ABA Routing Numbers In The US: A Comprehensive Guide

Table of Contents

- What Are ABA Routing Numbers?

- Who Issues ABA Routing Numbers In The US?

- What Is The Format Of An ABA Routing Number?

- What Is An ABA Routing Number Used For?

- What Are The Benefits Of Using An ABA Routing Number?

- How Can I Find My Bank's ABA Routing Number?

- ABA Routing Numbers for Major US Banks

- What is the ABA Routing Number for Wells Fargo Bank?

- What is the ABA Routing Number for Chase Bank?

- What is the ABA Routing Number for Bank of America (BoA or BofA)?

- What is the ABA Routing Number for United Services Automobile Association (USAA)?

- What is the ABA Routing Number for America First Credit Union?

- What is the ABA Routing Number for Boeing Employees Credit Union (BECU)?

- What is the ABA Routing Number for Navy Federal Credit Union (NFCU)?

- What is the ABA Routing Number for PNC Bank?

- What is the ABA Routing Number for US Bank?

- What is the ABA Routing Number for Mountain America Credit Union (MACU)?

- What is the ABA Routing Number for TD Bank?

- What is the ABA Routing Number for VyStar Credit Union?

- What is the ABA Routing Number for Capital One Bank?

- What is the ABA Routing Number for Citibank?

- What is the ABA Routing Number for Charles Schwab Bank?

- What is the ABA Routing Number for Associated Bank?

- What is the ABA Routing Number for Global Credit Union?

- What is the ABA Routing Number for Regions Bank?

- What is the ABA Routing Number for First Horizon Bank?

- What is the ABA Routing Number for Golden 1 Credit Union?

- What is the ABA Routing Number for Police and Fire Federal Credit Union (PFFCU)?

- What is the ABA Routing Number for State Employees Credit Union (SECU)?

- What is the ABA Routing Number for Randolph-Brooks Federal Credit Union (RBFCU)?

- What is the ABA Routing Number for Security Service Federal Credit Union (SSFCU)?

- What is the ABA Routing Number for BMO Bank?

- Frequently Asked Questions About ABA Routing Numbers

- Where is the Routing Number on a Check?

- Is an ABA Routing Number the same as a Bank Account Number?

- Is ABA Number the same as Routing Number?

- How to find Routing Transit Number?

- Which number is the Routing Number on a Check?

- How many digits is a Routing Number?

- How to find your Routing Number without a Check?

- Is an ABA Routing Number the same as a SWIFT Code?

- Is an ABA Routing Number the same as a CNAPS Code?

- Is it Safe to Share an ABA Routing Number?

- Are ABA Routing Numbers used outside of the US?

- RemitFinder's Key Takeaways: ABA Routing Numbers A Fundamental Pillar Of US Banking

Welcome to our comprehensive guide on ABA Routing Numbers used in the United States. If you have ever wondered about what these unique nine-digit numbers associated with your bank are, you are in the right place.

ABA Routing Numbers are crucial in facilitating various financial transactions, from direct deposits and wire transfers to online banking and payment processing.

This guide will break down the fundamentals of ABA Routing Numbers, explain how they work, help you find your bank's routing number and explore their importance in today's digital banking landscape in the US.

Whether you are a curious individual, a business owner, or someone who wants to enhance their financial literacy, this article will provide a comprehensive understanding of ABA Routing Numbers and their significance in the US banking system.

What Are ABA Routing Numbers?

ABA Routing Numbers, also known as ABA RTNs (Routing Transit Numbers), are bank identification codes used in the United States to facilitate the routing and processing of financial transactions. ABA stands for American Bankers Association which created the ABA specification and format back in 1910 to uniquely identify banks across the US.

Based on ABA guidelines, ABA Routing Numbers are 9-digit long and are a well-known banking concept throughout the US.

ABA Routing Numbers, also called, ABA RTNs (routing transit numbers) are 9-digit unique identifiers for banks in the US. The ABA Routing Number specification was developed by the American Bankers Association (ABA) in 1910.

