What Is PayID And How Does It Work?

Table of Contents

- What Is PayID?

- How Does PayID Work?

- What Are The Benefits Of Using PayID?

- Simplified Payment Experience

- Reduced Erroneous Payments And Scams

- Enhanced Security

- Interoperability Across Payment Networks

- Consistent And User-Friendly Experience

- Self-Sovereign Identity

- Innovation And Collaboration Opportunities

- How Can I Set Up My PayID?

- 1. Choose A PayID Provider

- 2. Create Your Account With The PayID Provider

- 3. Create Your PayID

- 4. Link Your Payment Accounts

- 5. Verify And Secure Your PayID

- 6. Start Using Your PayID

- Can I Send And Receive Money Internationally Using PayID?

- Who Offers PayID In Australia?

- Does Commbank Support PayID?

- Does ANZ Support PayID?

- Does Westpac Support PayID?

- Does NAB Support PayID?

- Does HSBC Support PayID?

- Does ING Support PayID?

- Does CBA Support PayID?

- Does Amex Support PayID?

- Does BOQ Support PayID?

- Does Suncorp Support PayID?

- Does Me Bank Support PayID?

- Does St George Support PayID?

- Does Bankwest Support PayID?

- Is PayID Safe?

- Additional FAQs Regarding PayID

- How To Use PayID?

- How To Pay Someone With PayID?

- How Long Does PayID Take?

- Can A PayID Payment Be Reversed?

- How To Setup PayID For Commbank?

- How To Setup PayID For Westpac?

- Can PayID Be Hacked?

- Can You Get Scammed Through PayID?

- What To Do If Someone Sent Money To My PayID But It Has Not Arrived?

- What To Do I Sent Money To Someone With PayID But It Has Not Arrived?

- Can Someone Create A PayID Using My Personal Information?

- Is PayID Instant?

- What Is My PayID Limit?

- Can PayID Payments Be Reversed By Commbank?

- What To Do If I Am Told My PayID Email Or Phone Is Already Registered?

- How Many Accounts Can I Link My PayID To?

- Can I Send And Receive PayID Payments Without Showing My Name?

- What Should I Do If My PayID Is Locked?

- Can I Cancel A PayID Payment?

- How Do I Move My PayID?

- How Do I Close My PayID?

- Looking Ahead: PayID's Future & Impact

- Conclusion: PayID Drives Australia's Payments Ecosystem Forward

In today's fast-paced digital world, payment systems continue to constantly evolve to meet the demands of the global financial ecosystem. As a result, several payment systems have emerged in various parts of the world to take the hassle out of digital payments.

Some examples include BACS, CHAPS and Faster Payments in the UK, NEFT, RTGS and IMPS as well as BHIM UPI in India, PayNow in Singapore, Interac e-Transfer in Canada and Paysafecard in Europe.

All these payment systems mentioned above streamline digital payments in their respective countries and regions by making it easier to conduct safe, quick and cost-effective financial transactions without relying on cash.

PayID is a similar financial payment ecosystem that is prevalent in Australia, and has emerged as a prominent solution to simplify the complexity of conducting transactions across multiple platforms.

In this article, we will explore the fundamental concepts of PayID and uncover how it works. From its universal payment address to its interoperability between networks, we will delve deeper into the world of PayID and unravel the mechanisms that help to make it a transformative power in digital payments.

What Is PayID?

PayID is a payment identification system that simplifies the way you can transact across multiple payment networks and platforms in Australia. To grasp the true potential of PayID, it is essential to explore its basic principles and key concepts that underpin its functionality.

Traditional payment systems have relied on bank account information exchange to be able to move money between bank accounts. For example, in Australia you can use the combination of your account number and a BSB number to send and receive payments.

PayID replaces this approach with a single, user-friendly, globally unique payment address. A universally global payment address is a core concept of the PayID ecosystem.

PayID's core tenet is the use of a universally unique payment address that unambiguously identifies an entity - an individual or a business.

Who Owns And Operates PayID?

PayID is a key initiative whose goal is to modernize and digitize Australia's payment ecosystem.

PayID is owned and operated by NPP (New Payments Platform), Australia. NPP is Australia's real-time payment ecosystem provided by NPP, Australia.

NPP Australia is fully owned and operated by Australian Payments Plus, which is the primary payment organization in Australia providing oversight over payment platforms and standards. Australian Payments Plus also includes BPAY Group and eftpos as its members.

What Is The Format Of A PayID?

