What Is A CLABE Number And What Is It Used For?

Table of Contents

- What Is A CLABE Number?

- Who Issues CLABE Numbers in Mexico?

- What Is The Format Of A CLABE Number?

- What Is A CLABE Number Used For?

- What Are The Benefits Of Using A CLABE Number?

- How Do You Find Your CLABE Number?

- CLABE Numbers for Major Mexican Banks

- What is Banco Azteca's CLABE Number?

- What is BBVA Bancomer's CLABE Number?

- What is BanCoppel's CLABE Number?

- What is Banco del Bajio's CLABE Number?

- What is Banco Santander Mexico's CLABE Number?

- What is Banco Nacional de Mexico's CLABE Number?

- What is Grupo Financiero Banorte's CLABE Number?

- What is HSBC Mexico's CLABE Number?

- What is Inbursa's CLABE Number?

- What is Scotiabank Mexico's CLABE Number?

- What is Banco Nacional de Comercio Exterior's CLABE Number?

- Frequently Asked Questions About CLABE Numbers

- Is a CLABE Number the same as a bank account number?

- Is a CLABE Number the same as a SWIFT Code?

- Is a CLABE Number the same as a BIC Code?

- Is a CLABE Number the same as an IBAN?

- Is a CLABE Number the same as a bank code?

- Is a CLABE Number the same as a UPI ID?

- Is a CLABE Number the same as a UTR Number?

- Is a CLABE Number the same as an IFSC Code?

- Is a CLABE Number the same as a BSB Number?

- Is a CLABE Number the same as a Sort Code?

- Is a CLABE Number the same as an MICR Code?

- Is a CLABE Number the same as a NUBAN Number?

- Is it Safe to Share a CLABE Number?

- Are CLABE Numbers used outside of Mexico?

- Our Concluding Thoughts

If you have ever made a banking transaction in Mexico, you may have encountered the term "CLABE Number". But what exactly is a CLABE Number, and what is it used for?

The CLABE Number is a unique 18-digit code that is assigned to each bank account in Mexico. It is a critical component of the banking system in Mexico and is used for a wide range of transactions, including bill payments, electronic transfers, and direct deposits.

Understanding the importance of the CLABE Number is crucial for anyone who wants to conduct financial transactions in Mexico.

In this article, we explore what a CLABE Number is, what the digits in a CLABE Number represent, and how it is used in the Mexican banking system.

We will also discuss the benefits of using a CLABE Number for banking transactions and how to find your CLABE Number if you do not already know where to find it.

What Is A CLABE Number?

The CLABE Number is an 18-digit code that is assigned to each bank account in Mexico. It is an acronym that stands for "Clave Bancaria Estandarizada", which translates to "Standardized Banking Code" in English.

The CLABE Number is a unique identifier that is used to track and process banking transactions in Mexico. Each digit in the CLABE Number has a specific meaning and serves a particular purpose.

A CLABE Number is a unique 18-digit identifier for every bank account in Mexico. CLABE is short for Clave Bancaria Estandarizada which is the Spanish term for standard bank code.

The CLABE Number is used for a wide range of financial transactions in Mexico. It is commonly used for electronic fund transfers, bill payments, direct deposits, and other types of financial transactions.

The CLABE Number helps ensure that transactions are processed accurately and efficiently, reducing the risk of errors and fraud. It also allows banks and financial institutions to track and monitor transactions, making identifying and preventing fraudulent activities easier.

Who Issues CLABE Numbers in Mexico?

The CLABE Number specification was created by the Asociación de Bancos de México (The Association of Banks of Mexico), also called ABM for short, in partnership with the Banco de México (Mexico's Central Bank).

The ABM was founded in 1928 with 32 participating banks to oversee the banking industry in Mexico. Over time, membership has grown and currently, there are 49 banking institutions that are ABM members.

The ABM issues, maintains and helps enforce various banking rules and regulations in Mexico, with the CLABE specification being one of them.

Additionally, the ABM also issues the 3-digit bank codes for all banks in Mexico. As per the records of the El Servicio de Administración Tributaria (SAT.gob.mx), the ABM has issued bank codes for various banks1 - these are essential to forming a CLABE Number as we will see in the section below.

The CLABE Number specification as well as 3-digit bank codes for all banks in Mexico are owned and issued by the Association of Banks of Mexico (ABM).

What Is The Format Of A CLABE Number?

