Bangladesh Remittance Cash Incentive: All You Need To Know

Table of Contents

- What Is The Bangladesh Remittance Cash Incentive Program?

- How Does The Bangladesh Remittance Cash Incentive Program Work?

- Who Can Take Advantage Of The Bangladesh Remittance Cash Incentive Program?

- What Types Of Remittances Qualify For The Bangladesh Remittance Cash Incentive Program?

- What Type Of Delivery Options Are Eligible For The Bangladesh Remittance Cash Incentive?

- Are There Any Requirements To Claim The Bangladesh Remittance Cash Incentive?

- Who Pays Out The Bangladesh Remittance Cash Incentive?

- Is There A Limit To Cash Incentives For Inward Remittances To Bangladesh?

- Has The Bangladesh Remittance Cash Incentive Program Helped Boost Incoming Remittances?

- How Can I Take Advantage Of Remittance Cash Incentive?

- Conclusion

Are you a Bangladeshi expat living overseas who sends money home to your loved ones back in Bangladesh? If so, you need to ensure you are taking advantage of the Remittance Cash Incentive Program offered by the Government of Bangladesh.

For a limited time, the Bangladeshi Government is offering a 2.5% cash incentive on qualifying international remittances sent to the country from overseas.

In this article, we will delve deeper into this attractive program created by the Bangladeshi Government, covering various aspects like eligibility, procedures, guidelines and other related sub-topics.

Interested to earn more on your international money transfers to Bangladesh and help your country's economy at the same time? Read on!

What Is The Bangladesh Remittance Cash Incentive Program?

The Bangladesh Remittance Cash Incentive Program is an initiative launched by the Government of Bangladesh to encourage overseas Bangladeshi residents to send more remittances back into the country.

Currently, qualifying remittance sent from abroad are eligible to earn an additional 2.5% cash incentive paid out to the recipient by the receiving bank. This is a huge advantage as this additional cash maximizes the power of your hard-earned money by putting more funds in your recipient's pocket.

Overseas remittances sent to Bangladesh by Bangladeshi residents living abroad are eligible to earn an additional 2.5% cash incentive.

This means that if you send USD 1000 to your family or friends in Bangladesh, your recipient will receive an additional amount calculated as below:

- Sending amount: USD 1000

- Receiving amount*: BDT 122,212

- Cash incentive**: BDT 3,055.30

* Assumed FX rate of USD 1 = BDT 122.2120 as of January 23, 2025

** Cash incentive of 2.5% applied to received amount

Who Created The Bangladesh Remittance Cash Incentive Program?

The Foreign Exchange Policy Department of Bangladesh Bank is the owner and administrator of this incentive program.

Various banks and financial institutions within Bangladesh implement this program based on the guidelines provided by the Foreign Exchange Policy Department.

How Does The Bangladesh Remittance Cash Incentive Program Work?

The Bangladesh Remittance Cash Incentive Program works by crediting the recipient with the 2.5% cash incentive.

When someone in Bangladesh receives a qualifying remittance from abroad, the receiving bank will provide the recipient a 2.5% cash incentive on the incoming BDT amount.

Note that the cash incentive is a separate transaction and paid out by the receiving bank that processes the remittance.

Qualifying remittances eligible for the 2.5% cash incentive trigger the cash incentive payout to the recipient in Bangladesh. The cash award payout is a separate transaction and not part of the original remittance payout.

Who Can Take Advantage Of The Bangladesh Remittance Cash Incentive Program?

Both the sender and the receiver who wish to take advantage of the Bangladesh Remittance Cash Incentive Program need to meet certain eligibility criteria.

If you are the sender of an international money transfer to someone in Bangladesh and with to take advantage of the cash incentive, you must meet the following requirements:

- You must be a Bangladeshi national. This also includes a Bangladesh national who “has his or her origin in Bangladesh but for any reason has assumed foreign nationality”.

- You must be working overseas.

- You must not paid be by a government, or statutory, autonomous or semi-autonomous body.

- You must be an individual and not a business or corporation.

- You must send your wages as part of your remittance transaction.

- As of September 2024, you can also send compensation funds received from employers or insurance companies for death or injuries abroad.

For recipients who wish to claim the 2.5% cash incentive on incoming remittance, the following conditions must be met:

- You must be a Bangladeshi national.

