PassTo Detailed ReviewRates, Fees, Limits, Safety and More

As of June 2024, PassTo have ceased their international money transfer operations. Please use other providers for your international remittance needs.

Last updated: August 28, 2022

What is PassTo? An introduction

PassTo company information

PassTo is a fintech money transfer service that helps expats send money from the UK to friends and family overseas. Their mission is to provide their customers with a seamless experience in sending money across the globe in real time with low fees and great rates.

PassTo started with their beta product in June 2019, and graduated to an official launch in just a few months to fully support international money transfers in December 2019. Ever since then, they have been expanding their portfolio to add more services and support additional countries across the globe.

PassTo is currently headquartered in London, UK.

What services does PassTo provide?

With a clear focus to serve the international community settled in the UK, PassTo provides the following 2 services to expats and overseas residents living in the UK:

- International money transfers: You can send money to numerous countries globally with PassTo. Pass's remittance service is a major focus of this detailed review, and you can read about various aspects like exchange rates, fees, transfer limits, transfer speed, and so on in this article.

- Mobile Airtime Top-up: This is the second service that PassTo provides to UK residents whereby you can top-up mobile airtime for friends and family in more than 150 countries. To facilitate international mobile airtime top-ups, PassTo has teamed up with major mobile operators and companies worldwide.

PassTo enables customers to send money overseas as well as do international mobile airtime top-ups.

Which countries does PassTo operate in?

PassTo currently enables you to send money from the UK. They do have plans to expand in overseas markets in the near future. You can send money to more than 60 global destinations using the PassTo international money transfer service.

Where can I send money from with PassTo?

PassTo offers its services to all residents of the UK. You can send money to all PassTo supported destination countries as long as you are a UK resident.

Where can I send money to with PassTo?

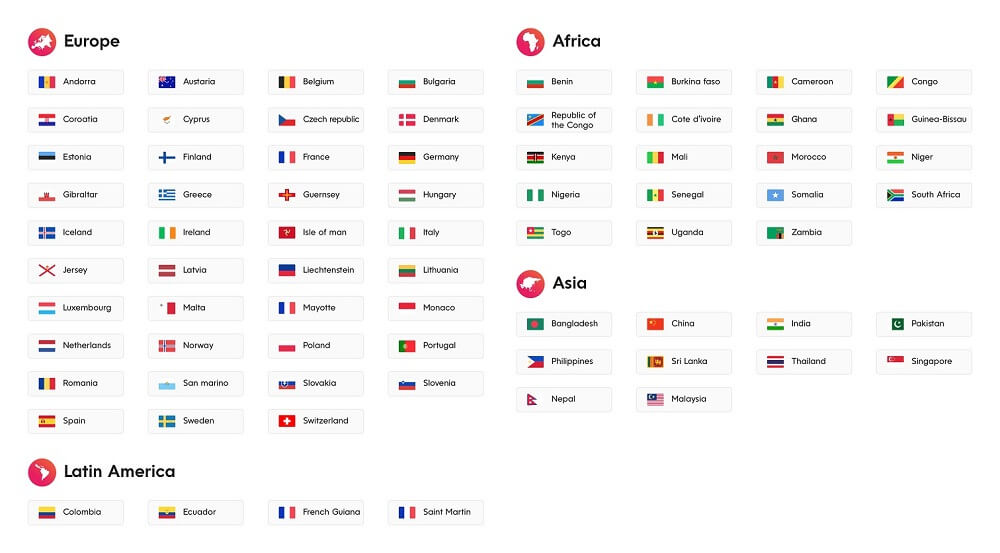

PassTo can help you send money to over 60 countries around the world across all major global regions. Destinations across Europe, Asia, Africa and Latin America are currently supported.

The below graphic shows the list of countries where you can send money to using PassTo.

PassTo is always expanding their supported destination country coverage, so check back here often in case your country is not currently supported.

PassTo lets you send money from UK to over 60 global destination countries.

What are PassTo's fees and exchange rates?

PassTo generally provides highly competitive exchange rates in comparison with their competitors in the international money transfer space.

To see if PassTo exchange rates are good or not, we will do some case studies and run some simple calculations. This will help us evaluate the exchange rates offered by PassTo.

