Atlantic Money Detailed ReviewRates, Fees, Limits, Safety and More

Last updated: November 23, 2022

What is Atlantic Money? An introduction

Atlantic Money company information

Atlantic Money was founded in 2021 by Robinhood's early employees, Patrick Kavanagh and Neeraj Baid, and is authorized and regulated as a payment institution by the Financial Conduct Authority (FCA) in the UK and by the National Bank of Belgium (NBB) in the EU.

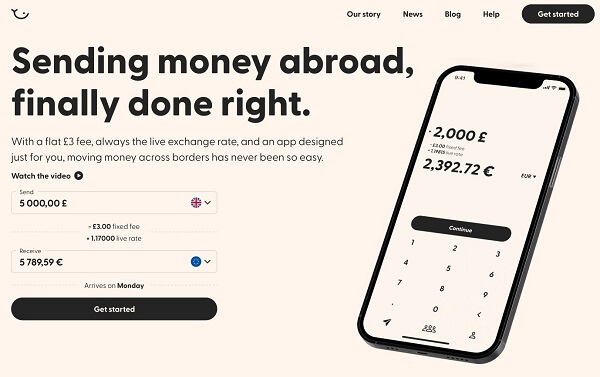

The key differentiator that sets Atlantic Money apart from the competition is the fact that it offers international transactions for a fixed flat fee of GBP 3 or EUR 3 and at the current exchange rate. The current exchange rate is also called the mid-market exchange rate, or the interbank exchange rate, and is a better rate than most retail exchange rates.

Additionally, you can send all the way up to GBP 1,000,000 or EUR 100,000 with Atlantic Money. The company is, thus, built to help people transfer money globally at a market-leading price with extremely low fees.

Compared to other money transfer providers like Wise, Revolut, PayPal and other services, customers can save up to 99% with Atlantic Money when sending money abroad – especially with larger transactions. This makes Atlantic Money the most cost-effective international money transfer service in the world for transfers above GBP 1000 or EUR 1000.

Atlantic Money has raised USD 7.5 million in seed funding, and their globally recognized investors include Ribbit, Index Ventures, Kleiner Parkins, Harry Stebbings, Elefund, Amplo, Susa, Day One & the founders of Robinhood.

Atlantic Money is a new fintech startup that allows you to send money overseas at a fixed flat fee of GBP 3 or EUR 3.

Atlantic Money facts and figures

Below is a summary of key facts and figures about Atlantic Money:

- Founders: Patrick Kavanagh, Neeraj Baid

- Headquarter: London

- Founded: 2021

- Funding: USD 7.5 million seed funding

- Countries: Transfer money to over 30 different countries

- Currencies: Exchange money into 9 different currencies: GBP, EUR, USD, CAD, AUD, PLN, SEK, NOK, and DKK

- Fees: Costs to transfer money are always only GBP 3 or EUR 3

- Limits: Transfer up to GBP 1,000,000 or EUR 100,000

- Speed: Pick between Standard delivery time (2 working days and more depending on the currency pair) and Express transfers (next day)

What services does Atlantic Money provide?

Atlantic Money provides international money transfers for a fixed flat fee at the current exchange rates. This makes it one of the cheapest services for international transfers above GBP 1000 or EUR 1000.

Many money transfer services charge their customers variable costs that change based on the amount sent. Means, the more you send, the more you pay. In that sense, Atlantic Money charges really low fixed fees that do not change with the transfer amount.

With the Atlantic Money account, you can send their transfers via their simple and easy to use iOS mobile app. Their Android app and the web app will follow soon.

The only thing you have to do as an Atlantic Money user after you have initiated the money transfer successfully in the app: Transfer your funds via bank transfer to the recommended bank details. Atlantic Money will do the rest, and your money will get to the recipient rather quickly.

Which countries does Atlantic Money operate in?

As a relatively young money transfer company, Atlantic Money is still in the early stages of global corridor support. At this time, they primarily support UK and other European countries. That said, Atlantic Money team has global ambitions and will likely continue adding support for additional countries.

Where can I send money from with Atlantic Money?

You can send money from 23 European countries with Atlantic Money; these are listed below:

- Austria

- Belgium

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- France

- Germany

- Greece

- Hungary

- Latvia

- Liechtenstein

- Lithuania

- Luxembourg

- Netherlands

- Norway

- Portugal

- Romania

- Slovakia

- Slovenia

- Sweden

- United Kingdom

Currently, Atlantic Money transfers can be sent in British Pounds (GBP) and Euros (EUR).

Where can I send money to with Atlantic Money?

