Abound Detailed ReviewRates, Fees, Limits, Safety and More

Last updated: May 09, 2025

What is Abound? An introduction

Abound company information

Abound is a rewards and remittance mobile app owned and created by the Times of India group. Formerly called Times Club, Abound is a super app that aims to help Non-Resident Indians (NRIs) maximize their savings in various ways.

You can send money from United States to India with Abound at very competitive exchange rates. However, Abound is not just a money transfer app.

Abound has partnered with thousands of merchants, retailers and brands to bring you attractive discounts and cashbacks. From groceries to online shopping to booking flights, you can earn rewards and put even more money in your pocket with Abound.

You might be surprised how much you can do with Abound. Read our detailed Abound review below to discover more.

Abound, formerly Times Club, is a money transfer and rewards super app from the Times of India group.

What services does Abound provide?

With Abound, you can send money and earn attractive rewards in various ways. Below is a summary of all you can do with Abound:

- Send money internationally: One of the best services from Abound is their international remittance service from USA to India. If you send money with Abound, you get very competitive exchange rates and 0 transfer fees.

- Earn rewards for everyday spending: Abound has partnered with numerous retailers, merchants and stores to help you earn rewards and cashbacks. For example, you can earn 5% cashback on more than 4,000 Indian grocery stores across the United States.

- Borderless account: Abound also offers a convenient borderless account that works in both the United States and India for your spending and purchases. In addition, you get 3% bonus on your cash deposits to this account.

- Premium spending card (coming soon): Abound is also planning to launch a Premium spending card in the near future, using which, you can get double cashback on your spending and purchases in the US. Additionally, your family in India can use the same card to get exclusive discounts and benefits.

Abound is a super app that you can use in the United States to send money to India and earn numerous cashbacks and rewards.

Which countries does Abound operate in?

Currently, Abound is available in the United States. If you reside in the US, you can download the Abound mobile app from either the Google Play Store or the Apple App Store.

Where can I send money from with Abound?

You can send money using Abound from the United States.

Where can I send money to with Abound?

Currently, Abound supports sending money to India from the US.

With Abound, you can send international money transfers from USA to India.

What are Abound's fees and exchange rates?

Abound usually provides new RemitFinder users with a special welcome exchange rate for a portion of their first international money transfer.

For the money transfer amount above an applicable threshold, you will get Abound's regular exchange rate, which is also very competitive as compared to other money transfer companies operating in the US-India remittance corridor.

Note that the welcome rate is only applicable for a limited time so hurry and take advantage while this great rate is still available!

Abound is offering new RemitFinder users a special welcome rate on a portion of their first international money transfer to India.

Are Abound's exchange rates good?

Abound's exchange rates are extremely competitive as noted in the prior section. Even after the threshold amount that earns you a one-time welcome exchange rate, the normal rate is very competitive.

We always recommend that you compare the market and see what other money transfer companies have to offer as well before you choose a partner to send money with. By comparing remittance companies, you can ensure that you are getting the maximum return on your international money transfers.

A really easy and convenient way to compare various remittance service providers is to use RemitFinder's online remittance comparison platform. We do all the hard work to fetch exchange rates from many companies and compare them for you so you can simply inspect various options and choose the best one for you.

Is Abound a cheap way to send money overseas?

Yes, Abound is a very cost-effective way to send money abroad. Currently, Abound is waiving all transfer fees for RemitFinder users.

Together with the welcome rate on the first transfer, highly competitive exchange rates on amounts thereafter, and 0 transfer fees, Abound is a definitely a cheap way to send money internationally.

With excellent exchange rates and 0 fees, Abound is a very economical way to send money to India.

How do I avoid Abound fees?

At this time, Abound is waiving all transfer fees for RemitFinder users. All you have to do to save on fees is to use RemitFinder's unique link to sign up with Abound and send money.

How much money can I send with Abound?

You can send up to USD 7,500 per day with Abound for money transfers from USA to India.

How long does it take for Abound to send money overseas?

Most Abound money transfers will finish between 3-4 business days. If you need to rush money urgently to your loved ones in India, you may have to explore other faster options.

