What Is A BACS Payment?

Table of Contents

- What Is BACS?

- What Is a BACS Payment?

- How Does the BACS Payment System Work?

- What Are Various BACS Payments Types?

- How To Make A BACS Payment?

- Advantages And Disadvantages of BACS Payments

- How Long Does A BACS Payment Take?

- Which UK Banks Support BACS Payments?

- What Are The Fees And Charges For BACS Payments?

- Is a BACS Payment the Same as a Bank Transfer?

- What Are the Alternatives to BACS Payments?

- Conclusion

BACS stands for Bacs Payment Schemes Limited, and is a highly secure and reliable electronic payment system used in the United Kingdom to transfer funds between banks.

Millions of people in the UK use the BACS payment system for various purposes, including paying salaries, settling bills, and making other types of payments. BACS payments are fast and convenient and offer several benefits over traditional payment methods, such as checks and cash transfers.

Together with CHAPS and Faster Payments, BACS completes the trio of the most popular payment solutions within the UK.

In this article, we will deep dive into what exactly a BACS payment is, how it works, and its advantages and disadvantages to help you understand this payment method better.

What Is BACS?

Bacs Payment Schemes Limited (BACS) is a payment and settlement system used in the UK for moving money between banks. BACS was previously known as Bankers Automated Clearing Services, and since 2018, it has been part of UK's Pay.UK umbrella.

BACS was originally founded in 1968 and is now used by all the major banks operating in the UK.

BACS has handled more than hundreds of billions of transactions amount to more than 5 trillion British Pounds.

BACS has processed billion of transactions worth more than GBP 5 trillion since its inception.

BACS is a secure and efficient payment method, especially for large sums of money or frequent payments, such as paying salaries or settling bills.

What Is a BACS Payment?

BACS is a secure electronic payment system used in the United Kingdom to transfer funds between banks.

In a BACS payment, funds are transferred from one bank account to another through a centralized electronic system, which processes and settles the transactions. The BACS system is very popular in the UL with all of UK's major banks participating in BACS payments.

BACS payments typically take 3 working days to process and settle, making it slower than other electronic payment methods, such as Faster Payments. However, it is widely used due to its high security and reliability, and low cost compared to other payment methods.

BACS payments are a safe and cost-effective method of making electronic payments in the UK. Payments via BACS are used for various purposes, including paying salaries, settling bills, and making other types of payments.

How Does the BACS Payment System Work?

BACS payments work by facilitating the transfer of funds from one bank account to another through a centralized electronic system. The process can be broken down into the following steps:

- Payment Initiation: A payer (e.g., an employer) initiates a BACS payment by providing the necessary information, such as the payee's (e.g., an employee's) bank account number and Sort Code, and the amount to be transferred, to their own bank.

- Payment Processing: The payer's bank sends the payment information to the BACS payment system, which then forwards the information to the payee's bank.

- Payment Verification: The payee's bank verifies the payment information and confirms that the payee's account is in good standing.

- Payment Settlement: The BACS processing center debits the payer's bank account and credits the payee's bank account. This process is known as "settlement" and typically takes three working days to complete.

- Payment Confirmation: The BACS processing center sends a confirmation of the payment to both the payer's and payee's banks, and the payee's bank updates their account to reflect the deposit.

It is important to note that BACS payments are processed and settled in batches, which typically occur once a day, and are not processed in real-time. This means that the funds may take up to 3 days to reach the recipient's account, but the system is designed to be highly secure and reliable.

What Are Various BACS Payments Types?

There are 2 types of BACS payments that can be sent via BACS; these are as below.

- Direct Debit: This type of BACS payment happens when you authorize a third party to debit money from your bank account. For example, when you pay bills directly from your bank account, BACS will take the funds out as a Direct Debit.

- Direct Credit: This is the exact opposite of Direct Debit BACS payment type. A Direct Credit happens when money gets deposited into your bank account. For example, if you receive your salary directly into your bank account, it likely comes as a BACS Direct Credit payment.

BACS payment types include Direct Debit and Direct Credit for withdrawing and depositing money from and to bank account, respectively.

The scope and impact of BACS Payments

BACS payments, including both Direct Debit and Direct Credit, play a pivotal role in UK's financial landscape.

