What Is A Sort Code And What Is It Used For?

Table of Contents

- What is a Bank Sort Code?

- Who Issues Sort Codes in the UK?

- What is the Format of a Sort Code?

- How to Find the Sort Code from an IBAN?

- What is a Sort Code Used for?

- What Are The Benefits Of Using Sort Codes?

- How Can I Find My Bank's Sort Code?

- Sort Codes for Major UK Banks

- What is National Westminster Bank's Sort Code?

- What is Yorkshire Bank's Sort Code?

- What is Nationwide Building Society Bank's Sort Code?

- What is The Co-operative Bank's Sort Code?

- What is Santander Bank's Sort Code?

- What is Bank of England's Sort Code?

- What is Halifax Bank's Sort Code?

- What is Bank of Scotland's Sort Code?

- What is Royal Bank of Scotland's Sort Code?

- What is Citibank's Sort Code?

- What is Barclays Bank's Sort Code?

- What is Allied Irish Bank's Sort Code?

- What is Lloyds Bank's Sort Code?

- What is HSBC Bank's Sort Code?

- What is Deutsche Bank's Sort Code?

- What is Alliance & Leicester Commercial Bank's Sort Code?

- What is Clydesdale Bank's Sort Code?

- What is TSB Bank's Sort Code?

- What is Bank of Ireland's Sort Code?

- What is Allied Irish Bank's Sort Code?

- What is First Trust Bank's Sort Code?

- What is Northern Bank's Sort Code?

- What is National Irish Bank's Sort Code?

- What is Ulster Bank's Sort Code?

- What is BNP Paribas Bank's Sort Code?

- Frequently Asked Questions about Sort Codes

- Is a Sort Code the same as a bank account number?

- Is a Sort Code the same as a SWIFT Code?

- Is a Sort Code the same as a BIC Code?

- Is a Sort Code the same as an IBAN?

- Is a Sort Code the same as a bank code?

- Is a Sort Code the same as a UPI ID?

- Is a Sort Code the same as a UTR Number?

- Is a Sort Code the same as a MICR Code?

- Is a Sort Code the same as a BSB Number?

- Is a Sort Code the same as an IFSC Code?

- Is a Sort Code the same as a CLABE Number?

- Is a Sort Code the same as a NUBAN Number?

- Are Sort Codes used outside UK?

- Is it safe to share your Sort Code?

- Conclusion

If you have received money from overseas in your UK bank account, or sent money to someone's bank account within the UK, you may have come across the term Sort Code.

A Sort Code is a crucial identifier that financial institutions in the United Kingdom use to route money transfers between banks. This 6-digit number is the backbone of a seamless and efficient banking systemin the UK, ensuring that funds are accurately credited to the correct account.

Sort codes play an important role in ensuring successful transaction processing between different banks accounts within the UK. They offer an accurate and secure reference for banks to process payments automatically without manually reviewing details.

Many other countries also have similar bank codes. For example, IFSC Codes are prevalent in India whilst BSB Numbers are used in Australia.

Read on to find out exactly what a Sort Code is, its origins as well as use cases. We will also touch upon differences between a Sort Code and other bank codes, safety considerations when sharing Sort Codes, and answers to frequently asked questions about these useful numbers.

What is a Bank Sort Code?

Sort Codes are 6-digit numeric codes that uniquely identify branches of banks in the UK, and hence help route money to the final recipient or destination bank account correctly.

A Sort Code is a 6-digit number used to identify banks and financial institutions in the UK.

The Sort Code, thus, serves as a routing number in the UK banking ecosystem by enabling banks to transfer money between accounts and ensure the funds reach the correct destination.

Understanding bank Sort Codes is essential for anyone who wants to make financial transactions in the UK, as it helps to ensure that the money ends up in the right place.

Sort Codes were introduced in the UK in the 1960s, and since then, they have become a critical component of the financial system. They allow banks to process payments quickly and accurately, reducing the risk of errors and fraudulent activity.

This makes Sort Codes a critical tool for protecting the financial system's integrity and ensuring that consumers' money stays safe.

