US Big Beautiful Bill's Impact On Remittances

Table of Contents

- What Is The Big Beautiful Bill?

- How Does The Big Beautiful Bill Impact Remittances?

- How Does The Big Beautiful Bill Remittance Tax Work?

- How Does The Big Beautiful Bill's Impact On Remittances Affect Individuals?

- How Does The Big Beautiful Bill's Impact On Remittances Affect Countries?

- How Does The Big Beautiful Bill's Impact On Remittances Affect Money Transfer Providers?

- How Does The Big Beautiful Bill's Impact On Remittances Affect The Global Remittance Market?

- How To Avoid The Remittance Tax Imposed By The Big Beautiful Bill?

- RemitFinder's Projection: Short-Term Ripples Will Be Replaced By Digital Remittance Growth

The United States government is set to pass the US Big Beautiful Bill into an Act in the near future. Amongst many other economic aspects impacted by the bill are also international money transfers, or remittances.

As a country that has a large number of immigrants, the US is one of the primary sending countries when it comes to global remittances.

In fact, based on data from the World Bank1, USD 98.42 Billion worth of remittances were sent from the US in 2024 alone. This made the US the biggest sender of international money transfer amongst all countries of the world.

Given this massive scale, the Big Beautiful Bill's impact on remittances will not be insignificant.

In this article, we delve deeper into how the proposals within the Big Beautiful Bill will affect international money transfers and remittances.

What Is The Big Beautiful Bill?

The Big Beautiful Bill, also called the One Big Beautiful Bill, and often abbreviated as OBBB or BBB, respectively, is a set of provisions aimed to implement the policies of the current US Government headed by President Donald Trump.

As of this writing, the Bill has passed both the US Senate (on July 1, 2025) as well as the House of Representatives (on July 3, 2025), and is set to become an Act once the President signs it.

There are numerous provisions and policy changes in the Bill that touch many aspects of the US economy as well as impact the lives of millions of Americans.

Here are just a few areas that will see changes once the Bill is implemented - individual tax rates, loans used to purchase cars manufactured in the US, child tax credits, income from investments in college endowments, tax-deferred higher education accounts, clean energy credits, and so on.

As you can see, the Bill impacts many areas, so if you are curious about a particular aspect, we recommend reading up on that domain so you can understand the impact better.

In the rest of this article, we will focus on the impact of the Bill on remittances, also called international money transfers.

How Does The Big Beautiful Bill Impact Remittances?

From a bird's eye view, the Big Beautiful Bill proposes a 1% tax on certain types of remittances sent from the United States. That said, there are numerous details and caveats to this, which we get into below.

The provisions related to remittance tax are mentioned in Section 70604 of the One Big Beautiful Bill Act2. The said sections details out various provisions, which can be summarized as below:

- An excise tax of 1% of the transfer amount will be charged on certain remittance transfers.

- The said 1% remittance tax will be paid by the sender of the remittance.

- The remittance tax will only apply to remittances sent using cash, a money order, a cashier's check, or any other cash-equivalent physical instrument.

- The remittance tax will not apply to remittances sent using a US bank account, or a debit card or a credit card issued in the United States.

- The proposed remittance tax will be applicable to transfers sent from January 1, 2026 onwards.

The Big Beautiful Bill proposes a 1% remittance tax on cash (or equivalent) remittances starting January 1, 2026. Remittances sent from a US bank account, or with a US-issued debit or credit card are exempt from the said tax.

Note that the remittance tax is applicable regardless of immigration status. So, whether you are a US citizen, permanent resident, foreign worker, international student or any other legal visa holder who sends money abroad from the United States, you are subject to the remittance tax.

How Does The Big Beautiful Bill Remittance Tax Work?

From an operational perspective, anytime someone in the United States sends a remittance to another country using cash (or equivalent physical instruments), the 1% remittance tax will be applicable.

The remittance tax will be collected by the remittance transfer provider, money transfer company or bank that facilitates the international remittance transaction. This means that if your remittance is subject to the 1% remittance tax, you will need to pay the tax to the company that you use to send that remittance.

As per the rules and regulations of the Big Beautiful Bill, the remittance transfer provider that collects the 1% remittance tax from senders is responsible for depositing such collected tax with the US Government on a quarterly basis.

How Does The Big Beautiful Bill's Impact On Remittances Affect Individuals?

