What Is A NUBAN Number And What Is It Used For?

Table of Contents

- What Is A NUBAN Number?

- Who Issues NUBAN Numbers in Nigeria?

- What Is The Format Of A NUBAN Number?

- What Is A NUBAN Number Used For?

- What Are The Benefits Of Using A NUBAN Number?

- How Can I Find My NUBAN Number?

- NUBAN Numbers for Major Nigerian Banks

- What is the NUBAN Number for Access Bank?

- What is the NUBAN Number for Afribank?

- What is the NUBAN Number for Citibank?

- What is the NUBAN Number for Diamond Bank?

- What is the NUBAN Number for Ecobank?

- What is the NUBAN Number for Equitorial Trust Bank?

- What is the NUBAN Number for First Bank?

- What is the NUBAN Number for First City Monument Bank (FCMB)?

- What is the NUBAN Number for Fidelity Bank?

- What is the NUBAN Number for Finbank?

- What is the NUBAN Number for Guaranty Trust Bank (GTB)?

- What is the NUBAN Number for Intercontinental Bank?

- What is the NUBAN Number for Oceanic Bank?

- What is the NUBAN Number for Skye Bank?

- What is the NUBAN Number for Spring Bank?

- What is the NUBAN Number for Stanbic IBTC Bank?

- What is the NUBAN Number for Standard Chartered Bank?

- What is the NUBAN Number for Sterling Bank?

- What is the NUBAN Number for United Bank for Africa?

- What is the NUBAN Number for Union Bank?

- What is the NUBAN Number for Wema Bank?

- What is the NUBAN Number for Zenith Bank?

- What is the NUBAN Number for Unity Bank?

- Frequently Asked Questions About NUBAN Numbers

- Is a NUBAN Number the same as a bank account number?

- Is a NUBAN Number the same as a NUBAN Account Number?

- Is a NUBAN Number the same as a SWIFT Code?

- Is a NUBAN Number the same as a BIC Code?

- Is a NUBAN Number the same as an IBAN?

- Is a NUBAN Number the same as a bank code?

- Is a NUBAN Number the same as a UPI ID?

- Is a NUBAN Number the same as a UTR Number?

- Is a NUBAN Number the same as an IFSC Code?

- Is a NUBAN Number the same as a BSB Number?

- Is a NUBAN Number the same as a Sort Code?

- Is a NUBAN Number the same as an MICR Code?

- Is a NUBAN Number the same as a CLABE Number?

- Is it Safe to Share a NUBAN Number?

- Are NUBAN Numbers used outside of Nigeria?

- Conclusion

If you have done any banking transactions in Nigeria, you may have come across the term “NUBAN Number”. The NUBAN is an essential ingredient of the Nigerian banking ecosystem, and helps uniquely identify bank accounts in the country.

In that sense, the NUBAN is similar to an IBAN (International Bank Account Number) but within Nigeria. NUBAN serves as a fundamental component of modern banking operations within Nigeria, ensuring accuracy, efficiency and security in financial transactions.

Understanding the basics of NUBAN Numbers is essential for individuals and businesses to navigate the Nigerian banking landscape effectively.

In this article, we provide an introduction to NUBAN Numbers, delving into their structure, purpose and significance in facilitating banking services and transactions within Nigeria.

What Is A NUBAN Number?

NUBAN stands for Nigerian Uniform Bank Account Number and represents a unique number for every bank account in Nigeria.

NUBAN Numbers are 10 digit long and the NUBAN format was created in 2011 in Nigeria by the Central Bank of Nigeria (CBN)1. Today, NUBAN Numbers are very common and help identify bank accounts unambiguously within Nigeria.

NUBAN Numbers have been in use in Nigeria since 2011. NUBAN stands for Nigerian Uniform Bank Account Number and helps identify a bank account within the Nigerian banking ecosystem.

Widely used daily in Nigeria for various financial transactions like electronic fund transfers, bill payments, direct deposits and various other types of financial transactions, NUBAN Numbers are a backbone of the country's banking sector.

NUBAN Numbers help identify bank accounts uniquely and, therefore, assist in accurate and efficient banking transactions. This further helps reduce the risk of errors and fraud, and brings the cost of banking operations down.

Who Issues NUBAN Numbers in Nigeria?