As an example, the Sort Code for Barclays Bank head office branch located at 1 Churchill Place, Canary Wharf, London, E14, 5HP is 200050.

Tracing the origin of Sort Codes

Sort Codes, also known as routing numbers, are numerical codes used to identify banks and other financial institutions in the United Kingdom and Ireland. The concept of Sort Codes has been in use since the late 1940s when they were introduced to simplify and speed up the processing of cheques.

Sort Codes were first introduced by the London Clearing House, established in the 19th century to provide a central location for banks to clear cheques.

In the early days of banking, cheques would be physically transported from one bank to another for clearing; this was a slow, expensive and error-prone process. The introduction of Sort Codes allowed banks to sort and clear cheques more efficiently using a standardized identification system.

In addition to their use in processing cheques, Sort Codes are now used in electronic transfers and other financial transactions. They are an essential component of the UK and Irish banking systems and play a critical role in ensuring that financial transactions are processed quickly and accurately.

Who Issues Sort Codes in the UK?

Traditionally, Sort Codes have been issued to banks and payment service providers (PSPs) by Bacs Payment Schemes Limited (BACS). BACS was previously called Bankers' Automated Clearing System.

Since May 2018, BACS became a subsidiary of Pay.UK. Since then, Sort Codes are issued and maintained in the UK by Pay.UK. Additionally, ongoing governance and maintenance of Sort Codes is provided by the Clearing Codes Operational Group within Pay.UK.

Sort Codes are issued, maintained and governed in the UK by Pay.UK.

Pay.UK also maintains an extensive database of all Sort Codes in the UK and the banking institutions that they are issued out to. This database is called the Extended Industry Sort Code Directory (EISCD)1 and is the central and authentic source of information for all UK Sort Codes.

Given the above, the EISCD can, therefore, be used as an up to date and reliable source to lookup Sort Codes in the UK.

What is the Format of a Sort Code?

A UK Bank Sort Code is written as a 6-digit number.

The first two numbers in a Sort Code represent the bank that this Sort Code belongs to, while the last four numbers serve as a unique identifier for the particular branch that the Sort Code represents.

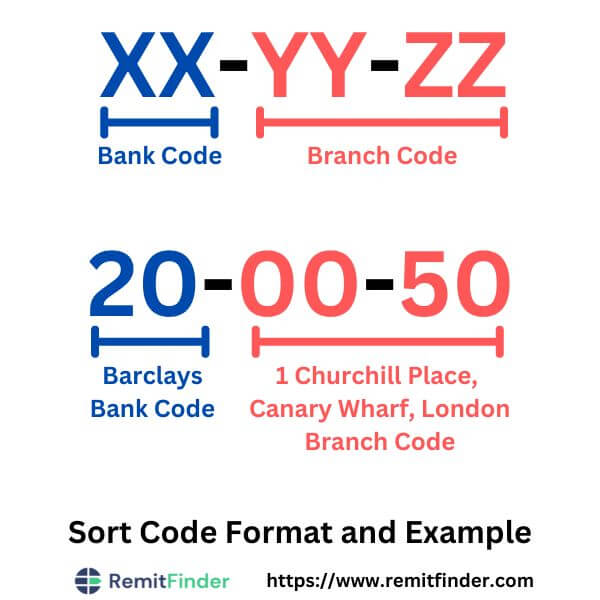

Sort Codes are written in both XX-YY-ZZ as well as XXYYZZ formats. Using the XX-YY-ZZ format as an example, the corresponding digits of a Sort Code in this format carry the information as below:

- The first two numbers, i.e., XX, represent the bank code.

- The last four numbers, i.e., YY-ZZ, represent the unique branch code of the concerned bank.

A UK Bank Sort Code helps to unambiguously identify the branch of a UK banks, and contains digits that represent both the bank and the branch.

Let's take an example to demonstrate how the Sort Code format works.

Barclays Bank is a popular UK bank with umpteen branches in the country. For the Barclays Bank head office branch located at 1 Churchill Place, Canary Wharf, London, E14, 5HP, the Sort Code is 20-00-50. Using our aforementioned Sort Code formatting rules, we can deduce the following information:

- The first two digits, i.e., 20, represent Barclays Bank.