If you send cash (or equivalent) remittances from the United States to other countries, you will be impacted by the new 1% remittance tax that starts from January 1, 2026.

To understand the impact of this on your pocket, let us look at the average cost of sending remittances from the US.

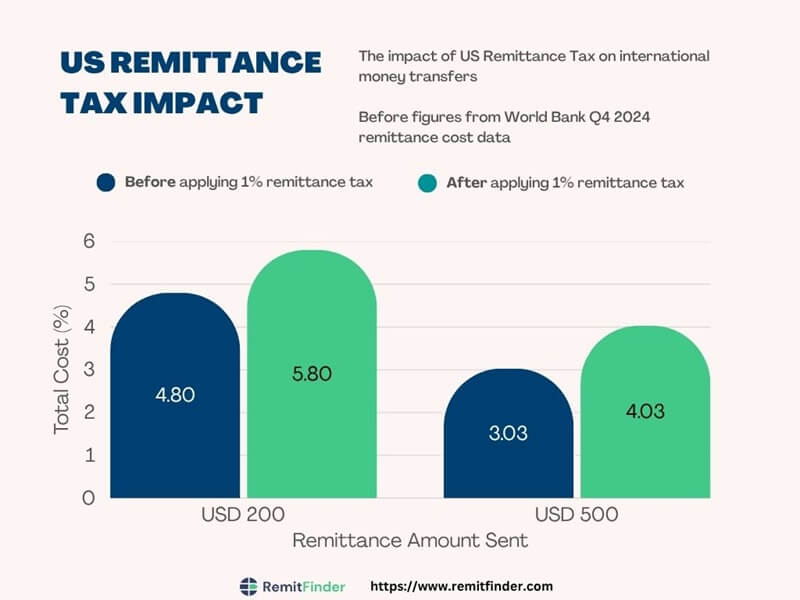

Based on data from the World Bank3, the average cost of sending USD 200 from US to Mexico was 4.80% in Q4 2024. In case you sent USD 500 during that time, you would have paid 3.03% on an average.

For simplicity, if we assume that the average remittance cost is more or less the same today, you would pay 1% more starting 2026 on your cash remittances.

For easy readability, we have captured this info in a graphical format below.

Whilst 1% may sound like a small number, it does increase your cost to send money abroad from the US. Later in the article, we present options on how to avoid the remittance tax altogether.

We also expect the cost of cash remittances to go up further since money transfer operators may pass on the additional expense of tax collection from senders and tax disbursement to the US government to consumers.

How Does The Big Beautiful Bill's Impact On Remittances Affect Countries?

One possible impact of the new remittance tax could be a decrease in the amount of money sent via cash remittances as well as the frequency of such transfers.

If this happens, it is natural to expect that less remittances will flow from the US into many countries. This may have an impact of the destination country's economy since many countries realize significant GDP from inbound remittances.

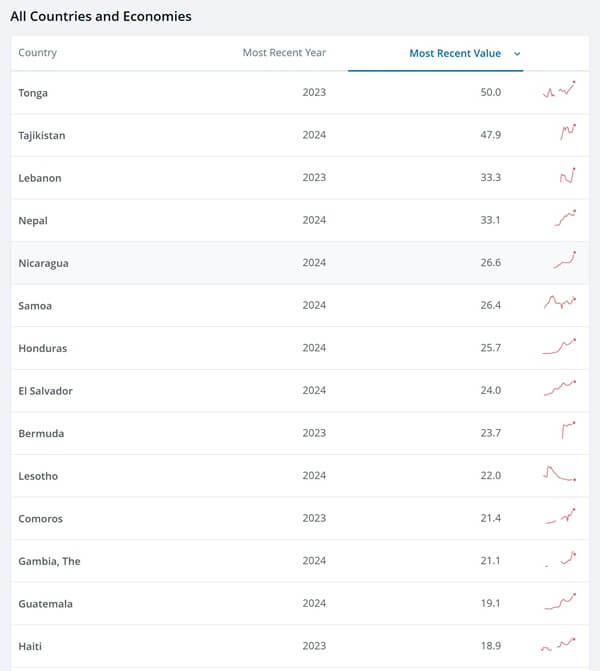

In fact, based on data published by the World Bank4, there were about a dozen countries as of 2023 and 2024 where inbound remittances contributed more than 20% to the national GDP. The below table shows this - notice that for some countries, this number is almost 50% of their total GDP.

