Wise vs Revolut: What Are The Differences?

Table of Contents

- Wise vs Revolut: Overview And Company Information

- Wise Introduction

- Wise fast facts and information

- Revolut introduction

- Revolut fast facts and information

- What Are The Differences Between Wise And Revolut?

- Corridor Coverage

- Which countries does Wise service?

- Which countries does Revolut operate in?

- Wise vs Revolut: Who services more countries worldwide?

- Exchange Rates And Fees

- Revolut vs Wise exchange rates: Which is better?

- Revolut vs Wise transfer fees: Which is cheaper?

- Overall winner for Revolut vs Wise exchange rates and fees

- Money Transfer Limits

- How much money can I send with Wise?

- How much money can I send with Revolut?

- Wise vs Revolut: What's better for sending large amounts?

- Money Transfer Speed

- How fast will Wise send my money?

- How fast will Revolut send my money?

- Revolut vs Wise: Which is faster?

- Payment Methods Accepted

- What payment methods does Wise support?

- What payment methods does Revolut support?

- Wise vs Revolut: Who has more payment methods?

- Delivery Methods Available

- What delivery methods does Wise support?

- What delivery methods does Revolut support?

- Revolut vs Wise: Who has more delivery methods?

- Sending And Receiving Money In-Person

- Can I send and receive money in-person with Wise?

- Can I send and receive money in-person with Revolut?

- Wise vs Revolut: Who is better for sending and receiving money in-person?

- Deals, Promotions And Offers

- Security And Compliance

- Customer Ratings and Reviews

- Who's better Wise vs Revolut? Summary

- Which is better Wise vs Revolut? Our Recommendation

- Alternatives To Wise And Revolut

Are you looking for the best ways to send money abroad?

Currently, a growing number of digital platforms are challenging traditional banks by offering more flexible and affordable ways to send money internationally. Amongst some of the leaders in this space are Wise (formerly TransferWise) and Revolut.

Both companies are excellent choices for modernizing your money management, have large user bases, and a customer-centric approach. However, they have distinct business models and target audiences.

Therefore, understanding their core differences is crucial for selecting the right platform for your specific needs. This article will break down how each company operates and compare them across key areas like corridor coverage, exchange rates, transfer fees, payment and delivery methods, and much more.

Let us dive in to help you compare these 2 popular money transfer providers so you can choose the best option for your international money transfer needs.

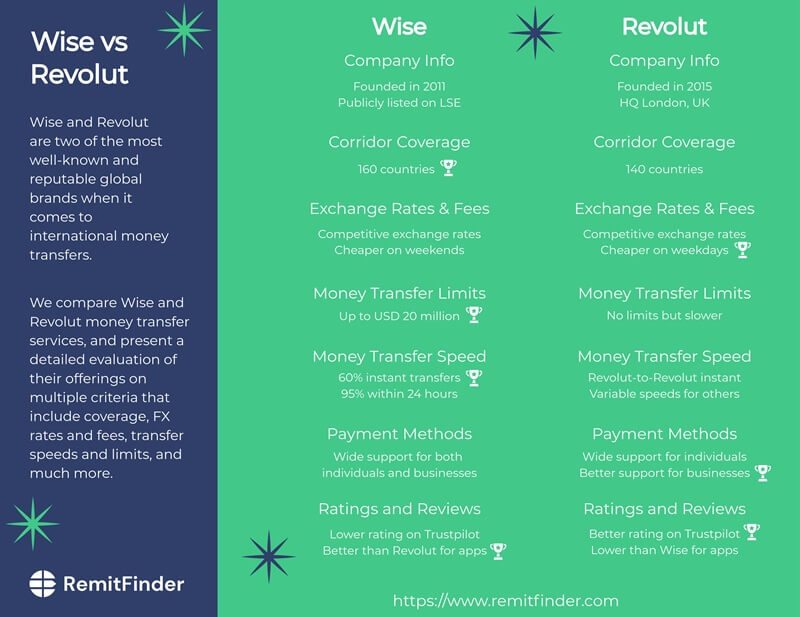

Wise vs Revolut: Overview And Company Information

Wise Introduction

Wise is a global technology company founded in 2011 with a mission to make international money transfers simple, fast, and affordable. Its core offering is a multi-currency account.

Wise is listed on the London Stock Exchange.

They allow users to hold, send, and receive money in over 50 currencies with the real mid-market exchange rate. Today, Wise serves millions of people. It is known for its transparent pricing model and has become a trusted name among those needing to move money across borders.

Wise fast facts and information

- Founded: 2011

- Headquarters: London, UK

- Key Services: International money transfers with small, upfront fees, multi-currency accounts, and business accounts.

- Mission: Wise is not a bank. It is an electronic institution for money transferring, making it fast, convenient, and free.

Revolut introduction

Revolut is a British financial technology company that started in 2015 as a money transfer service. Over time, they evolved to offer a wide range of financial services.

