How To Send Money From UK With PassTo

Table of Contents

- What is PassTo?

- Why Should I Use PassTo?

- How can I Send Money from the UK with PassTo?

- Step by Step Guide to Send Money with PassTo

- How Much Does It Cost To Transfer Money With PassTo?

- How Long Do PassTo Money Transfers To India Take?

- Is PassTo The Best Option To Send Money To India?

- Conclusion

In today's highly connected global economy, international money transfers are something everyone come across. While carrying cash or sending money orders were popular in the past, modern digital payment platforms have greatly reduced the cost of international payments.

In fact, the international money transfer space is saturated with numerous money transfer companies. From fintech startups to neo banks to cryptocurrency providers, and from established money transfer operators to multi-currency wallets, there are numerous choices to send money overseas.

Even traditional banks are continuing to modernize their systems to facilitate international remittances lest they lose out of the massive foreign currency exchange and international money transfer market.

There are several advantages to using money transfer services to send money overseas as compared to using traditional banks. The biggest advantage is that you will be able to send money with better exchange rates. In addition, you will also avoid having to worry about paying high transfer fees.

If you are looking for a quick way to transfer money from the UK, you can make use of the services offered by many leading money service providers.

One such money transfer company that specializes in send money from the UK is PassTo. In this blog post, we will take a deeper look at what PassTo has to offer when it comes to remittances from the UK.

So, if you are a foreigner or expat living in the UK and need to send money back home, or a UK resident who wants to remit funds overseas, you may want to check this article out.

What is PassTo?

PassTo is a popular and reputable FCA regulated international money transfer service that provides you with very competitive exchange rates and transparent pricing.

With PassTo, you have more than 120 options for the recipient to receive the funds you send them. These include cash pick-ups, mobile wallets, and bank deposits all across the world.

Some of the highlights of PassTo for sending money abroad include the below:

- Affordable Prices: Send up to GBP 3,000 as a daily limit with very competitive real-time FX rates and transparent pricing with no hidden costs.

- Easy To Use: With the PassTo mobile app, you can have an account set up and be sending money in just a few clicks in a matter of few minutes.

- Secure Platform: PassTo team puts a strong focus on safety and security to keep your money and information safe at all times.

- Flexible Delivery Options: Your recipient can receive money in any of following three flexible ways: at cash pick-up locations, through mobile wallet credits, or via bank deposits.

PassTo has many advantages when it comes to sending money overseas from the UK.

Why Should I Use PassTo?

With PassTo, money transfers are fast, safe, and include competitive real-time exchange rates. Furthermore, there are no hidden fees or charges.

PassTo aims to cater to residents in the UK and is focused on providing a secure, cost-effective service. PassTo uses a proprietary algorithm to compare the market exchange rates and provide the best possible exchange rates to its customers.

PassTo is a UK-based fintech company that provides money transfer services to more than 60 countries. It is regulated by the Financial Conduct Authority (FCA) and uses two-factor authentication for money transfer security. Moreover, it employs the latest technology to detect any suspicious activity.

At RemitFinder, we review international money transfer companies in detail so you have in-depth information available for your research.

Our team has also reviewed PassTo with a detailed with a deep dive analysis of their corridor coverage, exchange rates, transfer fees, sending limits, payment and delivery methods, customer ratings and reviews, and much more.

Check out our detailed PassTo review to learn more about them.

How can I Send Money from the UK with PassTo?

Given the large number of foreigners and expats living, working and studying in the United Kingdom, UK money transfer corridors are among the world's busiest remittance corridors.

If you are a UK resident and wish to send money overseas, you have likely utilized one of the numerous online money transfer services available.

Leading services such as PassTo offer transparent fees and competitive exchange rates, making them excellent choices for international money transfers.

Using a specialist money transfer service can save you a lot of money. Many of these services are also cheaper than using your bank. In addition, you can often get better exchange rates and fewer fees using a specialized provider.

You will save more money on your international remittances by going with money transfer companies instead of banks.

When initiating an international money transfer with a remittance firm, one of the first decisions you must consider is the method by which you fund your transfer. This is commonly known as a payment method.

PassTo supports the following payment methods:

- Bank transfers

- Debit cards

- Credit cards

Transferring funds from one bank account to another is typically the most cost-effective method of making a payment for a money transfer.

Finally, your money transfers sent from the UK with PassTo could finish within minutes. Money transfer speed depends on the payment and delivery methods chosen.

So, if your money transfer is urgent in nature, you can pay with a debit or credit card as those are faster payment methods. However, using a card to pay for your international money transfer may result in additional fees. On top of that, your credit card company may even charge you a cash advance fee.

Card transfers are generally fast but can be expensive. Bank transfers are low cost but slower.

Step by Step Guide to Send Money with PassTo

Now that we have introduced PassTo's international money transfer service and discussed their strengths, we want to walk you through the process of sending money with PassTo.

