Best Banks for Expats in Australia

Table of Contents

- Can a Foreigner Open a Bank Account in Australia?

- What are the Best Banks in Australia for Foreigners and Expats?

- Commonwealth Bank of Australia (CBA)

- Everyday Account Smart Access

- What are the fees for Commonwealth Bank Everyday Account Smart Access bank account?

- How can I avoid paying fees for Commonwealth Bank Everyday Account Smart Access bank account?

- Is Commonwealth Bank Everyday Account Smart Access bank account a good choice for me?

- Everyday Account Smart Access for Students

- What are the fees for Commonwealth Bank Everyday Account Smart Access for Students bank account?

- How can I avoid paying fees for Commonwealth Bank Everyday Account Smart Access for Students bank account?

- Is Commonwealth Bank Everyday Account Smart Access for Students bank account a good choice for me?

- What is Commonwealth Bank SWIFT Code?

- National Australia Bank (NAB)

- NAB Classic Banking Account

- What are the fees for NAB Classic Banking Account?

- Is NAB Classic Banking Account a good choice for me?

- What is National Australia Bank (NAB) SWIFT Code?

- Australia and New Zealand Banking Group (ANZ)

- Westpac Banking Corporation (Westpac)

- Suncorp Bank

- Suncorp Everyday Options Account

- What are the fees for Suncorp Everyday Options Account?

- Is Suncorp Everyday Options Account a good choice for me?

- What is Suncorp Bank SWIFT Code?

- Bank of Melbourne

- Complete Freedom Everyday Bank Account

- What are the fees for Bank of Melbourne Complete Freedom Everyday Bank Account?

- Is Bank of Melbourne Complete Freedom Everyday Bank Account a good choice for me?

- What is Bank of Melbourne SWIFT Code?

- Bankwest

- Easy Transaction Account

- What are the fees for Bankwest Easy Transaction Account?

- Is Bankwest Easy Transaction Account a good choice for me?

- What is Bankwest SWIFT Code?

- HSBC Bank Australia

- HSBC Everyday Global Account

- What are the fees for HSBC Global Currency Account?

- Is HSBC Global Currency Account a good choice for me?

- What is HSBC Australia SWIFT Code?

- Citibank Australia

- Best Australian Banks for Expats - Our Recommendations

- Which Australian bank is easiest for foreigners to open?

- Which Australian bank charges lowest fees?

- Which Australian bank is best for international students?

- Which Australian bank is best for earning interest on savings?

- Which Australian bank is best for traveling overseas?

- Which Australian bank supports maximum foreign currencies?

- Conclusion

If you are an expat living in Australia, it is important to find a bank that will meet your needs. There are many different banks to choose from, and it can be difficult to decide which one is right for you.

In this blog post, we will discuss the best banks in Australia for expats and foreigners. We will discuss the different services each bank offers and provide additional details about their online banking platforms.

We hope this information will help you make the best decision possible when choosing the best bank in Australia for your needs.

Can a Foreigner Open a Bank Account in Australia?

If you are planning to move to Australia for studying, working or settling in the country, the good news is that you can open a bank account in Australia.

Most popular banks in Australia welcome non-Australians to open bank accounts with them. The process is fairly simple and easy as long as you have the needed documents.

Below are the most common documents that you will need to open a bank account in Australia:

- Your original and current passport that you used to travel to Australia

- Your Tax Identification Number (TIN) for your foreign country of origin

- Your entry visa used to arrive in Australia

- Students may present a Student ID or letter of enrollment from an Australian educational institution

Foreigners and expats can open a bank account in Australia if they have the necessary documentation.

Depending on your situation and the bank you choose, you may have to provide additional documentation in addition to the above.

What are the Best Banks in Australia for Foreigners and Expats?

There are umpteen banks in Australia that provide services for expats and foreigners living, working and settled in Australia. These include both Australian banks as well as foreign banks that have a banking license to operate in Australia.

Choice is a good thing, but sometimes too much choice can lead to overwhelm and confusion. To make this easier, we have sifted through scores of options, and selected 9 best banks for expats in Australia.

Below is the list of the best Australian banks we have compiled for your consideration:

- Commonwealth Bank of Australia (CBA)

- National Australia Bank (NAB)

- Australia and New Zealand Banking Group (ANZ)

- Westpac Banking Corporation (Westpac)

- Suncorp Bank

- Bank of Melbourne

- Bankwest

- HSBC Bank Australia

- Citibank Australia

Of these, there are 4 banks which make up a large share of the Australian banking industry. We present which these are next.

What are the Big Four Australian Banks?

When you research and read upon Australian banks, you will most definitely come across the term "Big Four Australian Banks". These are the 4 most popular banks in Australia and include the below:

- Commonwealth Bank of Australia (CBA)

- National Australia Bank (NAB)

- Australia and New Zealand Banking Group (ANZ)

- Westpac Banking Corporation (Westpac)

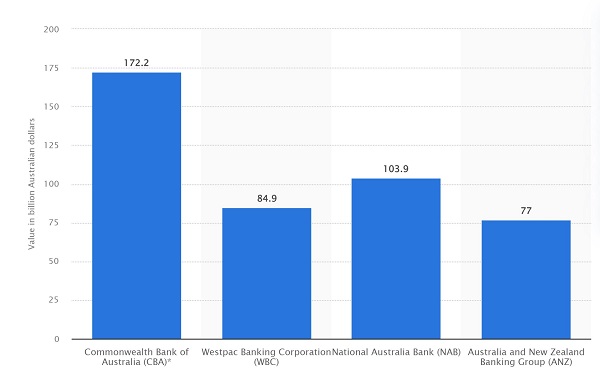

These 4 major Australian banks have a big share of the Australian banking sector. The below graph from Statista shows the market cap of these banks as of March 31, 2022.

Commonwealth Bank, NAB, ANZ and Westpac are the leading 4 banks in Australia based on market cap.

In the rest of this article, we will delve deeper into all these banks with a focus on their products and services geared towards Australian expats and foreigners.

Let's dive in!

Commonwealth Bank of Australia (CBA)

The Commonwealth Bank of Australia (CBA), also called CommBank, is one of the largest banks in Australia and has a long and rich history dating back to 1911. CommBank is a publicly listed company, with shares traded on the Australian Securities Exchange (ASX) with the ticker CBA.

