Instarem Detailed ReviewRates, Fees, Limits, Safety and More

Last updated: February 21, 2024

What is Instarem? An introduction

Instarem company information

Instarem was founded in 2014, as a solution for cross-border money transfers without the usual cost and delays associated with traditional international bank transfers. Initially, Instarem was designed to offer expats a cost-effective way of sending money home.

Later In October 2019, Instarem became a part of Nium, an embedded finance platform.

Instarem, now powered by the Nium platform, offers a wide range of payment services grouped into three categories: Send, Spend and Receive. These categories include the following focus areas for Nium.

- Send – Real-time cross-border payments, sending funds to a Visa debit card, remittance as a service, remittance apps, embeddable payouts, AP tool integrations.

- Spend – BIN sponsorship, B2B commercial payments, employee expense cards, supplier card payments and customer cards.

- Receive – Collection via virtual accounts, split payments, invoice collection, marketplace/website payments, automated receivables tracking and master merchant solutions.

Instarem is a fintech startup focused on international remittances since 2014.

There are many additional useful aspects of Instarem as per the below:

- Insta Points: Earn 25 InstaPoints by simply signing up with Instarem. It is Instarem's little way of saying hello. Score an additional 100 InstaPoints when you complete your e-verification in the first 36 hours after you sign up.

- Transfer money abroad: Each money transfer will reward you with InstaPoints. The bigger the amount, the greater the number of points you will earn. Do note that your transfer must be a minimum of SGD 500 (or equivalent in other currencies) to be eligible to receive InstaPoints.

- Refer a friend: Refer a friend to Instarem and earn 200 InstaPoints. This is Instarem's way of thanking you for the introduction.

- Use points as discounts on your money transfers: Redeem between 100 and 400 InstaPoints (SGD 1.25 - SGD 5, or equivalent in other currencies) per transaction once you meet the minimum transaction amount of SGD 500 (or equivalent in other currencies).

Which countries does Instarem operate in?

Instarem is licensed to operate in Australia, Canada, Singapore, Indonesia, Japan, Hong Kong, Malaysia, Lithuania, UK, India and the US, and allows you to send money to over 50 countries.

Where can I send money from with Instarem?

Currently, Instarem supports transfers from Australia, Canada, Singapore, Hong Kong, Malaysia, Indonesia, Euro Zone Countries, UK, India and the US.

As a result, Instarem allows you to send money using any of the following source currencies - Australian Dollar (AUD), Singapore Dollar (SGD), Hong Kong Dollar (HKD), Indian Rupee (INR), Malaysian Ringgit (MYR), Euro (EUR), British Pound (GBP) and US Dollar (USD).

Where can I send money to with Instarem?

Instarem supports money transfers to over 50 countries across various regions of the world that include Asia, Europe, North America, Africa and Oceania.

Below, we list all the countries you can send money to with Instarem, grouped by region.

- Asia - Bangladesh, China, Hong Kong, India, Indonesia, Malaysia, Nepal, Philippines, Singapore, South Korea, Sri Lanka, Thailand and Vietnam

- Europe - Austria, Belgium, Denmark, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Malta, Netherlands, Portugal, Spain and UK

- Oceania - Australia

- North America - Canada, Mexico, USA

- Africa - Ghana, Nigeria, Tanzania, Uganda

The below graphic illustrates Instarem's supported destination countries in a concise format and can be used as a quick reference to determine if your remittance destination is supported.

Make sure to review the latest and complete list of receiving Instarem corridors from your country of residence to ensure you can send money with Instarem to your destination successfully.

Instarem enables you to send money from Australia, Canada, Singapore, Hong Kong, Malaysia, Indonesia, Euro Zone Countries, UK, India and the US to over 50 countries worldwide.

What are Instarem's fees and exchange rates?

Instarem's fees and exchange rates vary depending on which country you are sending to; how much you are sending and your payment method.

Instarem shows their transaction fee and exchange rates to you upfront even before you make the payment. So, you know what you are paying for and what your beneficiary will receive.

To validate if Instarem's rates and fees are good or not, let's put them to the test.

