Verto Detailed ReviewRates, Fees, Limits, Safety and More

Last updated: March 20, 2025

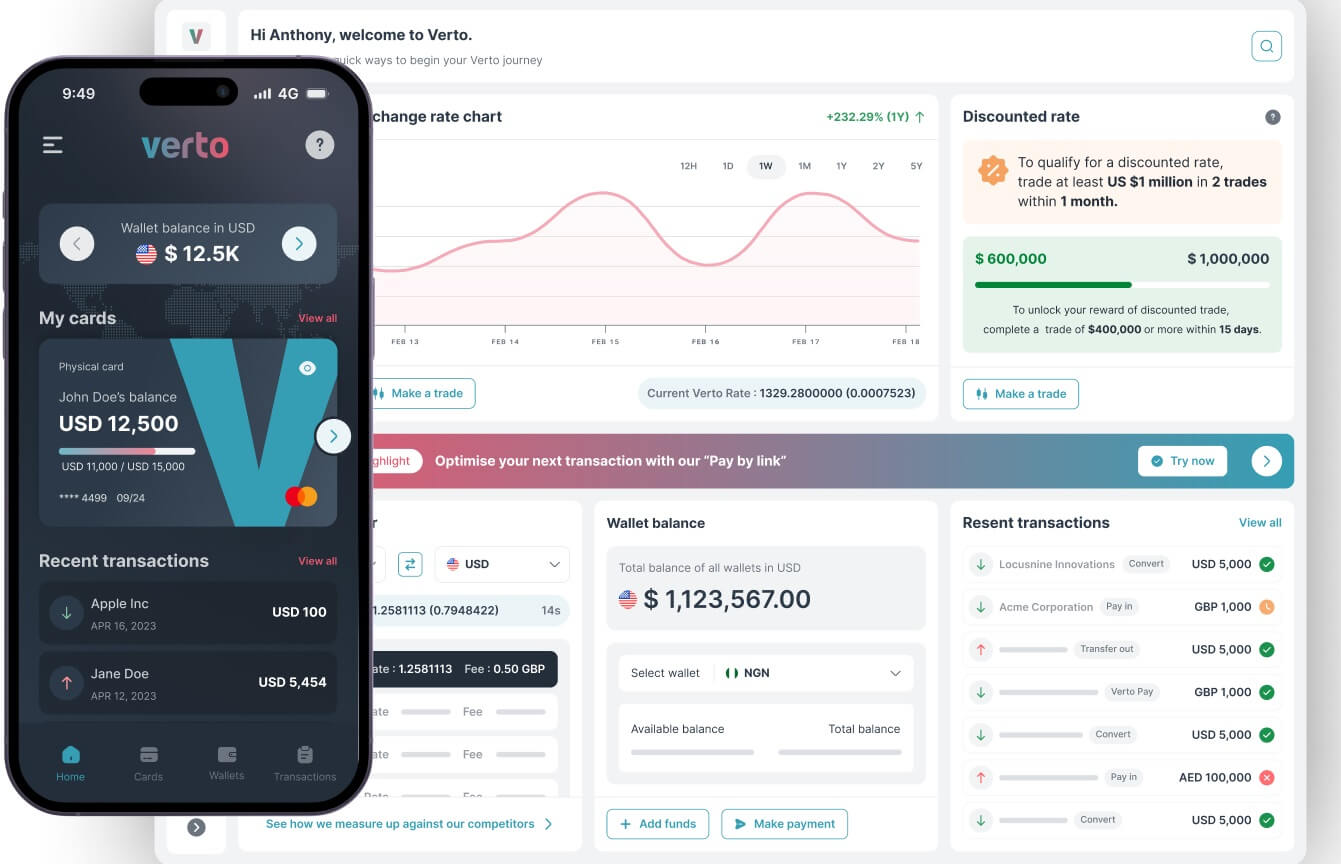

What is Verto? An introduction

Verto is a cross-border payment solution company that provides tools for collections, payouts and foreign exchange to startups, scaleups and enterprise companies.

With the unique ability to support cross-border payments in emerging markets in Africa, Verto can help you do business with the world.

Verto company information

In 2017, Verto co-founder and CEO Ola Oyetayo found an opportunity where he could help individuals within the UK, especially residents with families back in Nigeria send money home by setting up an online remittance company.

At the same time, Verto co-founder and CTO Anthony Ovuu was launching a prop-tech company and starting his MBA. Coincidentally both decided to quit their respective jobs and continue with their new ventures.

