How Fintech Is Pushing Banks Out Of The Remittance Business

Table of Contents

- The Rise Of Fintech Companies In The Cross-Border Remittance Ecosystem

- Advantages Of Fintech Remittance Services Over Banks

- 1. More Cost Effective Than Banks

- 2. Faster And More Efficient

- 3. More Convenient And Accessible

- 4. Enhanced User Experience

- 5. Technological Innovation

- 6. Financial Inclusion

- Fintech's Key Value Proposition: Lower Costs And Transparent Pricing

- 1. Competitive Exchange Rates

- 2. Lower Transaction Fees

- 3. Fee Transparency

- 4. No Hidden Charges

- 5. Cost Comparison Tools

- 6. Cost-Saving Innovations

- Regulatory Challenges And Fintech's Response

- Banks' Adaptation Strategies In The Face Of Fintech Disruption

- 1. Collaboration with Fintech

- 2. Digital Transformation

- 3. Innovation Initiatives

- 4. Customer Experience Improvement

- RemitFinder's Conclusion: Banks Vs Fintech - A Battle Worth Watching

For a long time, the international remittance industry was dominated by traditional banks. That has changed over the last few years with the emergence of fintech (short for financial technology) companies.

The disruption caused by fintech companies has been largely driven by their adoption of innovative technology and efficient business processes. This has resulted in fintech companies offering cheaper, faster and more user-friendly international money transfers as compared to traditional bank transfers.

With better exchange rates and lower fees, digital platforms, streamlined processes and a customer-centric approach, fintech companies continue to attract a growing number of individuals and businesses seeking to send money abroad.

In this article, we explore how fintech is challenging the traditional dominance of banks in the remittance industry, showcasing the advantages of fintech remittance services. We also discuss some of the strategies banks are trying to employ to adapt to this rapidly changing landscape.

The Rise Of Fintech Companies In The Cross-Border Remittance Ecosystem

The rise of fintech companies in the global cross-border remittance service business has revolutionized how money is sent and received internationally.

Fintech companies have introduced digital platforms, provided mobile applications and streamlined business and operational processes to differentiate themselves from banks. These innovations have helped reduce money transfer fees, increase convenience and expand financial inclusion, particularly in the unbanked and underbanked regions of the world. As a result, the remittance industry has become more competitive, benefiting consumers with improved services and increased innovation in the sector.

Let us look at the rise of fintech in the international money transfer from various angles. But first, let us define what fintech is.

What Is Fintech?

Fintech is short for financial technology. The term fintech company is used to describe companies or organizations that heavily rely on technology to drive their financial business use cases.

Whilst almost any business in the world today runs on technology in one way or another, fintech companies specialize in the innovative and efficient use of technology to provide create products and services, improve processes, lower costs and do things more efficiently.

Fintech, short for financial technology, implies the efficient use of technology by a financial company to provide better, faster, cheaper and more accessible products and services.

When it comes to the remittance industry, fintech companies would include various money transfer operators (MTOs), remittance service providers (RSPs), digital and mobile wallet providers and other payment and technology providers that help move money from one country to another.

Advantages Of Fintech Remittance Services Over Banks

Fintech companies have emerged as a disruptive force in the international remittance industry, dethroning traditional banks from their erstwhile dominance in the cross-border money transfer space.

Below, we list some key advantages that fintech remittance services offer over traditional banks.

1. More Cost Effective Than Banks

Fintech remittance services often provide significantly better exchange rates and lower transfer fees compared to traditional banks.

Banks generally charge 2-6% FX Markup on the exchange rate they provide for cross-border money transfers. Additionally, they charge anywhere from USD 20-45 in wire transfer fees when moving money internationally. Needless to say, this puts a huge dent in the money transferred overseas.

Fintech companies, on the other hand, provide highly competitive exchange rates and charge much lower, often 0 transfer fees.

Fintech companies provide better exchange rates and charge lower fees as compared to banks. The latter can charge up to 2-6% FX Markup as well as USD 20-45 in wire transfer fees.

In fact, we did a case study to compare banks with money transfer companies, and it validated that sending money internationally with banks can be really expensive.

How are money transfer companies able to provide more value for money as compared to traditional banks? The answer is simple - by adopting digital methods and by relying on technological and operational innovation to drive down cost. The realized cost savings help MTOs to be more competitive and beat big banks.