We will compare and check Instarem's exchange rates and fees for sending 1000 units of currency for some country/currency pairs below. This will help us understand how good their rates and fees are.

| Country Pair | Transfer Amount | Exchange Rate* | Fees* | Payout | Mid-Market Rate** | FX Markup |

|---|---|---|---|---|---|---|

| Canada to Philippines | CAD 1,000 | 1 CAD = 40.8460 PHP | CAD 0.0 | 40,846.00 PHP | 1 CAD = 40.9998 PHP | 0.37% |

| UK to Pakistan | GBP 1,000 | 1 GBP = 230.6466 PKR | GBP 0.0 | 230,646.60 PKR | 1 GBP = 232.2031 PKR | 0.67% |

| USA to Mexico | USD 1,000 | 1 USD = 20.1623 MXN | USD 0.0 | 20,162.30 MXN | 1 USD = 20.2839 MXN | 0.60% |

| Australia to India | AUD 1,000 | 1 AUD = 54.3518 INR | AUD 4.5 | 54,107.22 INR | 1 AUD = 54.3901 INR | 0.52% |

| France to Thailand | EUR 1,000 | 1 EUR = 35.8519 THB | EUR 2.0 | 35,780.20 THB | 1 EUR = 36.1233 THB | 0.95% |

*Exchange rates and fees as on May 04, 2022

**Mid-Market Rate from XE.com

See how we calculate FX Markup

You can go to the Instarem site and use their calculator to estimate exchange rates and fees for your chosen country combination. Simply choose your source and destination countries, and punch in the send amount to see rates and fees. This will give you an idea of the payout your recipient will get, and how much the money transfer will cost you.

When it comes to transfer fees charged by Instarem, you can expect to pay anywhere between 0.25% to 1% in fees. Instarem fees vary depending on the source and destination country and currency combinations, so make sure to get an online quote using their real time calculator.

Instarem's exchange rates tend to be fairly competitive. You can expect to pay transfer fees between 0.25% and 1%.

Are Instarem exchange rates good?

Instarem tends to provide very good and competitive exchange rates for various country combinations that they support worldwide. To get a real time quote anytime, you can use the exchange rate and fees calculator on their website for your chosen country and currency combo.

The FX markup charged by Instarem tends to be less than 1%. In our case studies spanning various Instarem corridors, we found that Instarem charges an FX markup between 0.37% to 0.95%.

Exchange rates constantly fluctuate so it is important that you stay updated of the latest rates at all times. This will increase the chances of you getting the best rate for your next money transfer.

Instead of manually searching and comparing money transfer options, using an automated system for tracking exchange rates will significantly make this easier for you.

You can always rely on RemitFinder's remittance comparison tool which compares numerous money transfer companies in an easy-to-understand manner.

Is Instarem a cheap way to send money overseas?

Instarem's competitive rates and transparent fee structure make overseas money transfers cost-effective.

Fees and exchange rates depend on the amount of money you are sending abroad, the transfer method and the country you are sending to. The best part about Instarem is that they show the transaction fee and exchange rate upfront even before you make the payment. Due to this, you will know how much you are going to pay as well as how much your beneficiary will receive.

In general, you will likely pay anywhere between 0.25% to 1% in fees when you send money with Instarem.

Before you send money with Instarem, it is advisable to check and compare their fees and exchange rates with other service providers that service your country combination.

Instarem transfer fees are generally between 0.25% to 1%.

How do I avoid Instarem fees?

Instarem is a money transfer service and charges a transaction fee to make money. You can minimize your fees by choosing the payment method that is the least expensive in your country of residence.

In general, using bank transfers to pay for your money transfer, as well as to payout your recipient will tend to attract the minimum fees.

How much money can I send with Instarem?

Instarem's send limits vary as per the sender's as well as recipient's country of residence. In some cases, legal and regulatory requirements may be in place that limit the amount of money that can be sent from or received in a particular country.

There are also limits to how much money can be received with an incoming remittance via Instarem in many countries.

Instarem keeps their sending and receiving limits updated, so be sure to check the latest on their website before sending money.

How long does it take for Instarem to send money overseas?

Most money transfers with Instarem are instant, which means money is available to your recipient within minutes.

In cases where Instarem is not able to execute an instant money transfer, it can take them up to 4 business days to process your transaction. Transfer speed will depend on few factors that include:-

- Chosen country combination

- Payment method used to pay for the transfer

- Bank holidays

- Bank cut off times

Instarem processes most transactions instantly. All other transfers process within 4 business days.

How can I pay for my Instarem money transfer?

Instarem facilitates paying for your money transfer using a variety of payment methods.

