How to Send Money to India Using UPI

Table of Contents

- What is UPI in India?

- How to Send Money from Overseas into a UPI Account in India?

- Why Choose Panda Remit for Sending Money to India?

For people of Indian origin who study or work abroad, remittance from abroad to family and friends in India is an unavoidable regular activity.

With the rapid and continuous development of technology, all you need nowadays is a smartphone to quickly remit money to family members at a fraction of the cost of traditional remittance methods.

One of the most popular payment methods in India is UPI. Unified Payments Interface, or UPI for short, is an innovative initiative from the Government of India to connect numerous banks into a single mobile application that you can use to send and receive payments.

Just like RuPay Debit and Credit Cards, the popularity of UPI payments in India continues to rise at a fast pace.

In this blog, we will show you how to send money to India using UPI payments. We will exemplify this by taking a case study showing how you can send money from US to India via Panda Remit.

Panda Remit is a popular fintech startup that helps send cross border remittances quickly and in a cost-effective manner.

Let's dive in!

What is UPI in India?

UPI stands for Unified Payments Interface, and is an instant payment gateway and a mobile payments ecosystem developed by the National Payments Corporation of India (NPCI). The NPCI is a payments and financial leader in India and is regulated by the Reserve Bank of India (RBI).

UPI is an innovative payments solution which brings together banks, customers, merchants and partners together in a mobile-first based payments ecosystem. It makes sending and receiving payments seamless by removing the need for cash and cards.

UPI is an innovative digital and mobile based payments ecosystem that connect customers, banks and partners together.

One of the biggest advantages of UPI is that you can send money to India directly into a UPI account. To do this, you will need to know the recipient's UPI ID.

Since December 2016, UPI has been also available on the widely popular BHIM UPI mobile app in India. BHIP UPI has helped amplify the reach of UPI to millions of new users in India.

What is a UPI ID?

The UPI ID is a unique identifier for every UPI user, and acts as a handle to send payments to someone using it.

In other words, a UPI ID serves as a globally unique identifier for every UPI user without any ambiguity. This helps banks and financial institutions to track that user in the UPI ecosystem.

From a customer's standpoint, the UPI ID shields a user from sharing their actual banking and financial information. It, therefore, helps a user achieve more privacy and enhances the security of their funds and information.

The UPI ID is a globally unique id for every UPI user, and can be used to identify a user in the UPI ecosystem.

Every UPI user must generate a unique UPI ID in order to participate in and use the UPI payments ecosystem.

What is the Format of a UPI ID?

A UPI ID has the following general format: xyz@bank whereby:

- "xyz" stands for the user's name, email address or phone number.

- "bank" stands for a bank's initials, abbreviation, short name or equivalent, and may or may not include a prefix or suffix for the bank.

In this way, the UPI ID can be a mobile phone number, email address or another contact method that can be used to receive funds.

By accepting money with an Indian UPI ID, users can transfer money quickly and securely without providing bank account information.

UPI is a more secure way to send and receive money since bank account details are not needed.

Many people in India refer to their UPI ID as an abbreviation of their bank account number and use it instead of their bank information to send and receive money.

How to Send Money from Overseas into a UPI Account in India?

If you are an Indian expat living, studying or working overseas, you can utilize the power of UPI to send money home to India to your friends and family.

However, not all money transfer companies support UPI yet, so make sure to look for UPI payment support if you want to send money to your recipient in India via UPI.

One premier global money transfer company that does support UPI payments to India is Panda Remit. There are many advantages to send money to India via Panda Remit (we will touch upon those later) - sending UPI payments being one of them!

Let's see how you can send money into a UPI account in India using Panda Remit. We will take an example of a US to India money transfer to illustrate this.

Step by Step Guide to Send Money to India Using UPI

Follow the below steps to send money with Panda Remit from US to India straight into your recipient's account using UPI.