The bank offers a wide range of financial products and services to retail, business, and corporate customers, including banking, credit cards, loans, insurance, investment, and wealth management.

CBA has a strong presence in the Australian market, with branches and ATMs located across the country. It also has a significant international presence, with operations in New Zealand, the United States, and the Asia-Pacific region. The bank is known for its strong focus on customer service and innovative financial products and services.

Commonwealth Bank puts a lot of focus on Australian expats and foreigners, and has the perfect accounts1 tailored just for you.

Below are two key CBA accounts that you may want to look at.

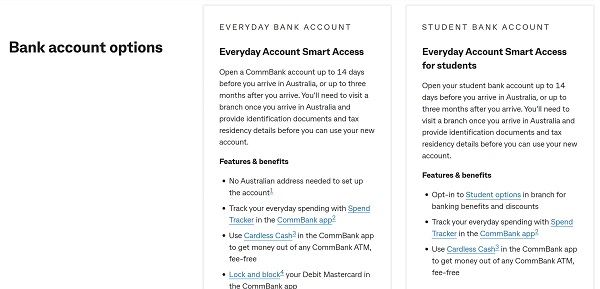

Everyday Account Smart Access

Commonwealth Bank's Everyday Account Smart Access allows potential newcomers to Australia to open an account up to 14 days before or three months after their arrival in the country. You do not need an Australian address to open this account.

Once you arrive in Australia and are ready to start using to Everyday Bank Account, you simply need to go to a nearby CBA Branch and submit your identification and tax residency documents, and your new account will be ready for use.

Here are the additional features and benefits of the Everyday Account Smart Access account:

- Use the CommBank mobile app to access and manage your account online at any time.

- Use Cardless Cash facility in the app to get free withdrawals from any CommBank ATM.

- Restrict your Mastercard debit card by locking it anytime via the CommBank app.

- Use the Spend Tracker feature in the app to track your spending and purchases.

Note that you will not earn any interest on your money in the Everyday Account Smart Access account regardless of amount held.

What are the fees for Commonwealth Bank Everyday Account Smart Access bank account?

If you open your CBA Everyday Account Smart Access bank account online, all fees are waived for the first 12 months.

After the first 12 months, there are quite a few noteworthy points that you should be aware of when it comes to fees on your CBA Everyday Account Smart Access bank account2; these are as below:

- You will incur a monthly fee of AUD 4 per month for your account.

- Withdrawals done at a bank branch or via telephone, or checks cleared at non-CommBank locations will incur a fee of AUD 3.

- CommBank ATM withdrawals are free, but other ATMs will be subject to fees charged by those ATM providers.

- For international access, you will need to pay AUD 2 for using ASB Bank ATMs in New Zealand or overseas CommBank ATMs.

- Excepting the above, any other overseas cash transactions get charged at AUD 5 plus 3% of transaction amount.

- International purchases done with Maestro (EFTPOS) or Debit MasterCard will get charged at 3%. This applies to foreign currency purchases as well as Australian Dollar purchases done at overseas merchants.

- Insufficient funds check or direct debit processing fee is AUD 5.

- Insufficient funds scheduled payment processing fee is AUD 5 after 5 unsuccessful payment attempts.

- Overdraft fee when overdraft limit is breached is AUD 15. Plus, you will be charged 14.90% interest per annum for the days that your account stays overdrawn.

You do not have to pay any fees for the first 12 months if you open your Commonwealth Bank Everyday Account Smart Access bank account online.

How can I avoid paying fees for Commonwealth Bank Everyday Account Smart Access bank account?

There are many ways to avoid paying various fees that apply to your Commonwealth Bank Everyday Account Smart Access bank account even after the initial 12 month promotions fee period is over.

Your monthly fee will be waived if you meet any of the criteria below:

- If you deposit at least AUD 2,000 every month.

- If you less than 25 years of age, or you are a student enrolled in an Australian educational institution, or you are pursuing an Australian apprenticeship.

- If your account gets a pension deposit from an aged, disabled or war veteran individual.

- If you have a balance of at least AUD 50,000 in your account.

- If you are disabled and need over the counter services at your bank branch.

- If you have a qualifying home loan.

There are many easy ways to avoid paying fees for your Commonwealth Bank Everyday Account Smart Access bank account even after the first 12 months no fee period is over.

Is Commonwealth Bank Everyday Account Smart Access bank account a good choice for me?

If you are a foreigner or expat in Australia, the Commonwealth Bank Everyday Account Smart Access bank account can be a great fit due to the below advantages:

- Commonwealth Bank is one of the top 4 banks in Australia and has a wide network of branches and ATMs across the country.

- You can open your account even before arriving in Australia, and activate it upon arrival to start using it right away.

- You do not need to be an Australian citizen to open this account.

- You do not pay any fees for the first 12 months if you open your account online.

- Commonwealth Bank has bilingual staff ready to help out in case language becomes an issue.

- Commonwealth Bank has its own CommBank mobile app that helps you track everything in your account, including a very helpful Spend Tracker feature to track and manage your expenses.

Everyday Account Smart Access for Students

Commonwealth Bank's Everyday Account Smart Access for Students is a specialized version of the Everyday Account but with a special focus on international students in Australia.

In addition to all the benefits that the Everyday Account Smart Access bank account comes with, the Everyday Account Smart Access for Students also adds the below benefits:

- Continue to pay no monthly fees even if you are above 25 years of age with Student Options enabled on your account.

- Tap into rewards with CommBank Rewards whereby you can earn rewards and cashback at many merchants and stores.

- Go cashless by adding your Debit Mastercard to your mobile phone with Apple Pay, Google Pay or Samsung Pay.

- Use the StepPay feature to pay for your purchases later.

- Use Klarna to show now and pay later for your online and in-store purchases.

- Use Cardless Cash feature like a mobile wallet to pay without cards or cash.

What are the fees for Commonwealth Bank Everyday Account Smart Access for Students bank account?

The fees for the Everyday Account Smart Access for Students bank account are the same as the normal Everyday Account Smart Access account as well. Please see our discussion above for this information.

How can I avoid paying fees for Commonwealth Bank Everyday Account Smart Access for Students bank account?