Unlike Wise's focused approach, Revolut aims to be a complete financial platform, offering services that go beyond simple money transfers. They offer their services through a mobile app that includes features for budgeting, crypto and stock trading, and much more.

The company offers its users a free standard plan along with more feature-rich paid plans.

Revolut fast facts and information

- Founded: 2015

- Headquarters: London, UK

- Key Services: International transfers, multi-currency accounts, debit cards, budgeting tools, crypto and stock trading, travel insurance, and more. It serves over 60 million customers and holds a banking license in the United Kingdom, the European Economic Area, and Mexico.

- Mission: To offer a global banking-like platform where users can manage all of their finances.

What Are The Differences Between Wise And Revolut?

Wise and Revolut both provide cross-border payments. However, their core business models are different.

Wise focuses on transparent, low-cost money transfers. Meanwhile, Revolut is an all-in-one app that offers many financial services.

In the rest of this article, we will compare both Wise and Revolut on various criteria pertinent to international money transfers such as corridor coverage, FX rates and fees, transfer limits, transfer speed, payment and delivery methods, and a lot more.

Read on to get a comprehensive insight into how Wise and Revolut compare with each other!

Corridor Coverage

It is important to know where a service can send money. This is called corridor coverage. Both Wise and Revolut operate in many countries. However, their global reach is not the same.

Which countries does Wise service?

Wise allows users to send money to over 160 countries and hold balances in more than 50 currencies.

Additionally, the Wise Multi-Currency Account provides local account details for up to 9 currencies. Hence, their users can receive payments as if they have a local bank account in those countries.

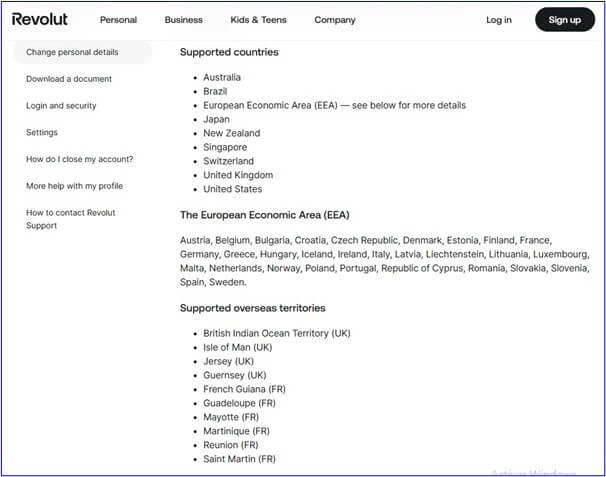

Which countries does Revolut operate in?

Revolut supports customers in more than 35 countries, mostly in Europe, the United States, and Australia.

Likewise, Revolut allows you to send money to over 140 countries and hold and exchange more than 35 currencies. Users can also receive money when abroad as if they had a local account.

Wise vs Revolut: Who services more countries worldwide? Wise 🏆

Wise serves more countries for international transfers. It has a slightly larger global reach. Wise supports transfers to over 160 countries.

Wise 🏆 has a wider global reach, serving a larger number of countries for international transfers. Currently, you can send money to 160 countries with Wise.

On the other hand, Revolut has a broader presence in the European Economic Area and is actively expanding. Yet, Wise's network for sending money remains more extensive.

Exchange Rates And Fees

The fees and exchange rates for both platforms are pivotal when sending money abroad. Here is a breakdown of how they compare.

To know which company is better between Wise and Revolut, we will show the differences between them by simulating a pair of case studies.

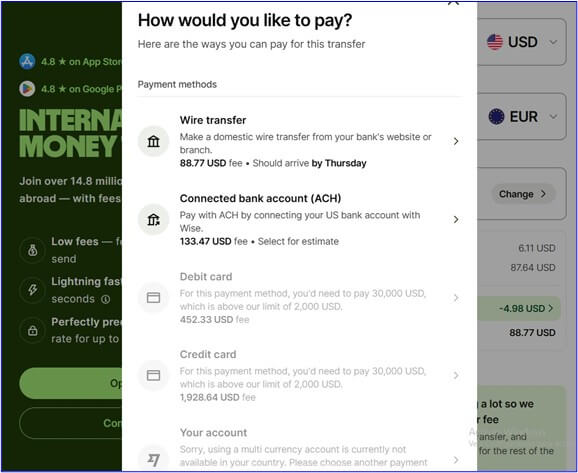

Let us start with a case for a USD 1,000 money transfer from United States to Germany where the sender will pay using an ACH bank account.

