What are IBAN, SWIFT and BIC codes?

Table of Contents

- What is an IBAN?

- How do IBANs Work and what is their structure?

- Is IBAN used in every country?

- What is the relationship between IBAN and SEPA?

- How to find your IBAN?

- What's the IBAN Registry?

- What is a SWIFT Code?

- What is a BIC Code?

- Are BIC and SWIFT codes the same?

- How does a SWIFT or BIC Code look like?

- Are IBAN and SWIFT codes the same?

- Where can I find my SWIFT or BIC code?

- IBANs, SWIFT and BIC Codes — Summary

- Frequently Asked Questions about IBAN, SWIFT and BIC Codes

- Is an IBAN the same as a bank account number?

- Is a SWIFT or BIC Code the same as a bank account number?

- Is an IBAN the same as a bank code?

- Is a SWIFT or BIC Code the same as a bank code?

- Is an IBAN the same as a UPI ID?

- Is a SWIFT or BIC Code the same as a UPI ID?

- Is an IBAN the same as a UPI ID?

- Is a SWIFT or BIC Code the same as a UPI ID?

- Is an IBAN the same as a UTR Number?

- Is a SWIFT or BIC Code the same as a UTR Number?

- Is an IBAN the same as a MICR Code?

- Is a SWIFT or BIC Code the same as a MICR Code?

- Is an IBAN the same as a BSB Number?

- Is a SWIFT or BIC Code the same as a BSB Number?

- Is an IBAN the same as an IFSC Code?

- Is a SWIFT or BIC Code the same as an IFSC Code?

- Is an IBAN the same as a Sort Code?

- Is a SWIFT or BIC Code the same as a Sort Code?

- Is an IBAN the same as a CLABE Number?

- Is a SWIFT or BIC Code the same as a CLABE Number?

- Is an IBAN the same as a NUBAN Number?

- Is a SWIFT or BIC Code the same as a NUBAN Number?

- Is it safe to share your IBAN?

- Is it safe to share your SWIFT or BIC Code?

- Conclusion

In today's connected, digital global economy, money transfers and bank transactions often span national boundaries. When you do international money transfer transactions, you will come across terms like IBAN, SWIFT and BIC. These are important parts of making a successful funds transfer, and are essential as they facilitate the completion of overseas payments to the right location.

In this article, we will discuss all you need to know about these codes and how to recognize them. You will also learn where to get them, and how and when to use them.

What is an IBAN?

IBAN stands for International Bank Account Number. The international banking & payments services sector uses IBANs for processing transfers from one country to another.

As you may have guessed from the name, an IBAN uniquely identifies foreign accounts taking part in cross-country transactions. In simple terms, it's a globally accepted standard and unique representation of your local account number.

Banks or other payment services companies prefer using IBANs for money transfers between countries. That is because these codes supply critical information necessary to deliver payments to the right account. So, you will most likely be required to submit an IBAN when moving money abroad or receiving cash from overseas.

An IBAN uniquely identifies foreign accounts taking part in cross-country transactions.

How do IBANs Work and what is their structure?

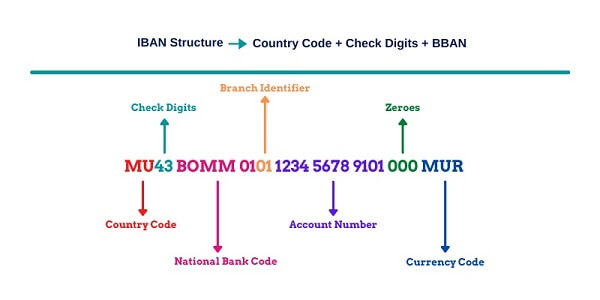

IBANs are special account identification codes that enable computers to read the ID of an account regardless where it is located. The IBAN format consists of letters combined with numbers according to certain globally accepted rules.

Each group of characters within an IBAN provides specific details about some particular information about a bank account. Just by looking at an IBAN, payment processors can tell in which country the bank branch is located and which bank account to deliver payment to.

IBANs also contain numbers using which banks can validate routing data even before initiating a transfer.

Before IBANs were invented, every country and their financial institutions followed their own rules for identifying accounts. Confusion often arose when processing transactions between countries because of the different styles, composition, and lengths of account numbers.

The lack of a global standard for accounts IDs was vulnerable to various interpretations of payment destinations and transaction types. Transcription errors occurred frequently, and many transfers were delivered to the wrong location.

