How To Save Money On Transfers From Europe To India

Table of Contents

- Why Are Money Transfers From Europe To India Popular?

- Why Do Many People Overpay For Remittances To India?

- What Are Some Popular Ways To Send Money To India?

- How To Choose A Money Transfer Service To Send Money To India?

- Profee: A Smart Solution For Transfers From Europe To India

- How Can Profee Help Me Send Money To India From Europe?

- Conclusion

According to the statistics collected by the European Commission, about 8% of people inhabiting Europe were born elsewhere.

Migrants come to Germany, Poland, Italy, Sweden, and other EU countries from all over the world, forming national diasporas and - at the same time - assimilating with the local culture and adapting to life in the country of their choice. European migrants create their own routines, depending on their country of origin.

Indians come to Europe to work and study and make up about 8% of the population. The number of expats originating from India in countries like Germany or Italy is rising every year, and so is the demand for services facilitating their lives.

Naturally, many Indians seek efficient ways to send money from Europe to India. This article discusses various money transfer options and explains how to save money on international remittances from Europe to India.

Why Are Money Transfers From Europe To India Popular?

Most expats in European countries like Germany, Italy, France, and others tend to send money home back to their country of origin. However, when it comes to expat Indians in Europe, the demand for remittance services is relatively high.

Here are the two most popular reasons for Indians to send money from Europe to their country of origin:

- Supporting their families: Many Indians with long-term employment contracts in Europe and obtaining EU blue cards come to the new country with their spouse and children. At the same time, they still have close bonds with their elder relatives - parents and grandparents - who stay in India and may need financial support.

- Increasing their savings: Many Indians look forward to returning to their home country after the end of their contract or when they retire. They open savings accounts in national banks or buy property in India - to invest beneficially. Therefore, they need international remittance to grow their savings.

In both cases, saving hard-earned money, managing a budget, and finding the cheapest way to send money to India is essential for those who live in Europe and transfer funds home.

Expat Indians living in European countries send money back home to India for a variety of reasons that include family support and building savings.

Immigrants work hard to earn their income, so looking for the best ways to send money back home is naturally something they are very interested in.

Why Do Many People Overpay For Remittances To India?

Whether expats in Europe send funds to support their family in India or add to a bank account of their own, they need to do it wisely: either to give more to their nearest and dearest or to save money for themselves.

Yet, they may be spending too much on their transfers to India - as international money transfers are still costly.

One may wonder how that is even possible: there is a wide variety of remittance options, and at first glance, their terms and conditions may seem almost identical. Nevertheless, these terms and conditions may sometimes be unclear or - in some cases - even misleading.

The cost of international money transfers to India can be high unless you are careful in choosing the most optimal way to send money to India from Europe.

Let us look at some of the popular ways to send money to India from abroad. In each case, we will provide a summary with pros and cons of each approach.

What Are Some Popular Ways To Send Money To India?

To send money to India wisely, we highly recommend to consider various parameters of the chosen transfer option. Below is a comparison of the most popular ways to send money to India from overseas.

Cryptocurrency Transfers

It is commonly known that a cryptocurrency transfer is a cheap way to send money to India. In fact, there are plenty of online brokers, and finding a P2P (peer-to-peer) deal that is indeed of value is easy enough.

However, sometimes finding the right deal is a matter of luck: many people have to wait for someone to take their terms to complete a money transfer to India - or tolerate less beneficial conditions.

And even though the transfer itself may be relatively quick, it may take time to figure out how cryptocurrency brokers work. This part must be taken seriously due to the high risk of fraud schemes that are prevalent in the cryptocurrency ecosystem.

Since crypto payments are not legalized in many countries, it is almost impossible to get the money back in case a scam happens.

Below are the pros and cons of sending money to India using cryptocurrency transfers.