- The last four digits, i.e., 00-50, represent the branch code for the Barclays branch located at 1 Churchill Place, Canary Wharf, London, E14, 5HP.

The picture below represents the information presented above in an image format, thereby showing the format of UK Bank Sort Codes with a real example.

You can easily see how the above format makes a Sort Code unique in the UK banking industry. It is this unambiguous uniqueness of a Sort Code that proves extremely helpful to transfer money to the correct UK bank without any issues.

A UK Bank Sort Code is a totally unique identifier for a bank branch in the UK.

Another important point about Sort Codes for online-only or challenger or neobanks in the UK is that they generally have a single Sort Code since they do not have physical branches. For example, Starling Bank's Sort Code is 608371.

In addition to helping banks send money to the correct bank account in the right branch, Sort Codes also help in distinguishing between various branches of the same bank.

For instance, the Sort Code for the Barclays Bank branch located at Wealth Centre, Level 16, 1 Churchill Place, London is 205707, while the Sort Code for the South London 3 branch located in Leicester, Leicestershire is 202963.

To ensure that payments and money transfers within UK banks complete without any issues, knowing and using the right Sort Codes is important. Before you decide to make any payments using your UK bank account, make sure you have important information like the name and address of the bank as well as the correct Sort Code.

How to Find the Sort Code from an IBAN?

An IBAN, short for an International Bank Account Number, is an international representation of a local account number. This makes it possible for a local bank to participate in cross-country payments and transactions.

IBANs have a specific format that complies with the ISO 13616-1:2007 standard. As per the ISO guidelines specified in the aforementioned standard, IBAN numbers can be up to maximum 34 characters in length.

The good news is that for UK IBAN's, you can easily get the Sort Code of your bank directly from your IBAN. The 9th to 14th characters in a UK IBAN are the Sort Code of the bank branch where the said account is held.

You can easily find the Sort Code from a UK IBAN. The Sort Code in a UK IBAN is located at 9-14 character positions.

Let's look at an example.

If your UK IBAN was GB22ABYZ20005131926819, then your bank's Sort Code would be 200051 since those are the 9th through the 14th character in the IBAN.

What is a Sort Code Used for?

Since a Sort Code identifies a UK bank branch without any ambiguity, it presents itself as a great way to route money between UK banks. That is the primary use of Sort Codes in the UK banking ecosystem - efficiently moving money between bank accounts without errors.

Sort Codes are used to move money correctly between UK bank accounts. This is possible as a Sort Code is akin to a fingerprint for a bank branch.

Therefore, any time an electronic funds transfer or payment happens in the UK that needs movement of money between various UK banks, Sort Codes help make the process smooth, error-free and fast.

If you are sending money to someone in the UK, make sure to use the correct Sort Code. This will ensure that your funds reach the destination bank account without any problems.

What Are The Benefits Of Using Sort Codes?

As we have seen earlier, the biggest value add of Sort Codes is that they establish a unique fingerprint for every bank branch within the UK. This literally eliminates the need to look up banks by their address and other info, and helps moving money between banks fast, efficient and error-free.

When you do online banking transactions and use a Sort Code, you are adopting a safe and secure manner of making payments and moving money around. Below are the major benefits of using Sort Codes for online banking:

- Error-Free Online Banking: Since Sort Codes help uniquely identify bank branches, you can rest assured that your money will reach the correct destination account. Using Sort Codes, payment gateways can make sure that the funds reach the correct destination bank account.

- Ease of Use and Convenience: Since Sort Codes are a fundamental enabler of online banking, you can make online transactions anytime and from anywhere. This increases the overall accessibility and adoption of online banking as it is quick, easy and convenient.

- Safety and Security: Given that Sort Codes in UK are maintained and issued by Pay.UK and are globally unique, you can do online banking using Sort Codes and without using other information like bank name and address. This means less data needs to be transmitted for online banking transactions. Additionally, the use of Pay.UK issued authentic and standardized Sort Codes adds an additional layer of safety to your transactions.

