What Is An IFSC Code And What Is It Used For?

Table of Contents

- What is an IFSC Code?

- Who Issues IFSC Codes in India?

- What is the Format of an IFSC Code?

- What is an IFSC Code Used for?

- How Can I Send Money to India from Overseas Using an IFSC Code?

- How to Send Money within India Using an IFSC Code?

- What Are The Benefits Of Using IFSC Codes For Online Banking?

- How Can I Find My Bank's IFSC Code?

- IFSC Codes for Major Indian Banks

- What is Axis Bank's IFSC Code?

- What is Bank of India's IFSC Code?

- What is Central Bank of India's IFSC Code?

- What is HDFC Bank's IFSC Code?

- What is ICICI Bank's IFSC Code?

- What is IndusInd Bank's IFSC Code?

- What is Kotak Mahindra Bank's IFSC Code?

- What is Reserve Bank of India's IFSC Code?

- What is State Bank of India's IFSC Code?

- What is Union Bank of India's IFSC Code?

- Frequently Asked Questions about IFSC Codes

- Is an IFSC Code the same as a bank account number?

- Is an IFSC Code the same as a SWIFT Code?

- Is an IFSC Code the same as a BIC Code?

- Is an IFSC Code the same as an IBAN?

- Is an IFSC Code the same as a bank code?

- Is an IFSC Code the same as a UPI ID?

- Is an IFSC Code the same as a UTR Number?

- Is an IFSC Code the same as a MICR Code?

- Is an IFSC Code the same as a BSB Number?

- Is an IFSC Code the same as a Sort Code?

- Is an IFSC Code the same as a CLABE Number?

- Is an IFSC Code the same as a NUBAN Number?

- Is an IFSC Code the same as a CNAPS Code?

- Is it Safe to Share an IFSC Code?

- Are IFSC Codes used outside of India?

- Conclusion

- Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

If you have sent money to India from overseas or done interbank transfers within the country, you may have come across the term IFSC Code.

IFSC stands for Indian Financial System Code, and the IFSC Code is a unique identifier used in India's banking system. Different banks in the country use it for online money transfers, such as transactions done via National Electronic Funds Transfer (NEFT), Real Time Gross Settlement (RTGS) and Immediate Payment Service (IMPS) systems.

If you wanted to transfer money from one Indian bank account to another, having access to the receiving bank's IFSC code would be crucial. Furthermore, the 11-character code contains various pieces of information about each bank, specifying which bank it is and where it is located.

In this article, we will deep dive into various aspects of the IFSC Code from what it is, its format, how to use it and much more. Keep reading to learn more about an IFSC code, what it is used for, and how to find yours quickly and easily.

What is an IFSC Code?

An Indian Financial System Code (IFSC) is an 11-character alphanumeric code used to facilitate online money transfers. This code is used to identify the specific bank branches that offer services such as National Electronic Funds Transfer (NEFT), Real-Time Gross Settlements (RTGS), Immediate Payment Service (IMPS) and Unified Payment Interfaces (UPI).

IFSC Codes are 11-character unique codes assigned to bank branches to help them participate in electronic payment and banking services.

The IFSC code is essential for carrying out financial transactions like transferring money from one bank account in India to another.

Here is an example of an IFSC code: ICIC0000227. This corresponds to ICICI Bank branch at Delhi University Campus in New Delhi.

Who Issues IFSC Codes in India?

IFSC Codes are issued by the Reserve Bank of India (RBI). The RBI assigns globally unique IFSC Codes to branches of various banks within India that want to participate in major Indian electronic payment and e-banking systems like NEFT, RTGS, and IMPS.

IFSC Codes are issued to banks by the Reserve Bank of India (RBI).

The RBI also maintains an up to date database of all IFSC Codes issued to various banks. The RBI IFSC Code database is a reliable and accurate source of information when it comes to IFSC Codes. As such, it can be used as a reliable tool to look up IFSC Code for any bank and branch in India.

What is the Format of an IFSC Code?