Comprising of 9 digits, these unique numbers are assigned to individual banks and credit unions to ensure the accurate transfer of funds during activities like direct deposits, wire transfers, electronic payments and check processing.

Who Issues ABA Routing Numbers In The US?

ABA Routing Numbers in the US are issued by the American Bankers Association (ABA)1. Every banking or financial institution in the US gets a unique 9-digit ABA Routing Number issued by the ABA.

To be eligible to obtain an ABA Routing Number, a bank or financial institution must have an account at a Federal Reserve Bank branch within the US. There are a total of 12 Federal Reserve Bank branches across the US in popular cities like New York, Boston, Chicago, Dallas, San Francisco and others.

ABA Routing Numbers are issued in the US by the American Bankers Association (ABA) to banks and financial institutions that have an account at a Federal Reserve Branch.

How Can A Bank Or Financial Institution Obtain An ABA Routing Number?

If a newly formed bank or financial institution wishes to obtain an ABA Routing Number, it must submit an application to LexisNexis Risk Solutions2, which is the official registrar of ABA Routing Numbers in the US.

What Is The Format Of An ABA Routing Number?

An ABA Routing Number is a 9-digit identifier for US banks, and follows a specific format as specified by the ABA Routing Number specification.

As per ABA guidelines, the 9-digit Routing Number is comprised of the specific, standard sub-parts.

The first 4 digits represent the Federal Reserve Routing Symbol. The first 2 digits of these 4 have been allocated as follows for various uses:

- 00 Series: Checks and drafts of the U.S. Government and its agencies (except federal banks).

- 01-12 Series: All checks and electronic transactions of banks, Federal Reserve Banks, Federal Home Loan Banks, Federal Land Banks, Federal Intermediate Credit Banks, Farm Credit Banks, and state government units.

- 21-32 Series: Checks, drafts and electronic transactions of thrift institutions. (Discontinued assignment in 1985. Since that date thrift institutions are assigned routing numbers in the 01-12 series.)

- 50-59 Series: Reserved for internal process control purposes by banks, Federal Reserve Banks, and other entities.

- 61-72 Series: Electronic Transaction Identifiers.

- 80 Series: Travelers Checks.

- 13-20 Series, 33-39 Series, 40-49 Series, 60 Series, 73-79 Series, 81-92 Series and 93-99 Series: Reserved for future use.

The next 4 digits represent the ABA Institution Identifier which is unique per bank or financial institution for the Federal Reserve district it is registered with.

The last digit is a Check digit that is used to validate that the whole 9-digit number is valid and has not been tampered with. The following algorithm is used to validate the ABA Routing Number using its 9 digits:

[ 3(d1 + d4 + d7) + 7(d2 + d5 + d8) + (d3 + d6 + d9) ] mod 10 = 0

where:

- dx is the xth digit of the ABA Routing Number

- Mod or modulo is the remainder after dividing the result by 10

Thus, to summarize, a 9-digit ABA Routing Number is made up of the following constituents:

- The first 4 digits stand for the Federal Reserve Routing Symbol.

- The next 4 digits signify the ABA Institution Identifier with the Federal Reserve Bank.

- The last and 9th digit helps to validate the accuracy of the ABA Routing Number by adhering to a specific validation algorithm.

As per ABA rules and guidelines, Routing Numbers are 9-digit long with the first 4 digits representing the Federal Reserve Routing Symbol, the next 4 digits signify the ABA Institution Identifier with the Federal Reserve Bank and the 9th digit helping validate the full 9-digit number using a validation formula.