Let's look at PassTo's exchange rates for sending 1000 units of currency for some country/currency pairs below.

| Country Pair | Transfer Amount | Exchange Rate* | Fees* | Payout | Mid-Market Rate** | FX Markup |

|---|---|---|---|---|---|---|

| UK to India | GBP 1,000 | 1 GBP = 93.8686 INR | GBP 2.5 | 93,633.93 INR | 1 GBP = 93.9494 INR | 0.34% |

| UK to Pakistan | GBP 1,000 | 1 GBP = 259.9737 PKR | GBP 2.0 | 259,453.75 PKR | 1 GBP = 258.6966 PKR | -0.29% |

| UK to Philippines | GBP 1,000 | 1 GBP = 65.9101 PHP | GBP 1.4 | 65,817.83 PHP | 1 GBP = 66.0082 PHP | 0.29% |

| UK to Germany | GBP 1,000 | 1 GBP = 1.1790 EUR | GBP 1.99 | 1,176.65 EUR | 1 GBP = 1.1791 EUR | 0.21% |

| UK to Ghana | GBP 1,000 | 1 GBP = 11.6498 GHS | GBP 1.49 | 11,632.44 GHS | 1 GBP = 11.7596 GHS | 1.08% |

*Exchange rates and fees as on August 27, 2022

**Mid-Market Rate from XE.com

See how we calculate FX Markup

To get a real time quote from PassTo for your international money transfer with them, you can use their online currency calculator to estimate the payout your recipient can expect to receive. Simply choose your destination country and enter the transfer amount, and you will be presented with the exchange rate, transfer fee and the final payout. This is a great way to estimate and plan before you actually send money with PassTo.

When it comes to PassTo's transfer fees, we have seen fees in the range of GBP 1.40 to GBP 2.50. The transfer fee charged by PassTo is variable and depends on factors such as the destination country and the chosen delivery service.

The good news is that PassTo has crystal clear pricing. PassTo reveals their transfer fee transparently, and you do not get charged any hidden fees.

PassTo provides highly competitive exchange rates, and low, transparent transfer fees. You do not pay any hidden fees with PassTo.

Are PassTo exchange rates good?

PassTo has very competitive exchange rates in pretty much most of the markets they operate their money transfer business in. At any time, you can access their real time calculator available on their website to get an instant quote for your destination country.

From time to time, PassTo might even provide an exchange rate that is higher than even the interbank exchange rate, also called the mid-market rate. Based on our case studies above, we notice that PassTo's FX Markup is anywhere between -0.29% to 1.08%. This means their exchange rates are generally pretty high.

From time to time, PassTo may even provide an exchange rate that is better than the interbank exchange rate. Take advantage when that happens!

As a general best practice, we always recommend that you do extensive research on various available options before you commit to any money transfer company.

One extremely easy way to compare many money transfer companies quickly is to use RemitFinder's real time money transfer comparison engine. We do the hard work for you and present a comparison table and other useful data from numerous remittance companies so it helps you make the right choices.

PassTo finds the best exchange rates possible for each country; however, there are variations in cost as exchange rates to send money internationally fluctuate. PassTo partners with RemitFinder to deliver the best rates possible for RemitFinder customers.

Is PassTo a cheap way to send money overseas?

PassTo is a cost-effective way to send money overseas given their fairly low FX Markup. Recall that based on our case studies, we observed an FX Markup between the range of -0.29% to 1.08%.

PassTo may not be the cheapest across the board but aims to remain competitive in the market. Their transfer fees tend to be low, and vary from GBP 1.4 to GBP 2.5. Plus, PassTo has no hidden fees as it delivers a transparent fee structure.

Given PassTo's good rates and lower fees, they can be a cheaper option to send money abroad.

How do I avoid PassTo fees?

There is always a cost for sending money internationally. That said, PassTo offers a low, cost effective fee structure which is competitive in the market. Additionally, you do not have to worry about any hidden fees and PassTo maintains full transparency around their fees.

Here are some ways to minimize your money transfer fees with PassTo:

- Your first two transfers are always fee-free.

- You can earn a reward every time you refer friends who make successful transfers.

- From time to time, PassTo may also introduce cashback coupons or other rewards, often exclusively for RemitFinder users. Such PassTo promotions can further help you maximize your money transfer payout.

You can minimize PassTo fees by taking advantage of 2 free transfers, referring friends and using promotions when available.

How much money can I send with PassTo?

PassTo's sending limits vary from country to country, and depend on the financial regulations and government rules of each country.

In most cases, you can send up to the below limits via PassTo:

- GBP 3,000 per day

- GBP 8,000 per month

- GBP 50,000 per year

How long does it take for PassTo to send money overseas?

PassTo can move money overseas quickly. In most cases your money transfer will be completed within minutes. However, in some cases it can be on the same day or next business day depending on service speed and quality in the destination country.

PassTo helps you send money overseas quickly, and in most cases, your recipient can access the funds within minutes.

PassTo's quick money transfers can be a great asset to you in case you need to send money overseas rapidly, especially for urgent reasons or emergency scenarios.

How can I pay for my PassTo money transfer?

When you make an international money transfer with a remittance company, one of the first things you need to decide is how you will pay for your money transfer. The way you fund your transfer is called a payment method.