It was around then, over a regular game of poker, that Ola mentioned all the issues he had seen with paying suppliers abroad, especially in the emerging markets. Thus, Verto was born.

Verto is now a global payment solution that is empowering seamless cross-border payments in 190+ countries worldwide.

Verto by the numbers

The below statistics help put Verto's financial and customer reach and impact in perspective.

- 4.5 million site visitors a year

- USD 15 billion plus global payments processed annually

- 3000+ customers covering nine industry sectors

- 49 currencies supported

- 190 countries from which you can accept payments

- 8 years in the currency business

Verto is a global payments solution trusted by more than 3000 business customers. It has achieved massive scale with more than USD 15 billion worth of global payments processed every year.

What services does Verto provide?

Verto is a global B2B payments platform that offers a suite of financial services designed to streamline cross-border transactions for businesses. Key services include:

- Local and global business accounts: Verto provides businesses with the ability to hold, receive, and make payments in over 50 currencies, simplifying international transactions and currency management. These capabilities also include multicurrency wallets, global expense management through cards and payment links that streamline invoice management.

- Foreign Exchange (FX) and Treasury Management: Verto offers access to competitive foreign exchange rates through its dynamic marketplace as well as over the counter exchange services, allowing businesses to manage currency conversions and mitigate market volatility effectively.

- API Solutions: Verto Atlas (suite of APIs) allows businesses to automate currency conversions, global payouts, and beneficiary management, integrating seamlessly with existing systems to enhance financial operations. Financial institutions can offer Verto services to their clients through their own systems and UI.

As a global B2B payments solution, Verto provides customers local and global business accounts that support more than 50 global currencies, and FX and treasury management solutions. Verto's API suite also enables customers to use their own systems whilst relying on the power of Verto's B2B payment infrastructure.

Which countries does Verto operate in?

Verto operates globally, offering services in over 190 countries.

Verto has obtained regulatory licenses and approvals in several key regions, including:

- United Kingdom: Authorized by the Financial Conduct Authority as an Electronic Money Institution.

- United States: Registered with FinCEN and holds Money Transmitter Licenses in Delaware, Wyoming, and Illinois.

- Nigeria: Authorized by the Central Bank of Nigeria as an International Money Transmission Operator.

- Kenya: Partners with licensed banks approved by the Central Bank of Kenya to provide cross-border collection and payment services.

- South Africa: Regulated as an authorized Financial Services Provider by the Financial Sector Conduct Authority.

- United Arab Emirates: Authorized by the Dubai Financial Services Authority to provide money services and carry on authorized financial services with or for retail clients holding or controlling client assets.

Where can I send money from with Verto?

With Verto, you can send money internationally in up to 49 currencies. These include all the world's popular currencies across various continents.

Where can I send money to with Verto?

When you send money internationally with Verto, you can send funds to over 190 countries worldwide in more than 50 popular currencies.

Verto's global corridor coverage spans 50 currencies and 190 countries; this can prove highly beneficial to your business if you need to pay employees, vendors and partners globally.

What are Verto's fees and exchange rates?

Verto has various plans that you can choose from, and exchange rates and fees vary according to your chosen plan.

Here are the Verto plans you can choose from (we have provided current pricing information for US and UK - you can check the pricing for your country as needed on the Verto website):

- Verto Free: Free of cost

- Verto Lite: USD 25/month in the US and GBP 25/month in the UK

- Verto Emerging: USD 50/month in the US and GBP 50/month in the UK

- Verto Enterprise: Custom pricing

Verto has various account levels that range from Verto Free, Verto Lite, Verto Emerging and Verto Enterprise - these are created to fit the needs of various business types and stages they are in.

When it comes to exchange rate margins on cross-border payments, here are Verto's transparent FX margins based on the plan you have chosen:

- Verto Free: 0.6% for popular currencies, 0.6-2.0% for exotic currencies

- Verto Lite: 0.5% for popular currencies, 0.5-2.0% for exotic currencies

- Verto Emerging: 0.4% for popular currencies, 0.4-2.0% for exotic currencies

- Verto Enterprise: Custom FX margin

When it comes to fees, the good news is that many of Verto's FX related fees are the same regardless of the plan you choose. Here are some examples:

- Wallet-to-Wallet transfers: Free for all Verto plans

- Local payment fees: Free for all Verto plans

- International SWIFT payment fees: USD 20 for all Verto plans

Verto exchange rates and fees vary based on the Verto account type you choose. The higher the membership tier, the better the exchange rates that you will get. Elevated membership levels do cost more though - carefully weigh your requirements against membership fees to assess the best Verto plan for your needs.