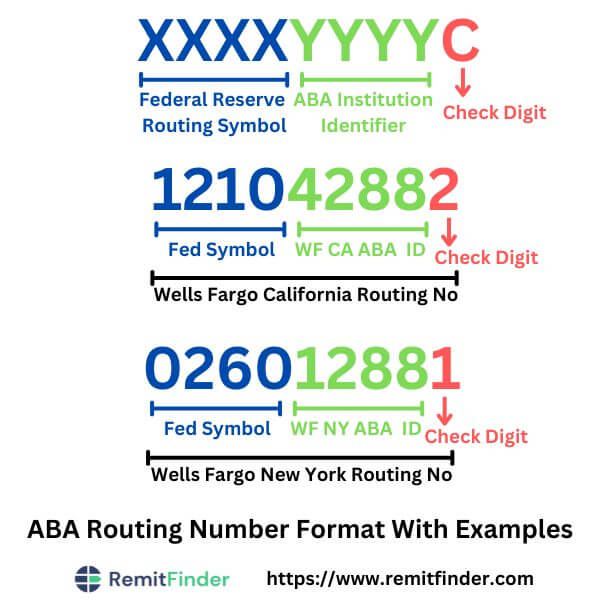

Let us look at an example.

The ABA Routing Number for Wells Fargo Bank is 121042882 for California customers. If we break this down into its sub-parts, we get the below constituents:

- 1210 is the Federal Reserve Routing Symbol for this Routing Number.

- 4288 is the ABA Institution Identifier for Well Fargo Bank branches in California with the Federal Reserve Bank.

- 2 is the check digit.

Here is the calculation to ensure that this is a valid ABA Routing Number:

[ 3(d1 + d4 + d7) + 7(d2 + d5 + d8) + (d3 + d6 + d9) ]

= [ 3(1 + 0 + 8) + 7(2 + 4 + 8) + (1 + 2 + 2) ]

= 27 + 98 + 5

= 130

Mod 10 of 130 is indeed 0. This means that this is a valid ABA Routing Number.

Let take another example for Wells Fargo Bank, but this time for New York.

The ABA Routing Number for Wells Fargo Bank in New York is 026012881. Here is the breakdown of this Routing Number:

- 0260 is the Federal Reserve Routing Symbol for this Wells Fargo Bank New York Routing Number.

- 1288 is the ABA Institution Identifier for Well Fargo Bank New York with the Federal Reserve Bank.

- 1 is the check digit.

Here is the calculation to check the validity of this ABA Routing Number:

[ 3(d1 + d4 + d7) + 7(d2 + d5 + d8) + (d3 + d6 + d9) ]

= [ 3(0 + 0 + 8) + 7(2 + 1 + 8) + (6 + 2 + 1) ]

= 24 + 77 + 9

= 110

Mod 10 of 110 also comes out to 0, thereby validating the accuracy of this Wells Fargo Bank New York ABA Routing Number.

The below image represents the format of an ABA Routing Number along with our 2 examples in an infographic format.

Can A Bank Or Financial Institution Have More Than One ABA Routing Number?

As you may have noted from the above, Wells Fargo Bank has different ABA Routing Numbers in different states. If you ever wondered whether the same bank or financial institution can have multiple ABA Routing Numbers, the answer is yes.

In fact, the ABA allows up to 9 additional ABA Routing Numbers to be assigned to a bank or financial institution if the latter requests them. The Routing Number Administrative Board of the ABA is the approving authority for banks or financial institutions requesting multiple ABA Routing Numbers.

What Is An ABA Routing Number Used For?

ABA Routing Numbers provide a standardized system for identifying banks and financial institutions within the United States. This is because each bank or financial institution that applies for an ABA Routing Number gets its own unique 9-digit Routing Number.

As a result, ABA Routing Numbers are very helpful anytime money needs to be routed between bank accounts held at various banks and financial institutions. This lends ABA Routing Numbers highly useful for many types of financial transactions; some of these include the below:

- Electronic Payments: ABA Routing Numbers are used to initiate electronic payments, such as automated clearing house (ACH) transactions and online bill payments. Providing the recipient's routing and account numbers allows the payment processor to route the funds to the correct bank and account.

- Direct Deposits: Many employers and government agencies use ABA Routing Numbers to facilitate direct deposits of salaries, benefits, and other payments. By providing your routing number and account number, you get the funds electronically deposited directly into your account.

- Merchant Payments: ABA Routing Numbers are utilized by merchants to process electronic payments from customers. When you make a purchase using electronic funds transfer (EFT), the merchant uses your routing number and account number to initiate the payment transaction.