On the receiving end, you can send money to overseas recipients in about 34 countries across Europe, North America and Australia.

The currencies that your receiver can get the funds you send to them via Atlantic Money include Euros (EUR), British Pounds (GBP), US Dollars (USD), Canadian Dollars (CAD), Australian Dollars (AUD), Norwegian Krones (NOK), Swedish Kronas (SEK), Polish Zlotys (PLN) and Danish Krone (DKK).

This results in Atlantic Money's corridor coverage to be around 780 country combinations, and 18 currency combinations.

With Atlantic Money, you can send money between 780 country combinations and in 9 global currencies.

Atlantic Money plans to keep adding more countries and currencies on their platform. Check back regularly in case your country or currency is not yet supported; chances are that it will be in the future.

What are Atlantic Money's fees and exchange rates?

Atlantic Money's exchange rate is very close to the live market rate and shows on the website or in the app. In this way, you get a very high rate which is not too far off the interbank exchange rate.

But let's put Atlantic Money's exchange rates to the test by doing some case studies to see if their rates are really good or not.

Below, we will check Atlantic Money's exchange rates for sending 1000 units of currency for some popular country/currency combinations. We will also do some helpful calculations that will aid in doing clear comparisons and validate if Atlantic Money's exchange rates are good.

| Country Pair | Transfer Amount | Exchange Rate* | Fees* | Payout | Mid-Market Rate** | FX Markup |

|---|---|---|---|---|---|---|

| UK to Australia | GBP 1,000 | 1 GBP = 1.7879 AUD | GBP 3.0 | 1,782.54 AUD | 1 GBP = 1.7906 AUD | 0.45% |

| UK to US | GBP 1,000 | 1 GBP = 1.2065 USD | GBP 3.0 | 1,202.88 USD | 1 GBP = 1.2066 USD | 0.31% |

| UK to Canada | GBP 1,000 | 1 GBP = 1.6074 CAD | GBP 3.0 | 1,602.58 CAD | 1 GBP = 1.6108 CAD | 0.51% |

| UK to Germany | GBP 1,000 | 1 GBP = 1.1596 EUR | GBP 3.0 | 1,156.12 EUR | 1 GBP = 1.1599 EUR | 0.33% |

| France to UK | EUR 1,000 | 1 EUR = 0.8667 GBP | EUR 3.0 | 864.10 GBP | 1 EUR = 0.8678 GBP | 0.43% |

| Germany to Poland | EUR 1,000 | 1 EUR = 4.7013 PLN | EUR 3.0 | 4,687.20 PLN | 1 EUR = 4.7018 PLN | 0.31% |

*Exchange rates and fees as on November 23, 2022

**Mid-Market Rate from XE.com

See how we calculate FX Markup

You can use the live exchange rate calculator on Atlantic Money's website at any time to get a real time quote. Simply choose the source and destination currencies, and enter your amount to see much your recipient will receive overseas for the intended money transfer.

When it comes to fees, Atlantic Money's currency transfers cost a flat fixed fee of GBP 3 or EUR 3 per transfer. If you want to use express delivery, you will have to pay a little extra fee of 0.05%.

Atlantic Money's exchange rates tend to be very competitive. Transfer fees are fixed at a low amount of GBP 3 or EUR 3.

Are Atlantic Money exchange rates good?

Atlantic Money uses an exchange rate that is close to the mid-market exchange rate for their money transfers – much like Wise or Revolut. In that sense, their exchange rates are highly competitive, and you will get a good payout for your overseas recipient.

Based on our case studies above, we see that Atlantic Money charges an FX Markup between 0.31% and 0.51%. This is a pretty competitive exchange rate that makes your hard earned money go father.

It is, nevertheless, always useful to do additional due diligence before you send your next international money transfer. We always recommend that you compare money transfer companies to make sure that you are getting the best rates and deals on your international remittances.

A very easy and convenient way to do this is by relying on RemitFinder's real time money transfer comparison engine to easily compare various remittance service providers.

Is Atlantic Money a cheap way to send money overseas?

Atlantic Money charges a fairly low, fixed transfer fee of GBP 3 or EUR 3. Even though this is very low, it is nevertheless not 0.

But once we put Atlantic Money's low transfer fees and highly competitive exchange rates together, it is clear to see that Atlantic Money is a cheap way to send money abroad.