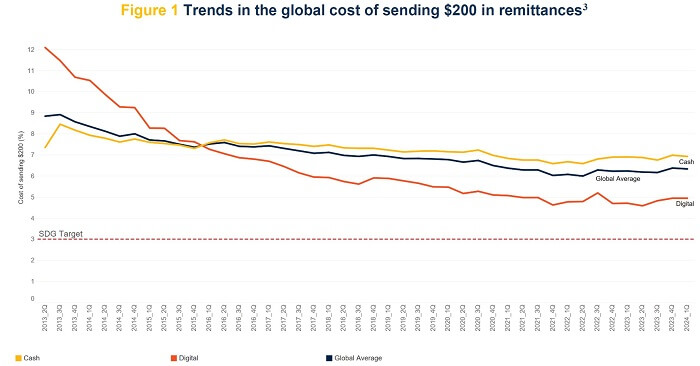

This is corroborated by World Bank data1 whereby we can clearly see that digital remittances are cheaper than non-digital means of sending money - in Q1 2024, non-digital remittances costed 6.94% whilst digital ones only 4.96%. Note that the price includes both FX Markup as well as transfer fees.

Global average cost of remittances in Q1 2024 for digital and other means - Source worldbank.com1

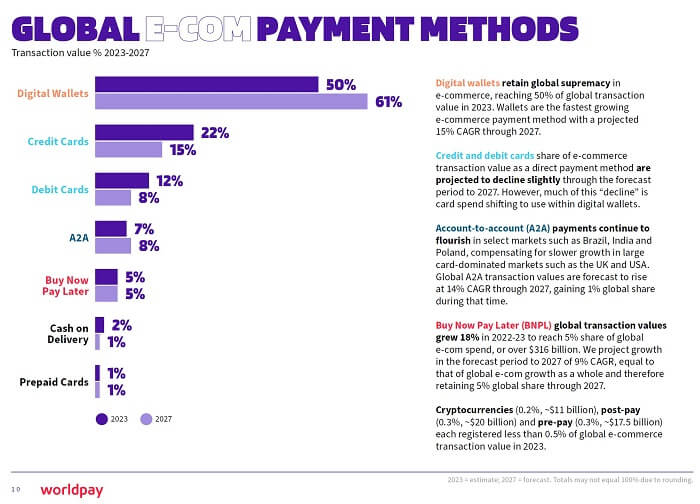

It is noteworthy that digital payments are not only making remittances cheaper, but also capturing a lion's share of global ecommerce spending. Based on data published by WorldPay2, we see digital wallets as the most popular payment method globally.

Market share of various payment methods in 2023 with projections for 2027 - Source worldpay.com2

Digital wallets accounted for an impressive 50% of all global ecommerce spending, with projections to capture 61% market share by 2027.

If you are looking to send money overseas, we strongly recommend comparing money transfer companies so you can get the best exchange rates and deals. Use RemitFinder's online money transfer comparison platform to easily compare providers side-by-side and make the most of your money.

2. Faster And More Efficient

Fintech remittance services are generally ahead of traditional banks when it comes to money transfer speed and efficiency.

This is primarily because bank transfers can be time-consuming due to various factors that include lengthy processes, extensive paperwork and multiple intermediary banks or financial institutions.

In contrast, fintech remittance companies rely on digital infrastructure and automated systems to expedite the transfer process. Fintech money transfers can be initiated, processed, and completed within minutes, providing quick transfers for individuals who need to send money urgently.

3. More Convenient And Accessible

Fintech remittance services offer a lot more convenience and accessibility as compared to banks.

With user-friendly mobile applications and online platforms, fintech remittance transactions can be initiated from anywhere, anytime. Once the transfer has been created, fintech companies allow easy tracking and management of the transaction.

This convenience and accessibility eliminate the need for physical visits to banks, saving time and effort. Note that banks do not work on holidays and weekends, so the sender may have to wait even longer to send money abroad with banks.

4. Enhanced User Experience

Fintech remittance services tend to provide a much better user experience, placing the customer at the center of their operations.

They often leverage data analytics and artificial intelligence to understand customer preferences, offer tailored recommendations, and provide proactive assistance, enhancing the overall user experience.