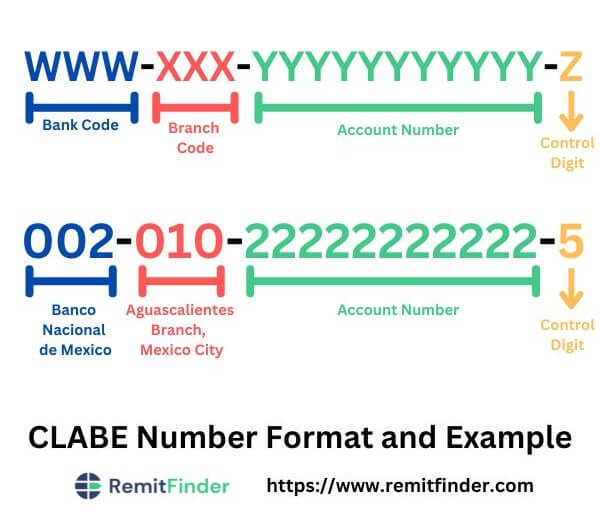

A CLABE Number is structured specifically to provide a standard format for bank account identification in Mexico. The 18-digit code is broken down into three distinct parts that provide information about the bank, the branch, and the account number.

The first 6 digits of the CLABE Number represent the bank and branch where the account is held. The first 3 digits indicate the bank code, while the next 3 digits represent the branch code. Together, these 6 digits identify the bank and branch where the account is held.

The following 11 digits of the CLABE Number represent the account number. This number can be up to 11 digits long and may include leading zeros to fill in any empty spaces.

The final digit of the CLABE Number is a control digit that is used to validate the entire code. It is calculated using a specific algorithm that ensures the accuracy of the code and helps prevent errors and fraud.

Thus, to summarize, an 18-digit CLABE Number is made up of the following constituents:

- First 3 digits make up the bank code

- Next 3 digits represent the branch code

- Next 11 digits are the account number (with leading 0's to fill up empty slots if needed)

- Last digit is a control digit that is calculated using the prior 17 digits and helps ensure that the whole CLABE Number is accurate and not tampered with.

From the above breakdown, we can clearly see that a CLABE Number is a globally unique bank account identifier in Mexico. You can think of it as a unique fingerprint for your bank account throughout Mexico.

A CLABE Number is 18-digits long and is composed of the bank code, branch code, account number and a control digit for verification. It is, thus, a unique identifier for a bank account in Mexico.

Let's take an example.

For a bank account number 22222222222 (we made it up since a bank account number is personal and sensitive information) held at the Aguascalientes branch of Banco Nacional de Mexico located in Mexico City, the CLABE Number would be 002010222222222225.

Let's break this down into its sub-parts as below:

- The first 3 digits, i.e., 002, represent Banco Nacional de Mexico.

- The next 3 digits, i.e., 101, represent the Aguascalientes branch in Mexico City.

- The next 11 digits, i.e., 22222222222 represent our made up account number.

- The last digit, i.e., 5, is the control digit; it is accurately calculated based on the correct verification algorithm for our made up account number.

The below image represents the format of a CLABE Number along with our example in an infographic format.

CLABE Numbers in Mexico are 18-digits long and follow a standardized format. This helps to uniquely identify any bank account within Mexico's banking ecosystem.

What Is A CLABE Number Used For?

As we have seen in the sections above, a CLABE Number is a unique identifier for any bank account within the Mexican banking ecosystem. This makes it suitable for any banking scenarios where money has to move in and out of a bank account.

As a result, the CLABE Number is used for various financial transactions in Mexico. Some of the most common uses of a CLABE Number include the below:

- International Money Transfers: The CLABE Number is critical to receive international remittances in Mexico as it helps route the overseas funds directly into a Mexican bank account.

- Electronic Fund Transfers: The CLABE Number is required to send and receive electronic transfers between bank accounts in Mexico. This includes both domestic and international transfers.

- Direct Deposits: The CLABE Number is used to identify a specific bank account for direct deposit payments from employers, government agencies, and other entities.

- Bill Payments: Many bills and utilities in Mexico require payment through electronic means, and the CLABE Number is used to ensure the payment is correctly applied to the appropriate account.

- Loan And Credit Card Payments: The CLABE Number is used to identify the bank account for loan and credit card payments.

- Account Verification: The CLABE Number is used to verify bank account information for transactions such as refunds, returns, and other credits.

The CLABE Number is a critical component of the Mexican banking system, and it plays a vital role in ensuring the accuracy and security of financial transactions.

