How Long Do International Money Transfers Take?

Table of Contents

- How Long Does an International Money Transfer Take?

- What are the Common Factors that Slow Down International Money Transfers?

- 1. Different Time Zones and Processing Cut-off Times

- 2. Currency Conversion

- 3. Fraud and Scams

- 4. Bank Holidays and Weekends

- 5. Errors and Missing Information

- 6. Payment and Delivery Method

- 7. Financial Institution Used

- 8. Intermediary Banks

- Are Same-Day International Money Transfers Possible?

- How to Send Money Overseas Quickly? Our Top Recommendations

- Revolut

- Panda Remit

- XE Money Transfer

- MoneyGram

- Instarem

- Remitly

- Wise (formerly TransferWise)

- WorldRemit

- Atlantic Money

- Paysend

- Conclusion

- Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

If you need to send money internationally, then you are probably wondering how long it will take for the transfer to go through.

The time it takes for an international money transfer to be completed can vary depending on several factors, including the money transfer company or the bank you are using and the country where the money is being sent to.

In this article, we will provide an overview of how long international money transfers usually take. We will touch upon the factors that impact the transfer time, as well as make some recommendations to speed up your transaction.

How Long Does an International Money Transfer Take?

Sending money across the globe is a fairly involved process. The movement of money internationally may involve many steps and payment institutions, and can sometimes feel like it's taking a long time.

Depending on your chosen source and destination currencies and financial regulations in different countries, transferring funds could range from a few short hours up to many seemingly endless days.

In general, you can expect your international money transfers to finish between 1-4 business days.

There are also major variations across money transfer companies and banks, but in general, banks tends to be bit on the slower side. Below are the typical times it takes these money movers to complete your international remittance:

- Banks will generally take anywhere from 2-4 business days.

- Money transfer specialists may take anywhere from minutes to 1-2 business days.

International money transfers can take anywhere from minutes to up to a few business days.

The good news is that there are choices you can make to speed up your transactions, both in relation to the money transfer company (or bank) you choose, as well as how to choose to fund and pay your transaction. We will touch upon some of these choices later.

But first, let us consider the various factors that affect the speed of international money transfers and contribute to transactions slowing down.

What are the Common Factors that Slow Down International Money Transfers?

International money transfers and cross-border payments have been becoming more accessible and easier with the introduction of electronic transfers.

However, there can still be delays due to several contributing factors such as fraud prevention and currency conversion. Even something as simple as different time zones or national holidays can introduce delays. This is why international transactions are generally not instantaneous.

Based on our research, here are the topmost common factors that slow down international money transfers.

1. Different Time Zones and Processing Cut-off Times

When you send an international money transfer, your money's journey can span multiple time zones and continents. Depending on the method you are sending your money through, delays are possible due to banking systems needing to be open for processing.

A good example of this is someone transferring funds from Singapore to a family member in the United States. Even if the sender sends the money at 10 am their local time, the banks in the US are already past their business hours. The potential delay spans at least 13 hours across two countries' schedules.

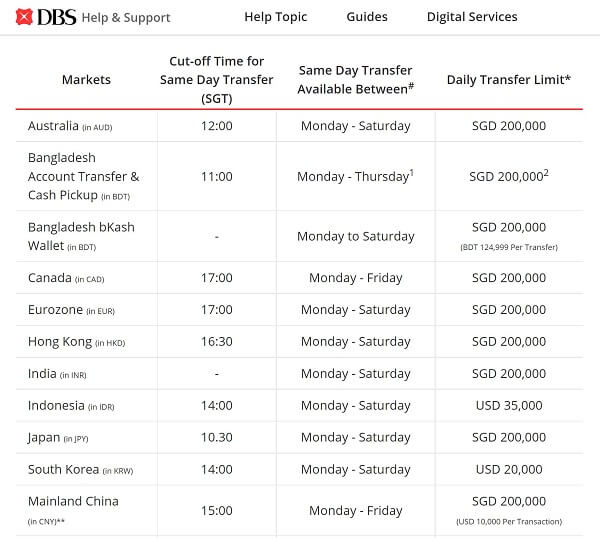

Bank cut-off times are also an important factor. For example, Chase Bank in the US has a cut-off time of 4 PM EST whilst DBS Bank in Singapore has varying cut-off times depending on the source currency.

If you miss the cut-off time deadline for a particular business day, you will have to send your bank wire transfer the next day. In the worst case, if you happen to miss the cut-off time on a Friday, you will have to wait till Monday to initiate your transfer.