How can I pay for my Abound money transfer?

When you send money abroad with Abound, you can fund your money transfer in a couple of ways. The way you choose to pay for your money transfer is called a payment method.

With Abound, you can use your bank account to pay for your money transfer.

Which payment method should I use to pay for my Abound money transfer?

We generally recommend staying away from using Credit cards to fund your money transfer. This is because many credit card companies treat money transfers as cash advance, and you may get hit with extra fees.

Therefore, it is better to use your bank account to pay for your money transfer as there are no fees to do so. The good news is that Abound fully supports bank account as a payment method.

How can my recipient get paid with Abound?

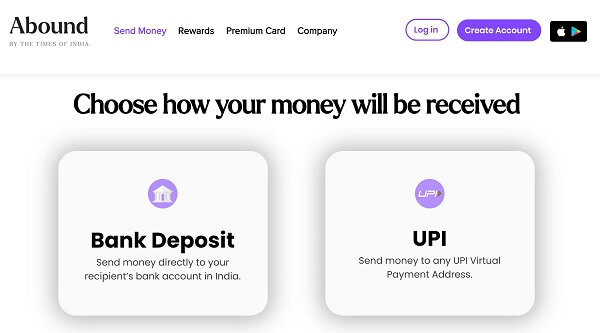

A delivery method is how you decide to pay your overseas recipient. Abound offers 2 very attractive delivery methods as below:

- Bank Deposit: Abound has partnerships with over 130 banks in India. This maximizes the reach of Abound money transfers when it comes to paying recipients in India via a direct bank deposit.

- UPI Address: UPI stands for Unified Payments Interface and is a payment gateway developed by the Government of India to streamline online and digital payments. Abound supports sending money to anyone in India using their UPI ID. No bank details need to be shared, and all you need is your recipients UPI ID.

Which delivery method should I use for my Abound money transfer?

Both bank deposit and UPI are great ways to send money overseas. UPI can be the faster option of the two, so go with UPI if you need to send money faster to your recipient.

If your recipient does not have a UPI account, then use bank deposit which will clear within 3-4 business days.

If your recipient has a UPI account, we recommend using UPI as a preferred delivery method as funds may arrive sooner. Otherwise, use bank deposit to pay your overseas recipient.

Are there any Abound coupon codes or promotions I can use?

Absolutely. Currently, there is a very attractive promotion from Abound whereby new RemitFinder users get a promotional FX rate on their first money transfer.

In addition, you also pay 0 money transfer fees when you send money with Abound.

These offers are available for a limited time only; take advantage while they last.

New RemitFinder users pay 0 fees and get a welcome FX rate on their first money transfer with Abound.

In case Abound adds additional promotions in the future, we will add them on this review. To ensure you are up to date on Abound offers and discounts, check this page from time to time.

Instead of checking for discounts and offers manually, you can also register for the RemitFinder daily exchange rate alert. The rate alert is free, and we will keep you updated with the latest deals as well as exchange rates from money transfer companies.

How can I find Abound near me?

Abound is an online only money transfer company and there are no branches or offices to go to. Staying digital only helps companies keep their operational costs low, and thus pass on savings to customers.

Abound is a fully digital money transfer service. You do not need to stand in lines at physical locations to send money with Abound.

What is the best way to find an Abound Sending Location near me?

Since Abound is a digital company, there is no need to look for any branches or offices near you. Abound is right in your pocket when you need to send money!

What is the best way to find an Abound Payment Location overseas?

Abound moves money overseas digitally, and you can pay your recipient via a direct bank deposit or via UPI. Therefore, your recipient does not need to go to any physical location to pick up the money you send to them.

Is Abound a safe way to send money abroad?

Abound seems to take the security and safety of your funds and private information seriously. Below are some methods that Abound employs to make it safe to transact on their system:

- Abound does full Know Your Customer (KYC) due diligence when you sign up with them. This involves identifying you to ensure you are transacting on your behalf and no one else. As part of the KYC verification process, you will need to provide your full name, address and US Social Security Number. Based on all this data, Abound does a verification check for you.

