UTR Number - Everything You Need To Know

Table of Contents

- What Is A UTR Number?

- Who Generates UTR Numbers in India?

- What is the Format of a UTR Number?

- What is the Format of a UTR Number for an RTGS Transaction?

- What is the Format of a UTR Number for an NEFT Transaction?

- What are the Differences Between RTGS and NEFT UTR Numbers?

- What are UTR Numbers Used for?

- How Can I Find the UTR Number for my Transaction?

- How Can I Find the UTR Number of my RTGS Transaction?

- How Can I Find the UTR Number of my NEFT Transaction?

- Is it Safe to Share a UTR Number?

- Frequently Asked Questions about UTR Numbers

- Is a UTR Number the same as a bank account number?

- Is a UTR Number the same as a SWIFT Code?

- Is a UTR Number the same as a BIC Code?

- Is a UTR Number the same as an IBAN?

- Is a UTR Number the same as a bank code?

- Is a UTR Number the same as a UPI ID?

- Is a UTR Number the same as an IFSC Code?

- Is a UTR Number the same as a MICR Code?

- Is a UTR Number the same as a BSB Number?

- Is a UTR Number the same as a Sort Code?

- Is a UTR Number the same as a CLABE Number?

- Is a UTR Number the same as a NUBAN Number?

- Are UTR Numbers used outside of India?

- Conclusion

- Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

If you have sent money to India from overseas or sent and received money within India, you may have come across UTR Numbers.

UTR Numbers are 16 or 22 character transaction numbers associated with transactions processed via National Electronic Funds Transfer (NEFT) or Real Time Gross Settlement (RTGS) systems. If you use NEFT or RTGS, your transaction will be assigned a UTR Number.

In this article, we will dive deep into the details of UTR Numbers and how they are used in different scenarios. Since all NEFT and RTGS transactions in India get a UTR Number, it is very useful to establish an understanding of the importance and application of UTR numbers.

What Is A UTR Number?

Unique Transaction Reference (UTR) Numbers are unique identification numbers that banks in India assign to transactions made via National Electronic Funds Transfer (NEFT) or Real Time Gross Settlement (RTGS) systems.

Every bank in India uses UTR Numbers for all types of money transfers and transactions done via NEFT and RTGS payment systems. In this way, a UTR number is an identifying reference that helps banks and financial institutions easily track payments from one entity to another.

A UTR Number is a unique transaction reference id assigned to every NEFT and RTGS transaction in the Indian banking ecosystem.

In India, banks use UTR numbers to verify each and every transaction. The number is generated by the bank conducting the transfer and serves as a useful tool for tracking the status of your transactions. The UTR Number helps ensure that payments are recorded accurately and can be used to determine any given transaction's progress quickly.

Note: Do not get confused between UTR Numbers in India and UK. The term UTR Number in UK means a Unique Taxpayer Refence (UTR) Number.

Who Generates UTR Numbers in India?

UTR Numbers are generated by banks in India to keep track of NEFT and RTGS transactions.

The Reserve Bank of India (RBI) has established guidelines1 around the format of UTR Numbers for tracking transactions. This helps standardize the definition and format of UTR Numbers across all banks in India so there is uniformity in their definition, understanding and usage.

The Reserve Bank of India (RBI) provides guidelines to standardize the format and definition of UTR Numbers.

Consequently, various Indian banks are obliged to follow these guidelines and generate UTR Numbers that are complaint with RBI recommendations.

What is the Format of a UTR Number?

UTR Numbers are either 16 or 22 characters long depending on which type of transaction they represent. UTR Numbers for RTGS transactions are 22 characters long whilst those for NEFT transactions are 16 characters long.

RTGS transaction UTR Numbers are 22 characters in length while NEFT ones are 16 characters long.

Let's look at the exact format of UTR Numbers for both RTGS and NEFT transactions.

What is the Format of a UTR Number for an RTGS Transaction?

