What Is An MICR Code And What Is It Used For?

Table of Contents

- What Does MICR Stand For?

- What Is An MICR Code?

- Who Issues MICR Codes?

- What Is The Format Of MICR Codes?

- What Are MICR Codes Used For?

- What Are The Benefits Of Using MICR Codes?

- How Are MICR Codes Used In Banking?

- How Can I Find My Bank's MICR Code?

- MICR Codes for Major Indian Banks

- What is Axis Bank's MICR Code?

- What is Bank of India's MICR Code?

- What is Canara Bank's MICR Code?

- What is Central Bank of India's MICR Code?

- What is Citibank's MICR Code?

- What is DBS Bank India Ltd's MICR Code?

- What is HDFC Bank's MICR Code?

- What is HSBC Bank's MICR Code?

- What is ICICI Bank's MICR Code?

- What is IDBI Bank's MICR Code?

- What is Indian Bank's MICR Code?

- What is Indian Overseas Bank's MICR Code?

- What is IndusInd Bank's MICR Code?

- What is Kotak Mahindra Bank's MICR Code?

- What is Punjab and Sind Bank's MICR Code?

- What is Punjab National Bank's MICR Code?

- What is Reserve Bank of India's MICR Code?

- What is State Bank of India's MICR Code?

- What is UCO Bank's MICR Code?

- What is Union Bank of India's MICR Code?

- What is Yes Bank's MICR Code?

- Frequently Asked Questions About MICR Codes

- Is an MICR Code the same as a bank account number?

- Is an MICR Code the same as a SWIFT Code?

- Is an MICR Code the same as a BIC Code?

- Is an MICR Code the same as an IBAN?

- Is an MICR Code the same as a bank code?

- Is an MICR Code the same as a UPI ID?

- Is an MICR Code the same as a UTR Number?

- Is an MICR Code the same as an IFSC Code?

- Is an MICR Code the same as a BSB Number?

- Is an MICR Code the same as a Sort Code?

- Is an MICR Code the same as a CLABE Number?

- Is an MICR Code the same as a NUBAN Number?

- Is it Safe to Share an MICR Code?

- Are MICR Codes used outside of India?

- Conclusion: The Importance Of MICR Codes In Banking

MICR stands for Magnetic Ink Character Recognition, and is a technology used in banking that automatically processes checks and other financial documents.

MICR Codes are a key component of this technology and are used to identify a unique bank branch for routing and processing of checks.

Understanding what MICR Codes are and how they work can be valuable for anyone who uses checks or other financial documents in their business or personal life. This article will provide an overview of MICR Codes, including what they are, how they work, and why they are important in banking.

By the end of this article, you will better understand MICR Codes and their role in the banking industry, and be better equipped to navigate the use of checks and other financial instruments in your own life.

What Does MICR Stand For?

MICR stands for Magnetic Ink Character Recognition. It is a technology used in the banking industry to process checks and other financial documents.

The use of MICR technology allows for the automatic reading and sorting of checks, thereby saving time and reducing errors as compared to manual processing.

The use of magnetic ink is a key component of MICR technology. Magnetic ink contains tiny particles of iron oxide that can be magnetized, creating patterns that magnetic scanners can read.

This is why checks and other financial documents that use MICR Codes have a unique font and magnetic ink, which are used to create the routing and account numbers that are read by MICR scanners.

MICR technology makes use of magnetic ink and a special font to create unique patterns that can be read by MICR scanners. This helps automate processing of documents with MICR patterns.

Overall, MICR technology has been a significant innovation in the banking industry, allowing for the automation of many tasks that were previously done manually.

By understanding what MICR stands for and how it works, we can better understand the role of this technology in processing financial documents and appreciate its importance in modern banking.

What Is An MICR Code?

MICR Codes use a special type of ink containing magnetic particles, which machines can read. When a check is processed, it is run through a machine that reads the MICR Code at the bottom of the check using a magnetic reader.

The MICR Code is made up of a series of numbers that identify the bank, the branch, and the city that the bank branch is located in. The machine reads these numbers and routes the check to the appropriate bank and branch. They also identify the account associated with the check.

