Remitly vs Xoom: A detailed comparison

Table of Contents

- Xoom vs Remitly: Overview and company information

- Remitly introduction

- Remitly fast facts and information

- Xoom introduction

- Xoom fast facts and information

- What are the differences between Remitly and Xoom?

- Corridor Coverage

- Which countries does Remitly operate in?

- Which countries does Xoom service?

- Xoom vs Remitly: Who services more countries worldwide?

- Exchange Rates and Fees

- Remitly vs Xoom exchange rates: which is better?

- Which is cheaper, Remitly or Xoom?

- Overall winner for Remitly vs Xoom rates and fees

- Money Transfer Limits

- How much money can I send with Remitly?

- How much money can I send with Xoom?

- What's better: Remitly or Xoom for sending large amounts?

- Money Transfer Speed

- How fast will Remitly send my money?

- How fast will Xoom send my money?

- Which is faster, Remitly or Xoom?

- Payment Methods Accepted

- What payment methods does Remitly support?

- What payment methods does Xoom support?

- Who has more payment methods, Remitly or Xoom?

- Delivery Methods Available

- What delivery methods does Remitly support?

- What delivery methods does Xoom support?

- Who has more delivery methods, Remitly or Xoom?

- Deals, Promotions and Offers

- Security and Compliance

- Customer Ratings and Reviews

- Who's better Remitly vs Xoom: Summary

- Which is better Xoom or Remitly: Our Recommendation

- Alternatives to Remitly and Xoom

With numerous money transfer companies available to send money internationally, choosing the right one may seem hard.

To start with, you can save time and money by choosing a remittance comparison platform. This will help you avoid searching and comparing money transfer operators manually.

The money transfer space used to be dominated by a few big players in the past, but rapid technology innovation has opened up the field for many new fintech companies.

Two such money transfer operators are Remitly and Xoom.

In this detailed article, we will compare Xoom and Remitly in depth. We will do this comparison on many criteria, and summarize our findings. We will also make recommendations along the way to help you choose between Remitly and Xoom.

Xoom vs Remitly: Overview and company information

Remitly introduction

Remitly is a premier player in the global money transfer ecosystem, and has been increasingly gaining traction. Founded in 2011, Remitly's vision is to "transform the lives of immigrants and their families by providing the most trusted financial services on the planet".

Remitly recently went public (stock ticker RELY) in September, 2021 and raised USD 300 million through an initial public offering (IPO) on Nasdaq. This was seen as a major event in the remittance and fintech world as Remitly is considered one of the disruptors in the global remittance industry.

Recall that earlier in July, 2021, Wise (formerly TransferWise) also went public with a direct listing on London Stock Exchange and was valued at USD 11 billion.

Remitly is currently headquartered in Seattle, Washington, US.

Remitly fast facts and information

- Founded in 2011

- Headquartered in Seattle, Washington, United States

- Public company (Nasdaq stock ticker RELY)

- About 1600 employees

Xoom introduction

Xoom offers fast and easy money transfer services to help send money overseas, as well as do mobile airtime top ups and pay bills internationally.

Xoom was founded in 2001, and 12 years later, went public in February, 2013 at a market cap of USD 509 million. Just a couple years later, in November, 2015, Xoom was acquired by PayPal for $25/share in an all cash deal. Since then, Xoom has been rebranded as Xoom, a PayPal Service.

Xoom is based out of San Francisco, California, USA, and has about 190 employees.

Xoom fast facts and information

- Founded in 2001

- Went public in 2013

- Acquired by PayPal in 2015, and rebranded as Xoom, a PayPal Service

- Based out of San Francisco, California, United States

- About 190 employees

Now, we will compare Remitly and Xoom on numerous factors, and present who is better in which category.

What are the differences between Remitly and Xoom?

In a side by side comparison, we will see how Remitly and Xoom fare on our comparison categories that include coverage of global countries and currencies, exchange rates and fees, payment and delivery methods, and numerous others.

We will provide useful information for each of the aforementioned categories for both Remitly and Xoom, and if applicable, decide a winner between the two.

Let's do this!

Corridor Coverage

Both Remitly and Xoom operate in hundreds of countries, and as such, are global money transfer companies. They also keep expanding their coverage network with more regional partnerships to tap into more countries worldwide.

Which countries does Remitly operate in?

Remitly currently allows sending money from 17 countries to 100 destinations worldwide. This makes for a matrix of 1700 supported country combinations*.

The 17 countries you can send money with Remitly from are as follows.

