The Ins And Outs Of International Mobile Money Transfers

Table of Contents

- Defining International Mobile Money Transfers

- What Is An International Mobile Money Transfer?

- How Does An International Mobile Money Transfer Work?

- What Is A Mobile Wallet?

- What Are The Advantages Of International Mobile Money Transfers?

- Some Challenges International Mobile Money Transfers Face

- How To Choose An International Mobile Money Transfer Provider?

- How To Send International Mobile Money Transfers Securely?

- RemitFinder's Conclusion: Mobile Money Transfers Are Awesome And Will Continue To Grow

In today's interconnected global economy, the ability to transfer money across borders quickly and securely has become essential for both individuals and businesses alike.

There are many ways to send and receive money internationally. For example, you could do international bank-to-bank transfers, or send and receive cash in most countries of the world. Additionally, you can send mobile money, which is our focus in this article.

International mobile money transfers have emerged as a convenient and efficient solution, revolutionizing the way we send and receive funds globally.

Whether you are a migrant worker supporting your family back home, a traveler in need of instant access to funds, or a business owner engaging in cross-border transactions, understanding the ins and outs of international mobile money transfers is crucial.

Defining International Mobile Money Transfers

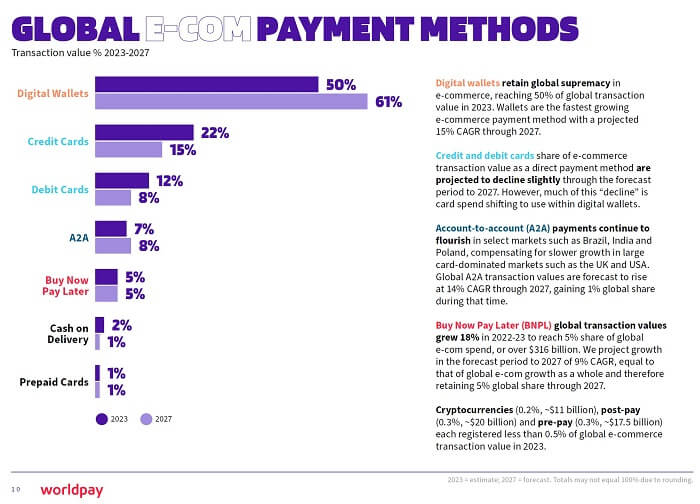

Based on data from the Global Payments Report 20241 published by Worldpay, digital and mobile wallets represented 50% of all global e-commerce spending. More than USD 3.1 trillion was spent worldwide via digital wallets; this is only projected to further increase to 61% by 2027.

Market share of various payment methods in 2023 with projected share for 2027 - Source worldpay.com1

This is no surprise given the widespread adoption of mobile technology across the world which, in turn, has accelerated the usage of mobile money. If we count sending money abroad as a subset of spending, we can immediately grasp the application of mobile money to international remittances.

What Is An International Mobile Money Transfer?

International mobile money transfers refer to the process of electronically sending and receiving money across borders using mobile devices such as smartphones or tablets.

Cross-border mobile money transfers imply the international movement of money electronically using mobile devices. This method of sending money abroad has gained tremendous popularity given widespread mobile penetration across the world.

Unlike traditional methods of money transfer, such as bank transfers or remittance services, international mobile money transfers offer several distinct advantages. They are typically faster, more accessible, and often more cost-effective.

Through dedicated mobile money platforms or mobile banking applications, you can initiate transfers, pay bills, purchase goods and services, and even manage your finances, all from the convenience of your mobile devices.

International mobile money transfers have gained significant traction, particularly in developing countries with limited access to traditional banking services. These transfers have proven instrumental in promoting financial inclusion by enabling previously unbanked individuals to participate in the formal financial system.