To see how the fixed transfer fee starts to pale into insignificance as the transfer amount increases, let us look at the simple comparison below where we simulate sending various amounts of money for a UK to Australia money transfer with Atlantic Money.

| Transfer Amount | Exchange Rate*** | Fees*** | Payout | FX Markup |

|---|---|---|---|---|

| GBP 100 | 1 GBP = 1.7879 AUD | GBP 3.0 | 173.43 AUD | 3.15% |

| GBP 1,000 | 1 GBP = 1.7879 AUD | GBP 3.0 | 1,782.54 AUD | 0.45% |

| GBP 3,000 | 1 GBP = 1.7879 AUD | GBP 3.0 | 5,358.34 AUD | 0.25% |

| GBP 5,000 | 1 GBP = 1.7879 AUD | GBP 3.0 | 8,934.14 AUD | 0.21% |

| GBP 10,000 | 1 GBP = 1.7879 AUD | GBP 3.0 | 17,873.64 AUD | 0.18% |

***Exchange rates and fees as on November 23, 2022

See how we calculate FX Markup

As you can see from the above calculations, if you send only GBP 100 with Atlantic Money, you end up paying an FX Markup of 3.15%. As you continue to send a larger transfer amount, the FX Markup continues to drop. In fact, it will keep going down more and more as the transfer amount increases.

Essentially, what this means is that the fixed transfer fee charged by Atlantic Money starts to become insignificant once you send higher amounts. In our assessment, 1,000 units of currency is the sweet spot where you start to really gain a lot on your Atlantic Money international remittance.

Atlantic Money offers very cost effective international money transfers for transfer amounts above GBP 1,000 or EUR 1,000.

How do I avoid Atlantic Money fees?

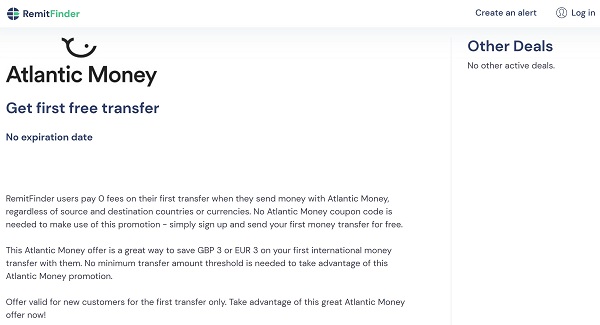

Atlantic Money and RemitFinder have teamed up to bring you an attractive discount whereby you pay 0 transfer fees on your first money transfer with Atlantic Money. Take advantage of this Atlantic Money offer to save GBP 3 or EUR 3 on your first international money transfer.

After your first transfer, you will have to pay the fixed GBP 3 or EUR 3 transfer fee on your subsequent money transfers.

How much money can I send with Atlantic Money?

Atlantic Money has pretty high transfer limits in place. This gives you the flexibility to send larger amounts in a single transaction with them.

However, when you sign up with Atlantic Money, you start with smaller limits which can then be increased as you submit more documentation. Below the various membership levels and associated limits.

Starter Limits

When you sign up with Atlantic Money, you are automatically assigned the Starter tier. The limits for this membership level are as below:

- UK transfers: GBP 850 per 30 days, and GBP 2,500 per 180 days on a rolling period basis

- EU transfers: EUR 850 per 30 days, and EUR 2,500 per 180 days on a rolling period basis

Plus Limits

If you submit a selfie and answer some questions about yourself and your account, Atlantic Money will elevate your account to the Plus level. At this point, the following limits apply:

- UK transfers: GBP 15,000 per 30 days, and GBP 50,000 per 180 days on a rolling period basis

- EU transfers: EUR 15,000 per 30 days, and EUR 50,000 per 180 days on a rolling period basis

Advanced Limits

To further increase your transfer limits, you need to tell Atlantic Money about the reason for your transaction as well as submit additional documentation. Once you do this, your account is elevated to an Advanced level, and the below limits apply:

- UK transfers: GBP 1,000,000 per transaction

- EU transfers: EUR 100,000 per transaction

You can send up to GBP 1,000,000 or EUR 100,000 with Atlantic Money once you submit all KYC and compliance documentation.

Receiving Limits

There are also some receiving limits in place when you send money with Atlantic Money. These vary by destinations, and are listed below:

- Australian Dollar (AUD): No limits

- British Pound (GBP): No limits

- Canadian Dollar (CAD): CAD 100,000 per transfer

- Danish Krone (DKK): DKK 500,000 per transfer

- Euro (EUR): No limits

- Norwegian Krone (NOK): No limits

- Polish Zloty (PLN): PLN 1,000,000 per transfer

- Swedish Krona (SEK): No limits

- US Dollar (USD): USD 1,000,000 per transfer

These are pretty high limits, but it is nevertheless good to be aware of these in case you plan to send higher amounts.