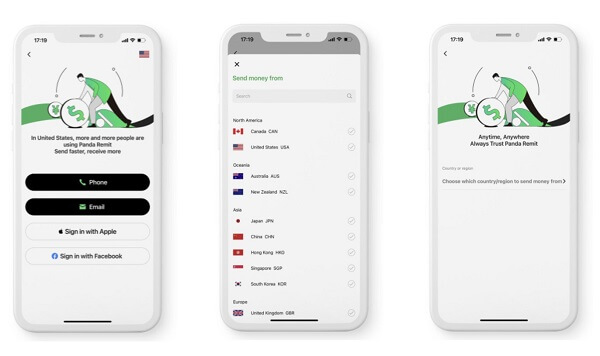

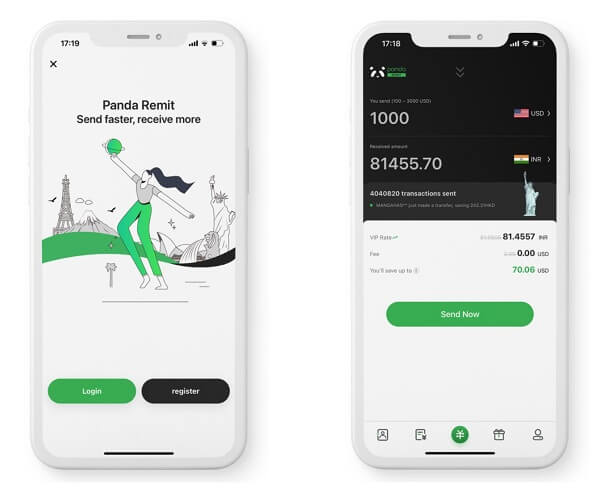

Step 1: Sign Up with Panda Remit. If you have never used Panda Remit before, then you need to first register a Panda Remit account. When you sign up, you need to choose which country you are sending money from - choose United States here. This is important as you will receive different remittance discounts depending on the country you decide to send money to.

Step 2: Login into your Panda Remit account. Next, login into Pandas Remit and select the receiving country - India. Enter the remittance amount, and you can see the exchange rate and the discount given by Panda Remit to RemitFinder users. If you remit money from the US to India using Panda Remit and receive money successfully using UPI, you will get the displayed discount coupon.

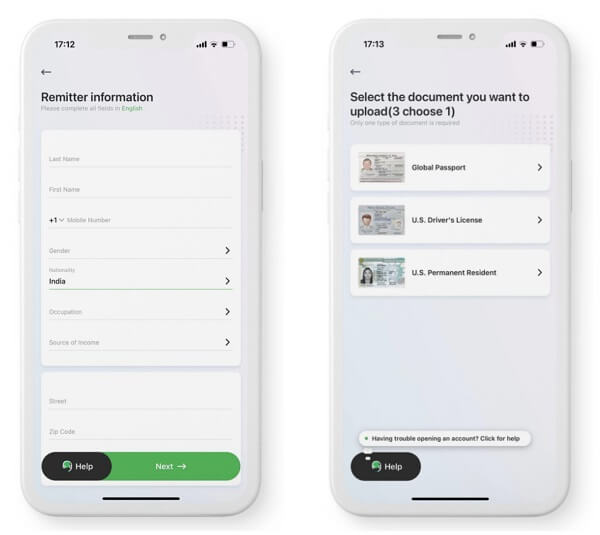

Step 3: Complete account opening details and provide KYC documents. In this step, you will need to finish your profile by adding sender information. Please ensure that your name is consistent with the name on the ID document you upload. After filling in the information, select the document type, and follow the system prompts to upload photos and selfies.

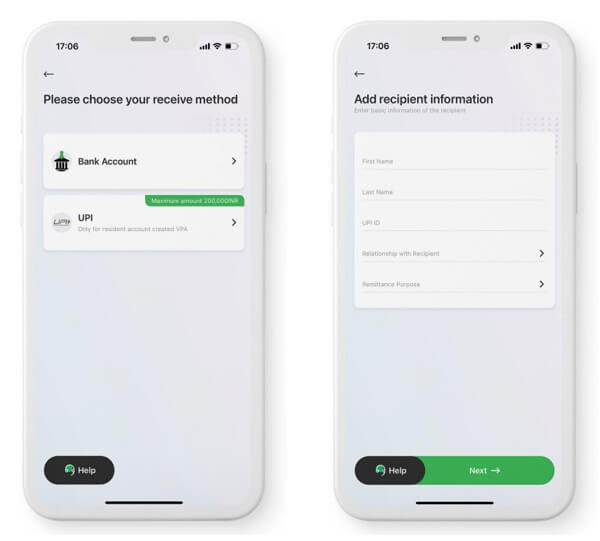

Step 4: Add UPI information for your receiver. Next, choose UPI as the payment receive method for your overseas recipient, and provide the needed information including the recipient's UPI ID. After the needed recipient information is filled in correctly, click Submit to start your money transfer.