Without a CLABE Number, it would be fairly cumbersome and error-prone to process many of the common financial transactions in Mexico.

How Can I Send Money to Mexico from Overseas Using a CLABE Number?

The CLABE Number is an essential foundational pillar when sending money from overseas to Mexico via a bank deposit into the recipient's account.

When an overseas sender wishes to credit their Mexican recipient directly into their bank account, they can simply enter the receiver's CLABE Number, and the funds will arrive straight into the desired bank account.

CLABE Number obviates the need to exchange detailed bank information and hence makes the overall international money transfer process seamless and error free.

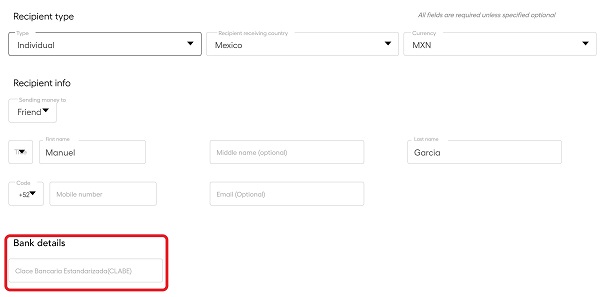

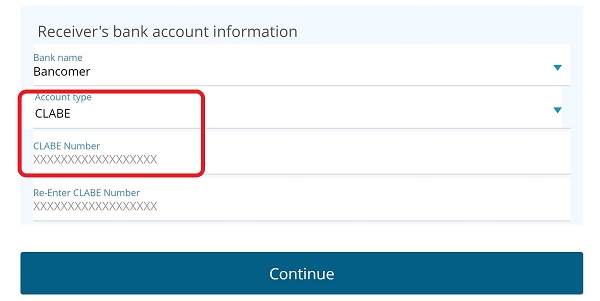

For example, if you send money from abroad to Mexico using Instarem, you can provide your recipient's CLABE Number when you add their details during the transfer process. The below screenshot shows how to do this.

Similarly, if you are using Western Union to send money to Mexico, you can also choose to pay your recipient via a bank deposit and add their CLABE Number as per the below screenshot.

Since CLABE Numbers are so widely used, most money transfer companies will allow you to add one when you send money to Mexico with them.

CLABE Numbers make it easy and error free to send money from overseas to Mexico. Simply provide your recipient's CLABE Number and the funds will be sent to their bank account directly.

If you need to send money to Mexico from abroad, there are many good options like money transfer companies. Check out RemitFinder to compare numerous remittance companies easily and pick the best one for your international money transfers to Mexico.

What Are The Benefits Of Using A CLABE Number?

There are several benefits to using a CLABE Number for banking transactions in Mexico; here are a few of them:

- Faster And More Efficient Transactions: Using a standardized and unique bank account number like the CLABE Number helps to streamline banking transactions, making them faster and more efficient. This can be especially beneficial for businesses or individuals who need to make multiple transactions in a short amount of time.

- Improved Accuracy: Using a check digit in the CLABE Number helps ensure that banking transactions are accurate and error-free and helps reduce the likelihood of errors or delays in processing transactions.

- Easy Identification Of Banks And Accounts: The first 6 digits of the CLABE Number correspond to the bank and branch code, making it easy to identify the bank associated with a particular account. This can be helpful when sending or receiving payments from different banks.

- Secure Transactions: The use of a unique identifier like the CLABE Number helps to ensure the security of banking transactions. It can help to prevent fraudsters from intercepting or altering account numbers as the control digit helps to ensure that there was no tampering.

- Compliance With Regulations: The use of the CLABE Number is mandated by Mexican banking regulations, so using it ensures compliance with these regulations. This can help to avoid penalties or other legal issues related to non-compliance.

Using a CLABE Number helps to simplify and secure banking transactions in Mexico, making it a valuable tool for businesses and individuals alike.

How Do You Find Your CLABE Number?

CLABE, or Clave Bancaria Estandarizada, is a standardized bank code used in Mexico for banking transactions. It consists of 18 digits, with the first 6 indicating the bank and branch code, the next 11 indicating the bank account number, and the last digit being a control digit used for error detection.

If you have a bank account in Mexico, you can easily find your CLABE Number on your bank statement or by logging into your online banking account. The CLABE Number is typically listed alongside your account information.