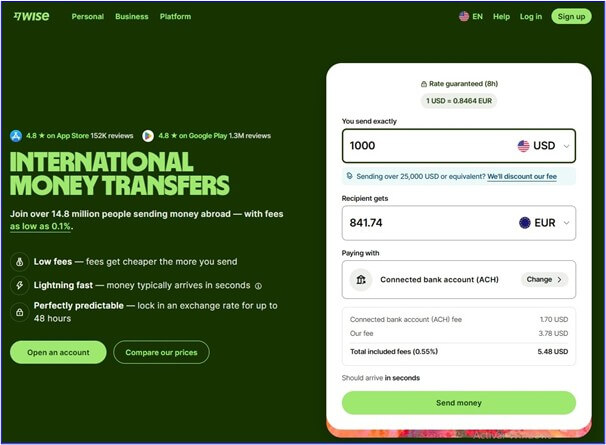

First, let us check how the Wise transaction looks like.

Wise applies the real mid-market rate and a small, upfront fee.

Here are some details about this Wise money transfer from USA to Germany:

- Exchange Rate: USD 1 = EUR 0.8464*

- Transfer Fee: 0.55% = USD 5.50 (EUR 4.66)*

- Total to send: USD 1,000

- Recipient Payout: (USD 1,000 x 0.8464) - EUR 4.66 = EUR 841.74

- Final Payout: The recipient receives EUR 841.74 when you send USD 1,000.00 through your bank account.

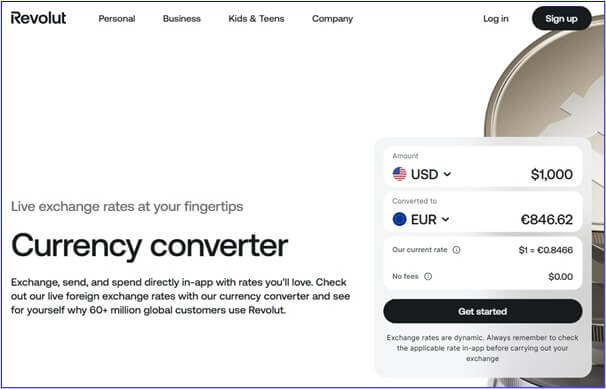

Now let us see how the Revolut transaction will look like.

During weekdays, Revolut applies fees and rates that differ from those on weekends.

During weekends, when the foreign exchange market is closed, they charge additional fees for currency conversions. Additionally, Revolut sets monthly exchange limits that vary depending on the user's plan.

Let us use the same USD 1,000 USA to Germany money transfer mentioned before, paying with an ACH bank account. We will assume you have a Standard user plan.

Revolut Scenario A: Weekday Transfer

If you make the transfer on a weekday, and you are still within your free exchange limit:

- Exchange Rate: USD 1 = EUR 0.8466 EUR*

- Transfer Fee: Free*

- Total to send: USD 1,000

- Recipient Payout: USD 1,000 x 0.8466 = EUR 846.60

- Final Payout: The recipient receives EUR 846.60, and your total cost is USD 1,000.

Now, let us look at a weekend transfer with Revolut for the same transfer as above.

Revolut Scenario B: Weekend Transfer

If you make the transfer on a weekend, Revolut applies a 1% markup and the calculations run as below:

- Exchange Rate: USD 1 = EUR 0.8466*

- Transfer Fee: 1% markup*

- Total to send: USD 1,000

- Recipient Payout: (USD 1,000 x 0.8466) - 1% markup = EUR 838.13

- Final Payout: The recipient receives EUR 838.10 when you send USD 1,000.

In this example, the recipient receives EUR 3.64 less on a weekend with Revolut than with Wise due to the markup.

The following table summarizes the calculations and eases the comparison:

| Provider | Currency Pair | Transfer Amount | Exchange Rate | Transfer Fee | Payout |

|---|---|---|---|---|---|

| Wise | USD to EUR | USD 1000 | EUR 0.8464 | USD 5.50 | EUR 841.74 |

| Revolut (On weekdays) | USD to EUR | USD 1000 | EUR 0.8466 | USD 0 | EUR 846.60 |

| Revolut (On weekends) | USD to EUR | USD 1000 | EUR 0.8466 | EUR 8.466 (1% markup) | EUR 838.13 |

As you have just seen, your best option is to use Revolut on weekdays. Remember that if you exceed your monthly exchange limit, you may pay a fee.

But what if you employ a different payment method? The applicable fees may change this result.

If you pay for the transfer with a debit card, the fees are as follows:

- Wise charges a fee of USD 16.10 (a fee of 1.61%)*

- Revolut charges a fee of up to USD 10 (a fee of up to 1%)*

And if you use your credit card, the fees would be:

- Wise charges a fee of USD 65.30 (a fee of 6.53%)*

- Revolut charges a fee of up to USD 30 (a fee of up to 3%)*

We will take this comparison a little further.

Let us pose another example to better understand which of these platforms is more cost effective.