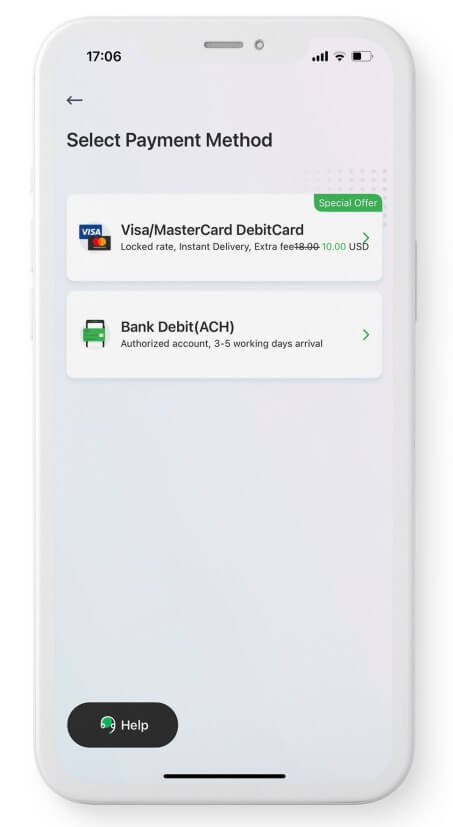

Step 5: Pay for your remittance. In this step, you will pay for your Panda Remit money transfer. You can choose from two supported payment methods. Card payments will be quicker, but ACH bank debt will be cheaper.

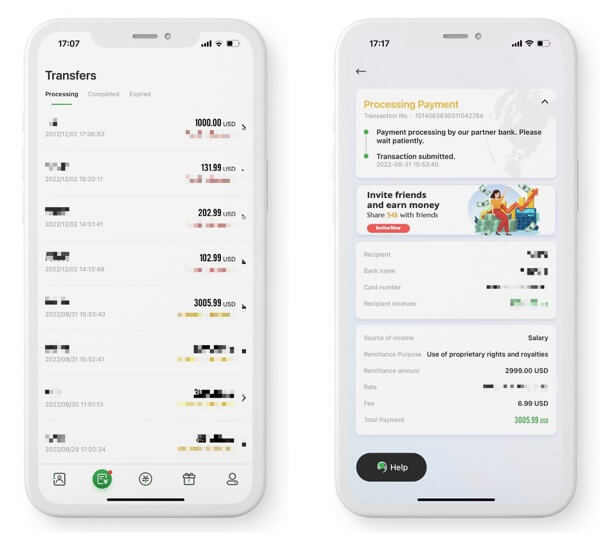

Step 6: Remittance submitted successfully. If all goes well, Panda Remit will accept your money transfer and you will be presented with a transaction successful screen. You can also look for your new transaction under the Transfers screen.

That's it. You are all done at this time, and Panda Remit will do the hard work to move your money to India into your recipients UPI linked account.

It is quick and easy to send money with Panda Remit to a UPI account in India.

Why Choose Panda Remit for Sending Money to India?

You work hard for your money, and therefore it is only natural that you would want to maximize the return on your remittance.

To send money overseas, you should strive to choose the right remittance platform that helps you achieve your goals. This is where Panda Remit comes in handy.

Sending money overseas with Panda Remit is one of the best ways to quickly, easily and securely exchange US Dollars for Indian Rupees. With Panda Remit, you will get very competitive exchange rates, low or even 0 remittance transfer fees and fast processing speed.

And with Panda Remit's robust support for many delivery options, you can now use it in combination with UPI, the most popular payment method in India.

What are the Biggest Benefits of using Panda Remit?

Sending money abroad often involves many complexities like the process of currency exchange, never ending exchange rate fluctuations, high remittance fees, variable transfer speeds, inability to use commonly used local payment methods to collect money and so on.

Panda Remit has solutions to all the problems above and can be a reliable partner to help you send money overseas to India.

Below are some of the advantages that Panda Remit offers:

Competitive Exchange Rates and Transfer Fees

Compared to banks and most of its peers, Panda Remit has an excellent exchange rate because of its lower costs of operations due to its fully online business model with no physical branches. As a result, Panda Remit is able to pass on some of the savings to customers.

Plus, on your first order using Panda Remit to convert US Dollars to Indian Rupees, you get one of the highest exchange rates in the entire market to help you send money to India.

For new RemitFinder users, Panda Remit will also waive the transfer fee for the first transaction. Furthermore, Panda Remit regularly provides RemitFinder users with various promotions and discounts. These will help you save even more money.

You can easily check Panda Remit's live rates using their online calculator. Simply select your country/currency pairs and enter your transfer amount, and the calculator will show you how much money your recipient will get. You will also see the applied exchange rate and the transfer fee.

Fast Transfer Speed

The speed of your Panda Remit money transfers depends on the type of payment and delivery options you select when you submit your transaction.