Are Verto exchange rates good?

Verto offers competitive B2B exchange rates. Based on their own assessment, Verto mentions that their exchange rates are 5x less the cost of traditional bank exchange rates.

That said, we always suggest to our readers to always shop around and see what other remittance service providers are offering. More information will help you best choose a partner to send money with. When you compare money transfer providers, the chances of your getting the most benefit on your international money transfers increase significantly.

Whilst you can compare remittance companies manually, a quick and convenient way to do so is to rely on RemitFinder's online money transfer comparison engine. RemitFinder compares umpteen providers side-by-side to give you accurate and updated information about exchange rates and deals.

Is Verto a cheap way to send money overseas?

Currently Verto offers minimal fees. Its advanced liquidity and banking relationships with African banks mean that its users encounter less hidden fees charged by banks on each side of the transaction.

How do I avoid Verto fees?

There are several ways to minimize the impact of Verto's fees on your international business payments; some of these are as below.

- Choose the appropriate pricing plan: Verto offers various pricing plans, each with specific allowances for transactions. Selecting a plan that aligns with your business's transaction volume can help you stay within the included allowances, thereby avoiding additional fees. For instance, exceeding the number of free transactions in your plan may result in charges of USD 10 per international payment and USD 1 per local payment.

- Utilize wallet-to-wallet transfers: Transfers between Verto clients (wallet-to-wallet payments) are free of charge. Leveraging this feature can help you avoid transaction fees associated with other payment methods.

- Leverage multi-currency accounts: By holding and managing funds in multiple currencies within Verto's platform, you can reduce the need for frequent currency conversions, which may incur fees. This approach is particularly beneficial if your business deals with multiple currencies regularly.

- Take advantage of free deposits: Depositing funds into your Verto wallet from a bank account registered in your company's name or the ultimate beneficial owner's name is free. Additionally, receiving payments from third parties into your Verto local or global accounts does not incur any fees.

- Monitor and adjust your plan as needed: Regularly reviewing your transaction patterns can help you determine if your current pricing plan is the most cost-effective. If your transaction volume changes, consider adjusting your plan accordingly to maintain optimal fee structures.

How much money can I send with Verto?

Verto offers various transaction limits depending on the currency and service used. Here's a detailed breakdown based on various services Verto offers.

Currency-Specific Transaction Limits

The maximum amount you can send varies by currency and is as below:

- GBP: £5,000,000

- USD: $1,000,000

- BDT: ৳1,000,000

- BRL: R$1,000,000

- EGP: E£1,000,000

- ETB: Br1,000,000

- GHS: GH₵1,000,000

- LKR: Rs1,000,000

- MAD: MAD1,000,000

- PKR: ₨1,000,000

- OMR: OMR1,000,000

- PHP: ₱1,000,000

- PLN: zł1,000,000

- QAR: QR1,000,000

- RON: lei1,000,000

- SAR: SR1,000,000

- SEK: kr1,000,000

- THB: ฿1,000,000

- TRY: ₺1,000,000

- HRK: kn2,300,000

- HUF: Ft99,000,000

- IDR: Rp1,000,000

- ILS: ₪1,000,000

Corporate Card Transaction Limits

For businesses utilizing Verto's corporate cards, the following limits apply:

- Daily Limits:

- ATM Withdrawals: USD 500

- Payments (in-store or online): USD 2,500

- Weekly Limits:

- ATM Withdrawals: USD 500

- Payments (in-store or online): USD 5,000

- Monthly Limits:

- ATM Withdrawals: USD 2,000

- Payments (in-store or online): USD 20,000

Mobile App Virtual Card Limits

For users of Verto's mobile app virtual cards, limits differ based on business registration status as below:

- Unregistered Businesses:

- Daily Limit: USD 1,000

- Weekly Limit: USD 2,000

- Monthly Limit: USD 8,000

- Registered Businesses:

- Daily Limit: USD 2,500

- Weekly Limit: USD 5,000

- Monthly Limit: USD 20,000

Note that these limits are subject to change. For the most current information, please consult Verto's official resources or contact their customer support.