The IBAN format is based on the ISO 13616-1:2007 standard1 which serves as a global benchmark for identifying international bank accounts.

A uniform global standard guarantees efficient data-exchange and an effective management of overseas monetary exchanges between banks.

In this way, the IBAN standard supports monetary operations internationally by guiding the movement of funds to the right deposit account.

IBANs follow the rules specified in the aforementioned ISO standard. For example, the number of characters in an IBAN must not exceed 34, they must not contain lowercase letters, the first two characters must be letters, the next two characters must be digits, and so on. The last part of an IBAN constitutes the basic bank account number (BBAN).

The BBAN carries information about the local account number, the bank branch and other essential routing details. Every country has its own specification that defines the composition and arrangement of various parts of BBANs.

IBAN Structure = 2-letter Country Code + 2-digit Check Number + BBAN

Let's look at a few examples of IBANs from a few countries.

| Components | Norway | Germany | Saint Lucia |

|---|---|---|---|

| Country Code | NO | DE | LC |

| Check Digits | 46 | 67 | 44 |

| BBAN | 74971111068 | 411222173795014000 | HEMM000500050044003300011012 |

| Bank Identifier | 7569 | 41122217 | HEMM |

| Local Account Number | 7569 11 11068 | 795014000 | 0005 0005 0044 0033 0001 1012 |

| IBAN Number | NO46 7569 1111 068 | DE67 4112 2217 3795 0140 00 | LC44 HEMM 0005 0005 0044 0033 0001 1012 |

| IBAN Length | 15 | 22 | 32 |

Is IBAN used in every country?

A quick answer to the question above is no!

The US and Canada, for example, do not officially use IBANs, whilst Europe does.

The European System of Central Banks (ESCB), a financial association in Europe, adopted the IBAN template to help standardize automated transfers between EU countries. Later, several nations outside the EU also accepted the IBAN specification as it is backed by an ISO numbering guideline.

Presently, there are 78 IBAN countries worldwide2, while another 26 countries are still developing their IBANs.

Furthermore, in over 50 countries, IBAN is obligatory, especially for overseas banking, with some of these countries enforcing an IBAN-only policy for international transfers. The said policy dictates that organizations only use the information available from IBANs to execute bank transfers, and ignore any other related information that customers submit.

What is the relationship between IBAN and SEPA?

SEPA is short for Single Euro Payment Area3 and currently comprises 36 member states. Europe's finance sector initiated the SEPA scheme to organize and unify Euro-based digital transfers between its member states.

IBAN is SEPA's preferred standard for describing accounts, and IBANs are a requirement for making both national as well as intercountry SEPA payments.

SEPA's goal is to make cross-border transactions as inexpensive, easy, and straightforward as domestic transactions.

Note, however, that the arrangement does not cover bank transfers executed in currencies other than the Euro. That's because SEPA guidelines within Europe operate on a single currency scheme using the Euro as its sole currency. Non-Euro payments within Europe continue to follow the usual course of currency exchange along with its associated costs.

How to find your IBAN?

You will need your IBAN before you execute an international bank transfer. If you do not know your IBAN already, there are a few ways you can find your it; below we list some of these.

- Call your bank or search through links on their web page.

- Check the top right corner of the printed copy of your account's statement.

- Construct your IBAN using IBAN calculators on the internet. You can also cross-check IBANs that you receive from your bank, or anyone else with these calculators.

What's the IBAN Registry?

The IBAN Registry2 is essentially a record of all nations complying with the latest IBAN standard, and how they construct their IBANs. This repository contains information on each participating country's IBAN template. It also holds guidelines on composition, arrangement, and meaning of various IBAN characters, a country's SEPA membership status, and more.

What is a SWIFT Code?

A SWIFT code is a number that represents each financial organization with a unique identification code that serves as a global messaging address for that organization.

SWIFT codes are maintained by the Society for Worldwide Interbank Financial Telecommunication (SWIFT), an association that maintains a massive finance-related data-sharing network. Apart from transmitting payment specifications, the SWIFT network also sends data for trade, depository, security, and other financial system transactions.

Banks, Securities and Brokerage companies, Trading organizations, Clearing Houses, Asset Management Companies and Corporate Business all use SWIFT nowadays.

One key advantage of the SWIFT network is that it facilitates fast and secure interchange of large volumes of financial transaction data.