If you are still looking for your CLABE Number or need access to your bank statement or online banking account, you can contact your bank directly and request your CLABE Number. They may ask you to provide some personal information to verify your identity before sharing your CLABE Number with you.

It is important to keep your CLABE Number confidential and only share it with trusted individuals or entities for legitimate banking transactions. Fraudsters may attempt to obtain your CLABE Number for fraud, so it is important to exercise caution and protect your personal information.

CLABE Numbers for Major Mexican Banks

If you send or receive money in Mexico, you will likely need a CLABE Number to be able to successfully make online payments. All banks in Mexico implement the CLABE specification and have bank codes assigned by the ABM, so it should be easy to find your CLABE Number.

In a prior section, we provided some easy ways you can located your CLABE Number. In this section, we will provide the CLABE Number for major banks in Mexico.

However, note that CLABE Number is only known to the bank account holder as it is private information. We will, therefore, only list the first 3 digits of CLABE Numbers for popular banks in Mexico. Look at your bank account statement or contact your branch to find your exact CLABE Number.

What is Banco Azteca's CLABE Number?

Banco Azteca CLABE Numbers start with 127. Check your account statement or contact your bank for the exact CLABE Number for your bank account.

What is BBVA Bancomer's CLABE Number?

BBVA Bancomer CLABE Numbers start with 012. Check your account statement or contact your bank for the exact CLABE Number for your bank account.

What is BanCoppel's CLABE Number?

BanCoppel CLABE Numbers start with 137. Check your account statement or contact your bank for the exact CLABE Number for your bank account.

What is Banco del Bajio's CLABE Number?

Banco del Bajio CLABE Numbers start with 030. Check your account statement or contact your bank for the exact CLABE Number for your bank account.

What is Banco Santander Mexico's CLABE Number?

Banco Santander Mexico CLABE Numbers start with 014. Check your account statement or contact your bank for the exact CLABE Number for your bank account.

What is Banco Nacional de Mexico's CLABE Number?

Banco Nacional de Mexico CLABE Numbers start with 002. Check your account statement or contact your bank for the exact CLABE Number for your bank account.

What is Grupo Financiero Banorte's CLABE Number?

Grupo Financiero Banorte CLABE Numbers start with 072. Check your account statement or contact your bank for the exact CLABE Number for your bank account.

What is HSBC Mexico's CLABE Number?

HSBC Mexico CLABE Numbers start with 021. Check your account statement or contact your bank for the exact CLABE Number for your bank account.

What is Inbursa's CLABE Number?

Inbursa CLABE Numbers start with 036. Check your account statement or contact your bank for the exact CLABE Number for your bank account.

What is Scotiabank Mexico's CLABE Number?

Scotiabank Mexico CLABE Numbers start with 044. Check your account statement or contact your bank for the exact CLABE Number for your bank account.

What is Banco Nacional de Comercio Exterior's CLABE Number?

Banco Nacional de Comercio Exterior CLABE Numbers start with 006. Check your account statement or contact your bank for the exact CLABE Number for your bank

Frequently Asked Questions About CLABE Numbers

In this section, we will cover some Frequently Asked Questions (FAQs) about CLABE Numbers.

Is a CLABE Number the same as a bank account number?

A CLABE Number is the same as a bank account number, but it is a globally unique version of it.

Usually, a bank account number simply means the actual account number that is printed on your bank statement or checkbook. CLABE Numbers, on the other hand, include bank and branch information, and hence help identify bank accounts across Mexico.

Is a CLABE Number the same as a SWIFT Code?

No, CLABE Numbers and SWIFT Codes are not the same. Even though both are used in routing money, they are different from each other.

SWIFT Codes are globally unique identifiers for banks and financial institutions. Due to this, SWIFT Codes are useful when moving funds between banks worldwide.

CLABE Numbers, on the other hand, help uniquely identify a bank account in Mexico.

Is a CLABE Number the same as a BIC Code?

BIC Codes and SWIFT Codes are similar in nature. Therefore, the differences between CLABE Numbers and SWIFT Codes are the same as those between CLABE Numbers and BIC Codes.

Is a CLABE Number the same as an IBAN?

CLABE Numbers and International Bank Account Numbers (IBANs) are very similar to each other.

The only difference is that whilst CLABE Numbers help uniquely identify bank accounts in Mexico, IBANs help identify bank account globally.

Is a CLABE Number the same as a bank code?

CLABE Numbers and bank codes are totally different concepts.