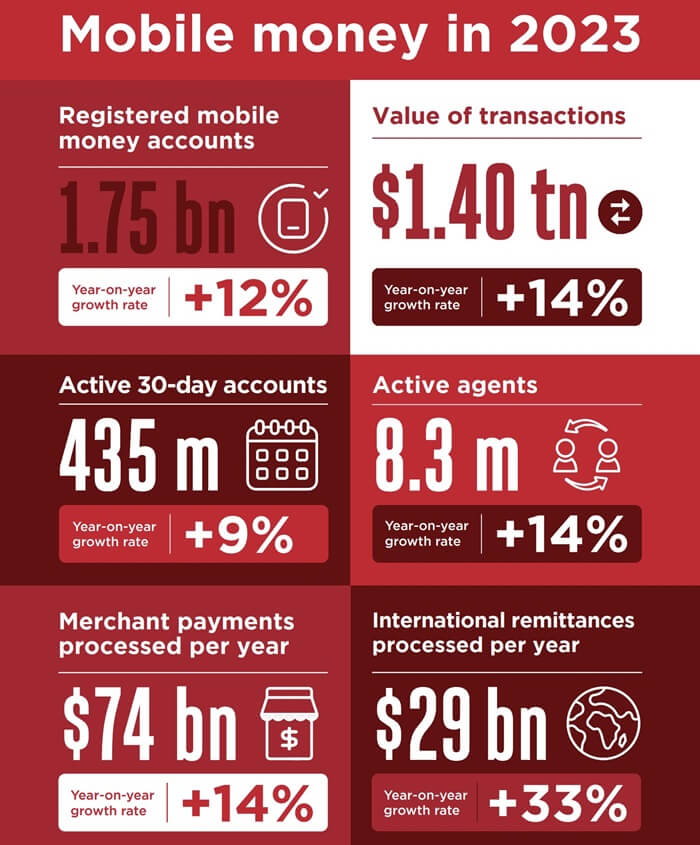

Based on data published by the GSMA2, mobile money saw tremendous growth YoY in 2023. International remittances sent via mobile money saw an impressive 33% YoY growth with mobile money transfers handling USD 29 billion worth remittance transactions.

Key mobile money statistics from 2023 - Source gsma.com2

International remittances sent using mobile money were worth USD 29 billion in 2023, representing a 33% YoY growth.

How Does An International Mobile Money Transfer Work?

The underlying technology behind international mobile money transfers varies, but it commonly relies on mobile wallets or accounts linked to your mobile phone number.

You can fund these accounts through various means, such as bank transfers, debit or credit card payments, or by depositing cash at authorized agents or mobile money agents.

Once funds are loaded into the mobile wallet, you can transfer money to recipients in different countries, who can access the funds through their mobile wallets or redeem them as cash at authorized agent locations.

Here are the main steps involved in the end-to-end execution of a typical mobile money transfer:

- Mobile Wallet Setup: If you are interested in sending an international mobile money transfer, you must first set up a mobile wallet account with a mobile money service provider. This involves registering with the provider, providing necessary identification and personal information, and linking your mobile phone number to the account.

- Account Funding: To initiate an international mobile money transfer, you need to load funds into your mobile wallet. This can be done through various methods such as bank transfers, linking a debit or credit card to the account, or depositing cash at authorized agents or mobile money agents.

- Transfer Initiation: Once the mobile wallet is funded, you can initiate an international transfer by accessing the mobile wallet app or platform. You will need to provide the necessary details of the recipient, such as their mobile phone number or account information, and specify the amount to be sent.

- Transfer Authorization: To ensure security, users may need to authenticate the transfer using security features provided by the mobile wallet app, such as PIN codes, passwords, or biometric authentication.

- Transaction Processing: Once the transfer is authorized, the mobile money service provider processes the transaction. The provider coordinates with the recipient's mobile money service provider or financial institution to facilitate the transfer.

- Recipient Notification: Upon successful completion of the transfer, both the sender and the recipient receive notifications confirming the transaction. The recipient is informed that funds have been received and are available in their mobile wallet, bank account or applicable delivery option.

- Fund Access: The recipient can then access the funds in their mobile wallet by using their mobile money app, visiting authorized agent locations, or withdrawing cash from compatible ATMs.

- Currency Conversion (if applicable): The mobile money service provider may handle the currency conversion in cases where the sender's and recipient's currencies differ. The exchange rate used and any associated fees or charges are typically communicated to the sender before the transaction is confirmed.

For international money transfers sent using mobile money, a currency conversion will definitely be involved. To ensure that you get the best possible exchange rate, make sure you compare various money transfer companies. This will allow you to inspect the pros and cons of various providers and make the best possible choice.