MICR Codes help identify a bank branch in a city, and hence help route checks automatically without manual intervention.

The machine reads the magnetic ink characters in the MICR Code and converts them into digital information that can be used to process the check. This digital information is then used to verify that the check is valid, to identify the account associated with the check, and to route the check to the appropriate bank and branch for processing.

Who Issues MICR Codes?

MICR Codes are generally issued and maintained by a country's financial and banking regulatory bodies or central banks.

In India, for example, the Reserve Bank of India (RBI) manages the allocation of MICR Codes to various banks and their branches.

In fact, the RBI maintains a up to date database of all banks in India and the MICR Codes for their branches in various cities throughout the country. In that sense, the RBI is a trusted and authentic source of MICR Codes for banks.

What Is The Format Of MICR Codes?

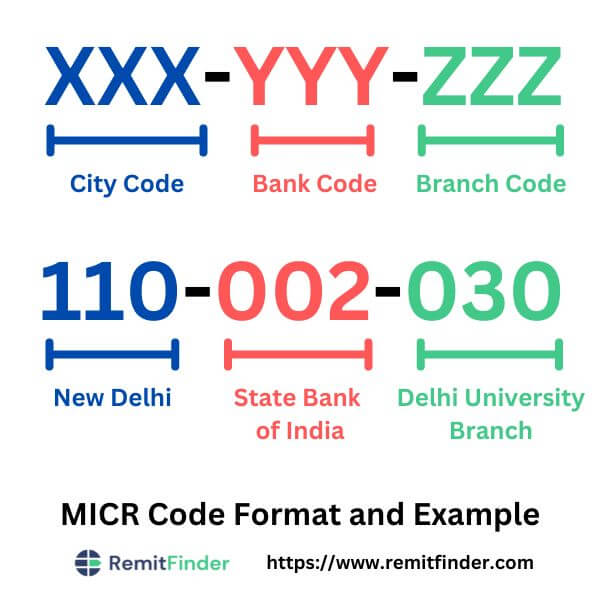

The MICR Code, which stands for Magnetic Ink Character Recognition Code, is used for processing checks securely and efficiently. The MICR Code is a 9-digit numeric code that includes the following 3 parts:

- City Code: The first 3 digits represent the city code, which identifies the city where the bank is located. The 3 digits are also aligned with the city's PIN code; they are actually the first 3 digits of the city's PIN code identifiers.

- Bank Code: The next 3 digits represent the bank code, which identifies the bank within the city.

- Branch Code: The last 3 digits represent the branch code, which identifies the specific branch of the bank.

As an example, the MICR Code for the State Bank of India branch located at Delhi University in New Delhi is 110002030. If we apply the above formula, this can be broken down into its constituent parts as below:

- The city code for Delhi is 110.

- The bank code for State Bank of India is 002.

- The branch code for the Delhi University branch is 030.

The below diagram captures the MICR Code format along with the above example in an infographic format.

Another example on an MICR Code is 110002051 - this is for the State Bank of India branch located at the Inter State Bus Terminal (ISBT) at Kashmiri Gate in New Delhi. Once again, we can see that 110 represents New Delhi, 002 State Bank of India and 051 the actual ISBT branch.

MICR Codes are 9-digit numbers that include city, bank and branch codes to uniquely identify the exact branch of a bank in a given city. In this way, MICR Codes are unique fingerprints of bank branches.

MICR Codes, thus, are similar to unique barcodes. Just as a barcode is a unique fingerprint for the item or product that it is printed on, MICR Codes also help identify bank branches uniquely.

Typically, the MICR Code is included after the check number and is separated by a space, for example:

XXXXXXX 110002051

where XXXXXXX is the Check Number, and 110002051 is the MICR Code.

What Are MICR Codes Used For?

The purpose of MICR Codes is to facilitate the processing of checks and other financial documents in the banking industry.

By encoding routing and account numbers in a format that magnetic scanners can read, MICR Codes allow for the automatic reading and sorting of checks, saving time and reducing errors compared to manual processing.