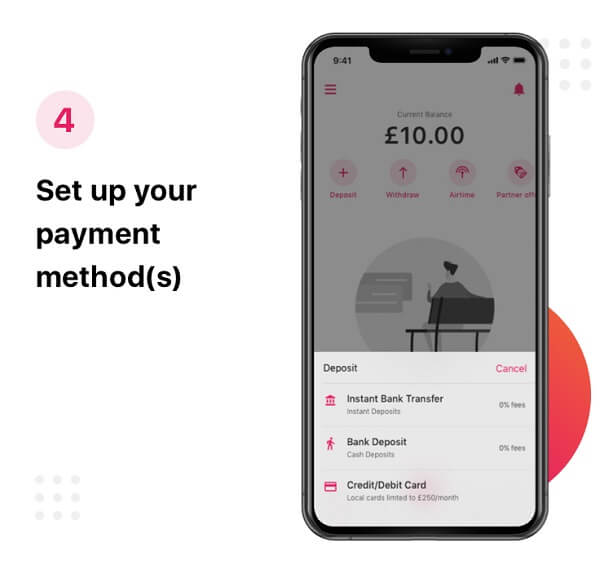

PassTo supports the following payment methods:

- Bank transfers

- Debit cards

- Credit cards

Those are all good options to pay for your transaction. However, many credit card companies treat paying for a remittance as a cash advance, and you may get hit with additional fees. So, before you decide to use your credit card to pay for your money transfer with PassTo, check with your financial institution that issued the card to see if you will have to pay additional fees.

Which payment method should I use to pay for my PassTo money transfer?

Usually, a bank account transfer is the cheapest way to pay for your money transfer. It may take a few business days for PassTo to get your money. If speed is important, then you can consider using debit or credit cards.

How can my recipient get paid with PassTo?

Whilst a payment method is the sender's payment instrument when sending money overseas, a delivery method it the equivalent on the other end of the transfer. In other words, a delivery method is how your recipient gets the funds you send to them via the remittance transaction.

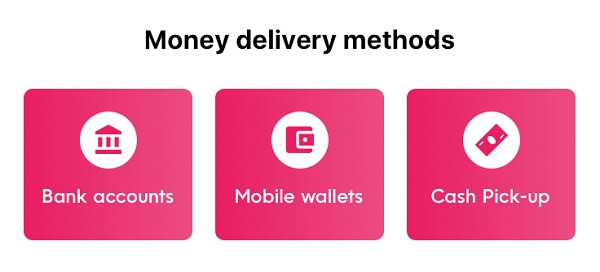

PassTo supports the following delivery methods to send money to your overseas recipients:

- Bank account deposits

- Mobile wallet credits

- Cash pickup at agent locations

Note that not all delivery methods may be available in every country as these are subject to any limitation in the destination country. The PassTo app will make you aware of available delivery options for your destination country.

Which delivery method should I use for my PassTo money transfer?

PassTo's flexible delivery methods give you a good deal of choice. You can, therefore, decide which option is best for you based on your or your recipient's preferences.

For example, if your recipient does not have a bank account, or does not want to share their bank information with you, you can use mobile wallet or cash pickup options.

Similarly, if your recipient lives in a remote area and cannot receive funds electronically, you can choose cash pickup option for them. All they would need to do to get the money would be to go to a nearby cash pickup agent location.

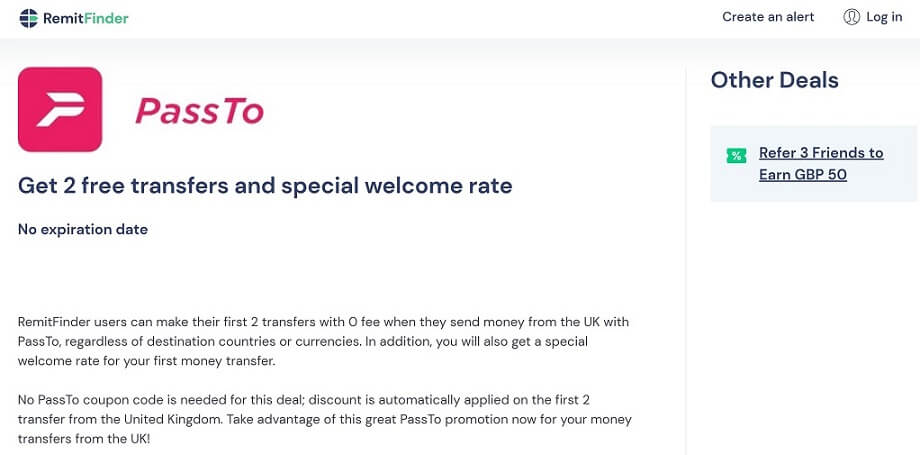

Are there any PassTo coupon codes or promotions I can use?