That may be why SWIFT still handles the bulk of assets transfers abroad.

The SWIFT code, thus, enables sharing of IDs of participating institutions alongside other details specific to banking operations. It shows the host country and the particular bank branch where the recipient account is held.

Many institutions use SWIFT to wire funds to another country as it is an effective means of fast data exchange. Hence, it is highly likely that you will need a SWIFT code when getting paid from abroad or sending funds to another country.

What is a BIC Code?

BIC (Business Identifier Code) is another famous code in the global banking arena. It is a unique identification number comprising of eight digits and letters (or 11 if the bank branch ID is also included). In addition to identifying the parties involved in a transaction, BICs also function as messaging addresses for the concerned financial organizations.

Institutions that are interested in using BIC do so by registering with the SWIFT network. The template and rules for constructing BIC codes are described in the ISO 9362:2014 standard4.

Apart from businesses that provide monetary services, organizations outside the finance industry can also use BICs to facilitate automatic data exchanges. For such institutional usage, there are two kinds of BICs as defined below.

- Connected BICs that are used by organizations to send finance-related messages via the SWIFT network.

- Non-connected BICs that only serve as international messaging addresses.

Are BIC and SWIFT codes the same?

Yes, BIC and SWIFT codes are the same.

In fact, both of these codes are also known by some other common names that include SWIFT ID/address and SWIFT-BIC. The SWIFT network basically enables the movement of monetary assets and other data transmissions using underlying BIC codes.

How does a SWIFT or BIC Code look like?

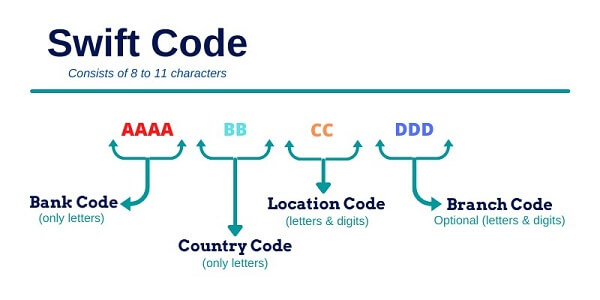

A typical SWIFT or BIC code is a unique 8 digits-letters combination (or 11 when it also contains a bank branch ID).

Each set of characters provide specific details about the organizations involved in a cross-border financial deal. The composing characters in these codes follow a certain specified order in their arrangement and have the following interpretations.

- The first 4 characters (only letters) represent the bank or organization identification code.

- The next 2 characters (only letters) capture the ISO2 country reference code.

- The next 2 characters (letters & numbers) signify the area/city code where the bank or the financial organization is headquartered.

- The last 3 characters (numbers & letters) are reserved for an optional reference code that specifies the exact divisions, offices or administration units of the concerned financial institution.

Are IBAN and SWIFT codes the same?

No, IBAN and SWIFT codes are not the same even though they both aid the movement of funds around the world.

SWIFT codes represent financial messaging addresses for businesses, whereas IBANs point to individual bank accounts in any given bank or financial establishment.

Before the SWIFT standards were around, international banking operations were slow, not secure, and did not follow any global standards. As a result, transaction errors due to human mistakes happened regularly. Sometimes payments got delivered to the wrong address, an expensive and time consuming problem to fix.

The introduction of IBANs, and the adoption of standardized SWIFT codes systematically reduced the incidence of human mistakes.

Where can I find my SWIFT or BIC code?

When you are ready to make your international bank transfer, you will see the need of SWIFT or BIC codes to start your transaction. Below are some easy ways you can find these important numbers.

- Call your bank or log in to their mobile app.

- Check the FAQs or wire transfer section or other related links on your bank's website.

- Check RemitFinder's free SWIFT Code lookup tool: RemitFinder has created a detailed list of SWIFT Codes of various banks, credit unions and financial institutions from all over the world. Check this free SWIFT Code lookup page to see if your country and bank are listed, and if so, click on your country to find the SWIFT Code(s) for your bank.

- Check the hard copy of your account statement.

- Some sites on the internet maintain a list of SWIFT/BIC codes. Select your country name and input your bank name to retrieve the SWIFT or BIC code for your bank.

IBANs, SWIFT and BIC Codes — Summary

In closing, we present a short summary of IBANs, SWIFT and BIC codes as a handy reference if you need to understand these quickly.