- APAC Region - Australia, Singapore

- Euro Zone - Austria, Belgium, Denmark, Finland, France, Germany, Ireland, Italy, Netherlands, Norway, Spain, Sweden, United Kingdom

- North America - United States, Canada

The 100 destinations include countries all over the world. Be sure to check the Remitly website to see if yours is supported.

Which countries does Xoom service?

With Xoom, you can send money from the following 40 countries.

- Euro Zone - Austria, Belgium, Bulgaria, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, French Guiana, Germany, Gibraltar, Greece, Guadeloupe, Hungary, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Martinique, Netherlands, Norway, Poland, Portugal, Réunion, Romania, Slovakia, Slovenia, Spain, Sweden, Isle of Man, Guernsey, Jersey, United Kingdom

- North America - United States, Canada

On the receiving side, Xoom supports 161 global destinations; this pretty much covers all major countries where remittances get sent worldwide.

Given the above, Xoom's current global coverage is around 6,440 countries*.

*Corridor coverage as on January 06, 2022

Xoom vs Remitly: Who services more countries worldwide? Xoom 🏆

Remitly has solid coverage for many popular remittance corridors, but Xoom supports many more countries.

Xoom 🏆 covers more global countries and currencies as compared to Remitly.

Exchange Rates and Fees

Which is cheaper - Remitly or Xoom?

We will take a couple of case studies to see who has better exchange rates and fees - Remitly vs Xoom.

Our first money transfer case study to compare both companies is a CAD 400 money transfer to India via a bank to bank transfer (paying with as well as payout to a bank account).

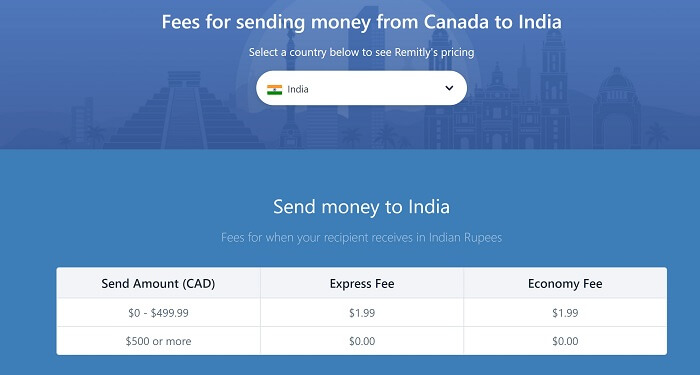

Remitly showed the below exchange rate and fees for this transaction to send CAD 400** from Canada to India.

- Exchange rate of 1 CAD = 58.0700 INR

- Canadian Dollar 1.99 fee for the transfer

- Payout of 23,112.44 Indian Rupees for the recipient

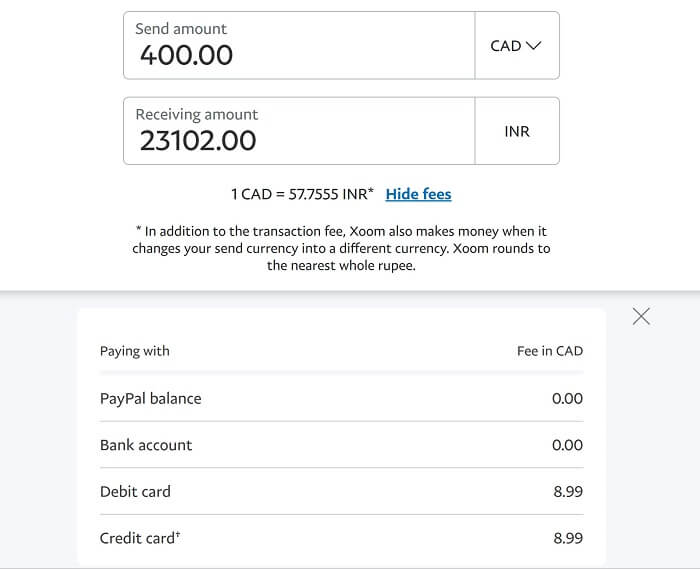

The corresponding numbers for Xoom for the same CAD 400 money transfer** from Canada to India are as below.