On a high level, you first need to download the app and create a new account. Once you've signed up for PassTo, you'll need to enter the details of the recipient.

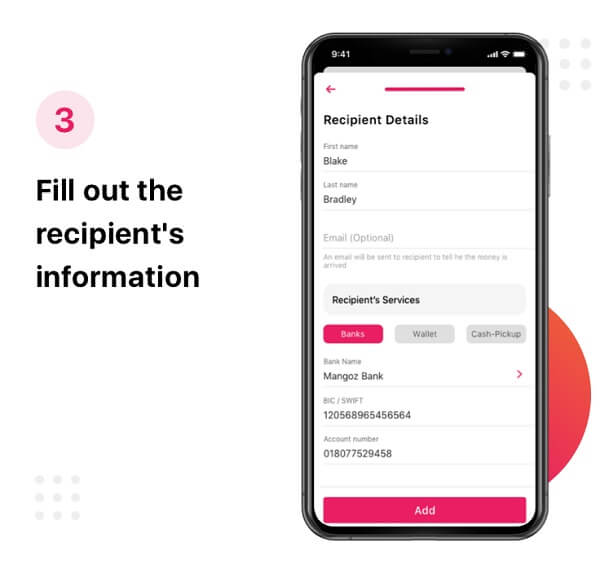

Note that these must be exactly the same as on their registered bank, wallet or cash pickup otherwise the transfer may not succeed.

Then you choose the method of payment and submit your money transfer.

We will take the example of a UK to India money transfer to see the exact steps needed to send money with PassTo.

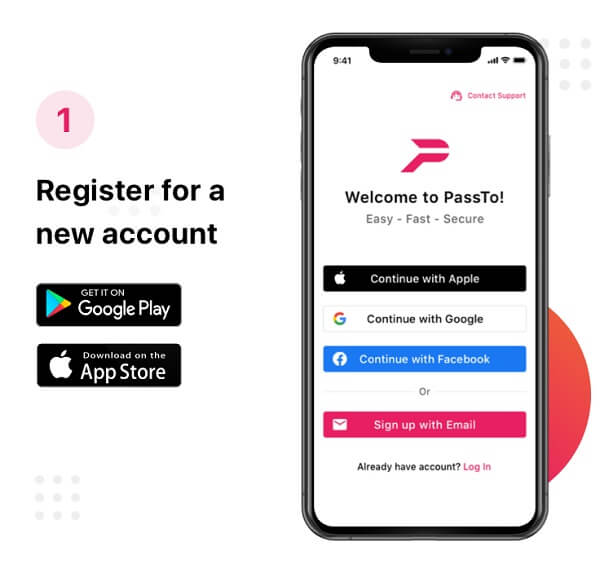

Below is the step by step guide to send money to India from the UK using PassTo's mobile app (available on both Android and iOS platforms).

Send Money to India with PassTo in 5 Quick Steps

Step 1: Register a new PassTo account. Create a new PassTo account by downloading the PassTo: Global Money Transfer app from the Apple App Store or Google Play Store. You will also need to submit identification documentation to complete Know Your Customer (KYC) requirements.

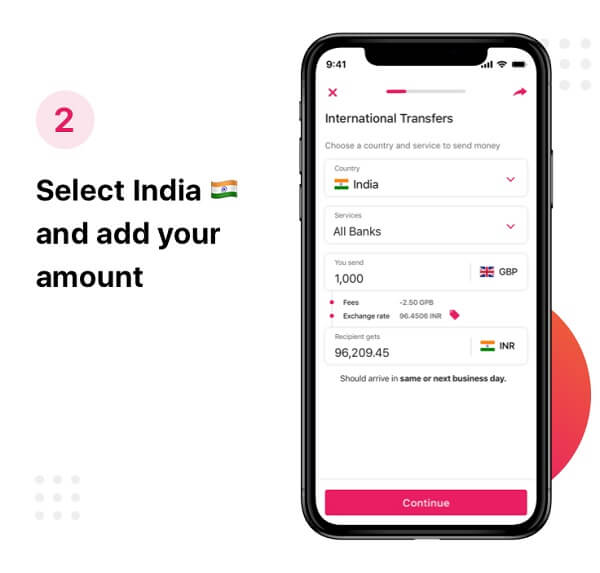

Step 2: Specify the recipient's country. Choose your receiver's country and enter the amount you wish to transfer. The app will show you how much amount your recipient will receive overseas.

Step 3: Fill out the recipient's information. Enter the recipient's information which must be exactly the same as that on their registered delivery method. This will ensure that there are no problems in the transfer process.