It is important to note that an end-to-end international mobile money transfer process is often facilitated by partnerships between mobile network operators, financial institutions, and money transfer service providers, creating an ecosystem that enables the seamless movement of money globally.

What Is A Mobile Wallet?

A mobile wallet, also known as a digital wallet or e-wallet, is a virtual payment method that allows you to securely store and manage their payment information, such as credit card details, bank account information, or digital currency. It serves as a digital counterpart to a physical wallet, enabling you to make various financial transactions using your mobile devices.

Mobile wallets provide a convenient and secure way to make payments, both online and in physical stores. They eliminate the need to carry physical payment cards or cash, as you can simply access your mobile wallet app on your smartphones or other mobile devices to initiate transactions.

Mobile wallets, also called digital, electronic or e-wallets, represent a virtual representation of physical payment methods. The use of mobile wallets obviates the need to carry cash or cards when making payments and spending money.

To use a mobile wallet, you typically need to install a dedicated mobile wallet application provided by a specific service provider or financial institution. Upon registration, you can link your payment methods, such as credit or debit cards, to your mobile wallet account.

When making a purchase, you can select your mobile wallet as the payment method and authenticate the transaction using various security features like PIN codes, biometric authentication (such as fingerprint or facial recognition), or passwords. The mobile wallet securely stores the payment credentials and encrypts the transaction data, ensuring the privacy and security of your information.

Mobile wallets can be used for various transactions beyond traditional retail purchases. They often support peer-to-peer payments, allowing you to send money to family and friends directly from your mobile devices. Mobile wallets may also integrate with other services, such as transportation apps for fare payments, bill payment platforms, or even enable mobile banking functionalities.

As the adoption of mobile wallets continues to grow, more and more service providers will strive to enhance their features and expand their partnerships to offer seamless experiences across different merchants and countries.

What Are The Advantages Of International Mobile Money Transfers?

International mobile money transfers offer several advantages that make them an attractive method of sending and receiving money overseas; we list some of these below.

- Convenience And Accessibility: Mobile money transfers provide are very convenient, allowing you to initiate transfers anytime, anywhere using your mobile devices. With an internet connection or mobile network coverage, you can access your mobile wallets and conduct transactions, eliminating the need to visit banks or remittance agents.

- Faster Transactions: International mobile money transfers are typically faster as compared to traditional methods. Funds can be sent and received almost instantly or within minutes, enabling immediate access to money. This is particularly beneficial for urgent situations or emergency financial needs.

- Financial Inclusion: Mobile money transfers have played a crucial role in promoting financial inclusion, especially in areas with limited access to traditional banking services. Mobile wallets offer a simple and accessible entry into the financial system, allowing unbanked individuals to receive, store, and manage their funds securely.

- Lower Costs: Compared to traditional remittance services or bank transfers, international mobile money transfers often come with lower transaction fees and more competitive exchange rates. This cost-effectiveness is especially useful if you sending money overseas frequently or are a migrant worker supporting your family in your home countries.

- Security And Transparency: Mobile money transfers incorporate various security features, including authentication mechanisms like PIN codes, passwords, and biometric verification, thereby ensuring the safety of transactions as well as personal information.

- Peer-To-Peer Payments: International mobile money transfers often facilitate peer-to-peer payments, allowing individuals to transfer funds directly to friends and family. This simplifies the process of sending money to trusted recipients.

- Enhanced Business Transactions: International mobile money transfers offer streamlined and efficient payments for businesses engaged in cross-border transactions. Businesses can promptly receive payments from international clients or customers, reducing reliance on slow and costly banking systems.

- Economic Empowerment: International mobile money transfers positively impact local economies, particularly in developing countries heavily reliant on remittances. By facilitating faster and more affordable transfers, mobile money enables individuals and communities to receive and utilize funds for personal consumption, education, healthcare, and entrepreneurial activities, ultimately driving economic growth in their country.