- Exchange rate of 57.7555 Indian Rupees to the Canadian Dollar

- CAD 0 fee for a bank to bank transfer

- Payout of 23,102.00 INR to the recipient

We compare both of the above money transfer transactions in the table below.

| Provider | Country Pair | Transfer Amount | Exchange Rate** | Fees** | Payout |

|---|---|---|---|---|---|

| Remitly | Canada to India | CAD 400 | 1 CAD = 58.0700 INR | CAD 1.99 | INR 23,112.44 |

| Xoom | Canada to India | CAD 400 | 1 CAD = 57.7555 INR | CAD 0.00 | INR 23,102.00 |

For the same currency pair (CAD to INR), we then tried a transfer amount of CAD 1000, and got the below results.

| Provider | Country Pair | Transfer Amount | Exchange Rate** | Fees** | Payout |

|---|---|---|---|---|---|

| Remitly | Canada to India | CAD 1000 | 1 CAD = 58.0700 INR | CAD 0.00 | INR 58,070.00 |

| Xoom | Canada to India | CAD 1000 | 1 CAD = 57.9004 INR | CAD 0.00 | INR 57,900.00 |

Couple of noteworthy observations from the above:-

- Xoom has a staggered exchange rate that increases with higher transfer amounts

- Remitly charges 0 fees for higher transfer amounts

Our second case study to compare Remitly and Xoom's exchange rates and transfer fees is a GBP 500 remittance from the UK to Pakistan. To compare apples to apples, this is also a bank to bank transfer.

For this scenario, the below table captures a side by side comparison of Xoom vs Remitly rates.

| Provider | Country Pair | Transfer Amount | Exchange Rate** | Fees** | Payout |

|---|---|---|---|---|---|

| Remitly | UK to Pakistan | GBP 500 | 1 GBP = 237.3700 PKR | GBP 0.00 | PKR 118,685.00 |

| Xoom | UK to Pakistan | GBP 500 | 1 GBP = 234.6795 PKR | GBP 2.99 | PKR 116,638.06 |

As before, there are nuances involved with both companies. For example:-

- For UK to Pakistan money transfers, Remitly charges a GBP 2.99 fee is the transfer amount is less than GBP 200.

- Xoom's exchange rate continues to increase as you send higher amounts. For example, the GBP/PKR exchange rate for a GBP 100 transfer is 234.2102, while that for a GBP 1000 transfer is 234.6795.

When it comes to fees, both Xoom and Remitly seem to follow a fairly similar approach.

Bank to bank transfers are free for most countries, and fees are limited to 1-3 currency units depending on chosen countries. We present some examples** below.

- Both Xoom and Remitly do not charge any fee if a US bank transfer is used as the payment method and the transfer amount is greater than USD 1000.

- If the transfer amount is less than USD 1000, Remitly charges a USD 3.99 fee.

- For under USD 1000 transfers, Xoom charges a USD 4.99 fee.

- If we look at EUR transfers, both companies charge fees regardless of the transfer amount. Xoom charges EUR 1.99 while Remitly charges EUR 2.99.

If the transfer is paid for by a Credit Card, there are minor differences between the fees charged by Remitly and Xoom.

- Remitly charges a flat 3% transfer fee on credit cards in the US, and 1% in Canada

- Xoom charges 3% fee on credit cards in the US, and 2% in Canada

The important caveat here is that the fee on credit card payments is a percentage of the transfer amount, so it may become expensive to send large transfer amounts.

Overall, both Remitly and Xoom seem to be mostly matched evenly when it comes to transfer fees. While there are variations from country to country, in general, we do not see transaction fees as a major differentiator between both companies.

**Exchange rates and fees as on January 06, 2022

Remitly vs Xoom exchange rates: which is better? Remitly 🏆

Remitly tends to have better exchange rates than Xoom.

That said, Xoom does have a staggered exchange rate that increases as the transfer amount increases. If you are sending higher amounts, be sure to check Xoom's exchange rate as well before ruling them out.

Which is cheaper, Remitly or Xoom? It's a tie!

There is not too much to choose between Remitly and Xoom when it comes to transfer fees. Both companies have very similar fee structures.

Look for other differentiating factors based on your money transfer needs as both Remitly and Xoom charge similar fees.

Overall winner for Remitly vs Xoom rates and fees - Remitly 🏆

Both Remitly and Xoom have similar fee structures. However, Remitly 🏆 generally provides better exchange rates as compared to Xoom.

Money Transfer Limits

A money transfer limit, also sometimes called a sending limit, is the maximum amount you can send in a single remittance transaction. Most money transfer companies have different transfer limits for various countries, and Remitly and Xoom are no different.

