TransferGo Detailed ReviewRates, Fees, Limits, Safety and More

Last updated: April 18, 2022

What is TransferGo? An introduction

TransferGo company information

TransferGo was established in 2012 and is a fast growing FinTech start-up company that provides tailored, affordable financial services to migrants around the world. It offers online money transfers to over 160 countries with 'high speeds, low fees and no hassle'.

TransferGo has over 200 employees in offices across Europe and serves over 3.5 million customers.

TransferGo's mission is to make global money transfers easy, convenient and fast. In their own words:-

We want to make a tangible difference to your lives, reward your hard work, and help every one of you become more prosperous. How? By making global money transfers as simple as sending a text.

TransferGo has partnerships with about 30 global banks, and are continually adding support for more global currencies and countries to help their customers move money abroad.

TransferGo is a fast growing money transfer operator that helps you send money to over 160 countries worldwide.

Let's take a deeper look into TransferGo's services and why they may be a great choice for your next international money transfer.

Which countries does TransferGo operate?

TransferGo is active in over 160 markets, and supports numerous global currencies to help you send money from and to various countries. They have several offices across major European countries; these include branches in:-

- Berlin, Germany

- Warsaw, Poland

- Krakow, Poland

- Vilnius, Lithuania

- London, United Kingdom

Where can I send money from with TransferGo?

You can send money from 34 countries with TransferGo.

TransferGo enables you to send money from Austria, Belgium, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Monaco, Netherlands, Norway, Poland, Portugal, Romania, San Marino, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey and the United Kingdom.

Where can I send money to with TransferGo?

TransferGo helps you send money to 160 countries that include all major popular global money transfer destinations all major continents of the world.

The list of countries where you can send money to with TransferGo includes Albania, Algeria, Andorra, Angola, Anguilla, Australia, Aruba, Austria, Bahamas, Bahrain, Bangladesh, Barbados, Belgium, Belize, Benin, Bermuda, Bhutan, Bolivia, Botswana, Bulgaria, Burkina Faso, British Virgin Islands, Brunei, Cambodia, Cameroon, Canada, Cayman Islands, Chad, Chile, China, Colombia, Comoros, Cook Islands, Costa Rica, Curacao, Croatia, Cyprus, Czech Republic, Denmark, Djibouti, Dominica, Dominican Republic, Ecuador, El Salvador, Equatorial Guinea, Estonia, Ethiopia, Fiji, Finland, France, Gabon, Gambia, Georgia, Germany, Ghana, Gibraltar, Grenada, Greece, Guam, Guyana, Hong Kong, Honduras, Hungary, Iceland, India, Indonesia, Ireland, Israel, Italy, Ivory Coast, Jamaica, Japan, Kazakhstan, Kiribati, Kosovo, Kyrgyzstan, Kenya, Kuwait, Latvia, Lesotho, Liechtenstein, Lithuania, Luxembourg, Macedonia, Madagascar, Malawi, Malaysia, Maldives, Malta, Martinique, Mauritania, Mauritius, Mexico, Micronesia, Moldova, Monaco, Mongolia, Morocco, Mozambique, Namibia, Nepal, Netherlands, New Zealand, Niger, Nigeria, Norway, Panama, Papua New Guinea, Paraguay, Peru, Philippines, Poland, Portugal, Puerto Rico, Qatar, Reunion, Romania, Russian Federation, Rwanda, Samoa, San Marino, Saudi Arabia, Senegal, Seychelles, Sierra Leone, Singapore, Slovakia, Slovenia, Solomon Islands, South Africa, Spain, Suriname, Sri Lanka, St Kitts and Nevis, St Lucia, St Vincent & Grenadines, Swaziland, Sweden, Switzerland, Tajikistan, Tanzania, Thailand, Timor-Leste, Togo, Tonga, Trinidad and Tobago, Turkey, Turkmenistan, Uganda, Ukraine, United Arab Emirates, United Kingdom, United States of America, Uruguay, Uzbekistan, Vanuatu, Vatican City, Vietnam and Zambia.

TransferGo is always looking to expand into new markets, so be sure to regularly check for their list of supported money transfer destinations to see if your country is supported.

TransferGo, thus, supports a matrix of 5,400 countries to send and receive money internationally.