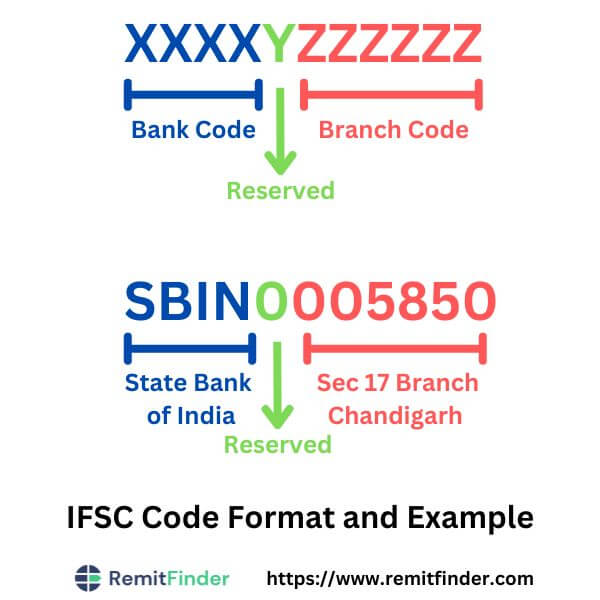

An IFSC code consists of exactly 11 alphanumeric characters.

The first four characters are letters used to indicate the bank name, while the last six are either numeric or alphanumeric and serve as a unique identifier for each branch. The fifth character in the code is always zero and does not vary from one code to another.

To further represent the above information in a codified format, if an IFSC Code was written as XXXXYZZZZZZ, then the corresponding characters would represent the below information:

- The first four characters, i.e., XXXX, represent the bank code.

- The firth character, i.e., Y, is reserved for future use and not currently used. It is, therefore, always a 0 in the current ISFC Code format.

- The last 6 characters, i.e., ZZZZZZ, represent the branch code of the concerned bank.

An IFSC Code contains bank as well as branch information to uniquely identify a bank branch in India.

Let's look at an example.

The IFSC Code for the State Bank of India (SBI) branch located in Sector 17-B, Chandigarh, India is SBIN0005850. Applying our above IFSC Code format breakdown, we can conclude that:

- SBIN represents State Bank of India.

- The fifth character, 0, is reserved and does not change in the current format.

- 005850 represents the branch code for the SBI Chandigarh branch located in Sector 17-B.

The below diagram encapsulates the above IFSC Code format breakdown as well as the example in a pictographic format.

In this way, an IFSC Code acts like a unique fingerprint for a bank branch within India. As you can imagine, this uniqueness can be advantageously used to route money to the correct bank without any errors or problems.

An IFSC Code is a unique fingerprint for a bank branch in India.

Not only do IFSC Codes ensure that the money goes to the right place, but they also help banks differentiate between branches within the same bank.

For example, a bigger ICICI Bank branch like the one in Andheri West, Mumbai might have an IFSC Code such as ICIC0000011 while a smaller branch like the one in Tilaknagar, Mumbai may have an IFSC code like ICIC0001214.

Knowledge and usage of the IFSC coding system helps ensure that payments are made safely and with no issues. Before making any kind of payment electronically, it's important to double-check information like the bank's name, location, and IFSC Code - accurate information will help ensure your money reaches its destination without any problems.

What is an IFSC Code Used for?

As we have seen above, an IFSC Code is a unique 11 character RBI-issued code for a bank branch within India. This presents a great opportunity to use IFSC Codes for routing funds to the correct bank.

IFSC Codes are used primarily for electronic fund transfers and online payments such as NEFT, RTGS and IMPS transactions.

IFSC Codes help route funds to the correct bank branch within the Indian banking ecosystem.

IFSC Codes enable payment gateways and systems to easily identify the correct bank branch and route funds to them seamlessly without any errors or mistakes.

If you are sending money from overseas to India, or making bank to bank transfers within India, using the IFSC Code will ensure that the payment processor is able to deposit your money into the correct receiving account.

How Can I Send Money to India from Overseas Using an IFSC Code?

If you are sending money to India from overseas, you can rely on the IFSC Code to quickly link up your recipient's bank account. Simply choose to pay your recipient in India via a bank deposit, and enter their IFSC Code when providing bank details to your money transfer company.

This will not only obviate the need to fill bank address and other information, but is also a more secure and error free way to send money.

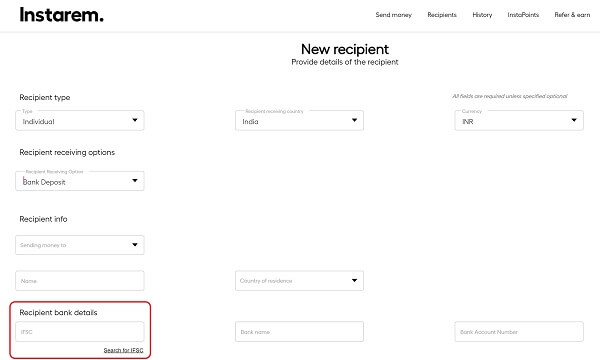

For example, if you send money via Instarem, you can add your recipient's bank information along with the requisite IFSC Code in a very simple form as per the below screenshot.