Suppose we want to send GBP 100 from UK to Australia. This table shows the comparison:

| Provider | Currency Pair | Transfer Amount | Exchange Rate | Transfer Fee | Payout |

|---|---|---|---|---|---|

| Wise | GBP to AUD | GBP 100 | AUD 2.0410 | GBP 1.15 | AUD 201.75 |

| Revolut (On weekdays) | GBP to AUD | GBP 100 | AUD 2.0348 | GBP 0 | AUD 203.48 |

| Revolut (On weekends) | GBP to AUD | GBP 100 | AUD 2.0348 | GBP 1 | AUD 199.44 |

*Exchange rates and fees as on September 24, 2025

Again, using Revolut on weekdays seems like the best option.

In this case, it is important to consider these factors:

- We used a bank account as the payment method.

- If you employ a credit card to pay for the transfer, Wise charges a GBP 3.37 fee, decreasing the payout to AUD 197.22. On the other hand, Revolut may charge a GBP 3.00 fee, and the payout would be AUD 197.38 on a weekday.

- Wise charges a 1.15% fee for the GBP to AUD exchange.

Revolut vs Wise exchange rates: Which is better? It's a tie!

When it comes to exchange rates, both Wise and Revolut provide fairly competitive exchange rates. Whilst the impact of fees (see below) may impact your final payout, the overall amounts are fairly comparable based on the vase studies we conducted above.

Revolut vs Wise transfer fees: Which is cheaper? Revolut 🏆

When paying via bank transfer, Revolut's Standard Plan is often cheaper as it charges a USD 0 transfer fee on weekdays, within its monthly exchange limit. Wise applies a small, variable, upfront fee (e.g., GBP 1.15 for the last case study).

Additionally, if you fund the transfer with a credit card, Wise's fee of GBP 3.37 is still higher than the GBP 3.00 fee that Revolut may apply. Therefore, Revolut is a more cost-effective option for card-funded transfers.

Overall winner for Revolut vs Wise exchange rates and fees - It's a tie!

The overall winner depends on when you send money and which payment methods you use to fund your transfer.

Revolut offers the higher payout if the transfer is executed on a weekday and stays within the free exchange limit of the Standard plan.

Still, Wise can be the overall more reliable and transparent choice.

Revolut's higher weekend markups and potential fees after exceeding the free limit introduce variable costs. These factors make Wise the better option for consistent, high-value transfers.

Revolut can be a more cost-effective option for sending money on weekdays if you are able to stay within the free plan limit and avoid additional charges. Wise, on the other hand, delivers consistent and transparent transfers regardless.

Money Transfer Limits

Both platforms have different limits on how much money you can send. Understanding these limits is crucial if you need to transfer large sums.

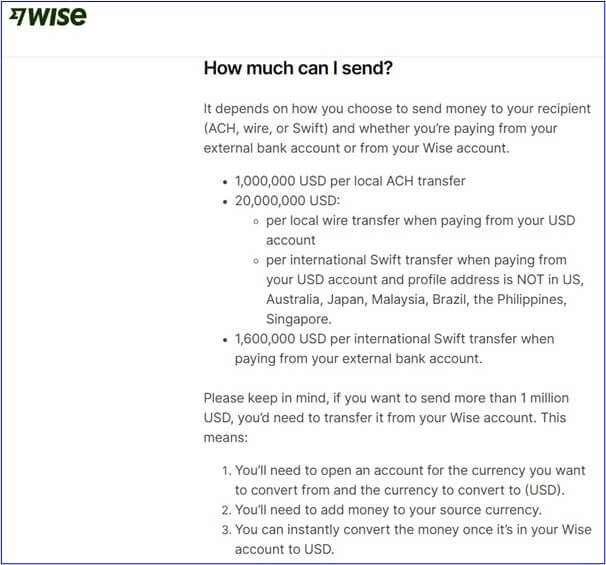

How much money can I send with Wise?

Wise has high transfer limits.

For example, you can send up to USD 20 million. Though if you need to send over USD 1 million, you will have to do it from your Wise account.

The limits vary by currency and country. You can easily check the specific limit for your transfer corridor on the Wise website or app.

This makes Wise a great option for those making large payments, such as purchasing property abroad or sending substantial sums to family members.

How much money can I send with Revolut?

Revolut does not set transfer limits for most currencies or destination countries. Thus, you may send transactions of any amount.

However, the companies they collaborate with to send and receive money may have set restrictions on some currencies. You will be able to view these in-app before clicking Send.

Do you need to send a large sum of money? In this case, Revolut may require more time to perform additional checks. But do not worry, they will keep you informed about the status of your transfer.

Likewise, Revolut allows you to receive large transactions as simply as you can send them. Just provide the sender with your Revolut account information. If they require information on the source of the funds, they will contact you.

Wise vs Revolut: What's better for sending large amounts? Wise 🏆

While both platforms support large transfers, Wise has a slight edge for those sending substantial amounts. Its model is designed for high-value, low-cost international transfers, and it often provides discounted fees for larger transactions.