CLABE Numbers are unique IDs for bank accounts in Mexico while bank codes are unique IDs for banks. In fact, CLABE Numbers contains a bank code in their format; the first 3 digits in a CLABE Number are the bank code for the concerned bank.

Is a CLABE Number the same as a UPI ID?

No, a CLABE Number is not the same as a UPI ID.

Unified Payments Interface (UPI) is a digital payments ecosystem created by the Government of India to make the country a cashless economy. A UPI ID identifies a user in the UPI payments ecosystem.

Hence, while a UPI ID identifies a UPI user, a CLABE Number identifies a bank account.

Is a CLABE Number the same as a UTR Number?

CLABE Numbers and UTR Numbers are not the same as they stand for very different concepts.

Unique Transaction Reference (UTR) Numbers are unique transaction IDs for transactions done via India's Real Time Gross Settlement (RTGS) and National Electronic Funds Transfer (NEFT) systems. A UTR Number enables checking the status of an RTGS or NEFT payment.

Hence, even though both CLABE Numbers and UTR Numbers are banking industry concepts, they represent different ideas - CLABE Numbers are for bank accounts while UTR Numbers for payment transactions.

Is a CLABE Number the same as an IFSC Code?

CLABE Numbers and IFSC Codes are different concepts altogether.

IFSC Codes identify bank branches uniquely in India whereas CLABE Numbers identify bank accounts in Mexico.

Is a CLABE Number the same as a BSB Number?

No, CLABE Numbers and BSB Numbers represent different concepts.

BSB Numbers are used in Australia to identify bank branches in the country. CLABE Numbers, on the other hand, help identify bank accounts in Mexico.

Is a CLABE Number the same as a Sort Code?

Sort Codes are used in the UK to uniquely identify a bank branch and can be used to route money amongst banks in the country. CLABE Numbers represent bank accounts in Mexico and hence help in routing funds into the right account.

Hence, even though CLABE Numbers and Sort Codes help route money, they are totally different entities.

Is a CLABE Number the same as an MICR Code?

No, CLABE Numbers and MICR Codes are very different from each other.

MICR Codes help identify bank branches and are primarily used in check processing and routing. CLABE Numbers stand for bank accounts in Mexico, thereby making it easy to move funds to the right account.

Is a CLABE Number the same as a NUBAN Number?

CLABE Numbers and NUBAN Numbers are very similar concepts.

NUBAN Numbers help uniquely identify bank accounts in Nigeria and help in accurate movement of money between bank accounts. CLABE Numbers are unique IDs for bank accounts in Mexico, thereby making it easy to move funds to the right account.

In that sense, both CLABE Numbers and NUBAN Numbers uniquely identify bank accounts albeit in different countries.

Is it Safe to Share a CLABE Number?

Since a CLABE Numbers is a unique version of a bank account number in Mexico, it is sensitive and personal information and should not be shared without caution.

We recommend sharing your CLABE Number very carefully with trusted parties only on a need to know basis.

Are CLABE Numbers used outside of Mexico?

CLABE is a Mexican standard developed by the ABM (Association of Banks of Mexico). Hence, CLABE Numbers are only used in Mexico.

That said, if someone is sending money to you from overseas, you should provide them with your CLABE Number so the money can be easily routed to your bank account in Mexico.

Our Concluding Thoughts

In summary, the CLABE Number is a standardized bank code used in Mexico for banking transactions. It consists of 18 digits and is used to identify specific bank accounts for the purpose of sending or receiving payments.

Using the CLABE Number helps streamline banking transactions, improve accuracy, and ensure the security of transactions. A CLABE Number is a mandatory requirement for banking transactions in Mexico and can be easily obtained from bank statements or online banking accounts.

Overall, the CLABE Number is a valuable tool for businesses and individuals in Mexico who need to make frequent banking transactions.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

References:

1. Bank codes issued by the ABM for various banks in Mexico

Categories

Similar Articles

CNAPS Codes Unraveled: Navigating China's Banking Landscape

Discover CNAPS Codes: China’s unique bank identifier for fast, secure transactions. Learn how CNAPS Codes simplify payments across China's banking system.

ABA Routing Numbers In The US: A Comprehensive Guide

Discover what ABA Routing Numbers are, how they work and their importance in US banking transactions like direct deposits, online transactions and wire transfers.

What Is A NUBAN Number And What Is It Used For?

Discover what NUBAN Numbers are and how they streamline bank account identification in Nigeria. Do not miss this essential guide if you transact in any way with the Nigerian banking system.