WorldFirst Detailed ReviewRates, Fees, Limits, Safety and More

Last updated: October 02, 2024

What is WorldFirst? An introduction

WorldFirst is a one-stop payment and financial services platform for businesses engaged in cross-border trade.

WorldFirst's goal is to enable truly borderless commerce with easy, fast and secure cross-border transactions. Founded in the UK, they have served the international payment needs of over one million businesses since 2004.

WorldFirst company information

WorldFirst's mission is to empower SMEs to succeed globally by providing digital financial solutions through the multi-currency World Account.

They believe that every business, no matter its size, deserves a shot at the global stage. Their products and services help you make and receive payments, reduce currency conversion risk and manage funds in multiple currencies so you can reduce costs, grow and react to international business opportunities fast.

WorldFirst by the numbers

The below statistics help put WorldFirst's financial and customer reach and impact in perspective.

- 6 million site visitors a year

- Over 1 million customers

- USD 200 billion transaction volume

- 90+ currencies available to transfer to 200+ countries and regions

- 20 years in the currency business

- 32 offices worldwide

WorldFirst is an international payments and financial services platform for businesses of all sizes. With 20 years' experience in the global FX and payments space, the multi-currency World Account enables businesses to manage cross border payments and other financial needs.

What services does WorldFirst provide?

When you sign up to use WorldFirst for your international business payment needs, your World Account comes with a ton of useful capabilities to drive your business forward.

Your World Account is a multi-currency account for global business and comes with the below capabilities.

Make payments

- Pay suppliers and staff all over the globe

- Make payments to tax authorities

- Pay in 90+ currencies to 200+ countries and regions

- Send same-day and next-day payments

- Enjoy competitive exchange rates

- Send payments to other World Account instantly, for free

- Make up to 200 payments in one transaction

- Schedule one-off or recurring payments

Pay 1688.com suppliers (select regions only)

- Pay suppliers on China's leading wholesale marketplace, 1688.com instantly

- No limits on payment sizes

Receive payments

- Open accounts in 20+ currencies with local bank details for faster payments

- No overseas address needed to open a currency account

- Receive payments from wholesale customers

- Collect payments from 130+ marketplaces and payment gateways

- Tax refunds can go into your World Account

- Pay zero fees to receive payments

Manage currency exchange

- Make an on-the-spot trade using a live rate

- Target an exchange rate to execute your trade, 24/7

- Lock in an exchange rate for up to 24 months with a forward contract

Manage funds

- Hold funds in 20+ currencies

- Convert the funds between your currency accounts

- Withdraw the funds home when it suits you

From sending and receiving international payments at competitive exchange rates to managing currency exchange and funds, your World Account is your one stop solution for all your cross border business payment needs.

Which countries does WorldFirst operate in?

WorldFirst has offices in Australia, China, Hong Kong, the Netherlands, Singapore and the UK, and enables you to send and receive money across numerous countries all over the world.

Where can I send money from with WorldFirst?

If your business is registered in one of the following countries, you are eligible to open an account with WorldFirst - Australia, Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Gibraltar, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, New Zealand, Norway, Poland, Portugal, Romania, Singapore, Slovakia, Slovenia, Spain, Sweden, United Kingdom and United States.

Where can I send money to with WorldFirst?

You can send money with the World Account to many countries and regions that include Australia, Austria, Belgium, Bulgaria, Canada, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Gibraltar, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, New Zealand, Norway, Poland, Portugal, Romania, Singapore, Slovakia, Slovenia, Spain, Sweden, United Kingdom and United States.

WorldFirst enables you to send and receive international business payments in 90 countries to over 200 destinations across the world.

What are WorldFirst's fees and exchange rates?

WorldFirst's exchange rates tend to be very competitive when it comes to making cross border FX payments. One of the best parts about their exchange rates is that they are transparent, which means you will be shown the exact rate you will get when you send your payment.

