How To Make The Most Of Your Remittance

Table of Contents

- How to maximize remittance yield?

- How to track a remittance?

- What are some best practices for sending a remittance?

In this guide on how to maximize the yield on remittances, we cover various factors that impact the final amount the recipient gets. Most importantly, we also discuss some key best practices to maximize remittance yield when sending money internationally.

How to maximize remittance yield?

Now that we have explained in detail what remittances are and how the work, we will jump into the most important topic - how to maximize the return on money transfers?

There are many ways to compare options to send a remittance - these could be based on rates, fees, etc. - all of which vary based on the amount sent and many other factors.

To simplify the discussion and keep it focused on yield, we define yield as the final amount that the recipient gets since this is what finally affects the bottom line of the recipient.

What factors influence remittance yield?

International money transfers are a complex space, and numerous factors come into play to influence the final payout that the recipient will get. Some of these include exchange rates, transfer fees, the timing of the money transfer, etc. Below we discuss how these factors contribute to the final amount realized by the beneficiary.

Rates

As would be obvious, the exchange rate is one of the most important factors that impact the return you get from a remittance.

Exchange rates for remittances are also called remittance rates, remittance exchange rates, money transfer rates, transfer rates, FX rates or just rates.

Interbank FX Rates

Interbank FX (foreign exchange) Rates, also called FOREX Rates as well as Mid-Market Rates are rates used by large banks and financial institutions to move large sums of money between their accounts. The interbank rates are usually not available to anyone else as big banks reserve them for ultra large transactions amongst themselves.

Interbank rates are also called FX rates, and are generally the rates you see on XE.com, and other global financial sites.

Generally, remittance exchange rates are lower than interbank rates.

The rate causes a huge impact to remittance yield since it has a multiplier effect based on the money sent.

For example, a USD to INR transfer executed at 1 USD = 70 Rupees vs 1 USD = 70.5 Rupees will affect the yield by only 50 Rupees if 100 Dollars are sent, but by 5000 Rupees if 10,000 Dollars are sent!

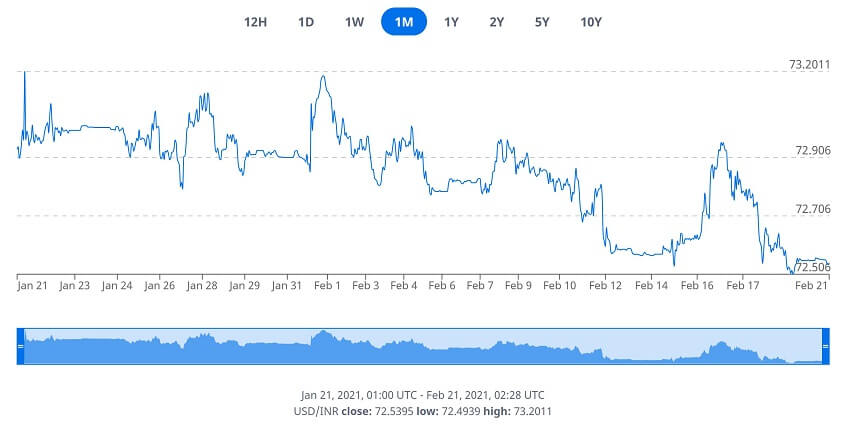

The below graphic shows the variation in the USD-INR FX Rate over just a month!

Remittance exchange rates are also of 2 types - indicative and fixed. Many remittance service providers use one or the other; some provide both.

Indicative Rates

An indicative rate (also called a non-fixed rate) is the rate quoted at the time the remittance transaction is initiated. The actual or realized rate may be different, and is generally the rate applicable on the day the transaction clears.

Fixed Rates

A fixed rate, as the name implies, stays constant till the time the remittance transaction clears out. In other words, if the remittance service provider is offering a fixed rate, it means that the quoted rate will be locked in and will be the rate used to realize the transaction - for this reason, fixed rates are also called locked-in rates.

Which rate should I choose - indicative or fixed?