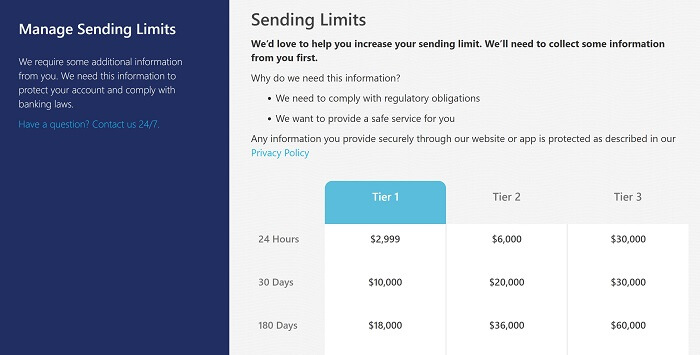

An important factor to consider when comparing Remitly and Xoom transfer limits is the time period. Both companies have limits for 24 hours, 30 days and 180 days.

Additionally, both Remitly and Xoom classify customers into tiers or levels (Remitly calls this Tier, while Xoom calls this Level). Essentially, the tier or level signifies your trustworthiness as a user. The higher the tier or level you are in, the more you can send.

There are qualification criteria to upgrade from one tier/level to the next, and both companies publish that transparently, and allow you to apply for higher tiers.

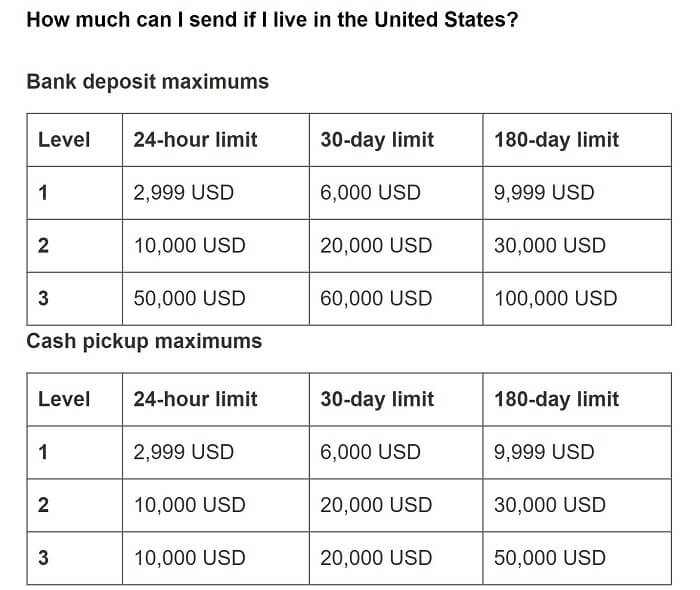

How much money can I send with Remitly?

Below are the sending limits for Remitly if you are sending money*** from the US to India.

For USD transfers, Remitly has the below criteria to decide membership tier.

- Tier 1 customers must provide name, address and date of birth

- Tier 2 customers additionally provide government issued Photo Id as well as proof of how to fund transactions (e.g., paystub, bank statement, etc.)

- Tier 3 customers qualify with same requirements as Tier 2

If sending money from the France to India, Remitly's transfer limits*** are as below.

- 24 hour limits - EUR 5,000 (Tier 1), EUR 25,000 (Tier 2), EUR 25,000 (Tier 3)

- 30 day limits - EUR 15,000 (Tier 1), EUR 25,000 (Tier 2), EUR 25,000 (Tier 3)

- 180 day limits - EUR 50,000 (Tier 1), EUR 75,000 (Tier 2), EUR 150,000 (Tier 3)

Since the transfer limits vary by country pairs, make sure you check the corresponding page for your country combination.

How much money can I send with Xoom?

Xoom transfer limits are based on the sending currency, and are also based on membership level. Below is a snapshot of how much you can send*** via Xoom from the US.

Below are the requirements in the US for membership levels that Xoom has.

- Level 1 customers must provide full profile information

- Level 2 customers additionally provide social security number or a government issued Photo ID like a passport

- Level 3 customers additionally provide driver's license, a proof of address (e.g., a utility bill) and proof of funds (bank statement or paystub)

Similarly, if you want to send money from anywhere in Europe, Xoom has the below transfer limits*** for payout as bank deposit (cash pickup limits are lower).

- 24 hour limits - EUR 1,000 (Level 1), EUR 3,000 (Level 2), EUR 6,000 (Level 3)

- 30 day limits - EUR 10,000 (Level 1), EUR 20,000 (Level 2), EUR 30,000 (Level 3)

- 180 day limits - EUR 25,000 (Level 1), EUR 50,000 (Level 2), EUR 100,000 (Level 3)

This is a lot of information on both companies. We present the below easy to digest side by side comparison to show the differences in transfer limits between Remitly and Xoom.