When you setup your PayID with your bank or financial institutions, you have a variety of choices to pick your PayID identifier. Below are accepted values for a PayID:

- Your mobile number.

- Your email address.

- Your ABN (ABN stands for Australian Business Number and is a unique 11-digit number to help identify your business).

- Your organization identifier.

You can choose your email address, mobile number, ABN or organization identifier as your PayID.

As you can see, this makes it easy to remember your PayID and share with others when you wish to receive payments.

Another major advantage is that when you pay someone using their PayID, your bank or financial institution will clearly show you who they are. This will help you double check that you are sending payment to the correct recipient.

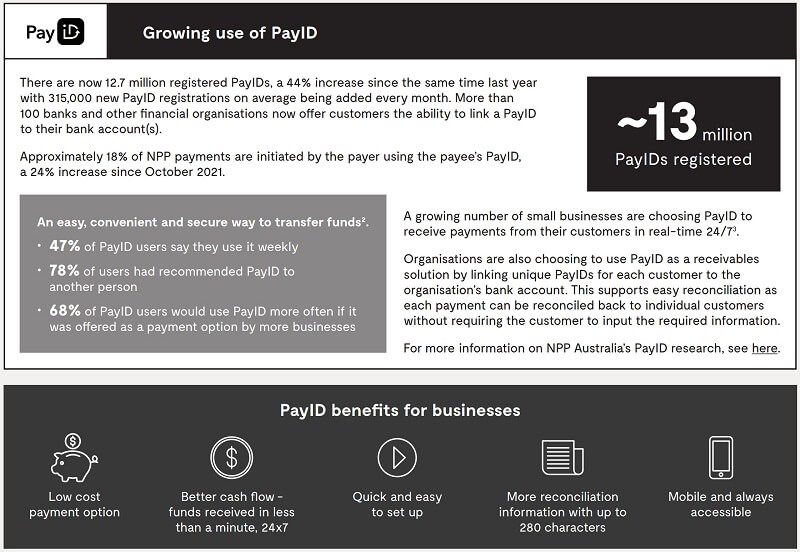

PayID By The Numbers

Since its inception, PayID has experienced solid growth and adoption in Australia.

Based on an article1 published by the Australian Banking Association, as of October 2022, PayID was used by 12.7 million people in Australia. This represented 20% market share for PayID within all payments made in the country at the time.

Here are some additional stats around PayID adoption and usage2 published by NPP, Australia:

- 7 million registered PayID users, representing a 44% YoY increase.

- Average of 315,000 new PayID registrations per month.

- 18% of all NPP payments done using PayID, representing a 24% YoY increase.

- 47% of PayID users used it weekly.

- 78% of PayID users recommended PayID to others.

- 68% of PayID users would use it more often if more businesses supported PayID.

Here is a pictographic representation of the above PayID facts and figures.

Source: NPP data and stats around PayID usage and adoption2 as of October, 2022.

PayID has become a popular payment method in Australia and is used by tens of millions of Australians to send and receive real-time payments.

How Does PayID Work?

To fully understand the inner workings of PayID, it is essential to delve into its technical framework.

PayID operates on a set of protocols and mechanisms that enable the seamless identification and routing of payments across different networks and platforms.

Let us explore the key components and processes that make PayID work below.

- 1. Universal Payment Address Format: PayID introduces a standardized format for payment addresses, typically in the form of a human-readable string. This format allows users to create unique payment addresses that are easy to remember and share.

- 2. PayID Server: One of the core pieces in the PayID ecosystem, the PayID acts as a repository that maps payment addresses to corresponding account information across different payment networks. When a payment is initiated, the PayID server retrieves the necessary routing information associated with the specified PayID.

- 3. Interoperable Protocol: PayID employs an interoperable protocol that allows different payment networks and platforms to communicate and recognize each other's payment addresses. This protocol ensures that payment addresses from different networks can be resolved and routed accurately, regardless of the underlying payment system.

- 4. Safety And Security: Since PayIDs are issued by Australian banks, credit unions and building societies, PayID transactions are as safe and secure as any other bank transactions. Bank grade security ensures peace of mind for customers as they can rely on their bank and not any 3rd parties to keep their money and information secure.

- 5. Payment Network Integration: PayID relies on the integration of different payment networks and platforms to achieve its interoperability goals. Participating payment service providers need to adopt the PayID standard and integrate it into their systems to recognize and process PayID-based transactions. This integration allows for seamless transfers of funds between different networks and enhances the overall payment experience for users.

