Why Are International Money Transfers So Expensive?

Table of Contents

- Introduction: International Money Transfers Can Be Costly

- What Is The Average Cost Of An International Money Transfer?

- What Types Of Fees And Charges Are Part Of International Remittance Cost?

- What Factors Make International Money Transfers Expensive?

- Reason #1: Higher FX Markup On Remittances

- Reason #2: Financial And Economic Landscape

- Reason #3: “Financial Distance” Between Countries

- Reason #4: Legal And Regulatory Compliance

- Reason #5: Frequently Or Rarely Traded Currencies

- Reason #6: Financial Institution Type

- Reason #7: Choice Of Payment And Delivery Methods

- How To Save On International Money Transfers?

- Tip #1: Compare Money Transfer Options

- Tip #2: Avoid Banks To Send Money Overseas

- Tip #3: P2P Apps Can Be Expensive

- Tip #4: Prefer Digital Payments Over Cash

- Tip #5: Choose Mobile Money For Payout

- Tip #6: Avoid Express Services For Faster Transfers

- Tip #7: Avoid Paying Internationally For Utility Services

- RemitFinder's Take On Future Outlook For Cost-Effective Transfers

- Conclusion: Navigating International Money Transfer Costs

Introduction: International Money Transfers Can Be Costly

When you send money overseas, you may have to pay transfer fees and other charges. These fees can sometimes be high, thereby putting a dent in your pocket. There are many factors that may contribute to the potentially high costs involved in sending money overseas.

In this article, we will explore why international money transfers can be costly and the underlying reasons that may cause that.

From exchange rate fluctuations and currency conversion fees to intermediary bank charges to regulatory compliance and payment and delivery option choices, we will discuss the many factors that drive up the expenses associated with sending money internationally.

Understanding these factors can be highly beneficial for individuals as well as businesses that wish to send money abroad or make international payments.

More importantly, we will share some proven strategies to minimize the impact of international money transfer fees so you can maximize the reach of your hard-earned money.

What Is The Average Cost Of An International Money Transfer?

Before we look into the reasons that contribute to making international money transfers expensive, let us first see the average cost of sending money overseas.

Based on data released by the World Bank1, the average cost of sending USD 200 abroad was 6.35% as of March 2024. Whilst this represents a slight decrease from the 6.39% in Q4 2023, it is still very high.

In fact, the G20 has a goal to lower the global average remittance cost to 5%. At the same time, the UN SDG (United Nations Sustainable Development Goal) objective is to bring this cost down to 3%.

The global average cost of remittances was 6.35% in Q1 2024. This is much higher than the 5% goal set by G20 and the 3% UN SDG objective.

In that sense, the current average remittance price of 6.35% is still fairly high compared to the above mentioned global goals.

The below graphic from the World Bank report represents the above facts and figures in a pictorial way.

Global average cost of sending international remittances in Q1 2024 - Source World Bank1

Global average cost of sending international remittances in Q1 2024 - Source World Bank1

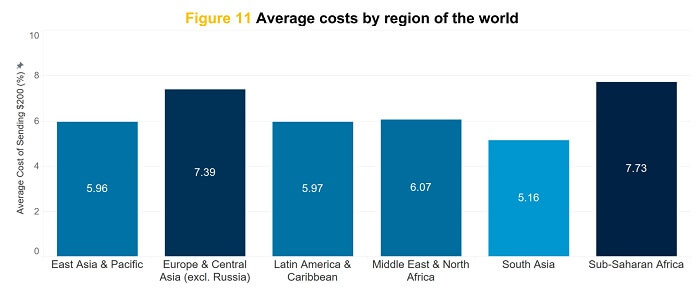

When we look at the regional variation in remittance costs, there is quite a bit of variation across the world.

Overall, South Asia has the lowest costs at 5.16% whilst Sub-Saharan Africa has the highest at 7.73%. This is perhaps not surprising - the massive rise of mobile payments in Asia may have contributed to lower money transfer costs whereas the lack of financial choices is likely driving the costs higher in Africa.

Regional cost of sending international remittances in Q1 2024 - Source World Bank1

Regional cost of sending international remittances in Q1 2024 - Source World Bank1

What is surprising though is the high cost of 7.39% in Europe and Central Asia. One would imagine that the proliferation of money transfer companies, banks and other financial institutions would drive remittance costs lower, but clearly this is not the case.