The NUBAN Number specification was designed and developed by the Central Bank of Nigeria (CBN) in 2011.

When you open a new bank account in Nigeria, your bank will also generate and issue your NUBAN Number in compliance with the NUBAN Number guidelines provided by the CBN. Therefore, even though the CBN itself does not generate NUBAN Numbers, banks in Nigeria do.

NUBAN Numbers are issued by banks that open accounts for individuals and businesses in Nigeria. Issuing banks have to comply with the NUBAN Number specification created by the Central Bank of Nigeria (CBN).

That said, it is important to note that the CBN does issue 3-digit bank codes for all banks operating in Nigeria. These bank codes are used in conjunction with the NUBAN Number to identify both the bank as well as unique bank account number.

Here are the 3-digit bank codes for major banks in Nigeria:

- Access Bank - 044

- Afribank - 014

- Citibank - 023

- Diamond Bank - 063

- Ecobank - 050

- Equitorial Trust Bank - 040

- First Bank - 011

- First City Monument Bank (FCMB) - 214

- Fidelity Bank - 070

- Finbank - 085

- Guaranty Trust Bank (GTB) - 058

- Intercontinental Bank - 06

- Oceanic Bank - 056

- Skye Bank - 076

- Spring Bank - 084

- Stanbic IBTC Bank - 221

- Standard Chartered Bank - 068

- Sterling Bank - 232

- United Bank for Africa - 033

- Union Bank - 032

- Wema Bank - 035

- Zenith Bank - 057

- Unity Bank - 215

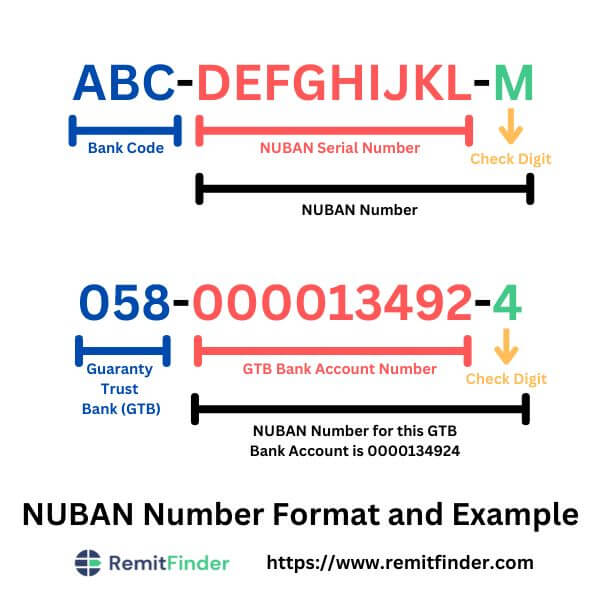

What Is The Format Of A NUBAN Number?

A NUBAN Number has a specialized structure and encoding to identify bank accounts in Nigeria's banking ecosystem. NUBAN Numbers are 10-digit long and are unique handles to bank accounts.

The Central Bank of Nigeria (CBN) has issued 3-digit bank codes for all banks operating in the country. These bank codes identify the bank where the account is held. For example, the 3-digit bank code for Guaranty Trust Bank (GTB) is 058.

Even though the 3-digit bank code is technically not written in the structure of a NUBAN Number, it is important information as it signifies the bank where the account is held.

The first 9 digits of the NUBAN Number represent the NUBAN serial number at the bank where the account is held. Note that this is generated by the bank for each account held at that bank.

The 10th and final digit of the NUBAN Number is a Check Digit that is required for NUBAN Number validation. It is calculated using a specific algorithm that ensures the accuracy of the NUBAN Number and, therefore, helps prevent errors and fraud.

Based on the NUBAN Number specification issued by the CBN, the Check Digit for a NUBAN Number is calculated using the algorithm below:

- Step 1: Compute the number A*3 + B*7 + C*3 + D*3 + E*7 + F*3 + G*3 + H*7 + I*3 + J*3 + K*7 + L*3 where ABC is the 3-digit bank code and DEFGHIJKL is the 9-digit NUBAN serial number for the account held at the said bank.

- Step 2: Calculate Modulus 10 of the above number from Step 1. In other words, divide the result from Step 1 by 10 and note the remainder.