With TransferGo, you can send money internationally from 34 countries to 160 countries.

What are TransferGo's fees and exchange rates?

When compared to their peers in the money transfer business, TransferGo has very good and competitive exchange rates and fees.

To validate the above assertion, let's inspect TransferGo's exchange rates and transfer fees.

To do this, we will take some corridors that TransferGo operates in, and do some calculations to see how good TransferGo's rates are. See the below table for sending 1000 units of currency for some popular global country combinations.

| Country Pair | Transfer Amount | Exchange Rate* | Fees* | Payout | Mid-Market Rate** | FX Markup |

|---|---|---|---|---|---|---|

| Germany to India | EUR 1,000 | 1 EUR = 82.4476 INR | EUR 0.0 | 82,476.54 INR | 1 EUR = 82.7917 INR | 0.42% |

| UK to Pakistan | GBP 1,000 | 1 GBP = 238.7453 PKR | GBP 0.0 | 238,745.33 PKR | 1 GBP = 240.7590 PKR | 0.84% |

| Norway to Ghana | NOK 1,000 | 1 NOK = 0.8543 GHS | NOK 0.0 | 854.27 GHS | 1 NOK = 0.8562 GHS | 0.22% |

| Poland to Indonesia | PLN 1,000 | 1 PLN = 3372.0629 IDR | PLN 0.0 | 3,372,063.00 IDR | 1 PLN = 3405.1800 IDR | 0.97% |

| Denmark to Vietnam | DKK 1,000 | 1 DKK = 3355.0347 VND | DKK 0.0 | 3,355,035.00 VND | 1 DKK = 3370.6657 VND | 0.46% |

*Exchange rates and fees as on April 06, 2022

**Mid-Market Rate from XE.com

See how we calculate FX Markup

Whenever you are ready to send money with TransferGo, you can easily see how much money your recipient will get by using their online calculator. Enter the amount you want to send, and select your source and destination countries and currencies, and you can easily see how much money your recipient will get.

TransferGo is further helping customers save even more by waiving fees for the first 2 transfers. You can take advantage of this to get an even higher return on your hard earned money.

TransferGo's exchange rates are very competitive in the money transfer industry. Take advantage of first 2 fee free transfers to save even more.

Once you have availed the first 2 free transfers, fees vary since you can choose from a range of delivery speeds and methods. TransferGo prides itself on keeping their fees '90% lower than banks' and lower than most digital transfer providers. Occasionally, their banking partners do add charges on international transfers, which then need to be added to the fee you pay.

TransferGo is also currently charging zero fees on all transfers to Ukraine.

Are TransferGo exchange rates good?

TransferGo currently offers mid-market rates on the first two transfers, and rates just marginally above that thereafter. They have received multiple positive reviews on Trustpilot for their favorable rates, although market fluctuations can sometimes affect them negatively.

As we have witnessed in the case studies above, the FX Markup charged by TransferGo varies from 0.22% to 0.97%.

Since exchange rates are so volatile, it is important that you check all available resources at your disposal to make the best possible money transfer decisions. Be sure to compare various remittance service providers so you can try to time your money transfer as best as possible.

A great way to simplify your money transfer research is to use RemitFinder's remittance comparison platform. You can easily compare money transfer operators to pick the best one for your needs.

Is TransferGo a cheap way to send money overseas?

With very competitive exchange rates and low (often 0) fees, TransferGo can be a cost effective way to send money abroad.

The cost of money transfer involves transfer fees as well as sub optimal exchange rates. A bad exchange rate will lower your payout, and hence make the money transfer more expensive.

With TransferGo's relatively low FX Markup, you often get a very good payout with them. A high payout means maximum money in your recipient's pocket, and a low cost money transfer for you.

How do I avoid TransferGo fees?

Currently, TransferGo is waiving fees for first 2 transfers. You should definitely take advantage of this great offer while it lasts.

Additionally, all transfers to Ukraine are free at the moment.

Once you have used up your free transfer quota, you may have to pay a fee for your money transfer. The good news is that there are no hidden fees with TransferGo. All their fees are marked clearly on each delivery option, so you can choose the one that is cheapest (or free).

TransferGo is providing first 2 transfers free. After that, you can choose the delivery option that results in the lowest (sometimes 0) fees.