MICR Codes primarily help with the routing and automatic processing of checks and other financial documents.

The use of magnetic ink is a key component of MICR technology, as it allows for the creation of patterns that magnetic scanners can read. The unique font and magnetic ink used in MICR Codes create a machine-readable format easily recognized by scanners, allowing for rapid processing of large volumes of checks and other financial documents.

What Are The Benefits Of Using MICR Codes?

The use of MICR Codes has several benefits for the banking industry.

MICR Codes allows for faster processing times and increased accuracy, reducing the risk of errors and improving customer satisfaction. They also allows for greater efficiency and cost savings, reducing the need for manual processing and associated labor costs.

MICR Codes enable the use of technology and automation for checks and other financial documents, thereby improving efficiency, saving cost and eliminating errors.

In addition to its use in the processing of checks, MICR technology is also used in other financial documents, such as deposit slips, money orders, and traveler's checks.

Overall, the purpose of MICR Codes is to streamline the processing of financial documents in the banking industry, making it faster, more efficient, and less error-prone than traditional manual processing methods.

How Are MICR Codes Used In Banking?

MICR Codes are used extensively in banking for processing checks.

When a customer deposits a check, the MICR Code on the bottom of the check is read by a machine and used to identify the bank, the branch, and the city where the bank is. Together with the account number which is also written on the check, this information is then used to credit the appropriate account with the funds from the check.

MICR Codes helps with routing and processing of checks and other financial documents.

MICR Codes are also used to verify the authenticity of a check. The magnetic ink used to print the MICR Code is difficult to replicate, making it difficult for fraudsters to create counterfeit checks.

MICR Codes can also be used to identify checks that have been altered or tampered with, as any changes to the MICR Code will be detected by the machine that reads the code.

In addition to processing checks, MICR Codes are also used in other banking operations, such as processing Automated Clearing House (ACH) transactions and for direct deposit of paychecks and other payments.

MICR Codes make it easy for banks to process large volumes of transactions quickly and accurately, which helps to improve efficiency and reduce errors in banking operations.

How Can I Find My Bank's MICR Code?

There are a few different ways to find your MICR Code, depending on the bank you use and your account type. Here are some common methods:

1. Inspect Your Check: Your MICR Code is printed in special magnetic ink at the bottom of each check. The MICR Code is usually located near the bottom of the check, to the right of the check number.

2. Check Your Bank Statement: Your MICR Code may be printed on your bank statement, either online or in paper form. Look for a section that shows your account number and routing information.

3. Contact Your Bank: If you cannot find your MICR Code on your check or bank statement, contact your bank directly. You can call the customer service number or visit a branch in person and ask for assistance in finding your MICR Code.

4. Search An Online MICR Registry: There are many online resources that provide a list of MICR Codes. One such reliable resource is the IFSC Code and MICR Code lookup tool provided by the Reserve Bank of India (RBI).

It is important to note that your MICR Code is specific to your bank and branch, so be sure to provide the correct information when you are asked for your MICR Code. Providing the wrong MICR Code can result in delays or errors in processing your transactions.

How Can I Find MICR Codes Using RBI's Website?

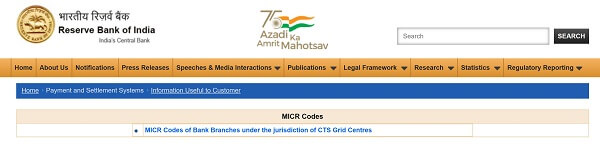

The Reserve Bank of India (RBI) maintains lists of MICR Codes1 for all banks operating in India. You can simply download this list from the RBI website, and search for your bank's branch in the downloaded Excel file.

Below is a screenshot of the section of the RBI website that provides the list of MICR Codes for all banks in India.

MICR Codes for Major Indian Banks

If you ever need to share your MICR Code with a business, organization or individual for legitimate purposes, you can look it up in various ways.