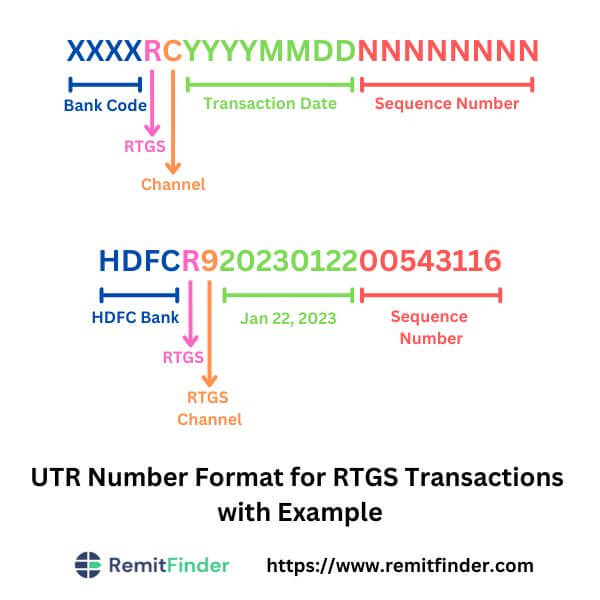

As per RBI guidelines1 on RTGS Systems, UTR Numbers for RTGS transactions are 22 characters long and are written in the following format: XXXXRCYYYYMMDDNNNNNNNN

Below is the breakdown of the above RTGS UTR Number format:

- The first 4 characters, i.e., XXXX, represent the 4 character bank code exactly as in the IFSC Code for the concerned bank.

- The 5th character represents that this transaction was processed by the RTGS system, and is always an R.

- The 6th character, i.e., C, represents the channel of the transaction - more on this later.

- The next 8 characters, i.e., YYYYMMDD, represent the date of the transaction in the year, month and day format.

- The last 8 characters, i.e., NNNNNNNN, represent the sequence number and are determined by the concerned bank. These last 8 characters are generally numeric.

The 6th character that represents the channel for the RTGS UTR Number can have any of the below possible values.

| Transaction Channel | Channel ID in UTR Number |

|---|---|

| RTGS | 9 |

| Internet Banking | 1 |

| Cash Management | 2 |

| Treasury | 3 |

| ATM | 4 |

| Mobile | 5 |

| Other | 6 |

UTR Numbers for RTGS transactions are 22 characters long and include bank, transaction date and transaction sequence information.

Let's look at an example.

Assuming you did an RTGS transaction with the UTR Number of HDFCR92023012200543116, we can draw the following conclusions about this transaction:

- This transaction was processed by HDFC Bank since the first 4 characters are the IFSC bank code for HDFC Bank.

- The 5th and 6th characters, R and 9, respectively, reveal that this was an RTGS transaction.

- This transaction was processed on Jan 22, 2023 as evidenced by the 8 digits of the date part of the UTR Number i.e., 20230122.

- The sequence number for HDFC Bank RTGS transactions for this particular transaction on Jan 22, 2023 was 00543116.

Note that banks must ensure that the sequence number is unique on a particular day to ensure the uniqueness of UTR Numbers of transactions of the same type on the same day. For example:

- UTR Number HDFCR92023012200543116 represents an RTGS transaction processed by HDFC Bank on Jan 22, 2023 with a sequence number of 00543116.

- UTR Number HDFCR92023012200865412 represents an RTGS transaction processed by HDFC Bank on Jan 22, 2023 with a sequence number of 00865412.

Banks must ensure that the sequence numbers are unique on a particular day to ensure the uniqueness of RTGS UTR Numbers.

The following infographic depicts the UTR Number format for RTGS transactions as well as the above example in an image format.

What is the Format of a UTR Number for an NEFT Transaction?

Just like UTR Numbers for RTGS transactions, UTR Numbers for NEFT transactions also follow a standard format.