Supported payment methods depend on the country you are sending money from, and are listed below.

- Australia - PayID, POLi, Credit Card, Debit Card & Bank Transfer

- Canada - Bank Transfer

- Hong Kong - Bank Transfer & Debit Card

- Malaysia - FPX & Bank Transfer

- Singapore - PayNow, Bank Transfer, Credit Card & Debit Card

- UK - Bank Transfer & Debit Card Transfer

- United States - ACH (direct debit), Credit Card, Debit Card, Set up Instarem as Payee & Wire Transfer

We recommend you always check the calculator on the Instarem site to make sure which payment methods are supported from your country of residence.

Instarem support numerous payment methods, including some local ones in many countries.

How can my recipient get paid with Instarem?

With Instarem, there are many ways you can choose to pay your recipient. Ways to pay your recipient are generally called delivery or payout methods.

Instarem supports the delivery methods listed below.

- Bank account transfer - This will credit money straight to your recipient's bank account

- Cash pickup - Pickup cash at a partner branch or agent location (only available in the Philippines)

- Direct deposit to a card - only available in Singapore

- Geoswift - only available in China

Instarem supports many delivery methods to help you pay your money transfer recipient overseas.

Are there any Instarem coupon codes or promotions I can use?

Instarem does offer promotions and coupons from time to time. These offers could be a great way to save even more on your money transfers with Instarem. RemitFinder users have access to numerous attractive Instarem coupon codes and promotions.

We will keep this page updated with the latest Instarem deals and offers, so make sure you check back regularly so you do not miss out on any good promotions.

To avoid checking manually for Instarem deals, you can also create your free RemitFinder exchange rate alert, and we will send you the latest exchange rates and deals. This is a great way to save your precious time and money.

Is Instarem a safe way to send money abroad?

Instarem is ISO 27001 certified, the Global Standard on Information Security Management Systems, which ensures adequate and proportionate security controls that protect information assets shared by the customers.

Instarem holds client money in accordance with regulations, and takes measures to safeguard clients' funds at all times.

Below are some measures Instarem implements to ensure your money and information are safe with them.

- Thoroughly verifying yours and your recipient's identity to ensure you are operating your account instead of a hacker or scammer.

- Ensuring compliance with KYC (Know your customer) guidelines and regulatory requirements.

- Maintaining complete transparency into various policies and compliance guidelines applicable in each country of operation.

- Holding your money in a segregated account - this means that your money is always kept separate from Instarem's funds used to run their business.

- Publishing detailed help guides and tutorials on various prevalent scams and how to avoid and detect scams and fraud.

- Relying on HTTPS and secure protocols to ensure that their website and mobile apps are safe from a technology security perspective.

Given a strong focus on security and related best practices, it seems like Instarem takes the safety of your funds and personal information very seriously.

Can I trust Instarem?

An important factor in building customer trust, especially in the financial services industry, is compliance with legal and regulatory requirements. Instarem takes this to heart, and is a licensed money transfer operator in every country they operate in.

Below, we present some useful legal and compliance information about Instarem for various markets they offer services in.

Note that NIUM Pte Ltd, the parent company of NIUM subsidiaries globally, is headquartered in Singapore. Instarem is the trading name of NIUM Pte Ltd.

- Australia - NIUM Pty Ltd trading as Instarem is a registered Remittance Provider with AUSTRAC and holds AFS License No. 464627 and is regulated by the Australian Securities and Investments Commission (ASIC).

- Canada - NIUM Canada Corporation trading as Instarem operates with License No. M15569293 and is regulated by the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC).

- Hong Kong - NIUM Limited trading as Instarem is regulated by the Hong Kong Customs and Excise Department (C&ED) with MSO License No. 16-010-01797.

- India - NIUM India Pvt. Ltd. trading as Instarem operates in association with SBM Bank and is regulated by the Reserve Bank of India vide its approval dated 24th April 2020.

- Indonesia - PT NIUM Mitra Indonesia trading as Instarem operates with License No: 21/261/Jkt/1 as a Fund Transfer Operator, and is regulated by the Bank Indonesia.

- Japan - NIUM Japan Kabushiki Kaisha trading as Instarem holds Registration No: 00073 with Kanto Local Finance Bureau and is a Type 2 Funds Transfer Services Provider under the Payment Services Act (Act No. 59).