- IBANs, SWIFT and BIC codes all assist with moving your money to the right location worldwide.

- Whilst IBANs uniquely identify a bank account globally, SWIFT and BIC codes act as globally unique identifiers for a bank or financial institution.

- BIC codes are also commonly called as SWIFT codes.

- The SWIFT network is in charge of assigning BICs to registered entities and also serves as the registrar for IBANs.

- SEPA processes electronic payments made in Euros only. It uses IBANs for all transactions, be they national payments or transfers to another country.

- For recognition purposes, SWIFT/BIC codes have 8 (or 11) letters-digits combinations whereas IBANs can have as much as 34.

Frequently Asked Questions about IBAN, SWIFT and BIC Codes

In this section, we will cover some Frequently Asked Questions (FAQs) about IBANs, SWIFT Codes and BIC Codes. Note that since SWIFT and BIC Codes are the same, we will be combining the FAQs related to both.

Is an IBAN the same as a bank account number?

An IBAN is an international bank account number, so yes, it is the same as an account number. However, an IBAN is the internationally accepted format of your bank account number.

The above distinction is important since an account number by itself is just a local bank account number in your country's banking system. The IBAN, however, makes your account number suitable for international use and access.

Is a SWIFT or BIC Code the same as a bank account number?

No, SWIFT or BIC Codes are not the same as your account number. In fact, they represent totally different entities.

SWIFT and BIC Codes are unique global addresses for banks and financial institutions, whereas your account number represents your account held at a bank.

Is an IBAN the same as a bank code?

IBANs and bank codes are different concepts. IBANs are international representations of bank accounts, whilst bank codes are codes that represent a bank within a country.

Bank codes are usually country specific only, and do not work outside of the country they are part of.

Is a SWIFT or BIC Code the same as a bank code?

There is some similarity when it comes to the purpose of SWIFT or BIC Codes and bank codes, but they are still different.

A SWIFT or BIC Code uniquely identifies a financial institution in the world, whereas a bank code only identifies a bank within a country and not globally.

Also, SWIFT and BIC Codes can sometimes pinpoint an exact bank branch in the world, while bank codes only represent a bank in a country without any branch information.

Is an IBAN the same as a UPI ID?

So, even though both an IBAN and a UPI ID help to route money to a final destination - a bank account in case of an IBAN and a UPI account in case of a UPI ID - they operate in totally different payment systems.

Is a SWIFT or BIC Code the same as a UPI ID?

SWIFT or BIC Codes represent financial institutions globally. On the other hand, a UPI ID points to a unique UPI user in the UPI payment ecosystem in India.

Thus, SWIFT or BIC Codes and UPI IDs are very different from each other.

Is an IBAN the same as a UTR Number?

UTR Numbers are very popular in India, and represent unique transaction IDs for payments made via the Real Time Gross Settlement (RTGS) and National Electronic Funds Transfer (NEFT) payment gateways.

In that sense, there is no similarity between IBANs and UTR Numbers as IBANs represent bank accounts while UTR Numbers are transaction identifiers.

Is a SWIFT or BIC Code the same as a UTR Number?

No, SWIFT or BIC Codes and UTR Numbers are totally different ideas.

SWIFT or BIC Codes help trace a financial institution or bank worldwide, while UTR Numbers help trace transactions in India's real time NEFT and RTGS payment ecosystems.

Is an IBAN the same as an MICR Code?

Magnetic Ink Character Recognition (MICR) is a standard used to process checks. MICR Codes are generally 9-digit long and printed on checks.

In that regard, IBANs are not the same as MICR Codes as both are used for totally different purposes.

Is a SWIFT or BIC Code the same as an MICR Code?

The only similarity between a SWIFT or BIC Code and an MICR Code is that both help route financial instruments to their correct destination.

The difference is that SWIFT or BIC Codes help route money internationally, while MICR Codes help with the processing of paper checks.

Is an IBAN the same as a BSB Number?

BSB Numbers are used in Australia, and are a unique way to identify the exact branch of any Australian bank. As a result, BSB Numbers facilitate seamless movement of money between banks in Australia.

Given the above, there is no similarity between IBANs and BSB Numbers.

Is a SWIFT or BIC Code the same as a BSB Number?

No, SWIFT or BIC Codes are not the same as a BSB Numbers even though they both help to identify financial institutions.

The scope of application of SWIFT or BIC Codes and BSB Numbers is entirely different. The former apply at an international level, while the latter only work within Australia.