You can avoid paying fees for the Everyday Account Smart Access for Students bank account in all the same ways applicable for the Everyday Account Smart Access account.

In addition, your monthly fees will get waived for 5 years of being a student in Australia even if you are above 25 years of age.

Is Commonwealth Bank Everyday Account Smart Access for Students bank account a good choice for me?

Yes, the Everyday Account Smart Access for Students bank account from Commonwealth Bank is a great option for you if you are an international student studying in Australia.

In addition to the various advantages we covered earlier for the Everyday Account Smart Access bank account, the Everyday Account Smart Access for Students account also comes with 0 fees for up to 5 years of study in Australia even if you are above 25 years of age.

What is Commonwealth Bank SWIFT Code?

If someone needs to send money into your Commonwealth Bank account in Australia, they will need the bank's SWIFT Code to be able to send the funds to you.

Commonwealth Bank SWIFT Code is CTBAAU2S. The 11-digit equivalent, if needed, is CTBAAU2SXXX.

Providing the CBA SWIFT Code listed above will ensure that the overseas funds arrive correctly in your CommBank account in Australia. Note that the SWIFT Code may also be called BIC Code, so if your sender asks for that, you can give them the same code as above.

National Australia Bank (NAB)

National Australia Bank (NAB) is one of the top 4 banks in Australia and has been around since 1982. With 40 years' experience under its belt, NAB operates in Australia, New Zealand and many Asian countries, and has more than 9 million customers.

NAB is listed as a public company on the Australian Securities Exchange (ASX) and operated under the ticker NAB. The bank provides a multitude of banking and other financial services for both personal as well as business customers.

NAB has a bank account that is a very good fit with foreigners and expats in Australia, and it is called the NAB Classic Banking Account. Let's learn more about this account below.

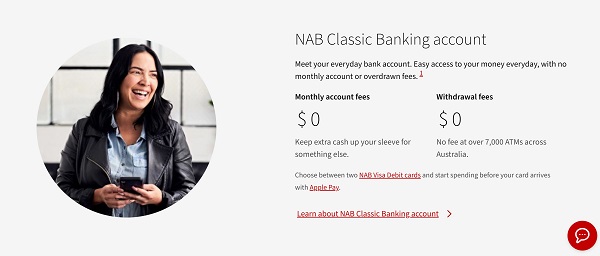

NAB Classic Banking Account

The NAB Classic Banking Account is NAB's best account for you if you are a foreigner living, working or studying in Australia.

Note that you cannot open your NAB Classic Banking Account from overseas before you arrive in Australia. You will need to visit a NAB branch to open your new account in person once you are in Australia. The process is really simple, and once your new account is open, you can start using it right away.

One of key advantages of a NAB Classic Banking Account is that you get a NAB Visa Debit Card which can be used across hundreds of thousands of stores, merchants and restaurants where Visa is accepted. There are no monthly fees for your Visa Debit Card either.

Additionally, you have 24x7 access to NAB Online Banking using any of the 2 below digital banking facilities:

- Using the NAB Internet Banking portal

- Using the NAB mobile app that is available for both Android and iOS devices

You can access your NAB Classic Banking Account 24x7 via either internet banking or the NAB mobile app.

What are the fees for NAB Classic Banking Account?

One of the best features of your NAB Classic Banking Account is 0 fees for many common banking needs and services.

When it comes to fees3, the below key points are useful to know about this account:

- You do not have to pay any monthly account fees.

- You do not have to maintain any minimum deposit.

- You do not have to pay overdrawn fees if you go over your account balance. You may have to pay interest on the overdrawn amount though.

- You do not have to pay any ATM withdrawal fees for cash withdrawals across more than 7,000 ATMs spread throughout Australia.

- You do not have to pay any transaction fees on purchases and spending done in Australia.

- You do not have to pay any monthly card fee or ATM withdrawal fee for using your NAB Visa Debit Card. If you choose to upgrade to the NAB Platinum Visa Debit Card, you will have to pay an AUD 10 monthly fee.

There are no fees or minimum deposit requirements for the NAB Classic Banking account.

Is NAB Classic Banking Account a good choice for me?

With 0 monthly account fees, no overdrawn fees and 0 withdrawal fees, the NAB Classic Banking Account can certainly be a very attractive option for you if you are concerned about saving on fees.

Pretty much all standard banking services are free of cost, and this only helps you maximize the potential of your hard earned money.

National Australia Bank has definitely set up the NAB Classic Banking Account to help you settle into your new home with ease. Additionally, if you are worried about language barriers, NAB can arrange for an interpreter to help you with your banking inquiries in the language of your preference.

NAB Classic Banking account comes with 0 or low fees for most banking needs.

What is National Australia Bank (NAB) SWIFT Code?

If you intend to receive money into your NAB Classic Banking Account from overseas, you will need to provide the sender information about your account, including the NAB SWIFT Code (also called the BIC Code).

NAB's SWIFT Code is NATAAU3303M.

Make sure your overseas sender use the above code as this will ensure the funds make it into your account successfully.

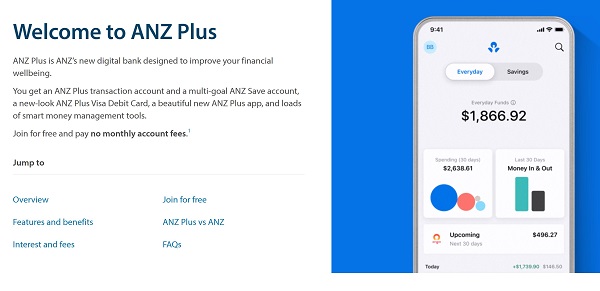

Australia and New Zealand Banking Group (ANZ)

The Australia and New Zealand Banking Group Limited (ANZ) is the second largest bank in Australia, and has been around for more than 50 years. The bank is a publicly listed company on both the Australian Securities Exchange (ASX) as well as the New Zealand's Exchange (NZX), and is listed with stock ticker ANZ.

ANZ is also the largest bank in New Zealand and operates in an additional 34 countries. With more than 9 million customers worldwide, ANZ offers a full host of banking, financial and investment products to its individual as well as corporate customers alike.

ANZ is the second largest bank in Australia, and the largest bank in New Zealand.