At first glance, it may seem like you should always choose a fixed rate. Whilst this may sound like a winning strategy, it may not be so; there are several reasons for this.

First, most providers who offer both fixed and indicative rates offer a higher indicative rate and a lower fixed rate. The indicative rate is quoted higher as it entails the risk of a lower actual rate in case FX rates trend down.

If the market stays stable, then it is possible that the actual rate may be very close to the indicative rate, in which case, it will end up being a better deal than a lower fixed rate. On the flip side, if the market slides, the final rate can be worse than the lower quoted fixed rate.

Next, even though remittance exchange rates are an important influencer in determining remittance yield, they are not the only factor. Numerous other forces are at play; we discuss these below.

What is FX Markup?

Central to the notion of FX Rates is also the concept of FX Markup.

The markup is the cut that a remittance service provider takes from the interbank exchange rate. The remittance exchange rate given by the provider is, thus, a decrement of the interbank rate by the markup.

For example, if the interbank FX rate for GBP-PHP transfers is 65.30, and a service provider takes 1% markup, the remittance exchange rate offered by the provider will be calculated as below:-

Remittance exchange rate = 65.30 - markup = 65.30 - 1% of 65.30 = 64.65

As is obvious from the above, the markup is one of the ways a service provider makes money. Another way is transfer fees, which we will discuss below.

Fees

Money transfer fees are another important factor that directly influence the ROI on remittances. In addition to FX markup, transfer fees are another way money transfer operators cover their cost of operation and generate profits.

Fees generally come in 2 forms - fixed fees, and percent based fees.

Fixed fees are flat amount fees whilst percent based fees are a percentage of the transfer amount. As the transfer amount increases, the percent based fees increase as well. As a result, if fees were considered in isolation, it may seem that fixed fees are better than percent based fees, but as we discussed in the remittance exchange rates section, it all depends.

Another factor to keep in mind is that remittance fees also usually vary by payment method. Generally, fees are the lowest when funding a money transfer with a bank account, and increase once other payment methods like debit and credit cards are used. Some of this is obvious as credit cards, for example, involve processing fees that the remittance service provider will have to pay, hence fees on such funding sources are higher.

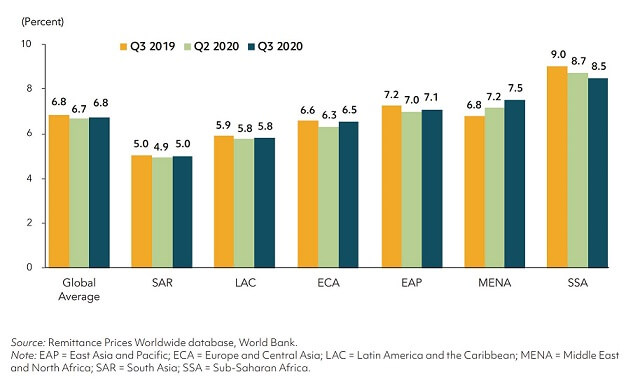

According to this study:-

"The cost was the lowest in South Asia, at around 5 percent, while Sub-Saharan Africa continued to have the highest average cost, at about 8.5 percent (figure 1.15). Remittance costs across many African corridors and small islands in the Pacific remain above 10 percent."

"Banks continue to be the costliest channel for sending remittances, with an average cost of 10.9 percent in 2020 Q3, while post offices are recorded at 8.6 percent, money transfer operators at 5.8 percent, and mobile operators at 2.8 percent."

The below chart shows the cost to send $200 across global regions, comparing 2019 and 2020 remittance fees.

Transfer Amount

The amount being transferred is also an important factor that influences the final payout that the recipient gets.

This is especially relevant since both rates and fees are generally tiered - generally, for higher transfer amounts, rates are better and fees lower.

For example, a provider may offer better rates for GBP-PHP transfers above 1000 GBP transfer amounts, and additionally waive the transfer fee if the transfer amount exceeds 2000 GBP.

To maximize your remittance yield, pay attention to transfer amount tiers that cause variations in rates as well as fees. If your transfer amount is close to a tier limit, it might make sense to add an additional amount to be in a higher tier and take advantage of better rates and/or lower fees.