- Lithuania - UAB NIUM EU trading as Instarem operates with License No. 14 and is regulated by Lietuvos Banks (Bank of Lithuania).

- Malaysia - NIUM SDN. BHD. trading as Instarem operates with Registration No. 201701000367 (1214517-X) and is regulated in Malaysia by the Central Bank of Malaysia (BNM) under License Number: 00222.

- Singapore - NIUM Pte Ltd trading as Instarem is regulated by the Monetary Authority of Singapore (MAS) as a Major Payment Institution under License No. PS20200276.

- United States of America - NIUM Inc. trading as Instarem operates in the United States under a program sponsored by Community Federal Savings Bank (CFSB) to which NIUM is a service provider (NMLS ID No. 1528562).

- UK - Nium Fintech Limited trading as Instarem operates with Reference number 901024 and is regulated by the Financial Conduct Authority (FCA) as an Authorized Electronic Money Institution (EMI) provider and is licensed to issue electronic money (e-money) and provide payment services.

For more detailed legal and regulatory compliance information, be sure to check the Instarem website for your country of residence.

Instarem is fully licensed and regulated in their operating countries, and implements various security practices to keep your money and information safe.

How good is Instarem's service?

A really good barometer of how good Instarem's service is to examine what other customers like you think about their money transfer products and services.

What do users have to say about Instarem?

Let us check some popular rating and review^ platforms to see how Instarem is perceived by their customers.

- Instarem has a 4.5/5.0 rating on Trustpilot with a little over 7k reviews

- Instarem has a 3.9/5.0 rating on the Google Play Store with more than 6k ratings

- Instarem has a 3.9/5.0 rating on Apple App Store with 162 ratings

- Instarem has a 4.8/5.0 rating on RemitFinder

^Ratings on various platforms as on May 07, 2022

Instarem's Trustpilot rating is excellent, and it seems like users like their service. Mobile app ratings are less than 4 though.

Is Instarem the best choice for me?

After doing a detailed analysis of Instarem's money transfer services, we notice that relative to their competitors, they are strong in the below areas.

- Good corridor coverage - Instarem lets you send money from more than 10 countries to about 50 or so global destinations. They also seems to expandingly rapidly to newer markets.

- Competitive exchange rates and fees - Instarem's FX markup ranges between 0.37% to 0.95% and they charge transfer fees between 0.25% and 1%. This makes Instarem a very good choice when it comes to raw pricing and rates.

- High transfer limits - For many markets, Instarem imposes no maximum transfer limits. In some countries, there are limits enforced by legal and regulatory bodies.

- Fast money transfer processing - Instarem is able to move money overseas rapidly. Most transfers clear within minutes, and the rest within 1-4 business days.

- Good payment and delivery options support - Instarem lets you pay for your money transfer in many ways including local payment methods in some countries. Similarly, you can also choose from a few options for paying your recipient.

- Good deals, offers and discounts - Instarem offers many good deals and promotions for RemitFinder customers. You can use Instarem coupon codes to save more money for your overseas funds' transfers.

RemitFinder likes Instarem for good corridor coverage, offering competitive rates and fees, moving money overseas fast and offering a variety of payment and delivery methods.

What are the best reasons to use Instarem?

Based on our deep dive into Instarem's money transfer service, we find them strong in many areas as compared to their competitors. Consequently, there are some remittance scenarios where Instarem may be a strong fit for your needs. Below, we list some such possibilities.

- As a leading overseas money transfer company, Instarem enables both consumers and businesses to send and receive international money transfers conveniently and securely. Given their strong international currency and country support, Instarem may be a very good choice in your country of residence.

- Instarem's competitive rates, transparent fee structure, intuitive platform and user-friendly mobile app make overseas money transfers cost-effective and simple. As compared to banks, you may save a decent amount of money by sending money overseas with Instarem.

- Instarem service charges a nominal fee between 0.25% and 1%, and all costs are displayed upfront so you know what they are paying for at all times.

- Instarem is licensed and fully regulated in several countries including India, US, UK, Europe, Australia, Canada, Singapore, Malaysia and Hong Kong. It is also ISO/IEC 27001 Certified, an internationally recognized standard, that ensures firms have information security risks under control. Hence, your money and information should be safe with them.

- Instarem's clients speak very highly about their money transfer service. Most reviews highlight the platform's cost-efficiency and transparency. The reviews also show that Instarem scores well on the trust factor.