- Step 3: If the result from Step 2 is 10, then the Check Digit is 0. Otherwise, subtract the result from Step 2 from 10 to get the Check Digit.

Thus, to summarize, a 10-digit NUBAN Number is made up of the following constituents:

- First 9 digits are the NUBAN serial number for the bank account held at the issuing bank.

- 10th digit is a Check Digit that is calculated using the 3-digit bank code issued by the CBN and the 9-digit NUBAN serial number corresponding to the bank account at the issuing bank. The Check Digit helps to validate the authenticity of the NUBAN Number and hence ensures that the NUBAN Number is accurate and has not been tampered with.

Based on the above analysis and breakdown of the format of a NUBAN Number, we can easily see how a NUBAN Number is useful to identify any bank account in Nigeria. Note that the 3-digit bank code plays an important role in this despite it being not written in the 10-digit NUBAN Number.

Consequently, you can think of a NUBAN Number as a unique fingerprint for your bank account throughout Nigeria. If someone wishes to send money to you using your NUBAN Number, Nigerian banks will be able to easily route the funds correctly into your bank account.

A NUBAN Number is 10-digit long and is composed of the 9-digit NUBAN serial number generated for each bank account by the issuing bank and a Check Digit for verification. Therefore, along with the 3-digit bank code, a NUBAN Number helps to uniquely identify a bank account in Nigeria.

Let us look at an example.

We will assume a bank account number 22222222222 (this is made up since a bank account number is personal and sensitive information and hence should not be shared) held at Guaranty Trust Bank (GTB) in Nigeria. Let us also assume that GTB generated a NUBAN serial number of 000013492 (this is also made up for illustration) for bank account number 22222222222.

Here is how we calculate the Check Digit for this GTB bank account:

- Step 1: Using GTB bank code of 058 and NUBAN serial number of 000013492, we get 0*3 + 5*7 + 8*3 + 0*3 + 0*7 + 0*3 + 0*3 + 1*7 + 3*3 + 4*3 + 9*7 + 2*3 = 156.

- Step 2: We calculate Modulus 10 of 156 as 6. This is because when we divide 156 by 10, the remainder is 6.

- Step 3: We subtract 6 from 10 to get the Check Digit as 4.

Therefore, our calculated NUBAN Number for this GTB bank account is 0000134924. Here is the breakdown of this NUBAN Number into its constituent parts:

- The first 9 digits, i.e., 000013492, represent the NUBAN serial number generated by GTB bank for this account held at the said bank.

- The last and 10th digit, i.e., 4, is the Check Digit calculated as per the NUBAN Number specification from the Central Bank of Nigeria (CBN). Since the Check Digit is accurately calculated based on the correct CBN algorithm, the NUBAN Number for our made-up account number is totally valid.

The below image represents the format of a NUBAN Number along with our example in an infographic format.

NUBAN Numbers in Nigeria are 10-digits long and follow a standardized format defined by the Central Bank of Nigeria (CBN). This helps to uniquely identify any bank account within the Nigerian banking ecosystem.

What Is A NUBAN Number Used For?

As discussed in earlier sections, a NUBAN Number is a unique identifier for a bank account in a Nigerian bank. This uniqueness of the NUBAN Number across the Nigerian banking industry lends it to drive various financial transactions that involve the movement of money.

Consequently, it is no surprise that the NUBAN Number scheme is widely used in Nigeria for a variety of banking and financial transactions. Here are a few scenarios that benefit from using NUBAN Numbers:

- Electronic Fund Transfers: The most common use of a NUBAN Number is to send and receive electronic transfers between bank accounts within Nigeria. Whenever money needs to move in between Nigerian bank accounts, NUBAN Numbers help with error-free transfers. Both domestic as well as international electronic transfers can benefit from the NUBAN Number scheme.

- International Money Transfers: Another key scenario where a NUBAN Number comes in handy is when sending money from overseas to Nigeria. Using a NUBAN Number makes it very simple to send money to Nigeria from abroad as the sender does not have to enter full bank details of the recipient's Nigerian bank account. They can simply provide the recipient's NUBAN Number, and the payment systems will automatically route the funds to the correct bank account in Nigeria.