Here are some ways in which fintech remittance services enhance user experience and convenience:

- Intuitive Interfaces: Fintech remittance platforms prioritize user-friendly interfaces that are intuitive and easy to navigate. With clear instructions, minimal steps, and well-designed layouts, users can easily navigate the platform, reducing the learning curve and making the process straightforward.

- Mobile Accessibility: Fintech remittance enable individuals to access their services through mobile applications. This mobile accessibility allows users to send and receive money anytime and anywhere, eliminating the need to visit physical locations.

- Seamless Onboarding And Verification: Fintech remittance platforms streamline the onboarding and verification process, minimizing the time and effort required to set up an account. They leverage technology to simplify identity verification procedures, often allowing users to submit digital copies of their IDs and conduct remote verifications. This reduces the need for physical visits and lengthy paperwork.

- Real-Time Transaction Tracking: Fintech remittance services offer real-time transaction tracking, empowering users to monitor the progress of their transfers at any time. Users can receive updates on the status of their transactions, including confirmation of funds sent and received, estimated delivery times, and any potential delays. This transparency and visibility give users peace of mind and allows them to stay informed throughout the remittance process.

- Personalized Services And Recommendations: Fintech remittance platforms leverage data analytics and artificial intelligence to personalize the user experience. They analyze user behavior, transaction history, and preferences to offer tailored recommendations, such as suggesting optimal times for currency conversion or providing insights on cost-saving measures. These personalized services enhance the user experience, ensuring that individuals receive relevant information and assistance specific to their remittance needs.

- Responsive Customer Support: Fintech remittance services prioritize responsive customer support, recognizing the importance of assisting users when needed. They often offer multiple channels for customer support, including live chat, email, or phone, allowing users to seek help or resolve any issues they encounter during the remittance process. Quick and efficient customer support enhances user satisfaction and builds trust in the platform.

Fintech companies put a lot of focus on intuitive and simple user experience to make it easier and faster for customers to start, fund and manager international money transfers. By enabling mobile access, streamlining processes and providing responsive customer support, they strive to delight their users.

5. Technological Innovation

Fintech remittance services are at the forefront of technological innovation adoption. They leverage cutting-edge technologies like blockchain, mobile payments, and digital wallets to streamline processes, enhance security, and improve transparency.

For example, blockchain technology ensures secure and transparent transactions, eliminating the need for intermediaries and reducing the risk of fraud. These technological advancements drive efficiency, security, and trust in fintech remittance services.

6. Financial Inclusion

Fintech companies significantly impact financial inclusion by making financial services and mobile money transfers accessible to people who have not had such access before.

Traditional banks may have stringent requirements and documentation procedures that exclude many individuals from accessing their services. On the other hand, fintech remittance services often have fewer barriers to entry and can serve the unbanked and underbanked populations.

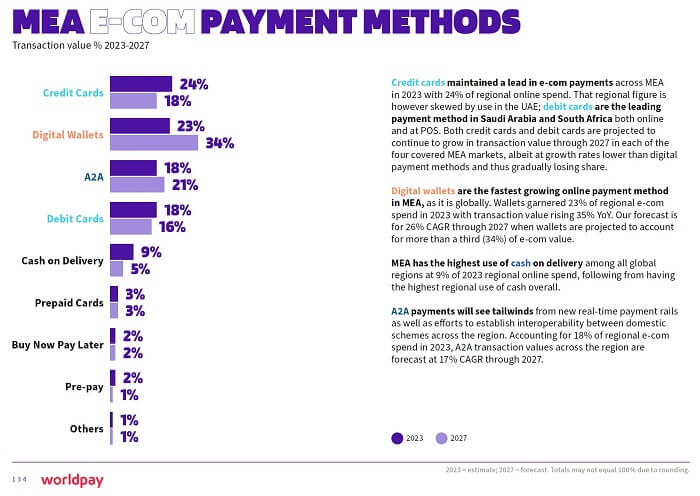

For example, African economies have been transforming thanks to digital wallet adoption driven by mobile penetration. Based on data published by WorldPay, mobile wallets accounted for 23% market share in Africa in Q1 2024, with projections to grow to 34% by 2027.

Market share of various payment methods in Middle East and Africa in 2023 with projections for 2027 - Source worldpay.com2

By leveraging mobile technology and digital platforms, fintech companies extend financial services to individuals who previously lacked access, empowering them to participate in the global economy.