For transfers from the United States, this is how Remitly and Xoom compare***.

| Provider | Tier/Level | 24 hour limit | 30 day limit | 180 day limit |

|---|---|---|---|---|

| Remitly | 1 | USD 2,999 | USD 6,000 | USD 30,000 |

| Remitly | 2 | USD 10,000 | USD 20,000 | USD 30,000 |

| Remitly | 3 | USD 18,000 | USD 36,000 | USD 60,000 |

| Xoom | 1 | USD 2,999 | USD 6,000 | USD 9,999 |

| Xoom | 2 | USD 10,000 | USD 20,000 | USD 30,000 |

| Xoom | 3 | USD 50,000 | USD 60,000 | USD 100,000 |

Both are fairly similar, but there are some differences as well. Remitly has a higher 180 day limit of USD 30,000 for Tier 1 customers while Xoom only allows USD 9,999 for Level 1.

However, Level 3 Xoom customers can send a lot more (USD 100,000) over 180 days compared to Remitly which only allows Tier 3 customers to send a maximum USD 60,000 over that time period.

Corresponding transfer limit comparison*** between both companies for transfers from Europe is as below.

| Provider | Tier/Level | 24 hour limit | 30 day limit | 180 day limit |

|---|---|---|---|---|

| Remitly | 1 | EUR 5,000 | EUR 25,000 | EUR 25,000 |

| Remitly | 2 | EUR 15,000 | EUR 25,000 | EUR 25,000 |

| Remitly | 3 | EUR 50,000 | EUR 75,000 | EUR 150,000 |

| Xoom | 1 | EUR 1,000 | EUR 3,000 | EUR 6,000 |

| Xoom | 2 | EUR 10,000 | EUR 20,000 | EUR 30,000 |

| Xoom | 3 | EUR 25,000 | EUR 50,000 | EUR 100,000 |

In this case, Remitly has higher transfer limits for EUR transfers across the board with the exception of the 180 day limit for Tier 2 customers where Xoom is slightly higher (Remitly EUR 25,000 vs Xoom EUR 30,000).

***Sending limits as on January 06, 2022

What's better: Remitly or Xoom for sending large amounts? Remitly 🏆

While both Remitly and Xoom have similar transfer limits in the US, Remitly tends to have higher limits in other countries.

If you need to send higher amounts over time, then prefer Remitly 🏆.

Money Transfer Speed

There are many factors that can impact how fast your money transfer completes. These include the country/currency pairs involved, the amount sent as well as payment/delivery methods used for the transaction.

Bank or local holidays may also introduce delays for bank transfers as well as cash pickups (in case agent offices are closed).

Bank size and location may also impact transfer speed - international and national banks will generally process transactions faster than local banks and credit unions.

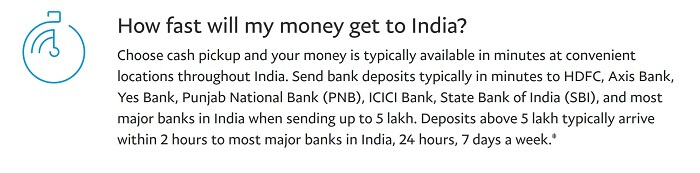

How fast will Remitly send my money?

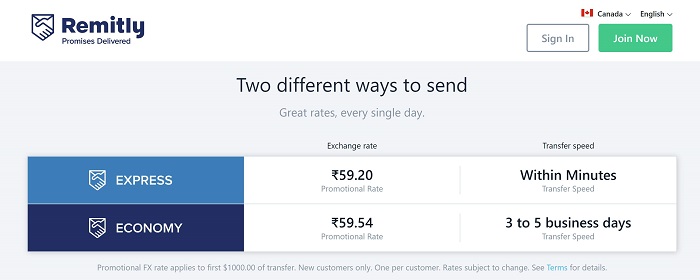

Remitly has 2 transfer speeds called Economy and Express.

With the Express option, money is usually available within minutes. However, the exchange rate is usually lower, and you may also be charged a fee.

Economy transfers take 3-5 business days for funds to arrive, and give you a better exchange rate than the Express option.

Below is an example of a Canada to India money transfer with Remitly showing both Express and Economy options.

Which transfer speed should you use - Express or Economy?

Our recommendation: Use Express if you really need funds quickly (for example, in emergency situations). Otherwise, rely on the Economy option as you will get a better exchange rate.