- Abound verifies that you have possession of your phone by sending you a verification code on your mobile.

- Abound relies on SSL encryption to ensure data is protected both while in transit as well as when at rest.

- For linking your bank account, Abound relies on Plaid, which uses strict security standards to ensure the safety of financial and personal information.

- Abound also monitors transactions regularly and notifies you if any suspected or fraudulent activity happens on your account.

- You can enable and disable biometric authentication on your mobile phone via the Abound app anytime.

Abound implements various security practices to try to keep your money and information safe and secure.

Can I trust Abound?

Abound relies on a few partners for various functions of their ecosystem. Some of these include Synapse Financial Technologies, Inc.'s affiliate, Synapse Brokerage LLC for cash management accounts, Synapse's bank partners ("Synapse Program Banks") for Card services and Plaid for linking bank accounts.

You should check the safety and security of Abound's partners to ensure you feel safe transacting with them.

Abound relies on a few partners like Synapse Brokerage LLC, Synapse's bank partners and Plaid for some of the services offered on their platform. Make sure to ensure you are comfortable using these services via Abound.

How good is Abound's service?

One of the most reliable ways to check if a service is good or not is to see what other customers have to say about it. We will do the same to see if customers are happy with Abound or not.

What do users have to say about Abound?

Let's look into Abound's ratings and reviews^ on popular app stores to see what users think about their service.

- On the Google Play Store, Abound has a 3.3/5.0 rating with 216 reviews and more than 100,000 downloads

- Abound's iOS app is rated 4.6/5.0 on the App Store with 5,800 ratings

^Ratings on various platforms as on June 07, 2023

Abound has excellent ratings on the Apple App Store; Android reviews on Google Play Store are a mixed bag though.

Have you used Abound yet? If so, please consider leaving a review on RemitFinder so other users can benefit from your expertise and experience.

Is Abound the best choice for me?

There are quite a few benefits to use Abound to send money internationally. Given our in-depth analysis of Abound's money transfer service, we find it to be strong in the below aspects:

- Amazing welcome FX rate: Abound is offering a higher, welcome FX rate for every US Dollar on a portion of your first transfer when sending money from the US to India as a special exchange rate to welcome new RemitFinder users. This can mean an additional saving on your money transfers to India!

- Very competitive exchange rates: For amounts higher than USD 1,000, Abound is offering competitive exchange rates that are amongst the best in the current USD-INR remittance landscape.

- 0 fees for new RemitFinder users: Abound is waiving all fees for new RemitFinder users. This will help you save even more money on your first money transfer with Abound.

- Flexible delivery methods: With Abound, you can send money to your recipient directly in their bank account or into their UPI account. These are secure and convenient ways for your recipient to access the funds you send to them.

- Good customer feedback: Abound has excellent mobile app ratings on the Apple App Store. This seems to suggest that their iOS app is well liked by customers. That said, Google Play Store ratings are a mixed bag; you may run into an occasional glitch on the Android app.

RemitFinder likes Abound for providing an amazing welcome FX rate, highly competitive rates in general, 0 fees and flexible delivery methods.

What are the best reasons to use Abound?

Abound's strengths make it a good fit for many international money transfer scenarios. Given our detailed analysis of Abound's money transfer service in prior sections of this review, we find it to be a good match for many international remittance scenarios.

Below, we present some examples where Abound may be a good partner for your next overseas money transfer.

- If you live in the United States and need to send money to India at very competitive exchange rates, Abound may be a great fit. For new RemitFinder customers, Abound is currently offering a welcome FX rate on a portion of your first money transfer. Thereafter, Abound's regular exchange rate will apply.

- If you wish to save on money transfer fees, Abound may be a good choice as they are currently waiving all money transfer fees for US-India remittances.

- If your recipient in India does not have a bank account (or does not feel comfortable sharing their bank account information with you), you can still send money to them using UPI. This is because Abound supports UPI as a delivery method to pay your overseas funds receiver.

- If you like to enjoy a seamless app experience, Abound's iOS app may be a good fit given really good ratings and review on the Apple App Store.