ANZ allows foreigners to bank with it, and their ANZ Plus account is something you would want to look at as an Australian expat. Read on for more details.

ANZ Plus Account

When you open the ANZ Plus Account4, you get 2 useful accounts that include the ANZ Plus transaction account and the multi-goal ANZ Save account.

In addition, you get an ANZ Plus Visa Debit Card as well as access to the ANZ Plus app that is very feature rich and useful.

Additional benefits of using the ANZ Plus account include the below:

- Earn 3.75% interest per annum if your balance in ANZ Save account is up to AUD 250,000, and 0.60% per annum on balances above AUD 250,000.

- 0 monthly fees on your account as well as free withdrawals from most Australian bank ATMs.

- ANZ Plus transaction and ANZ Save accounts help stay on top of spending as well as saving in parallel.

- ANZ Plus mobile app can be used to access your accounts anytime, anywhere. You can also use the ANZ Internet Banking login to access your accounts 24x7.

- ANZ Plus Visa Debit Card can be used anywhere Visa is accepted.

- Make cashless and contactless payments using various mobile payment methods like Apple Pay, Google Pay and Samsung Pay.

You can earn up to 3.75% interest per annum on your savings of up to AUD 250,000 held in your ANZ Plus Account.

What are the fees for ANZ Plus Account?

Your ANZ Plus account comes with mostly 0 or low fees5; below is a detailed breakdown of various fees you should be aware of:

- No monthly fee for your ANZ Plus and ANZ Save accounts.

- No ATM withdrawal fees at major Australian bank ATMs.

- International withdrawals at ANZ ATMs are free; other non-ANZ ATMs get charged at AUD 5 per transaction.

- Overseas transactions will get charged a 3% fee.

- Incoming transfers into ANZ accounts may get charged at AUD 15.

Is ANZ Plus Account a good choice for me?

With two very useful bundled accounts – the ANZ Plus transaction account and the ANZ Save account – the ANZ Plus account can be a great choice.

The chance of earning 3.75% interest per annum on your savings is certainly another reason to seriously consider ANZ for your banking needs as an Aussie expat.

You also have global access to your ANZ Plus account via the ANZ Plus mobile app which is very efficient and effective for customers who are always on the go. The app also has numerous useful tools to help you spend less and save more.

Plus, you have peace of mind with round-the-clock monitoring from the reliable security team at ANZ. They can help identify any suspicious activity and will check in if anything looks off. With this secure system keeping an eye on things for you 24/7, it's easy to sit back and rest assured knowing that your funds are always safe.

The ANZ Plus Account lets you earn up to 3.75% interest per annum and comes with a feature rich ANZ Mobile app.

What is Australia and New Zealand Banking Group (ANZ) SWIFT Code?

ANZ's SWIFT Code, also called a BIC Code, is ANZBAU3MXXX for Australian ANZ banks.

That said, ANZ uses different SWICT Codes for different banking purposes, so make sure to double check with your ANZ branch to verify which SWIFT Code to use.

If you are expecting funds into your ANZ bank account from overseas, make sure to provide the sender with the correct ANZ SWIFT Code. This will ensure that the funds arrive into your account without any problems.

Since ANZ is also a major bank in New Zealand, you may also want to note their New Zealand SWIFT Code, which is ANZBNZ22XXX.

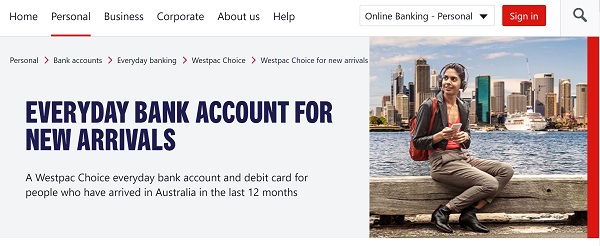

Westpac Banking Corporation (Westpac)

Westpac Banking Corporation, also called Westpac in short, was originally founded in 1817, and is oldest bank in Australia.

Westpac is part of the big four Australian banks, and is publicly listed on both the Australian Securities Exchange (ASX) and the New Zealand's Exchange (NZX) with stock ticker WBC. The word "Westpac" is a portmanteau of the words "Western" and "Pacific".

As Australia's first banking institution, Westpac has more than 14 million customers worldwide, and provides numerous personal and corporate banking, investment and wealth management solutions.

If you are a foreigner or expat in Australia, you will want to look at the Westpac Choice Everyday bank account6. We provide more details on this account below.

Westpac Choice Everyday Bank Account

The Westpac Choice everyday bank account is Westpac's offering for people who have arrived in Australia within the last 12 months. Even though you cannot open the Choice Account from overseas, it only takes 3 minutes to open your new account at a Westpac Bank branch once you are in Australia.

Here are the key features and benefits you can take advantage of with your Westpac Choice Account:

- Your Debit Mastercard enables you to securely shop online in a cashless way, do ATM withdrawals and use PayPass for smaller purchases.

- 0 fees for withdrawals at ATMs at major banks in Australia that include Westpac, ANZ, Commonwealth Bank, NAB, Bank of Melbourne, St. George and BankSA).

- Access to a digital card to start making purchases before your physical debit card arrives in the mail.

- Use the Westpac Mobile Banking App to access and manage your account online 24x7 from anywhere.

- Access to mobile wallet functions within Apple Pay and Google Pay for contactless payments.

- Secure fingerprint login into the Westpac Mobile Banking app for an added layer of security.

Now the best part. You can also earn up to 4.35% interest per annum on your balances of up to AUD 30,000 held in a Westpac Life savings account for saving your money, and spending it using the Westpac Choice bank account.

If you have savings held in the Westpac Life savings account, you can earn up to 4.35% interest per annum on up to AUD 30,000.

What are the fees for Westpac Choice Account?

The standard monthly fee for a Westpac Choice bank account is AUD 5. However, this fee is waived for the first 12 months for new Westpac customers as well as if you are a full time student.

In addition, below are some other Westpac fee related points you should be aware of:

- 0 fee for ATM cash withdrawals at major Australian banks as well as overseas withdrawals from Global Alliance Partner ATMs. Overseas ATM withdrawal fee for non-Global Alliance Partner ATMs is AUD 5.

- AUD 15 overdrawn balance fee applies if you withdraw more than your account balance.