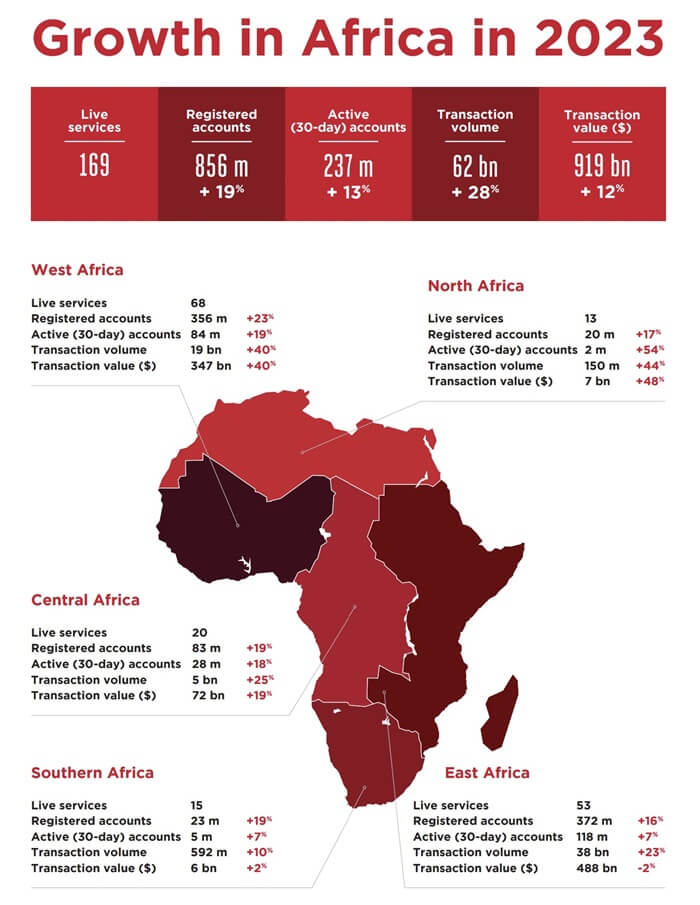

This could not be truer for Africa! Based on data published by the GSMA2, Africa saw 62 billion mobile money transactions worth USD 919 billion in 2023.

Mobile money adoption and growth statistics in Africa in 2023 - Source gsma.com2

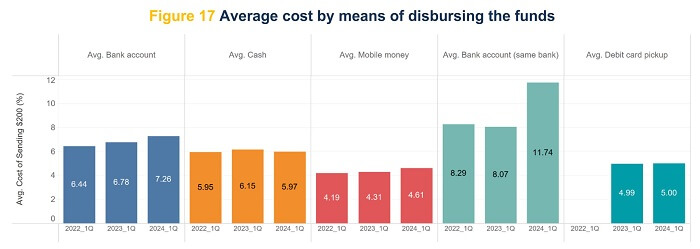

In fact, World Bank has published ample data3 that demonstrates that mobile money is the cheapest of all available delivery options. Debit cards then follow as the next cheapest option.

Given this, we recommend that anytime you have the option to send money abroad using mobile payment methods, you should choose that.

RemitFinder recommends sending money overseas to your recipient's mobile wallet if possible. This is because mobile money is the cheapest way to send money internationally.

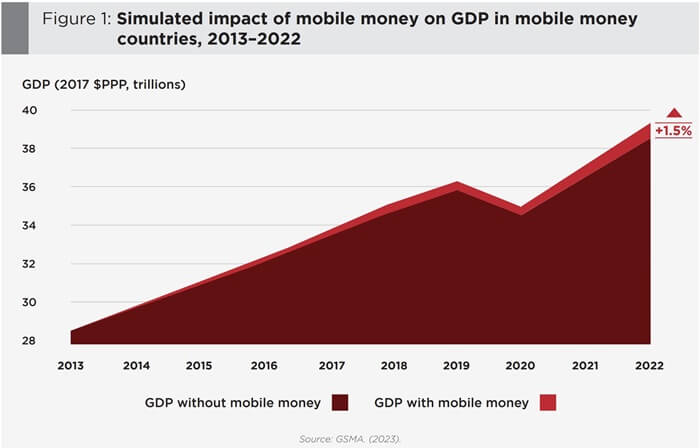

In fact, if we look at data from the GSMA2, the cumulative impact of mobile money from 2013-2022 has been an increase of 1.5% GDP in countries that use mobile money. This amounts to USD 600 billion higher GDP in countries where mobile money was adopted and used between the years of 2013 and 2022.

Cumulative GDP impact of mobile money from 2013 to 2022 - Source gsma.com2

For smaller countries or financially weaker regions of the world, these numbers are very significant and mobile money has proven itself to be a major engine of economic growth and empowerment.