PassTo does offer many attractive deals and promotions that you can use to save even more on your money transfers with them. PassTo promotions come in a few different forms; these are as below:

- Free transfers: With PassTo, the first two transfers are fee-free. This is a great way to save right off the bat as a new PassTo customer.

- Referral program: PassTo also has a referral program which will pay you a reward for each successful referral.

- Periodic promotions: From time to time, PassTo adds seasonal or special promotions around popular holidays.

At this time, RemitFinder customers can take advantage of the below 2 PassTo promotions:

Below is a screenshot of the PassTo promotion that allows you 2 free transfers as a new customer, as well as a welcome, promotional exchange rate.

PassTo promotion to get 1 free transfer and special welcome rate

If we see any future PassTo deals and discounts, we will add them to this page, so make sure to check back regularly. To automate this, you can create your free exchange rate alert, and we will keep you posted about the latest exchange rates and promotions for your chosen country combination.

How can I find PassTo near me?

PassTo's money transfer services are all online, so there are no branches, offices or agent locations to go to. Hence, you can send money internationally with PassTo from your home or office 24x7 conveniently. No need to deal with traffic congestion, stand in lines or deal with COVID fears.

Is PassTo a safe way to send money abroad?

PassTo implements a variety of security measures to ensure the safety of your money and information at all times. Below are some of the best practices that PassTo undertakes to provide you with a secure system:

- PassTo implements advanced security protocols including Know Your Customer (KYC) procedures. KYC ensures that you are operating your account and not someone else who could be impersonating you. By doing this, PassTo protects your account by ensuring it's not opened and operated by someone else.

- The PassTo system implements two-factor authentication (2FA) which gives your account's info and payments an extra layer of protection from any fraudulent or suspicious behavior.

- PassTo complies with a key financial best practice called safeguarding to comply with Payment Services Regulations (PSRs). This means PassTo keeps customer funds separate from their own business funds and business accounts. The funds that PassTo is required to safeguard are held in dedicated safeguarding accounts that they hold with major banks in the UK.

- PassTo invests in technology products that automatically evaluate and monitor any unusual activity and flags it as potentially fraudulent. This type of proactive monitoring helps prevent and detect fraud before it wreaks any havoc.

- PassTo ensures 100% data protection and security as part of their conformance and compliance with legal and regulatory financial agencies.

- PassTo is regulated by the Financial Conduct Authority (FCA) in the UK. In order to maintain their compliance with strict FCA regulations, PassTo has to continuously ensure that their systems are safe at all times.

PassTo seems to be very serious about their security policy, and the above points demonstrate their commitment to data privacy and safety.

Can I trust PassTo?

An important aspect in trusting a business is their level of accreditation with reputed legal and regulatory organizations. In the financial services domain, this becomes even more important.

In the case of PassTo, they are authorized and regulated by the Financial Conduct Authority (FCA) in the UK (Firm number: 900662). The FCA enforced strict guidelines and regulations, and companies have to adhere to those to ensure they keep their license intact.

PassTo is owned by BlaBla Connect Ltd, which is authorized and regulated by the FCA under the Electronic Money Regulations 2011 with the Firm Reference Number 900667.

Given that PassTo has put numerous methods in place to protect your money and information, you can be reasonably confident that you are in safe and reliable hands when you send money overseas using their services.

Given PassTo's focus on security and safety, your funds and private information should be safe with them.

How good is PassTo's service?

PassTo aims to deliver a service which will exceed all expectations. A possible way to check if customers like PassTo's service is by seeing what sort of feedback they provide about them.

What do users have to say about PassTo?

Below we present what customers think about PassTo's money transfer service by looking at their ratings on some popular review^ platforms.

- PassTo is rated Excellent with a 4.6/5.0 score on Trustpilot and has 83 reviews

- On the Google Play Store, PassTo's Android app has a 5.0/5.0 rating with more than 10k downloads and 343 reviews

- PassTo's iOS app is rated 5.0/5.0 on the App Store with 5 ratings

^Ratings on various platforms as on August 28, 2022

Some of the themes on which customers tend to rate PassTo really well include highly competitive exchange rates, fast speed of money transfers and very good customer support.

PassTo has excellent customer reviews on all major platforms. Customers seem to like their money transfer service.

It is always reassuring to see that other remitters like you have not faced any major problems with a money transfer company you might be considering. If PassTo's service had any major issues, customers would have likely provided their feedback to highlight that. On the contrary, PassTo's money transfer service seems to be well liked by their customers.

Is PassTo the best choice for me?

Given our deep dive into PassTo's money transfer product and services, we find that PassTo has strengths in many areas we looked into. In particular, we observe PassTo to be outstanding in some of the following aspects:

- Strong focus on UK money transfers: PassTo has a strong support for money transfers sent from the UK with a coverage of 60 plus countries, and growing. If you are a UK resident, and send money overseas, they can be a great asset to help you with your remittances.