Compared to banks, fintech money transfer companies offer numerous advantages that include better exchange rates and lower transfer fees, faster and more efficient remittances, better usability and user experience, and convenience, accessibility and financial inclusion.

Fintech's Key Value Proposition: Lower Costs And Transparent Pricing

One of the biggest value propositions that fintech companies offer in various sectors, including international remittance services, is lower costs and transparent pricing.

Fintech has disrupted traditional financial services, challenging established players by introducing innovative business models and leveraging technology to reduce costs and provide greater pricing transparency. This cannot be truer in the remittance industry where fintech has displaced traditional banks as the market leader.

Here are some ways in which fintech delivers on this key value proposition.

1. Competitive Exchange Rates

Fintech remittance services often offer more competitive exchange rates compared to traditional banks.

In general, banks charge FX Markups anywhere between 2-6%. In contrast, fintech companies provide exchange rates that are much better, often charging less than 1% FX Markups.

For a more detailed analysis, see our case study where we compared banks and remittance companies for international money transfers.

This means that individuals who use fintech remittance services can benefit from their better exchange rates, ensuring that their overseas recipient receives a higher amount in the local currency.

2. Lower Transaction Fees

The second direct way in which fintech companies impact their customer's bottom line is by offering lower transaction fees compared to traditional banks.

Whilst banks charge anywhere from USD 20-45 for sending international wire transfers, fintech companies often provide low-cost, and sometimes even free, money transfers.

By adopting streamlined operations, digital processes and eliminating physical infrastructure, fintech companies reduce overhead costs significantly. These savings are passed on to customers in the form of lower fees, allowing individuals to send money internationally without incurring high costs.

This cost-effectiveness makes fintech remittance services attractive, particularly for individuals who send money frequently or in smaller amounts.

Better exchange rates and lower transfer fees are 2 impactful ways in which fintech remittance services provide more value for money as compared to traditional bank transfers.

3. Fee Transparency

Fintech remittance services provide pricing transparency, ensuring customers understand the fees associated with their transactions.

The fees are often presented upfront, either on the fintech company's website or within the mobile application, allowing users to see the exact amount they will be charged before confirming the transaction.

This transparency enables individuals to make informed decisions and compare different money transfer companies to choose the most cost-effective remittance service for their needs.

4. No Hidden Charges

Fintech companies aim to eliminate hidden charges and surprise fees that may be prevalent in traditional remittance services. They strive to provide a straightforward fee structure with no additional or unexpected charges.

This transparency instills trust in customers, as they clearly understand the total cost involved in sending money internationally, without the worry of hidden fees eating into the amount received by the recipient.

5. Cost Comparison Tools

Fintech remittance platforms sometimes provide cost comparison tools that allow users to compare the fees and exchange rates offered by different providers.

In addition, there are dedicated fintech remittance comparison platforms like RemitFinder that help customers compare numerous global money transfer companies. This enables even more transparency into the exchange rates, pricing and other related factors of various options.

By facilitating easy comparisons, fintech platforms enable users to find the best value for their money and maximize the amount received by the recipient.

6. Cost-Saving Innovations

Fintech companies continuously explore and develop cost-saving innovations to provide added value to their customers.

For example, some fintech remittance services leverage blockchain technology to eliminate the need for intermediaries and reduce transaction costs. Others leverage digital wallets or mobile money platforms to bypass traditional banking systems, further lowering costs associated with traditional remittance channels.

Fintech companies operating in the international money transfer space provide high value to their customers by giving them better exchange rates, lower transfer fees that are transparent and shared upfront and cost comparison tools.

Regulatory Challenges And Fintech's Response

The road to disruption of bank's dominance and capturing bigger market shares has not been easy for fintech companies.

The biggest hurdles faced by fast-moving, digital and innovative fintech companies in the financial services sector have been regulatory challenges. These challenges arise due to the need to comply with complex regulations designed for financial institutions.

Fintech's response to these challenges has been commendable though, and has included collaboration with regulatory agencies, proactive implementation of compliance measures and the development of compliance sandboxes. These efforts by fintech companies have helped them strike a sustainable balance between rapid innovation and consumer protection and safety.

Fintech companies have actively engaged with regulatory authorities to navigate the evolving regulatory landscape. They participate in discussions and provide insights to regulators to help shape policies that govern emerging technologies.