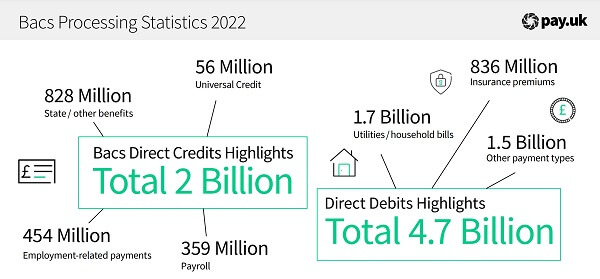

As per the official statistics on BACS Payments1 shared by Pay.UK, in 2022 alone, the BACS ecosystem handled GBP 6.7 billion worth of transfers that included GBP 2 billion in Direct Credit and GBP 4.7 billion in Direct Debit transactions.

The biggest share of Direct Credits includes salaries, pensions and related payments that include state benefits that go out to citizens monthly. For the Direct Debits, the biggest share of payments includes bill pays for utilities and other household bills.

BACS Direct Debits and Direct Credits sustain billions of pounds worth of transactions every year, and are a huge part of UK's financial ecosystem.

Over 80% of all UK employees receive their wages through BACS Direct Credit transfers, cementing its place at the top of preferred methods for corporate transactions across the UK.

How To Make A BACS Payment?

BACS payments are generally not accessible to retail customers by default via online banking. This means that while you can easily make online payments, money transfers and wire transfers via your bank, you cannot readily send BACS payments.

The ability to perform BACS transfers is not a default feature of your bank account and requires additional setup steps depending on the specific financial institution.

By default, most banks allow individual customers to receive BACS payments, but not send them.

You may be wondering how to send BACS payments then?

You will need to apply for sending BACS payments by following your bank's BACS approval process. Check with your bank on what procedures they follow to enable you to send BACS payments.

This is why BACS payments are generally sent by businesses, organizations and financial institutions like banks. For example, your employer may be enrolled in BACS and hence able to send direct deposits for employee's salaries into their respective bank accounts.

The application and approval process for sending BACS payments may seem like an inconvenience that must be addressed before you can utilize the benefits of this payment method. That said, it is a one-time process, and once you are approved for sending BACS payments, you are good to go.

In you want to make BACS payments for your business, you have 2 options as below:

- Go through your bank's BACS approval process.

- Use a BACS Approved Bureau, although this may come with additional fees.

You can send BACS payments by getting approved for BACS by your bank, or by using the services of a BACS Approved Bureau.

Either way, before you are able to send any BACS payment, you will need to sign up for BACS and get your official BACS Service User Number (SUN). Once you are approved for BACS and have a valid BACS SUN, you can send BACS payments via your bank.

Advantages And Disadvantages of BACS Payments

BACS payment is a widely used payment method in the UK due to its security, reliability, and efficiency. However, like any payment method, BACS payment has its advantages and disadvantages, which are outlined below.

What are the advantages of BACS?

The main advantages of BACS are as below:

- Security: BACS is highly secure, as all transactions are processed through a centralized electronic system that is managed by BACS which is part of Pay.UK and has all of UK's major banks as members.

- Reliability: BACS is a reliable payment method and has been used for many years. Additionally, it is adopted and by all major banks in the UK.

- Convenience: BACS is a convenient way to make payments, especially for large sums of money or for frequent payments, such as paying salaries or settling bills.

- Cost-Effective: BACS is a cost-effective payment method compared to other payment methods, such as checks and cash transfers.

What are the disadvantages of BACS?

There are also some drawbacks to using BACS as below:

- Slower Processing Time: BACS payments typically take 3 working days to process and settle, making it a slower method of payment compared to some other electronic payment methods, such as Faster Payments.

- Limited Use: BACS payment is only available in the UK and can only be used for payments between UK bank accounts.

- Complexity: BACS payment can be complex, requiring submitting payment information through the payer's bank, which may require special software or systems.

Given the above considerations, BACS is best used by business and organizations to move large sums of money around or for frequently sent payments.

For example, BACS is great for paying bills online, making tax payments and receiving refunds, salary and pensions.

On the other hand, BACS is not the best for sending money to your family and friends due to the complexity involved in getting approved for BACS. If you wish to send money to family and friends, especially internationally, there are numerous other great options.

How Long Does A BACS Payment Take?

BACS payments usually take 3 days to process and for funds to get credited into the recipient's account.

Here are some additional caveats when it comes to the timing and speed of BACS payments:

- BACS system is operational from 7 AM to 10:30 PM, so payments must be submitted in this window.

- BACS only works on weekdays and not on weekends.

If you are able to submit a BACS payment within the working hours of BACS, the funds will reach the destination account on the 3rd working day (excluding weekends) in the early morning around 7 AM.