- 3% fee for foreign currency transactions at merchants outside Australia.

- 2.2% fee for foreign currency transactions at merchants within Australia.

You do not pay any fees on your Westpac Choice Account for the first 12 months or if you are a full time student.

Is Westpac Choice Account a good choice for me?

With 0 monthly fees and no ATM withdrawal fees at not only Westpac ATMs but also all other major Australian bank ATMs, the Westpac Choice Account is definitely something you should closely look at. As an Aussie expat who wants to maximize your Dollar, the cost savings of this account may be aligned with your financial goals.

Additionally, the prospect of earning up to 4.35% interest per annum on your savings of up to AUD 30,000 further increase the attraction of this account for foreigners and expats settled in Australia. After all, you want your money and savings to grow, and the Westpac Choice Account helps you do just that.

Finally, Westpac takes the security and safety of your money as well as information very seriously. With features like card holds, money back guarantee for fraud victimization, 2 factor authentication (2FA) for important transactions and safe online banking guarantee, you can rest assured that you are in safe hands with Westpac.

Westpac Choice Account comes with 0 fees as well as a chance to earn up to 4.35% interest in your savings of up to AUD 30,000.

What is Westpac SWIFT Code?

Westpac SWIFT Code is WPACAU2S, or WPACAU2SXXX is the 11 digit SWIFT or BIC Code is required.

To ensure that overseas funds arrive correctly in your Westpac bank account in Australia without any hassle, make sure to give your sender the above Westpac SWIFT Code.

Suncorp Bank

Suncorp Bank started as Queensland Agricultural Bank in 1902, and now is part of the bigger Suncorp Group with headquarters in Brisbane, Australia. At this time, Suncorp Bank is the 6th largest bank in Australia.

Suncorp Bank provides a wide array of banking and financial services that include personal banking as well as small to medium enterprise (SME) banking. You can also take advantage of a host of other products like bank accounts, home loans and credit cards.

If you are an expat living in Australia, Suncorp Bank has their Everyday Options Account7 as a good option for you. We present useful information on this account below.

Suncorp Everyday Options Account

You can open the Suncorp Everyday Options Account in less than 5 minutes online, and then go into a Suncorp branch near you to verify your identity or do it yourself online.

If you are over 18 years old, all you need is a valid foreign passport with an Australian via to verify your identity, and you can start using your new account.

Specially geared to help you manage your money more efficiently, the Suncorp Everyday Options Account comes with the below useful features:

- There are no minimum deposit requirements or monthly account keeping fees.

- You pay 0 foreign currency conversion fees on Visa Debit Card purchases.

- You can open up to 9 Suncorp sub-accounts that help you save your money.

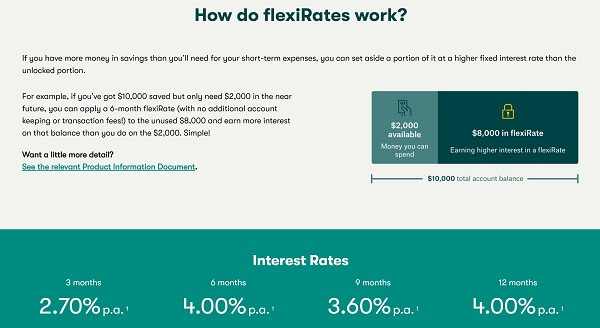

- You can earn higher interest rate on money you do not need to spend in the short term and choose flexiRates higher rate on such amount. Current Suncorp flexiRates are 2.70% per annum for 3 months, 4.00% per annum for 6 months, 3.60% per annum for 9 months and 4.00% per annum for 12 months.

- Use the Suncorp App 24x7 for Suncorp internet banking from anywhere. The app also comes with handy tools like the Suncorp Dollar Tracker that can help you budget better.

- Lock your Visa Debit Card instantly in case of loss or theft to avoid misuse.

The Suncorp Everyday Option Accounts lets you earn interest via the flexiRates option where you can choose the duration you want to earn interest for.

If you want to use Suncorp internet banking, you have the following 2 options:

- Use Suncorp online banking using their website and using your Suncorp banking login to access your account.

- Use the Suncorp mobile app anytime and from anywhere.

What are the fees for Suncorp Everyday Options Account?

You do not have to pay any monthly account fees for your Suncorp Everyday Options Account. Additionally, there are no minimum deposit requirements in place.

Below are some other facts and information related to Suncorp Everyday Options Account fees:

- You do not pay any foreign currency conversion fees as long as you use your Visa Debit Card for purchases done online as well as overseas.

- You do not pay any ATM withdrawal fees at either Suncorp ATMs or ATMs owned by the big four banks in Australia – these are Commonwealth Bank, ANZ, NAB and Westpac. All other ATMs may incur a fee for withdrawals.

- You do not pay any fees for transfers between your Suncorp Everyday Options account and your linked Suncorp sub-accounts.

Is Suncorp Everyday Options Account a good choice for me?

One of the biggest advantages of the Suncorp Everyday Options Account is the ability to earn interest on your money in a very flexible manner using Suncorp's creative flexiRates8 approach.

With Suncorp flexiRates, you can set aside money that you do not plan to use in the short-term for flexible time period that earn a much higher interest rate on your money. At this time, Suncorp's flexiRates are as below:

- 2.70% per annum for 3 months investment

- 4.00% per annum for 6 months investment

- 3.60% per annum for 9 months investment

- 4.00% per annum for 12 months investment

The below graphic shows how Suncorp flexiRates works in a pictographic format.

With 0 monthly fees as well as no fees for foreign currency purchases with the Visa Debit Card as well as ATM withdrawals at both Suncorp ATMs as well as ATMs owned by the big four banks in Australia, the Suncorp Everyday Options Account is definitely a money saver account.

You have complete flexibility on how long you want to earn interest on your money with the Suncorp Bank flexiRates option. Interest earned depends on the duration you choose.

What is Suncorp Bank SWIFT Code?

If someone is sending you money from overseas into your Suncorp bank account in Australia, you will need to provide them with Suncorp's SWIFT Code. This will ensure the funds arrive in your bank account without any problems.

Suncorp Bank SWIFT Code is METWAU4B.

If the overseas bank requires an 11-digit SWIFT Code, then METWAU4BXXX can be used.