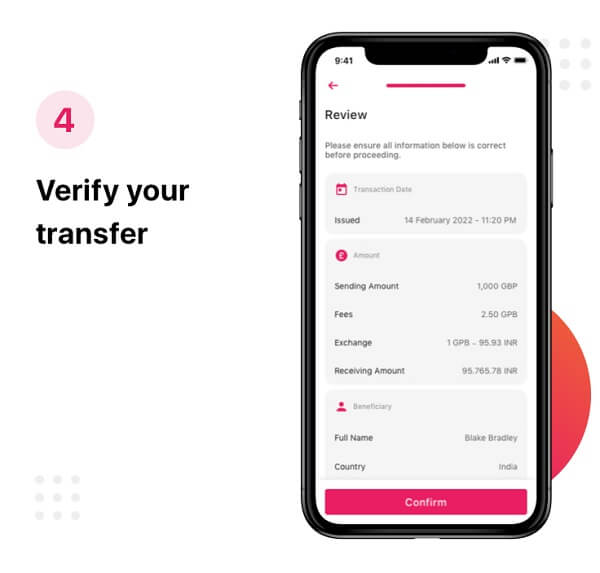

Step 4: Verify the transfer. Review your transaction for accuracy and verify that all the transaction particulars and information is correct. This is an important step and do not rush though this screen. Any potential mistakes can either delay or even fail the whole transfer later.

Step 5: Transaction submitted. Once everything is validated by the PassTo platform, your transaction will be submitted and PassTo will begin working on your transfer. At this time, you have successfully sent the funds, and they are on their way to the designated recipient.

PassTo will also keep you informed of transaction status as it progresses to next steps.

How Much Does It Cost To Transfer Money With PassTo?

PassTo provides various discounts and promotions to RemitFinder users to help them save more on their money transfers.

Currently, there is an active PassTo promotion whereby your first transfer is free and has a special welcome exchange rate. This is a great way to save more on your PassTo remittance and put more money in your recipient's pocket.

Take advantage of attractive PassTo promotions for RemitFinder users to save even more money on your international money transfers.

After you have taken advantage of 2 free money transfers with PassTo, you will have to pay a small fee. PassTo's transfer fees tend to range between GBP 1.40 and GBP 2.50. The transfer fees vary based on many criteria such as the country of destination and the delivery option chosen.

The good news is that PassTo's pricing is fully transparent and there are no hidden fees that you may get surprised with. PassTo clearly shows their exchange rates as well as transfer fees with full transparency and in a straightforward manner.

To see how your transfer will be priced, you can get a quote for your international money transfer in real time by using the calculator on the PassTo website or from within the app.

Simply choose the destination country and enter the transfer amount to see the exchange rate, transfer fee and the final payout amount. Getting a quote first is a good way to estimate and prepare before sending money with PassTo.

How Long Do PassTo Money Transfers To India Take?

Typically, 90% of PassTo's international money transfers to India are completed within minutes.

When you send money from the United Kingdom to India, the PassTo app will provide the estimated timeframe in which the transfer is scheduled to complete. You can track your transfer anytime in the PassTo app.

Is PassTo The Best Option To Send Money To India?

PassTo generally offers highly competitive exchange rates compared to its rivals in the international money transfer industry. Additionally, there are no hidden fees associated with PassTo, and both the exchange rate as well as the transfer fee are fully transparent.

As an FCA regulated money transfer company, PassTo also has a number of safeguards are in place to protect your funds and personal data at all times.

PassTo is FCA regulated and implements many security best practices to keep your money and information safe.

Given this, PassTo is certainly a great option to send money to India from the UK.

If you are interested in checking out additional money transfer companies, you can use RemitFinder's real time remittance comparison platform. Simply enter your source and destination countries, and the amount you want to send, and you will be presented with an easy to understand comparison table.

You can also read in-depth reviews on various money transfer companies.

Another huge advantage is access to many attractive deals and promotions from various providers. Many of these coupons and discounts are exclusive to RemitFinder customers to help you save even more on your international remittances.

Conclusion

There are many money transfer companies to choose from nowadays. With ever changing exchange rates and so much choice, it can get hard to decide who to go with.

If you live in the UK, you should certainly look into PassTo as a potential partner for your overseas money transfers. With very competitive exchange rates and low, transparent transfer fees, PassTo can be a reliable provider for your next money transfer from the UK.

PassTo's mission is to provide a great service and a smooth user experience. It has received consistently top ratings from customers for its excellent customer service, quick money transfers and highly competitive exchange rates. It places a premium on security, so you can rest assured that your money and data are safe in their hands.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

Categories

Similar Articles

Wise vs Revolut: What Are The Differences?

Both Wise and Revolut have grown massively over the last few years and are popular, established money transfer companies. We delve deep into both to bring you a head-to-head detailed comparison.

How To Save On B2B International Transfer Fees

B2B international payments have been expensive, slow and cumbersome in the past. Are there any new fintech companies that take the hassle out of cross-border business payments?

How To Save Money On Transfers From Europe To India

Are you looking to send money from Europe to India? Check out our guide on how to save money on your international money transfers to India from Europe.