Payment Method

A payment method is how the sender funds their remittance. In other words, the payment method is the mechanism by which the sender provides funds to the money transfer operator so they can execute the remittance. Most providers support cash payments, ACH bank transfers, wire transfers, and credit/debit cards as popular payment methods.

A payment method has 2 direct impacts on the remittance:-

- First, fees vary based on the chosen payment method. Cash and bank transfers usually entail very low or even 0 fees. On the other end of the spectrum, credit cards will increase the remittance fee since the provider will likely have to pay processing fees to the credit card companies involved. Additionally, payment methods like wire transfers will come with extra fees charged by the banking institution to execute the wire transfer.

- Second, payment method has a direct impact on transfer speed. This should be obvious as various payment methods have variability in the speed at which the provider gets the sender's funds. Cash and credit/debit cards are considered instant modes of payment while bank transfers and wire transfers will take a few days.

When possible, choose electronic methods to keep fees lower and try to stay away from credit cards and wire transfers as they will increase the cost of your remittance.

Delivery Method

A delivery method is how a recipient gets the funds once the remittance has been successfully executed. Popular delivery methods include cash pickup, automatic bank transfer and mobile top up.

Just like the payment method, the delivery method also impacts remittances fees as well as how fast the recipient has access to funds.

Timing of Transfer

Since FX rates vary continuously, remittance exchange rates do the same as they depend on FX rates. Akin to the stock market, the FX market is super dynamic and rates fluctuate every second! Since remittance exchange rates are the FX rate minus the provider markup, they follow suit.

Variations in FX rates depend on various factors; these include but are not limited to:-

- Ongoing economic climate

- Stock market performance

- Other major economic indicators like housing market, interest rates, unemployment rates, inflation rates, etc.

- Political landscape

- Any other global phenomenon like natural disasters, wars, terrorist attacks, etc.

Given this, the timing of a remittance is definitely a key factor in determining whether you get a good rate or not. One way to stay ahead of this is to automate the searching of rates by employing rate alerts. RemitFinder offers a free rate alert so you can stay updated about rate changes without having to manually search and compare rates.

Offers, Promotions and Deals

Many remittance service providers offer deals, discounts and promotions; these can be ongoing offers applicable at any time of the year, or could be around special occasions like major holidays, New Year, etc.

There are many types of promotions that providers use to either attract new customers or reward existing ones for their loyalty; below we list some deal types.

- Zero fee for the first few transactions, or during special holiday events like Diwali, Christmas, New Year, etc.

- Cashback when sending some minimal threshold - for example, GBP 10 cashback when sending at least GBP 1000.

- Gift cards for certain transaction volume - for example, USD 25 Amazon Gift card for cumulative transfers of at least USD 5,000 through November-December holiday season.

- Refer a Friend programs whereby the referring member earns a bonus for every referred friend who signs up and makes a transfer with the provider. Sometimes both the referrer and the referred individuals get the bonus amount.

RemitFinder has exclusive partnerships with many providers whereby our partners provide preferential treatment to our customers and thereby offer special deals and promotions to our customers; below are some examples of this.

CurrencyFair deal offering 3 free transfers for RemitFinder users

Instarem promotion offering USD 12 cashback on first transfer for RemitFinder users

XE Refer a Friend offer for RemitFinder users

Needless to say, deals and promotions can contribute to increasing remittance yield by either lowering or negating transfer fees, or adding cash back amounts thereby adding net new money to the transfer amount. The key is to keep an eye out as many useful promotions are seasonal.

At RemitFinder, we notify our customers every time a partner adds a new promotion. If you are signed up for our free rate alert, you will get these notifications.

Transfer Speed

Transfer Speed in itself does not influence remittance yield directly, but is worthy of mention as it may impact yield indirectly.

For example, money received faster by the recipient could be invested or used quickly, thereby tapping into opportunities that may be delayed or missed for transfers that arrive later.