- Direct Deposits: NUBAN Numbers are also heavily used for direct deposits into bank accounts in Nigeria. Employers, government agencies and other financial institutions regularly rely on NUBAN Numbers to route funds correctly into receiving bank accounts.

- Bill Payments: It is very common to pay bills electronically nowadays. If you do online bill pay in Nigeria, you can use the recipient's NUBAN Number to ensure that you are sending money into the correct account without any mistake.

- Loan And Credit Card Payments: The NUBAN Number is also used to identify the bank account for loan and credit card payments to be made.

- Account Verification: Finally, NUBAN Numbers are very handy when it comes to various types of financial transactions like refunds, returns and other credits. All these transaction types need to rely on accurate and reliable account identification which the NUBAN Number guarantees.

NUBAN Numbers are a key driver of financial transactions in the Nigerian banking system, and play an important role in accurate bank account identification thereby ensuring accurate and secure movement of money within Nigeria.

Without a NUBAN Number, a sender of a payment would have to use detailed account details which would make many of the common financial transactions in Nigeria cumbersome and error-prone.

How Can I Send Money to Nigeria from Overseas Using a NUBAN Number?

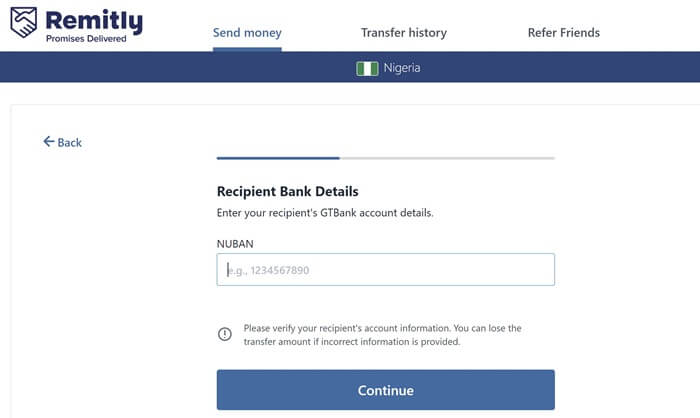

The NUBAN Number is very pertinent and useful for international money transfers to Nigeria from overseas, especially when the preferred delivery option is bank deposit.

If you are the sender of an international remittance from abroad to Nigeria, and you wish you credit the funds directly into the bank account of your recipient, you can simply use the receiver's NUBAN Number, and the funds will arrive straight into the desired bank account.

In this way, the NUBAN Number obviates the need to exchange detailed bank information like recipient personal information, bank information and bank account number, and helps to make the international money transfer process efficient and error free.

For example, if you send money to someone in Nigeria from overseas using Remitly, you can provide your recipient's NUBAN Number when you add their details during the transfer process. This looks as below.

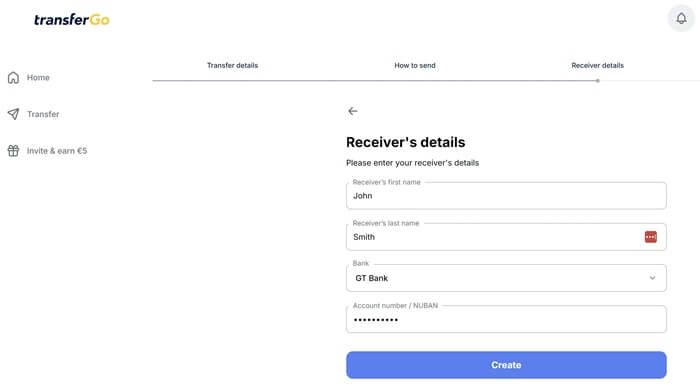

Similarly, if you choose to send money from overseas to Nigeria with TransferGo, and wish to pay your recipient with a bank deposit, simply add their NUBAN Number in recipient details screen during the transfer process. The below screenshot shows how to do this.

In fact, since NUBAN Numbers are so widely used in Nigeria, almost all money transfer companies will allow you to add it when you send money to someone in Nigeria with them.

NUBAN Numbers make it quick, convenient and error free to send money to Nigeria from abroad. Simply provide your recipient's NUBAN Number to the money transfer company and the funds will be credited directly into their local bank account in Nigeria.