Verto transfer and payment limits depend on many factors that include service type, account membership level and registration status.

How long does it take for Verto to send money overseas?

The time it takes for Verto to process international payments varies based on several factors, including the currencies involved, the destination country, and the payment method used. Here is an overview:

- GBP (British Pound) Transfers: Payments to your Verto GBP local account are typically received almost instantly when sent via Faster Payments (FPS) for amounts under GBP 1,000,000. Transfers made through CHAPS (Clearing House Automated Payment System) usually arrive on the same day if initiated before the sending bank's cutoff time.

- USD (US Dollar) Transfers: Transactions completed via Fedwire are generally processed on the same day. Unlike the SWIFT system, most Fedwire transactions do not require specific instructions to the sending bank for same-day completion.

- DKK (Danish Krone) Transfers: Payments sent to your Verto DKK local account via KRONOS2 before 14:00 UK time are usually received on the same day. It's advisable to check with the sending bank regarding their cutoff times for time-sensitive payments.

- General International Transfers: After Verto receives funds, outward transfers are typically completed as soon as possible but may take up to two working days to arrive in the beneficiary's bank account.

Please note that actual processing times can vary depending on factors such as the destination country's banking infrastructure, intermediary banks involved, and compliance checks. For the most accurate information, it is recommended to consult Verto's official resources or contact their customer support.

Verto strives to finish international payments and transfers as soon as possible after they receive your funds.

How can I pay for my Verto money transfer?

To be able to complete an international money transfer, you first need to send your funds in local currency to the money transfer company you choose. The mechanism to pay for your remittance transaction is called a payment method.

To fund your Verto money transfer, you can utilize the following methods:

- Bank Transfers via Local and Global Accounts: Verto provides unique IBANs and account details for various currencies. You can transfer funds from your bank account to your Verto account using these details.

- Payment Links for Receiving Payments: Verto's Payment Links enable you to receive payments from clients or customers. By generating a secure payment link, you can share it via email, SMS, or other messaging platforms, allowing payees to complete transactions using credit or debit cards.

- Corporate Cards and Verto Pay: Verto offers virtual and physical corporate cards through the Verto Pay mobile app, facilitating global payments to suppliers or vendors.

- API Integration for Automated Payments: For businesses seeking automation, Verto provides API solutions to integrate payment functionalities directly into your systems, streamlining the payment process.

It's important to note that Verto supports various payment systems, including SEPA, SWIFT, ACH, Fedwire, TARGET2, and NGN, offering flexibility in how you fund your transfers.

Before initiating a transfer, ensure that the chosen funding method aligns with your business needs and complies with Verto's policies.

Verto supports numerous payment methods including many local payment methods in various countries. You can pay for your Verto payments and transfers in a variety of flexible ways.

Which payment method should I use to pay for my Verto money transfer?

This depends on your business needs and requirements. Verto provides numerous ways to pay for your payments and transfers, including several local payment methods in many countries.

When possible, we recommend choosing local payment methods as they are often cheaper, if not free altogether.

How can my recipient get paid with Verto?

The method you choose to credit your overseas receiver is generally called a delivery method. To facilitate payments to your recipients using Verto, you have several options as below:

- Provide Unique Account Details: If your recipient has a Verto Global or Local Account, they can receive payments directly from third-party businesses. They should:

- Log in to the Verto platform.

- Navigate to 'Accounts and wallets' on the sidebar.

- Select 'Global' or 'Local' based on the account type.

- Choose the currency for the payment.

- Access 'Bank Account Details' to obtain their unique IBAN or account number.

These details can be shared with payers to receive funds directly into their Verto account.

- Utilize Payment Links: Verto offers a feature that allows users to create and share payment links, enabling recipients to get paid instantly. Recipients can:

- Generate a payment link within the Verto platform.

- Share the link via email, SMS, or messaging apps.

- Payers can then use the link to complete payments securely and promptly.

This method provides flexibility and convenience, especially for one-time or irregular payments.

Verto supports 2 delivery options that include transfers into local and global bank accounts, as well as payment links to receive incoming payments.

By leveraging these features, your recipients can efficiently receive payments through Verto's secure and versatile platform.

Which delivery method should I use for my Verto money transfer?

This depends on your and your recipient's needs and requirements. Both of Verto's supported delivery methods are fully safe and secure, so you can choose the one that fits your needs well.

Are there any Verto coupon codes or promotions I can use?