Below is some pertinent information about WorldFirst's FX markup for calculating the exchange rate that you will get on your FX transaction with them:

- Currency conversions in the UK are marked up by maximum 0.5%

- Transfers made from ANZ region are marked up by maximum 0.6%

When it comes to fees, most activities that you can perform with your World Account are free. Below is a summary of pertinent fees:

- Open an account: Free

- Ongoing account fees: Free

- Payment fees: Varies by currency and amount

- Payments to other World Accounts: Free

- 1688.com payments: Up to 0.8%

- Receive funds: Free

- Hold funds in multiple currencies: Free

Are WorldFirst exchange rates good?

WorldFirst's exchange rates are very competitive so you can keep more of what your business makes.

That said, we always recommend to our business customers to always shop around and see what other remittance service providers have in store for your payment needs. The more information you have at your disposal, the better the choices you can make.

Comparing money transfer providers significantly boosts up the chances of your getting maximum benefit on your international business money transfers needs.

Even though it is possible to compare money transfer companies manually, a better and more efficient method is to make use of RemitFinder's online money transfer comparison engine. RemitFinder compares many remittance providers side-by-side to give you accurate and updated information about their exchange rates and deals.

Is WorldFirst a cheap way to send money overseas?

Yes; WorldFirst offers competitive exchange rates and has no hidden costs. All fees are displayed upfront before you make your trade so you will know exactly what you are paying for and how much.

How do I avoid WorldFirst fees?

If your business transacts a high monthly volume, you may be eligible for a discount on the foreign exchange rate.

We encourage you to discuss your situation with your account manager at World First to see if your business qualifies for additional discounts and better exchange rates.

How much money can I send with WorldFirst?

The good news is that there is no limit on the minimum or maximum amount you can send with WorldFirst. That said, note that there may be country-wide limits or restrictions imposed by governments or local financial regulatory bodies.

Also, be aware that only businesses are eligible to open an account with WorldFirst.

There are no limits to the amount of money you can send and receive with WorldFirst.

How long does it take for WorldFirst to send money overseas?

You can make same-day payments in major currencies. For other currencies, it may take up to 3 business days.

Additionally, transfers between World Accounts are instant. This means that if your recipient also has a World Account, you can send money to them instantly.

WorldFirst is a fast way to send and receive business payments internationally. Transfers amongst World Accounts are instant, and most payments to non-WorldFirst customers clear within 1-3 business days.

How can I pay for my WorldFirst money transfer?

To be able to complete an international business money transfer, you first need to send your funds in local currency to the money transfer company you choose. The method you employ to pay for your remittance transaction is called a payment method.

For making payments with WorldFirst, simply make sure that the amount you want to transfer is in your World Account before the trade occurs.

The easiest way to fund your World Account is by linking your local currency bank account and using that to transfer funds directly to your account.

Which payment method should I use to pay for my WorldFirst money transfer?

We recommend using your bank account to fund your World Account. This is because local bank payments are generally free vs using credit card or other ways which may involve additional fees.

How can my recipient get paid with WorldFirst?

The method you choose to credit your overseas receiver is generally called a delivery method. WorldFirst supports the following delivery methods:

- Bank deposit: Money will be credited directly into the overseas recipient's local bank account in their local currency.

- World Account deposit: Funds will be sent to the recipients World Account. They could use the money to make other transactions or transfer it to their local bank account.

With WorldFirst, you can send overseas business payments to your recipient's bank account or their World Account.

Which delivery method should I use for my WorldFirst money transfer?

If your overseas receiver also has a WorldFirst account, we recommend using that as the preferred delivery method. This is because payments between World Accounts are not only free but also instant.

If your recipient is not a WorldFirst customer, then choose bank deposit as the delivery method so the funds will credit to their bank account.

Are there any WorldFirst coupon codes or promotions I can use?

WorldFirst has promotions from time to time. Check the website of the country where your business is registered to see any applicable offers that you can take advantage of.

If WorldFirst runs any offers or promotions in the future, we will add them on this page. Check this WorldFirst review periodically to ensure that you do not miss out on any future deals.

Whilst you can check for WorldFirst deals and discounts manually, doing so is time consuming. A better way is to sign up for the RemitFinder daily exchange rate alert. Our daily alert is totally free of cost; we will keep you posted on exchange rates and latest offers from many money transfer companies.

How can I find WorldFirst near me?