How long does it take for Atlantic Money to send money overseas?

Atlantic Money has 2 transfer speeds called Express and Standard. As the names suggest, Express Delivery is faster but also involves an additional fee of 0.05% of the transfer amount.

Please see below for more details about Atlantic Money's delivery speeds.

Express Delivery

Express Delivery is the faster of the 2 available delivery speeds. This is because if you choose Express Delivery speed, Atlantic Money will not wait for currency conversion and will transfer the funds over to your recipient right away.

Express Delivery speeds depend on the destination currencies and are as below:

- Australian Dollar (AUD): 2 business days

- British Pound (GBP): Instant, 24/7

- Canadian Dollar (CAD): 1 business day

- Danish Krone (DKK): 1 business day

- Euro (EUR): Instant, 24/7

- Norwegian Krone (NOK): 1 business day

- Polish Zloty (PLN): 1 business day

- Swedish Krona (SEK): 1 business day

- US Dollar (USD): 1 business day

Note that if Express Delivery is available, and you choose to go with it, you will have to pay an additional fee of 0.05% of the transfer amount.

Standard Delivery

If you choose the Standard Delivery option to send money with Atlantic Money, their system will first do the currency conversion and then send the funds overseas.

Currency conversion settlement generally takes 2 business days. Given this, Atlantic Money's Standard Delivery speeds are as below:

- Australian Dollar (AUD): 4 business days

- British Pound (GBP): 2 business days

- Canadian Dollar (CAD): 3 business day

- Danish Krone (DKK): 3 business day

- Euro (EUR): 2 business days

- Norwegian Krone (NOK): 3 business day

- Polish Zloty (PLN): 3 business day

- Swedish Krona (SEK): 3 business day

- US Dollar (USD): 3 business day

Unlike Express Delivery, there is no additional fee for Standard Delivery.

You can choose between Standard and Express Delivery options with Atlantic Money. Standard Delivery adds 2 business days but is free of cost.

Also, be aware that bank holidays or processing cut off times may add additional time delay to your money transfer. This is because Atlantic Money moves your funds from bank to bank, and is, therefore, dependent on banks being able to process and settle the transfer.

How can I avoid processing delays when sending money with Atlantic Money?

Follow the below best practices and guidelines to eliminate any potential delays to your money transfers with Atlantic Money:

- Avoid weekend transfers: If you send money with Atlantic Money over the weekend, your transfer will begin processing on Monday. Hence, try to send over the weekdays to avoid delays. The only exception to this is when you choose Express Delivery, and the destination currency supports Instant transfers (like GBP and EUR).

- Plan for holidays: If you want to avoid delays in your transfer process, keep an eye on national and bank holidays. Avoid sending when banks are non-operational so your funds can settle without delays.

- Avoid processing cut-off times: Try to send your money before 8:30 PM on a weekday so Atlantic Money can start processing your transaction on the same day. If you send money after the cut-off time of 8:30 PM, your transfer will be picked up on the next business day.

- Provide all needed documentation: Atlantic Money has to review every single transaction for security and compliance reasons. To avoid delays, provide all necessary KYC and other documentation. If your documentation is incomplete, your transfer may get delayed, and you may need to provide the missing documentation first.

How can I pay for my Atlantic Money money transfer?

The first thing you will need to do after you start a new money transfer with Atlantic Money would be to fund your money transfer by sending money to Atlantic Money's account. The mechanism to do so is called a payment method, or a payment option.

Atlantic Money supports a single payment method, and that is a bank transfer.

This means you will need to send your money to Atlantic Money's bank account to pay for your money transfer with them. When you start a new transaction, you will be provided with instructions on how to send the money to Atlantic Money's bank account.

Atlantic Money supports a direct bank transfer as the supported payment method to fund your money transfer with them.

Tips for sending money to Atlantic Money

There are some conditions that need to be satisfied for Atlantic Money to be able to receive your funds successfully. These are listed below; failure to follow these guidelines may result in failed transfers.

- Only bank transfers are accepted: You must send money to Atlantic Money's bank account via a direct bank transfer from your account. Do not send wire transfers via SWIFT or other means as the funds will be returned as well.

- Only UK and EU banks allowed: Make sure to send money from your bank account in the UK or EU, else Atlantic Money will reject your transfer and your funds will be returned. Money sent from accounts located elsewhere will not be accepted.

- Name should match exactly: Your name on your bank account and your Atlantic Money account must match, else your funds will not be accepted. If there are valid reasons for a name mismatch, you can contact the Atlantic Money customer support team to work around this.