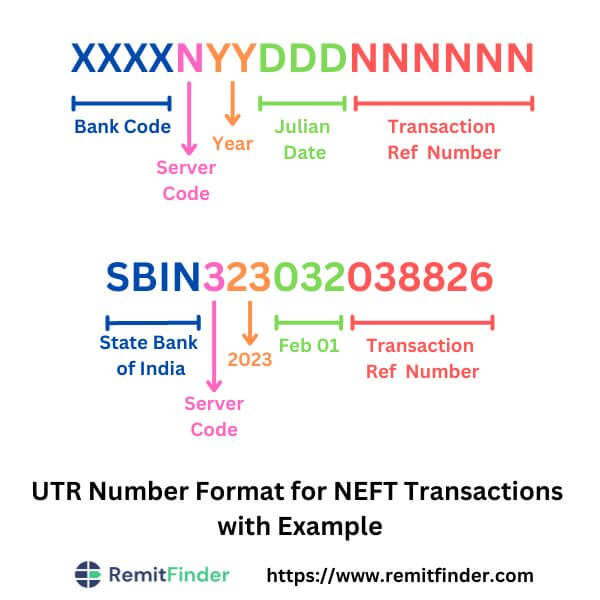

NEFT transaction UTR Numbers are 16 characters long and are written in the following format: XXXXNYYDDDNNNNNN

Below is the breakdown of the above RTGS UTR Number format:

- The first 4 characters, i.e., XXXX, represent the 4 character bank code exactly as in the IFSC Code for the concerned bank.

- The 5th character represents that this transaction was processed by an NEFT server. Possible values could be H (branch), P (backend) or even a numeric digit representing the server number.

- The next 2 characters, i.e., YY, represent the year the transaction.

- The next 3 characters, i.e., DDD, represent the Julian Date the transaction. The Julian Date is the day number of a particular day in a year. For example, the Julian Date for January 1 is 001, for January 20 is 020, for February 1 is 032 and for December 31 is 365.

- The last 6 characters, i.e., NNNNNN, represent the unique transaction reference number and are determined by the concerned bank. These last 6 characters are generally numeric.

UTR Numbers for NEFT transactions are 16 characters long and include bank, transaction date and unique transaction reference number information.

Let's look at an example.

If you did an NEFT transaction with the UTR Number of SBIN323032038826, we can draw the following conclusions about this NEFT transaction:

- This transaction was processed by State Bank of India (SBI) since the first 4 characters are the IFSC bank code for State Bank of India.

- The 5th character, i.e., 3. Represents SBI's server number that processed this NEFT transaction. This character varies from bank to bank and can have an alphabet or a numeric value.

- This transaction was processed on Feb 01, 2023 as the year digits are 23 and the Julian Date number is 032 which equates to Feb 01.

- The unique transaction reference number for SBI NEFT transactions for this particular transaction on Feb 01, 2023 was 038826.

Note that banks must ensure that the transaction reference number is unique on a particular day to ensure the uniqueness of UTR Numbers of transactions of the same type on the same day. For example:

- UTR Number SBIN323032038826 represents an NEFT transaction processed by State Bank of India on Feb 01, 2023 with a transaction reference number of 038826.

- UTR Number SBIN323032121145 represents an RTGS transaction processed by State Bank of India on Feb 01, 2023 with a transaction reference number of 121145.

Banks must ensure that the transaction reference numbers are unique on a particular day to ensure the uniqueness of NEFT UTR Numbers.

The following infographic depicts the UTR Number format for NEFT transactions with an example included in an image format.

What are the Differences Between RTGS and NEFT UTR Numbers?

Now that we have looked at the formats for UTR Numbers for both RTGS and NEFT transactions, we can summarize the key differences between them; these are as below.

- RTGS UTR Numbers are 22 characters long while NEFT UTR Numbers are 16 characters long.

- RTGS UTR Numbers have a character for channel code while NEFT UTR Numbers have a character for server code. Channel codes for RTGS have predefined values as per RBI guidelines while banks are free to choose a server code for NEFT transactions.

- Transaction date is encoded differently for RTGS and NEFT UTR Numbers. For RTGS UTR Numbers, the transaction date is captured in full YYYYMMDD format whereas for NEFT UTR Numbers, it is represented by the 2 digit year followed by 3 digit Julian Date.

- Finally, RTGS UTR Numbers have an 8 digit sequence number while NEFT UTR Numbers have a 6 digit transaction reference number.

Both RTGS and NEFT UTR Numbers encode similar information but in different formats.

Now that you know exactly how UTR Numbers are formatted for RTGS and NEFT transactions, you will be able to easily understand them on your account statements and bank transaction records.