If you need to send money from overseas to someone in Nigeria, there are numerous money transfer companies to choose from. A quick and easy way to compare numerous remittance companies is to use RemitFinder so you can compare their pros and cons, and pick the best provider for your international money transfers to Nigeria.

What Are The Benefits Of Using A NUBAN Number?

There are many advantages of using a NUBAN Number for various banking and financial transactions in Nigeria. Below, we list some of them.

- Accurate Account Identification: NUBAN Numbers provide a standardized and unique identification for bank accounts. This ensures that funds are accurately directed to the intended account. The precise account identification facilitated by NUBAN Numbers minimizes the risk of errors, misrouting and delays in electronic transactions.

- Interbank Transfers: NUBAN Numbers are particularly valuable for interbank transfers. The sender can input the recipient's NUBAN Number during the transfer process to ensure that the funds reach the correct account. This streamlines the transfer process, reduces manual intervention and improves the speed and efficiency of interbank transactions.

- Integration With Payment Systems: NUBAN Numbers seamlessly integrate with various electronic payment systems in Nigeria, including online banking, mobile banking applications and third-party payment platforms. This integration enhances the accessibility and convenience of electronic transactions, providing users with a wide range of options to manage their finances.

- Validation And Verification: NUBAN Numbers are validated during electronic fund transfers and payments to ensure accuracy and security. Financial institutions utilize the structured format of NUBAN Numbers to verify the correctness of the account details provided by the sender.

- Safe And Seamless Payment Experience: With NUBAN Numbers, users can make quick and secure payments by linking their NUBAN Numbers to mobile wallets or other payment applications. This eliminates the need for physical cash or checks, reduces reliance on traditional payment methods and promotes a more efficient and digital payment ecosystem.

- Fraud Prevention: NUBAN Numbers aid in preventing fraudulent activities in banking operations. The structured format of NUBAN Numbers enables financial institutions to verify the validity of account details during transactions. This verification process adds a layer of security, protecting customers and banks from potential fraud attempts.

- Regulatory Compliance: NUBAN Numbers contribute to regulatory compliance in the banking sector by enabling financial institutions adhere to regulatory guidelines and ensure uniformity in account identification. Compliance with regulatory requirements fosters an overall more secure banking environment.

The adoption and use of NUBAN Numbers has helped simplify and secure banking transactions in Nigeria, making it a valuable asset to individuals as well as businesses.

How Can I Find My NUBAN Number?

If you do not know the NUBAN Number for your bank account in Nigeria, it is pretty easy to find it. Here are a few ways you can find your NUBAN Number:

- By sending an SMS message to your bank

- By dialing in the USSD code provided by your bank

- By checking your bank's online banking website or mobile app

- By calling the customer support service team of your bank

- By visiting your local bank branch and asking a teller

Let us look at an example using Guaranty Trust Bank (GTB), one of Nigeria's most popular banks.

How To Find Your Guaranty Trust Bank (GTB) NUBAN Account Number?

If you are a GTB customer and have forgotten your NUBAN Number, you can obtain it using any of the following methods:

- By sending an SMS message titled ‘My Account' to 08076665555.

- By dialing the USSD code *737*6*1#.

- By logging into your GTB online banking website or mobile app.

The process to locate your NUBAN Number is very similar for other banks in Nigeria.

NUBAN Numbers for Major Nigerian Banks

If you bank in Nigeria and send or receive money or make payments, you will need a NUBAN Number to be able to make online and mobile payments. The good news is that every bank in Nigeria implements the NUBAN scheme and has a unique 3-digit bank code that is by the Central Bank of Nigeria (CBN), so it is quick and easy to find your NUBAN Number.

In the prior section, we shared many simple and easy methods using which you can located your NUBAN Number. In this section, we will provide the NUBAN Numbers for major banks in Nigeria.

However, it is important to remember that your NUBAN Number is private information and should not be shared publicly. Given that, we will only provide the unique 3-digit bank codes for various banks in Nigeria. If you need to find your NUBAN Number, check a prior section on ways to easily find it.

What is the NUBAN Number for Access Bank?

The unique 3-digit bank code assigned by the CBN to Access Bank is 044, which is used to compute Access Bank NUBAN Numbers. Check your account or contact your bank to find your NUBAN Number.