- Instarem's support for many flexible payment and delivery methods helps you pay for your money transfer as well as get your beneficiary paid in multiple ways. You can also pay for your money transfer with local payment methods in some countries, which may further lower your cost as local payment methods tend to be more cost effective.

Overall, we see Instarem as a secure and reliable solution for many possible money transfer needs.

What type of transfers can I make with Instarem?

You can use Instarem to make a variety of money transfers, including:

- Sending to family for personal reasons

- Paying for overseas mortgage, rent, utilities and other bills

- Buying property overseas

- Travel

- Medical expenses

- Educational expenses

- Business transfers

Whatever be the reason you need to send money overseas, Instarem is a robust and cost effective money transfer operator that can help you save money and time.

What are various ways to send money with Instarem?

Instarem mostly supports online money transfers to all countries that they operate in. They typically do not have agent locations or branch offices where you can go physically to send money with Instarem.

For online money transfers with Instarem, you have 2 options to start your transaction. These are:

- Use the Instarem website

- Use the Instarem mobile app (available on both Android and iOS devices)

Instarem also supports cash pick up in the Philippines. In case your recipient does not have a bank account, cash pickup may be a great option to send money to them.

How to send and receive money with Instarem?

Sending money with Instarem is easy and convenient. There are no stores to go and no lines to stand in, as Instarem only supports online money transfers.

You can, therefore, send money from the comfort of your home with your computer or mobile phone. Below, we present a step wise guide to help you get started.

Step by step guide to send money with Instarem

You can follow the step-by-step guide below to send money with Instarem quickly and easily.

- Step 1 - Decide if you are ready to send money overseas with Instarem. A very convenient and automated way to do this is to use RemitFinder's online money transfer comparison platform which compared many remittance providers and helps you see their strengths and weaknesses.

- Step 2 - Create your Instarem account on the website or the mobile app. This is free. You will need to provide your personal information as well as photo ID to comply with KYC requirements.

- Step 3 - Once your account is approved, add a recipient through your phone contacts, or add one manually.

- Step 4 - Choose your payment method and currency; enter the amount you wish to transfer.

- Step 5 - Input transfer details and proceed with your transaction.

- Step 6 - On the summary page, enter your coupon code (if any), click apply and authorize the transfer. Note that RemitFinder users have access to many Instarem coupon codes; this can help you save even more on your money transfer.

- Step 7 - Make sure you transfer the exact amount shown in the 'You Pay Only' field.

- Step 8 - Enter the verification code sent to your phone to authorize the transaction.

- Step 9 - To complete your transaction, make the payment to Instarem to fund your transfer.

- Step 10 - Once you make the payment, Instarem will keep you posted about the status of your transaction.

It is convenient and easy to send money online via the Instarem website or mobile app.

How can Instarem help me send money?

Instarem can help you send money overseas regardless of the reason to make an international transfer. For example, if you're sending money to family and friends, travelling, moving to a different country or if you are in business, Instarem can help you send money overseas in a reliable and easy manner.

Instarem also has numerous helpful pages targeted to send money to various countries. For example:

- Send money to India

- Send money to China

- Send money to Philippines

- Send money to Indonesia

- Send money to Nepal

- Send money to Thailand

- Send money to Vietnam

- Send money to Bangladesh

- Send money to Mexico

- Send money to Nigeria

These country specific pages are a good way to get started with money transfers with Instarem to the destination country of your choice.

Do I need a Instarem account to receive money?

You do not need a Instarem account to receive money.

When you send money via Instarem, your recipient can receive the funds directly into their account, or pick up cash (available only in the Philippines) at an agent location.

You do not need an Instarem account to receive money overseas.

Does Instarem have a mobile app?

Yes, Instarem has a mobile app both for Android as well as iOS users. You can send money on the go with the Instarem mobile app.

How do I track my Instarem transfer?

You can easily track your Instarem transfer via either the website or mobile app. Simply go to your transaction history to see the latest status on your transactions.

Instarem also sends you emails to keep you posted on the status of your transaction.

Can I use Instarem for international bank transfers?

Yes, you can use Instarem for making international bank transfers.