Verto has an exclusive offer for those attending Pay360. You can redeem 100 international transactions if you visit Verto's stand at the show and sign up to Verto with a unique code, using which, you can save up to 2000 USD. The offer can be redeemed within 30 days after the show.

If Verto runs any offers or promotions in the future, we will add them on this page. Check this Verto review periodically to ensure that you do not miss out on any future deals.

Whilst you can check for Verto deals and discounts manually, doing so is time consuming. A better way is to sign up for the RemitFinder daily exchange rate alert. Our daily alert is totally free of cost; we will keep you posted on exchange rates and latest offers from many money transfer companies.

How can I find Verto near me?

Verto's main headquarters is located at 1 Finsbury Avenue, London, England EC2M 2PF. The company also maintains offices in several other countries, including India where the location is Office No. 601, 9 Honey Gold, Plot No. 43, Rangehills Road, Ashoknagar, Shivajinagar, Pune - 411007.

There are also offices in Kenya, South Africa and Lagos, Nigeria.

What is the best way to find a Verto Sending Location near me?

The best way to access Verto is via their website and mobile app. This way, you do not have to go to any physical location or office.

What is the best way to find an Verto Payment Location overseas?

Verto's supported delivery options are all digital, so there is no need to visit an overseas payment location to receive the funds.

Is Verto a safe way to send money abroad?

Verto has many measures in place to ensure the safety and security of their customers' funds and personal information, and is generally considered a safe and reliable way to send money abroad, especially for businesses engaging in cross-border payments. Below, we present some of Verto's security measures.

- Regulatory Compliance

- Verto is regulated by the Financial Conduct Authority (FCA) in the UK, ensuring compliance with financial laws and security standards.

- Verto follows strict anti-money laundering (AML) and know-your-customer (KYC) regulations to prevent fraud.

- Security Measures

- Funds are held in segregated accounts, meaning your money is separate from Verto's operational funds.

- Verto uses bank-level encryption to protect transactions and user data.

- Trusted by Businesses

- Primarily designed for businesses and corporate payments rather than personal remittances.

- Used by companies worldwide to send and receive payments in multiple currencies.

Can I trust Verto?

A major aspect of trusting a financial institution entails inspecting their legal and regulatory status in the countries of their operation. When it comes to Verto, we notice the below pertinent information:

- Verto is authorized by the Financial Conduct Authority (FCA) in the UK under the Electronic Money Regulations 2011, Firm Reference 901073, for the issuing of electronic money.

- The VertoFX card is issued by Monavate Limited pursuant to license by Mastercard International. Monavate Limited is authorized and regulated by the Financial Conduct Authority as an Electronic Money Institution under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 901097).

- VertoFX Inc operates in the USA through a partnership with Global Innovations Bank, to which VertoFX Ltd is a service provider.

Verto implements various industry standard security protocols and measures to keep your money and information safe. It is also a fully regulated financial company in various markets it operates in.

How good is Verto's service?

Verto is authorized and regulated by the UK's Financial Conduct Authority (FCA), ensuring adherence to stringent financial standards. It also has a range of reviews praising it for superior customer service.

One of the most reliable ways to check if a service is good or not is to see what other customers have to say about it. We will do the same to see if Verto's customers are happy with their service or not.

What do users have to say about Verto?

In this section, we look into Verto's ratings and reviews^ on popular review platforms and major mobile app stores to see what users think about their service.

- On Trustpilot, Verto is rated 4.4/5.0 with 703 reviews

- On the Google Play Store, Verto is rated 4.2/5.0 with 174 reviews and more than 100K downloads

- On the Apple App Store, Verto is rated 2.6/5.0 with 5 ratings

^Ratings on various platforms as on March 19, 2025

Verto has excellent ratings and reviews on Trustpilot as well as Google Play Store. Apple App Store ratings are low as well as lesser in number.

Have you used Verto yet? If so, please consider leaving a review on RemitFinder so other users can benefit from your expertise and experience.

Is Verto the best choice for me?

Given our detailed analysis of Verto international money transfer service and related aspects, it is clear that Verto has many strengths. Here are some areas where we find Verto standing tall in the international remittance use case:

- Competitive exchange rates and low fees: Verto offers better rates than banks and traditional forex services. There are also no hidden fees and transparent pricing on transactions.

- Multi-currency accounts for businesses: Hold and manage over 200 currencies in one account.