Pros

- Favorable exchange rates

- High transfer limits

Cons

- Safety concerns and risk of fraud

- Complex process

International Bank Transfers

Bank transfers are well-known; everyone has been to a bank and has a particular trust in the system. Sending money abroad with the bank is more accessible and convenient than any other method of sending money to India.

However, bank transfers to India take time - which may be a subject of concern when sending money to the family or when counting on percentages from the amount in a savings account.

Apart from that, banks come with a lot of bureaucracy: the process of signing papers and filling forms requires effort and time, and a misspelt name can make the transfer delivery time several days longer (obviously, banking days).

Furthermore, banks in different countries may vary in terms of standards and procedures; the European banking system may seem unusual to an expat from India; for example, the role of state-owned banks may be less significant in Europe than in Asia.

Finally, banks charge fees (which may apply both to incoming and outcoming transactions) and offer a lower currency exchange rate. When transferring euros to Indian rupees, it is better to check out a more beneficial option.

International wire transfers with banks usually come with hefty wire fees as well as inferior exchange rates. Check prices before you decide to lean in on the convenience of bank transfers.

Here are the advantages and disadvantages of using your bank to send money to India from Europe.

Pros

- Solid reputation

- Habitual process

Cons

- Relatively high transfer fees

- Unfavorable exchange rates

- Longer delivery

Money Transfer Services

Money transfer services are becoming more popular nowadays because their creators strive to avoid the typical problems of other remittance options. They are faster, cheaper than bank transfers, and more secure than crypto/P2P options.

Sending money to India via an online international money transfer service comes with one big problem: there are dozens of services nowadays, and with such a wide range, choosing the cheapest and best way to send money to India may be difficult.

In worst cases, some 'services' may be created by scammers: if a website does not have any proven legal information, it may have been created for phishing and scamming.

International money transfer companies generally offer competitive exchange rates and charge low transfer fees, but choosing the right provider may seem difficult due to the large number of choices available.

This is where an online money transfer comparison engine like RemitFinder can help. Simply punch in your source and destination countries, and the amount you want to send. RemitFinder then provides a list of money transfer providers in an easy-to-understand comparison table. This can help you narrow down your choices for your next money transfer from Europe to India.

Here are the pros and cons of international money transfer services.

Pros

- Faster & easier to use

- Beneficial exchange rates

- Lower fees

Cons

- Too many choices

- Risk of fraud

How To Choose A Money Transfer Service To Send Money To India?

With so many money transfer companies operating in the international money transfer space, it may seem hard to decide who to go with. But there are some best practices that can help you narrow down the choices.

Here are a few things to check before you decide which money transfer service to go with:

- Check out legal information: A reliable service that provides beneficial transfers to India should have a license, and the information on it should be easily accessible on its website.

- Analyze terms of service: The transfer terms should be transparent and comprehensive - and if the service claims to offer the fastest or the cheapest way to send money to India, it should be clear what is behind these words.

- Do not forget ratings and reviews: Check relevant reviews on trusted sources or expert websites, like mobile app stores like Google Play Store and Apple App Store as well as specialist platforms like RemitFinder.

Check out various aspects of money transfer companies like exchange rates and transfer fees, legal and compliance information, transfer speed and limits, as well as ratings and reviews before you pick who to go with.

Profee: A Smart Solution For Transfers From Europe To India

One transfer service that offers a value deal for sending money from Europe to India is Profee - a company taking international remittance to a whole new level.

There are many reasons that make Profee a money transfer option worth choosing. Below, we list some of these.

- Profee is safe: Profee is registered as an EMI (electronic money institution) - meaning that all the transactions from Europe to India are 100% legal. Profee complies with European law and regularly updates its PCI DSS certification, ensuring the highest possible level of data security.

- Profee is transparent: Profee has all the legal information displayed on its website. The transfer terms (particularly for sending money to India) can also be easily seen on the website: one can enter the transfer amount and then see the details on delivery time, fees, and exchange rate.