- Highly competitive exchange rates: PassTo aims to offer the best exchange rates possible to send money abroad. Based on our case studies done earlier, they charge a low FX Margin which means your recipient gets more money in their pocket.

- Fast money transfers: When it comes to transfer speed, PassTo is one of the fastest companies to move your money abroad. Most PassTo money transfers are completed within just a few minutes, or within the same day.

- No hidden fees: PassTo's fees for each transaction are crystal clear. You will not pay a hidden fee for your money transfer with them. Full transparency ensures that you will not be surprised with any hidden charges.

- Coupons and discounts: PassTo provides ongoing as well as occasional promotions and offers to both new and existing customers. These deals are a great way to save even more money on your PassTo remittances.

- Comprehensive support: Should you have any questions or need assistance, PassTo's customer support experts are available via phone, chat & email. It is pretty easy to connect with someone and get help when needed.

RemitFinder likes PassTo for providing very competitive exchange rates, low and transparent fees, fast money transfers and ongoing deals and promotions.

What are the best reasons to use PassTo?

Based on our detailed analysis of PassTo, and their strong areas within their money transfer product offering, there are many remittance scenarios where PassTo could be a great choice for your next overseas funds transfer. We provide some such suitable money transfer scenarios below:

- If you need to send money overseas urgently or for some emergency situation, PassTo can be a go to choice for you. This is because they specialize in moving money overseas quickly. Many PassTo transactions complete within minutes, and the rest within a day. You can, therefore, rush money to your overseas friends and family quickly if the need arises.

- Sometimes your recipient does not have a bank account, or you are dealing with someone for the first time, and they are uncomfortable sharing their bank information. In such situations, PassTo's support for additional delivery methods like mobile wallet credit and cash pickup can come in handy.

- PassTo is also a very cost-effective way to send money overseas. With highly competitive exchange rates and low fees (plus, first 2 free transfers when you sign up), you can certainly make the most of your international money transfers with PassTo.

- If you reside in the UK and need to send money internationally, PassTo is a great contender you should definitely look at. They cover more than 60 destinations, and if your target country is supported, you can save some more with them.

- From time to time, PassTo provides useful deals and discounts. Many of these are applicable for existing customers as well. This helps you save even more money by taking advantage of additional discounts. Additionally, PassTo has a referral program whereby you can earn money by referring your friends to PassTo.

- Finally, there are no branches or agent locations to go to with PassTo. Everything is online, and you can send money using the PassTo mobile app with just a few clicks. This saves you precious time that would otherwise get wasted in traffic and lines in offices.

PassTo is a great fit with many international money transfer needs.

What type of transfers can I make with PassTo?

PassTo money transfers can take several forms, including airtime top-ups. Below is the complete list of the types of money transfers with PassTo supports:

- Bank to bank transfers

- Bank transfers to mobile wallets

- Bank transfers to cash pickups

- Debit/credit card transfers to bank accounts

- Debit/credit card transfers to cash pickups

- Debit/credit card transfers to mobile wallets

- Airtime top-ups

That is a good deal of flexibility for the money transfers you can make with PassTo. Depending on your needs, pick the right transfer type for your next international remittance via PassTo.

What are various ways to send money with PassTo?

Currently, you can only send money with PassTo by using their mobile application. PassTo's mobile app is available on both iOS and Android phones from the respective app stores. A web version of PassTo money transfers is coming soon.

How to send and receive money with PassTo?

The PassTo mobile app makes sending money overseas a very easy process. You should be able to finish your transaction in just a few minutes.

In the next section, we will present a step by step guide that you can use to send money with PassTo.

Step by step guide to send money with PassTo

Follow the below easy and quick steps to send money abroad with PassTo in just a few clicks:

- Pre-Step: Determine if PassTo is your preferred money transfer company. With so many remittance companies to choose from, it may seem like a tough task to decide who you want to go with. To take the hassle out and avoid comparing money transfer companies one by one, use RemitFinder's comparison platform to easily compare various money transfer companies. Our simple interface enables you to compare numerous companies side by side, and see their strengths and weaknesses.

- Step 1: Download the PassTo mobile app. Download the PassTo mobile app from the Apple App Store or the Google Play Store depending on your device type. You can also use the PassTo deeplink to get routed to the right app store based on your device type to download the app.

- Step 2: Sign up for a PassTo account. After you have downloaded the PassTo mobile app, register for a new PassTo account. Registration is quick and easy, and only takes a couple of minutes. You have many options that include signing up with Apple, Google, Facebook or your email.