Revolut also handles large transfers, but its structure and procedures can make the transfers slower and less clear for big payments.

Wise 🏆 has a more streamlined and established model for large value transfers. That said, you can also send high value transfers with Revolut without any issues.

Money Transfer Speed

For many users, transfer speed is just as important as cost. The speed of a transfer can vary based on the currency, the destination country, and the payment method.

How fast will Wise send my money?

Wise is known for its speed. Over 60% of Wise transfers are instant and arrive in under 20 seconds. The vast majority of transfers (95%) arrive within 24 hours.

The platform's direct-to-local-account network helps it bypass traditional banking intermediaries, which significantly speeds up the process.

How fast will Revolut send my money?

Revolut money transfer times vary, depending on the type of transfer.

For example, Revolut-to-Revolut transfers are instant and generally finish under 20 seconds.

On the other hand, card transfers take seconds to minutes (or up to 30 minutes). Meanwhile, local bank transfers take a few hours to one business day, and international (SWIFT) transfers take up to two business days.

Factors like weekends, holidays, and the recipient's bank can cause delays. You can always check the recipient's account details and the estimated delivery time in the Revolut app.

Revolut vs Wise: Which is faster? Wise 🏆

Wise has a slight edge in international transfer speed for bank-to-bank transfers. With a large percentage of its transfers arriving instantly, it is a great choice for urgent payments.

Revolut's instant transfers between its users are a major plus. But Wise's overall speed for traditional international transfers makes it the faster option.

Wise 🏆 specializes in moving money overseas quickly, with most of their transfers finishing instantly. Whilst Revolut-to-Revolut transfers are instant, other transfer types are not and may need some time to finish.

Payment Methods Accepted

The convenience of a money transfer platform is often determined by the payment methods it supports. If you have not heard of the term Payment Method before, it is simply how you pay for your money transfer.

What payment methods does Wise support?

Wise supports a wide variety of payment methods to fund your transfers. These vary for individual and business transfers and are listed below.

For Individuals:

- Wise transfers: You can pay from your Wise balance.

- Debit/Credit Cards: You can pay for transfers using Visa, Mastercard, and some Maestro cards.

- Bank Transfers: ACH, wire, or SWIFT.

- Payment apps: Apple Pay and Google Pay.

- Payment Links: You can also send payment links to others.

For Businesses:

- Payment Links: Businesses can create links to accept payments by debit card, credit card, Apple Pay, or bank transfer for goods and services.

- Bank Transfers: Wise provides local bank account details in multiple currencies, allowing customers to pay in their local currency via a standard bank transfer.

- Wise Business Account: Customers with their own Wise Business accounts can send instant, free payments within the app.

What payment methods does Revolut support?

Revolut supports a wide range of payment methods for both individuals and businesses; we list these below.

For Individuals:

- Revolut-to-Revolut transfers: Send money to other Revolut users for free.

- International wire transfers: Send money to bank accounts outside of Revolut using traditional bank transfers.

- Payment links: Create a link to send to others to request payment.

- Visa and Mastercard: You can receive a Revolut card that runs on Visa or Mastercard networks. You can use them wherever these cards are accepted.

For Businesses:

- Card Payments: Accept payments from Visa, Mastercard, and American Express cards.

- Mobile Wallets: Accept payments via Apple Pay and Google Pay.

- Revolut Pay: Allow customers to pay with their Revolut balance or cards through this platform.

- In-person payments: Accept chip and PIN or contactless payments using devices like the Revolut Reader or Revolut Terminal.

- Online Integration: Embed a card field, pop-up, or hosted checkout page on your website to accept payments.

Wise vs Revolut: Who has more payment methods? Revolut 🏆

Revolut offers a wider array of payment methods, particularly due to its comprehensive features for business users. This includes accepting card payments, utilizing mobile wallets, in-person terminals, and Revolut Pay.

Basically, Wise's payment methods are similar for both individuals and businesses (bank, card, P2P options). Revolut's extensive suite of merchant services gives it an advantage in overall payment versatility.

Both Wise and Revolut provide extensive support for numerous payment methods for individuals, but Revolut's 🏆 support for business payment methods is more extensive.

Delivery Methods Available

The delivery methods available specify the ways a recipient can access the funds sent through each service.

What delivery methods does Wise support?

Wise primarily supports delivery through bank transfers, utilizing local clearing methods such as:

- ACH for USD.

- SEPA transfers for EUR.

- Faster Payments for GBP.

- Or the global SWIFT network.

Recipients can also receive money directly into their Wise account by providing their local account details, Wise Tag, email, or phone number.

Additionally, you can also receive funds directly onto a Wise card by sharing its digital card number.