- Amount must match exactly: You must transfer the exact amount of your money transfer to Atlantic Money's bank account, down to the pennies. Even if the amounts mismatch by the 2nd decimal place, your funds will be returned.

- Only one active transfer allowed: You must have only one active money transfer in progress when you send money to Atlantic Money. If you wish to start another transaction, make sure to either complete or cancel your in-flight transfer first.

- Only active transfers can be paid for: You must not send money to Atlantic Money when you do not have an active money transfer in progress, else your funds will be returned. Atlantic Money will tell you when to send funds; simply follow their prompts to send money and your funds will be accepted.

Pay attention to these rules and guidelines to ensure that your funds are successfully accepted by Atlantic Money and there are no delays in the overall money transfer process.

How can my recipient get paid with Atlantic Money?

In the context of international money transfers, the method in which you choose to pay your overseas recipient is called a delivery method (or delivery option). Some popular delivery methods include bank deposit, mobile wallet credit, card transfer, airtime top-up and cash pickup.

Atlantic Money supports direct bank deposit as their preferred and only delivery method.

You cannot pay your overseas recipient in any other way except a bank deposit. In case your overseas receiver does not have a bank account and wants to access the funds via cash pickup or a card payment, you may have to look for other options.

Atlantic Money lets you pay your overseas recipient via a direct bank deposit.

Are there any Atlantic Money coupon codes or promotions I can use?

Atlantic Money is offering RemitFinder customers with a first free transfer after they sign up. Take advantage of this great Atlantic Money promotion to save on your first money transfer with them.

Simply sign up with Atlantic Money as a RemitFinder user, and your first transfer will be automatically free. No coupon code or minimum transfer amount is needed to qualify.

Below is a screenshot of the aforementioned Atlantic Money deal on RemitFinder.

Atlantic Money promotion - RemitFinder users get first free money transfer

Using this promotion, you can save GBP 3 or EUR 3 on your first money transfer with Atlantic Money. Take advantage and save on your next money transfer!

We will keep this page updated with any future Atlantic Money deals and promotions, so be sure to check back periodically. To avoid checking manually, you can also register for our daily exchange rate alert. It's totally free, and a great way to stay updated with the latest exchange rates and deals from many money transfer companies.

How can I find Atlantic Money near me?

Atlantic Money is an online only money transfer company. They do not have any physical locations, branches or agent offices that you can go to for sending or receiving money.

Currently, Atlantic Money is available via their iOS mobile app.

In the future, they plan to launch their Android app as well as support money transfers via their website.

Is Atlantic Money a safe way to send money abroad?

As a licensed money transfer operator authorized and regulated by the Financial Conduct Authority (FCA), Atlantic Money has to comply with strict rules and regulations to keep your funds and private information safe at all times.

Below are some security measures that Atlantic Money has in place to ensure that neither your money nor your confidential information are at risk at any time.

- Implementing KYC guidelines: Atlantic Money implements Know Your Customer (KYC) guidelines to ensure that your identity is established and proven before you can send money with them. This works in your favor by ensuring that you are acting on your behalf, and not someone else. As part of KYC documentation, you will need to submit government issued photo ID, selfie and other related documentation.

- Providing account levels/tiers: When you sign up with Atlantic Money, you are placed in a Starter tier with very low sending limits. As you provide more documentation and information about yourself, your funds and the reasons for your transfer, your account gets elevated to Plus and Advanced levels. This ensures a safe environment whereby you slowly graduate to higher levels of membership based on proving your identity and income by providing Atlantic Money with the requisite documentation.

- Safeguarding your money: Atlantic Money keeps the money you send to them in accounts that are separate from their own funds. This technique is a financial services industry best practice and is called safeguarding. This way, even if Atlantic Money becomes insolvent, your money is safe as it is held in a safeguarded account and could thus be returned back to you.

- Only accepting direct bank transfers as payments: Atlantic Money only accepts incoming payments from you for an active transfer via a direct bank account transfer from your bank account within the UK or EU. Plus, if your name or the transfer amount does not match exactly, your money is not accepted. This minimizes any risk or fraud.

- Ensuring secure access to data and information: Atlantic Money implements bank grade security and enforces strict controls on access to bank accounts and confidential information. This ensures that financial and private information is not easily accessible to those who do not need to know it.

- Regulating banking and payment partners: Any system is as strong or weak as all of its constituents. To ensure your safety, Atlantic Money ensures that all of their payment, banking and other partners are fully secure, regulated and comply with the needed security standards.