What is the NUBAN Number for Afribank?

The unique 3-digit bank code assigned by the CBN to Afribank is 014, which is used to compute Afribank NUBAN Numbers. Check your account or contact your bank to find your NUBAN Number.

What is the NUBAN Number for Citibank?

The unique 3-digit bank code assigned by the CBN to Citibank is 023, which is used to compute Citibank NUBAN Numbers. Check your account or contact your bank to find your NUBAN Number.

What is the NUBAN Number for Diamond Bank?

The unique 3-digit bank code assigned by the CBN to Diamond Bank is 063, which is used to compute Diamond Bank NUBAN Numbers. Check your account or contact your bank to find your NUBAN Number.

What is the NUBAN Number for Ecobank?

The unique 3-digit bank code assigned by the CBN to Ecobank is 050, which is used to compute Ecobank NUBAN Numbers. Check your account or contact your bank to find your NUBAN Number.

What is the NUBAN Number for Equitorial Trust Bank?

The unique 3-digit bank code assigned by the CBN to Equitorial Trust Bank is 040, which is used to compute Equitorial Trust Bank NUBAN Numbers. Check your account or contact your bank to find your NUBAN Number.

What is the NUBAN Number for First Bank?

The unique 3-digit bank code assigned by the CBN to First Bank is 011, which is used to compute First Bank NUBAN Numbers. Check your account or contact your bank to find your NUBAN Number.

What is the NUBAN Number for First City Monument Bank (FCMB)?

The unique 3-digit bank code assigned by the CBN to First City Monument Bank (FCMB)is 214, which is used to compute First City Monument Bank (FCMB)NUBAN Numbers. Check your account or contact your bank to find your NUBAN Number.

What is the NUBAN Number for Fidelity Bank?

The unique 3-digit bank code assigned by the CBN to Fidelity Bank is 070, which is used to compute Fidelity Bank NUBAN Numbers. Check your account or contact your bank to find your NUBAN Number.

What is the NUBAN Number for Finbank?

The unique 3-digit bank code assigned by the CBN to Finbank is 085, which is used to compute Finbank NUBAN Numbers. Check your account or contact your bank to find your NUBAN Number.

What is the NUBAN Number for Guaranty Trust Bank (GTB)?

The unique 3-digit bank code assigned by the CBN to Guaranty Trust Bank (GTB)is 058, which is used to compute Guaranty Trust Bank (GTB)NUBAN Numbers. Check your account or contact your bank to find your NUBAN Number.

What is the NUBAN Number for Intercontinental Bank?

The unique 3-digit bank code assigned by the CBN to Intercontinental Bank is 06, which is used to compute Intercontinental Bank NUBAN Numbers. Check your account or contact your bank to find your NUBAN Number.

What is the NUBAN Number for Oceanic Bank?

The unique 3-digit bank code assigned by the CBN to Oceanic Bank is 056, which is used to compute Oceanic Bank NUBAN Numbers. Check your account or contact your bank to find your NUBAN Number.

What is the NUBAN Number for Skye Bank?

The unique 3-digit bank code assigned by the CBN to Skye Bank is 076, which is used to compute Skye Bank NUBAN Numbers. Check your account or contact your bank to find your NUBAN Number.

What is the NUBAN Number for Spring Bank?

The unique 3-digit bank code assigned by the CBN to Spring Bank is 084, which is used to compute Spring Bank NUBAN Numbers. Check your account or contact your bank to find your NUBAN Number.

What is the NUBAN Number for Stanbic IBTC Bank?

The unique 3-digit bank code assigned by the CBN to Stanbic IBTC Bank is 221, which is used to compute Stanbic IBTC Bank NUBAN Numbers. Check your account or contact your bank to find your NUBAN Number.

What is the NUBAN Number for Standard Chartered Bank?

The unique 3-digit bank code assigned by the CBN to Standard Chartered Bank is 068, which is used to compute Standard Chartered Bank NUBAN Numbers. Check your account or contact your bank to find your NUBAN Number.

What is the NUBAN Number for Sterling Bank?

The unique 3-digit bank code assigned by the CBN to Sterling Bank is 232, which is used to compute Sterling Bank NUBAN Numbers. Check your account or contact your bank to find your NUBAN Number.