Next, let us understand what types of fees and charges are included in remittance cost.

What Types Of Fees And Charges Are Part Of International Remittance Cost?

When it comes to international money transfers, exchange rates and currency conversion fees play a significant role in determining the overall cost. Exchange rates refer to the value of one currency in relation to another, and they are constantly fluctuating due to various economic factors.

Financial institutions generally offer their own exchange rates, which are often lower than the market rates - this means that the rate you get will be lower than the mid-market rate as the provider will include a markup or spread to make a profit.

The markup charged by money transfer companies on the mid-market exchange rate means that your overseas recipient gets less money in their pocket. Since the funds lost to lower exchange rates are sometimes not easy to understand and see, the term hidden fee is often used to signify the cost of low exchange rates.

In addition, banks or money transfer companies often impose currency conversion fees for converting one currency into another. These fees can vary widely and may be applied as a percentage of the transfer amount or as a fixed fee.

International remittance cost includes currency conversion fees charged by financial institutions to move money abroad as well as hidden fees caused by lower exchange rates.

The combination of exchange rate markups and currency conversion fees can significantly impact the final amount received by your overseas recipient.

It is, therefore, important for individuals and businesses sending money internationally to consider these factors and compare various options before sending money overseas. Keeping an eye on exchange rates and choosing services with better rates and lower fees can help reduce the overall cost of international money transfers.

Now that we understand what the global and regional remittance costs are and what is included in the same, let us try to understand why sending money internationally can be so expensive at times.

What Factors Make International Money Transfers Expensive?

There can be many reasons why international remittances can be expensive; here are some factors that contribute to money transfer costs.

Reason #1: Higher FX Markup On Remittances

Most money transfer companies will price their service at an exchange rate that is lower than the mid-market or interbank exchange rate, which is the rate that big banks use to move billions abroad. The differential in exchange rates is called the FX Markup, or FX Spread, and represents the profit that the provider will make on the transaction.

Whilst is it totally obvious and normal for the money transfer operator to generate a profit as they also have a business to run, employees to pay and income to produce, how much profit (or how much FX Markup) depends on many factors, some of which include:

- Local remittance market conditions in the sending country: For example, the rise of mobile money continues to drive down cost in Asian markets.

- Money transfer choices and competition amongst providers: A good example of this is UK where neobanks are on the rise to compete with money transfer companies for a share of the remittance market.

- Lack of choices drives up costs: For instance, lack of financial choices in Africa contributes to relatively higher costs.

- Presence of large migrant communities: Case in point here would be the US where a large % of immigrants drive massive demand and the resulting competition levels the playing field.

Reason #2: Financial And Economic Landscape

The financial and economic policy of both the sending and receiving country have a major impact on the price of the money transfer.

Economic policy drives how much access people have to financial products and services. More open economies spur competition and many global and local players vie for consumer and business FX.

Hand in hand with economic policy goes regulation. In some countries, governments may ban outward remittances or put limits on how much money can be sent out. This restricts the free flow of money and makes its movement more expensive.

Financial relations between the sending and receiving countries can also play an important role. For example, many countries have double tax avoidance agreements (DTAAs) in place to help avoid double tax. This makes it easier for immigrants and businesses to move money back and forth without having to pay tax twice.

Reason #3: “Financial Distance” Between Countries

The “financial distance” between the sending and receiving countries significantly impacts the cost of money transfers between them. We define financial distance as an indicator of how many hops money has to make to reach from the source country to the destination country.

The less connected the financial systems of both countries are, the more hops money has to make, and the higher the price. The more connected payment systems are, less hops are needed and hence the price of moving money is lower.

Sending money internationally between “financially distant countries” involves additional hops with every participating bank or financial institution charging a fee. This drives the overall cost higher.

More hops mean more financial institutions and hence more fees. This plays out in 2 major ways when it comes to international money transfers:

- Intermediary banks involved in the transfer process charge fees.

- Correspondent banks get involved when the sending and receiving banks do not have a direct relationship and charge fees.

Reason #4: Legal And Regulatory Compliance

The legal and regulatory compliance cost of international money transfers is another factor that contributes to the higher cost of remittances.