- Online Banking: ABA Routing Numbers are essential for various online banking activities, including transferring funds between accounts, paying bills electronically, and setting up automatic recurring payments. Your bank's routing number is required to ensure accurate routing and processing of these transactions.

- Payment Gateways: Payment gateways, which facilitate online payments and e-commerce transactions, rely on ABA Routing Numbers to route funds between customers, merchants and banks. When a customer makes a payment online, the payment gateway uses the provided routing number to direct the funds to the appropriate bank account.

From electronic payments to direct deposits to online banking, ABA Routing Numbers are a critical component of electronic and digital payment processing within the United States.

ABA Routing Numbers are a fundamental component of the payment processing infrastructure in the United States. They ensure the smooth and secure movement of funds, thereby enabling individuals, businesses and financial institutions to handle a wide range of payment transactions efficiently.

Can I Send Or Receive Money Internationally Using ABA Routing Numbers?

ABA Routing Numbers are internal to the US banking infrastructure. As a result, they cannot be used to send or receive money internationally.

If you wish to send or receive international payments, relying on money transfer companies might be a better option since they will provide you with much better exchange rates and charge lower fees as compared to banks.

We also strongly recommend that you compare various money transfer companies before sending money abroad. This will help you compare the pros and cons of various providers and choose the one that suits your needs the best.

What Are The Benefits Of Using An ABA Routing Number?

ABA Routing Numbers are unique 9-digit identifiers used to unambiguously identify banks and financial institutions in the US. There are many benefits to using ABA Routing Numbers; below we list some of these.

- Error-Free Bank Identification: An ABA Routing Number is a unique identification code for each bank and financial institution in the US. This helps distinguish one bank from another and makes financial transactions error-free and secure by routing funds to the correct bank.

- Digital Economy Driver: ABA Routing Numbers drive the digital economy within the US since you can use them to easily transfer money, pay bills and make other transactions online without visiting the bank. This helps foster a digital and cashless economy in the United States.

- Secure Transactions: Since each bank's ABA Routing Number is issued by the ABA and is unique within the US, online transactions can simply make use of the ABA Routing Number without necessitating full bank details and address. This increases transaction security due to the need for lesser data transmission and reliance on ABA-issued standard ABA Routing Numbers.

- US Banking Standard: All banks and financial institutions across the United States are registered with the ABA and use ABA Routing Numbers for online transactions. This makes it faster and easier to move funds from one bank to another anywhere in the US without worrying about compatibility issues.

- Convenience: By using ABA Routing Numbers, you can easily initiate online banking transactions in the US from anywhere in the world. This is very convenient as you do not need to visit your bank to do financial transactions.

- Cost Saving: Using ABA Routing Numbers reduces costs associated with manual transactions like using checks. Additionally, online and digital transactions reduce traffic and long lines at banks, thereby helping in saving time and money for one and all.

There are many advantages of using ABA Routing Numbers for various financial transactions in the US. From improved accuracy, enhanced security and convenience to driving the digital economy forward, ABA Routing Numbers are a critical pillar in the US banking system.

How Can I Find My Bank's ABA Routing Number?

If you wish to find your bank's ABA Routing Number in the US, there are several easy ways to do so. Below, we list some of the easiest ways to find the ABA Routing Number for your bank.