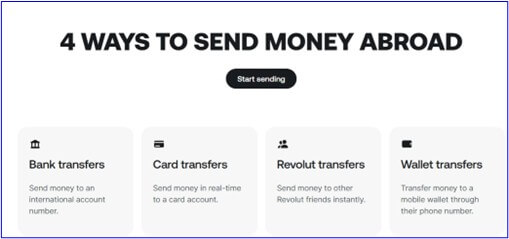

What delivery methods does Revolut support?

Revolut's delivery methods center on digital access. The most common method is instant, free transfer to other Revolut users.

Likewise, you can deliver funds to a recipient's external bank account via international wire transfers (SWIFT, SEPA).

Additionally, a recipient can receive funds via a payment link or onto a physical Revolut card, which runs on the Visa or Mastercard networks. You can withdraw cash from an ATM with this card.

Revolut vs Wise: Who has more delivery methods? It's a tie!

Both platforms offer a similar array of fundamental digital delivery options, including bank transfers and P2P transfers between users. Also, they allow users to send funds directly to their respective cards.

Wise has a slight edge due to its more expansive global network of local bank account details. This network allows recipients in more countries to receive payments efficiently as local transfers.

Both Wise and Revolut have robust support for various delivery methods so you can pay your overseas recipient in a variety of flexible ways.

Sending And Receiving Money In-Person

Given that both Wise and Revolut are purely digital financial technology services, their model differs fundamentally from traditional cash transfer companies.

Can I send and receive money in-person with Wise?

You cannot send or receive physical cash in person with Wise.

Wise operates exclusively online and via its mobile application; it does not maintain a physical branch network or retail locations for cash pickup or deposit. You must source funds from and deposit into a digital bank account.

Likewise, Wise does not have partners with physical, publicly accessible locations. Instead, they work with local banks and payment providers to send money within a country.

However, you can send and receive money in person with Wise using digital methods. You can use the “Quick Pay” feature or share QR codes or payment links to accept payments at a physical location, such as shops. Similarly, you can scan a Quick Pay QR code to pay through Wise, even if you do not have a Wise account.

Can I send and receive money in-person with Revolut?

Similar to Wise, Revolut does not support cash transactions. Hence, they do not maintain physical locations for customer deposits or withdrawals.

The platform is designed for entirely digital financial management. Hence, you must initiate and manage all money transfers, exchanges, and banking functions through the mobile app or online portal.

Still, you can send and receive money in person with Revolut by using a QR code, a Revtag, or the "Near Me" feature to find and pay Revolut users in your vicinity. You can also send money to a contact's bank details or by creating a personalized payment link.

The "Near Me" feature provides a list of other Revolut users in your area. You can send or receive money directly with them if they have the feature enabled. With Revtag, you can transfer money to others by searching for their username.

Wise vs Revolut: Who is better for sending and receiving money in-person? Neither!

Neither Wise nor Revolut offers a cash or in-person service. Therefore, neither platform is suitable for users who require physical sending or receiving locations.

Both companies focus on providing fast, cheap, and secure bank-to-bank or digital wallet transfers, making them exclusively digital solutions.

Both Wise and Revolut are digital platforms so there are no branch offices or agent locations to send and receive cash in-person.

Deals, Promotions And Offers

While both services compete on price, their strategies for using incentives and rewards differ markedly.

Revolut generally features a broader and more substantial range of promotions and offers, which are primarily tied to its tiered subscription model (Premium, Metal, and Ultra).

When you subscribe to any of these plans, you may obtain waived fees or lower rates. Additionally, these paid plans offer lifestyle benefits, including travel insurance, discounted airport lounge access, and higher cashback on card spending.

Additionally, Revolut offers deals such as cashback offers and partner promotions. Such promotions include top-ups or discounts on other services, like ride-sharing platforms. They also provide opportunities to earn RevPoints, which can be redeemed for airline miles or other benefits.

Wise, conversely, relies on its inherent low-cost structure as its main value proposition and focuses its promotions on its referral program, which offers users discounted or fee-free transfers for inviting new customers.

Since offers and promotions can change anytime, we encourage you to frequently check our dedicated Revolut and Wise pages so you do not miss out on any promotions.

Additionally, you can also sign up for our free exchange rate alert which will keep you updated about ongoing deals and promotions from various money transfer operators.

Revolut vs Wise: Who has better promotions and offers? Revolut 🏆

Revolut's comprehensive perks are superior for frequent travelers and those seeking an all-in-one digital banking experience.

Revolut 🏆 has better support for deals, coupons and promotions that vary from discounted plans to lifestyle benefits and perks. Both Wise and Revolut offer referral programs to reward customers for spreading the word about their brand.

Security And Compliance

For any financial platform, the safety and security of user funds and private information is the single most important factor. Here is how Wise and Revolut measure up.

Is Wise safe?

Wise is a publicly traded company on the London Stock Exchange (WISE), regulated by financial authorities in the countries where they operate.

