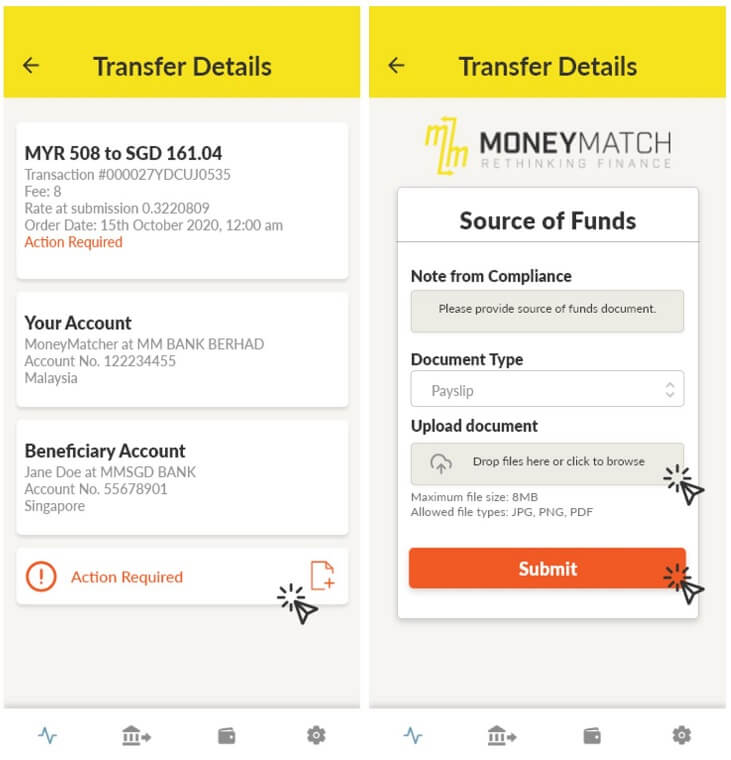

- Step 6: Confirm your money transfer details. Confirm everything is correct, and provide some additional information in this step. MoneyMatch will ask you about source of funds, purpose of transaction, and if you want to add a note to the recipient. You can also enter additional remarks as well as optionally add a coupon to redeem money. Once you are satisfied, click on Submit button at the bottom to proceed.

- Step 7: Provide supporting documentation. For legal and compliance requirements, MoneyMatch may need you to provide additional documentation. For example, if you are sending above MYR 30,000, you need to upload documents for the source of your funds (e.g., a payslip). Once done, click on Submit.

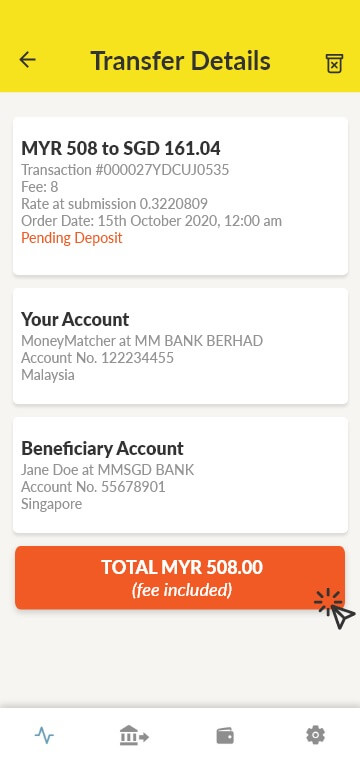

- Step 8: Pay for your money transfer. In this last step, click on the bottom Pay button to fund your money transfer.

That's it. From this point on, MoneyMatch will take care of the rest and start working on sending your money overseas to your recipient. They will keep you posted about the progress of your transaction.

It is quick and easy to send money overseas with MoneyMatch. You can send money via the website or the mobile app in just a few click.

How can MoneyMatch help me send money?

MoneyMatch helps you send money overseas to individuals as well as businesses. From a money sender's perspective, you can also open a personal or business account based on your needs. Both types of accounts come with different transfer limits, fees, etc. so make sure you do your research before deciding which account is right for you.

We recommend that you do not mix personal and business transfers in one account, so if you intend to use MoneyMatch for both personal and business needs, we suggest that you open separate accounts with them for each use case.

MoneyMatch provides several helpful guides and documentation to help you get started with them to make your first international money transfer. Once you send money once, you will be able to repeat the process in very few clicks. Below are some helpful guides and support pages that may be helpful to you, especially if you are new to MoneyMatch.

- MoneyMatch Personal user registration guide

- MoneyMatch Business user registration guide

- Helpful articles on transaction limits and transfer fees

- Information on safety and security

- General support documentation with guides on many topics

There are many other support docs and information available on the MoneyMatch site. You can also search for a specific topic for other questions. Finally, you can also reach out to the MoneyMatch customer support team if you need help or have questions.

Do I need a MoneyMatch account to receive money?

Your recipient does not need a MoneyMatch account to receive the money you send to them using MoneyMatch money transfer services.

Regardless of which country your recipient resides in, you can always send money directly into their bank account with MoneyMatch. For some countries, MoneyMatch also supports cash pickup and mobile wallet credits as delivery options.

You do not need a MoneyMatch account to access money sent to you via a MoneyMatch international remittance.