Is an IBAN the same as an IFSC Code?

IBANs and IFSC Codes are not the same as they not only represent different entities, but also work at a different level.

IFSC Codes are unique handles to bank branches in India. As a result, they are a critical pillar in moving money between banks in India as well as for receiving money transfers in India from overseas.

IBANs are bank account numbers that help identify bank accounts internationally.

Is a SWIFT or BIC Code the same as an IFSC Code?

SWIFT or BIC Codes and IFSC Codes help move money to the right destination bank or financial institution, but they work at different scopes.

SWIFT or BIC Codes are used to represent banks internationally, while IFSC Codes are used for banks located in India.

Is an IBAN the same as a Sort Code?

Sort Codes are distinct identifiers for UK bank branches, and by virtue of their uniqueness, they help route money seamless within UK banks.

Therefore, Sort Codes and IBANs are completely unrelated concepts.

Is a SWIFT or BIC Code the same as a Sort Code?

SWIFT or BIC Codes and Sort Codes are used for similar purposes - to identify financial institutions without any ambiguity and help route money to them.

The only difference is that SWIFT or BIC Codes represent banks internationally whilst Sort Codes represent UK banks and are not valid outside of UK.

Is an IBAN the same as a CLABE Number?

CLABE Numbers are unique identifiers for bank accounts in Mexico, and hence they are very useful for ensuring money gets credited into the correct bank account.

Therefore, IBANs and CLABE Numbers are very much related concepts.

The only difference is that both numbers follow different specifications. Additionally, IBANs are a global standard whilst CLABE Numbers are only used in Mexico.

Is a SWIFT or BIC Code the same as a CLABE Number?

SWIFT or BIC Codes and CLABE Numbers represent completely different concepts.

While SWIFT or BIC Codes are unique global addresses for banks and financial institutions, CLABE Numbers are unique IDs for bank accounts in Mexico.

Is an IBAN the same as a NUBAN Number?

NUBAN Numbers are 10-digit unique identifiers for bank accounts in Nigeria, and hence they are very useful for routing money correctly into the recipient bank account.

In that sense, IBANs and NUBAN Numbers are very much related concepts.

The only difference is that both numbers adhere to different guidelines and specifications. Additionally, IBANs are used internationally whilst NUBAN Numbers are only used in Nigeria.

Is a SWIFT or BIC Code the same as a NUBAN Number?

SWIFT or BIC Codes and NUBAN Numbers are not the same, and represent completely different entities.

While SWIFT or BIC Codes are globally unique identifiers for banks and financial institutions, NUBAN Numbers are unique IDs for bank accounts in Nigeria.

Is it safe to share your IBAN?

Since your IBAN represents your bank account internationally, you should not share your IBAN unless it is absolutely necessary.

Only share your IBAN with institutions and individuals you know and trust, and if you plan to receive any money from them from overseas.

Is it safe to share your SWIFT or BIC Code?

SWIFT and BIC Codes are public information and it should be generally OK to share them.

That said, we always recommend sharing any financial information on a need to know basis only, and only with authorized and trustworthy parties.

Conclusion

IBANs, SWIFT and BIC codes all help you move money internationally in a secure, efficient and fast manner.

Use these important codes effectively each time you make international bank or wire transfers to prevent delays and errors.

Always cross-check any requested identification code before initiating a transaction by quickly calling your bank or visiting their website, checking your account statement, or searching online. This will ensure that you are using the right code, and your funds will settle hassle free!

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

References:

1. ISO 13616-1:2007 standard for IBANs

2. IBAN registry maintained by SWIFT

3. Single Euro Payment Area (SEPA)

4. ISO 9362:2014 standard for BIC Codes

Categories

Similar Articles

US Big Beautiful Bill's Impact On Remittances

The Big Beautiful Bill has been passed in the US, and remittances are impacted. Learn how the Bill impacts remittances and what to do if you are affected by the new law.

Bangladesh Remittance Cash Incentive: All You Need To Know

Are you an overseas Bangladeshi resident who sends money home to your loved ones? Read on to learn how to earn an additional 2.5% cash on your international remittances sent to Bangladesh.

How Fintech Is Pushing Banks Out Of The Remittance Business

The fintech revolution is disrupting the international remittance business. Discover how innovative startups are reshaping the international money transfer industry and challenging traditional banks.