What is the NUBAN Number for United Bank for Africa?

The unique 3-digit bank code assigned by the CBN to United Bank for Africa is 033, which is used to compute United Bank for Africa NUBAN Numbers. Check your account or contact your bank to find your NUBAN Number.

What is the NUBAN Number for Union Bank?

The unique 3-digit bank code assigned by the CBN to Union Bank is 032, which is used to compute Union Bank NUBAN Numbers. Check your account or contact your bank to find your NUBAN Number.

What is the NUBAN Number for Wema Bank?

The unique 3-digit bank code assigned by the CBN to Wema Bank is 035, which is used to compute Wema Bank NUBAN Numbers. Check your account or contact your bank to find your NUBAN Number.

What is the NUBAN Number for Zenith Bank?

The unique 3-digit bank code assigned by the CBN to Zenith Bank is 057, which is used to compute Zenith Bank NUBAN Numbers. Check your account or contact your bank to find your NUBAN Number.

What is the NUBAN Number for Unity Bank?

The unique 3-digit bank code assigned by the CBN to Unity Bank is 215, which is used to compute Unity Bank NUBAN Numbers. Check your account or contact your bank to find your NUBAN Number.

Frequently Asked Questions About NUBAN Numbers

In this section, we will cover some Frequently Asked Questions (FAQs) about NUBAN Numbers.

Is a NUBAN Number the same as a bank account number?

A NUBAN Number is not the same as a bank account number.

If you hold a bank account in Nigeria, your bank will likely issue you a regular bank account number. But in addition, you will also get a NUBAN Number which complies with CBN's NUBAN Number specification.

You can use your NUBAN Number to receive funds into your account electronically without having to share any additional information.

Is a NUBAN Number the same as a NUBAN Account Number?

The terms NUBAN Number and NUBAN Account Number are used interchangeably, and mean the same thing. But in general, the shorter form, i.e., NUBAN Number, is more often used.

Note that NUBAN Account Number is not the same as a regular account number that a bank may assign to your account. NUBAN Numbers, or NUBAN Account Numbers, follow the NUBAN specification whilst regular account numbers do not.

Is a NUBAN Number the same as a SWIFT Code?

No, NUBAN Numbers are not the same as SWIFT Codes. Even though both numbers are useful in routing funds between bank accounts, they are different from each other.

SWIFT Codes are internationally unique identifiers for banks and financial institutions. Due to this, SWIFT Codes are useful when moving funds between banks worldwide.

NUBAN Numbers, on the other hand, help uniquely identify a bank account in Nigeria, and hence are useful to route funds to Nigerian bank accounts.

Is a NUBAN Number the same as a BIC Code?

BIC Codes and SWIFT Codes are similar in nature. Therefore, the differences between NUBAN Numbers and SWIFT Codes are the same as those between NUBAN Numbers and BIC Codes.

Is a NUBAN Number the same as an IBAN?

NUBAN Numbers and International Bank Account Numbers (IBANs) serve very similar purposes.

The only difference is that NUBAN Numbers help uniquely identify bank accounts within the Nigerian banking system, whereas IBANs help identify bank account globally.

Is a NUBAN Number the same as a bank code?

NUBAN Numbers and bank codes are not the same, and are totally different entities.

Whilst NUBAN Numbers are unique IDs for bank accounts in Nigeria, bank codes are unique IDs for banks. Bank codes in Nigeria are 3-digit numbers and are issued by the Central Bank of Nigeria (CBN).

In fact, NUBAN Number calculation makes use of the 3-digit bank code.

Is a NUBAN Number the same as a UPI ID?

A NUBAN Number and a UPI ID are totally different from each other. Both numbers represent totally disparate concepts.

Unified Payments Interface (UPI) is a digital payments network designed, created and fostered by the Indian Government to spur the country towards a digital, cashless economy. A UPI ID identifies a user in the UPI financial payment network.

Hence, whilst a UPI ID represents a UPI user, a NUBAN Number identifies a bank account in Nigeria.

Is a NUBAN Number the same as a UTR Number?

NUBAN Numbers and UTR Numbers are very different from each other and represent different ideas.

Unique Transaction Reference (UTR) Numbers are unique transaction IDs for transactions done via India's Real Time Gross Settlement (RTGS) and National Electronic Funds Transfer (NEFT) systems.