Wise is licensed and regulated by numerous authorities, including the Financial Conduct Authority (FCA) in the UK, FinCEN in the US, and similar bodies in every major region it operates.

They employ bank-level security measures, such as:

- HTTPS encryption

- 2-step verification

- In-house security team to protect against fraud

On a related note, Wise safeguards your money by holding it in separate accounts with established institutions.

Is Revolut safe?

Revolut is also regulated by various financial watchdog institutions globally.

Their certifications include registration with the European Central Bank (ECB) through the Bank of Lithuania. Additionally, in July 2024, they received a UK banking license allowing them to operate in the UK. The company also has authorizations to provide e-money, stock trading, and virtual currency services in different regions.

Revolut implements various security measures to protect users, including AI-powered fraud detection, biometric and two-factor authentication, virtual cards, and a dedicated 24/7 financial crime team.

Wise vs Revolut: Who is safer? It's a tie!

Both companies maintain excellent security and compliance records, but their approaches differ slightly.

Revolut gains a marginal advantage in regions where it holds a full banking license, which offers state-backed deposit insurance (like FSCS or similar schemes).

Wise, operating as a payment institution globally, relies on regulatory safeguarding of funds.

For sending money abroad, both Wise and Revolut are extremely secure, employing industry-leading digital security and comprehensive global regulatory oversight, ensuring your money is protected regardless of your choice.

Both Wise and Revolut implement various security measures and industry best practices to keep your money and information secure. They are also regulated by numerous financial institutions in their respective countries of operation.

Customer Ratings and Reviews

Evaluating customer feedback from independent platforms provides crucial insight into the user experience and customer service quality. Let us see what Trustpilot, Google Play Store, and Apple App Store users have said about Wise and Revolut.

Wise reviews

We checked Wise's reviews^ on various platforms, and below is a summary of how customers rate their services:

- On Trustpilot, Wise has an excellent 4.3/5.0 rating and has more than 270k reviews.

- On the Google Play Store, Wise is rated 4.7/5.0 rating with over 1.49 million reviews and more than 10 million downloads.

- On the Apple App Store, Wise iOS app is rated 4.8/5.0 with more than 157k ratings.

^Ratings and review information as of October 4, 2025

Wise generally receives a high volume of positive reviews across all platforms. Customers frequently praise the platform's transparency regarding fees and exchange rates.

Users also value the speed of its international transfers and the simplicity of the multi-currency card for use abroad.

The main critiques often center on the demanding verification process. The platform may require extensive source of income documents to meet regulatory requirements. Some users find this requisite frustrating.

Revolut reviews

Revolut's reviews^^ on popular review platforms are as below:

- On Trustpilot, users have rated Revolut with a 4.6/5.0 rating, and it has more than 270k reviews.

- On the Google Play Store, Revolut has a 4.5/5.0 rating with 3.6 million reviews and more than 50 million downloads.

- On the Apple App Store, the Revolut iOS app is rated 4.7/5.0 with over 59k ratings.

^^Ratings and review information as of October 4, 2025

Revolut's reviews are polarized, often reflecting its "super app" model. Many users praise the extensive suite of features, including budgeting tools, crypto trading, and the convenience of instant P2P transfers.

However, a significant number of negative reviews highlight issues related to account blocking or holding funds for extended verification checks. Additionally, some users of the free Standard plan express frustration with unexpected or high fees when exceeding monthly limits.

Revolut vs Wise: Who has better reviews? It's a tie!

Wise consistently achieves higher average ratings largely due to its focused business model centered on transparent international transfers. Customers value the platform's reliable functionality and honest pricing structure.

While Revolut offers a broader range of features that many users love, the negative feedback regarding account access and non-transparent fees (for standard users) suggests a less consistent customer experience.

For core money transfer needs, both Wise and Revolut seem to be well-liked and rated platforms.

Both Wise and Revolut have very good ratings and reviews on popular review platforms. Customers tend to like their international money transfer services.

We have summarized the above differences between Wise and Revolut in a detailed infographic as well.

The above can help as a handy reference to quickly compare both companies side-by-side.

Who's better Wise vs Revolut? Summary

Deciding between Wise and Revolut ultimately depends on your main priority, as each platform excels in a specific area of digital finance. Both provide excellent alternatives to traditional banks, but their core value proposition targets different use cases and scenarios.

In the following sections, we will discuss some scenarios where it may be better to use Wise or Revolut.

When to use Wise to send money internationally?

Based on our detailed analysis, we find Wise to be strong in the below areas:

- Wise has a very wide coverage of global countries and currencies whereby you can send money to 160 countries worldwide; you can also hold balances in over 50 currencies in your Wise multi-currency account.

- Wise maintains absolute transparency about their exchange rates and transfer fees; you will never pay a hidden fee and what you see if exactly what you will pay

- Wise allows sending large amounts abroad; you can send up to USD 20 million in a single transaction with Wise.