By combining these technical components, PayID streamlines the payment process by providing a universal addressing system and enabling interoperability across diverse payment networks.

Users can initiate payments by simply specifying the PayID associated with the recipient, and the payment is routed to the appropriate account through the PayID server and integrated payment networks.

What Are The Benefits Of Using PayID?

PayID offers various benefits, making it an attractive payment identification system for individuals and businesses.

By leveraging a universal payment address format and interoperability protocols, PayID enhances security and provides a seamless and convenient payment experience.

Here are the key advantages of using PayID for sending and receiving payments within Australia.

Simplified Payment Experience

One of the primary benefits of PayID is its ability to simplify the payment process.

With PayID, you no longer need to share and manage bank account numbers, routing numbers, BSB numbers or other related information for different payment services. A single PayID serves as a universal payment address, making transactions more straightforward and eliminating the need to navigate various payment methods.

Reduced Erroneous Payments And Scams

The PayID specification and ecosystem was designed to include a payee confirmation step whereby the system asks you to verify that you are sending the payment to the right recipient, whether individual or business.

This is a great benefit of PayID as the payee confirmation step helps to minimize mistaken payments and scams.

When you are provided the opportunity to verify who you are sending the payment to before actually submitting the payment, the chances of errors reduce and transaction accuracy goes up.

Enhanced Security

Since PayID is offered by banks and financial institutions in Australia, it is considered very safe and secure as it relies on bank grade security and safety mechanisms.

Most banks, credit unions, building societies and other financial institutions are fully authorized and regulated in Australia by the Australian Transaction Reports and Analysis Centre (AUSTRAC).

As a result, these financial institutions have to adhere to strict standards and regulatory measures to obtain their banking license and continue to keep it valid. Given this, you can rest assured that PayID is as safe as your bank or financial institution is.

Interoperability Across Payment Networks

PayID promotes interoperability by allowing different payment networks and platforms to recognize and process PayID-based transactions.

This means that you can send and receive funds seamlessly across various payment services, regardless of the underlying network or platform. The interoperability offered by PayID simplifies cross-platform transactions and expands the reach and accessibility of payments.

Consistent And User-Friendly Experience

PayID provides a consistent and user-friendly payment experience.

You can use the same PayID across different payment platforms and networks, reducing confusion and potential errors. Additionally, PayID's human-readable format makes it easy to share payment addresses with others, enhancing convenience and ensuring accuracy in payment details.

Self-Sovereign Identity

PayID incorporates the concept of self-sovereign identity by empowering you with control over your payment addresses and associated data.

You can link multiple payment accounts, such as bank accounts, digital wallets, or cryptocurrency addresses, to your PayID (depending on the capabilities offered by your bank or financial institution). This ownership and autonomy over your financial identity contributes to a more secure and personalized payment ecosystem.

Innovation And Collaboration Opportunities

PayID's open standard nature fosters innovation and collaboration within the financial industry.

By adopting the PayID standard, payment service providers can collaborate and integrate their systems, driving the development of new services and expanding the possibilities for seamless financial transactions.

This open environment encourages the growth of the payment ecosystem and promotes the adoption of emerging technologies.

RemitFinder likes PayID for creating a standardized payment address format that is accepted by various participating payment networks and platforms. This fosters ease, safety, adoption and speed of payments within the PayID ecosystem.

How Can I Set Up My PayID?

Setting up PayID is a straightforward process that enables individuals and businesses to establish their unique payment addresses and join the growing ecosystem of simplified and interconnected payments.

To get started with PayID, follow the below steps.

1. Choose A PayID Provider

The first step is to select your preferred PayID provider.

PayID providers are organizations or platforms that offer PayID services and facilitate creating and managing payment addresses. These providers include banks, digital wallets, or specialized PayID service providers.

Make sure to research and choose a reliable and trusted PayID provider that aligns with your specific needs.

Your bank, for example, might already be integrated with the PayID ecosystem. If this is the case, you can easily create your PayID using your bank's website or mobile app and link your bank account to your PayID.

2. Create Your Account With The PayID Provider

Once you have selected a PayID provider, sign up for an account with them.

This typically involves providing personal or business information, verifying your identity, and agreeing to the terms and conditions of the PayID service. Follow the instructions provided by the PayID provider to complete the account creation process.

If your chosen PayID provider is your bank, this step is optional as you already have an account with them.

3. Create Your PayID

Creating your PayID with your PayID provider is super easy.

If you are an individual, you can choose your email address or mobile number as your PayID. If you are a business or organization, you can use your ABN or organization identifier as your PayID.