What are UTR Numbers Used for?

Your Universal Transaction Reference (UTR) Number is an alphanumeric code that identifies a unique transaction made through India's Real Time Gross Settlement (RTGS) or National Electronic Funds Transfer (NEFT) system.

UTR Numbers are used to track and monitor transactions thereby allowing your bank or other financial institutions to verify payments and track their progress. In other words, a UTR Number is a unique identifier for any RTGS or NEFT transaction in the Indian banking system.

UTR Numbers help uniquely identify RTGS and NEFT transactions across all Indian banks and can be used to track and monitor them.

UTR Numbers can be used for tracking various transactions such as bill payments, online purchases and money transfers as long as the payment was made using RTGS or NEFT.

In general, the UTR Number will be available to both the sender as well as the recipient. This makes it easy for both parties to track the transaction. In case the transaction is delayed or fails for any reason, you can always check with your bank by providing the UTR Number.

With your UTR Number for your transaction, you can quickly know whether a payment has been successfully transferred to the intended recipient and ensure that your money is safe. You can also review your bank account transaction history to look for certain UTR Numbers. This helps you keep track of all your financial transactions both as a sender as well as a recipient.

In summary, you can use your UTR Number in India for various purposes like verifying transaction status and progress, showing proof of payments like tax payments, making investments and reviewing your transaction history.

How can I use UTR Number for Money Transfers to India from Overseas?

When you send money to India from overseas, both you and your recipient will get the associated UTR Number for the transaction since most money transfer companies rely on RTGS or NEFT to process remittances sent to India.

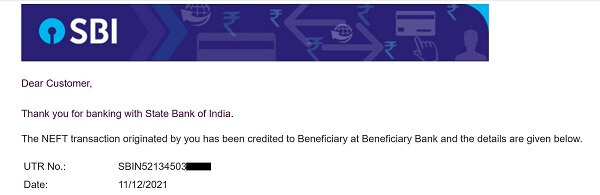

The associated banks will generally notify both the sender and recipient of the transaction UTR Number. For example, State Bank of India (SBI) notifies its customers of transactions and their UTR Numbers via an email notification that looks like the below image.

Once you have this UTR Number available, you can easily cross check the status of your money transfer by checking with your money transfer company or the receiving bank in India. This is especially useful in case there are any delays or problems with the transaction.

UTR Number can be used to track, monitor and troubleshoot international money transfers sent to India.

How Can I Find the UTR Number for my Transaction?

It is pretty easy to find the UTR Number for your transactions done via RTGS or NEFT payment systems in India. Having your UTR Number handy can be a plus in case there are any issues with the transaction.

Your bank account statement is the fastest and most reliable way to obtain the UTR Number associated with a given transaction. You can access this through your bank's mobile app or internet banking services.

Another easy way to find UTR Numbers is by looking at the transaction history in your bank account. You can check this online via your bank's website or mobile app.

Look at your bank account statement or transaction history to see UTR Numbers for your RTGS or NEFT transactions.

Once you have located your statement, all you need to do is locate the 16-22 long alphanumeric transaction number beside the transaction date - that number is the UTR Number for the transaction. Here is an example of what one might look like for an RTGS transaction: HDFCR92023012200543116.

How Can I Find the UTR Number of my RTGS Transaction?

RTGS transactions have a 22 character UTR Number that will start with the 4 digit bank code of your bank - these first 4 digits are the same as in the IFSC Code for your bank.

Simply look at your bank account statement or transaction history to find out your RTGS transaction UTR Number. It will be the long 22 character number starting with your bank code. See our detailed article on IFSC Codes to see the bank codes for popular Indian banks.

If you are still unable to located your RTGS UTR Number, get in touch with your bank's customer service and they should be able to assist you.

How Can I Find the UTR Number of my NEFT Transaction?

The procedure to find the UTR Number for your NEFT transaction is exactly the same as for RTGS transactions.

The only difference is that the NEFT UTR Number is 16 characters long. However, it also starts with the 4 letter bank code which makes it very easy to see on your bank account statement or transaction history.

Is it Safe to Share a UTR Number?