In the best case scenario, your money can reach the recipient in just a few minutes. Non-instant transfers are generally completed within 1-3 business days.

Note that for new account, it may take longer for your transaction to process since Panda Remit needs time to review your information to ensure the safety of your funds and information. Sometimes delays can also happen as a result of bank holidays and processing cut-off times.

UPI as a Delivery Option for India

The method in which you choose to pay your overseas recipient is called a delivery method or a delivery option. Panda Remit support many flexible delivery options, including some local ones in some countries.

In India, Panda Remit has full support for UPI, which means you can simply and quickly exchange send money to India using your recipient's UPI ID only. This is much more secure as your recipient does not need to provide you with their bank account information.

Panda Remit is one of few money transfer companies that support UPI payments in India.

Receiving remittances using UPI is a new and more convenient way to receive money. Your recipient has no action to take, and the funds will go into their UPI linked account. Additionally, through their UPI ID, they can use PayTM, PhonePe, GPay, or other digital wallets supported by UPI, which is very convenient.

Panda Remit also supports sending money to an Indian bank account in case your recipient does not have a UPI ID yet.

Exclusive Promotions and Discounts

Panda Remit and RemitFinder have teamed up to bring you many exclusive coupons, discounts and offers. These help you save even more on your money transfers to India with Panda Remit.

Below are some examples of currently active Panda Remit promotions for RemitFinder users:

- Send money to India from United States and get up to USD 30 off and free transfers

- Send money to India from Europe and get EUR 5 off and free transfers

- Send money to India from United Kingdom and get GBP 5 off and free transfers

- Send money to India from Canada and get up to CAD 30 off and free transfers

- Send money to India from Hong Kong and get HKD 10 off and free transfers

- Send money to India from New Zealand and get NZD 5 off and free transfers

- Send money to India from Singapore and get SGD 5 off and free transfers

Flexible Payment Methods

A payment method represents how you pay for your international money transfer with a remittance company.

Panda Remit supports quite a few different payment methods like Debit Card, ACH bank transfer and ATM transfer. This gives you the needed flexibility to fund your transfer in many possible ways.

Customer Service from within the App

Panda Remit provides 24x7 online customer service for cases when you encounter any problems with your money transfer, or have a question.

The best part is that you can access Panda Remit's customer service team from within the app itself. Additionally, you can also contact Panda Remit customer support team via email or WhatsApp.

Ease of Use

The Panda Remit mobile app is intuitive, simple and easy to use. From registration to your first time transfer, it only take a few clicks to send money overseas to India using UPI payments.

Plus, you can track your money transfer in real time and look at your past transactions any time. Check out the Panda Remit mobile app to see how easy it is to send money to India.

Safety and Security

Panda Remit is a licensed and regulated money transfer company in every country they operate in.

In the United States, for example, Panda Remit's parent company, Wo Transfer (HK) Limited, is licensed as a money transmitter in the state of Georgia in the United States, and is supervised by Georgia's Department of Banking and Finance.

There are numerous benefits to sending money overseas to India using Panda Remit.

These are just some of the highlights of Panda Remit that makes it a standout remittance company in today's international money transfer ecosystem.

At RemitFinder, we review money transfer companies and remittance service providers in detail. If you are interested in learning about Panda Remit further, check out our in-depth Panda Remit review below.

Conclusion

Unified Payments Interface (UPI) is an exciting payments ecosystem developed by the Government of India to streamline mobile payments and continue to spur India's digital economy forward.

One of the best parts about UPI is that you can also use is to send money from overseas to Indian UPI account holders. Not only is this fully safe and secure, but it also makes accessing the funds much easier for your overseas family and friends in India.

That said, not all money transfer companies support UPI just yet. Panda Remit, however, does.

In addition to UPI support, Panda Remit has numerous other strengths to their international money transfer service. We touched upon many of those in this blog. If you wish to read further, check out our detailed Panda Remit review.

If you wish to send money to India using UPI, Panda Remit could be a good partner for you in helping you achieve your money transfer goals.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

Categories

Similar Articles

Popular Mobile Wallets Across The World

Discover the top mobile wallets transforming how we pay globally. Explore the world of convenient and secure digital transactions. Do not miss this ultimate guide to the most popular mobile wallets across the world!

What Is PayID And How Does It Work?

If you send or receive money in Australia, say goodbye to complex bank details. Use PayID and experience hassle-free payments. PayID has revolutionized the payment experience in Australia – learn all about it.

Complete Guide To Cash App Limits

Cash App is convenient and easy to use, but there are limits you should be aware of. Our comprehensive guide to Cash App limits has all you need to know to maximize the value of your account.