In a very dynamic global economic environment that we live in today, time is precious - this totally applies to money and finances as well since there are often strategic time windows that can be used to tap into beneficial financial opportunities.

Also, as a sender, you would want your money to reach the destination as fast as possible. That said, other factors exist that may influence the choice of a faster vs slower remittance vehicle. For example, when sending a very large sum of money overseas, a wire transfer (albeit slower than modern fintech and remittance providers) might be the best vehicle.

Transfer Limits

Transfer Limits are maximum transfer amounts enforced by the remittance service providers; such limits could be daily, weekly, monthly and/or a combination of all of those.

Like Transfer Speed, Transfer Limits may not directly influence remittance yield, but can have an indirect impact based on the transfer amount.

For example, if the provider with the best rate allows sending only 3000 per day, and you need to send 5000 urgently, then a compromise on the best rate would have to be made to either use a different provider altogether or split the transfer amount into multiple transactions with different providers.

Barring emergencies, if you plan well in advance, it should not be a major issue as compromises can be avoided with planning.

How to track a remittance?

After a remittance has been made, there are various useful tools to track it. With the advent of internet services, pretty much every service provider has either mobile apps or a website or both where they provide tracking capabilities for remittances sent via their platform.

Providers will generally also send email alerts at key stages of the remittance lifecycle - for example, when the remittance is initiated, when the sender's payment is received, when the remittance has been executed, and when the receiver has received the funds.

What are some best practices for sending a remittance?

With so many factors influencing remittance yield, and given the highly dynamic and volatile nature of forex and remittance exchange rates, it may seem difficult to come up with the winning formula to maximize the ROI on remittances.

How do you decide when to send a remittance and who to send it with given so many complexities? In this section, we discuss some best practices to maximize remittance yield. Every remittance use case is unique, but these best practices should help you to get a better average yield than if no caution was exercised.

Whilst the below guidelines are not a mathematical playbook or equation to always come up with a winning formula, they are nevertheless good principles and practices that should, on average, contribute to a better ROI on remittances.

Keep an open mind

The first and most important paradigm is to keep an open mind. Sometimes, one can get into the mindset of continuing with what one has always done.

This certainly applies to remittance choices as well. Whether it is comfort level, inertia or brand loyalty, one could keep using the same remittance vehicle again and again. This may not be a bad thing, but having a flexible strategy in place certainly helps.

For example, a person may develop a strong affinity towards fixed rates, and may even stop looking at indicative rates. Whilst it's true that fixed rates afford more peace of mind, but it is also possible that the indicative rate offered by one provider is so much higher than the fixed rate of another that the difference is more than enough to cover for any potential market change loss incurred on an indicative rate.

Similarly, it could be a natural preference to gravitate towards providers with 0 fees. Again, this may sound good at face value, but there are so many parameters at play that paying attention only to fees may not help maximize remittance yield.

In a nutshell, we advise remitters to be open to new ideas and new providers and not get stuck with something that they have been using. The fact that something worked well in the past does not mean that it will continue to do great in the future as well.

Focus on remittance yield

A remitters biggest focus should be on maximizing their remittance yield as this directly impacts the funds that the recipient gets.

For personal transfers, the receiving family member or friend will get more money, and for business transfers, the sender has to send less source currency to buy the same target currency. As we mentioned in the previous section, keeping an adaptable strategy helps.

For example, let's consider the following scenario for a USD-INR money transfer.

- Provider A offers an INR 70.50 rate with $5 fee till $1000 transfers, and no fee thereafter.

- Provider B offers an INR 70.30 rate with no fee at all.

If you were to send $100, you would get the below payouts.

- Provider A = (100 - 5) * 70.50 = INR 6,697.50

- Provider B = 100 * 70.30 = INR 7030.00

Similarly, if the transfer amount was $500, the calculations play out as below.

- Provider A = (500 - 5) * 70.50 = INR 34,897.50

- Provider B = 500 * 70.30 = INR 35,150.00

Finally, for a transfer amount of $1000, Provider A will start giving more yield as the fee stops being a factor.