First, money transfer companies and banks have to obtain money transmitter licenses in their countries of operation. This requires adherence to increasingly complex financial, legal and technical requirements to obtain licensing.

Additionally, they have to constantly ensure compliance to stay in good standing with financial watchdog institutions. This may mean implementing new and emerging financial standards and safety protocols.

Next, money transfer operators have to ensure compliance with anti-money laundering (AML) and other fraud prevention activities. In many countries, the implementation of Know Your Customer (KYC) procedures could be costly due to lack of electronic methods of ID verification and manual verification processes may have to be used instead.

All these factors contribute to the complexities of international money transfers. Implementing stringent AML measures and other security and safety protocols requires investments in technology, staff training, and infrastructure, which may be reflected in the fees charged by money transfer operators.

Reason #5: Frequently Or Rarely Traded Currencies

Another reason that contributes to the cost of international money transfers is how frequently, or rarely, traded the 2 currencies involved in the transfer are.

Major international currencies trade numerous times a day on the world's well-connected global payment gateways and are, therefore, cheaper to exchange.

As an example, sending money from US to India involves USD and INR, both of which are popular and frequently traded currencies. As a result, an exchange between these frequently traded currencies will be cheaper as compared to that between rarely traded currencies.

Additionally, sanctions or embargoes also impact how currencies trade. For example, during the Russia-Ukraine war, the Russian Ruble has been banned from most global payment gateways. Hence, even though the Ruble is frequently traded currency during normal times, it became a rarely traded currency due to the conflict.

Reason #6: Financial Institution Type

What type of financial institution is used to send money overseas also makes a big impact of how much the cost of the transfer is.

Banks, for example, are notorious in charging high fees on international money transfers. If you send money overseas with your bank, you may be charged many or all of the below fees:

- Outgoing international wire transfer fee charged by the sending bank

- Intermediary bank fees by banks involved in the transfer process

- Correspondent bank fees in case sending and receiving banks do not have a direct relationship

- Incoming international wire transfer fee charged by the receiving bank

Sending money overseas via banks may involve incurring outgoing international wire transfer fee, intermediary bank fees, correspondent bank fees and an incoming international wire transfer fee. This makes international bank wire transfers an expensive way to send money overseas.

In addition to high transfer fees, banks also generally charge 2-6% FX Markup on wire transfers. This further erodes the money you send overseas by reducing the final amount the overseas recipient will receive.

We recommend that you do not send money overseas with banks unless you have no other choice. In case you are forced to use a bank, make sure to compare various banks in your local region to ensure you get the best price.

Money transfer companies are a much better choice given their lower transfer fees and better exchange rates.

Reason #7: Choice Of Payment And Delivery Methods

Payment and delivery options also impact the cost of an international money transfer. A payment method is how you pay for your international remittance whilst a delivery method is how you decide to credit your overseas recipient.

Here are some general trends that we see related to payment and delivery methods:

- Digital payments are cheaper: Sending money into mobile wallets or cards is more cost-effective as compared to other digital methods like bank accounts or other non-digital methods like cash.

- Mobile money is most cost-effective: Mobile payments sent into mobile or digital wallets are slowly becoming a standard in many parts of the world due to their cost-effectiveness. In addition, mobile payments are lightning fast and tend to be very secure.

- Cash is more expensive: Sending and receiving cash is not only risky but also more expensive. This is because money transfer companies have to open branches or sub-contract local agents or offices that need facilities, staff and maintenance. All these factors drive the cost up.

- Faster or express services are more expensive: Many money transfer companies offer variable remittance speeds, often calling them standard or express delivery. Standard delivery is slower, but cheaper or even free, whereas express delivery is faster or even instant, but comes with a fee.

- Convenience services may not be cheap: Many money transfer companies offer convenience services like international bill pay, mobile top-ups, overseas tax payments and paying for services like rides, groceries and other services. Whilst these may be convenient, there are often fees associated with them.

Now that we have shared the top reasons why international money transfers can be expensive, we provide some guidance on how to save on international remittances.

How To Save On International Money Transfers?

Below we present our best advice to help you save money on your next international money transfer. This is based on our more than a decade long experience helping the global remittance community find the best ways to send money overseas.

Tip #1: Compare Money Transfer Options

With so many money transfer companies, banks and fintech startups competing for your business, it may seem overwhelming to decide who to go with in a bid to get the best exchange rate and low transfer fees.