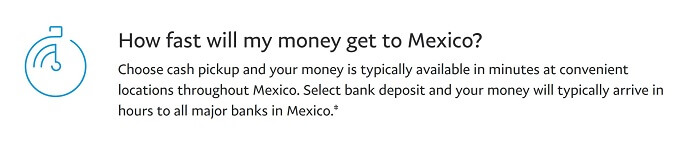

How fast will Xoom send my money?

With Xoom, most money transfers are available in just a few minutes, while some can take up to a few business days.

We checked a few destination countries and it does seem like Xoom is able to deliver money pretty quickly to most destinations. Below are some examples of their transfer speed to various countries.

Which is faster, Remitly or Xoom? Xoom 🏆

Remitly's Express service matches Xoom's transfer speed, but other than that, Xoom is able to deliver money overseas faster.

Xoom 🏆 specializes in moving money overseas fast.

Payment Methods Accepted

To send money overseas, you will need to pay for your transaction. You do that with what is called a payment method. In this section, we compare payment methods supported by Remitly and Xoom.

What payment methods does Remitly support?

With Remitly, there are a variety of ways you can pay for your money transfer. Below we list the payment methods supported by Remitly.

- Debit and credit cards - all countries

- Prepaid cards - all countries

- Bank account transfer - Australia, Canada and US

- Maestro Cards - EU countries and UK

- Sofort - Austria and Germany

- Faster Payments - UK

- iDEAL - Netherlands

- Remitly's Passbook Visa Debit Card - US

- SEPA Credit transfers - France

Paying with local payment methods in some countries is a good way to reduce fees and use your trusted local payment networks. Remitly does a good job of supporting quite a few local payment methods.

What payment methods does Xoom support?

Xoom lets you pay for your money transfer with the following payment methods.

- Bank account transfer

- Debit and credit cards

- PayPal account - you can pay with additional payment methods from within your PayPal account

Who has more payment methods, Remitly or Xoom? It's a tie!

While Remitly supports local payment methods in some countries, Xoom supports PayPal which is also available in numerous countries. Given that, we score both companies with a tie on support for payment methods.

Both Remitly and Xoom support various payment methods. Remitly has some local payment networks available, while Xoom allows you to use PayPal.

Delivery Methods Available

Another important aspect of international money transfers is how the recipient accesses the funds. This is called a delivery method or a payout option. Let's see which delivery options do Remitly and Xoom provide.

What delivery methods does Remitly support?

Remitly allows your recipient to receive money in the following ways.

- Bank deposit

- Cash pickup at an agent location

- Mobile wallet credit

- Cash home delivery - available in Dominican Republic, Philippines and Vietnam only

What delivery methods does Xoom support?

Xoom also supports many delivery methods for your recipient to receive the funds. We present them below.

- Bank deposit

- Cash pickup at an agent location

- Mobile wallet credit

- Door to door cash delivery

- Mobile airtime top up - not available in all countries

- Pay bills overseas - available in limited countries

Who has more delivery methods, Remitly or Xoom? Xoom 🏆

While both Remitly and Xoom are tied on the delivery methods for receiving money abroad, Xoom has additional support for mobile airtime top up and paying bills internationally.

Both Remitly and Xoom support various ways to receive money. But Xoom 🏆 also allows you to top up mobiles and pay bills internationally.

Deals, Promotions and Offers

Neither Remitly nor Xoom seem to have a strong support for deals and promotions (compared to other money transfer operators who have numerous offers and discounts available).

That said, we do see Remitly offering some promotions to customers; we present some examples below.

RemitFinder users get special FX rate when sending money with Remitly

RemitFinder users get one free transfer when sending money with Remitly

Money transfer operators constantly add deals and promotions from time to time. Please check dedicated pages for Remitly and Xoom periodically so you can take advantage of any future offers from these companies.

Another good way to stay updated with offers and discounts from various money transfer companies is to sign up for our free exchange rate alert.

Who has better promotions and offers Remitly or Xoom? Remitly 🏆

At the time of this writing, we did not find any Xoom promotions, while Remitly did have a few promotions ongoing.

That said, offers can change anytime to make sure to stay updated with both companies to ensure you can take advantage of good deals when they come.

Remitly 🏆 tends to have more offers and promotions for new customers as compared to Xoom.

Security and Compliance

Security and compliance is a very important area to ensure that your money is safe at all times during the end to end transfer process.

Let's see how Remitly and Xoom compare on this criterion.

Is Remitly safe?