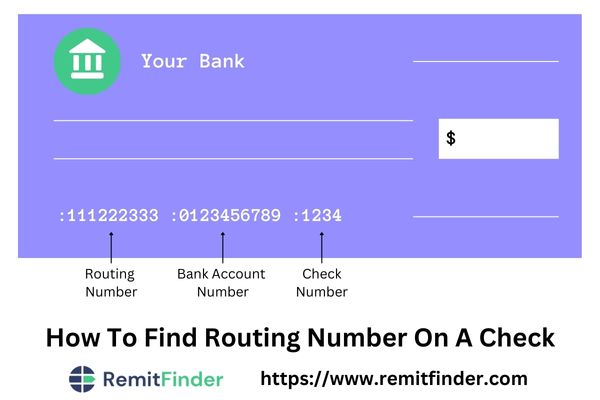

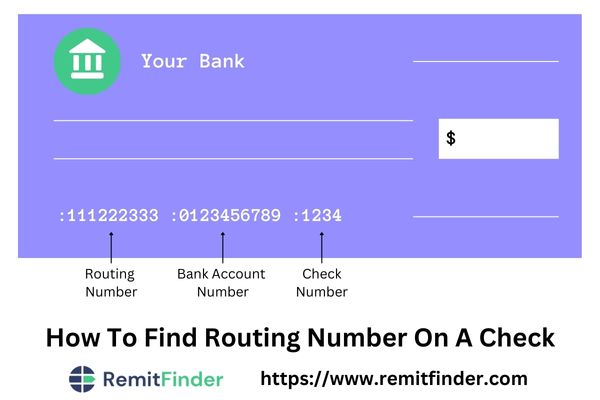

- Using checks or deposit slips: ABA Routing Numbers are often printed on the bottom left corner of personal checks and deposit slips. Look for a series of nine digits, and the routing number should be the first nine digits on the left. Below is an example of how this looks like.

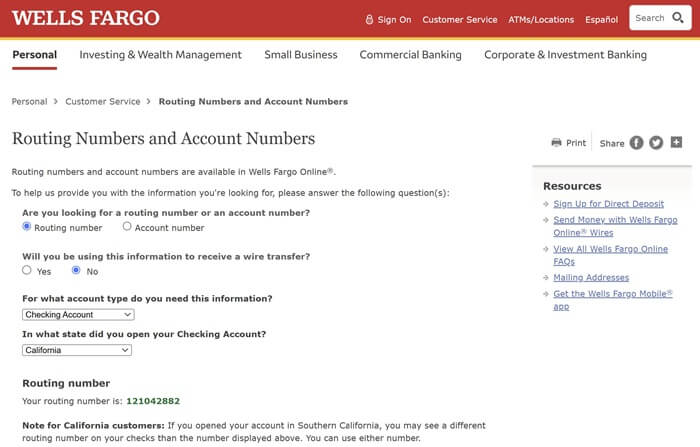

- Visit your bank's website: Most banks provide their ABA Routing Numbers on their official websites. Look for a section or page dedicated to FAQs, customer support, or account information. Here is a screenshot on how to find Wells Fargo's ABA Routing Numbers using their website3.

- Contact your bank directly: If you are unable to find your bank's Routing Number through above means, reach out to your bank's customer service. You can call their customer support hotline or visit a local branch to ask for assistance.

- Check RemitFinder's free Routing Number lookup tool: RemitFinder has compiled a comprehensive list of Routing Numbers of various US banks, credit unions and financial institutions. Check this free Routing Number lookup page to see if your bank is listed, and if so, click on your bank name to find their Routing Number(s).

- Use online routing number directories: There are several reliable online directories available where you can search for your bank's routing number by entering the bank's name. These directories compile information from various financial institutions, making finding your routing number easier.

Whilst there are several ways to find your bank's ABA Routing Number, the easiest method is to look at your checks or deposit slips. Most banks also provide their Routing Numbers on their website.

When using your ABA Routing Number, make sure that you provide the correct information to prevent any errors or delays in your financial transactions. This is especially relevant since many banks and financial institutions use multiple ABA Routing Numbers for various purposes.

Always double-check your bank's ABA Routing Number before initiating any electronic transfers or providing it to others for direct deposits or payments.

ABA Routing Numbers for Major US Banks

If you send or receive electronic payments within the US, you will need your 9-digit ABA Routing Number to make error-free financial transactions.

In the prior section, we listed quite a few easy and simple ways to find your bank's ABA Routing Number. In this section, we will provide the ABA Routing Numbers for some popular US banks and credit unions.

Note that this is not a comprehensive list. Also, many banks and financial institutions have multiple ABA Routing Numbers, so make sure to double-check your ABA Routing Number with your bank before you use it to for transactions.