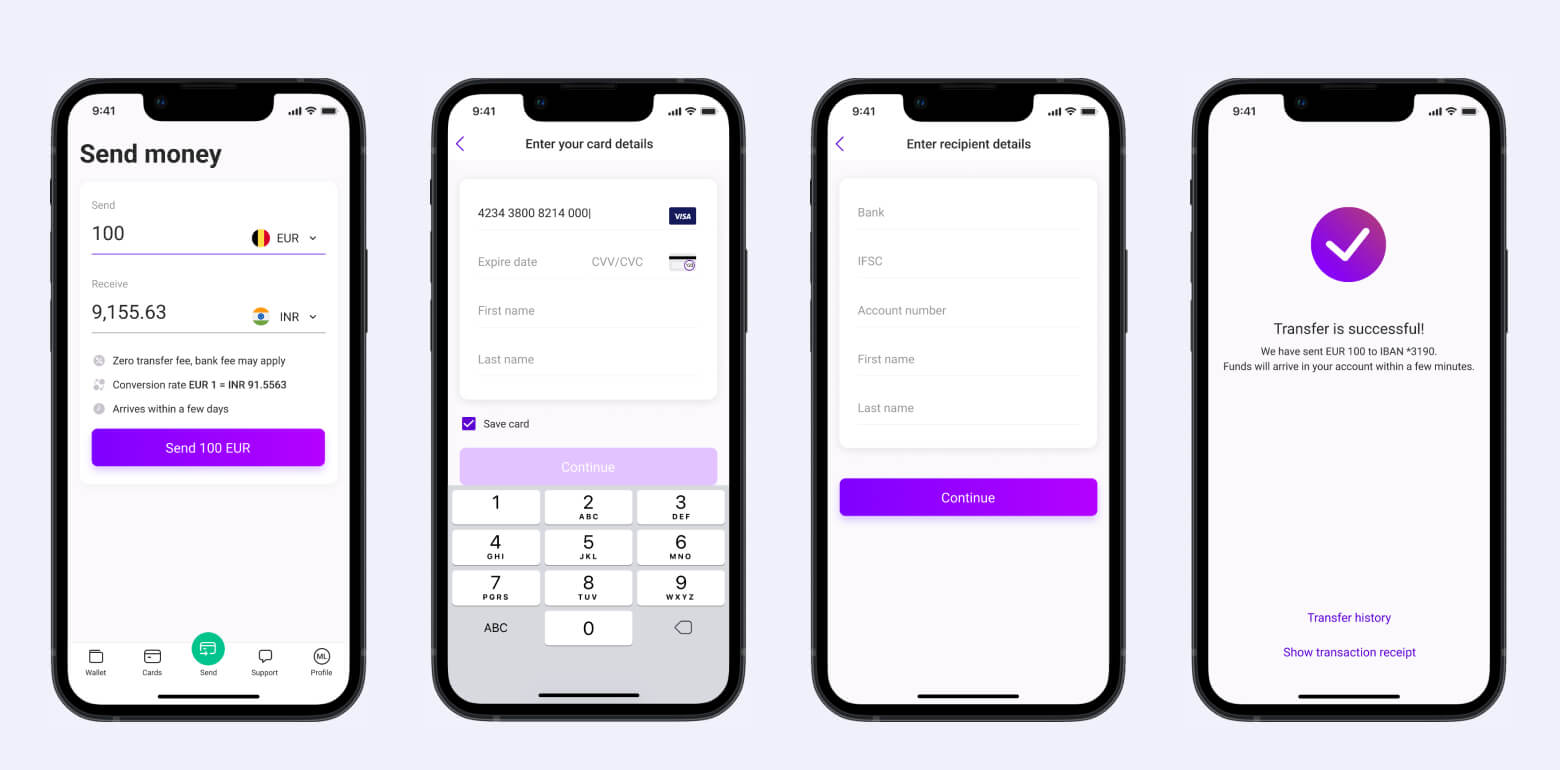

- Profee is convenient: Profee transfers to a bank account from a card in the EU are received almost instantly. Signing up and sending money to India for the first time is easy and therefore fast - so Profee's claim that the transfers from Europe to India arrive 'within minutes' is indeed valid. In addition to that, Profee has a comprehensive interface and is easily accessible either via a mobile app or by web.