- You must be an individual and not a business or corporation.

Both the sender as well as the recipient of a remittance must meet certain qualifying criteria to avail the 2.5% remittance cash incentive payout.

Make sure both you and your recipient meet the above listed criteria otherwise you will not able to claim the 2.5% cash incentive for your overseas funds transfer to Bangladesh.

What Types Of Remittances Qualify For The Bangladesh Remittance Cash Incentive Program?

Based on the directives laid down by the Foreign Exchange Policy Department of Bangladesh Bank, only certain types of remittances are eligible for the 2.5% remittance cash award. These are as below:

- Wages earned by overseas Bangladeshi workers.

- Compensation received by overseas Bangladeshi workers from employers or insurance companies in the case of death or injuries that occurred abroad.

Additionally, remittances must be sent via legitimate remittance channels approved by the Bangladesh Bank. This includes licensed and regulated money transfer companies, payment service providers and other approved financial institutions.

What Type Of Delivery Options Are Eligible For The Bangladesh Remittance Cash Incentive?

A delivery option is the method that is used to pay the funds to a recipient of an international money transfer.

The good news is that when it comes to the approved delivery options for the remittance cash incentive, most popular delivery methods are eligible; these include the below:

- Bank deposits

- Mobile wallet credits, including the popular bKash mobile wallet

- Cash pickups

Remittances sent to Bangladesh and paid out via bank deposit, mobile wallet or cash pickup are eligible for the 2.5% remittance cash incentive as long as other conditions are met.

Are There Any Requirements To Claim The Bangladesh Remittance Cash Incentive?

First and foremost, the cash incentive on a qualifying international remittance can only be claimed by the remittance beneficiary. No one else can claim the incentive on the recipient's behalf.

Additionally, if the transfer amount is up to BDT 150,000, there are no additional ID requirements and the 2.5% cash award is automatically approved.

In case the received amount is higher than BDT 150,000, the recipient will need to submit additional documentation that includes:

- Copy of the sender's passport

- Proof of the sender's employment status that includes the below:

- Copy of Appointment Letter provided by the overseas employer

- Copy of BMET (Bureau of Manpower, Employment and Training) Approval that authorizes the sender to work overseas

Note that the above documents must be submitted within 60 days of receiving the remittance to successfully claim the 2.5% remittance cash incentive.

If the remittance amount is higher than BDT 150,000, the recipient must provide additional documentation to claim the 2.5% remittance cash incentive.

Who Pays Out The Bangladesh Remittance Cash Incentive?

The 2.5% remittance cash incentive is paid out to the Bangladeshi recipient of a qualifying international remittance by the payment processor who handled the incoming money transfer.

This would generally be a bank, but could also be another financial institution like a payment service provider or a mobile wallet operator.

The financial institution that pays out the 2.5% remittance cash incentives to eligible recipients gets reimbursed by the Bangladesh Bank that manages and administers the Bangladesh Remittance Cash Incentive program.

Is There A Limit To Cash Incentives For Inward Remittances To Bangladesh?

The good news is that there is currently no upper limit to the remittance cash incentives issued to recipients of international remittances sent to Bangladesh.

As long as the sender and recipient satisfy all the requisite criteria and the money transfer is a qualifying remittance, the cash incentive will apply at the current rate of 2.5% of the final amount received in BDT.

Has The Bangladesh Remittance Cash Incentive Program Helped Boost Incoming Remittances?

The Bangladesh Remittance Cash Incentive Program was primarily created by the Government of Bangladesh to encourage overseas Bangladeshis to send more money back home. The uber goal was to boost up the overall GDP of the country, spur the economy and increase foreign currency reserves.

Let us look at some numbers to see if these desired outcomes have been achieved.

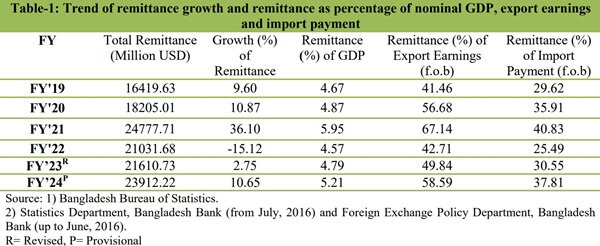

Based on a report published by the Research Department of Bangladesh Bank, the following promising statistics were observed:

- Total remittances in FY24 had significant growth of 10.65% compared to 2.75% during FY23.