A good approach is to compare numerous remittance companies. You can use RemitFinder to do this easily. Simply select your source and destination countries to compare many providers in an easy to understand format.

This will help you see which options get you the best return on your hard-earned money and help make the most of your international remittance.

Tip #2: Avoid Banks To Send Money Overseas

Banks usually charge high FX Markups as well as high transfer fees on international money transfers. When we did a case study to compare banks and money transfer companies, banks fared poorly in the comparison.

As a result, we recommend avoiding banks to send money abroad unless you have no other options. If you have to use a bank, we suggest at least comparing a few banks in your region to get the best deal.

Tip #3: P2P Apps Can Be Expensive

Peer-to-peer (P2P) mobile apps like PayPal, Venmo, CashApp and others are popular and convenient ways to send money to friends and family. Some of them, like PayPal, also support international money transfers.

However, when we compared PayPal to a money transfer company, we found it to be an expensive way to send money internationally.

We, therefore, recommend paying very close attention to P2P app exchange rates and fees if you prefer to use them given their convenience.

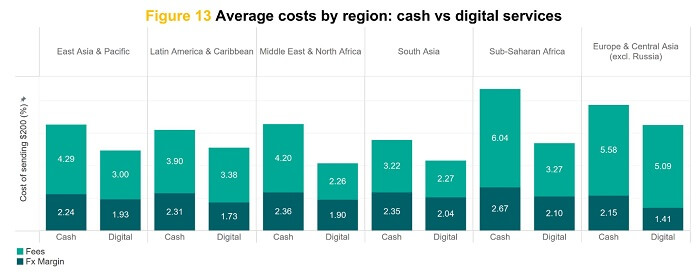

Tip #4: Prefer Digital Payments Over Cash

Based on data from the World Bank1, cash remittances are more costly as compared to digital ones. This is a uniform trend all over the world and applies to both FX margin costs and transfer fees.

Cost of sending international remittances using cash and digital methods in Q1 2024 - Source World Bank1

Cost of sending international remittances using cash and digital methods in Q1 2024 - Source World Bank1

Sometimes you may need to send cash for urgent situations, but be aware that you will end up paying more. Instead, plan ahead and use digital payments to make the most of your international remittance.

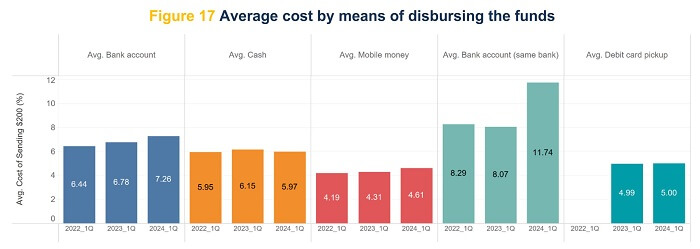

Tip #5: Choose Mobile Money For Payout

Most money transfer companies will present multiple options to pay your overseas recipient. Generally, you can choose between bank deposit, mobile money, cash pickup, card payments or even mobile top-up.

Based on data published by the World Bank1, mobile money is the cheapest of all available delivery options followed by debit cards.

Cost of sending international remittances for various delivery methods in Q1 2024 - Source World Bank1

Cost of sending international remittances for various delivery methods in Q1 2024 - Source World Bank1

We, therefore, recommend sending funds into your recipient's mobile wallet if they have one.

Tip #6: Avoid Express Services For Faster Transfers

Many money transfer operators offer express services for instant or faster payments. These, however, come at an added price.

We recommend avoiding express payments to save on the extra fees unless you have to rush money overseas urgently.

Tip #7: Avoid Paying Internationally For Utility Services

Some money transfer companies offer international bill pay and other services which offer convenience if you are away from your home country. However, these always come at an additional cost.

We suggest not using such services to make international bill and other payments to avoid paying the extra fees.

Most utilities offer free bill pay in local payment methods - you can, therefore, simply move money from overseas into your own or a relative's local account to pay for bills and utilities locally.

We hope that by utilizing these recommendations, you can save more on your international remittances.

RemitFinder's Take On Future Outlook For Cost-Effective Transfers

As noted earlier in our analysis, the current cost of 6.35% for international remittances is far above G20's goal of 5% and UN's SDG (Sustainable Development Goal) objective of 3%. Such high remittance costs continue to be a cause for concern for individuals as well as businesses alike.