What is the ABA Routing Number for Wells Fargo Bank?

Wells Fargo uses multiple ABA Routing Numbers.

For example, Wells Fargo Routing Number for Domestic Wire Transfers is 121000248 whilst the Routing Number for Wells Fargo in California and Colorado is 121042882.

Make sure to get the correct Routing Number for Wells Fargo in your region.

What is the ABA Routing Number for Chase Bank?

Chase Bank also used multiple ABA Routing Numbers with some examples below:

- Domestic Wire Transfer: 021000021

- California and Nevada: 322271627

- New Jersey: 021202337

Make sure that you verify your Chase Bank Routing Number before you use it for transactions.

What is the ABA Routing Number for Bank of America (BoA or BofA)?

Like other major US banks, Bank of America also uses multiple ABA Routing Numbers. For instance, for California, use 121000358 whilst for Hawaii, use 51000017.

Once again, we recommend verifying your Bank of America ABA Routing Number before using it for a real transaction.

What is the ABA Routing Number for United Services Automobile Association (USAA)?

The ABA Routing Number for United Services Automobile Association (USAA) is 314074269.

What is the ABA Routing Number for America First Credit Union?

America First Credit Union's ABA Routing Number is 324377516.

What is the ABA Routing Number for Boeing Employees Credit Union (BECU)?

The ABA Routing Number for Boeing Employees Credit Union (BECU) is 325081403.

What is the ABA Routing Number for Navy Federal Credit Union (NFCU)?

The ABA Routing Number for Navy Federal Credit Union (NFCU) is 256074974.

What is the ABA Routing Number for PNC Bank?

PNC Bank has multiple ABA Routing Numbers.

For example, the Routing Number for incoming domestic wire transfers is 043000096, which is different from regular Routing Numbers printed on PNC checks. Make sure to look up the correct PNC Bank ABA Routing Number before you use it.

What is the ABA Routing Number for US Bank?

Just like other big American banks, US Bank also has multiple ABA Routing Numbers. Here are a few examples:

- North California: 121122676

- South California: 122235821

- Kansas: 101000187

- Missouri: 081000210

Make sure to use the correct ABA Routing Number for the region or state your US Bank is located in.

What is the ABA Routing Number for Mountain America Credit Union (MACU)?

The good news is that Mountain America Credit Union (MACU) uses a single ABA Routing Number for all its branches.

Mountain America Credit Union's ABA Routing Number is 324079555.

What is the ABA Routing Number for TD Bank?

TD Bank uses multiple ABA Routing Numbers that vary by location as well as transaction type. Here are some of TD Bank's ABA Routing Numbers:

- Domestic and international wire transfers: 031101266

- Connecticut: 011103093

- Florida: 067014822

What is the ABA Routing Number for VyStar Credit Union?

VyStar Credit Union's ABA Routing Number is 263079276.

What is the ABA Routing Number for Capital One Bank?

Capital One Bank has multiple ABA Routing Numbers depending on the type of transfer and the Capital One bank institution where the account is held. Here are couple of examples:

- Domestic or international wire transfer: 256074974

- Checking accounts: 031176110

Double-check your Capital One Bank ABA Routing Number before you employ the same for a financial or banking transaction.

What is the ABA Routing Number for Citibank?

Citibank is a major bank in the US, and like other big banks in the country, is it no surprise that Citibank also uses multiple ABA Routing Numbers - these vary by state and are always located at the bottom left corner of your Citibank check.

Here are a few Citibank ABA Routing Numbers for some US states:

- Northern California: 321171184

- Southern California: 322271724

- Connecticut: 221172610

- Delaware: 031100209

- New Jersey: 052002166

- New York: 021000089

Always make sure to check your Citibank ABA Routing Number for accuracy to ensure you are using the correct one.

What is the ABA Routing Number for Charles Schwab Bank?

The ABA Routing Number for all Charles Schwab Bank accounts is 121202211.

What is the ABA Routing Number for Associated Bank?

The ABA Routing Number for Associated Bank is 075900575.

What is the ABA Routing Number for Global Credit Union?