This is where careful planning ahead of time could save valuable waiting times down the line.

2. Currency Conversion

International money transfers involve currency conversion which will add some time in the transaction processing time.

If the money transfer operator or the sending bank cannot process currency conversion themselves, they generally partner with other financial institutions for such conversions, and this may add additional time to the overall process.

Additionally, the currency pair being converted may also have an impact on processing time. Popular global currencies like the US Dollar, British Pound, Euro, Australian Dollar, Canadian Dollar, Singapore Dollar, Japanese Yen, Indian Rupee, etc. may convert faster than exotic and less-mainstream currencies.

For countries under economic sanctions or restrictions, or experiencing major financial trouble, it may take even longer for financial institutions to be able to interconvert money in those currencies.

3. Fraud and Scams

Cyberattacks in today's digital world pose a formidable threat with potentially damaging reputational consequences. As such, multiple fraud-prevention steps must be taken during an international money transfer process, which can lead to long waiting times.

On top of this, there are complex regulations from local and global governing bodies that require additional checks, making it even harder for financial institutions whose operations span different countries.

Ensuring secure and safe international money transfers is important not only for the consumer looking to transfer money but also for money transfer operators and international banks who are responsible for keeping these funds protected.

Finally, you should ensure you exercise the maximum caution and adopt best practices to keep your account and money safe at all times.

4. Bank Holidays and Weekends

When you are making an international money transfer, it's wise to remember that the time zone is not the only thing that could affect transfer speed. Holidays and weekends in each nation can cause delays - sometimes up to several business days.

For instance, if you are transferring funds from UAE to Pakistan, you should be mindful of their weekend days which are Friday and Saturday. Similarly, major holidays like the Chinese New Year holiday may impact the speed of your money transfers to China.

In these cases, financial institutions and staff may not be able to process transactions until usual banking hours resume again after the break.

5. Errors and Missing Information

When you send an international money transfer, you need to provide recipient information as well as bank details and other related payment information for both the source as well as the destination sides.

Any typos or mistakes in such information will certainly contribute to delays. One wrong number or letter could send fail your money transfer and the funds will be sent straight back to you. Therefore, always double-check all the details before sending money.

Additionally, since the money transfer institution needs to comply with legal and regulatory requirements, you will need to submit needed documentation. If you submit the wrong documents or provide incomplete information, you will need to redo those steps. Needless to say, this will delay your transaction.

Sending money overseas may seem daunting at first. But with a few simple precautions, you can ensure your payment is received as quickly and securely as possible.

6. Payment and Delivery Method

When it comes to international money transfers, the payment method can determine how quickly your funds arrive. For example, paying with a credit or debit card may speed up your transaction as the money transfer company will get your money faster.

Similarly, the delivery method you choose to pay the recipient will also have a direct impact on how soon the funds arrive overseas. For example, paying into a mobile wallet or a card will be faster than making a bank transfer.

Both payment and delivery method will have a major impact on the speed of your international money transfer.

Therefore, if speed is important to you when you send money abroad, choose your payment and delivery methods carefully to minimize transfer time.

7. Financial Institution Used

Various money transfer companies and banks offer varied transfer times, so do your research before you decide who to go with.

In general, money transfer specialists are able to send money overseas faster than banks.

You can ask around and find out which financial institution will move your funds overseas quickest. If a money transfer company or bank is not good enough for your needs, consider another provider to speed up the process.

While manual searches can help, you would ideally want to automate the process to evaluate money transfer companies. One good way to do this is to rely on RemitFinder's online money transfer comparison platform. You can compare numerous providers in a simple to understand view and compare their pros and cons.

8. Intermediary Banks

The amount of time it takes for your money to reach its destination also depends on intermediary banks and financial institutions.

Some banks can convert money themselves, thereby transferring the funds quickly and efficiently. Others may require other intermediary banks and financial institutions before your money finally reaches the destination. This will obviously result in a longer transaction processing time.

There are numerous factors that influence the speed of international money transfers. Pay attention to the transfer company, payment and delivery methods, as well as holidays and cut-off times.

Are Same-Day International Money Transfers Possible?

With Same-Day international money transfers, you can have your funds arrive overseas within 24 hours. Extra fees may apply, but if time is essential and the transfer must be made quickly, this option could save the day for you and your recipient.

Below, we cover some best practices and options you can use for fast international money transfers.

What Should I Do to Send Money Overseas Quickly? Our Top Tips

Below are our top recommendations for sending money overseas quickly:

- Use a Money Transfer Specialist: Banks usually take longer to move money overseas. Hence, we recommend relying on a money transfer company that can move your money abroad quickly.