- Unique Bank Branch Identification: Sort Codes are unique fingerprints for each bank branch within the UK banking industry. Sort Codes, thus, serve to differentiate one branch from another even within the same bank. This facilitates safe and error-free online transactions and movement of funds.

- UK Banking Standard: All Sort Codes for banks, payment processors and other financial institutions in the UK are issued by Pay.UK. Since Sort Codes are standardized, they facilitate efficient transfer of money from one bank to another in the UK without worrying about any compliance or compatibility problems.

- Cost Savings: Since Sort Codes facilitate online transactions, banks save on operational costs there are fewer manual transactions. Additionally, you save time and money by avoiding having to visit your bank's branch to execute manual transactions. In this way, Sort Codes help drive online banking forward and save money for everyone involved.

From better security to ease of use to cost savings, there are many benefits of using Sort Codes for online banking transactions in the UK.

If you want to take advantage of seamless online banking and payments, you can rely on Sort Codes. Doing so eliminates many errors that happen due to manual data entry. This also leads to reduction in fraud and increases the overall safety of your funds and information.

Finally, Sort Codes increase the adoption of online banking by making it more convenient, faster and cost-effective. Contrast this to manual transactions where more data entry is needed and errors can easily happen. Sort Codes are, therefore, the preferred choice for online banking.

How Can I Find My Bank's Sort Code?

If you know that you will receive funds into your UK bank account from within the UK or even overseas, it will be highly beneficial to provide your bank's Sort Code to the sender. Doing so will ensure that there are no problems in the funds reaching your account.

The good news is that finding your bank's Sort Code is pretty easy. You can use any of the below methods to find Sort Code for your bank:

- Look at your bank account statement: Most banks list their Sort Code on their account statements. Check yours and you should be able to locate the 6-digit Sort Code.

- Check your debit card: Sort Codes are usually also printed on debit cards. Check the front and back of your card, and you should be able to see the Sort Code there.

- Lookup information on your bank's website or mobile app: You can also search for your bank's Sort Code on their website or mobile app. Branch locator pages on bank sites or apps typically list Sort Codes along with branches. You can also check the FAQ section to see if the Sort Code is listed here.

- Contact your bank: You can stop by at your bank's branch or call them over the phone to ask for their Sort Code.

- Use Sort Code finder online: In case you are not able to find your bank's Sort Code using any of ways listed above, you can search online to find it. There are numerous online Sort Code finder and Sort Code checker websites available. Pay.UK, in fact, Pay.UK, maintains an online directory of all Sort Codes in the UK. This directory is the Extended Industry Sort Code Directory (EISCD)1 and an authoritative and correct source of information when it comes to UK Sort Codes.

There are several easy ways to find your bank's Sort Code.

The Pay.UK EISCD website also provides a Sort Code checker service using which you can verify that your bank's Sort Code is correct.

Sort Codes for Major UK Banks

Whenever you send or receive money within the UK, you will need the Sort Code of the recipient bank to ensure that the transaction will finish smoothly. Since Pay.UK allocates Sort Codes for all banks operating within the UK, it is pretty easy to find the requisite information.

In the prior section, we listed out various easy ways to find the Sort Code for your bank. In this section, we will provide the Sort Codes for many major UK banks.

Since Sort Codes are branch specific and many of UK's banks have hundreds of branches across the country, it is not possible to list all Sort Codes for every bank. Instead, we will list the first 2 digits of many UK banks since they identify the bank in the Sort Code.

The only exception to this is online-only banks (also called challenger banks, neobanks, digital banks, mobile banks or fintech banks). Since online or challenger banks generally do not have any physical branches, they tend to have a single Sort Code; we will call this out where applicable.

Since online challenger banks usually do not have physical branches, they often have a single Sort Code.

If you are ever in doubt, check with your bank or use the Pay.UK Sort Code finder tool to find your bank's exact Sort Code.

What is National Westminster Bank's Sort Code?

National Westminster Bank Sort Codes start with 01, 50, 51, 52, 53, 54, 55, 56, 57, 60 and 62. Check with your bank for the exact Sort Code for your branch.

What is Yorkshire Bank's Sort Code?