In case you choose your bank as your PayID provider, all of the possible PayID types will already be in your account to select from.

4. Link Your Payment Accounts

After creating your PayID with the PayID provider, you need to link your payment accounts to your PayID. This step varies depending on the PayID provider and the payment accounts you wish to associate with your PayID.

For example, if you want to link your bank account, you may need to provide your account details, verify ownership, and authorize the connection between your bank account and your PayID.

Once again, if your PayID provider is your bank, this step is seamless as your bank account information is already available to link with your PayID.

5. Verify And Secure Your PayID

It is essential to verify and secure your PayID to maintain its integrity and protect your account. PayID providers may require additional verification steps, such as email or phone verification, to ensure the validity of your PayID.

Additionally, enable any security features offered by your PayID provider, such as two-factor authentication, to enhance the security of your account.

6. Start Using Your PayID

With your PayID set up and verified, you can now use it for payments and transactions. Simply share your PayID with others when sending or receiving funds, whether it is for personal transactions or business payments.

It is quick and easy to setup your PayID with a PayID provider. The process is even more streamlined if you choose your bank as your PayID provider.

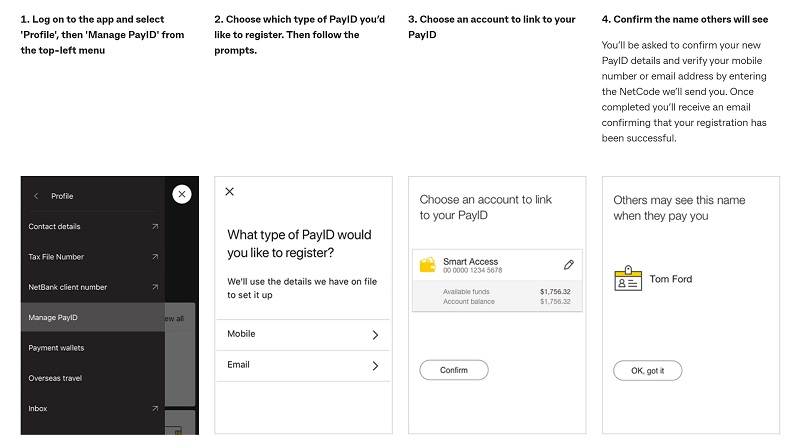

As an example, here is a screenshot from Commonwealth Bank showing how to setup your PayID3 if you bank with them.

As you can see, the process is really quick and simple. Other participating banks and PayID providers will have similar simple workflows to setup your PayID with them.

As PayID gains wider adoption, more platforms and networks will recognize and support PayID-based payments, providing an even more seamless and streamlined payment experience.

Remember to regularly review and update your PayID settings, such as adding or removing linked payment accounts, and to ensure that your information remains accurate and up to date.

Can I Send And Receive Money Internationally Using PayID?

PayID only works in Australia and cannot be used overseas. That may make you think that PayID is not relevant when it comes to international money transfers. You will be surprised to know that this is not true.

When it comes to sending and receiving money internationally, PayID plays an important role by virtue of it being an attractive pay-in or pay-out option. In other words, you could fund your international money transfer with PayID, or receive money sent from overseas into your PayID.

PayID, by virtue of being a local payment method that is popular in Australia, is highly useful in the international money transfer space. You can fund your overseas remittance with PayID or receive money from overseas into your local PayID.

Let us look at some pertinent international remittance scenarios.

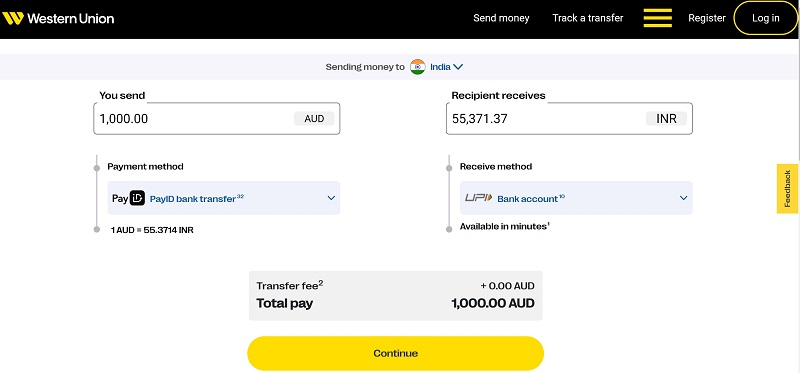

If you were sending money from Australia to India, for example, you can pay for your international money transfer directly with PayID. Below is how this would look like with Western Union.