The Reserve Bank of India (RBI) issues and maintains MICR Codes for all major Indian banks. As a result, finding your bank's MICR Code should not be too difficult. Recall that we listed many easy ways to lookup your bank's MICR Code in a prior section.

In this section, we will provide the MICR Codes for major Indian banks.

That said, since India is a big country, major banks in the country can have hundreds of thousands of branches. Given that, it would be impossible to list all MICR Codes for all banks.

To make the information more digestible, we will provide the middle 3 digits of the MICR Codes for popular Indian banks; recall that the 4th, 5th and 6th digits of an MICR Code are the bank code.

You should contact your bank's branch or use the RBI MICR Code search tool to find the exact MICR Code for your bank branch.

What is Axis Bank's MICR Code?

Axis Bank MICR Codes will have 211 as the middle digits, which is the bank code for Axis Bank. Contact your bank for the full MICR Code with the city and branch codes included.

What is Bank of India's MICR Code?

Bank of India MICR Codes will have 013 as the middle digits, which is the bank code for Bank of India. Contact your bank for the full MICR Code with the city and branch codes included.

What is Canara Bank's MICR Code?

Canara Bank MICR Codes will have 015 as the middle digits, which is the bank code for Canara Bank. Contact your bank for the full MICR Code with the city and branch codes included.

What is Central Bank of India's MICR Code?

Central Bank of India MICR Codes will have 016 as the middle digits, which is the bank code for Central Bank of India. Contact your bank for the full MICR Code with the city and branch codes included.

What is Citibank's MICR Code?

Citibank MICR Codes will have 037 as the middle digits, which is the bank code for Citibank. Contact your bank for the full MICR Code with the city and branch codes included.

What is DBS Bank India Ltd's MICR Code?

DBS Bank India Ltd MICR Codes will have 641 as the middle digits, which is the bank code for DBS Bank India Ltd. Contact your bank for the full MICR Code with the city and branch codes included.

What is HDFC Bank's MICR Code?

HDFC Bank MICR Codes will have 240 as the middle digits, which is the bank code for HDFC Bank. Contact your bank for the full MICR Code with the city and branch codes included.

What is HSBC Bank's MICR Code?

HSBC Bank MICR Codes will have 039 as the middle digits, which is the bank code for HSBC Bank. Contact your bank for the full MICR Code with the city and branch codes included.

What is ICICI Bank's MICR Code?

ICICI Bank MICR Codes will have 229 as the middle digits, which is the bank code for ICICI Bank. Contact your bank for the full MICR Code with the city and branch codes included.

What is IDBI Bank's MICR Code?

IDBI Bank MICR Codes will have 259 as the middle digits, which is the bank code for IDBI Bank. Contact your bank for the full MICR Code with the city and branch codes included.

What is Indian Bank's MICR Code?

Indian Bank MICR Codes will have 019 as the middle digits, which is the bank code for Indian Bank. Contact your bank for the full MICR Code with the city and branch codes included.

What is Indian Overseas Bank's MICR Code?

Indian Overseas Bank MICR Codes will have 020 as the middle digits, which is the bank code for Indian Overseas Bank. Contact your bank for the full MICR Code with the city and branch codes included.

What is IndusInd Bank's MICR Code?

IndusInd Bank MICR Codes will have 234 as the middle digits, which is the bank code for IndusInd Bank. Contact your bank for the full MICR Code with the city and branch codes included.

What is Kotak Mahindra Bank's MICR Code?

Kotak Mahindra Bank MICR Codes will have 485 as the middle digits, which is the bank code for Kotak Mahindra Bank. Contact your bank for the full MICR Code with the city and branch codes included.

What is Punjab and Sind Bank's MICR Code?

Punjab and Sind Bank MICR Codes will have 023 as the middle digits, which is the bank code for Punjab and Sind Bank. Contact your bank for the full MICR Code with the city and branch codes included.

What is Punjab National Bank's MICR Code?

Punjab National Bank MICR Codes will have 024 as the middle digits, which is the bank code for Punjab National Bank. Contact your bank for the full MICR Code with the city and branch codes included.

