8 Quick Tips to Send Money Online Instantly

Table of Contents

- Can You Send Money Online in Real Time?

- Factors That Influence Money Transfer Speed

- 1. Source and Destination Countries

- 2. Currency Exchange Rates

- 3. The Payment Method

- 4. The Delivery Method

- 5. Money Transfer Fees

- 6. Money Transfer Limits

- 7. The Money Transfer Service

- 8. Check for Security Features

- How to Keep Your Money Secure When Sending Online

- Final Thoughts on How to Send Money Quickly

Sending money overseas used to be a difficult and time-consuming process, but thankfully, there are now plenty of ways to do it quickly and easily.

In this post, we will share eight things to consider when sending money online instantly.

Whether you are looking to send money to a family member or friend, or need to transfer funds for business purposes, these tips will help you get the job done quickly and efficiently.

Can You Send Money Online in Real Time?

Sending money online is a quick and easy way to transfer funds from one person to another. There are many ways to send money online, but not all of them offer instant transfers.

If you need to send money quickly, you will want to use a service that offers real-time or near real-time money transfers.

Let's look at the essential ingredients of a money transfer in totality, and how they impact the overall speed of the transaction.

Factors That Influence Money Transfer Speed

There are many factors at play when it comes to how fast a money transfer company will be able to move your money overseas. From payment and delivery methods to fees and exchange rates, there is a lot to consider if you want to send money overseas quickly.

Here are eight topics to consider when sending money online:

1. Source and Destination Countries

Your transaction will probably go more quickly if you are sending money between two nations that have well-known transfer channels. Choose your preferred money transfer method or provider based on the sending and receiving countries.

For example, some money transfer companies specialize in European international transfers, while others might provide quicker transfers to Asian or African countries. Understanding which regions of the world various providers specializes in will help determine the best one for your online money transfer.

In general, countries that are more connected with global financial economic hubs and international banking and payment systems will be faster to send money to and from. On the other hand, more remote parts of the world, sanctioned countries, etc. will be slower to move money to and from.

Sending money to less financially connected countries will take longer.

2. Currency Exchange Rates

When sending money internationally, always check the currency conversion rates, also called currency exchange rates, before you transfer any funds. This way, you will know how much the recipient will receive.

Exchange rates are one of the most important factors that will affect the final payout your overseas recipient gets. Bad exchange rates work like hidden fee in the sense that they are not obvious as a disclosed money transfer fee, but they end up reducing your payout nevertheless. That is why they are sometimes called a "hidden" fee.

Some services may have hidden fees, so be sure to check the exchange rates carefully before you send any money.

Inferior exchange rates reduce your overseas recipient's payout and make you lose your hard earned money.

And this may be hard given so many choices available these days to send money internationally. Innovations in fintech have opened the playing field for international remittances, and more and more companies are increasingly offering their services.

This is great as you have more choice, but it is also a ton of work for you for keep up to date with so many companies and services out there.

One way to reduce the pain of manual searches and the possibility of not knowing the ever-increasing number of money transfer services coming up is to rely on a remittance comparison platform like RemitFinder. Simply choose your country combination and the amount you want to send, and RemitFinder will show you numerous good options to send money abroad.

It's totally free to use, and you can easily compare various good options in an easy-to-follow format. When you see the pros and cons of various providers side by side, it helps you to make informed choices, and therefore, make the most of your hard earned money.

3. The Payment Method

The method you use to pay for your transfer will also have an impact on how long it takes to arrive. Different payment methods have different speeds, and till the money transfer company receives your funds, they will not move the money overseas.

The slowest payment method would be a bank transfer as it will take at least a few business days for the money to get to your provider. Add to that weekends or bank holidays, and your overall transfer will further slow down.

Generally, cash payments or debit and credit card payments are much faster as your funds will reach the money transfer company quickly, and they can start working on your international money transfer.

Payment methods that move your money faster to the money transfer operator will help speed up the overall transfer process.

4. The Delivery Method

Much like the payment method, the delivery method will also have an important impact on transfer speed. A delivery method is how you choose to pay your overseas recipient.

Also called a delivery option, a delivery method like mobile wallet credit or cash pickup is a very fast way to have your recipient gain access to the funds.

Once again, one of the slowest delivery methods will be bank account credit which will take a few business days to complete. Any bank closures due to national holidays or processing cut off times may add more time lag to the overall transfer process.

Cash pickup and mobile wallet credits are some of the fastest delivery options available.

5. Money Transfer Fees

Depending on the service you use, there may be a fee for each transaction. Be sure to check for any fees that may be associated with your chosen payment and delivery methods. Some platforms charge a small fee for each transaction, while others may not charge any fees at all.

Whilst transfer fee does not have a direct impact on transfer speed, in general, faster transfers may need extra fees. Alternatively, if you choose a slower transaction speed, you will have to pay low or 0 fees.