WorldFirst is a fully online company and there are no branch offices or agent locations that you need to go to for your international business payment needs. Simply go online to use WorldFirst anytime from anywhere.

What is the best way to find a WorldFirst Sending Location near me?

You can send money with WorldFirst quickly and easily from your phone or computer. There is no need to go to a payment or sending location for making international business payments with WorldFirst.

What is the best way to find an WorldFirst Payment Location overseas?

Recipients of WorldFirst international payments can get the funds either into their bank account, or into their World Account if they are WorldFirst customers. Therefore, there is no need to go to a payment location overseas to access the funds.

Is WorldFirst a safe way to send money abroad?

WorldFirst has many measures in place to ensure the safety and security of their customers' funds and personal information. Protecting your data and money is a priority for WorldFirst. Security features include:

- Real-time 24/7 fraud monitoring

- One-time passcodes for every payment

- Your money is 100% safeguarded with trusted global banks including JP Morgan, Citibank and Barclays

WorldFirst implements many security features and protocols to ensure that funds as well as private information of their customers is safe at all times.

Can I trust WorldFirst?

A major aspect of trusting a financial institution entails inspecting their legal and regulatory status in the countries of their operation. When it comes to WorldFirst, they are authorized and regulated across six regions by:

- The Financial Conduct Authority (UK)

- De Nederlandsche Bank (Netherlands)

- Financial Transactions Reports Analysis Centre of Canada (Canada)

- The Monetary Authority of Singapore (Singapore)

- Australian Securities and Investments Commission (Australia)

- Hong Kong Customs and Excise Department (Hong Kong)

WorldFirst is regulated and authorized by numerous financial watchdog and regulatory institutions in all the countries they operate in.

How good is WorldFirst's service?

One of the most reliable ways to check if a service is good or not is to see what other customers have to say about it. We will do the same to see if WorldFirst's customers are happy with their service or not.

What do users have to say about WorldFirst?

In this section, we look into WorldFirst's ratings and reviews^ on popular review platforms and major mobile app stores to see what users think about their service.

- On Trustpilot, WorldFirst is rated Great with a 4.2/5.0 rating and 2401 reviews

- On Trustpilot, WorldFirst Australia & New Zealand is rated Excellent with a 4.8/5.0 rating and 324 reviews

- WorldFirst is currently not promoting their mobile app on Google Play and App Store so there are no ratings and reviews there yet. Once that changes, we will update this review with relevant information.

^Ratings on various platforms as on September 21, 2024

WorldFirst has very good ratings and reviews on Trustpilot. Their mobile app is not marketed yet so there are no reviews on Google Play and App Store.

Have you used WorldFirst yet? If so, please consider leaving a review on RemitFinder so other users can benefit from your expertise and experience.

Is WorldFirst the best choice for me?

Given our detailed analysis of WorldFirst international business money transfer service and related aspects, it is clear that WorldFirst has many strong areas. Here are some areas where we find WorldFirst standing tall in the international business remittance ecosystem:

- Comprehensive business payment solution: WorldFirst's multi-currency account, called the World Account, comes in with easy and streamlined international business payments for both sending and receiving money. With additional capabilities to manage currency exchange as well as funds, it is a one-stop solution for all your business financial needs.

- Wide corridor support: With WorldFirst, you can send and receive business payments in-between more than 1300 country combinations, with built in support for all major currencies. This makes it seamless for you to scale your business internationally as WorldFirst has you covered already.

- Competitive exchange rates and fees: WorldFirst's exchanges rates are very competitive and much better than traditional banks. Most account aspects are free, and whenever there is a fee for any service, it is disclosed transparently so you always know exactly what you are paying for and how much.

- No sending limits: WorldFirst does not impose any limits on the amount of money you can send overseas with them. This makes it easier to pay large invoices or make major investments without having to worry about transaction limits.

- Quick international payments: International transfers and payments with WorldFirst clear instantly if your recipient also has a World Account. Otherwise, transactions process within 1-3 business days.

- Focus on safety and security: WorldFirst has been around for more than 2 decades and puts in a lot of focus on the safety and security of your funds as well as information. They implement various security measures to enhance safety and are a regulated company in various countries of operation.