RemitFinder likes and recommends mobile money transfers for their cost-effectiveness, speed, ease of use, security and accessibility. Mobile money continues to gain popularity and makes a big impact on economic growth as well as financial inclusion.

International mobile money transfers continue to evolve and expand, with new features and partnerships continuously driving the field forward. As technology advances, the advantages of mobile money transfers will further increase, continuing to establish them as an integral part of the global financial landscape.

Some Challenges International Mobile Money Transfers Face

Whilst international mobile money transfers offer numerous advantages, some challenges exist - addressing these will continue to grow mobile money adoption. Here are some common challenges international mobile money transfers face:

- Regulatory Compliance: International money transfers are subject to various regulations and compliance requirements imposed by governments and financial authorities. Mobile money service providers must navigate a complex landscape of regulatory frameworks, which can vary significantly across different countries. Adhering to these regulations adds operational complexity and may result in additional costs for the service providers, which they could potentially pass on to users.

- Interoperability And Fragmentation: The interoperability between different mobile money platforms can pose challenges. Users may face limitations when trying to transfer funds between different mobile money services, requiring additional steps or multiple accounts.

- Limited Agent Networks: Access to physical agent locations where users can deposit or withdraw cash can be limited in certain areas, especially in remote or underserved regions. Less prevalent agent networks can create challenges for individuals who rely on cash-based transactions.

- Connectivity And Infrastructure: International mobile money transfers rely heavily on internet connectivity and network coverage. In regions with limited or unreliable network infrastructure, users may experience disruptions or delays in accessing their mobile wallets.

- Security Concerns: While mobile money transfers incorporate many security features, there is still a risk of fraud. Cybercriminals may attempt to exploit vulnerabilities in mobile wallets, compromising the security and privacy of user information.

- Currency Exchange and Exchange Rates: International mobile money transfers often involve currency conversion. Exchange rates and associated fees may vary between providers, impacting the overall cost of the transaction. Users should be aware of the applicable exchange rates and any fees involved to obtain the best value for their transfers.

- Financial Literacy and User Education: Promoting financial literacy and education is vital to ensure users understand the features, benefits, and risks of international mobile money transfers. Clear and accessible information shared by mobile money providers can help users to make the most of their mobile wallets.

At RemitFinder, we strongly encourage our readers to always compare exchange rates from various money transfer companies to ensure that they are getting the best exchange rates and deals on their international money transfers.

By addressing and overcoming these hurdles, international mobile money transfer companies can continue to provide accessible and secure financial services, contributing to increased financial inclusion and economic empowerment globally.

How To Choose An International Mobile Money Transfer Provider?

When choosing a provider for international mobile money transfers, there are several factors to consider; we present some guidelines below.

- Reputation And Trustworthiness: Select a provider with a solid reputation and positive customer reviews. Look for well-established companies or financial institutions that have a track record of reliability and security.

- Coverage And Reach: Consider the provider's coverage and reach in terms of countries and regions where you frequently send or receive money. Ensure that the provider has a wide network of agents or service providers in your desired locations.

- Transfer Cost And Fees: Compare transfer fees and exchange rates from different providers. Look for fee transparency, and keep an eye out for hidden charges or high FX Markups on exchange rates. Prefer providers that offers competitive rates and reasonable fees.

- Convenience And Accessibility: Evaluate the user experience of the provider's mobile wallet app or platform. Consider factors such as ease of use, availability of key features, and compatibility with different devices and operating systems. Choose a provider that offers a seamless and user-friendly experience.

- Security Measures: Ensure that the provider implements robust security measures to protect your personal and financial information. Look for features like secure login, data encryption and account activity alerts.

- Customer Support: Consider the availability and quality of customer support provided. Check if the provider offers multiple channels for assistance, such as phone, email, or live chat, and assess their responsiveness and effectiveness.

- Integration With Local Financial Institutions: If your recipient plans to access or withdraw funds from local banks or ATMs in their country, check if the provider has partnerships or integrations with local financial institutions. This can ensure smoother fund access and avoid additional charges or inconvenience.