Yorkshire Bank Sort Codes start with 05. Check with your bank for the exact Sort Code for your branch.

What is Nationwide Building Society Bank's Sort Code?

Nationwide Building Society Bank Sort Codes start with 07. Check with your bank for the exact Sort Code for your branch.

What is The Co-operative Bank's Sort Code?

The Co-operative Bank Sort Codes start with 08. Check with your bank for the exact Sort Code for your branch.

What is Santander Bank's Sort Code?

Santander Bank Sort Codes start with 09. Check with your bank for the exact Sort Code for your branch.

What is Bank of England's Sort Code?

Bank of England Sort Codes start with 10. Check with your bank for the exact Sort Code for your branch.

What is Halifax Bank's Sort Code?

Halifax Bank Sort Codes start with 11. Check with your bank for the exact Sort Code for your branch.

What is Bank of Scotland's Sort Code?

Bank of Scotland Sort Codes start with 12 and 80 in the UK, and with 99 in Ireland. Check with your bank for the exact Sort Code for your branch.

What is Royal Bank of Scotland's Sort Code?

Royal Bank of Scotland Sort Codes start with 15, 16 and 83. Check with your bank for the exact Sort Code for your branch.

What is Citibank's Sort Code?

Citibank Sort Codes start with 18. Check with your bank for the exact Sort Code for your branch.

What is Barclays Bank's Sort Code?

Barclays Bank Sort Codes start with 20. Check with your bank for the exact Sort Code for your branch.

What is Allied Irish Bank's Sort Code?

Allied Irish Bank Sort Codes start with 23. Check with your bank for the exact Sort Code for your branch.

What is Lloyds Bank's Sort Code?

Lloyds Bank Sort Codes start with 30 and 77. Check with your bank for the exact Sort Code for your branch.

What is HSBC Bank's Sort Code?

HSBC Bank Sort Codes start with 40, 42, 43 and 44. Check with your bank for the exact Sort Code for your branch.

What is Deutsche Bank's Sort Code?

Deutsche Bank Sort Codes start with 49. Check with your bank for the exact Sort Code for your branch.

What is Alliance & Leicester Commercial Bank's Sort Code?

Alliance & Leicester Commercial Bank Sort Codes start with 72 and 89. Check with your bank for the exact Sort Code for your branch.

What is Clydesdale Bank's Sort Code?

Clydesdale Bank Sort Codes start with 82. Check with your bank for the exact Sort Code for your branch.

What is TSB Bank's Sort Code?

TSB Bank Sort Codes start with 87. Check with your bank for the exact Sort Code for your branch.

What is Bank of Ireland's Sort Code?

Bank of Ireland Sort Codes start with 90. Check with your bank for the exact Sort Code for your branch.

What is Allied Irish Bank's Sort Code?

Allied Irish Bank Sort Codes start with 93. Check with your bank for the exact Sort Code for your branch.

What is First Trust Bank's Sort Code?

First Trust Bank Sort Codes start with 93. Check with your bank for the exact Sort Code for your branch.

What is Northern Bank's Sort Code?

Northern Bank Sort Codes start with 95. Check with your bank for the exact Sort Code for your branch.

What is National Irish Bank's Sort Code?

National Irish Bank Sort Codes start with 95. Check with your bank for the exact Sort Code for your branch.

What is Ulster Bank's Sort Code?

Ulster Bank Sort Codes start with 98. Check with your bank for the exact Sort Code for your branch.

What is BNP Paribas Bank's Sort Code?

BNP Paribas Bank Sort Codes start with 99. Check with your bank for the exact Sort Code for your branch.

Frequently Asked Questions about Sort Codes

In this section, we will cover some Frequently Asked Questions (FAQs) about Sort Codes.

Is a Sort Code the same as a bank account number?

No, the Sort Code is not the same as an account number. While a Sort Code is a unique identifier for a UK bank branch, the account number is specific to a bank account held by you as an account holder with your bank.

When combined together, the Sort Code and the bank account number help to uniquely identify your bank account in the UK, and can be used to move money into your account without any problems.