Hence, even though both NUBAN Numbers and UTR Numbers are used in their respective country's banking ecosystems, they represent totally different concepts - NUBAN Numbers are unique IDs for bank accounts while UTR Numbers are unique IDs for payment transactions.

Is a NUBAN Number the same as an IFSC Code?

No, NUBAN Numbers and IFSC Codes are not similar in any way.

IFSC Codes are unique identifiers for bank branches in India whereas NUBAN Numbers identify bank accounts in Nigeria.

Is a NUBAN Number the same as a BSB Number?

No, NUBAN Numbers and BSB Numbers represent different concepts.

BSB Numbers are used in Australia to uniquely identify branches of various banks in the country. NUBAN Numbers, on the other hand, help identify bank accounts in Nigeria.

Is a NUBAN Number the same as a Sort Code?

Sort Codes are used in the UK to uniquely identify a bank branch and are, therefore, very helpful in the accurate movement of money amongst various banks in the country.

NUBAN Numbers, on the other hand, are unique IDs for bank accounts in Nigeria and hence help transferring money into the right bank account.

Hence, despite the fact that both NUBAN Numbers and Sort Codes help route funds accurately, they are totally different from each other.

Is a NUBAN Number the same as an MICR Code?

No, NUBAN Numbers and MICR Codes are not the same ideas.

MICR Codes help identify branches of bank and are mostly useful in the processing of checks and their appropriate routing. NUBAN Numbers, on the other hand, signify bank accounts in Nigeria, thereby facilitating accurate movement of funds to the right account.

Is a NUBAN Number the same as a CLABE Number?

NUBAN Numbers and CLABE Numbers are similar concepts.

NUBAN Numbers are 10-digit unique IDs for bank accounts in Nigeria whilst CLABE Numbers are 18-digit unique IDs for bank accounts in Mexico. Both numbers, therefore, help with bank account identification in their respective countries.

Is it Safe to Share a NUBAN Number?

If you are a bank account holder in Nigeria, you will have a NUBAN Number for your account. Your NUBAN Number is a unique to your specific bank account in Nigeria, and hence is sensitive and personal information.

Therefore, we recommend that you do not share your NUBAN Number without exercising care. Share your NUBAN Number very carefully with trusted parties and strictly on a need-to-know basis.

Are NUBAN Numbers used outside of Nigeria?

The NUBAN Number is a Nigerian banking standard developed by the Central Bank of Nigeria (CBN). As a result, NUBAN Numbers are only used in Nigeria.

However, if you have a bank account in Nigeria and someone is sending money to you from overseas, you should provide them with your NUBAN Number so the money can be easily routed to your bank account in Nigeria.

Conclusion

NUBAN (Nigerian Uniform Bank Account Number) Numbers are a fundamental element in the Nigerian banking system, enabling efficient and secure financial transactions. They provide unique identification for bank accounts, ensuring accurate routing of funds and enhancing the overall accuracy and integrity of banking and financial transactions.

NUBAN Numbers play a crucial role in various aspects of banking including electronic fund transfers, payments, interbank transactions, bill payments and much more. They enhance banking transaction security, prevent fraudulent activities and help with regulatory compliance.

With their standardized format and integration with electronic payment systems, NUBAN Numbers simplify account identification, streamline banking processes and contribute to a seamless banking experience for individuals and businesses alike.

As the Nigerian banking industry continues to grow, NUBAN Numbers will remain a vital asset in ensuring efficient, secure and accurate banking operations in the country.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

References:

1. NUBAN Number specification by Central Bank of Nigeria (CBN)

Categories

Similar Articles

CNAPS Codes Unraveled: Navigating China's Banking Landscape

Discover CNAPS Codes: China’s unique bank identifier for fast, secure transactions. Learn how CNAPS Codes simplify payments across China's banking system.

ABA Routing Numbers In The US: A Comprehensive Guide

Discover what ABA Routing Numbers are, how they work and their importance in US banking transactions like direct deposits, online transactions and wire transfers.

What Is RuPay And How Does It Work?

RuPay is India's indigenous and innovative payment system. Discover the mechanics of this game-changing platform and upgrade your payment experience within India with RuPay.