No one can predict the future, but in case individual remittances to some countries where mostly cash remittances are sent do decline, there may be a corresponding decline in such countries' GDP numbers. This may have a negative effect on the overall economy of affected countries.

How Does The Big Beautiful Bill's Impact On Remittances Affect Money Transfer Providers?

If cash remittances decline from the United States as a result of the additional 1% remittance tax imposed by the Big Beautiful Bill, then it is possible that money transfer providers that primarily facilitate cash remittances may see a decline in their business.

This could be especially true for local remittance players who operate from malls, grocery stores and physical outlets.

It is likely that over time, outgoing cash remittances convert into digital, non-cash remittances. When that happens, there will be a recovery in the remittance volumes that may decrease in the short-term as remittance senders manage the impact of the new remittance tax.

If you are a money transfer company that facilitates cash remittances, we recommend that you consider supporting digital remittances as more and more remitters would move away from cash to avoid the remittance tax.

Another impact to money transfer companies would entail additional documentation and process for tax collection from senders, and quarterly tax amount deposits to the US government.

It is also possible that money transfer operators further increase their fees for cash remittances to cover for this additional expense they have to incur. This, in turn, will further increase the cost of cash remittances for the consumer.

How Does The Big Beautiful Bill's Impact On Remittances Affect The Global Remittance Market?

Similar to our analysis presented in the prior section, we feel that there may be a decline in cash remittances in the short-term. This may, therefore, cause a small decrement in global remittance transfer volumes.

However, after a short period of instability, cash remitters will start migrating away from cash and lean more on digital remittances. Once that happens, we envision global remittance volumes to return to their usual levels.

How To Avoid The Remittance Tax Imposed By The Big Beautiful Bill?

If you are a cash remitter who send money from the US to other countries, you may be wondering how to avoid the new 1% remittance tax. This is very easy to accomplish.

Instead of sending money overseas with cash, consider switching to digital remittances whereby you can send money directly from your US bank account, or via a US-issued debit or credit card. Such funding methods do not attract the 1% remittance tax.

Note that the above recommendation applies only to your payment method for your remittance transaction. You can still choose to pay your overseas recipient using cash pickup in their country in case that is the preferred delivery option for you and your recipient abroad.

In case you receive your income as cash, you may need to deposit that into your US bank account to be able to move away from cash remittances towards digital money transfers.

RemitFinder's Projection: Short-Term Ripples Will Be Replaced By Digital Remittance Growth

The US Big Beautiful Bill comes with umpteen changes, and one of them in the introduction of a new 1% remittance tax on cash (or equivalent) remittance sent from the United States from January 1, 2026.

We expect short-term pain for people who primarily rely on cash remittances. For example, there may be ripple effects on overseas recipients who might receive less money or receive it less frequently, money transfer providers who may see a decline in cash remittance business and countries who depend on inbound remittances as a major GDP growth driver.

But once the dust settles, we believe that US cash remitters will gradually move towards sending more digital remittances. Once that happens, the overall global volume of remittances will go back to normal levels.

Change is sometimes hard. But change also brings opportunities.

If you are a money transfer provider who built a business in the US primarily around cash remittances, now might be a good time to start looking into non-cash, digital money transfers.

And if you are an individual who sends cash abroad from the US, you should definitely start considering electronic money transfers to avoid sending cash remittances. Most global economies are turning increasingly cashless and more digital, so the move might be worth it for you anyways.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

References:

1. World Bank data on global remittances sent from various countries.

2. One Big Beautiful Bill Act as documented by the US Congress website.

3. World Bank data on the average cost of sending a remittance from US to Mexico.

4. World Bank data on inbound remittance GDP share in % for various countries.

Categories

Similar Articles

Bangladesh Remittance Cash Incentive: All You Need To Know

Are you an overseas Bangladeshi resident who sends money home to your loved ones? Read on to learn how to earn an additional 2.5% cash on your international remittances sent to Bangladesh.

How Fintech Is Pushing Banks Out Of The Remittance Business

The fintech revolution is disrupting the international remittance business. Discover how innovative startups are reshaping the international money transfer industry and challenging traditional banks.

Why Are International Money Transfers So Expensive?

International money transfers often come with underlying fees and charges that make a dent in your pocket. Discover why overseas transfers can be expensive and learn strategies to minimize the impact of fees.