Additionally, avoid paying for your transfer with a Credit card since most credit card companies will treat a money transfer payment as a cash advance, and you may end up paying high fees for the same.

Generally, the best and cheapest option to pay for your money transfer is with your bank account via a direct bank transfer. In this case, you send the transfer amount from your bank into TransferGo's bank account in your country.

How much money can I send with TransferGo?

Due to anti-fraud regulations, TransferGo does not divulge the upper limit on money transfers you can send with them.

You can use their online calculator to estimate your transfer, and once ready, login to your account to see if your transfer amount in within the authorized limits for your country.

TransferGo does not reveal sending limits due to anti-fraud regulations.

How long does it take for TransferGo to send money overseas?

Depending on the two countries involved, most transfers are either instant, or take up to half an hour to arrive. On rarer occasions, transfers take up to 2 working days, but TransferGo are always clear about when this is the case.

Depending on the countries involved and the delivery options chosen, your money can reach the recipient in any of the following timeframes.

- Within 30 minutes

- By end of the day you started the transfer

- Withing 1 working day

- By noon of the next working day

Some factors that may slow down your transfer include:-

- Bank holidays - If your transfer is done on a bank holiday, it will clear on the next working day.

- Security checks - Due to legal and regulatory requirements, TransferGo has to do various security checks on your transaction. In some cases, these may delay your transaction from clearing quickly.

TransferGo is a quick way to send money overseas - your money will arrive as early as within 30 minutes and up to 1 working day.

If you send money to some destinations - including Australia, Bangladesh, Bulgaria, Canada, Czech Republic, Hong Kong, Hungary, Indonesia, Israel, Kenya, Mexico, Nepal, Thailand, Russia, USA, South Africa, Sri Lanka and Switzerland if the receiving currency is CHF - it may take more than 1 working day if you chose bank transfer as your delivery method.

How can I pay for my TransferGo money transfer?

There are a few ways you can pay for your money transfer with TransferGo; we list these below.

- Bank transfer - If you choose to pay for your TransferGo money transfer with your bank account, you will need to make a local bank transfer to TransferGo's account in your country.

- Debit card - Fill in your Debit card details if you wish to pay for your money transfer with a Debit card.

- Credit card - If you want to fund your transfer with a Credit card, simply provide all the necessary details to TransferGo.

With TransferGo, you can pay for your money transfer with Bank transfer, Debit card or Credit card.

How do I decide which TransferGo payment method to use when paying for my money transfer?

Below we list some additional useful tips that you should keep in mind when choosing the above TransferGo payment methods.

- If you choose Bank transfer as the payment method, make sure you transfer the exact amount you ordered for your money transfer.

- For Bank transfers, ensure that you add your client number (TGXXXXXX) in the payment reference field when paying for the transaction.

- TransferGo only accepts Visa and Mastercard if you choose to pay with Debit or Credit card.

- Visa and Mastercard Debit and Credit cards (in GBP, EUR, PLN, NOK, SEK, and DKK) have a transfer limit of GBP 10,000 if you use TransferGo's standard delivery option.

- Note that if you choose to pay with a Credit card, you may be charged additional credit card processing fees which will make your transfer more expensive.

TransferGo also provides many helpful tips in case you are paying for your transfer with a Debit card, and your card gets declined.

How can my recipient get paid with TransferGo?

With TransferGo, you can choose several ways for your recipient to get paid. Below, we list the delivery methods supported by TransferGo.

- Receive money on the recipient's Debit card or Credit card - Note that there is a limit of USD 2500 (or equivalent in other currencies) per transaction if you decide to send money to a Debit or Credit card.

- Bank transfer

- Cash pickup

- Link on phone to collect money

With TransferGo, recipients can receive money to their Debit or Credit cards, Bank accounts, or as cash payouts. They can also receive links on their phone and choose how to collect the money themselves.

Below, we provide some additional helpful information on TransferGo's supported delivery options.

How does sending money with TransferGo to a Debit card or Credit card work?

If you choose to send money to your recipient by paying out to their Debit or Credit card, you need to provide their full name and card information when you send money with TransferGo.

Enter the 16 digits card number as well as the card expiration date when you provide your recipient's card information.