Other money transfer providers also have similar mechanisms in place. Simply check their website or mobile app to see how you can send money to a bank account in India using an IFSC Code.

How to Send Money within India Using an IFSC Code?

The process to send money within India using an IFSC Code is very similar to the above listed method when sending money from overseas.

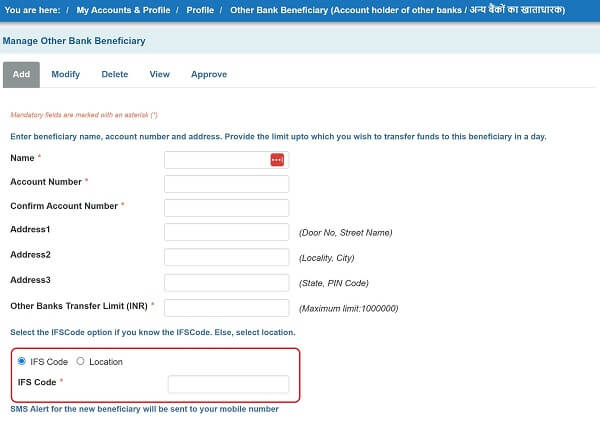

Simply add your beneficiary in your online banking portal and provide the IFSC Code for their bank. After this, you can move money seamlessly to your recipient via online banking.

Below is an example of how to add the IFSC Code for your beneficiary in an SBI Account using the SBI online banking portal.

Other banks in India will have similar screens to help you add the IFSC Code for your recipient's bank account.

IFSC Codes simplify sending money to Indian bank accounts from overseas as well as within India.

What Are The Benefits Of Using IFSC Codes For Online Banking?

The biggest advantage of IFSC Codes is that they allow for quick and accurate identification of a bank and its branch during banking transactions. This reduces the risk of discrepancies or errors, and helps make the process more efficient and faster than conventional transfer methods.

Using an IFSC Code for online banking offers many advantages to ensure a safe and secure way of doing transactions online. Below are some key benefits of using IFSC Codes:

- Unique Bank Identification: An IFSC Code is a unique identification code for each bank branch registered with the Reserve Bank of India. This helps distinguish one branch from another and makes online transactions error-free and secure.

- Ease Of Use: With an IFSC Code, you can easily transfer money, pay bills and make other transactions online without visiting the bank. This helps save time and money.

- Data Security: Since each branch's IFSC Code is issued by the RBI and is globally unique, online transactions can simply make use of the IFSC Code without necessitating full bank details and address. Lesser data transmission and reliance on RBI-issued standard IFSC Code add additional security to online transactions.

- Universal Acceptance: All banks and financial institutions across India are registered with the Reserve Bank of India and use IFSC Codes for online transactions. This makes it easier to transfer money from one branch to another in any part of India without worrying about compatibility issues.

- Convenience: By using IFSC Codes, you can easily participate in online banking transactions in India from anywhere in the world. This eliminates the need to physically visit a branch and make transactions.

- Cost Saving: Using an IFSC Code reduces costs associated with manual transactions and saves you the hassle to visit the branch to make payments or transfer money. This helps in saving time and money spent in traveling from one place to another.

- Improved Accuracy: Automated transactions using IFSC Codes reduce errors since there is no need for manual intervention. You can be assured of accurate financial transactions since IFSC Code helps payment gateways route your money to the right destination.

There are numerous benefits to using IFSC Codes for online banking transactions in India.

By utilizing IFSC codes, you can enjoy a hassle-free experience while making online transactions. IFSC Codes reduce the chances of errors and fraudulent activities and provide an added layer of security to your financial data.

Furthermore, IFSC Codes offer convenience and cost savings compared to manual transactions, making them a preferred choice for online banking.

How Can I Find My Bank's IFSC Code?

If you need to receive money into an Indian bank account from overseas or via online payment methods within India, you will need to provide the sender with your bank's IFSC Code. This will ensure that the money reaches your account successfully.

There are several easy ways to find your bank's IFSC Code. Some of these include the below:

- Look at your cheque book: Most Indian banks list their IFSC Code on the cheques in their cheque book. Check the top left corner of your cheque book and find the branch's full address. At the end of this address, there will be an 11-digit code - this is your IFSC Code.