- Finally, if you also want to take advantage of rewards, discounts and cashbacks on your daily spending and purchases, you can rely on Abound to earn you some money back.

Abound can be a really good ally for many popular international money transfer use cases.

What type of transfers can I make with Abound?

Currently, you can make international money transfers from the United States to India using Abound. It is possible that more countries get added in the future, but for now, Abound only supports the USD-INR market.

You have 2 flexible ways to pay your overseas recipients with Abound - direct bank deposit or UPI. For scenarios where bank account information is hard to obtain, UPI is a great way to pay anyone in India.

What are various ways to send money with Abound?

You can send money via Abound by using their mobile app. Both Android and iOS devices are supported; simply download the correct app from the respective app store and get going.

You can also login into the Abound website, but at this time, you cannot send money using it. You will need to use the mobile app to send money with Abound.

How to send and receive money with Abound?

If you wish to send money overseas using Abound, the process is very simple, quick and easy. In fact, you can finish the whole end to end remittance flow on Abound's mobile app in just a few minutes. Check the next section for the steps to complete a money transfer with Abound.

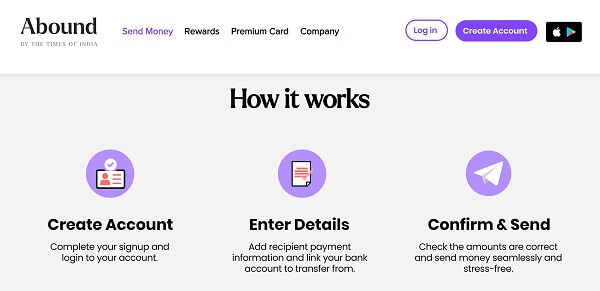

Step by step guide to send money with Abound

Below is an easy to follow step-by-step guide that will enable you to send money internationally with Abound quickly.

- Step 1: Decide if Abound is your preferred money transfer company. Given so many money transfer companies playing in the international remittance ecosystem these days, just deciding who to go with might be harder than actually sending money abroad. An easy answer to this seemingly big problem is to compare various money transfer companies using RemitFinder's online remittance comparison platform. RemitFinder helps you compares the pros and cons of many money transfer companies side by side, thereby helping you narrow down your choices and select who to go with.

- Step 2: Register with Abound and setup your new account. Once you have decided that you wish to send money overseas with Abound, download the mobile app from the correct app store and register a new account. Then complete the KYC process and provide necessary information to correctly setup your account.

- Step 3: Enter payment and delivery information. Next, enter recipient details including which delivery method you want to pay them with. Also, link your own bank account to ensure you can fund your money transfer transaction.

- Step 4: Verify information and complete the money transfer. In this final step, review all the entered information and if all looks OK, send your money transfer. From this point on, Abound will take over and work on completing your money transfer transaction.

You can send money overseas using the Abound mobile app in just a few minutes by following an easy and intuitive money transfer flow.

How can Abound help me send money?

The steps to send a money transfer using Abound's mobile app are very simple and intuitive. You should be able to finish the process in just a few minutes.

In case you need assistance, you can refer to the below graphic for guidance.

Finally, if you face any problems, you can also contact Abound's customer support to get further help.

Do I need a Abound account to receive money?

With Abound, there are 2 ways an overseas recipient can get paid - direct bank transfer or UPI. Neither of these necessitate the receiver having an Abound account.

The overseas recipient does not need an Abound account to receive money sent to them via Abound.

Does Abound have a mobile app?

Abound is primarily accessible via its mobile apps only. You can download Abound's Android app from the Google Play Store or the iOS app from the Apple App Store.

Abound also has a website but it only supports registration and login for new customers. If you want to send money with Abound, you will need to use the mobile app to do so.

How do I track my Abound transfer?

Abound will keep you posted on the progress of your money transfer with them by sending you notification on every step along the way.

Additionally, you can go to your transaction history in the app to check the status of your in-progress money transfer as well as to see your old, completed ones.

Can I use Abound for international bank transfers?