Collaboration between fintech and regulators has created compliance sandboxes that enable firms to test their innovative solutions within a controlled environment. These sandboxes provide an environment for fintech companies to demonstrate compliance, address potential risks and gather valuable feedback from regulators.

To address regulatory challenges, fintech companies have also adopted proactive compliance measures. They invest in robust compliance frameworks, risk management systems and security protocol implementations to ensure adherence to regulations and protect consumer interests.

Finally, cross collaborations and self-regulatory initiatives have emerged within the fintech ecosystem. Associations and industry bodies have been established to establish best practices, develop standards and promote self-regulation.

These initiatives help set guidelines for responsible innovation, data privacy, cybersecurity and customer protection. By proactively addressing industry concerns through self-regulation, fintech companies demonstrate their commitment to ethical practices and responsible business conduct.

Banks' Adaptation Strategies In The Face Of Fintech Disruption

Faced with the disruptive impact of fintech companies, banks have implemented various strategies to adapt and stay competitive in the evolving financial landscape. These strategies include collaboration, digital transformation, innovation initiatives, and improving customer experience.

1. Collaboration with Fintech

Many banks have recognized the value of collaborating with fintech companies rather than viewing them solely as competitors. Partnerships and strategic alliances allow banks to leverage fintech's innovative technologies, agility, and customer-centric approaches.

Collaboration between banks and fintech companies generally involves joint ventures, investments, or integrating fintech solutions into their existing banking systems. These partnerships enable banks to benefit from fintech's expertise while leveraging their established customer base and regulatory compliance.

2. Digital Transformation

Traditional banks have embarked on comprehensive digital transformation journeys to enhance their operational efficiency, agility, and customer experience.

Many have invested in upgrading legacy systems, adopting cloud-based infrastructure, and implementing advanced data analytics and artificial intelligence technologies. Digital transformation enables banks to offer seamless online and mobile banking services, expedite internal processes, and personalize customer interactions.

3. Innovation Initiatives

Many banks strive to innovate by establishing dedicated labs or centers. These innovation hubs serve as incubators for new ideas, fostering a culture of experimentation, and facilitating the development of disruptive solutions.

Banks aim to create competitive advantages and enhance their product offerings by encouraging internal innovation and exploring emerging technologies.

4. Customer Experience Improvement

Recognizing the importance of customer-centricity, banks are investing in improving customer experience across various touchpoints. They focus on creating user-friendly digital interfaces, enhancing self-service options, and providing personalized financial solutions.

Banks aim to offer seamless omnichannel experiences, enabling customers to access their accounts, perform transactions, and seek assistance through multiple channels, including mobile apps, websites, and chatbots.

It will be interesting to see how banks continue to evolve in the new international remittance landscape. One thing that is for sure is that banks are here to stay and will do everything they can to win back market share they lost to fintech companies.

RemitFinder's Conclusion: Banks Vs Fintech - A Battle Worth Watching

The rise of fintech in the remittance business has presented a significant challenge to traditional banks. Fintech companies have revolutionized the industry by leveraging technology and customer-centric approaches to offer enhanced user experiences, lower costs, and greater transparency.

Fintech is pushing banks out of the remittance business, forcing them to transform their strategies and approaches.

However, banks are demonstrating resilience and adaptability by embracing collaboration, digital transformation, innovation, and regulatory compliance. By doing so, banks can navigate the evolving landscape and continue to provide efficient and reliable remittance services to customers.

Going forward, it will be interesting to monitor the international remittance ecosystem and see how the banks vs fintech battle continues to play out. Both sides are here to stay and wield tremendous power in their own ways.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

References:

1. World Bank data on worldwide remittance prices - Issue 49, March 2024.

2. Global Payments Report 2024 published by Worldpay.

Categories

Similar Articles

US Big Beautiful Bill's Impact On Remittances

The Big Beautiful Bill has been passed in the US, and remittances are impacted. Learn how the Bill impacts remittances and what to do if you are affected by the new law.

Bangladesh Remittance Cash Incentive: All You Need To Know

Are you an overseas Bangladeshi resident who sends money home to your loved ones? Read on to learn how to earn an additional 2.5% cash on your international remittances sent to Bangladesh.

Why Are International Money Transfers So Expensive?

International money transfers often come with underlying fees and charges that make a dent in your pocket. Discover why overseas transfers can be expensive and learn strategies to minimize the impact of fees.