- Check your bank account statement: Your bank's IFSC Code should also be listed on your bank account statement. Check your statement and you should be able to located this 11 character code.

- Call your bank: You can also simply call your bank to ask for their IFSC Code.

- Search on your bank's website or app: Most banks readily provide their IFSC Codes on their website and mobile apps. You can search for IFSC Code or visit the FAQ section to look for it.

- Use IFSC Code lookup tools online: If you are unable to locate your bank's IFSC Code using any of the prior methods, you can go online and search for it. There are many dedicated sites that help lookup IFSC Codes. In fact, the RBI website is one such accurate and authentic resource. See the next section for instructions on how to find your bank's IFSC Code on the RBI website.

How to Find an IFSC Code Using the RBI Website?

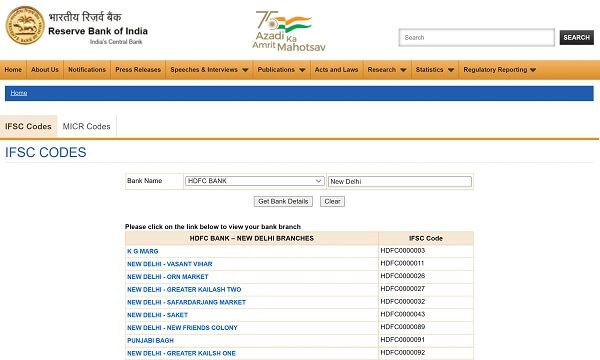

Since IFSC Codes are issued to Indian banks by the Reserve Bank of India (RBI), it is no surprise that the RBI itself is one of the most accurate and up to date resources to lookup IFSC Codes.

In fact, the RBI provides a handy online tool to search and lookup IFSC Codes1 for all Indian banks.

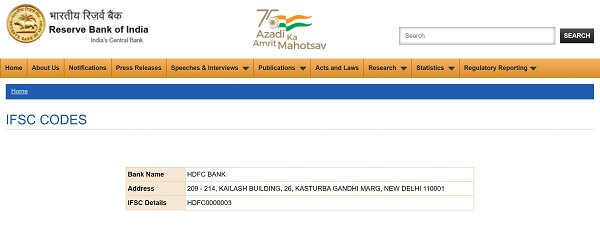

The below screenshot shows how to use the RBI IFSC Code lookup utility. Simply enter your bank and branch name and search. Below is a screenshot with an example of HDFC Bank branches in New Delhi.

The search results will show all bank branches that meet your search criteria along with their IFSC Codes. You can also click on your target branch to lookup full information including branch address and IFSC Code. This should look like the below screenshot.

It is quick and easy to look up bank IFSC Codes on the RBI IFSC Code online lookup tool.

IFSC Codes for Major Indian Banks

If you send or receive money in India, you will likely need an IFSC Code to make online payments. All major Indian banks have been issued IFSC Codes by the RBI, so this information is easy to obtain.

Earlier we listed useful resources on how to lookup your bank's IFSC Code. In this section, we will provide the IFSC Codes for major Indian banks.

Note that since all major banks have numerous branches across India, it is impossible to list all their IFSC Codes. We will, therefore, only list the first 4 digits of the IFSC Codes for popular Indian banks. Contact your branch or use the RBI IFSC Code search tool to find the exact IFSC Code for your bank branch.

What is Axis Bank's IFSC Code?

Axis Bank IFSC Codes start with UTIB. Contact your bank for the full IFSC Code with the branch code included.

What is Bank of India's IFSC Code?

Bank of India IFSC Codes start with BKID. Contact your bank for the full IFSC Code with the branch code included.

What is Central Bank of India's IFSC Code?

Central Bank of India IFSC Codes start with CBIN. Contact your bank for the full IFSC Code with the branch code included.

What is HDFC Bank's IFSC Code?

HDFC Bank IFSC Codes start with HDFC. Contact your bank for the full IFSC Code with the branch code included.

What is ICICI Bank's IFSC Code?

ICICI Bank IFSC Codes start with ICIC. Contact your bank for the full IFSC Code with the branch code included.

What is IndusInd Bank's IFSC Code?

IndusInd Bank IFSC Codes start with INDB. Contact your bank for the full IFSC Code with the branch code included.

What is Kotak Mahindra Bank's IFSC Code?

Kotak Mahindra Bank IFSC Codes start with KKBK. Contact your bank for the full IFSC Code with the branch code included.