- Keeping records and doing financial audits: Atlantic Money maintains secure records of every transaction that happens on their system, and regularly conducts independent financial audits on their systems and processes.

In addition to implementing the above security measures, Atlantic Money also maintains a minimum amount of funds and capital on their balance sheet as part of compliance with regulatory requirements.

Can I trust Atlantic Money?

An important aspect of being able to trust a money transfer company is to see if they are regulated by major financial regulatory watchdog organizations.

In the case of Atlantic Money, they are authorized and regulated by internationally recognized financial regulators in every region they operate in. We provide pertinent information below.

- For their UK operations, Atlantic Money Limited is a Financial Conduct Authority (FCA) regulated payment institution. Their company registration number with the FCA is FRN: 947491.

- For their European operations, Atlantic Money NV is a National Bank of Belgium (NBB) authorized payment institution. Their unique identification number with the NBB is 0783.476.423.

To be able to keep their licensing current and active with these global financial institutions, Atlantic Money has to implement strict security controls. This is great news for you as you can be confident that they are doing everything possible to protect you and your money.

Given Atlantic Money's registration with global financial regulators as well as their adoption and enforcement of numerous security practices, your money and information should be safe with them at all times.

Atlantic Money takes the security and safety of your funds as well as private information very seriously, and you can trust them.

How good is Atlantic Money's service?

Atlantic Money currently only has an iOS mobile app which seems to be designed well keeping good usability in mind. That said, a good way to find out if Atlantic Money provides a good experience or not is by looking at what other customers like you think about their service.

What do users have to say about Atlantic Money?

Let us check what other customers have to say about Atlantic Money on some popular rating and review platforms^.

- Atlantic Money's iOS app is rated 4.5/5.0 on the Apple App Store with about 21 ratings

- Atlantic Money is rated 3.2/5.0 on Trustpilot with only 1 review so far

^Ratings on various platforms as on October 28, 2022

The lack of many reviews is not surprising given the fact that Atlantic Money is still a very young company. Since they do not have an Android app yet, so there is information on the Google Play Store.

At this time, the most trustworthy data is from the App Store, based on which it seems like customers are happy using Atlantic Money's iOS app to send money overseas.

Atlantic Money is still a young company. Initial reviews on the Apple App Store seem to indicate customers like their service.

Is Atlantic Money the best choice for me?

Based on our in-depth analysis of Atlantic Money's international remittance service on various spectrums, we notice their strengths in several areas. Below, we list some advantages you can expect if you use their money transfer service.

- Very competitive exchange rates: Atlantic Money will give you a really good exchange rate on your money transfer with them. Their rates are very close to the interbank exchange rate. This makes Atlantic Money a great choice to send money overseas as your money will generate a higher payout for your overseas recipient.

- Low, fixed transfer fees: Atlantic Money's low, fixed money transfer fees set them apart from many companies that charge fees that are a percentage of the transfer amount. Unlike such companies, Atlantic Money does not increase the transfer fee as the amount increases. You always pay a fixed fee of GBP 3 or EUR 3 whether you send in the hundreds, thousands or millions.

- High transfer limits: Atlantic Money lets you send very high amounts per transfer once you provide full KYC and related documentation. With their highest membership level, you can send up to GBP 1,000,000 or EUR 100,000 in a single transaction. There may be receiving limits in place as well, so make sure to check those too.

- Easy to use mobile app: Atlantic Money has an iOS app which customers seem to like based on their ratings and reviews. Atlantic Money is still a fairly new company, so you should keep an eye on reviews, but the initial feedback from customers is certainly very positive.

- Major focus on security: Atlantic Money seems to take the security of your money as well as private information very seriously. They implement numerous security measures to ensure that your funds and information are safe with them.

- Complete transparency: Atlantic Money maintains complete transparency about their exchange rates, transfer fees, sending limits, membership levels and various other aspects of their money transfer services. This is great as you always know what you are dealing with, and there are no hidden fees or surprises.

RemitFinder likes Atlantic Money for providing high exchange rates, low, fixed fees, high sending limits and having a strong focus on security.

What are the best reasons to use Atlantic Money?

Based on our detailed inspection of Atlantic Money's remittance services, and the above listed strengths of their product, they are a good fit for many international money transfer scenarios. Below we provide some examples where you may find Atlantic Money a great partner to send money overseas with.

- If you need to send large amounts of money overseas, Atlantic Money is a great way to achieve that. Once you graduate your account to the Advanced level, you can send up to GBP 1,000,000 or EUR 100,000 per transaction. This eliminates the need to send higher amounts in many smaller transactions with other companies that only allow sending smaller amounts.