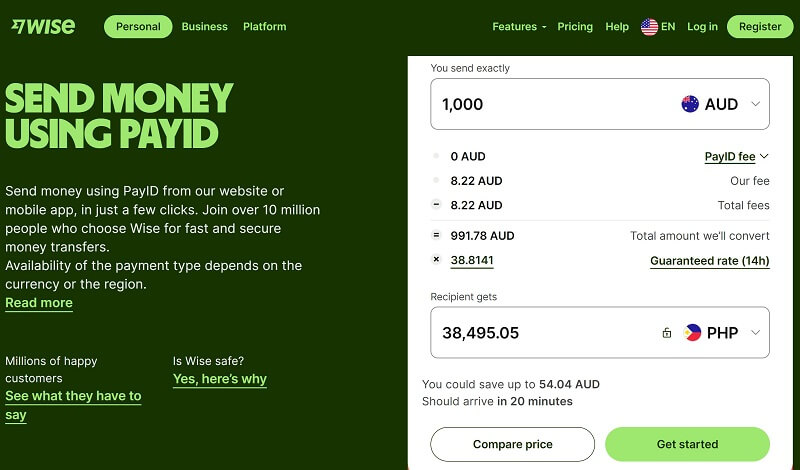

Similarly, if you were using Wise (formerly TransferWise) to send money from Australia to the Philippines, you could conveniently pay for your international remittance using your local PayID in Australia.

If you operate a business, the good news is that PayID can play a useful role in international business money transfers and payments as well.

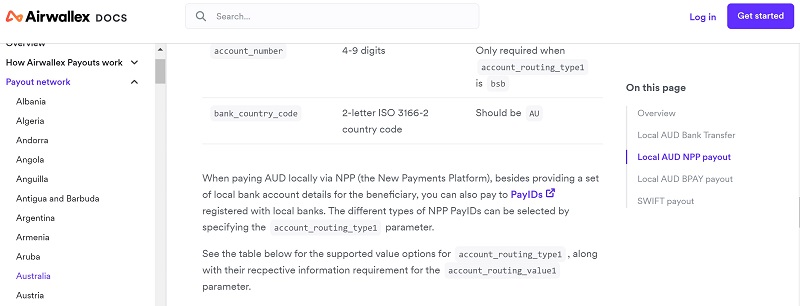

For example, Airwallex, a B2B international payment specialist, allows you to receive money in Australia directly into your PayID. Below is a screenshot from Airwallex's payout network options for Australia.

If you use other money transfer companies for sending money from and to Australia, check their capabilities for PayID support.

A great way to get the most out of your money transfers in and out of Australia is to compare money transfer companies to get the best exchange rates and deals.

RemitFinder does this seamlessly for you by comparing numerous remittance service providers side-by-side so you can make the best choice and get the most out of your international remittance.

Who Offers PayID In Australia?

There are many financial institutions in Australia that participate in the PayID ecosystem and offer a PayID to their users. Primarily, many banks, credit unions and building societies Australia are integrated with PayID.

To see if your bank or financial institution offers PayID, check your online account or mobile app, or reach out to them to find out.

Many banks, credit unions and building societies in Australia offer PayID to their customers.

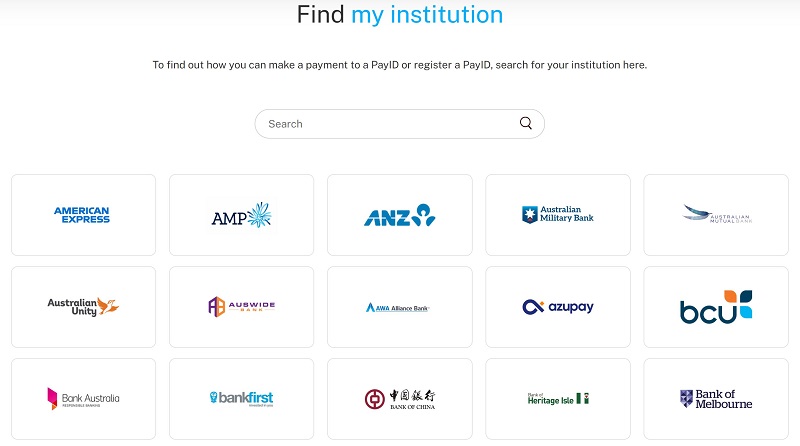

Another useful tool is the PayID provider search on the official PayID website4. You can simply search for your bank or financial institution there to see if they support PayID. This PayID provider search tool looks as below.