What is Reserve Bank of India's IFSC Code?

Reserve Bank of India IFSC Codes start with RBIS. Contact your bank for the full IFSC Code with the branch code included.

What is State Bank of India's IFSC Code?

State Bank of India IFSC Codes start with SBIN. Contact your bank for the full IFSC Code with the branch code included.

What is Union Bank of India's IFSC Code?

Union Bank of India IFSC Codes start with UBIN. Contact your bank for the full IFSC Code with the branch code included.

Frequently Asked Questions about IFSC Codes

In this section, we will cover some Frequently Asked Questions (FAQs) about IFSC Codes.

Is an IFSC Code the same as a bank account number?

An IFSC Code is not the same as your bank account number. Both numbers represent entirely different types of information - an IFSC Code identifies a bank branch, whereas a bank account number identifies your actual bank account.

Both the IFSC Code of your bank and your bank account number combined help to uniquely identify your account in your bank branch, and can therefore we used to route money into your account.

If you are planning to receive funds into your account from overseas or within India, make sure to provide both your bank's IFSC Code and your account number to the sender. This will ensure the money gets into your account without any problems.

Is an IFSC Code the same as a SWIFT Code?

IFSC Codes and SWIFT Codes both help move money within banks, but they are still very different from each other.

An IFSC Code helps to uniquely identify a bank within India. A SWIFT Code, on the other hand, is a unique id for a bank on an international level. Hence, SWIFT Codes can be used to route money to India banks from overseas banks directly.

IFSC Codes help move money between Indian banks while SWIFT Codes help move money between international banks.

For instance, if someone was sending money from a US Bank directly into your bank in India via an international wire transfer, you would need to provide them with your Indian bank's SWIFT Code.

On the other hand, if your sender is within India, or using a money transfer company from outside India, they will need your IFSC Code so the payment processing within India can ensure that the funds end up in your account.

Is an IFSC Code the same as a BIC Code?

BIC Codes are very similar to SWIFT Codes. Given that, the same difference that applies between IFSC Codes and SWIFT Codes also applies between IFSC Codes and BIC Codes.

Is an IFSC Code the same as an IBAN?

IFSC Codes and International Bank Account Numbers (IBANs) are not alike in any way as they represent totally difference concepts.

The main distinction between both is that an IFSC Code represents the branch of a bank while an IBAN represents an account number. As such, both numbers stand for totally different entities.

IFSC Codes help uniquely identify branches of Indian banks within India. IBANs, on the other hand, help uniquely identify bank accounts at an international level.

The other distinction between IFSC Codes and IBANs is their scope of application - IFSC Codes are applicable within the Indian banking ecosystem whilst IBANs are used in the international banking arena.

Is an IFSC Code the same as a bank code?

A bank code is a unique identifier for a banking institution whereas an IFSC Code is a unique identifier for a particular bank branch.

For instance, the bank code for State Bank of India (SBI) is SBIN - this means that all SBI branches in India inherit the parent bank code of SBIN.

However, the IFSC Code for the SBI Branch located at Connaught Place, New Delhi is SBIN0040278.

Is an IFSC Code the same as a UPI ID?

IFSC Codes and UPI IDs serve different purposes, and hence are not the same.

Unified Payments Interface (UPI) is an innovative initiative led by the Government of India to streamline digital payments and encourage a cashless economy. Your UPI ID is a unique identifier for you in the UPI ecosystem.

Therefore, while an IFSC Code identifies a bank branch in India, a UPI ID helps to uniquely identify a UPI user in the UPI payments system.

Is an IFSC Code the same as a UTR Number?

No, IFSC Codes and UTR Numbers represent different concepts and are used for very different purposes.

Unique Transaction Reference (UTR) Numbers are unique identifiers for Real Time Gross Settlement (RTGS) and National Electronic Funds Transfer (NEFT) transactions in India. They can be used to track and monitor transactions in the Indian banking ecosystem.

The biggest difference between UTR Numbers and IFSC Codes lies in what they represent - UTR Numbers are unique transaction identifiers whilst IFSC Codes are unique codes for bank branches in India.

Is an IFSC Code the same as a MICR Code?

MICR stands for Magnetic Ink Character Recognition, and it is a banking standard that helps with the processing of checks. An MICR Code is a 9 digit code printed on the bottom of checks, and helps to identify a bank branch.

In that way, MICR Codes are similar to IFSC Codes since they help to identify a bank branch.