Would we see more cost-effective and affordable international remittances in the future? At RemitFinder, we believe that we will, and here are some reasons why we think so.

1. Increased Competition And Expansion

Technology breaks down many barriers to entry in business, and this could not be truer in the fintech world where the global financial landscape is booming with numerous startups.

We believe that with more companies entering the remittance marketplace, the increased competition will drive prices down. Additionally, as money transfer companies expand into more regions and serve more corridors, they will have to compete on pricing and quality of service with incumbents.

2. Continued Rise Of Financial Inclusion

Residents in many parts of the world do not have enough financial choices. Whether due to past political and economic policies, or monopolistic situations, there are still many who have limited choices when it comes to banking and payments.

As financial inclusion continues to increase in the future, spurred by technological advancements and mobile penetration, we believe that the cost of remittances will continue to go down in parallel.

3. Newer Ways To Move Money Overseas

With Fintech innovation happening at a rapid pace, we believe that international payments will continue to be more streamlined, convenient, accessible, fast and cost-effective.

Some areas where we feel innovative ideas will surface in the international FX and payments space will be instant messaging (IM) payments, cashless payments with mobile money leading the way, newer local payment and delivery methods that are more cost-effective and identification mechanisms like retina scans.

We also feel that blockchain technology will see wider adoption for umpteen use cases, remittances included. If this happens, the cost of international money transfers will decrease as blockchain provides economies of scale.

4. Big Banks And Governments Join In

We believe that big banks and governments will join in to become remittance players in a highly competitive ecosystem.

As money transfer companies continue to take the lead in the international money transfer space, first banks, and then governments, will modernize their systems and infrastructure to vie for both consumer and business international remittances.

5. Interoperability And Open APIs

As the international money transfer space will become more crowded with various players, we believe that new standards and specifications will emerge that will help create interoperability within a diversified remittance ecosystem.

Open standards will help interconnect payment systems and gateways using APIs (application programming interfaces) to foster an even faster, easier and cheaper movement of money across the globe.

6. Financial Regulatory Reforms

Financial watchdog institutions and governments will come together to streamline regulatory procedures and further increase the safety and security of money transfers to protect both customers' money as well as private information.

Consequently, regulatory reforms will reduce the burden on money transfer companies to some extent and hence help drive remittance cost lower. These reforms will also increase transparency and further reduce cost to entry and hence increase competition.

RemitFinder believes that remittance cost will continue to steadily decline in the future due to technological advancements, increased competition, newer ways to send and receive money, and regulatory reforms.

Conclusion: Navigating International Money Transfer Costs

The high cost of international remittances, at 6.35% as of Q1 2024, continues to be a cause for concern for individuals as well as businesses. This cost is far above the G20 goal of 5% and UN SDG (Sustainable Development Goal) objective of 3%.

Numerous reasons contribute to the high costs of remittances including lack of competition and financial inclusion, monopolistic situations in certain markets, traditional banks charging high fees, costly regulatory and legal compliance and the financial distance between involved countries.

That said, there are many ways you can save on high remittance costs. Some best practices that we recommend include comparing money transfer services, avoiding costly bank and P2P transfers, choosing payment and delivery options wisely and avoiding cash remittances.

Finally, we believe that with continued technical innovation, remittance cost will continue to decline as more competition sets in due to ever-increasing mobile penetration and financial inclusion. Newer ways to send and receive money, coupled with regulatory reforms in the international money transfer space will help drive costs down further.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

References:

1. World Bank data on worldwide remittance prices - Issue 49, March 2024

Categories

Similar Articles

US Big Beautiful Bill's Impact On Remittances

The Big Beautiful Bill has been passed in the US, and remittances are impacted. Learn how the Bill impacts remittances and what to do if you are affected by the new law.

Bangladesh Remittance Cash Incentive: All You Need To Know

Are you an overseas Bangladeshi resident who sends money home to your loved ones? Read on to learn how to earn an additional 2.5% cash on your international remittances sent to Bangladesh.

How Fintech Is Pushing Banks Out Of The Remittance Business

The fintech revolution is disrupting the international remittance business. Discover how innovative startups are reshaping the international money transfer industry and challenging traditional banks.