- Pay for your money transfer quickly: The sooner your money transfer company will get your funds, the faster they will move money overseas. To speed up the process, pay for your transfer via cash or cards that are faster as compared to bank transfers.

- Choose a fast delivery method: Similar to payment method, choose a faster delivery method like cask pick up, mobile wallet credit or card transfer. Other payout methods like bank transfer or home delivery will take longer.

- Be open to pay fees for fast transfers: In some cases, money transfer companies may provide faster transfers for a fee. So, if transfer speed is an important consideration for your transfer, you may want to pay the transfer fee to execute a quick transaction.

- Do not send very high amounts: Sending very high amounts may need additional documentation and compliance checks; all of these steps will slow down your money transfer. Check with your provider and send within transfer limits that do not trigger additional regulatory and legal scrutiny.

Money transfer best practices that focus on transfer speed can help you send money overseas quickly.

How to Send Money Overseas Quickly? Our Top Recommendations

In this section, we present some of our top recommendations for sending money overseas quickly.

Revolut

Revolut is a financial ecosystem that provides numerous financial services that also include international money transfers. Many transfers with Revolut can finish within seconds, and the rest can take up to 2-5 business days.

Panda Remit

Panda Remit is a fintech company that has been expanding internationally at a fast pace. Many of their money transfers finish instantly within minutes, and the rest within a few business days.

XE Money Transfer

As a veteran in the international money transfer and currency exchange space, XE specializes in fast money transfer. XE transfers to many countries can finish within minutes, or within 1-4 business days.

MoneyGram

MoneyGram is a household name when it comes to international money transfers and needs no introduction. When it comes to speed, MoneyGram can move your money rapidly with the below speeds:

- Bank transfers can finish within 1 hour to 1 business day.

- Cash pickup transfers are available within minutes.

Instarem

Instarem is a Singapore based fintech startup that has been getting stronger and bigger over the last few years, and is becoming a global brand. Many Instarem money transfers are instant; others will finish within 1-4 business days.

Remitly

Remitly is a well-known and established money transfer company that can help you send money overseas fast. Their Express service can help money your money overseas within minutes; however, you will have to pay a fee for express Remitly transfers.

If you do not want to pay the fee for Express transfers, you can go with Remitly's Economy service and your money will reach overseas within 3-5 business days.

Wise (formerly TransferWise)

Wise is a global brand that also helps move money overseas rapidly. Many Wise transfers can finish within minutes. When Wise is unable to move your funds overseas instantly, it will take a few business days for your transaction to complete.

WorldRemit

WorldRemit is another popular and established global money transfer company. International money transfers sent with WorldRemit can finish instantly or within 1-2 business days.

Atlantic Money

Atlantic Money is a new fintech startup that wants to revolutionize international money transfers by providing cheap and fast remittances. Like Remitly, Atlantic Money also has an Express Delivery whereby your money will move overseas either instantly or within 24 hours. You do have to pay a fee for Atlantic Money's Express Delivery service though.

Standard Delivery is free, but if you choose this option, Atlantic Money will move your money abroad within 2-4 business days.

Paysend

Paysend specializes in card transfers by tapping into the global network of 12 billion Visa, Mastercard or UnionPay cards across the world. As a result, 70% of Paysend money transfers finish in 20 seconds or less, and the rest complete within 3 business days.

This rounds off our list of the faster money transfer companies you can use to send money overseas quickly.

There are many other factors to consider if you want to make the most of your international money transfers, but if speed is an important factor, we recommend looking at the above companies.

Conclusion

How long does an international money transfer take? Depending on the provider and your location, it can take anywhere from a few minutes to a few days.

Additionally, same-day international money transfers are possible in many cases. If you need to send or receive money quickly, be sure to compare money transfer providers and check their money transfer options.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

Categories

Similar Articles

US Big Beautiful Bill's Impact On Remittances

The Big Beautiful Bill has been passed in the US, and remittances are impacted. Learn how the Bill impacts remittances and what to do if you are affected by the new law.

Bangladesh Remittance Cash Incentive: All You Need To Know

Are you an overseas Bangladeshi resident who sends money home to your loved ones? Read on to learn how to earn an additional 2.5% cash on your international remittances sent to Bangladesh.

How Fintech Is Pushing Banks Out Of The Remittance Business

The fintech revolution is disrupting the international remittance business. Discover how innovative startups are reshaping the international money transfer industry and challenging traditional banks.