Remitly seems to take security very seriously, and takes numerous measures to ensure your money is safe with them. Some of these include the below.

- Verification to ensure your identity to protect against fraud

- Technological solutions to detect fraudulent activity

- Encryption of sensitive information (Remitly is a PCI [Payment Card Industry] certified company)

- Notifications to let you know in case any unusual account activity is detected

- Informing customers of safety best practices

Remitly is also licensed to handle payments and make money transfers in all the markets they operate in. For example:-

- In the US, Remitly is registered with the US Department of Treasury as a Money Services Business and is licensed in several US states as a money transmitter

- In the UK, Remitly is registered in England and Wales (registration no. 09896841), regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 (reference no. 728639) and registered by the HMRC as a money service business (registration no. XCLM00000164259)

- In Europe, Remitly is registered with and regulated by the Central Bank of Ireland (company no. 629909)

In summary, Remitly is well regulated and implements many methods to ensure your money is safe with them.

Is Xoom safe?

Like Remitly, Xoom also seems to take security very seriously.

Additionally, as a PayPal company, Xoom relies on all the security and compliance best practices that PayPal already has in place as a global payment company.

Below are some ways Xoom keeps your money and data safe.

- Data encryption to ensure privacy and security

- Regular security policy audits to ensure ongoing safety protocols

- Financial and criminal background checks for all employees

- Use of VeriSign SSL security certificate to ensure secure data transmission

- Money back guarantee in case your recipient does not receive funds

- Sharing tips to send money securely via Xoom

From a regulatory compliance standpoint, Xoom is licensed as below:-

- In the US, Xoom is licensed as per PayPal's licenses in various US states

- For UK and Europe, PayPal is licensed with Luxemburg's Commission de Surveillance du Secteur Financier, and authorized and regulated by the Financial Conduct Authority

As a PayPal owned service, Xoom should not have any problems handling your money and information safely.

Who is safer, Remitly or Xoom? It's a tie!

In our viewpoint, both Remitly and Xoom take security seriously and use numerous methods to protect your money and information. From a security standpoint, it should not be a concern to use their services.

You should, though, always take protective measures on an ongoing basis to ensure your account is safe at all times.

Both Remitly and Xoom take the security of your money and information very seriously.

Customer Ratings and Reviews

When choosing between Remitly and Xoom, you should definitely pay attention to what other remitters are saying about both of these companies.

In the following sections, we present a summary of ratings and reviews for both operators on various platforms.

Remitly reviews

Below is how Remitly's money transfer services are rated^ on various platforms by their customers.

- On Trustpilot, Remitly has a rating of 4.2/5.0 with almost 34k reviews

- Remitly's Android app is rated 4.8/5.0 on Google Play store with over 319k ratings

- On Apple Store, Remitly has an impressive 4.9/5.0 rating with about 638k reviews

- Remitly has a 4.3/5.0 rating on RemitFinder

Xoom reviews

On the same platforms where we checked Remitly's ratings, Xoom has the below reviews.

- Xoom is rated 3.8/5.0 on Trustpilot with a little bit over 22k reviews

- On Google Play store, Xoom is rated 4.7/5.0 with over 214k reviews

- Xoom has almost 809k reviews on Apple Store with an average rating of 4.8/5.0

- On RemitFinder, Xoom has a rating of 3.8/5.0

^Ratings on various platforms as on January 06, 2022

Who has better reviews, Remitly or Xoom? Remitly 🏆

On both Google Play and Apple Store, mobile apps of Remitly and Xoom have impressive ratings, with Remitly marginally ahead. However, on Trustpilot, Remitly has much better reviews compared to Xoom.

Remitly is the winner in this category.

Both Remitly and Xoom have very good mobile app ratings, but Remitly 🏆 has better reviews on Trustpilot.

This concludes our comparison categories for this detailed side by side comparison between Remitly and Xoom.

Since this was a lot of information, we have compiled a summary of Remitly vs Xoom key differentiators in an easy to read infographic. You can use this to quickly review the strengths and weaknesses of both companies.

In the sections below, we summarize our findings and, more importantly, make some suggestions and recommendations for when to use Remitly vs Xoom for your international money transfer needs.

Who's better Remitly vs Xoom: Summary

Both Remitly and Xoom are reputable money transfer operators and have been around for several years. As you may have witnessed in our detailed comparison above, they have strengths and weaknesses in various areas we compared them on.

Below, we present some money transfer needs that may be best served by Remitly or Xoom.

When to use Remitly to send money?