- Atlantic Money provides exchange rates that are pretty close to the interbank exchange rates. This makes that you get more return on your international money transfers with them. When sending money overseas, you naturally want to put maximum money in your recipient's pocket, and Atlantic Money's high exchange rates let you do just that.

- You will save a lot on transfer fees with Atlantic Money due to their fixed fee of GBP 3 or EUR 3. This becomes very important when you send higher amounts. Whilst paying a GBP 3 fee on a GBP 100 transfer does not feel cost effective, but the same fixed GBP 3 fee on a GBP 10,000 or GBP 100,000 transfer is very cheap, almost free once you calculate the fee as a percentage.

- If you want to do an international bank to bank transfer, Atlantic Money is the way to go given their low fees and high exchange rates. Once you compare that with banks that charge very high wire transfer fees and provide low exchange rates, you will see that the advantages to use Atlantic Money for bank to bank transfers internationally are glaringly obvious.

- Atlantic Money takes the security of their customers' money and confidential information very seriously. If you want to ensure you have peace of mind and can trust a money transfer company, Atlantic Money can certainly be a good choice. They are also authorized and regulated by the UK's FCA so you can rest assured that you are dealing with a safe money transfer operator.

Atlantic Money is a very good fit with many international money transfer scenarios given the many strengths of their service.

What type of transfers can I make with Atlantic Money?

Atlantic Money offers two options to send money overseas to its customers - the standard transfer and the express transfer.

While standard transfers take at least two working days to process, the express service delivers the payment in up to one day – depending on the currency pair. The service is currently available via the iOS app.

What are various ways to send money with Atlantic Money?

There are a few easy to use and convenient ways using which you can send money overseas with Atlantic Money. Depending on your needs, you can use any of the following options to send money with Atlantic Money.

- Online via Atlantic Money's website

- Using the Atlantic Money mobile app - Currently, Atlantic Money has an iOS app available for download; the Android app will be launched in the near future.

How to send and receive money with Atlantic Money?

Transferring money with Atlantic Money is unbelievably easy and takes less than 2 minutes or so. In the following section, we provide the exact steps you need to undertake to send money with Atlantic Money.

Step by step guide to send money with Atlantic Money

Below is a simple step by step guide that will allow you to send money with Atlantic Money within just a few minutes.

- Step 1: Determine if Atlantic Money is your best choice. With so many money transfer companies available, your first step is to decide if you want to send money with Atlantic Money. A quick, simple and easy way to do this is by comparing various money transfer companies using RemitFinder's online money transfer comparison platform. Using this, you can easily compare money transfer operators side by side, and decide who to go with for your next money transfer.

- Step 2: Download the Atlantic Money app. Download the Atlantic Money app on your iPhone or iPad from the Apple App Store. Note that the Android app is not available yet and will be launched in the future.

- Step 3: Sign up for an account. Sign up for a new Atlantic Money account, and provide the necessary information requested so that your identity can be checked by the system.

- Step 4: Add a recipient. Add a new beneficiary to send money to. For repeat transfers, you can simply choose one of your saved recipients. Then select one of the currencies to send money in.

- Step 5: Start the transfer. Follow the in-app instructions to start your money transfer. The small fixed fee of GBP 3 or EUR 3 is part of the transaction. If questions arise you can contact customer service via app or email.

From this point on, sit back and relax as Atlantic Money will take care of the rest. It takes Atlantic Money at least two working days to deliver your credit if you chose the standard transfer. If you want to convert your money quicker, select the offered express transfer in the app.

Important Note: Atlantic Money only accepts local bank transfers. Do not use wire transfers (SWIFT, CHAPS, etc.). Ensure you send the payment to your own name, as the bank transfer recipient. This is to verify the payee details. If you transmit your money straight to 'Atlantic Money' directly, your bank will not be able to verify the payee details.

It is quick and easy to send money with Atlantic Money using their mobile app.

How can Atlantic Money help me send money?

The best resource to help you send money with Atlantic Money is their detailed guide to send money.

In addition to that, you can also check out their support site which has many useful sections and help documents to get you started. You can also type in a question or phrase at the top and the support site will present relevant answers.

Do I need an Atlantic Money account to receive money?

If you are receiving money sent by someone to you via Atlantic Money, you do not need an Atlantic Money account to access the funds sent to you.

This is because Atlantic Money supports a bank deposit delivery method, and the funds will, therefore, be directly deposited into the recipient's bank account overseas.

You do not need an Atlantic Money account to receive money since the funds will be deposited into your bank account.

Does Atlantic Money have a mobile app?