- Positive Trustpilot ratings and reviews: WorldFirst has great ratings and reviews on Trustpilot. This indicates that customers are happy with their international payment service and the multi-currency World Account.

RemitFinder likes WorldFirst for providing a comprehensive international business payment platform, handling more than 1300 country combinations, offering highly competitive exchange rates and charging low fees, facilitating transactions without limits, moving money overseas fast and providing a safe and secure financial platform.

Here are some additional criteria that you can evaluate to ascertain if WorldFirst may be the best choice for you:

- You hold a registered business license

- You are an e-commerce or marketplace seller

- You are an SME or enterprise business

- You trade in non-restricted goods and services

What are the best reasons to use WorldFirst?

WorldFirst's key advantages make it a very good choice for quite a few cross border business payment and money transfer needs. Based on the in-depth analysis that we have conducted on WorldFirst's international business remittance service in prior sections of this review, we notice that it can be a great fit for many money transfer scenarios.

Below, we provide some scenarios whereby WorldFirst can act as a reliable partner for your next overseas business payment or funds transfer.

- If you need more than just an FX provider and need to send and receive seamless international business payments with a safe and secure platform, WorldFirst could be a great fit. The World Account comes with numerous capabilities to help you fulfil a wide array of day-to-day business financial needs.

- With a wide 1300+ country corridor support, the chances that WorldFirst has you covered for your international business payment needs are pretty high. If your country combination is not supported right now, there are chances that it may be in the future, so keep checking back.

- Businesses work hard to earn their money, and it is no surprise that international businesses would like to save as much as possible on their international FX needs. This is where WorldFirst could be a great fit given their transparent and competitive exchange rates as well as low fees.

- As your business grows, you may look at large investments or partnerships that may necessitate international movement of large sums of money. The good news is that WorldFirst does not impose any upper limits on transfers, so you can move as much money overseas we you need to for business growth.

- In today's fast moving digital economy, time is money. This cannot be truer for businesses as you may need to make fast payments where time is of the essence. WorldFirst helps move money overseas quickly, especially if the recipient is also a WorldFirst customer - in this case, the transfer will be instant. All other transfers finish within 1-3 business days.

- WorldFirst also has numerous integrations built in into their platform. For example, Xero and NetSuite are both already integrated. This elevates your World Account to next levels whereby you do not have to move data around and deal with multiple systems.

WorldFirst's strengths and advantages make it a very good choice for many business money transfer scenarios for businesses that operate in more than one country.

Here is a summary of key capabilities that WorldFirst offers for your business:

- All-in-one platform to manage your international payments – pay, receive, hold, convert and withdraw funds from one account

- Accounting software integration – Xero and NetSuite

- Competitive exchange rates and transparent fees

- Fast payments

- No account opening fee, no ongoing fees and free to receive payments

- Dedicated customer service team

- Currency risk management with forward contracts

- Team access with the ability to set roles and access levels

- Unfunded payments – book a trade and just make sure the funds are in your account before the trade occurs

What type of transfers can I make with WorldFirst?

You can make international business payments and money transfers with WorldFirst.

If your business is registered in a WorldFirst supported operating country, you are eligible to sign up and take advantage of WorldFirst's multi-currency account called the World Account. This account comes with numerous capabilities and helps sending and receiving international business payments seamless.

What are various ways to send money with WorldFirst?

You can send cross border business FX payments online via the World Account platform offered by WorldFirst.

Note that the WorldFirst mobile app is not being marketed at this time, so you will need to use the website. The good news is that the website works on both computer and mobile, so you can easily access it with your smartphone as well.

How to send and receive money with WorldFirst?

It is quick and easy to send business payments internationally with WorldFirst. In fact, the whole flow from start to finish can be completed from within your World Account in just a few minutes. Check out the section below for the exact steps needed to do an overseas business money transfer with WorldFirst.

Step by step guide to send money with WorldFirst

With WorldFirst, sending business money transfers overseas takes only a few clicks. Here are the steps you need to undertake to finish an end-to-end money transfer with WorldFirst.