- Profee is trusted: Profee boasts a 4.7/5 rate on Trustpilot based on reviews from more than 1,500 people. Furthermore, Profee has been rewarded as a rapidly developing and customer-oriented service by industry experts.

Why Are Profee Transfers To India Beneficial?

Profee has multiple advantages, but its core offer is about saving money on transfers from Europe to India.

Here is what Profee has to offer:

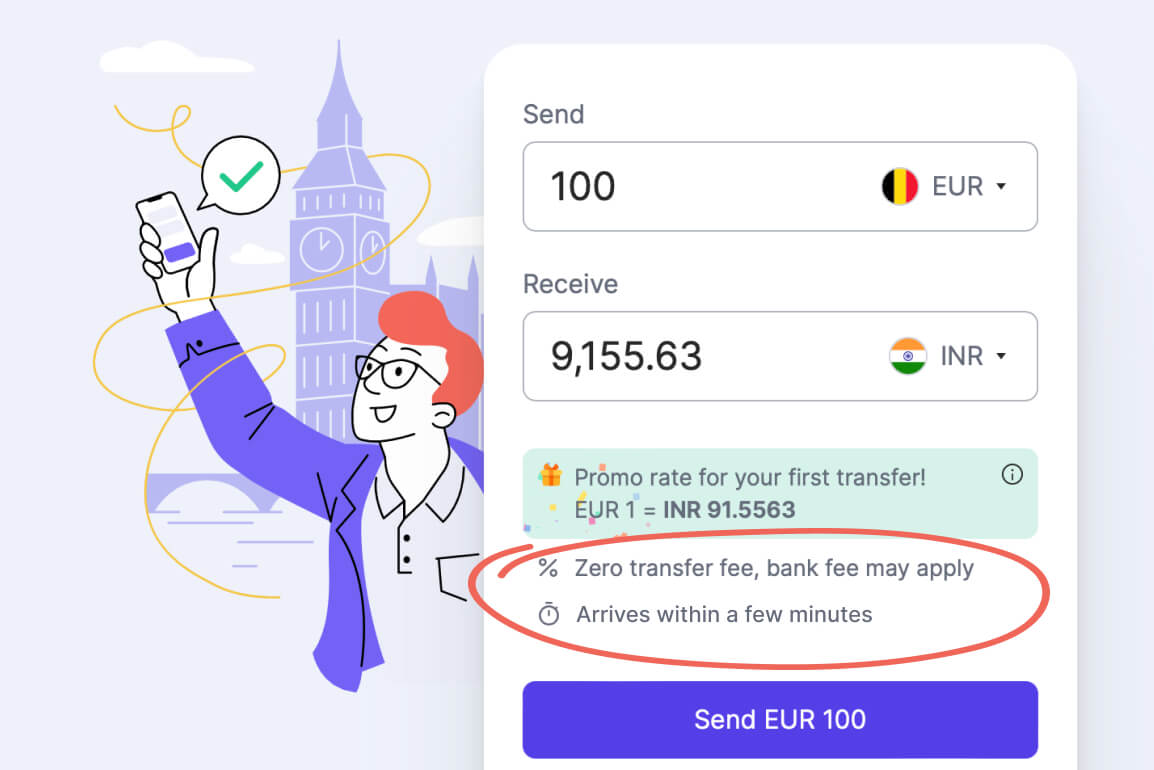

- No money transfer fee: Currently, Profee charges zero service commission for transfers from Europe to bank accounts in India, regardless of the transfer amount. The service has no hidden fees or additional payments.