Yes, Atlantic Money does have a mobile app. Currently, Atlantic Money only has the iOS mobile app available for download from the Apple App Store.

Even though Atlantic Money is still a young company, initial feedback from remitters like you seems to indicate that customers like their iOS app to send money internationally.

Atlantic Money is working on launching their Android app as well as money transfers from their website for the upcoming future.

How do I track my Atlantic Money transfer?

You can easily see the latest status of your Atlantic Money transaction at any time using the mobile app.

Simply login into your mobile app and go to the Profile section. Then click on Transfer history, and you will see all your transfers listed. Simply click on the transfer you want to check the status of, and the app will show you the latest status.

Atlantic Money will also keep you updated as your transfer progresses to next steps.

Can I use Atlantic Money for international bank transfers?

Yes, you can absolutely use Atlantic Money for bank transfers. In fact, Atlantic Money currently only supports a bank transfer as a payment method to send money to them, and a bank deposit as the delivery method to pay your overseas recipient.

By using bank accounts on both the sending and receiving side of the money transfer, you essentially simulate an international bank to bank transfer using Atlantic Money.

Sending money with Atlantic Money is a great choice compared to traditional bank to bank transfers as banks tend to charge very high fees and provide very low exchange rates. With Atlantic Money, you get an exchange rate close to the interbank exchange rate, and pay low, fixed fee of GBP 3 or EUR 3 (which is waived for your first transfer).

Atlantic Money helps you send international bank to bank transfers with great exchange rates and very low fees.

Is Atlantic Money online better than sending money in-person in stores?

In today's digital economy, everyone prefers online access for various things, including financial services. Atlantic Money is, in fact, only available online via their mobile app.

You can use Atlantic Money's mobile app 24x7 from the convenience of your home or office. There is no need to go to stores or stand in lines at offices or agent locations.

Does Atlantic Money have a rewards program?

Atlantic Money does not currently have a rewards program.

There is, however, a referral program available whereby you can get a free money transfer for every friend you refer that signs up and makes at least 1 money transfer with Atlantic Money. This will help you save GBP 3 or EUR 3 on your next money transfer with Atlantic Money.

What customer support options are available with Atlantic Money?

If you need to get in touch with Atlantic Money's customer support team, there are 2 ways to do so. These are as below:

- From within the mobile app: You can use the chat feature in the Atlantic Money mobile app to get in touch with someone.

- Email: If you wish to reach out to Atlantic Money team via email, you can write to them at support@atlantic.money.

Before you decide to contact Atlantic Money's customer support team, make sure to check the helpful documentation on their website. There are detailed guides available on various topics, and it is possible that your question may be already answered there.

Can I cancel my Atlantic Money transfer?

Atlantic Money transfers can only be canceled if you have still not paid for your transaction by sending funds to Atlantic Money's bank account. In such cases where your transfer is still unpaid, you can simply cancel your pending transfer from the transfer details screen.

If you have already sent funds over to Atlantic Money, you cannot cancel your transfer as Atlantic Money starts processing your transaction as soon as they receive your funds.

How do I delete my Atlantic Money account?

If you wish to delete your Atlantic Money account, you can reach out to their customer support team, and someone will assist you with your request.

Note that you will lose access to your transfer history after your Atlantic Money is closed, so make sure to make a copy of your old transfers in case you may need to refer to them in the future.

Additional Information

Legal and Regulatory Compliance

Atlantic Money is authorized and regulated by global financial institutions in all major regions they operate in. Below is more information about their licenses with major financial regulatory institutions.

- United Kingdom (UK): Atlantic Money Limited is authorized and regulated by the Financial Conduct Authority (FCA) as a payment institution with FRN number 947491.

- European Economic Area (EEA): Atlantic Money NV is authorized and regulated by the National Bank of Belgium (NBB) as a payment institution with unique identification number 0783.476.423.

Helpful Links

- Atlantic Money's EU launch announcement

Awards, Prizes and News

- Atlantic Money's newsroom with all the latest news

- Atlantic Money emerges from stealth mode

Deals

Reviews

I used Atlantic for a transfer of £3,500 to the US and found it incredible smooth and cheap. Loved the fixed rate. Thanks for the recommendation RemitFinder!

Atlantic Money is the new kid on the block but therefore even more powerful. Being the only provider who offers a flat fixed fee of only 3 gbp or eur for all transfers (I haven't seen a similar offer) Atlantic is especially useful for transfers above >1000 gbp, eur, usd etc. Speed wise they take a bit longer than other providers, but that's not really my concern as they save me hundreds per transfer.