- Step 1: Decide if you want to send international business payments with WorldFirst. With so many international remittance service providers available, it may seem difficult to even choose one for your payment needs. A great start is to compare various money transfer companies using RemitFinder's online remittance comparison platform. RemitFinder does all the work to show you latest and updated FX rates from providers so you can easily compare their relative strengths and weaknesses side by side. This can prove useful to help narrow down the choices that meet your selection criteria and assist you in selecting who to go with.

- Step 2: Register for your new World Account. If you do not have a WorldFirst account already, register for your World Account. You will need to provide personal and business information, and go through KYC (know your customer) requirements by providing identification information. This ensures that you are opening your account on your own behalf and no one else is impersonating you.

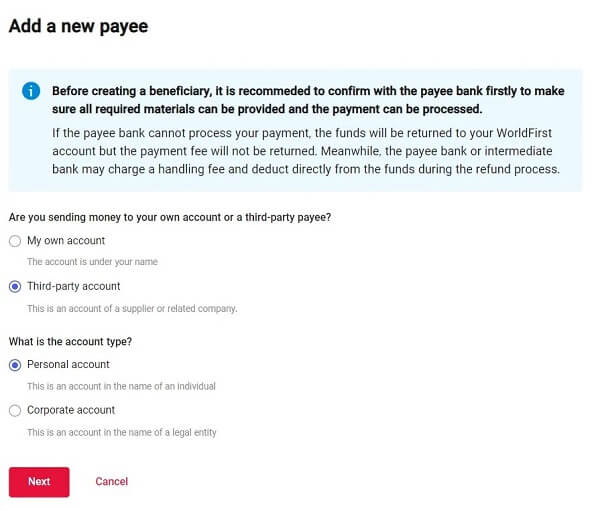

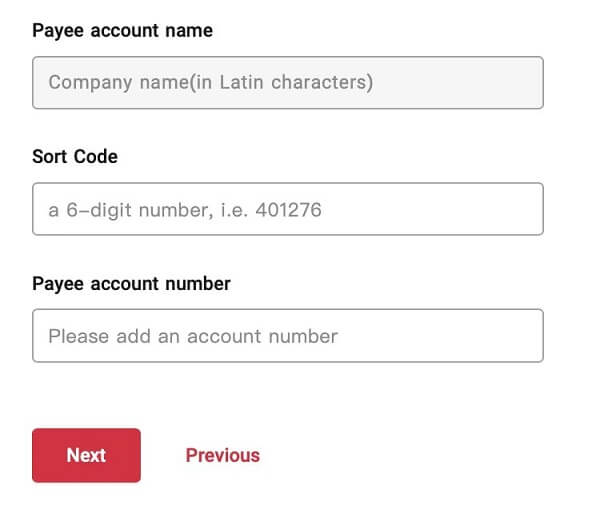

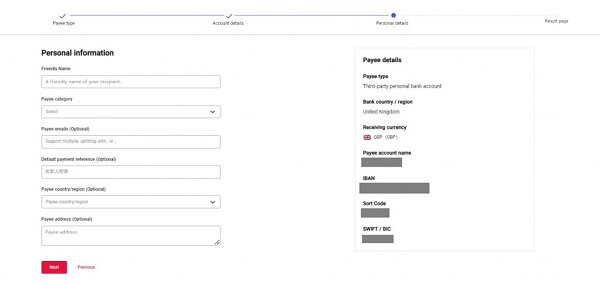

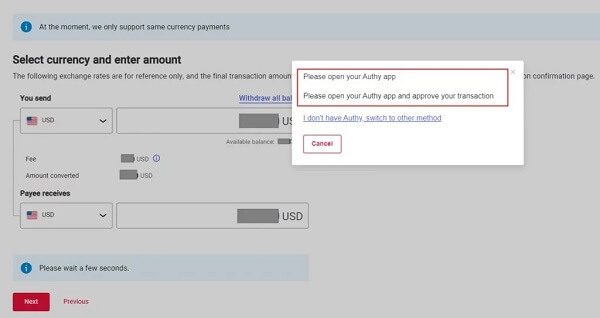

- Step 3: Add your overseas recipient as a payee. The next step is to add your overseas recipient as a payee. If you have sent money to the intended recipient before, simply choose them from your existing payee list. Otherwise, choose "Payees" from the dashboard and then click on "Add a new payee". Select "Single payee" and then "Third-party account". After this, choose your account country and the currency to send payments in for this payee. Then, enter the third-party account details as required. In the final step of new payee flow, you will be asked to verify using 2FA (2 factor authentication) via the Authy App or an SMS message. After this, the payee will be immediately approved, or you will be asked for additional information if needed.