Check out detailed guides that MoneyMatch publishes for each destination country to see your options. But in any case, your recipient will not need to sign up with MoneyMatch and create an account to access the funds.

Does MoneyMatch have a mobile app?

MoneyMatch does have a mobile app that is available on both the Google Play Store for Android devices as well as on the Apple App Store for iOS devices.

The mobile app is a great way to access MoneyMatch services on the go without being in front of a computer or laptop.

How do I track my MoneyMatch transfer?

Tracking your money transfers with MoneyMatch is easy. Simply login into your account on the website or the mobile app, and go to your transaction history. Then look for your pending transfer to see what state it is currently in.

MoneyMatch will also send you email notifications as your transactions progresses forward.

Can I use MoneyMatch for international bank transfers?

Since you can use bank account on either end of a MoneyMatch international money transfer, the answer is yes.

If you pay for your money transfer with a bank account, and you also have your recipient receive the funds directly in their bank account, you essentially achieve an international bank transfer with your MoneyMatch remittance transaction. All this without paying high fees to your bank, and possible getting a bad exchange rate from them.

Is MoneyMatch online better than sending money in-person in stores?

MoneyMatch is only available online. You do not need to go to any branches, office or agent locations to make your money transfers with them.

Use the MoneyMatch website or mobile apps 24x7 from anywhere in the world; there is no need to deal with traffic or stand in lines.

Does MoneyMatch have a rewards program?

MoneyMatch does have a referral program whereby you can earn money for referring your friends to MoneyMatch. Here are the steps to refer a friend and earn your credit:

- Step 1: Get your unique Referral Link from your MoneyMatch account. You can find this information in your Dashboard after you login into your account. Your personal referral link should look like this - Use my referral code: REF_XXXX to get RM30 off your first cross-border transfer!https://transfer.moneymatch.co/?ref=signup&code=REF_XXXX

- Step 2: Share your personal referral link to your friends via email, social media or any other means.

- Step 3: Once your friend signs up for a new account with MoneyMatch, they will be able to use the discount code they received with your referral invitation. After they finish their first transaction, you become eligible for your reward.

- Step 4: You can access your reward code on the Available Coupons area in your MoneyMatch dashboard.

The MoneyMatch referral program is a great way to share the MoneyMatch service with friends. Both you and your friends earn credits on your transfers.

What customer support options are available with MoneyMatch?

If you face any problems with your MoneyMatch remittance, or have questions in general, you can contact the MoneyMatch customer support team anytime. You can contact customer support in any of the following ways:

- Email: You can write to customer support at customer.support@moneymatch.co.

- Phone: You can call +603 3099 3889 and someone will assist you.

- Online form: You can fill up an online form to contact customer support.

Can I cancel my MoneyMatch transfer?

If you wish to cancel your MoneyMatch money transfer, contact their customer support immediately. Since MoneyMatch completes international money transfers quickly, you should let them know as soon as possible if you wish to cancel your transaction.

Generally, transactions that have not progressed beyond the Processing stage can be canceled and the funds can be refunded to you. Beyond that, it may not be possible to cancel your transfer. Therefore, the sooner you contact MoneyMatch support team, the easier it is for them to try to honor your cancelation request.

It may not be possible to cancel a transfer after certain stages, so make sure to reach out to MoneyMatch support team asap with your request.

How do I delete my MoneyMatch account?

To delete your MoneyMatch account, simply contact their customer support team, and someone will assist you with your request. Note that you will lose access after account deletion, so make sure to take a full backup of your transaction history for your recordkeeping.

How can I purchase MoneyMatch business insurance?

MoneyMatch also provides business insurance products whereby you can purchase various insurance policies for your business. If you are interested in knowing more and purchasing business insurance with MoneyMatch, get in touch with a MoneyMatch agent. They will help you in all steps of the process including understanding your needs, planning, choosing the right policy and purchasing coverage.

Additional Information

Legal and Regulatory Compliance

MoneyMatch is licensed and authorized to operate in every country that they facilitate money transfers in. Below is some information about their licenses in various countries:

- Fully licensed under the Money Service Business (Class B Remittance license, Membership no. 0499) by the Central Bank of Malaysia.

- Possesses a digital banking license in Malaysia under the Islamic Financial Services Act 2013 (IFSA).

- Licensed by Australia's financial regulator, AUSTRAC, to operate money transfers in Australia (Registration Number 100585019-001).

- Approved participant in the Brunei Darussalam Central Bank (BDCB) FinTech Regulatory Sandbox.

- Licensed by the Hong Kong Customs and Excise Department as a Money Service Operator.

- Certified FinTech company with the Singapore FinTech Association (SFA).

Awards, Prizes and News

- Finalist for Most Promising Growth Company during the Top In Tech Innovation Awards 2021.

- Semi-Finalist under Payments pitch competition organized by Invest HK Hong Kong Fintech Week 2021.

- Finalist for RegTech of the Year Award by Asia FinTech Awards, Apr 2021.

- ASEAN SME Award by Singapore FinTech Festival 2018, Nov 2018.

- Malaysia Pitch Fest by Singapore FinTech Festival 2018, Aug 2018.

- Startup Disruptor of the Year by Wild Digital Asia 2018, Jun 2018.

- Fintech Startup of the Year by Fintech News Malaysia, Mar 2018.

- Best Technological Innovation by MDEC, Dec 2017.