If you plan to receive any money into your UK bank account from within the country or from overseas, you should provide the sender with both your Sort Code as well as your account number. This information will help the sender send money to your account without any glitches.

Is a Sort Code the same as a SWIFT Code?

Sort Codes and SWIFT Codes both have similar goals in the sense that they are useful for routing money between banks. That said, they are quite different from each other.

Sort Codes only work within the UK banking system and help to uniquely identify branches of UK banks. SWIFT Codes, on the other hand, are internationally unique identifiers for banks worldwide. This means that SWIFT Codes can be used funds from all over the world directly into a UK bank account.

Sort Codes and SWIFT Codes both help route money correctly. Sort Codes help move money between UK banks while SWIFT Codes help so the same between banks worldwide.

Let's take an example.

If someone was sending you money from USA to UK, they would need your bank's SWIFT Code for the funds to be correctly deposited via an international money transfer, or an international wire transfer.

Similarly, if the sender has a UK bank account and sends you money from within the UK, you should provide them with your bank's Sort Code. This will ensure that the funds get deposited to your bank account without any routing problems.

Is a Sort Code the same as a BIC Code?

BIC Codes and SWIFT Codes are very similar to each other. As a result, the difference Sort Codes and SWIFT Codes are the same as those between Sort Codes and BIC Codes.

Is a Sort Code the same as an IBAN?

Sort Codes and International Bank Account Numbers (IBANs) signify completely different concepts, and are not the same in any shape or form.

While a Sort Code helps uniquely trace the branch of a bank within the UK, an IBAN is the globally unique representation of a bank account number. Given this, Sort Code and IBAN represent completely disparate pieces of information.

Since IBANs help identify local bank accounts at a global level, they can be used to send money to a bank account from overseas. Sort Codes, on the other hand, are useful for moving money between UK banks.

Another difference is that the scope of Sort Codes and IBANs is very different from each other. IBANs are international in nature as they represent local bank accounts uniquely worldwide, whereas Sort Codes are applicable within the UK only.

Is a Sort Code the same as a bank code?

No, a Sort Code and a bank code are not the same thing. While a Sort Code helps find a UK bank branch without any ambiguity, a bank code only represents a bank without any branch information.

That said, the bank code is part of the Sort Code. In fact, the first 2 digits of a Sort Code are the bank code that helps find which bank the said branch is located in.

Let's take an example.

Barclays Bank's bank code is 20 as per the assignment from Pay.UK. This means that all Barclays Bank branches will have Sort Codes that will start with 20.

On the other hand, the Sort Code for the Barclays Bank main branch located at 1 Churchill Place, Canary Wharf, London, E14, 5HP is 200050.

Is a Sort Code the same as a UPI ID?

Sort Codes and UPI IDs are not the same and are meant for completely different purposes.

Unified Payments Interface (UPI) is a new digital payments initiative introduced by the Government of India to encourage mobile and digital payments and reduce the reliance on cash. A UPI ID represents you uniquely within the UPI ecosystem in India, and can be used to send and receive money.

To summarize, Sort Codes are a unique fingerprint of a bank branch within the UK, while a UPI ID is a unique fingerprint of a UPI user in the UPI payments ecosystem within India.

Is a Sort Code the same as a UTR Number?

Sort Codes and UTR Numbers are not the same as they are used for very different purposes and represent completely different entities.

Unique Transaction Reference (UTR) Numbers are transaction IDs for payments that happen in India's Real Time Gross Settlement (RTGS) and National Electronic Funds Transfer (NEFT) payment systems. Since UTR Numbers represent transaction IDs, they can be used to trace payments done via RTGS and NEFT within banking ecosystem.

Given this, Sort Codes and UTR Numbers represent different concepts. UTR Numbers are unique transaction IDs for RTGS and NEFT payments in India while Sort Codes are unique IDs for branches of various bank in the UK.

Is a Sort Code the same as a MICR Code?

MICR, short for Magnetic Ink Character Recognition, and is a standard specification used by the banking industry in India to helps process cheques. MICR Code help to identify Indian bank branches and are generally 9-digit codes printed on the bottom of cheques.