- Quick settlement times: Much faster than traditional banks, which have been the main vehicle for business payments and transfers in the past.

- Safe and secure platform: Verto provides secure transactions with FCA regulation (UK Financial Conduct Authority).

- Support for various tools and integrations: Offers business-friendly financial tools such as invoice management, bulk payments for multiple recipients and API integrations

- Flexible payment and delivery options: Verto offers a variety of flexible payment and delivery methods that help you find the best fit for your needs.

- High transfer limits: Verto allows you to send higher amounts, especially if you elevate your membership level with them.

RemitFinder likes Verto for providing competitive exchange rates and low fees, quick settlement times, flexible payment and delivery options, multiple account types that fit the needs of all types of businesses and a secure platform that can be trusted.

What are the best reasons to use Verto?

Verto's key advantages make it a very good choice for quite a few international money transfer use cases. Based on the in-depth analysis that we have conducted on Verto's remittance service in prior sections of this review, we notice that it can be a great fit for many international money transfer scenarios.

Here are some examples where Verto can prove to be a reliable ally for your next overseas funds transfer.

- If you run a business and need to send/receive payments internationally, Verto can be a great fit given their specialty in international business payments and transfers.

- Verto provides competitive exchange rates with low fees for B2B transactions, which can help you maximize the reach of your business payments.

- If you deal with many currencies, Verto multi-currency accounts can help to manage funds in different countries and currencies seamlessly.

- We all want our funds and information to be safe - Verto is a regulated platform (FCA-regulated in the UK). This way, you can ensure that your money and confidential information is safe with Verto.

Verto's strengths and advantages make it a very good choice for many business payment and money transfer scenarios for remitting money out of Africa.

What type of transfers can I make with Verto?

You can make various types of international business payments and transfers with Verto that include the below:

- Local payments

- International payments

- Multi-currency wallet transfers

- Bulk or mass payments.

What are various ways to send money with Verto?

With Verto, businesses can send money in several ways, depending on their needs. Here are the main methods:

- Cross-border transfers (international payments)

- Send money to over 190 countries in 200+ currencies.

- Ideal for paying international suppliers, vendors, or partners.

- Local transfers

- Send payments within the same country using local banking networks.

- Faster and cheaper than international transfers.

- Multi-Currency Wallet Transfers

- Instantly transfer funds between different currency wallets in your Verto account.

- Helps businesses manage multiple currencies in one place.

- Bulk & mass payments

- Send payments to multiple recipients at once—great for payroll, freelancer payments, or supplier payouts.

- Automate payments to save time and reduce errors.

- Verto payment links

- Generate a payment request link and share it with clients.

- Customers can pay you in their local currency, making it easier to receive funds globally.

- SWIFT & local banking network payments

- SWIFT Transfers for secure international wire transfers.

- Local banking networks in supported regions for faster, lower-cost payments.

- API Integration for automated payments

- Businesses can integrate Verto’s API to send payments automatically from their own platform.

- Useful for e-commerce, fintech, and companies handling high-volume transactions.

As you can see, you can send international business payments and money transfers in many flexible ways using Verto.

How to send and receive money with Verto?

It is quick and easy to send money internationally with Verto. In fact, the whole flow from start to finish can be completed on any of Verto's channels to send money with in just a few minutes. Check out the section below for the exact steps needed to do an overseas money transfer with Verto.

Step by step guide to send money with Verto

With Verto, sending money overseas takes only a few clicks. Here are the steps you need to undertake to finish an end-to-end money transfer with Verto:

- Step 1: Decide if you want to send your next money transfer with Verto. With the recent explosion of money transfer operators, it may seem daunting to even choose who to go with. One helpful way to reach a decision is to compare various money transfer companies using RemitFinder's real-time money transfer comparison platform. RemitFinder does all the heavy lifting to assist you to easily compare the relative strengths and weaknesses of many remittance companies side by side. This can really help you to narrow down the choices that meet your selection criteria and therefore, help you to select who to go with.

- Step 2: Create a Verto account. Sign up on Verto by providing your business details. Complete KYC (Know Your Customer) verification to ensure the security and compliance of the platform.

- Step 3: Add your payment method. Link your bank account or set up a payment method to fund transfers. You can add multiple currencies depending on your business needs.

- Step 4: Choose the type of transfer. For international transfer, select the country and currency of the recipient. For local payment, choose the local bank network if sending domestically. For bulk transfer, you can upload a bulk payment file if you need to pay multiple recipients (e.g., payroll).