- Wise moves money overseas fast, with 60% of their transfers finishing instantly.

- Wise has a comprehensive support for many payment methods as well as delivery methods for both individuals and businesses alike.

- Wise is a secure, regulated and trusted platform with excellent ratings and reviews on both Trustpilot as well as mobile app stores.

RemitFinder likes Wise for providing a multi-currency account that can hold balances in 50 currencies, enabling international money transfers to 160 countries, moving money overseas quickly, supporting large transfers and providing wide payment and delivery methods.

Due to the above strengths and advantages of Wise international money transfers, we recommend Wise for the following scenarios:

- Large Transfers: You need to move a large sum of money (e.g., buying property) and prioritize a consistently low-cost, predictable service.

- Weekend Transfers: You frequently need to send money on weekends, as Wise avoids the rate markups Revolut applies during non-business hours.

- Global Reach: Your recipient is in a country with a less common currency, as Wise supports transfers to over 160 countries.

- Super quick transfers: You need to move money overseas urgently in case of an emergency; most Wise transfers are instant so this could be a great advantage to rush money abroad.

- Business Transfers: Your primary business need is receiving local payments in multiple currencies and sending fast, low-cost international payments.

Is your goal to get the maximum transfer payout? If so, you should primarily use Wise for transparency and consistency.

When to use Revolut to send money internationally?

Given our deep dive on Revolut, here are the areas where we find it standing tall:

- Revolut is not just a money transfer company but a financial platform. This means you can do much more with Revolut than just sending money abroad.

- Just like Wise, Revolut also has a wide coverage whereby you can send money to over 140 countries worldwide by exchanging 35 supported currencies.

- Revolut has various membership levels that come with varying benefits. This gives you the flexibility to pick and choose what you want and at what price. For example, you start getting better exchange rates and pay lower fees with premium memberships.

- Revolut imposes no upper limits on transfers; note that correspondent banks or governments may still impose limits.

- Similar to Wise, Revolut supports umpteen payment and delivery methods. That said, their support for payment methods for businesses seems better than that of Wise.

RemitFinder likes Revolut for providing a financial ecosystem with numerous products and services including international money transfers, wide global coverage with 140 countries and 35 currencies, various plans to choose from and flexible payment and delivery methods for individuals as well as businesses.

Given these strengths of Revolut, it is a better fit for the below scenarios:

- Daily Spending & Budgeting: You want to consolidate your banking, spending analytics, and budgeting into a single "super app".

- Instant P2P Transfers: You frequently send money to friends, family, or colleagues who also use a Revolut account.

- Frequent Travelers: You benefit from the perks offered in the Premium or Metal plans, such as travel insurance and lounge access.

- Trading: You want in-app access to trading features like crypto and fractional stocks alongside your banking features.

- Lifestyle Perks: You want to take advantage of various Revolut lifestyles perks and benefits that come with various membership levels.

You should primarily choose Revolut if you are looking for an all-in-one financial app with lifestyle benefits and do not mind a tiered fee structure.

Which is better Wise vs Revolut? Our Recommendation

Choosing between Wise and Revolut is not about finding a universally "better" service. You should select the company that aligns best with your financial lifestyle.

We recommend Wise if:

- You prioritize reliable, cost-effective, transparent international money transfers, with multi-currency accounts.

- You require a service committed to the mid-market rate 24/7 with a superior global transfer network.

These features make Wise the leader for moving money across borders. Besides, they offer maximum consistency with minimum fuss.

We recommend Revolut if:

- You are looking for a comprehensive digital banking alternative that offers lifestyle features, trading, and budgeting tools all in one app.

While its fee structure is less predictable than Wise's, its broad feature set provides great value for users who want a single hub for all their finance needs.

You cannot go wrong with either Wise or Revolut as both companies are great at what they do with slight edge over each other in some areas. In general, we suggest choosing Wise for money transfers and Revolut for overall financial services and lifestyle perks.

This concludes our detailed head to head comparison between Wise and Revolut, covering numerous aspects of their money transfer services in-depth. We hope you now have additional knowledge about both companies and can make more informed decisions for your next international money transfer.

Alternatives To Wise And Revolut

Are you looking for additional money transfer providers in addition to Wise and Revolut? If so, use RemitFinder's online money transfer comparison platform to easily compare numerous money transfer companies and choose the best one for your unique needs.

Other money transfer comparison guides

Categories

Similar Articles

How To Save On B2B International Transfer Fees

B2B international payments have been expensive, slow and cumbersome in the past. Are there any new fintech companies that take the hassle out of cross-border business payments?

How To Save Money On Transfers From Europe To India

Are you looking to send money from Europe to India? Check out our guide on how to save money on your international money transfers to India from Europe.

How To Send Money From UK With PassTo

There are many money transfer companies to send money from UK. We zoom into PassTo's remittance service from the UK so you know all you need to about them.