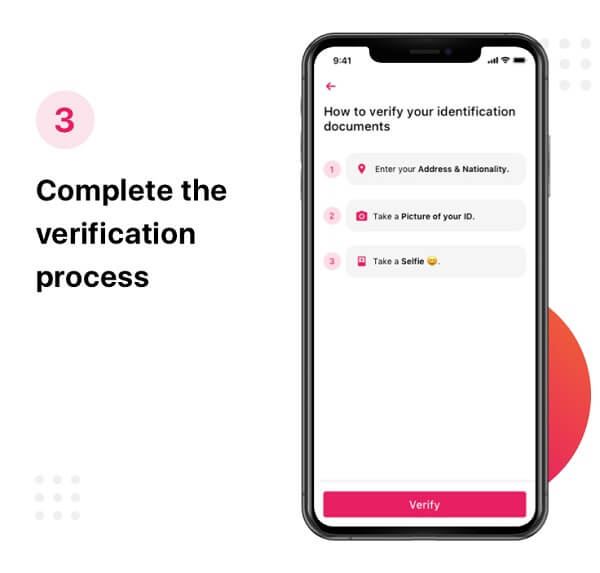

- Step 3: Complete the verification process. After signing up, the next step is to complete the verification process so PassTo can verify your identity. You will need to provide your address, nationality, picture of your photo ID and a selfie. This is a very important step as it enables PassTo to validate that you are creating your own account and not an imposter.

- Step 4: Set up your payment method. With signup and verification out of the way, you are now ready to make your first money transfer with PassTo. In this step of the process, configure how you want to pay for your money transfer. You can either choose a bank account or a credit/debit card as your payment method.

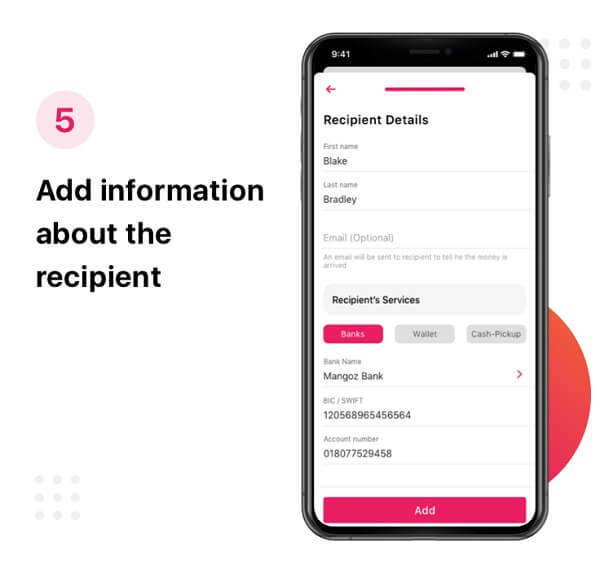

- Step 5: Add information about the recipient. Now it's time to add details about your recipient. In this step, you will provide receiver information like full name, email and delivery method. With PassTo, you can choose to pay your recipient with a bank deposit, mobile wallet credit or cash pickup. Enter the necessary details based on which delivery method you pick.

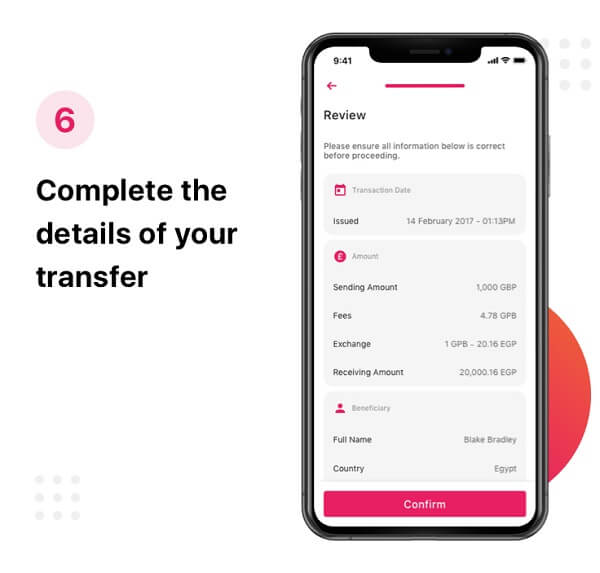

- Step 6: Complete the details of your transfer. The next step is to ensure all entered information is correct. Verify recipient details and transfer amount, and once you are satisfied with everything, click on the Confirm button at the bottom to submit your transfer. If all goes well, PassTo will display a confirmation message that your transaction has been accepted and will be processed.