Bank of Melbourne

Bank of Melbourne is a subsidiary of the Westpac Group, and was launched as an independent banking and financial institution in July 2011. The bank is headquartered in Victoria, Australia.

Bank of Melbourne provides a full gamut of banking and financial products and services geared towards both consumer as well as business customers. In addition to banking, the bank also provides loans, insurance, investments and credit cards amongst its most popular services.

Given that Australia is home to a lot of expats and foreigners, it is no surprise that Bank of Melbourne caters to non-Australians as well. Below are the 2 most popular accounts9 that foreigners can take advantage of:

- Complete Freedom Everyday Bank Account

- Complete Freedom Everyday Bank Account for Students

Both accounts are very similar in nature, so we will present details of the Complete Freedom Everyday Bank Account below.

Complete Freedom Everyday Bank Account

Bank of Melbourne's Complete Freedom Everyday Bank Account can be opened in less than 10 minutes. All you need as proof of identification is your valid foreign passport, and you can open this account.

Below are the key benefits of the Complete Freedom Everyday Bank Account:

- Your account comes with a Visa Debit Card that can be used at hundreds of thousands of merchants and shops that accept Visa payments.

- You can directly deposit your salary into your account, and make ATM withdrawals anytime for free across Westpac Group ATMs.

- You can use internet as well as mobile banking to access and manage your money from anywhere.

- You can access My Offers Hub to take advantage of umpteen rewards and discounts and save money.

- Your money and information are secure at all times with many safety features like card locking built in.

What are the fees for Bank of Melbourne Complete Freedom Everyday Bank Account?

One of the best parts of having a Bank of Melbourne Complete Freedom Everyday Bank Account is that you do not have to pay any monthly account keeping fees10.

Outside of that, you should be aware of the below information when it comes to potential fees related to this account:

- 0 fees for cash withdrawals at all major ATMs in Australia, including Westpac Group ATMs as well as Global Alliance ATMs.

- 0 fees for overseas cash withdrawals at Global Alliance ATMs, and AUD 5 for non- Global Alliance ATMs.

- AUD 15 overdrawn fee if you withdraw more money than your account balance.

- 3% fee on transactions that involved foreign currency conversion.

The Bank of Melbourne Complete Freedom Everyday Bank Account does not entail any monthly fees.

Is Bank of Melbourne Complete Freedom Everyday Bank Account a good choice for me?

The Complete Freedom Everyday Bank Account from Bank of Melbourne is a good bank account that should be on your radar as you shop for the best bank accounts in Australia for foreigners and expats.

The biggest benefits of this account include quick and hassle free account opening – all you need is your valid foreign passport to satisfy the identification requirement. Plus, you do not pay any monthly fee for your account.

Bank of Melbourne also offers multilingual bankers who speak several languages as well as multilingual ATMs. This will make it easier for you to bank with them in case English is not your first language.

Finally, internet as well as mobile banking make managing your money anytime and from anywhere a breeze. Simply use your Bank of Melbourne login credentials to access your account on the website or the mobile app.

Bank of Melbourne Complete Freedom Everyday Bank Account is quick and easy to open, and comes with 0 monthly fees.

What is Bank of Melbourne SWIFT Code?

Bank of Melbourne SWIFT Code is SGBLAU2S, and SGBLAU2SXXX if the 11-digit equivalent is required.

Also called the BIC Code, SWIFT Code is needed to ensure money gets credited into an overseas account correctly. So, if someone is sending money from overseas into your Bank of Melbourne bank account, make sure to provide them the SWIFT Code SGBLAU2S.

Bankwest

Bankwest is an Australian bank owned by the Commonwealth Bank of Australia, and is headquartered in Perth, Australia. Commonwealth Bank acquired Bankwest in October 2008 for AUD 2.1 billion, and Bankwest has operated as its subsidiary since then.

Much like all the other Australian banks that we have covered so far, Bankwest also provides a wide range of banking and financial products and services that include bank accounts, various types of loans, credit cards and savings accounts.

If you are a foreigner living, working or studying in Australia, Bankwest has the prefect account for you – it's called the Easy Transaction Account11. Read below to learn more about this account.

Easy Transaction Account

Bankwest's Easy Transaction Account is the perfect fit for all your banking needs if you are an Aussie expat.

It is quick and easy to open this account from overseas even before you arrive in Australia. All you need is your foreign passport, using which you can verify your identity to get your account operational.

Below are the main features and benefits of the Bankwest Easy Transaction Account:

- You do not need to maintain any minimum monthly deposit, and there are no monthly account keeping fees.

- You can use the Platinum Debit Mastercard to shop online and at stores both within Australia and overseas at more than 38 million Mastercard locations.

- For overseas purchases done with your Platinum Debit Mastercard, you do not need to pay any foreign transaction or ATM fees.

- Your Platinum Debit Mastercard is protected by the Mastercard 24/7 Zero Liability Protection.

- You can open up to 10 linked accounts and manage your budgeting and spending with them.

- Use the Bankwest mobile app for managing your account anytime and from anywhere. You can also use Bankwest Online Banking to use Bankwest online services.

What are the fees for Bankwest Easy Transaction Account?

The Bankwest Easy Transaction Account has 0 fees for most common banking needs, and is, therefore, a very cost effective account for Australian expats.

Below are key points you should be aware of w.r.t. fees associated with your Easy Transaction Account with Bankwest:

- 0 monthly account fee, and no minimum amount threshold requirements

- 0 fees for overseas ATM access when you use your Platinum Debit Mastercard

- 0 foreign transaction fees

Bankwest Easy Transaction Account comes with 0 fees for overseas ATM access as well as 0 foreign transaction fees.

Is Bankwest Easy Transaction Account a good choice for me?

With most of your common banking needs fee-free, the Bankwest Easy Transaction Account is a highly cost effective bank account especially if you are an expat living in Australia.

Another big advantage of using Bankwest is their feature rich and highly useful mobile app called the Bankwest App. Using the Bankwest mobile app, you can:

- Access your account 24x7 from anywhere

- Manage your sub-accounts for easy spending and budget tracking

- Use convenient features like card lock and unlock

- Configure Easy Alerts to get notified of key financial events in your account

- Set up your mobile digital wallet for cashless and cardless purchases

- Chat with support staff 24x7 in case you have questions

The Bankwest Mobile App has plenty of useful features that help you manage your accounts and spending 24x7 seamlessly.