To make an international bank to bank transfer with Instarem, simply choose:

- Payment method as bank transfer - this way, money will come out of your bank account to fund your transfer

- Delivery method as bank transfer - this will ensure that your recipient gets the money credited to their bank account

By choosing both the payment and delivery methods as bank transfer, you have effectively executed an international bank to bank transfer but with much better rates and fees compared to banks.

Choose payment and delivery method as bank transfer to send an international bank to bank transfer.

Is Instarem online better than sending money in-person in stores?

Online money transfers are more convenient as you can send money from anywhere and at any time.

Online transfers via Instarem's website as well as their mobile app are a convenient and hassle-free way to send money.

Does Instarem have a rewards program?

Instarem has a rewards program that lets you earn InstaPoints on every single transfer. You are also rewarded with InstaPoints upon sign up and upon making referrals. These InstaPoints can then be redeemed as discounts on future transfers to enjoy great savings.

The below activities will earn you InstaPoints as part of Instarem's rewards program.

- Every money transfer earns you InstaPoints. The more you send, the more InstaPoints you receive.

- Open a new Instarem account and earn 75 InstaPoints.

- Complete your identity verification within 36 hours of signing up and each 300 InstaPoints.

- Refer a friend to earn 400 InstaPoints.

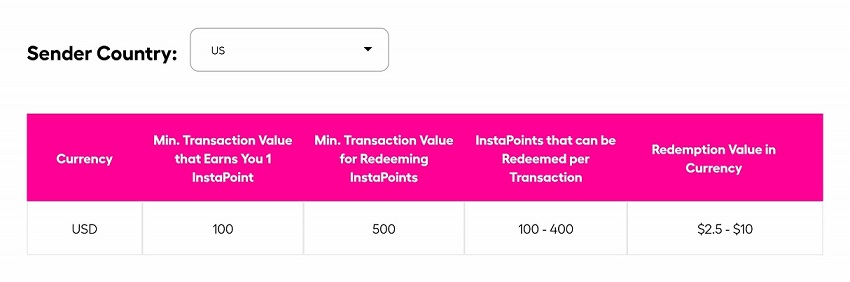

Instarem has a handy InstaPoints calculator that shows you how many InstaPoints you earn every time you send money with them. Below screenshot shows the relevant InstaPoints calculation for money transfers from the US.

InstaPoints never expire, and you can redeem them anytime on a future money transfer to get discounts.

What customer support options are available with Instarem?

In case you need assistance, Instarem offers a live chat option you can use to contact them. Simply go to the website and click on 'Ask Adam' to initiate a chat with their team.

You also have an option to raise an enquiry through 'Help Centre' in your Instarem account. This will create a support case that an Instarem support representative will respond to.

Additionally, you can email Instarem's support team at support@instarem.com, and someone will respond to your inquiry.

Finally, you can also read through numerous help topics in the Help section on Instarem's website. This includes FAQs and several other topics that educate and assist customers like you with relevant information.

Can I cancel my Instarem transfer?

You can cancel your Instarem transaction depending on the status of your transfer.

If you have not funded the transaction, you can cancel your transaction by clicking on the 'Cancel' button on the transaction history page.

If you wish to cancel a funded transaction, you can contact Instarem's team via chat or raise an enquiry via 'Help Centre' in your Instarem account. Someone from Instarem's support team will assist you with your cancel transfer request.

Please note that once the funds have been transferred to the recipient, the transaction cannot be cancelled.

How do I delete my Instarem account?

You can choose to close your account with Instarem by notifying their customer experience team via chat.

Note that closing the account will lead you to lose any InstaPoints that you may have accumulated with Instarem.

Additional Information

Legal and Regulatory Compliance

Instarem is a licensed remittance service provider and is regulated and licensed by authorized bodies of the countries they operate from.

- Instarem is the trading name of NIUM Pte Ltd, the parent company of NIUM subsidiaries globally. NIUM Pte Ltd is regulated by the Monetary Authority of Singapore as a Major Payment Institution under License No. PS20200276.

- Australia: Instarem is the trading name of NIUM Pty Ltd, a subsidiary of NIUM Pte Ltd, the parent company of NIUM subsidiaries globally. NIUM Pty Ltd is a registered Remittance Provider with AUSTRAC and holds AFS License No. 464627 and is regulated by the Australian Securities and Investment Commission (ASIC).