The difference between IFSC Codes and MICR Codes lies in their usage and application. IFSC Codes help route funds to bank accounts in India, whilst MICR Codes are primarily used for check processing.

Is an IFSC Code the same as a BSB Number?

Both the IFSC Code and the BSB Number serve a similar purpose as they help identify a bank branch in their countries without any ambiguity.

The only difference is that IFSC Codes are used in the Indian banking ecosystem whilst BSB Numbers are applicable to the Australian banking industry.

IFSC Codes and BSB Numbers serve to uniquely identify bank branches in India and Australia, respectively.

Is an IFSC Code the same as a Sort Code?

IFSC Codes and Sort Codes are unique fingerprints for bank branches in their respective countries, and help to move money between banks without any issues.

The only difference is that IFSC Codes and Sort Codes are applicable in their countries and do not work overseas. IFSC Codes are used in India and Sort Codes are used in the UK.

In this way, IFSC Codes in India, BSB Numbers in Australia and Sort Codes in UK help to route funds properly within their respective country's banking and payment systems.

Is an IFSC Code the same as a CLABE Number?

IFSC Codes are unique fingerprints for bank branches in India, and help to route funds amongst banks without any issues.

CLABE Numbers, on the other hand, are unique fingerprints for bank accounts in Mexico.

In that sense, even though both IFSC Codes and CLABE Numbers help route money properly to the final destination, they represent very different concepts.

Is an IFSC Code the same as a NUBAN Number?

IFSC Codes help to uniquely identify bank branches in India, and hence, assist in routing funds in-between banks without any issues.

NUBAN Numbers, on the other hand, are unique IDs for bank accounts in Nigeria.

Therefore, despite the fact both IFSC Codes and NUBAN Numbers help move money accurately to the final destination bank, they represent totally different concepts.

Is an IFSC Code the same as a CNAPS Code?

CNAPS Code are unique IDs of bank branches in China, and hence help route funds accurately amongst banks and financial institutions in the country. In that sense, both IFSC Codes and CNAPS Codes serve similar needs in their respective countries.

Is it Safe to Share an IFSC Code?

In general, it should be safe to share your bank's IFSC Code since IFSC Codes are public information. Also, an IFSC Code by itself does not point to your bank account or other personal information; it only represents the branch of a bank.

That said, if you share your bank's IFSC Code with someone, you are indirectly disclosing the bank branch where your account is located in. This may prove problematic if someone gets access to your account number as well.

We, therefore, recommend that you follow the below guidelines to keep your account safe:

- Disclose your IFSC Code only on a need to know basis.

- Share your IFSC Code with organizations or people you trust only.

- If you suspect any unauthorized access or fraudulent activity, notify your bank immediately.

Are IFSC Codes used outside of India?

IFSC Codes are specific to Indian banks as they are issued by the Reserve Bank of India (RBI) to facilitate seamless online transactions within India.

The only time you would need an IFSC Code outside of India is when you send money to India from overseas via a money transfer company that relies on the Indian payment systems like NEFT, RTGS or IMPS to settle the overseas remittance transaction in India.

Simply provide your recipient's bank's IFSC Code to the money transfer company, and they will use that to route the funds into your receiver's Indian bank account.

Conclusion

An IFSC Code is an 11-digit alphanumeric code that helps to uniquely and unambiguously identify a specific bank branch in India. This is very useful for the purposes of online banking and money transfers within the Indian banking system.

If someone wants to send you money from within India or from overseas, make sure to give them your bank's IFSC Code. If you need to find your bank's IFSC Code, it's easy to look it up using an online search or by contacting your bank directly.

And finally, remember that an IFSC Code differs from other banking terms like SWIFT Code, BIC Code, IBAN and others even though all these terms are applicable to banking and money transfers.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

References:

1. Reserve Bank of India (RBI) IFSC Code search and lookup tool

Categories

Similar Articles

CNAPS Codes Unraveled: Navigating China's Banking Landscape

Discover CNAPS Codes: China’s unique bank identifier for fast, secure transactions. Learn how CNAPS Codes simplify payments across China's banking system.

ABA Routing Numbers In The US: A Comprehensive Guide

Discover what ABA Routing Numbers are, how they work and their importance in US banking transactions like direct deposits, online transactions and wire transfers.

What Is A NUBAN Number And What Is It Used For?

Discover what NUBAN Numbers are and how they streamline bank account identification in Nigeria. Do not miss this essential guide if you transact in any way with the Nigerian banking system.