- Step 5: Enter recipient details. Provide the recipient's bank account information, including details such as bank name, account number, and SWIFT/BIC code. For bulk payments, upload a list of recipients.

- Step 6: Confirm your transfer. Double-check the details of the transaction, including the amount, fees, and exchange rate (if applicable). Confirm and authorize the payment. Verto will process your transfer.

- Step 7: Track your transfer. Once the payment is sent, you can track its status through your Verto account dashboard.

Step by step guide to receive money with Verto

With Verto, receiving money from abroad is also a breeze. Here are the steps you need to undertake to receive an international payment sent to you with Verto:

- Step 1: Create your Verto account and complete KYC. Sign up on Verto and complete the KYC verification.

- Step 2: Get your local account details. Verto provides you with local bank account details in different currencies (USD, EUR, GBP, etc.). These details can be shared with clients or partners for direct deposits into your Verto account.

- Step 3: Share your Verto account details. Provide the recipient with your Verto account details for payments (e.g., IBAN, SWIFT/BIC, etc.). You can share these details via email, payment link, or an invoice.

- Step 4: Receive payments. Once the payment is sent, it will be deposited into your Verto multi-currency account. You will receive a notification of the successful deposit.

- Step 5: Manage received funds. You can convert received funds into another currency, transfer them to a linked bank account, or use them for additional payments.

It is quick, easy and convenient to send and receive international business payments and money transfers with Verto.

How can Verto help me send money?

Verto can help you send money via local and global accounts and payouts.

- Global payouts: Verto allows you to send money internationally to over 190 countries. You can make payments in 200+ currencies, allowing you to send money to suppliers, partners, and clients around the world. Verto also offers market-leading exchange rates, often better than traditional banks, meaning you save money on currency conversions when sending funds abroad.

- Local transfers: You can send money locally in certain countries, which can be faster and more cost-effective than international transfers. Verto uses local bank networks to send funds domestically, reducing costs and making transfers quicker.

Do I need a Verto account to receive money?

Yes, the recipient of a Verto international business payment needs a Verto account to receive the funds. This is because both of Verto's supported delivery options require a Verto account to access the money.

Once you have received funds into your Verto account, you can move them out to your bank account if needed.

Does Verto have a mobile app?

Yes, Verto Pay is a mobile app designed to simplify international transactions for small to medium-sized businesses, offering features like instant virtual multi-currency cards, multi-currency wallets, and global payment capabilities.

How do I track my Verto transfer?

You can track all payments on Verto's platform which can also be integrated with your systems via API.

Can I use Verto for international bank transfers?

Yes, you can use Verto for international bank transfers. To do this, simply fund your transfer with your local bank account in the sending country, and have the recipient withdraw the funds to their bank account.

Is Verto online better than sending money in-person in stores?

Yes. It is a faster, more seamless way of paying businesses worldwide.

Does Verto have a rewards program?

Verto is primarily focused on providing business-to-business (B2B) payment solutions, such as cross-border payments, currency conversion, and other services tailored to businesses that need to send or receive money internationally.

Its features are centered around competitive exchange rates, low fees, bulk payments, and multi-currency accounts rather than consumer rewards or loyalty incentives.

What customer support options are available with Verto?

In case you need any help with your Verto money transfer, or have any other general questions, you can contact the Verto customer support team.

Verto offers extensive resources for help along with a live chat option for customer support.

You can also get in touch with Verto support via its customer support email: support@vertofx.com.

They also offer tailored services for foreign exchange customers - referred to as their Over-the-Counter (OTC) Services. This is a tailored, personalized financial service that allows businesses to execute large, customized foreign exchange (FX) transactions outside of the regular marketplace. The OTC services are ideal for businesses that need to manage large sums of money, engage in complex trades, or need specialized FX solutions that cannot be satisfied by standard platforms.

If you need to contact Verto's customer support team, you can reach them via live chat or by emailing them.

Can I cancel my Verto transfer?

Once a transfer has been initiated through Verto, it is generally difficult or impossible to cancel the transaction, especially if it has already been processed and funds have been sent to the recipient.

However, the possibility of cancellation depends on the status of the transfer and the specific circumstances. Here is what you should know about Verto's cancellation policy.

Factors Affecting Transfer Cancellation

- Transfer Status

- Pending Transfers: If the transfer has not yet been processed or is still in a "pending" state, there may be a chance to cancel it. It is best to contact Verto immediately in this case.