Yes, you can use Abound to simulate international bank-to-bank transfers. You can achieve this by using a bank account on both the sender and the recipient sides - pay for your money transfer via your bank account, and choose bank deposit as the delivery method for your overseas recipient.

In this way, you can send an international bank-to-bank remittance via Abound while taking advantage of Abound's highly competitive exchange rates and no transfer fees.

Is Abound online better than sending money in-person in stores?

Yes, and in fact, Abound is an online-only money transfer app. This means that not only is Abound available 24x7 all year round, but also there are no physical branches or locations to go to.

Abound is a fully online and digital money transfer service, and you do not need to stand in lines in stores or branches.

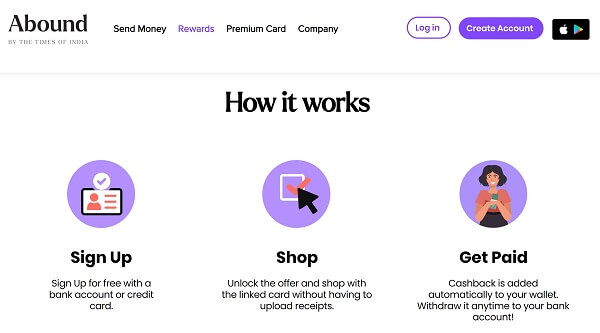

Does Abound have a rewards program?

Abound is a rewards, discounts and cashback super app, so yes, Abound does have a very attractive rewards program!

For the benefit of non-resident Indians (NRIs) settled in the United States, Abound has partnered with thousands of grocery, entertainment and fashion merchants and shops to bring you numerous discounts and cashback offers.

To earn rewards, simply link your bank account or credit card with Abound and start making purchases at supported merchants and shops. Spending and purchases will earn you rewards which get accumulated in your Abound wallet. You can withdraw your rewards anytime into your linked bank account.

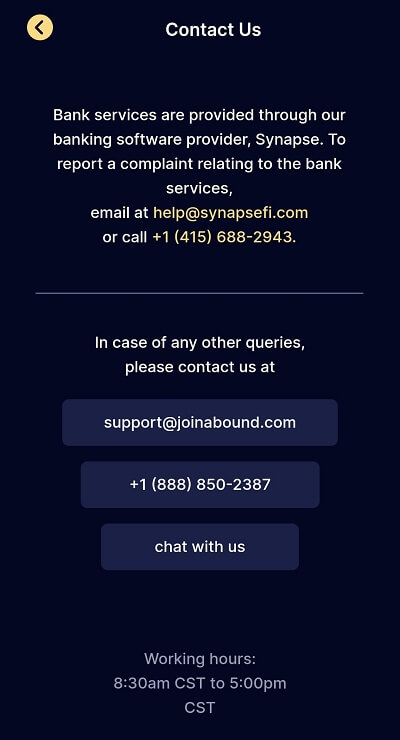

What customer support options are available with Abound?

If you ever need to contact Abound customer service team, the good news is that there are many easy ways to get in touch with them.

You can access the Contact Us menu on the Abound mobile app to see the available options to contact support. This looks like the screenshot below.

As shown above, you can get in touch with Abound support team using any of the below channels:

- By emailing support@joinabound.com

- By calling +1 (888) 850-2387

- By chatting with Abound team from within the app

Note that support is available between 8:30 AM CST and 5:00 PM CST times.

There are many easy ways to contact Abound customer support team - you can use phone, email or chat to get in touch with them.

Can I cancel my Abound transfer?

If you think you made a money transfer by mistake, contact Abound customer service team asap. They will be your best resource in canceling your money transfer.

The possibility, or lack thereof, of a transaction cancelation also depends on how far ahead your money transfer has progressed. Hence, it is important to get in touch with Customer Support as soon as you realize you need to cancel.

How do I delete my Abound account?

If you wish to delete your Abound account, simply contact their customer service team, and someone will assist you with your request.

We recommend that you make a backup of your transaction history before you delete your account. This information may prove helpful if needed in the future as you will no longer have access to your historical transactions after deleting your Abound account.