- Canada: Instarem is the trading name of NIUM Canada Corporation, a subsidiary of NIUM Pte Ltd, which is the parent company of NIUM subsidiaries globally. NIUM Canada Corporation with License No. M15569293 is regulated by the Financial Transactions & Reports Analysis Centre of Canada.

- Hong Kong: Instarem is the trading name of NIUM Limited, a subsidiary of NIUM Pte Ltd, which is the parent company of NIUM subsidiaries globally. NIUM Limited is regulated by the Hong Kong Customs and Excise Department (C&ED) with MSO License No. 16-010-01797.

- India: Instarem is the trading name of NIUM India Pvt. Ltd., a subsidiary of NIUM Pte Ltd, which is the parent company of NIUM subsidiaries globally. NIUM India Pvt. Ltd. operates in association with SBM Bank and is regulated by the Reserve Bank of India (RBI) vide its approval dated 24th April 2020.

- Indonesia: Instarem is the trading name of PT NIUM Mitra Indonesia, a subsidiary of NIUM Pte Ltd, which is the parent company of NIUM subsidiaries globally. PT NIUM Mitra Indonesia, with License No: 21/261/Jkt/1 as a Fund Transfer Operator, is regulated by the Bank Indonesia.

- Japan: Instarem is the trading name of NIUM Japan Kabushiki Kaisha, a subsidiary of NIUM Pte Ltd, which is the parent company of NIUM subsidiaries globally. NIUM Japan Kabushiki Kaisha holds Registration No: 00073 with Kanto Local Finance Bureau and is a Type 2 Funds Transfer Services Provider under the Payment Services Act (Act No. 59).

- Lithuania: Instarem is the trading name of UAB NIUM EU, a subsidiary of NIUM Pte Ltd, which is the parent company of NIUM subsidiaries globally. UAB NIUM EU with License No. 14 is regulated by Lietuvos Banks (Bank of Lithuania).

- Malaysia: Instarem is the trading name of NIUM SDN. BHD., a subsidiary of NIUM Pte Ltd, which is the parent company of NIUM subsidiaries globally. NIUM SDN. BHD. with Registration No. 201701000367 (1214517-X) is regulated in Malaysia by the Central Bank of Malaysia, or Bank Negara Malaysia (BNM), under License Number: 00222.

- Singapore: Instarem is the trading name of NIUM Pte Ltd, the parent company of NIUM subsidiaries globally. NIUM Pte Ltd is regulated by the Monetary Authority of Singapore (MAS) as a Major Payment Institution under License No. PS20200276.

- United States of America: Instarem is the trading name of NIUM Inc., a subsidiary of NIUM Pte Ltd, which is the parent company of NIUM subsidiaries globally. NIUM Inc. operates in the United States under a program sponsored by Community Federal Savings Bank (CFSB) to which NIUM is a service provider (NMLS ID No. 1528562).

- UK: Instarem is the trading name of Nium Fintech Limited, a subsidiary of NIUM Pte Ltd, which is the parent company of NIUM subsidiaries globally. Nium Fintech Limited with Reference number 901024 is regulated by the Financial Conduct Authority as an Authorized Electronic Money Institution (EMI) provider and is licensed to issue electronic money (e-money) and provide payment services.

Helpful Links

- RemitFinder blog on top 7 best international money transfer apps

- RemitFinder blog about how Instarem is making an impact in the global remittance industry

- RemitFinder blog on the best ways to send money from the United States

- All you need to know about Instarem's compliance, security and reviews

- Key information and things to know about the remittance ecosystem

- Find out what makes sending money with Instarem simple

- How to send money with Instarem

Awards, Prizes and News

- 2021: Instarem's BizPay was awarded an Honorable Mention for Product Innovation of the Year at the Global SME Finance Awards 2021

- 2018: Winner, Network Accelerator Award, Blockchain Innovator Awards, SwellByRipple, San Francisco

- 2018: Finalist in FinTech Australia 2018 Finnie Awards

- 2018: Winner, Outstanding Digital Cross-Border Money Transfer Service, ET Net FinTech Awards, Hong Kong

- 2017: Winner, FinTech Rising Star Award, India FinTech Awards, Mumbai

- 2017: Winner, Singapore Open Award, MAS FinTech Awards, Singapore

- Instarem & Beetech to Enable Fast Cross-Border Money Transfers Between Asia Pacific and South America on RippleNet

Reviews

Excellent rates!

Very good service and great rate that almost matches interbank rate.