There is a limit of USD 2500 per transaction if you send money to a Debit or Credit card, so plan your transfer accordingly.

Sending money with TransferGo to a Debit or Credit card is a great way to pay someone who does not have a bank account.

How does sending money with TransferGo to a phone number work?

Sending money to a phone number with TransferGo is convenient and quick. All you need is to provide your recipient's name and phone number.

Once your transaction is processed successfully, TransferGo will send the recipient an SMS with a payment link to let them know that money is available. They have to then add their bank details within 48 hours, and TransferGo will transfer the money to their account.

What should the recipient do if I send money with TransferGo to their phone number?

If you send money overseas with TransferGo to someone's phone number, they will get a text message once the funds are available. The message will have a payment link, which they can use to provide their bank details.

The bank details must be provided within 48 hours of receiving the SMS, and once that is done, TransferGo will transfer the money to the recipient's bank account.

In case your recipient did not receive the SMS message with the payment link, please contact TransferGo customer support team and they will assist you.

Are there any TransferGo coupon codes or promotions I can use?

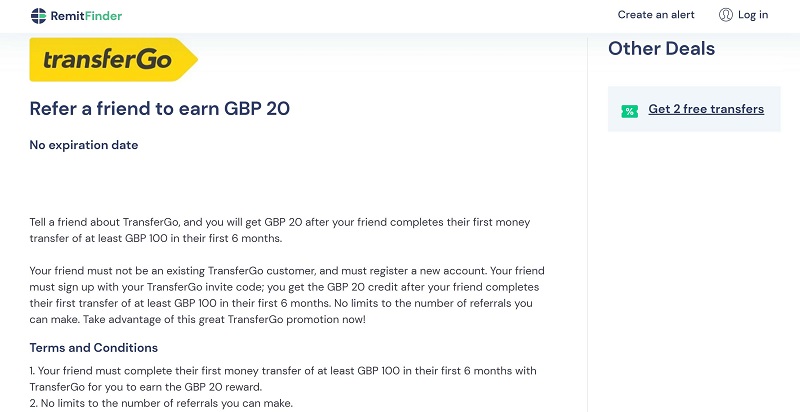

There are currently 2 great TransferGo offers active that you can take advantage of. Deals and promotions are a great way to lower the cost of your money transfers, and maximize payout for your recipient.

The below 2 TransferGo promotions are active at this time.

Below is a picture of the TransferGo refer a friend to earn GBP 20 deal. This applies to all supported TransferGo country and currency combinations, and is a great way to earn referral credits.

TransferGo promotion to refer a friend and earn GBP 20

We keep this page updated with any ongoing TransferGo coupon codes and offers, so make sure to check here regularly. To automate this, you can also use RemitFinder's daily free exchange rate alert, and we will send you the latest exchange rates and promotions so you do not have to search them manually.

Is TransferGo a safe way to send money abroad?

As an established money transfer business, TransferGo implements numerous security measures and industry best practices to ensure that your money and information is safe with them at all times.

For example, TransferGo has a comprehensive set of guidelines to verify your identity as part of KYC (know your customer) compliance. This helps TransferGo to ensure that you are operating your account with them, and not someone else.

Let's take a closer look at how TransferGo verifies your identity.

How do I verify my identity with TransferGo?

TransferGo will ask you to verify your identity in either of the below scenarios.

- You are sending more than GBP 900 in your first money transfer

- You are sending your second money transfer (regardless of the amount)

To verify your identity, simply login into your TransferGo account, and follow instructions in the Identity section in the Verification menu item. Choose your country, and upload necessary documents.

TransferGo will also ask you to take a selfie with your computer or phone camera and upload it as well.

Whilst this may seem extra work, identity verification is a really important step to ensure your safety and security.

Which identification documents does TransferGo accept?

TransferGo allows you to verify your identity by accepting a variety of identification documents that include the below.

- International Passport

- National ID card issued in the EU/EEA (Plastic only)

- Driving License issued in the United Kingdom or Turkey - Drivers Licenses from other countries are not accepted

- Residence Permit

- Domestic Ukrainian Passports

You can upload scanned copies of any of these documents from within your TransferGo account.

How does TransferGo keep my money safe?

TransferGo ensures your money is safe at all times by using an approach called safeguarding. This means that even if TransferGo was to go out of business, your money is still safe.