Next, let us see if some popular banks in Australia support PayID.

Does Commbank Support PayID?

Yes, Commbank supports PayID. Access your online account to see how to set up your Commbank PayID.

Does ANZ Support PayID?

ANZ is integrated into the PayID network, so yes, you can easily setup your ANZ PayID. It is worth noting that you can also create your ANZ Plus PayID as well.

Does Westpac Support PayID?

Westpac is a PayID provider as well. If you have an account with Westpac, you can setup your Westpac PayID very quickly.

Does NAB Support PayID?

NAB, which stands for National Australia Bank, is a valid PayID financial institution. To setup your NAB PayID, simply login into your online NAB bank account and follow the instructions.

Does HSBC Support PayID?

Unfortunately, HSBC Australia does not support PayID at this time. If you bank with HSBC Australia, you cannot have an HSBC PayID at the moment.

Does ING Support PayID?

If you bank with ING, you can easily setup your ING PayID as the bank is a valid PayID provider.

Does CBA Support PayID?

CBA (Commonwealth Bank of Australia), also called Commonwealth Bank for short, does support PayID. It is quick and easy to setup your CBA PayID. Simply login into your online account to set up you Commonwealth Bank PayID

Does Amex Support PayID?

You can certainly setup an Amex PayID if you are an American Express customer in Australia since Amex is connected to the PayID payments network.

Does BOQ Support PayID?

BOQ, short for Bank of Queensland, is a PayID provider. This means you can obtain your BOQ PayID anytime by logging into your bank account and creating your PayID linked to your BOQ bank account.

Does Suncorp Support PayID?

Suncorp Bank has successfully integrated PayID into their platform. As a result, you can create your Suncorp PayID if you have a bank account with Suncorp Bank.

Does Me Bank Support PayID?

Me Bank is a division of the Bank of Queensland, and is a valid PayID provider. To setup your Me Bank PayID, simply login into your account and follow easy steps to create your PayID.

Does St George Support PayID?

St George Bank participates in the PayID financial ecosystem. This is good news if you bank with this institution; simply access your account to create your St George PayID.

Does Bankwest Support PayID?

Bankwest is yet another major Australian financial institution that has PayID plugged in into its platform. To provision your Bankwest PayID, just login into your online account and follow easy steps to create your new PayID.

If we have not covered your bank above, simply search on the official PayID website to see if your bank provides PayID. You can also contact your local branch to inquire about PayID, or login into your account to look for potential PayID support.

Is PayID Safe?

Recall that PayID is offered by various financial institutions in Australia that include banks, credit unions and building societies. Most of these organizations are registered with and regulated by the Australian Transaction Reports and Analysis Centre (AUSTRAC).

Given that, your PayID transactions are as safe as your bank account. Bank grade security is something we all trust in our daily life, and generally, bank transactions are considered very secure.

Also, your bank or financial institution has to comply with strict AUSTRAC guidelines and regulations, and their license is granted and renewed only if they meet the requisite security and safety standards.

PayIDs are issued by banks, credit unions and building societies in Australia, and PayID transactions are as safe and secure as any other bank transactions.

Is My Personal Information Safe With PayID?

Your personal and confidential information should be safe with PayID as PayIDs are issued by banks, credit unions and building societies.

If you have questions about how your PayID provider manages your personal information, read their privacy policy or get in touch with them.

Are There Any PayID Scams That I Should Be Aware Of?

As with any financial or payment system, there are scammers and fraudsters out there who will try to manipulate the system or steal information. PayID is also a target for scams given its tremendous popularity and growth in Australia in the recent years.

Here are some PayID scams we have heard about that you should be aware of:

- Emails claiming to be from PayID: In this type of PayID scam, you will get an email that will claim it is from PayID. Usually there will be some link or button asking you to take some action. Never click anything on such emails as PayIDs are managed by your bank or financial institution. PayID will never contact you directly about anything.

- Tricks to pay money to someone: Another popular PayID scamming technique is to try to have you pay someone via PayID for some service. You may, for example, receive some invoice asking you to pay. Always double check everything before you ever send money via PayID. If you believe you have been tricked into paying someone via PayID, contact your bank and local police immediately.

- Marketplace PayID scams: In this type of PayID scam, you may be tricked into buying something on a marketplace. You will be asked to send the payment via PayID, but will never get the merchandise. Always examine the authenticity of online and physical stores and marketplaces before buying anything and making a payment. For example, there are Facebook marketplace PayID scams where someone will sell you something, get paid and never send anything.