- Provider A = 1000 * 70.50 = INR 70,500.00

- Provider B = 1000 * 70.30 = INR 70,300.00

This simple calculation validates the fact that various combinations of the factors that influence remittance yield may produce various outputs depending on the transfer amount. It is, therefore, vital to keep your options open.

Have accounts with multiple providers

We strongly suggest that remitters have accounts with multiple remittance service providers. This may be already evident from the previous sections, but we wanted to highlight the importance of this.

Having accounts with multiple providers will allow you to get the best rates, promotions and use any other factors to their advantage to maximize the payout for international money transfers.

Another advantage of having accounts with few providers is the flexibility of tapping into seasonal offers, discounts and deals. Many providers float offers around major global and national holidays, and some of these could be very short lived deals that expire as early as just a couple of days.

If such a short lived deal does show up, it will be virtually impossible to create a brand new account, submit identification, go through the KYC (know your customer) process, etc. in time to avail the promotion.

Additionally, should an emergency need to send funds arise, already having accounts with multiple providers will still afford the flexibility to make the best choice vs being forced to stay with your often used provider.

Even if your regular provider works well in normal circumstances, it is quite possible that other providers have better payouts for different situations like emergency funds transfers that need to reach the recipient in hours, or high value transfers where a single large transaction is more convenient.

Plan your remittances in advance

As much as possible, we recommend exercising planning before remitting money overseas. Unless it's an emergency situation that comes up suddenly, regular international money transfers will produce maximum yield if they are planned in advance. That way, you can best achieve the right balance between various factors that influence how much money gets across to the recipient.

Keeping a buffer amount also helps as any upswings in remittance exchange rates can be exploited. This is especially applicable for people who send money home regularly. Instead of being on the edge of the financial limit, a small amount saved can be transferred at times when rates are at their peak.

Keep an eye out for deals, promotions and discounts

Many remittance service providers will offer deals, discounts and promotions from time to time.

Some of these could be ongoing whilst others could be seasonal around major holidays like Diwali, Thanksgiving, Christmas, New Year, etc. Yet others could be around other major events like Father's Day, Mother's Day, Black Friday, etc. International money transfers will get a boost if you can take advantage of a promotion.

Another way to look at this is that there is a timing aspect to send money overseas whereby you could try to send more money during the holidays vs other times; this will allow deals and promotions to kick in, thereby increasing payout.

Automate searching and comparing FX rates

With so many factors to keep an eye on, and with the inherent dynamic and fluctuating foreign exchange market, it can be highly stressful to stay on top of everything in a bid to get maximum benefit on remittances.

Additionally, with the entry of numerous fintech companies and startups disrupting the remittance ecosystem, it can be difficult to track everything that goes on. The amount of research needed to execute a hassle free and profitable international money transfer can be significant. Not everyone may have the time and energy to do so on an ongoing basis.

This is where RemitFinder comes in!

We created RemitFinder to automate the searching and comparison of remittance exchange rates. This way, we provide all the information our customers need to be able to make the most of their hard earned money. We have forged exclusive partnerships with some of the world's leading remittance companies and providers to get you the best rates and deals.

We also offer free rate alerts so we can keep you abreast of ever changing rates as well as notify you of ongoing deals and promotions. Our services are completely free for our customers, and can be accessed via our mobile apps as well as our website.

We are working hard to take the hassle out of searching and comparing money transfer companies. We invite you to try our services and save on your next money transfer!

Categories

Similar Articles

US Big Beautiful Bill's Impact On Remittances

The Big Beautiful Bill has been passed in the US, and remittances are impacted. Learn how the Bill impacts remittances and what to do if you are affected by the new law.

Bangladesh Remittance Cash Incentive: All You Need To Know

Are you an overseas Bangladeshi resident who sends money home to your loved ones? Read on to learn how to earn an additional 2.5% cash on your international remittances sent to Bangladesh.

How Fintech Is Pushing Banks Out Of The Remittance Business

The fintech revolution is disrupting the international remittance business. Discover how innovative startups are reshaping the international money transfer industry and challenging traditional banks.