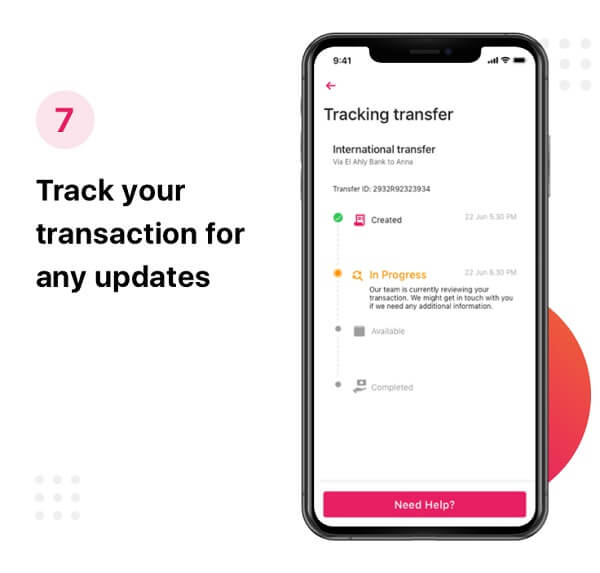

- Step 7: Track your transaction for any updates. You can check the status of your money transfer with PassTo at any time. Simply selection the transaction from your list of money transfers, and the app will display the latest status. PassTo will also send you notifications as your transaction progresses to next steps.

It is quick and easy to send money with the PassTo mobile app. You can send money overseas with just a few clicks.

How can PassTo help me send money?

PassTo is a reliable, secure and low cost money transfer service that supports over 60 countries around the world.

The PassTo mobile app is pretty easy to follow and you can just go with the user flow to send money. If you face any issues, or have any questions, you can contact their customer support for help.

You can scan the below QR code to install PassTo's mobile app.

Additionally, PassTo provides several helpful resources to help you with your money transfers with them.

Do I need a PassTo account to receive money?

No, you do not need a PassTo account to receive money sent via a PassTo international money transfer. This is because the delivery methods that PassTo supports are bank deposits, mobile wallet credits and cash pickups. None of these necessitate that your recipient have a PassTo account to access the funds.

Your recipient does not need a PassTo account to access the money you send to them via PassTo.

Does PassTo have a mobile app?

The PassTo money transfer service is currently only accessible via their mobile app. The app is available for download from the Google Play Store for Android devices, and from the Apple App Store for iOS devices.

The PassTo mobile app is a convenient and quick way to send money overseas. Plus, its available 24x7 to send money from the comfort of your home or office.

PassTo is working on providing registration, login and money transfer capabilities via their website as well.

How do I track my PassTo transfer?

You can track your PassTo money transfer within the application. Simply click on any of your transactions from your transaction history, and the PassTo app will tell you the latest status on your money transfer.

You can also adjust your notification settings for prompt updates. If you choose to, PassTo will send you notifications when your transactions proceeds forward to the next step.

Can I use PassTo for international bank transfers?

You can simulate an international bank transfer with PassTo by choosing a bank account as the payment as well as delivery method on both ends of the transaction.

Simply choose to pay for your PassTo remittance with your bank account, and choose to pay your recipient via a direct deposit into their overseas bank account. By doing so, you basically emulate an international bank to bank transfer, but with PassTo's higher exchange rates and lower fees.

Note that banks typically charge high fees and provide bad exchange rates to send money abroad. Plus, bank transfers can take numerous days, but with PassTo, your money transfers move fast.

Is PassTo online better than sending money in-person in stores?

PassTo offers a convenient service via a mobile app which can be used from the comfort of your home or office. In that regard, there are no in-person branches or offices or agent locations to go to for sending money via PassTo.

The PassTo mobile app lets you send money 24x7 and is always at your fingertips.

Does PassTo have a rewards program?

PassTo has an attractive referral program whereby you can earn money by sharing PassTo with your friends and family.