TransferGo implements safeguarding by completely separating your money from the money they use to run the company. This means your money is kept in complete separate accounts. These accounts are held at large banks that comply with legal and regulatory requirements.

TransferGo keeps your money safe at all times by using safeguarding (keeping your money separate from their own funds).

Can I trust TransferGo?

In addition to implementing numerous security protocols, TransferGo is also fully regulated by various financial governing bodies. This further ensures the safety of your money and information.

Specifically, TransferGo complies with strict financial guidelines and policies enforced by the following financial institutions.

- TransferGo is a registered payment service provider authorized to perform international money transfers.

- TransferGo is supervised by HM Revenue & Customs (HMRC) under Money Laundering Regulations: 12667079.

- TransferGo is also regulated by the UK Financial Conduct Authority (FCA) as an authorized payment institution: 600886.

- TransferGo Lithuania is an electronic money institution established in the Republic of Lithuania, and is authorized and regulated by the Bank of Lithuania with registration number 304871705, FI Code 32400.

- TransferGo is also registered with the ICO (Information Commissioner's Office) in the UK (registration number: Z316680X).

Below are even more ways in which TransferGo ensures security and safety of your confidential information as well as payments.

- By only working with trusted and secure banks throughout the world.

- By implementing industry standard HTTPS encryption for all financial transactions.

- By keeping your money separate from their own funds in segregated accounts.

- By never sharing your confidential information with any third parties.

- By using SSL technology to keep your information safe.

- By educating customers about how to protect themselves from fraud.

TransferGo has a very strong focus on security, and your money and information is safe with them at all times.

How good is TransferGo's service?

TransferGo is used by millions of users around the world, which is a great testament to their service quality. Another way we can see if TransferGo's product and service is good is by seeing what other money transfer customers like you say about them.

What do users have to say about TransferGo?

Below we share a summary of TransferGo's ratings and reviews on some of the prevalent review^ ecosystems where their customers rate them.

- On Trustpilot, TransferGo has an excellent rating of 4.8/5.0 based on more than 25k reviews

- On the Google Play Store, TransferGo's Android mobile app has an average rating of 3.8/5.0 with more than 20k reviews

- On the Apple App Store, TransferGo's iOS mobile app has an aggregated rating of 4.5/5.0 with 33 reviews

^Ratings on various platforms as on April 06, 2022

TransferGo's Trustpilot rating of 4.8 from over 25,000 reviews is indeed excellent. Most reviews focus on the speed of transfers, the low fees, and the quick and friendly customer service.

TransferGo has excellent ratings on Trustpilot. Customers seem to love their product. Google Play Store ratings are lower though.

Is TransferGo the best choice for me?

After inspecting TransferGo's money transfer service in detail, we find that there are quite a few advantages to using them over their competitors.

Below, we list areas where we find TransferGo to be strong when compared with other money transfer companies.

- Strong corridor coverage - With TransferGo, you can send money between a matrix of 5400 countries. This includes 160 global destinations, literally covering most of the world's popular remittance receiving countries.

- Very competitive exchange rates - TransferGo charges less than 1% FX Markup on their money transfers, and this helps you get a higher payout for your international remittances.

- Extremely fast money transfer speed - TransferGo specializes in moving your money overseas very quickly. Transfer speeds vary anywhere from within 30 minutes to 1 working day.

- Convenient payment method support - TransferGo lets you pay for your money transfers with your bank account, a debit card or a credit card.

- Wide range of delivery options - With TransferGo, you can send money to your recipient on their debit or credit card, into their bank account, for cash pickup as well as with a payment link on their phone.

- Excellent customer reviews - TransferGo has an excellent rating of 4.8/5.0 on Trustpilot which indicates that customers love their service.

RemitFinder likes TransferGo for strong corridor support, very competitive exchange rates, good payment and delivery options, excellent customer reviews and moving money overseas very quickly.

What are the best reasons to use TransferGo?

Seeing the numerous strengths of TransferGo's money transfer services, we believe they are a great fit for many remittance use cases. Below we provide some example scenarios where it might be advantageous to use TransferGo for your next money transfer.