- Social media PayID scams: Social media comes with all sorts of possibilities to get tricked into buying something or sending someone money. For example, there may be Facebook PayID scams whereby someone will ask for help, charity, or even sell you a commodity or service. Once you send the payment via PayID, you will never hear back from the scammer.

- PayID business account scams: You may also get emails or other marketing outreach that advertise great deals and discounts. These may seem very genuine and enticing. But once fall prey to these PayID business account scams, you will never get the promised product or service after making a payment. Always check everything carefully before sending any payment to anyone.

There are various types of PayID scams that, if you are not careful, can cause you to pay someone and lose money. Always be extra careful when making a PayID payment and check for the authenticity of the seller or service provider as well as the site, marketplace and product or service being offered.

Additional FAQs Regarding PayID

Here are some additional Frequently Asked Questions (FAQs) regarding PayID that may prove helpful.

How To Use PayID?

You can use PayID by sharing your PayID to receive payments from others. Additionally, you can also send payments to individuals as well as businesses as long as you know their PayID.

How To Pay Someone With PayID?

If you wish to pay someone with PayID, simply ask them for their PayID. Once you have the recipient's PayID, simply use your online banking facility to send money to them using their PayID.

How Long Does PayID Take?

PayID payments generally finish in less than a minute. In case your payment has not completed within a minute, either the PayID was incorrect or your transaction may be on a security hold. In such cases, check with your bank.

Can A PayID Payment Be Reversed?

In general, PayID payments cannot be reversed once they have been authorized and completed. In some cases, your bank may be able to get the funds back from the recipient account.

If you feel you have made a payment in error or have been tricked, contact your bank immediately.

How To Setup PayID For Commbank?

Setting up your PayID for Commbank is quick and easy. Simply login into your Commbank account online and follow the simple steps to setup your PayID.

How To Setup PayID For Westpac?

If you wish to setup PayID for your Westpac account, access your online bank account. Then look for settings and follow the instructions to setup your Westpac PayID.

Can PayID Be Hacked?

There have been couple of instances where PayID issuing banks have been hacked. As a result, data breaches happened and personal information may have been disclosed.

Whilst there is no guarantee of no compromises in the future, banks are always working to strengthen their systems to ensure data and information is not compromised.

Can You Get Scammed Through PayID?

It is possible to get scammed through PayID. Popular scams include emails claiming they came from PayID, marketplace scams, social media scams and other related fraudulent efforts that trick you into sending money to someone via PayID.

Always be extra careful and diligent before you send money using PayID.

What To Do If Someone Sent Money To My PayID But It Has Not Arrived?

Most PayID payments finish in less than a minute. If your payment has not arrived, double check with the sender to ensure it was sent to your PayID. If the correct PayID was used, check with your bank to see why your payment has not arrived.

What To Do I Sent Money To Someone With PayID But It Has Not Arrived?

In general, PayID transactions complete within a minute. If you sent money to someone using PayID and they claim that the payment has not arrived, verify that it was sent to the correct PayID.

If you used the right PayID to send money, reach out to your bank to look deeper into why the transaction did not finish.

Can Someone Create A PayID Using My Personal Information?

When you create a new PayID, the PayID provider will execute a few verification steps to identify you accurately and determine that you are the authentic owner of the information you provide to setup your PayID with them.

This also applies to the account that you wish to link to PayID. Therefore, unless someone has access to your personal information and bank accounts, it will be difficult for them to create a PayID with your information.

Is PayID Instant?

Most PayID transactions finish in less than a minute. In that sense, PayID is a very quick way to send and receive money in Australia. If your PayID transaction has not finished within a minute, check with your bank to see why.

What Is My PayID Limit?

Most banks have PayID limits in place that inform how much money you can send with PayID in a given time period. For example, PayID transaction limits vary from AUD 1,000 per day for ING Bank to AUD 10,000 per day for Macquarie Bank. Check with your bank to find your PayID limits.

Can PayID Payments Be Reversed By Commbank?

If your PayID payment has been authorized and completed, it cannot be reversed. Contact Commbank immediately if you think you have made an incorrect payment or have been tricked into paying someone as part of a PayID scam.

What To Do If I Am Told My PayID Email Or Phone Is Already Registered?

If you are trying to setup a PayID using your email address or mobile phone and get an error message that it is already registered with another PayID account, check all your bank accounts and unregister the PayID from the other account.