- Additional Services And Features: Some providers offer additional services like bill payments, airtime top-ups, merchant partnerships and loyalty programs that can further enhance the utility of the mobile wallet. Consider whether these additional services are useful to you.

By carefully considering these factors, you can choose a provider that meets your requirements for international mobile money transfers, providing you with a reliable, cost-effective, and user-friendly platform.

How To Send International Mobile Money Transfers Securely?

To protect your personal and financial information, it is crucial to ensure that you send international mobile money transfers safely and securely. Here are some best practices to follow:

- Choose A Trusted Provider: Select a reputable and trusted mobile money service provider that has a proven track record in security and customer protection. Research and read reviews to ensure the provider has implemented robust security measures.

- Use Authentication Methods: Enable and use various authentication methods provided by the mobile money app or platform, such as PIN codes, passwords, or biometric verification (fingerprint or facial recognition). Avoid using easily guessable or common passwords.

- Keep Software Updated: Regularly update your mobile wallet app and operating system to ensure you have the latest security patches and enhancements. Enable automatic updates whenever possible.

- Be Careful Of Phishing Attempts: Be wary of unsolicited emails, messages, or calls requesting your personal or financial information. Avoid clicking on suspicious links or sharing sensitive details. Legitimate mobile money providers will not ask for your credentials via unsolicited communication.

- Use Secure Networks: When accessing your mobile wallet or initiating transactions, use secure and trusted networks. Avoid using public Wi-Fi networks, as they may not be secure and can expose your information to potential hackers. Use a virtual private network (VPN) for added security when connecting to public networks.

- Monitor Account Activity: Regularly review your transaction history and account activity within the mobile wallet app. Report any unauthorized transactions or suspicious activity to your mobile money service provider immediately.

- Protect Personal Information: Avoid sharing personal information related to your mobile money account. Do not share account details, PIN codes, or passwords with anyone. Use strong, unique passwords for your mobile wallet and associated accounts.

- Educate Yourself: Stay informed about common security practices and scams related to mobile money transfers. Regularly educate yourself on new security threats and techniques used by cybercriminals to protect yourself from potential risks.

Enhance the safety of your international mobile money transfers by ensuring that your financial transactions are conducted securely and your information is protected from unauthorized access.

RemitFinder's Conclusion: Mobile Money Transfers Are Awesome And Will Continue To Grow

International mobile money transfers have revolutionized how we send and receive money across borders. They offer a convenient, speedy, and cost-effective alternative to traditional methods, empowering individuals and businesses to engage in global financial transactions easily.

Various advantages of international mobile money transfers, such as convenience, financial inclusion, lower costs, and enhanced security, have propelled their widespread adoption.

However, navigating the challenges associated with these transfers is essential, including regulatory compliance, interoperability, limited agent networks, connectivity issues, security concerns, and the need for user education. By addressing these challenges and working towards innovative solutions, the mobile money industry can continue evolving and provide greater value to users worldwide.

As the popularity of mobile money transfers grows, choosing reliable providers that prioritize security, transparency, and customer support becomes increasingly crucial. Users must take proactive steps to ensure the security of their transactions, such as using strong authentication methods, avoiding phishing attempts, and monitoring account activity.

With the potential for financial inclusion, economic empowerment, and streamlined global transactions, international mobile money transfers continue to reshape the way we manage and move money across borders.

By understanding the ins and outs of this transformative financial technology, individuals and businesses can make informed decisions and harness the benefits of international mobile money transfers in today's interconnected world.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

References:

1. Global Payments Report 2024 published by Worldpay.

2. State of the Industry Report on Mobile Money by GSMA - 12th Edition, 2024.

3. World Bank data on worldwide remittance prices - Issue 49, March 2024.

Categories

Similar Articles

Tax Treatment On Sale Of Property By NRI In India

Are you a Non-Resident Indian (NRI) who needs to sell property in India? Discover the tax implications of property sale in India and ensure that you comply with all legal regulations.

Popular Mobile Wallets In Middle East And Africa

Mobile wallets have significantly improved financial inclusion for residents of Middle East and Africa. Learn about the most popular mobile wallets that people use in this region to participate in the new cashless economy.

Popular Mobile Wallets In North America

Mobile wallet adoption in North America continues to increase. Discover the most popular mobile wallets in North America and see how you can streamline your payments and purchases using them.