BACS payments take 3 days to clear. Also, BACS is only available on weekdays between 7 AM and 10:30 PM.

Which UK Banks Support BACS Payments?

BACS has widespread adoption in the UK, and pretty much all major banks support BACS payments.

As per the BACS website2, below is a list of major UK banks that are able to handle BACS payments:

- Allied Irish Bank

- Atom bank

- Bank of England

- Bank of Scotland

- Barclays Bank

- Barclays Bank UK

- Citibank NA

- ClearBank

- Clydesdale Bank

- Coutts & Co

- Goldman Sachs

- HSBC Bank

- HSBC UK Bank

- LHV

- Lloyds Bank

- Metro Bank

- Modulr

- Monzo Bank

- Nationwide Building Society

- NatWest

- Northern Bank

- PayrNet

- Santander

- Starling Bank

- The Access Bank UK

- The Bank of London

- The Co-operative Bank

- The Royal Bank of Scotland

- TSB

- Turkish Bank UK

- Virgin Money

What Are The Fees And Charges For BACS Payments?

The cost of using BACS transfers depends on several factors, including the transfer size, the frequency of transfers, and the service provider you use. For businesses, the cost of processing BACS transfers can vary based on the volume of payments they send.

In general, the cost of sending BACS payments should be in pennies, especially if you send a larger number of transfers. Note that there is no cost to receiving BACS payments.

Sending BACS payments tends to be cheap especially if you send lots of transfers. Receiving BACS payments is absolutely free of cost.

Some banks and service providers offer tiered pricing, where businesses are charged a lower fee for processing a higher volume of payments. Other providers may offer a flat fee per transaction, regardless of the volume of payments processed.

For individual consumers, there may be no cost for making a BACS transfer. However, some banks may charge a fee for using their online banking service, which is often used to initiate BACS transfers.

Additionally, if you end up over-drafting your account while making a BACS transfer, you may be charged an overdraft fee by their bank.

Finally, since there is a bit of variation when it comes to BACS fees, make sure to check with your bank or service provider for their specific fee structure for BACS transfers and any applicable terms and conditions.

Is a BACS Payment the Same as a Bank Transfer?

Yes, BACS payments and bank transfers are equivalent terms in the sense that a BACS transfer is a type of a bank transfer.

Note that there are additional types of bank transfers as well like domestic and international wire transfers, Faster Payments and CHAPS.

In that sense, BACS payments are a subset of bank transfers which can be of additional types as well.

What Are the Alternatives to BACS Payments?

BACS is a secure, reliable, trusted and widely used payment system in the UK. But sometimes, it may not be the best fit for your needs.

For example, if you need to send money to friends and family, BACS may not be the best way to do so. Similarly, if you want to prevent paying any fees, you should avoid BACS.

Also, if you need to send money urgently, BACS may not work for you as it will take 3 days for the funds to reach the recipient's bank account.

Here are some alternatives to BACS:

- Faster Payments that can process within just 2 hours.

- CHAPS transfers that are guaranteed to finish on the same business day as long as you meet the daily cut-off time.

- Domestic wire transfers that may be a great fit to move large sums of money. Your bank may charge you a wire fee though.

There are several alternatives to BACS payments like Faster Payments, CHAPS and wire transfers.

There are several differences between BACS, Faster Payments and CHAPS, as well as wire transfers. Make sure you look into these before you decide which one to go with.

Conclusion

BACS payments are a safe, secure and convenient payment method in the UK. They allow for the automatic transfer of funds from a person's bank account to a company or vice-versa without manual intervention.

BACS payments are widely used for making recurring payments, such as utility bills and memberships, and offer a cost-effective and efficient solution for both businesses and consumers. They are also widely popular for receiving refunds, salaries and pensions directly into a bank account.

Overall, BACS payments are a reliable and trustworthy payment method, making financial transactions quick and easy within the UK.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

References:

1. BACS payments processing volumes for 2022

2. BACS participating banks in the UK

Categories

Similar Articles

CNAPS Codes Unraveled: Navigating China's Banking Landscape

Discover CNAPS Codes: China’s unique bank identifier for fast, secure transactions. Learn how CNAPS Codes simplify payments across China's banking system.

ABA Routing Numbers In The US: A Comprehensive Guide

Discover what ABA Routing Numbers are, how they work and their importance in US banking transactions like direct deposits, online transactions and wire transfers.

What Is A NUBAN Number And What Is It Used For?

Discover what NUBAN Numbers are and how they streamline bank account identification in Nigeria. Do not miss this essential guide if you transact in any way with the Nigerian banking system.