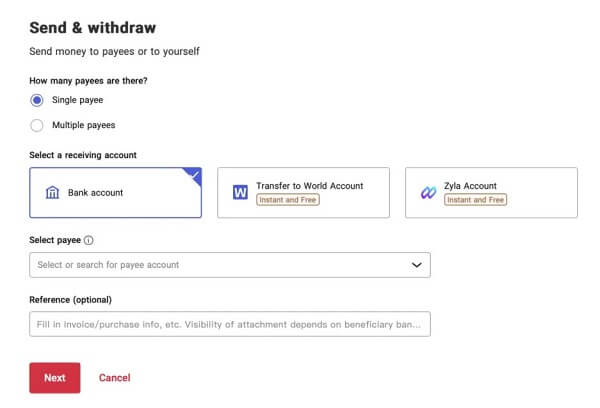

- Step 4: Initiate a payment to a third party payee. To start an international payment, click on "Payments" and then "Send & withdraw". Choose "single payee" and select the payee you want to send the payment to.

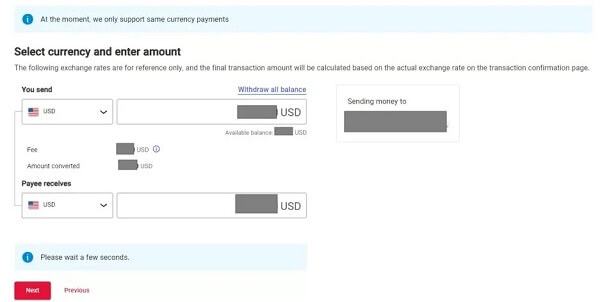

- Step 5: Select currency and enter amount. The next vital step in the process is to select your funding currency, the recipient's currency and the amount. You can also select whether to send the payment now or schedule it for later. For scheduled payments, WorldFirst will default to booking a currency forward if the currency pair is supported. If by any chance the currency pair is not supported for currency forward, WorldFirst will apply the spot rate at the time of the transfer.

- Step 6: Verify your transaction. Before you can submit your transaction, you will need to verify it using 2FA via either the Authy App or with an SMS message.

- Step 7: Check everything and submit your transfer. After you have finished 2FA verification, you will be presented with a summary of everything for review. If you need to change anything, you can go back and edit information as needed. Once you are satisfied with everything, click on "Confirm payment" to submit your transaction.

Choose payee account type in the add payee flow

Add payee account details in the add payee flow

Add payee personal information in the add payee flow

After this, the payment is complete from your side and from this point on, WorldFirst will work on completing your transfer. WorldFirst will keep you informed about transaction progress, plus you can check status anytime from your transaction history.

It is quick and easy to make international payments with the WorldFirst World Account. The whole flow can be completed in just a few minutes easily.

How can WorldFirst help me send money?

WorldFirst can help you make international business payments for many scenarios. Some common examples of cases where you can use your World Account to send money overseas include:

- Pay suppliers overseas

- Pay staff, contractors and freelancers overseas

- Pay tax authorities

- Move money between your business accounts in different countries and currencies

Do I need a WorldFirst account to receive money?

If you are receiving money from a World Account user you do not need a world Account to receive the funds that the sender is sending over to you. This is because WorldFirst is able to make bank deposits and the funds can arrive directly into your bank account.

However, funds sent between World Accounts are instant and free. Plus, if you have a WorldFirst account, you can tap into the various services and benefits that your multi-currency World Account comes with.

Does WorldFirst have a mobile app?

WorldFirst launched a mobile app in the UK/EEA markets in Q3 2024, but it has not been actively promoted yet as the team is currently working on a promotional strategy. Once the WorldFirst mobile app is generally available, we will update this review with that information.