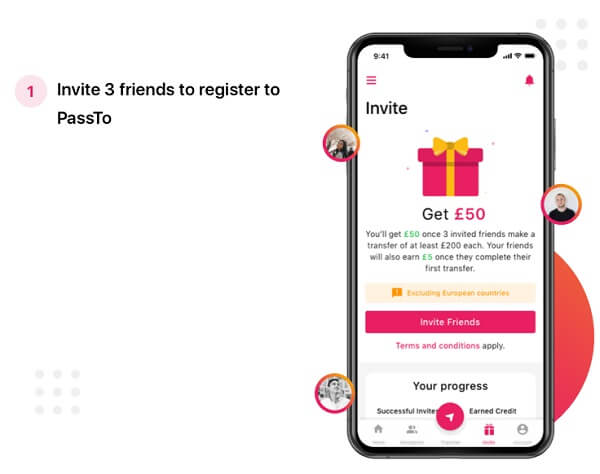

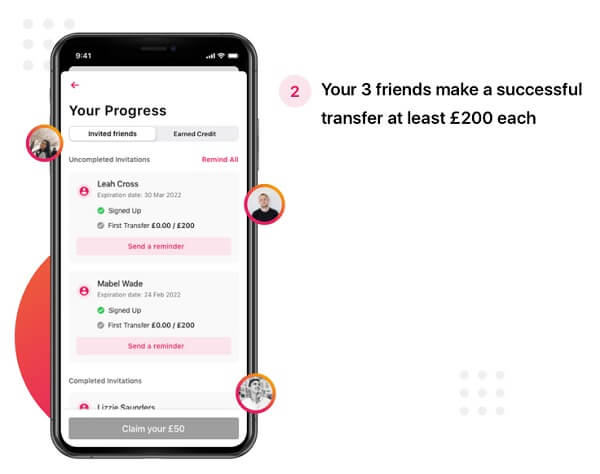

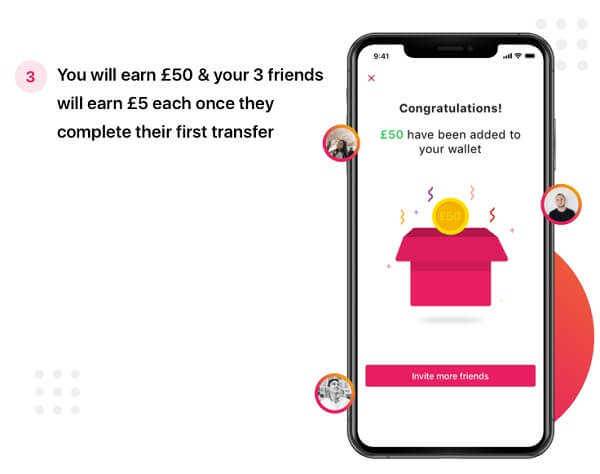

The PassTo referral programs allows you to earn GBP 50 gift when you invite 3 friends to make their first transfer of at least GBP 200 each. Your 3 friends will also receive a GBP 5 gift each.

You can follow the below steps to take advantage of PassTo's referral program:

- Step 1: Invite 3 friends to register to PassTo. The first step in the process is to invite your friends. Simply follow the in-app referral screen to invite your friends. The more people you invite, the higher the chances to earn your referral reward!

- Step 2: Your 3 friends make a successful transfer at least GBP 200 each. After you send the invites out, your friends have to sign up with PassTo and make their first money transfer of at least GBP 200. By doing so, your friends will also each a GBP 5 credit.

- Step 3: Earn the rewards. Once 3 of your friends send at least GBP 200 with PassTo after they sign up, you will earn GBP 50. Additionally, your 3 friends will earn GBP 5 each once they complete their first transfer. This way, everyone gets to gain and make money.

The PassTo referral program is a great way for both you and your friends to earn money.

What customer support options are available with PassTo?

In you have any questions related to PassTo's money transfer service, or get stuck on any step when making your money transfer, you can contact their customer support team to get help.

PassTo's customer support team can be contacted via any of the following options:

- Email: You can email PassTo customer support team at support@passto.co.uk.

- Online chat: You can chat with a PassTo support rep from inside the app or via their website.

- Phone: If you wish you speak with someone in the PassTo support team, you can call them at +44 20 3389 7959.

- Online web form: You can also get in touch with PassTo support by filling up an online web form on their Contact Us page.

PassTo also has a support center on their website with answers to frequently asked questions. Make sure to check these out as your question may already be answered there.

Can I cancel my PassTo transfer?

Transfer cancelations with PassTo depend on many factors including when the cancel request is made and what is the status of the transaction at that time. It may not be possible to cancel your transfer if the money has already been picked up by the recipient.

If you need to cancel a transfer, contact the PassTo customer support team immediately. They will advise you of options and assist you with your request.

How do I delete my PassTo account?

If you wish to delete your PassTo account, contact their customer support team and someone will assist you with your request. You should also review their privacy policy for conditions on requests to delete personal data.

It is always a good idea to make a backup of your transaction history and any other information before you delete your account. After account deletion, you will not have access to such information anymore.

Additional Information

Legal and Regulatory Compliance

To operate their UK business, PassTo is authorized and regulated by the Financial Conduct Authority (FCA). PassTo's Firm Number with the FCA is 900662).

PassTo is owned and operated by BlaBla Connect Ltd, which is also an FCA authorized and regulated company as per the Electronic Money Regulations Act of 2011. BlaBla Connect Ltd is registered in the UK with the Firm Reference Number 900667.

Helpful Links

- RemitFinder blog on how to send money from UK with PassTo

Awards, Prizes and News

- Bloomberg's press release related to PassTo's global expansion

- Central Charts news announcing the partnership between PassTo and TrueLayer

- Business Insider's press release announcing PassTo's increased coverage

- IBS Intelligence news related to PassTo's remittance corridor expansion