What is Reserve Bank of India's MICR Code?

Reserve Bank of India MICR Codes will have 001 as the middle digits, which is the bank code for Reserve Bank of India. Contact your bank for the full MICR Code with the city and branch codes included.

What is State Bank of India's MICR Code?

State Bank of India MICR Codes will have 002 as the middle digits, which is the bank code for State Bank of India. Contact your bank for the full MICR Code with the city and branch codes included.

What is UCO Bank's MICR Code?

UCO Bank MICR Codes will have 028 as the middle digits, which is the bank code for UCO Bank. Contact your bank for the full MICR Code with the city and branch codes included.

What is Union Bank of India's MICR Code?

Union Bank of India MICR Codes will have 026 as the middle digits, which is the bank code for Union Bank of India. Contact your bank for the full MICR Code with the city and branch codes included.

What is Yes Bank's MICR Code?

Yes Bank MICR Codes will have 532 as the middle digits, which is the bank code for Yes Bank. Contact your bank for the full MICR Code with the city and branch codes included.

Frequently Asked Questions About MICR Codes

In this section, we will cover some Frequently Asked Questions (FAQs) about MICR Codes.

Is an MICR Code the same as a bank account number?

No, an MICR Code is not the same as an account number for a bank account. Both of these numbers signify different information - an MICR Code represents a bank branch, whereas a bank account number represents your actual bank account.

Is an MICR Code the same as a SWIFT Code?

No, MICR Codes and SWIFT Codes are disparate entities. Even though both are used in routing monetary instruments, they are still not the same.

MICR Codes are unique fingerprints for bank branches within India. SWIFT Codes, instead, are globally unique fingerprints for banks. Due to this, SWIFT Codes are used to move money between banks worldwide.

MICR Codes, on the other hand, help with the efficient and automated routing of checks between banks.

Is an MICR Code the same as a BIC Code?

BIC Codes and SWIFT Codes are synonymous terms. Therefore, the differences between MICR Codes and SWIFT Codes are the same as those between MICR Codes and BIC Codes.

Is an MICR Code the same as an IBAN?

MICR Codes and International Bank Account Numbers (IBANs) are completely different concepts and not the same.

While MICR Codes help identify bank branches uniquely, IBANs help identify bank account globally. In this way, both numbers stand for different concepts within the banking industry.

Is an MICR Code the same as a bank code?

MICR Codes and bank codes are also different in what they are and what they represent.

MICR Codes are unique IDs for bank branches while bank codes are unique IDs for banks. In fact, MICR contains a bank code in its format; the middle 3 digits in an MICR Code, i.e., the 4th, 5th and 6th digits, are bank codes.

Is an MICR Code the same as a UPI ID?

No, an MICR Code is not the same as a UPI ID.

Unified Payments Interface (UPI) is a recent innovative payments system developed by the Government of India to continue to spur India's digital economy. Within the UPI system, every user has a unique UPI ID that identifies them without any ambiguity.

As a result, while a UPI ID identifies a UPI user, an MICR Code identifies a bank branch.

Is an MICR Code the same as a UTR Number?

MICR Codes and UTR Numbers are not the same as they identify very different entities.

Unique Transaction Reference (UTR) Numbers are globally unique transaction IDs for payments made via India's Real Time Gross Settlement (RTGS) and National Electronic Funds Transfer (NEFT) systems. If you have a UTR Number, you can use it to check the status of an RTGS or NEFT payment.

Hence, even though both MICR Codes and UTR Numbers are banking industry concepts, they stand for different things - MICR Codes for bank branches while UTR Numbers for transactions.

Is an MICR Code the same as an IFSC Code?

MICR Codes and IFSC Codes are very similar in nature, yet different.

The similarity is that both MICR Codes and IFSC Codes identify bank branches uniquely. Hence, they are useful for identifying an exact branch of a bank without any ambiguity. This can help with automation and technology-driven management of money and transactions.

The differences between MICR Codes and IFSC Codes are listed below:

- MICR Codes are 9-digit long while IFSC Codes are 11-character long.