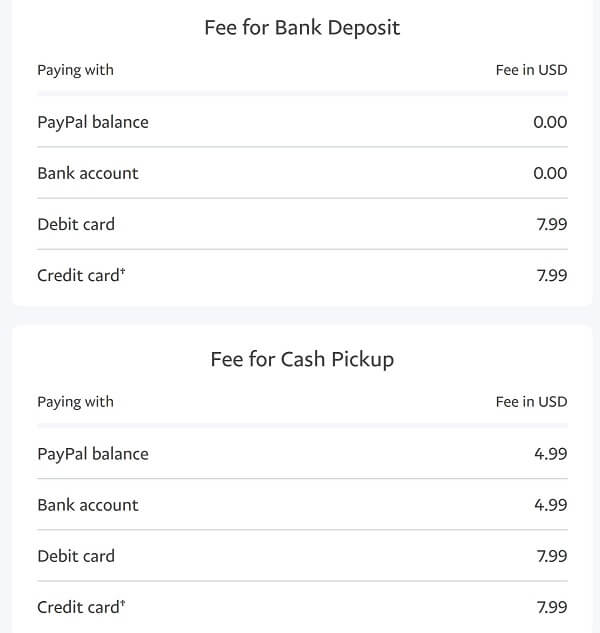

For example, if you send money internationally with Xoom (a PayPal service), you will have to pay more fees for cash pickups that are faster, and lesser fees for bank deposits that are slower.

In this way, transfer fee and transfer speed can sometimes work as opposing forces on your international money transfer. The faster you want to move your money overseas, the higher the fees you may have to pay, and vice-versa.

You may have to pay a higher transfer fee if you want to move your money abroad faster.

6. Money Transfer Limits

Most online money transfer services have limits on how much money you can send in a single transaction. When you are sending a large amount of money, it is important to check the limit beforehand. This way, you can avoid any delays or issues with your transfer.

If you are looking to send a large amount of money, consider using a service that does not have strict limits. This way, you will be able to send the full amount without any problems.

However, sending exceptionally large amounts may mean slower speed. For example, an international wire transfer is a particularly good way to send high amounts overseas. But it may take a few days for the transaction to complete.

7. The Money Transfer Service

The transfer service you choose has a significant impact on the actual transfer speed. In terms of accepting, exchanging, and sending money, providers function differently. The effectiveness of these mechanisms will determine the transfer speed.

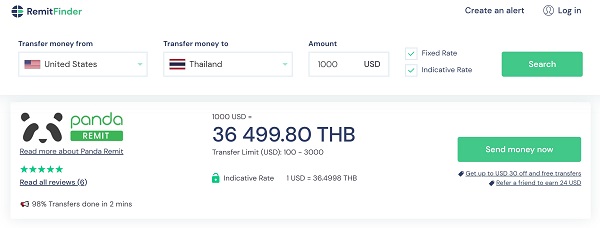

For instance, if you send money with Panda Remit, you may be able to send money overseas quickly. Most of their money transfers finish within just a few minutes.

As an example, see the below screenshot for Panda Remit's money transfer service to send money from the United States to Thailand.

As you evaluate various money transfer companies, pay attention to their transfer speed as well.

Money transfer companies move money overseas at different speeds. Pay attention to this aspect as you compare providers.

8. Check for Security Features

When sending money online, security should always be a top priority. You want to make sure the site you are using is legitimate and that your personal information will be safe. You also want to be sure that the recipient will receive the money quickly and without any issues.

Never opt for speed at the expense of security. If you have any doubts about the security and safety of a money transfer company or provider that promises fast transfers, do not rush into making a transfer.

Do detailed research on the company first to ensure everything is safe and sound. The cost of dealing with stolen money or identity is many times higher than waiting a few days for a money transfer to finish.

One way to ensure security is to use a site that is backed by a major financial institution. Money transfer companies that are regulated and authorized by major financial watchdog institutions have to comply with strict security requirements to keep their licenses.

For example, remittance provider based out of the UK should be registered with the UK's Financial Conduct Authority (FCA).This way, you know that you are not dealing with a rogue or insecure company, and that your information is safe and the transaction will go smoothly.

How to Keep Your Money Secure When Sending Online

When you are sending money online, it's important to take some extra steps to ensure that your money is safe. Here are a few tips:

d money transfer companies, you can expect to:- Use a secure website: Make sure the website you are using is encrypted and has a valid SSL certificate. You can check this by looking for the green lock icon in your browser's address bar.

- Use a strong password: Create a strong password for your account that includes numbers, letters, and special characters. Do not use easily guessed words such as your name or birthdate.

- Keep your software up to date: Always make sure you are using the latest version of your web browser and security software. Outdated software can leave you vulnerable to attacks.

- Watch out for scams: Be careful of phishing emails and other scams that attempt to trick you into revealing your personal or financial information. Never click on links or attachments from people you do not know and be suspicious of any email that asks for sensitive information.

By following these tips, you can help keep your money safe when sending it online. Remember to always be cautious when sharing your personal or financial information online.

Final Thoughts on How to Send Money Quickly

There are many ways to send money overseas quickly and easily. Most places in the world may receive money transfers sent instantaneously online and recipients frequently receive the payments within minutes.

The actual transfer pace is determined by several variables, including how the transfer is funded, the currency used, and the delivery method you choose. For faster transactions, it is better to fund the transaction with a debit card or cash and choose cash pickup as a delivery option.

Finally, the exchange rate for money transfers is generally fixed, with additional fees on top of this for instant transfers, so keep an eye on how much your transfer is costing you.

Categories

Similar Articles

US Big Beautiful Bill's Impact On Remittances

The Big Beautiful Bill has been passed in the US, and remittances are impacted. Learn how the Bill impacts remittances and what to do if you are affected by the new law.

Bangladesh Remittance Cash Incentive: All You Need To Know

Are you an overseas Bangladeshi resident who sends money home to your loved ones? Read on to learn how to earn an additional 2.5% cash on your international remittances sent to Bangladesh.

How Fintech Is Pushing Banks Out Of The Remittance Business

The fintech revolution is disrupting the international remittance business. Discover how innovative startups are reshaping the international money transfer industry and challenging traditional banks.