Global Credit Union's ABA Routing Number is 325272021.

What is the ABA Routing Number for Regions Bank?

The ABA Routing Numbers for Regions Bank vary based on the transaction type as well as the state where the account is held. Here are a couple of examples of Regions Bank's ABA Routing Numbers:

- Domestic wire transfers: 062005690

- Regions Now Card: 065402892

What is the ABA Routing Number for First Horizon Bank?

First Horizon Bank also uses multiple ABA Routing Numbers. That said, the good news is that you can also use First Horizon Bank's main ABA Routing Number which is 084000026.

What is the ABA Routing Number for Golden 1 Credit Union?

Golden 1 Credit Union's ABA Routing Number is 321175261.

What is the ABA Routing Number for Police and Fire Federal Credit Union (PFFCU)?

Police and Fire Federal Credit Union (PFFCU) uses a single ABA Routing Number which is 236084285.

What is the ABA Routing Number for State Employees Credit Union (SECU)?

The ABA Routing Number for State Employees Credit Union (SECU) accounts is 255076753.

What is the ABA Routing Number for Randolph-Brooks Federal Credit Union (RBFCU)?

The ABA Routing Number for Randolph-Brooks Federal Credit Union (RBFCU) is 314089681.

What is the ABA Routing Number for Security Service Federal Credit Union (SSFCU)?

The Routing Number for Security Service Federal Credit Union (SSFCU) is 314088637.

What is the ABA Routing Number for BMO Bank?

The ABA Routing Number for all BMO Bank personal bank accounts is 071025661.

Since many banks and financial institutions in the US have multiple ABA Routing Numbers, make sure to check the correct one before you start using it.

Here are some important points about Routing Numbers:

- Routing Numbers in the US are owned by the American Bankers Association (ABA).

- We recommend double-checking your Routing Number with the ABA. To do this, check out ABA's useful Routing Number Lookup tool.

Frequently Asked Questions About ABA Routing Numbers

In this section, we will cover some Frequently Asked Questions (FAQs) about ABA Routing Numbers.

Where is the Routing Number on a Check?

ABA Routing Numbers in the US are always printed on checks issued by various banks and financial institutions.

As per ABA guidelines and standard bank procedures in the country, the ABA Routing Number is always printed on the bottom left of a check. See the below image to see how to find your Routing Number using your check.

The first 9 digits on the bottom left of checks issued by US banks or financial institutions are the ABA Routing Number for that bank or financial institution.

This standard format makes it easy for anyone to quickly look up their bank's ABA Routing Number.

Is an ABA Routing Number the same as a Bank Account Number?

An ABA Routing Number is not the same as a bank account number as the 2 numbers represent different concepts.

If you have a US bank account, your bank will have a 9-digit ABA Routing Number that helps to identify your bank in the country's banking ecosystem. Your account number, on the other hand, is specific and personal information for just your account.

Is ABA Number the same as Routing Number?

The term ABA Number is not an official term and may be used as a short form for ABA Routing Number. In that sense, ABA Number is the same as a Routing Number.

How to find Routing Transit Number?

Note that ABA Routing Numbers are also called ABA Routing Transit Numbers (RTNs). Hence you can use the same steps to look up Routing Numbers or Routing Transit Numbers. See a prior section on how to easily find your Routing Number.

Which number is the Routing Number on a Check?

All US checks issued by banks or financial institutions in the country have their ABA Routing Number printed on them. The first 9 digits printed on the bottom left of a check are the ABA Routing Number for the issuing bank or financial institution.

How many digits is a Routing Number?

As per ABA guidelines, ABA Routing Numbers are 9 digit long. They contain the below information:

- The Federal Reserve Routing Symbol makes up the first 4 digits.

- The ABA Institution Identifier with the Federal Reserve Bank is used for the next 4 digits.

- A check digit is the last and 9th digit and is used to validate the accuracy of the ABA Routing Number.

See an earlier section in this article for more details about ABA Routing Number format with examples.

How to find your Routing Number without a Check?