Since UTR Numbers are unique identifiers for RTGS and NEFT transactions within the banking system of India, they are generally safe in the sense that they do not contain any sensitive information about your account or you.

In other words, if someone got hold of a UTR Number for one of your RTGS or NEFT transactions, they would not be able to do much with just the UTR Number alone. In that way, it is not unsafe to share your UTR Number.

However, we generally advise against sharing information that does not need to be shared. What is means is that you should follow the principle of least disclosure whereby you should share minimal information with authorized parties only.

For example, there is no need to share your UTR Number publicly on social media, etc. However, if you need to track a transaction, it would be totally OK to share the UTR Number with customer support team of your bank.

As a security best practice, share your UTR Number only with authorized parties who need to know it for a specific purpose.

Frequently Asked Questions about UTR Numbers

In this section, we will cover some Frequently Asked Questions (FAQs) about UTR Numbers.

Is a UTR Number the same as a bank account number?

A UTR Number is not the same as your bank account number.

UTR Numbers represent unique transaction identifiers for RTGS and NEFT transactions, and hence are completely different from bank account numbers.

Is a UTR Number the same as a SWIFT Code?

SWIFT Codes help the movement of funds sent via an international wire transfer. If someone wanted to send money into your Indian bank account from their overseas bank, you would need to give them the SWIFT Code of your bank to ensure the funds arrive correctly in your account.

UTR Numbers, on the other hand, help track RTGS and NEFT transactions in the Indian banking system.

Given that, UTR Numbers and SWIFT Codes are completely separate concepts.

Is a UTR Number the same as a BIC Code?

BIC Codes are very much like SWIFT Codes in their purpose and application. Therefore, the differences we discussed above between UTR Numbers and SWIFT Codes also apply between UTR Numbers and BIC Codes.

Is a UTR Number the same as an IBAN?

UTR Numbers and International Bank Account Numbers (IBANs) are also completely disparate concepts.

An IBAN is an international number for your bank account, and therefore, can be used to send money to your account from overseas. In other words, an IBAN is the international equivalent of your local Indian bank account number.

Given the above, UTR Numbers and IBANs have completely different usage and application.

Is a UTR Number the same as a bank code?

Bank codes are unique identifiers for banks in a particular country. Indian bank codes are 4 characters long. For example, the bank code for HDFC Bank is HDFC. This implies that all HDFC branches in India all share the same bank code.

UTR Numbers are unique transaction identifiers for RTGS and NEFT transactions in India. Hence, they are completely different from bank codes.

One noteworthy point is that UTR Numbers start with a bank code. Both RTGS UTR Numbers and NEFT UTR Numbers start with the 4 character bank code. This will help you easily identify your bank's UTR Numbers since they will start with the same bank code.

UTR Numbers in India always start with the 4 letter bank code for the bank that processed the transaction.

Is a UTR Number the same as a UPI ID?

Unified Payments Interface (UPI) is a digital and mobile payment system developed by the Government of India to facilitate seamless online payments. Your UPI ID is your unique identity within the UPI ecosystem in India, and anyone can send you money using your UPI ID.

UTR Numbers, on the other hand, help distinguish NEFT and RTGS transactions.

Both a UTR Number and a UPI ID are unique identifiers in their respective systems, but they represent completely different entities. UTR Numbers identify transactions within the Indian banking system while UPI IDs identify users in the UPI payment ecosystem.

Hence, a UTR Number and a UPI ID are not the same.

Is a UTR Number the same as an IFSC Code?

UTR Numbers and IFSC Codes are not related to each other in any way, and are completely separate concepts.

IFSC Codes are unique identifiers for branches of Indian banks. Due to this uniqueness, they can be used to identify any bank branch in India without any ambiguity. This helps route money to the correct bank branch without any problems, or having to rely on bank name and address which are additional information and may be entered incorrectly.

UTR Numbers are transaction identifiers for payments processed via India's RTGS and NEFT payment systems. They are unique per transaction and can be used to track, monitor and troubleshoot payments.

Is a UTR Number the same as an MICR Code?