What is Bankwest SWIFT Code?

Also called the BIC, the SWIFT Code is a key routing mechanism to ensure international bank transfers correctly reach the destination account. So, if someone is sending money into your Bankwest account from overseas, you would want to pass them your bank's SWIFT Code.

Bankwest SWIFT Code is BKWAAU6P. If an 11-digit SWIFT Code is needed, then BKWAAU6PXXX can be used.

Make sure your overseas sender uses the above to ensure a smooth transfer of funds into your Bankwest account.

HSBC Bank Australia

HSBC Bank Australia is one of the most popular foreign banks in Australia, and was granted its banking license to operate in the country in 1986. HSBC Australia is the Australian subsidiary of HSBC, and has 36 branches and office within the country.

HSBC Australia provides a wide range of banking services geared towards individual, commercial, corporate as well as institutional customers. These services include banking, payments, cash management, financial planning and trading and investments.

If you are an expat living in Australia, HSBC Australia has the prefect account for you – the HSBC Everyday Global Account12. Let's deep dive into this account further in sections below.

HSBC Everyday Global Account

HSBC's Everyday Global Account is an attractive option to consider if you are a foreigner living, studying or working in Australia. You can hold up to 10 global currencies in parallel in this account; these include the below:

- Australian Dollar (AUD)

- US Dollar (USD)

- British Pound (GBP)

- Euro (EUR)

- Hong Kong Dollar (HKD)

- Canadian Dollar (CAD)

- Japanese Yen (JPY)

- New Zealand Dollar (NZD)

- Singapore Dollar (SGD)

- Chinese Yuan (CNY)

Being able to buy, hold and spend in 10 global currencies makes this account ideal if you travel overseas frequently for business or leisure.

Additional benefits of the HSBC Everyday Global Account include:

- You can send money internationally with HSBC for AUD 8 transfer fee.

- You can earn 2% cashback on eligible purchases that are under AUD 100.

- You can use the feature rich HSBC Mobile Banking App to access your account 24x7 from anywhere in the world.

- You can use your account as a mobile wallet for cashless and touchless purchases by linking it with Google Pay, Apple Pay and Visa payWave.

- You can make payments and purchases in both Australia as well as overseas.

One thing to note is that you do not earn any interest on your balances held in the Global Currency Account for any of the 10 currencies you hold.

You can hold up to 10 currencies in parallel in your HSBC Everyday Global Account

What are the fees for HSBC Global Currency Account?

The best part about the HSBC Global Currency Account is that it is absolutely free to use for almost all your banking needs. This is no surprise as HSBC has specifically designed this account with foreigners' and expats' needs in view.

Specifically, below is everything you need to know about fees associated with your HSBC Global Currency Account:

- 0 monthly service fee

- 0 fee for online banking, deposits and ATM withdrawals

- 0 fee for EFTPOS, Bank@Post, phone banking and BPAY

- 0 fee for overseas ATM withdrawals

- 0% fee for overseas transactions done in foreign currencies

The HSBC Global Currency Account is absolutely free to use and comes with 0 fees for all your banking needs.

Is HSBC Global Currency Account a good choice for me?

In designing their Global Currency Account, HSBC has put a very strong focus on ease of use, convenience and cost effectiveness for Australian expats and foreigners.

The ability to hold 10 major global currencies in parallel makes this account a very attractive proposition especially if you travel outside of Australia frequently. This is because overseas ATM withdrawals as well as transactions in foreign currencies are totally free.

You can switch currencies in your account anytime using the HSBC Australia Mobile Banking App depending on where you are. Finally, HSBC's strong commitment to security and fraud protection ensure your money and information is safe in this account.

The HSBC Global Currency Account is prefect for you if you travel overseas frequently.

What is HSBC Australia SWIFT Code?

If you wish to receive funds from overseas into your HSBC bank account in Australia, HSBC's SWIFT Code is part of the required information that your overseas sender will need to send you money from their country.

HSBC Australia SWIFT Code is HKBAAU2S.

In case the sender's bank requires an 11-digit SWIFT Code for HSBC Australia, you can provide them with the following code: HKBAAU2SXXX.

Make sure your sender uses the correct HSBC Australia SWIFT Code else the funds may not reach out bank account correctly.

Citibank Australia

Citibank Australia has been in operation since 1985 and was one of the first global banks to receive a banking license to operate in the country. As part of the bigger Citigroup umbrella, Citibank Australia provides numerous banking services to customers.

Citibank Australia caters to banking and financial needs of its Australian individual as well as business customers who can open bank accounts, savings accounts, term deposits and credit cards with the bank. Customers can also use Citibank for loans and wealth management services.

Citibank has a very useful Citi Global Currency Account which customers can use to hold up to 10 global currencies in parallel. Unfortunately, Citibank Australia does not offer opening up with account anymore.

However, if you already have a Citi Global Currency Account open in your home country, you can add Australian Dollar as one of your foreign currencies and use this account when you are in Australia. If you need assistance on this, you can also consult with your Citibank relationship manager.

The Citi Global Currency Account lets you hold 10 currencies in parallel, but can no longer be opened in Australia. If you already have this account from another country, you can add Australian Dollar in it.

What is Citibank Australia SWIFT Code?

If someone is sending you money from overseas into your Citibank account in Australia, you will need to pass them Citibank Australia's SWIFT Code for the funds to arrive in your account correctly.

Citibank Australia SWIFT Code is NATAAU34.

SWIFT Codes are also called BIC Codes. If the sender asks for the BIC Code, you can pass them the same code as above.

This wraps up our detailed analysis of the best Australian banks for expats and foreigners in Australia. That was a lot of information, and you may still be wondering which bank is the best suited for your unique needs.

To help you further fine tune your research, we summarize our analysis with recommendations for specific needs and scenarios.

Best Australian Banks for Expats – Our Recommendations

In this final section, we present the best Australian banks for expats and foreigners consider specific scenarios you may be more interested in. Our suggestions are based on the detailed analysis into each bank and insights gained from the same.

Which Australian bank is easiest for foreigners to open?