How do I track my WorldFirst transfer?

You can track your transfer by going to your transaction history and finding the relevant transaction. You can also choose to receive transaction updates and WorldFirst will keep you posted as your transaction progresses.

Can I use WorldFirst for international bank transfers?

Yes, you can use WorldFirst to make transfers to international bank accounts.

To do this, simply fund your World Account from your linked bank account, and choose to pay your overseas recipient directly into their bank account. By doing this, you would simulate an international bank transfer, albeit at much better exchange rates and lower fees as compared to traditional banks.

Is WorldFirst online better than sending money in-person in stores?

WorldFirst is an online only international business payment company so there is no need to go to stores, branches or agent locations to send money overseas with them. Simply use your online World Account to send and receive money internationally.

Does WorldFirst have a rewards program?

WorldFirst offers a referral program, cashback, fee-free transfers and other promotions from time to time. Check this review periodically for details on active offers.

What customer support options are available with WorldFirst?

In case you need any assistance with your WorldFirst payments and money transfers, or have any other general questions, you can contact the WorldFirst customer support team.

Note that the WorldFirst customer support team is available on weekdays (Monday to Friday) between 8:30 am to 5:30 pm. Support is not available on Bank Holidays and weekends.

There are many easy ways to get in touch with WorldFirst customer support as below:

- Phone

- In the UK: 020 7801 1065

- Outside the UK: +44 20 7801 1065

- Germany: +49 895 4197 172

- Netherlands: +31 (0)20 299 4960

- France: +33 185 142 195

- Italy: +39 023 055 94 08

- All other European countries: +31 20 299 4960

- In Australia: 1800 701 540

- In New Zealand: 0800 666 114

- Outside Australia: +61 2 8298 4999

- Hong Kong: +852 3002 4499

- Singapore: +65 6805 4380

- Email

- UK: clients@service.worldfirst.com

- EU: eeaclients@service.worldfirst.com

- ANZ: ausclientrelations@worldfirst.com

- Hong Kong: clientsupport@worldfirst.com.cn

- Singapore: seaclients@service.worldfirst.com

- Live Chat

- WeChat: specific regions only

- WhatsApp: specific regions only

There are many easy ways to get in touch with the WorldFirst customer support team. Supported contact channels include phone, email and live chat. For some regions, you can also use WeChat and WhatsApp.

Can I cancel my WorldFirst transfer?

You can cancel your WorldFirst transfer provided the transaction has not taken place yet. For completed transfer, get in touch with the WorldFirst customer support team to see if there are any possible options.

How do I delete my WorldFirst account?

If you wish to delete your WorldFirst account, please get in touch with the customer support team in your region and someone will assist with your request.

Once your account is deleted, you will lose all access. We, therefore, recommend that you save all transaction history for future reference purposes.

Additional Information

Legal and Regulatory Compliance

World First UK Limited is authorized by the Financial Conduct Authority ("FCA") as an Electronic Money Institution under the Electronic Money Regulations 2011. WorldFirst is a UK registered limited company with company number 05022388 and has an FCA Firm Reference number 900508.

In the UK, WorldFirst is headquartered at Millbank Tower, 21-24 Millbank, London SW1P 4QP.

Additionally, WorldFirst is regulated and authorized by the following financial and regulatory organizations in various countries of operation:

- De Nederlandsche Bank (Netherlands)

- Financial Transactions Reports Analysis Centre of Canada (Canada)

- The Monetary Authority of Singapore (Singapore)

- Australian Securities and Investments Commission (Australia)

- Hong Kong Customs and Excise Department (Hong Kong)

Awards, Prizes and News

- Queen's Award for Enterprise in International Trade

- Official payment partner of UEFA UERO 2024

- Finalist for "Fintech Company of the Year" at the Fintech Asia Awards

Reviews

I signed up with World First after I saw their rates in RemitFinder. I really liked the fact that you get a dedicated customer rep who works with you. There can be less initial friction in the experience though. The sign up process is slow and multi step, and you can only wire the funds for transfer first time. Everyone else support ACH and cards from the start. It will be great if World First can make some improvements.