- MICR Codes are always only numeric while IFSC Codes are alphanumeric.

- MICR Codes are generally used for automated check processing and routing while IFSC Codes are used to route money between banks.

- MICR Codes are printed with magnetic ink as per the MICR standard; there is no such requirement for IFSC Codes.

Even though both MICR Codes and IFSC Codes help identify bank branches, their format and purpose are completely different.

Is an MICR Code the same as a BSB Number?

There is definitely a similarity in MICR Codes and BSB Numbers - both these codes represent bank branch in their respective countries of usage clearly and uniquely.

The differences stem from scope and usage.

MICR Codes are applicable in India while BSB Numbers are prevalent in Australia. Additionally, MICR Codes are mainly used for routing checks while BSB Numbers are used to routing money between banks.

Is an MICR Code the same as a Sort Code?

MICR Codes and Sort Codes are unique IDs for bank branches in their respective countries. This makes them helpful in routing financial instruments between banks.

The differences are twofold:

- MICR Codes are used in India while Sort Codes are used in the UK.

- MICR Codes are used to process checks while Sort Codes are used to move money between banks.

Is an MICR Code the same as a CLABE Number?

MICR Codes and CLABE Numbers are not the same as they represent different things.

MICR Codes help process and route checks by identifying the correct bank and branch. CLABE Numbers, on the other hand, are unique handles to bank accounts in Mexico, and help move money to the correct destination bank account.

Is an MICR Code the same as a NUBAN Number?

MICR Codes and NUBAN Numbers stand for different concepts and hence are not the same.

MICR Codes identify a bank branch with the goal to process and route checks. NUBAN Numbers, on the other hand, are unique identifiers for bank accounts in Nigeria, and assist in accurately moving funds to the correct destination bank account.

Is it Safe to Share an MICR Code?

Since MICR Codes are public information, it should be safe to share them. This is mainly because an MICR Code by itself does not tell anyone what your bank account number is - it only carries information about a bank branch.

That said, sharing your bank's MICR Code does tell the recipient of this information about which branch you bank account is located in. In case they were to get hold of your account numbers as well, this may pose problems.

Given this, we always recommend sharing any banking and financial information - even if it is publicly available - on a need to know basis with trusted parties only.

Are MICR Codes used outside of India?

MICR Codes are issued and managed by the Reserve Bank of India (RBI), so they are heavily used in India for sure. Their biggest application is in the automated processing and routing of paper checks.

The MICR standard is globally useful and many other countries use it in one form or another. They may also have their own system of codes similar to MICR Codes.

Conclusion: The Importance Of MICR Codes In Banking

MICR Codes play a vital role in banking operations, particularly in processing checks. They provide a fast, accurate, and secure way to process checks, ensuring that the correct accounts are debited or credited with the correct amounts.

MICR Codes are also used to verify the authenticity of checks and to detect fraud or tampering attempts. By using MICR Codes, banks can process large volumes of transactions quickly and efficiently, which helps to improve the overall speed and accuracy of banking operations.

MICR Codes also provide a high level of security, making it difficult for fraudsters to create counterfeit checks or to alter existing checks.

Overall, the use of MICR Codes has revolutionized how checks are processed and has made banking operations faster, more efficient, and more secure. As technology evolves, MICR Codes will likely remain an important part of banking operations for many years.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

References:

1. Reserve Bank of India (RBI) List of MICR Codes for banks in India

Categories

Similar Articles

CNAPS Codes Unraveled: Navigating China's Banking Landscape

Discover CNAPS Codes: China’s unique bank identifier for fast, secure transactions. Learn how CNAPS Codes simplify payments across China's banking system.

ABA Routing Numbers In The US: A Comprehensive Guide

Discover what ABA Routing Numbers are, how they work and their importance in US banking transactions like direct deposits, online transactions and wire transfers.

What Is A NUBAN Number And What Is It Used For?

Discover what NUBAN Numbers are and how they streamline bank account identification in Nigeria. Do not miss this essential guide if you transact in any way with the Nigerian banking system.