If you cannot find the PayID account that is linked to your email address or phone number, contact your bank so that they can raise an investigation on your behalf to resolve the matter.

How Many Accounts Can I Link My PayID To?

One PayID can only be linked to a single account at a time. If you wish to link your PayID to another account, you will have to unregister from its currently linked account.

Alternatively, you can create multiple PayIDs that can be linked to the same account, or to different accounts.

Can I Send And Receive PayID Payments Without Showing My Name?

One of the major advantages of PayID is a payee confirmation step that is mandatory when creating PayIDs. This helps verify who the payment is going to and reduces mistaken payments and scams. Due to this conscious design choice, PayIDs cannot be created without this identification step.

When you setup a PayID with your bank, you will have access to a few options to control your name will be displayed in the PayID ecosystem. This may also include the ability to use your initials. Check with your bank for options and more information.

What Should I Do If My PayID Is Locked?

If your PayID is locked, it is possible that your account may be subject to a security investigation. Reach out to your bank for further assistance.

Can I Cancel A PayID Payment?

Once you submit a PayID payment, it generally finishes within a minute. As a result, it may be difficult to cancel your PayID payment.

If you think you made a PayID payment by mistake or were tricked into sending money to someone, reach out to your bank as soon as possible.

How Do I Move My PayID?

Most PayID providers will provide easy options to move or transfer your PayID. Generally, you will find this in your online banking portal under settings or my account sections where your PayID is registered. If you are unable to access the pertinent section, reach out to your bank for assistance.

How Do I Close My PayID?

You should be able to unregister and close your PayID from your bank's online or mobile banking facility. If you are unable to see an option to do this, check with your bank.

In case your questions in not covered above, contact your bank or PayID provider and they should be able to help you.

Looking Ahead: PayID's Future & Impact

The future of PayID holds great promise for continuing to transforming the digital payment and financial landscape in Australia.

With its universal payment identifier system, PayID has the potential to streamline cash-free digital transactions, enhance financial inclusion, and foster peer-to-peer payments. By simplifying payment processes, reducing costs, and promoting interoperability, PayID can facilitate faster and more secure transactions.

As more and more PayID providers integrate into the PayID ecosystem, consumer adoption will continue to increase. PayID can also bridge the gap between traditional and decentralized financial systems, opening up new possibilities for innovative financial services.

Additionally, PayID's increasing popularity and adoption will lead to enhanced data analytics and statistical capabilities which will help drive insights and improvements in risk assessment, fraud detection, and personalized financial solutions.

RemitFinder believes that the future of PayID is strong and promising. The open nature of the PayID standard encourages collaboration and innovation, paving the way for a more efficient and user-centric financial ecosystem.

Overall, the future of PayID holds the potential to revolutionize the way Australians transact, expanding access, and driving the country's digital economy forward.

Conclusion: PayID Drives Australia's Payments Ecosystem Forward

In conclusion, PayID is a revolutionary payment ecosystem that simplifies and streamlines the local payment experience in Australia.

PayID enables users to create a single identifier linked to their preferred payment accounts by providing a universal format for payment addresses. This eliminates the need to remember complex account numbers or deal with multiple payment identifiers across different platforms.

PayID works by leveraging the existing infrastructure of financial institutions and payment service providers, integrating seamlessly with various payment systems and networks. The underlying technology behind PayID ensures secure and efficient routing of payments, enabling fast and reliable transactions.

With its potential to streamline payments, enhance financial inclusion, and foster innovation in Australia's growing digital economy, PayID represents a significant advancement in digital payments.

As more organizations and individuals adopt PayID, we can expect to see a transformation in the way Australians transact, making payments simpler, more convenient, and more accessible for everyone.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

References:

1. Australian Banking Association article on PayID adoption in October, 2022.

2. PayID adoption and usage statistics published by NPP, Australia in October, 2022.

3. How to setup your PayID with Commonwealth Bank.

4. The official PayID website.

Categories

Similar Articles

Popular Mobile Wallets Across The World

Discover the top mobile wallets transforming how we pay globally. Explore the world of convenient and secure digital transactions. Do not miss this ultimate guide to the most popular mobile wallets across the world!

Complete Guide To Cash App Limits

Cash App is convenient and easy to use, but there are limits you should be aware of. Our comprehensive guide to Cash App limits has all you need to know to maximize the value of your account.

Complete Guide To Cash App Fees And Charges

Ready to take control of your Cash App experience and avoid costly fees? Our complete guide to fees and charges covers everything you need to know - from transaction fees to monthly fees and more.