Based on our detailed evaluation, we see Remitly better than Xoom in the below categories.

- Remitly has better exchange rates overall as compared to Xoom

- Remitly has higher money transfer limits over time so you can send more money abroad with them

- Remitly has good support for local payment methods in some countries - using local payment networks can be convenient and sometimes cheaper

- Remitly has better customer reviews and ratings on Trustpilot

- Remitly's mobile apps are very highly rates on both Google Play store as well as Apple Store

RemitFinder likes Remitly for providing better exchange rates, higher transfer limits, support for local payment methods and excellent customer reviews.

Based on the aforementioned strong points of Remitly's money transfer services, we recommend them for the following cases.

- Remitly tends to provide better exchange rates than Xoom. All else being equal or not that materially important to your money transfer, we recommend you choose Remitly to maximize the money your recipient gets.

- If you need to send more money in a single transaction or over time, choose Remitly since they have higher money transfer limits.

- Remitly has integrated with some local payment networks in some countries. If you happen to be sending money from such countries, it may not only be convenient but also cheaper to use your local payment method. We recommend you use Remitly if you are able to use your local payment method to fund your transaction.

- Remitly website and mobile apps present great customer experience and usability as evidenced by their strong Trustpilot and mobile app reviews. Use them if you prefer a seamless customer experience. You will not face any glitches or difficulties in using their money transfer services.

When to use Xoom to send money?

Xoom fares better than Remitly in some areas as well; below we list them out.

- Xoom has a wider global coverage of countries and currencies. Depending on where you live and where you want to send money to, it is highly likely that Xoom has you covered.

- Xoom specializes in sending money fast. If you need to send money overseas quickly (for example, in an emergency situation), we recommend you use Xoom.

- Xoom has a wide variety of delivery methods available. In addition to helping you send money overseas, Xoom also allows you to pay bills internationally as well as do a mobile airtime top up in various countries. If you help your family and friends with bills and airtime top up, you can rely on Xoom to do so.

Be aware, though, that Xoom does tend to have lower exchange rates as compared to Remitly. You should factor that in your money transfer decisions when taking advantage of Xoom's strengths in the aforementioned areas.

RemitFinder likes Xoom for covering more than 6000 global corridors, sending money overseas quickly and robust delivery method support. Be aware of lower exchange rates though.

If the difference in exchange rate is not much, Xoom can certainly be an attractive choice if you need to send money fast, as well as pay bills and top up mobile airtime overseas.

Xoom's exchange rate increases as you send higher amounts, so that may become a mitigating factor to help offset their lower than Remitly exchange rates.

Which is better Xoom or Remitly: Our Recommendation

Both Remitly and Xoom have been in the money transfer business for more than 10 years, and are well known, established global brands. There are strengths and weaknesses associated with their money transfer offerings.

Our overall recommendation is to go with Remitly as they tend to have better exchange rates than Xoom. If you send money overseas frequently, better rates can translate to more savings over time.

That said, Xoom's strengths lie in better corridor coverage, so it's possible that Remitly is not even an option in your country. If you use Xoom for your next money transfer, pay attention to exchange rates and try to time your transfer to get the best possible rate.

One area where Xoom stands out is the ability to help you pay bills overseas as well as do mobile airtime top up (available in limited countries). This may be a great option if you want to help friends and family overseas in these ways.

Choose Remitly to get better exchange rates. Go with Xoom if you want to pay bills internationally or want to top up airtime on mobile phones overseas.

This brings us to the end of this detailed evaluation of money transfer services offered by Remitly and Xoom. We hope our in depth comparison between both of these companies will help you decide which one to choose for your next money transfer.

Alternatives to Remitly and Xoom

Are you looking for alternatives to Remitly and Xoom? If so, you can use RemitFinder's remittance comparison tool to compare numerous money transfer companies in a single place. We support more than 35,000 global corridors and have hundreds of money transfer operators to help you choose the best one for your remittance needs.

Other money transfer comparison guides

Categories

Similar Articles

Wise vs Revolut: What Are The Differences?

Both Wise and Revolut have grown massively over the last few years and are popular, established money transfer companies. We delve deep into both to bring you a head-to-head detailed comparison.

How To Save On B2B International Transfer Fees

B2B international payments have been expensive, slow and cumbersome in the past. Are there any new fintech companies that take the hassle out of cross-border business payments?

How To Save Money On Transfers From Europe To India

Are you looking to send money from Europe to India? Check out our guide on how to save money on your international money transfers to India from Europe.