When sending money home, timing is key

Table of Contents

- The timing of your money transfer is critical to maximize your return

- GBP to INR Exchange Rate Example

- Impact of transfer timing on remittance yield

- Conclusion

The timing of your money transfer is critical to maximize your return

Fluctuating exchange rates a headache for remitters sending money home?

Money transfer exchange rates fluctuate regularly, so if you are thinking of sending money home to your loved ones, the timing of your transfer could make a significant difference in maximizing the total amount your recipient gets.

Let's take an example scenario to illustrate this point.

GBP to INR Exchange Rate Example

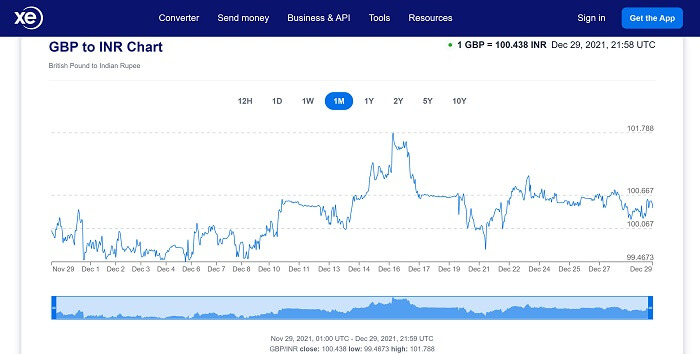

We will examine exchange rate fluctuations for British Pound (GBP) to Indian Rupee (INR). Below is a chart of how GBP-INR rates changed over a 1 month period from November 29, 2021 through December 29, 2021.

Chart from XE GBP-INR exchange rate variation over time

As the graph above demonstrates, GBP-INR exchange rate experienced a lot of change during the 1 month duration we are examining in this scenario. Below are some noteworthy pieces of information from the above graphic.

Money transfer exchange rates fluctuate constantly.

30 day GBP-INR exchange rate range

- Highest rate was 1 GBP = 101.7880 INR on Dec 16, 2021

- Lowest rate was 1 GBP = 99.4673 INR on Dec 5, 2021

- Difference between 30 day high/low = 2.3207 INR

Some variations within same day and consecutive days

Intraday variations

- 100.4070 @Nov 30 10:00 UTC to 99.5014 @Nov 30 17:00 UTC = 0.9056 difference

- 100.6000 @Dec 15 00:00 UTC to 101.2540 @Dec 15 13:00 UTC = 0.6540 difference

Consecutive day variations

- 99.9340 @Dec 10 01:00 UTC to 100.5620 @Dec 11 03:00 UTC = 0.6280 difference

- 100.6000 @Dec 15 00:00 UTC to 101.7880 @Dec 16 14:00 UTC = 1.1880 difference

Impact of transfer timing on remittance yield

Now, let's imagine that you send GBP 1000 home to your family in India. If we apply that amount over some of the above fluctuations of exchange rates, we get the following high level monetary gains/losses for your money transfer.

- Savings of INR 2320.70 with the best rate over 30 days

- Savings of INR 1188.00 if you sent money on Dec 16 instead of Dec 15

- Savings of INR 905.60 if you sent money on Dec 15 afternoon instead of the morning

The timing of your money transfer impacts how much money your recipient gets.

If you are a regular remitter who sends money to their loved ones very frequently, the above savings could translate to significant money saved annual for you.

Conclusion

As demonstrated by the above scenarios, timing of your money transfer is an important factor when you want to send money abroad. However, it is hard to search and track exchange rates manually.

RemitFinder solves this exact problem by providing you with access to latest exchange rates from multiple remit service providers. By relying on an online money transfer comparison platform, you save precious time and money.

You can also set a free exchange rate alert to stay updated on money transfer rates as they vary. Try RemitFinder to see how we can help you save on your next money transfer.

Categories

Similar Articles

US Big Beautiful Bill's Impact On Remittances

The Big Beautiful Bill has been passed in the US, and remittances are impacted. Learn how the Bill impacts remittances and what to do if you are affected by the new law.

Bangladesh Remittance Cash Incentive: All You Need To Know

Are you an overseas Bangladeshi resident who sends money home to your loved ones? Read on to learn how to earn an additional 2.5% cash on your international remittances sent to Bangladesh.

How Fintech Is Pushing Banks Out Of The Remittance Business

The fintech revolution is disrupting the international remittance business. Discover how innovative startups are reshaping the international money transfer industry and challenging traditional banks.