Even though it is quick and easy to find your bank's Routing Number using your check, there are other simple ways to find the same information.

Most banks have search and lookup facilities in their online banking portal or mobile apps to help you access your Routing Number. You can also call their customer service or visit your local branch to find out this information.

Is an ABA Routing Number the same as a SWIFT Code?

ABA Routing Numbers and SWIFT Codes are both used in financial transactions, but they serve different purposes and operate in different systems. Here is a quick comparison between ABA Routing Numbers and SWIFT Codes:

ABA Routing Numbers:

- Used primarily in the United States for domestic transactions.

- Consist of 9 digits and are unique to each bank or financial institution.

- Identify the specific bank or financial institution within the US.

- Used for various transactions such as direct deposits, wire transfers, electronic payments and check processing within the US banking system.

- Ensure accurate routing and processing of funds within the US.

SWIFT Codes:

- Used internationally for cross-border transactions.

- Also known as Bank Identifier Codes (BICs).

- Consist of a combination of 8 or 11 alphanumeric characters.

- Identify the bank and branch involved in international financial transactions.

- Used for international wire transfers, foreign currency exchange and communication between financial institutions globally.

- Facilitate secure and standardized transactions across different countries and currencies.

Is an ABA Routing Number the same as a CNAPS Code?

CNAPS Code in China help to uniquely identify bank branches in the country, and hence are very useful for accurately routing funds within the Chinese banking ecosystem. In that way, ABA Routing Numbers in the US are similar to CNAPS Codes in China.

Is it Safe to Share an ABA Routing Number?

If you are a bank account holder in the United States, your bank or credit union will have an ABA Routing Number. ABA Routing Numbers are specific to banks and are public information. In that sense, it is safe to share an ABA Routing Number.

That said, by sharing your bank's ABA Routing Number, you are indirectly disclosing that you have an account at that bank. Given this, we recommend that you do not share your bank's ABA Routing Number without caution. Only share your ABA Routing Number with trusted parties like employers and safe entities on a need-to-know basis.

Are ABA Routing Numbers used outside of the US?

The ABA Routing Number specification was developed by the ABA for use within the US banking ecosystem to uniquely identify banks and financial institutions participating in financial transactions within the country.

Given this, ABA Routing Numbers are not used outside of the US. You may still hear of them outside the US as international transactions may finally get cleared by local US banks that might use a recipient's bank's Routing Number to move the money into their account.

RemitFinder's Key Takeaways: ABA Routing Numbers A Fundamental Pillar Of US Banking

ABA Routing Numbers are a vital aspect of the US banking system, enabling secure and accurate routing of funds for domestic transactions.

This comprehensive guide has provided an overview of what ABA Routing Numbers are, their format, benefits and their significance in various financial activities such as online banking, payment processing and fraud prevention.

Understanding and properly handling ABA Routing Numbers is crucial for conducting seamless and secure financial transactions. Whether you need to initiate transfers, set up direct deposits, make online payments, or verify the legitimacy of recipients, knowing your bank's Routing Number is essential.

By adopting and using ABA Routing Numbers, participating banks and financial institutions as well as consumers can protect their financial information, minimize the risk of fraud and ensure a smooth and efficient flow of funds within the US banking system.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

References:

1. American Bankers Association (ABA) routing number policy and procedures.

2. LexisNexis Risk Solutions, official registrar of ABA Routing Numbers in the US.

3. Wells Fargo ABA Routing Number search page.

Categories

Similar Articles

CNAPS Codes Unraveled: Navigating China's Banking Landscape

Discover CNAPS Codes: China’s unique bank identifier for fast, secure transactions. Learn how CNAPS Codes simplify payments across China's banking system.

What Is A NUBAN Number And What Is It Used For?

Discover what NUBAN Numbers are and how they streamline bank account identification in Nigeria. Do not miss this essential guide if you transact in any way with the Nigerian banking system.

What Is RuPay And How Does It Work?

RuPay is India's indigenous and innovative payment system. Discover the mechanics of this game-changing platform and upgrade your payment experience within India with RuPay.