- Competitive currency exchange rates: Profee has an internal system that monitors the exchange rates for cross-currency remittances. It checks the Euro-to-Rupee market rate as well as those of other primary services and generates a profitable rate for its customers.

- Promotional exchange rate for RemitFinder users: Profee has a special treat for RemitFinder users who become its new clients: a promo rate for the first transfer from Europe to India. The promo currency exchange rate is even more beneficial than that for other transfers, as the company welcomes newly registered customers.

While the difference between the currency exchange rates of various transfer services may seem small and the transfer fees may look relatively low, these numbers are of great importance for those who regularly send money from Europe to India for years.

The sums that look small in the beginning turn out to be significant in the end. With Profee, saving money on transfers from Europe to India does not require additional effort or time - so why not use this opportunity?

How Can Profee Help Me Send Money To India From Europe?

If you wish to check out more information on Profee and learn about their service in further detail, you can read RemitFinder's detailed Profee review.

We have done a comprehensive analysis of Profee's international money transfer service with detailed coverage of various aspects like corridor coverage, exchange rates and transfer fees, transfer limits, payment and delivery methods, legal and compliance information, customer ratings and reviews, and much more.

Our in-depth Profee review will help you get to know about Profee in detail and prove useful to your potential decision to go with Profee for your next money transfer from Europe to India.

The above resource also includes a step-by-step guide to send money overseas using Profee. It is very quick and easy to send money from Europe to India via Profee - the process only takes a few minutes.

Additionally, below are some useful money transfer comparison pages for sending money from Europe to India. Here, you can compare Profee with other money transfer companies.

- Send money from Austria to India

- Send money from Belgium to India

- Send money from Bulgaria to India

- Send money from Croatia to India

- Send money from Cyprus to India

- Send money from Czech Republic to India

- Send money from Denmark to India

- Send money from Estonia to India

- Send money from Finland to India

- Send money from France to India

- Send money from Germany to India

- Send money from Greece to India

- Send money from Hungary to India

- Send money from Ireland to India

- Send money from Italy to India

- Send money from Latvia to India

- Send money from Liechtenstein to India

- Send money from Lithuania to India

- Send money from Luxembourg to India

- Send money from Malta to India

- Send money from Netherlands to India

- Send money from Norway to India

- Send money from Poland to India

- Send money from Portugal to India

- Send money from Romania to India

- Send money from Slovakia to India

- Send money from Slovenia to India

- Send money from Spain to India

- Send money from Sweden to India

In case your country is not listed above, simply search on RemitFinder website or mobile apps (available for both iOS and Android) to see the options for sending money from Europe to India.

Conclusion

Sending money from Europe to India comes with some challenges. At the very minimum, you want to ensure you are using a safe and reliable option so your money and private information are always safe.

Next, you want to ensure that you can maximize the return on your hard-earned money by trying to get the best exchange rate and low, or ideally 0, transfer fees. This will ensure that your overseas recipient in India gets the maximum payout for the money you send to them.

One of the problems that you may encounter is the explosion of international remittance service providers that cater to the highly popular remittance routes from Europe to India. With so many choices available, how do you decide who to go with?

This is where Profee comes in. It is a reliable, cheap, and fast service that you could use for your next money transfer from Europe to India. Check out RemitFinder's detailed review about Profee to learn more about this dependable money transfer service for sending money to India from anywhere in the EU region.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

Categories

Similar Articles

Wise vs Revolut: What Are The Differences?

Both Wise and Revolut have grown massively over the last few years and are popular, established money transfer companies. We delve deep into both to bring you a head-to-head detailed comparison.

How To Save On B2B International Transfer Fees

B2B international payments have been expensive, slow and cumbersome in the past. Are there any new fintech companies that take the hassle out of cross-border business payments?

How To Send Money From UK With PassTo

There are many money transfer companies to send money from UK. We zoom into PassTo's remittance service from the UK so you know all you need to about them.