- The share of remittances in Bangladesh's GDP increased to 5.21% in FY24.

- The share of remittances in export earnings increased to 58.59% in FY24.

- The share of remittances in import payments increased to 37.81% in FY24.

- The increased share of remittances as a percentage of exports and imports helped reduce the overall financial deficit during FY24.

The below graphic from the Statistics Department of Bangladesh Bank illustrates the above points in a pictorial format.

Source: Quarterly Report on Remittance Inflows in Bangladesh: April-June of FY241.

Given the above, it is clear that proactive measures of the Bangladeshi Government, like the Remittance Cash Incentive Program, have certainly helped increase the volume of inward remittances into the country.

The Bangladesh Remittance Cash Incentive Program helped increase inward remittance flows, increased GDP, improvement import and export activities and helped decrease the financial deficit in FY24.

How Can I Take Advantage Of Remittance Cash Incentive?

It is uncertain as to how long the Bangladesh Remittance Cash Incentive Program may last. Therefore, it is prudent to take advantage of this attractive option whilst it is available.

If you are an overseas Bangladeshi resident and have funds that you wish to send back home to your loved ones, consider sending them soon so your recipient can tap into the extra 2.5% of the received amount.

Send money to Bangladesh to earn an extra 2.5% cash back on qualifying remittances. Plus, your remittance helps fuel the Bangladeshi economy, contributes to GDP growth and reduces the country's fiscal deficit.

If you do decide to send money overseas, you may be wondering how to do so. One of the best ways to maximize the value of your hard-earned money is to compare various money transfer companies and pick the best option.

RemitFinder has the world's best money transfer companies that can help you send money to Bangladesh at bank-beating exchange rates and low transfer fees.

Simply search for your sending and receiving countries and enter the amount you wish to send, and you will be presented with clear and easy to understand comparison of numerous money transfer companies.

In addition, make sure to look out for exclusive deals and promotions for RemitFinder users. These offers will take your money further by helping you save more of your hard-earned money.

Here are some popular countries to send money to Bangladesh from:

- Send money to Bangladesh from the United States

- Send money to Bangladesh from the United Kingdom

- Send money to Bangladesh from Canada

- Send money to Bangladesh from Australia

- Send money to Bangladesh from Germany

- Send money to Bangladesh from Italy

- Send money to Bangladesh from UAE

- Send money to Bangladesh from Saudi Arabia

- Send money to Bangladesh from Qatar

- Send money to Bangladesh from Oman

- Send money to Bangladesh from Malaysia

- Send money to Bangladesh from Kuwait

If your sending country is not listed above, simply search on RemitFinder to see various money transfer providers compared for your chosen country combination.

Conclusion

The Bangladesh Remittance Cash Incentive Program is a creative way in which the Government of Bangladesh is attracting elevated volumes of inward remittances into the country.

As part of the Remittance Cash Incentive Program, overseas Bangladeshis that send their wages back home to their loved ones can earn an additional 2.5% cash incentive. The extra cash is directly paid out to the recipient in Bangladesh.

The results from this cash incentive program have been very promising with the country's GDP increasing as well as fiscal deficit decreasing.

Overall, the program has proved to be an effective way to reward Bangladeshi residents to send more money back home and utilize those funds to spur the national economy.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

References:

1. Quarterly Report on Remittance Inflows in Bangladesh: April-June of FY24 published by the External Economics Wing of the Research Department of Bangladesh Bank.

Categories

Similar Articles

US Big Beautiful Bill's Impact On Remittances

The Big Beautiful Bill has been passed in the US, and remittances are impacted. Learn how the Bill impacts remittances and what to do if you are affected by the new law.

How Fintech Is Pushing Banks Out Of The Remittance Business

The fintech revolution is disrupting the international remittance business. Discover how innovative startups are reshaping the international money transfer industry and challenging traditional banks.

Why Are International Money Transfers So Expensive?

International money transfers often come with underlying fees and charges that make a dent in your pocket. Discover why overseas transfers can be expensive and learn strategies to minimize the impact of fees.