- If you want to get very good exchange rates with low fees, TransferGo may be a really good choice to send money with. As evidenced by our case studies earlier, their FX Markup is less than 1%. This makes them a cost effective way to send money overseas.

- Sometimes we all need to rush money abroad for urgencies. If you find yourself in such a situation, TransferGo can be an excellent choice as they are able to send money internationally very quickly. In many cases, money is available overseas within 30 minutes.

- Not everyone in the world has a bank account, and if this is the case with your recipient overseas, TransferGo is a great option. You can easily send money to your recipient's debit or credit card. They can, thus, receive money without having a bank account.

- Similar to the above scenario, if your recipient wants to receive money on their phone, you can so that as well with TransferGo. Simply provide their phone number, and TransferGo will send them a payment link which they can use to access the funds overseas.

- Another reason you may want to use TransferGo is simply their stellar customer feedback. With an excellent rating of 4.8/5.0 on Trustpilot, you can rest assured that their product is very customer friendly and easy to use.

There are many money transfer scenarios for which TransferGo is a great fit.

What type of transfers can I make with TransferGo?

With TransferGo, you can make 2 types of money transfers - local transfers as well as international transfers.

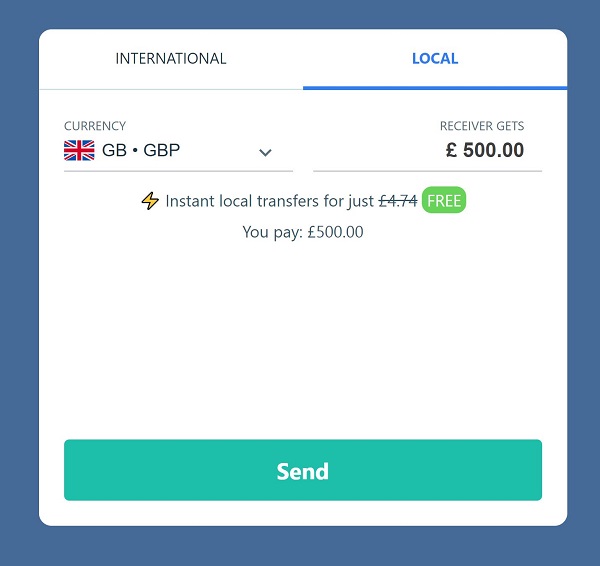

Local transfers are transfers within the same country, and for a limited time, TransferGo is waiving all fees on local transfers. See the below screenshot for an example of a local GBP 500 transfer within the UK.

How to send a local money transfer with TransferGo

The second type of money transfer you can do with TransferGo is an international money transfer whereby you send money overseas from one country to another. In this case, currency conversion is involved, and your recipient will get funds overseas in their local currency.

You can send both local and international money transfers with TransferGo.

What are various ways to send money with TransferGo?

TransferGo is a very convenient way to send money abroad, and you can do so with them in the following 2 ways.

- By using TransferGo's website

- By using TransferGo's mobile apps

When it comes to sending money via TransferGo with your mobile phone, you have 3 options based on your device type; these are listed below.

- Use TransferGo's Android app listed on the Google Play Store

- Use TransferGo's iOS app available on the Apple App Store

- Use TransferGo's Huawei app hosted on the Huawei App Gallery

With its website and various mobile apps available at your disposal, TransferGo is a great way to send money from the convenience of your home or office.

How to send and receive money with TransferGo?

Sending and receiving money with TransferGo is quick and easy. You can use their website as well as mobile apps (available on Google Play Store, Apple App Store as well as the Huawei App Gallery) to send money.

In the next section, we will list the steps you need to take to be able to send money with TransferGo.

Step by step guide to send money with TransferGo

You can follow the easy steps outlined below to send money with TransferGo. Its quick and easy!

- Step 1 - Determine if TransferGo is your chosen money transfer company. First and foremost, you need to decide if TransferGo is the best choice to send money with. One of the best ways to arrive at that decision is to compare TransferGo with their peers. To do so easily, you can rely on RemitFinder to quickly compare many money transfer companies in a single place. This way, you can easily decide who to go with.

- Step 2 - Choose how much to send, and by when. Simply choose the amount you want to send, and by when do you need to send the money. In case you do not have an account with TransferGo, make sure to sign up first.