- Completed Transfers: If the funds have already been sent and the transaction is complete, cancellation is generally not possible.

- Recipient's Bank Processing

- Once the funds reach the recipient's bank, it becomes more difficult to reverse the transaction, as it may have been credited to the recipient's account.

- Processing Time

- The timing of the transfer can also play a role. If the transfer is in the process of conversion or routing, there might still be a chance to halt it, but if the funds have already been dispatched, cancellation may not be feasible.

Steps to Take if You Need to Cancel a Transfer

- Contact Verto Support Immediately

- If the transfer is still in progress or hasn't been finalized, contact Verto customer support right away. They may be able to help you stop the payment or explore other options.

- Use their contact channels or reach out via your Verto account.

- Provide Transfer Details

- Have all the relevant details on hand, such as the transaction ID, recipient information, and amount sent to help their support team locate and assess the situation more quickly.

- Check the Cancellation Policy

- Review Verto's terms of service or FAQs to confirm their official policies on transfer cancellations and any potential fees involved if you attempt to cancel a transaction.

Refunds

If a transfer cannot be canceled, but there was an issue with the transaction (like the recipient not receiving the funds), Verto may be able to assist with a refund or investigation into the matter.

How do I delete my Verto account?

If you want to delete your Verto account, you will need to follow their official process, as account deletion typically involves contacting their support team for assistance. Here is how you can go about account deletion.

Steps to Delete Your Verto Account

- Log into Your Verto Account

- First, log into your Verto account on their website or app.

- Contact Verto Support

- You can contact their customer support team to request the deletion of your account. Reach out via their contact form, email, or live chat (if available).

- Customer Support Email: support@vertofx.com (You can email them directly with your request.)

- Live Chat: Look for a live chat option on their website, which can be a quick way to get in touch.

- Provide Your Account Information

- Include important details in your request, such as your account ID or registered email address, a clear request to delete your account and any reason (if you feel comfortable sharing) that might help their team understand your request better.

- Complete Any Verification Steps

- Verto may require you to verify your identity to ensure you are the account owner before they process the deletion request. Follow their instructions if prompted.

- Check for Pending Transactions

- Make sure that there are no pending transfers or funds left in your account, as these may need to be completed or refunded before your account can be deleted.

- Wait for Confirmation

- After your request is processed, you should receive confirmation from Verto that your account has been deleted. Keep an eye on your email for any updates.

Things to Keep in Mind

- Pending Transactions: If you have any pending transfers or balances in your Verto account, you may need to clear these before requesting deletion.

- Data Retention: Some financial service providers may retain certain account information for legal or regulatory reasons, even after account deletion. Ask Verto about their data retention policy if you are concerned.

Additional Information

Legal and Regulatory Compliance

- Verto is authorized by the Financial Conduct Authority (FCA) in the UK under the Electronic Money Regulations 2011, Firm Reference 901073, for the issuing of electronic money.

- The VertoFX card is issued by Monavate Limited pursuant to license by Mastercard International. Monavate Limited is authorized and regulated by the Financial Conduct Authority as an Electronic Money Institution under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 901097).

- VertoFX Inc operates in the USA through a partnership with Global Innovations Bank, to which VertoFX Ltd is a service provider.

Awards, Prizes and News

Verto, a leading cross-border payments platform, has recently been involved in several notable developments:

- Verto Awards launch: In February 2025, Verto introduced the Verto Awards, aiming to celebrate innovation, leadership, and impact among early-stage startups. The awards offer a grand prize of up to USD 15,000, with USD 10,000 awarded to the winner and an additional USD 5,000 in runner-up prizes. The initiative seeks to recognize and support startups with global potential.

- Regulatory milestones: Verto has secured key regulatory licenses in the United Arab Emirates (UAE), enhancing its ability to offer cross-border payment services in the region. Additionally, the company has expanded its capabilities in the United States, aiming to make global payments faster and more efficient for its users.

- Recent news: On March 3, 2025, Verto announced the acquisition of key regulatory licenses, expanding access to cross-border payments for businesses. The company also published insights on navigating cross-border payments in emerging African markets, highlighting its innovative approach to payment technologies in the region.

These developments reflect Verto's ongoing efforts to innovate and expand its services in the cross-border payments industry.

Deals

Reviews

Good service

1 XAF = 2.45 cheaper rates