Most of the top Australian banks we have covered are easy to open if you are a foreigner or expat in Australia. In fact, some banks even allow you to open your Australian bank account from overseas.

Below are our top picks for easy to open Australian bank accounts for expats:

- Commonwealth Bank's Everyday Account Smart Access can be opened up to 14 days before you arrive in Australia. Plus, you do not need an Australian address to open this account.

- Suncorp Bank's Everyday Options Account can be opened in less than 5 minutes online as long as you have a valid foreign passport.

- Bank of Melbourne's Complete Freedom Everyday Bank Account is quick and easy to open with a valid foreign passport.

- Bankwest's Easy Transaction Account can be opened from overseas with your valid foreign passport as identification proof.

Commonwealth Bank, Suncorp Bank, Bank of Melbourne and Bankwest all provide easy to open accounts for Australian expats.

Which Australian bank charges lowest fees?

HSBC Global Currency Account, Suncorp Everyday Options Account, NAB Classic Banking Account and Bankwest Easy Transaction Account all come with 0 fees for most common banking needs like ATM withdrawals and online purchases within Australia and overseas.

In addition, the Commonwealth Bank Everyday Account Smart Access bank account comes with 0 fees for the first 12 months for new customers.

HSBC, Suncorp Bank, NAB and Bankwest all provide bank for Australian expats with 0 fees for most common banking needs.

If you are an Australian expat and are concerned about paying fees for your bank account and other banking services, we recommend looking at the above options to save on fees.

Which Australian bank is best for international students?

If you are an international student in Australia, we recommend looking at Commonwealth Bank's Everyday Account Smart Access for Students. This is a curated version of CommBank's Everyday Account with a particular focus on international students in Australia.

One of the biggest advantages of the above CommBank account is that your monthly account fees are waived for up to 5 years you are a student in Australia.

Another good option for international students in Australia is the Bank of Melbourne Complete Freedom Everyday Bank Account for Students.

If you are an international student in Australian, you may want to look at specialized student accounts from Commonwealth Bank and Bank of Melbourne.

Which Australian bank is best for earning interest on savings?

If you are an expat working in Australia, you naturally want your money to grow. One of the best ways to do this is to earn interest on your savings, and based on our research, below are the best options to do so:

- The ANZ Plus account lets you earn 3.75% interest per annum on your savings of up to AUD 250,000 in your ANZ Save account, and 0.60% on amounts thereafter.

- The Westpac Choice bank account enables you to earn up to 4.35% interest per annum on balances up to AUD 30,000 in a Westpac Life savings account.

- The Suncorp Everyday Options Account has an attractive flexiRates facility that lets you earn 2.70% per annum for 3 months, 4.00% per annum for 6 months, 3.60% per annum for 9 months and 4.00% per annum for 12 months.

Consider looking at ANZ, Westpac and Suncorp bank accounts if you wish to earn interest on your savings.

Which Australian bank is best for traveling overseas?

The HSBC Everyday Global Account is your best companion if you travel overseas frequently from and to Australia.

The reasons for this are manifold and are listed below:

- You can hold up to 10 global currencies in your account.

- You can switch currencies seamlessly using the HSBC Mobile Banking App based on where you are at a given time.

- You do not pay any fees on currency conversion for overseas spending and purchases.

- You do not pay any fees for overseas ATM withdrawals.

The Everyday Global Account from HSBC Australia is best suited for your overseas spending if you are an Aussie expat who travels overseas frequently.

Which Australian bank supports maximum foreign currencies?

Both the Everyday Global Account from HSBC Australia and the Citi Global Currency Account from Citibank Australia support holding 10 global currencies in your account.

However, Citibank Australia no longer allows opening new Citi Global Currency Accounts. If you have one open in your overseas country already, you can add the Australian Dollar as one of your currencies and use it in Australia. Otherwise, you cannot open this account.

If the Citi Global Currency Account is not an option, then your best bet is the HSBC Everyday Global Account which allows you to hold 10 popular global currencies. These are Australian Dollar (AUD), US Dollar (USD), British Pound (GBP), Euro (EUR), Hong Kong Dollar (HKD), Canadian Dollar (CAD), Japanese Yen (JPY), New Zealand Dollar (NZD), Singapore Dollar (SGD) and Chinese Yuan (CNY).

The HSBC Everyday Global Account lets you handle 10 global currencies in parallel. You may also open Citi Global Currency Account in your home country.

Conclusion

If you are an expat in Australia looking for the best banking options available to you, there are many choices to consider. In this article, we presented some of the best Australian banks that you can use.

We put a special focus on the best bank accounts for Australian expats, and covered all the major Australian banks like the Commonwealth Bank of Australia, NAB, ANZ Bank, Westpac Bank, Suncorp Bank, Bank of Melbourne, Bankwest, HSBC Australia and Citibank Australia.

However, do not forget that your individual needs may vary so it's always a good idea to look into the pros and cons of each of the above banks, and see which account suits your needs the best. You can also speak with a representative from each bank to find out what they can offer you.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

References:

1. Commonwealth Bank accounts for foreigners and expats

2. Commonwealth Bank rates and fees for accounts

3. NAB intro page for the NAB Classic Banking account

4. ANZ Plus Account detailed information

5. ANZ Plus Account interest and fees information

6. Westpac Choice Everyday Bank Account for expats

7. Suncorp Bank's Everyday Bank Accounts

8. Suncorp Bank's flexiRates option for earning interest on savings

9. Bank of Melbourne everyday bank accounts

10. Bank of Melbourne Everyday Bank account fee and other information

11. Bankwest Easy Transaction Account

12. HSBC Bank Australia's Everyday Global Account

Categories

Similar Articles

CNAPS Codes Unraveled: Navigating China's Banking Landscape

Discover CNAPS Codes: China’s unique bank identifier for fast, secure transactions. Learn how CNAPS Codes simplify payments across China's banking system.

ABA Routing Numbers In The US: A Comprehensive Guide

Discover what ABA Routing Numbers are, how they work and their importance in US banking transactions like direct deposits, online transactions and wire transfers.

What Is A NUBAN Number And What Is It Used For?

Discover what NUBAN Numbers are and how they streamline bank account identification in Nigeria. Do not miss this essential guide if you transact in any way with the Nigerian banking system.