- Step 3 - Add your recipient and their information. Provide necessary information about your recipient, as well as add their bank or card details. You can also add just their phone number in case they want to receive a payment link on their phone.

- Step 4 - Choose how to pay. Decide how you want to pay for your transfer, and add relevant details for your payment method. TransferGo lets you pay with your bank account or with a debit or credit card.

- Step 5 - Make the transfer. Once you have added your payment method details, simply hit send to start your money transfer transaction. That's it! TransferGo will take it on from there and move your money abroad. They will also keep you informed of progress as your transaction proceeds to next steps.

As you can see from the above steps, TransferGo provides a very convenient workflow to make a money transfer with them.

It is quick and easy to send money with TransferGo.

How can TransferGo help me send money?

TransferGo provides numerous helpful resources to assist you with sending money overseas.

Some of the reasons you may want to send money with TransferGo include the below.

- Paying people and merchants locally in your own country

- Sending money internationally to your family overseas

- Paying your local as well as international bills

- Helping pay for mortgages for your family home abroad

- Making payments to businesses in other countries

- Sustain your family and friends in another country

- And so much more...

The reasons to send money overseas may be many, but TransferGo is there to help all along the process. You can check out their very detailed and helpful money transfer guide to see how easily you can send money with them.

Additionally, TransferGo providers country specific resources to help you send money to more than 160 countries worldwide. Below are some examples of their popular money transfer destinations.

- Send money to India

- Send money to Philippines

- Send money to Mexico

- Send money to Pakistan

- Send money to Indonesia

- Send money to Thailand

Be sure to check the page specific to your country when you decide to send money with TransferGo.

Do I need a TransferGo account to receive money?

No, you do not need a TransferGo account to be able to receive money overseas.

TransferGo lets you send money to international bank accounts, debit or credit cards, phones and cash payouts all over the world, whether or not the receiver has a TransferGo account.

Your recipient does not need a TransferGo account to be able to receive money you send to them via TransferGo.

Does TransferGo have a mobile app?

Yes, TransferGo does have a mobile app that you can use to send money on the go with them.

You can download the TransferGo mobile app on multiple app stores based on your device type; these include the below.

- Android app from the Google Play Store

- iOS app from the Apple App Store

- Huawei app from the Huawei App Gallery

Be sure to use the right application for your mobile platform and operating system.

You can download the TransferGo mobile app from Google Play, App Store or the Huawei App Gallery.

How do I track my TransferGo transfer?

You can track the progress of your active TransferGo money transfer any time by logging into your account on their website or mobile app, and looking at your transaction history.

In addition, TransferGo will keep you updated on your transfer's progress as it proceeds through various stages.

Can I use TransferGo for international bank transfers?

You can definitely use TransferGo to make international bank transfers. To do this, simply choose to pay your money transfer with your bank account, and make a bank account payout to your recipient.

By choosing funds in and out of bank accounts on both the sending and receiving end, you achieve the same goal as a traditional international bank transfer, but with the better exchange rates and low fees that TransferGo offers.

In fact, TransferGo was initially built purely to make international bank transfers fairer and faster.

Is TransferGo online better than sending money in-person in stores?

It really depends on your preference, but for many people, yes. You can send money online with TransferGo anytime using their website or mobile applications.

Send money online with TransferGo is so quick and easy that you can do it in the time it takes to put your shoes on!

Sending money online with TransferGo is quick and easy with either their website or mobile apps.

Does TransferGo have a rewards program?

TransferGo does have a rewards program whereby you can refer your friends to them, and make money doing so.

If you refer a friend to TransferGo, and they sign up with them, you will get a GBP 20 (or equivalent in another currency) referral reward.

There's no limit on how many friends you can invite, and some 'star' users have earned tens of thousands with the TransferGo referral program.

What customer support options are available with TransferGo?

Should you face any problem with your money transfers with TransferGo, there are several ways to contact their customer support team; these are listed below.

- Live chat - You will get an instant response from the TransferGo team

- Email - TransferGo customer support usually responds within half an hour to emails

- Phone - If you contact TransferGo via phone, your call will usually be answered in under 20 seconds

TransferGo's dedicated Customer Support team can assist you several languages that include English, Ukrainian, Russian, Polish, German, Romanian, Lithuanian and Turkish.