Magnetic Ink Character Recognition (MICR) is a standard baking specification that is used to process checks. MICR Codes help identify a branch of any bank within India. MICR Codes are 9 character long and you can usually find them printed at the bottom of a check.

UTR Numbers are meant for a totally different purpose - the tracking of RTGS and NEFT transactions within the respective payment systems. RTGS and NEFT UTR Numbers are 22 and 16 characters long, respectively.

Given this, UTR Numbers and MICR Codes are not the same as they represent totally different concepts.

Is a UTR Number the same as a BSB Number?

BSB stands for Bank State Branch and a BSB Number is the unique identifier for a bank branch within Australia. In that sense, BSB Numbers in Australia serve the same purpose as IFSC Codes in India.

Given this, UTR Numbers and BSB Numbers are not the same thing. UTR Numbers identify RTGS and NEFT transactions in India, while BSB Numbers identify bank branches in Australia.

Is a UTR Number the same as a Sort Code?

Sort Codes are 6-digit numbers that help to uniquely identify branches of UK banks. Due to this uniqueness, they are useful in routing money between UK banks.

In that sense, they are similar to BSB Numbers in Australia and IFSC Codes in India.

Therefore, UTR Numbers and Sort Codes do not represent the same thing. UTR Numbers are unique IDs for RTGS and NEFT transactions in India, while Sort Codes help differentiate UK bank branches.

Is a UTR Number the same as a CLABE Number?

UTR Numbers and CLABE Numbers do not represent the same thing.

UTR Numbers are unique IDs for RTGS and NEFT transactions in India, while CLABE Numbers are unique fingerprints for bank accounts in Mexico.

Is a UTR Number the same as a NUBAN Number?

UTR Numbers and NUBAN Numbers are completely different ideas.

UTR Numbers are unique IDs for RTGS and NEFT transactions in India, while NUBAN Numbers are unique identifiers for bank accounts in Nigeria.

Are UTR Numbers used outside of India?

UTR Numbers are used in the Indian banking system to uniquely represent RTGS and NEFT transactions handled by those payment systems. They are, therefore, unique to India.

That said, if you send money to India from abroad, it is very likely that your money transfer operator will rely on RTGS or NEFT payments to finish the international money transfer transaction for a final payout to an Indian bank account.

In that case, your recipient in India will see a UTR Number assigned to their transaction. Both you and your recipient can use this UTR Number to monitor and track the remittance transaction.

Most overseas money transfers to India are processed via RTGS or NEFT systems and will get a UTR Numbers assigned to them.

UTR Numbers for international money transfers sent to India become even more useful if there are any processing delays, problems or cancellations involved. In such cases, you can check with the money transfer company as well as the Indian bank for status by providing them with your transaction's UTR Number.

Conclusion

In summary, a Unique Transaction Reference (UTR) Number is a unique and secure identifier used to identify Real Time Gross Settlement (RTGS) and National Electronic Funds Transfer (NEFT) bank transactions in India.

UTR Numbers are mandatory for NEFT and RTGS transactions and provide transaction tracking and traceability within the Indian banking system. They are also based on well-defined standardized formats that helps ensure uniformity and structure within the whole banking industry.

Your transaction's UTR Number can be found on the confirmation page or statement generated after the completion of an RTGS or NEFT transaction. Additionally, you can find it on your bank account statement or within the transaction history section of your bank's website or mobile app.

Now that you understand what UTR Numbers are in detail and how they are formatted and used, you can establish more comfort when doing RTGS and NEFT payments and transactions in India.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

References:

1. Reserve Bank of India (RBI) Guidelines for RTGS Systems

Categories

Similar Articles

CNAPS Codes Unraveled: Navigating China's Banking Landscape

Discover CNAPS Codes: China’s unique bank identifier for fast, secure transactions. Learn how CNAPS Codes simplify payments across China's banking system.

ABA Routing Numbers In The US: A Comprehensive Guide

Discover what ABA Routing Numbers are, how they work and their importance in US banking transactions like direct deposits, online transactions and wire transfers.

What Is A NUBAN Number And What Is It Used For?

Discover what NUBAN Numbers are and how they streamline bank account identification in Nigeria. Do not miss this essential guide if you transact in any way with the Nigerian banking system.