In that way, MICR Codes in India are similar to Sort Codes in the UK as both numbers represent a bank branch uniquely.

The difference between Sort Codes and MICR Codes are twofold as below:

- Sort Codes are used in the UK while MICR Codes are used in India.

- Sort Codes are used to move money between bank accounts in the UK, while MICR Codes are mainly used for cheque processing in India.

Is a Sort Code the same as a BSB Number?

Even though Sort Codes and BSB Numbers are different, they are used for the same purpose - to uniquely identify a bank branch in their country of use.

The biggest difference between Sort Codes and BSB Numbers is that Sort Codes are used in the UK banking system while BSB Numbers are used in the Australian banking system.

Sort Codes and BSB Numbers are unique fingerprints for branches of banks in the UK and Australia, respectively.

Is a Sort Code the same as an IFSC Code?

Sort Codes and IFSC Codes are fairly similar in nature in the sense that they both represent bank branches in the UK and India, respectively.

The different is that they apply in different countries and are used only in their own countries and not globally.

IFSC Codes represent bank branches uniquely in India, and Sort Codes do the same in the UK. Similarly, Australia has BSB Numbers for the same purpose.

Sort Codes in UK, IFSC Codes in India and BSB Numbers in Australia all help uniquely represent bank branches in their respective countries.

Is a Sort Code the same as a CLABE Number?

Sort Codes and CLABE Numbers represent different things, and are not the same.

While Sort Codes are useful to route funds to specific bank branches in the UK, CLABE Numbers are unique identifiers for Mexican bank accounts.

Is a Sort Code the same as a NUBAN Number?

Sort Codes and NUBAN Numbers do not represent the same banking concepts, and are not the same.

Whilst Sort Codes help identify bank branches in the UK and help move money between banks, NUBAN Numbers help to uniquely identify bank accounts in Nigeria.

Are Sort Codes used outside UK?

It is important to note that Sort Codes are specific to the UK, Scotland and Ireland and not used in other countries.

If you are making a payment or transferring to someone in another country, you will need to use a different routing or identification number.

For example, if you want to send money to someone in India, you will need to use an IFSC Code to ensure your funds reach the correct destination bank account in India.

Similarly, for sending money to an Australian bank account, you may need to use a BSB Number, which is the equivalent of a Sort Code in the UK.

Sort Codes are specific to banks in UK, Scotland and Ireland only. Other countries may have equivalent bank codes.

Is it safe to share your Sort Code?

Since Sort Codes are public information, it should be generally safe to share them.

That said, we recommend that you share this information on a need to know basis only, and with authorized entities like your bank, a reputable money transfer company or people and organizations you know and trust.

The main reason for this is that by sharing your Sort Code, you are disclosing where your account is held. This may lead to unauthorized access in case your account number also gets compromised.

Therefore, is it always important to be cautious when sharing your Sort Code with others.

Conclusion

In conclusion, a Sort Code is a 6-digit numerical code used to identify banks and financial institutions uniquely in the United Kingdom, Scotland and Ireland.

In this way, a Sort Code plays a critical role in the processing of financial transactions, including cheques and electronic transfers, by providing a standardized system of identification for banks and branches.

As banking systems in the UK have evolved, Sort Codes have become more sophisticated and standardized, and are an essential component of the UK payment ecosystem.

By allowing for more efficient and accurate processing of financial transactions, Sort Codes play a vital role in ensuring the smooth functioning of the modern banking landscape in the UK.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

References:

1. EISCD Sort Code Directory

Categories

Similar Articles

CNAPS Codes Unraveled: Navigating China's Banking Landscape

Discover CNAPS Codes: China’s unique bank identifier for fast, secure transactions. Learn how CNAPS Codes simplify payments across China's banking system.

ABA Routing Numbers In The US: A Comprehensive Guide

Discover what ABA Routing Numbers are, how they work and their importance in US banking transactions like direct deposits, online transactions and wire transfers.

What Is A NUBAN Number And What Is It Used For?

Discover what NUBAN Numbers are and how they streamline bank account identification in Nigeria. Do not miss this essential guide if you transact in any way with the Nigerian banking system.