Customer support is available during working hours 5 days a week on live chat, email and by phone. Additionally, Ukrainian and Russian support is also available over the weekend.

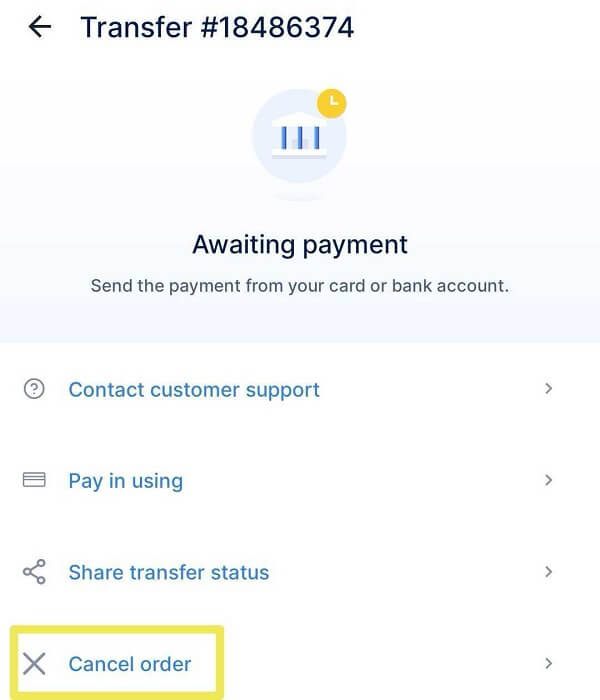

Can I cancel my TransferGo transfer?

Canceling your TransferGo transfer is possible, but depends on how far the money transfer has progressed.

If you created a money transfer order, but wish to not proceed, then simply do not send your payment to TransferGo. This will effectively cancel your pending order as it will expire.

For transfers currently in progress, you can click on Cancel Order from your TransferGo account, and they will process your cancellation.

How to cancel your money transfer with TransferGo

There are 2 circumstances in which you cannot cancel your money transfer yourself; these are:-

- TransferGo has received your funds for the transfer

- TransferGo has processed your payment

In such cases, you should contact TransferGo customer support immediately, and they will help you with the appropriate next steps.

You can review TransferGo's money transfer cancellation guidelines to further understand the nuances involved in case you need to ever cancel your transaction.

How do I delete my TransferGo account?

If you wish you delete your TransferGo account, you can contact their customer support team via email, phone or live chat, and they will assist you with your request.

Bear in mind that account deletion will mean that you will no longer have access to your transaction history. Hence, make sure to take a note of your past transactions before deleting your account.

Additional Information

Legal and Regulatory Compliance

TransferGo is a registered payment service provider and is supervised and regulated by various financial services boards and organizations in many countries. Some of these are listed below; you can check their website for more details.

- HM Revenue & Customs (HMRC) under the Money Laundering Regulations: 12667079

- UK Financial Conduct Authority (FCA) as an authorized payment institution: 600886.

- Bank of Lithuania with registration number 304871705, FI Code 32400

- ICO (Information Commissioner's Office) in the UK (registration number: Z316680X)

Helpful Links

- RemitFinder blog on sending money to Nigeria with TransferGo

- Quick and easy steps on how to do an online money transfer with TransferGo

- How TransferGo ensures data and money transfers are secure

- Very helpful article about FX industry and key terminology

- How long goes a bank transfer take

- How can TransferGo help businesses

- TransferGo's registration record with the UK Financial Conduct Authority (FCA)

Awards, Prizes and News

- TransferGo won the 2021 Startup of the Year Award with Start-up Lithuania

- TransferGo won the 2021 Cross-Border Solution of the Year on Global Payments Day

- TransferGo raised a further $50 million in 2021

- TransferGo celebrated 10 millionth transaction in 2021

- TransferGo opened first non-EU send market in Turkey 2021

- TransferGo was the 2017 MoneyAge Awards finalist

- TransferGo won the 2014 Silver innovation prize at HackOsaka in Japan

- TransferGo won the 2013 Most Innovative Business Talent Award from the most popular Lithuanian news portal Delfi and the Danish Chamber of Commerce

Deals

Reviews

Nice rate but the transfer speed is poor.