Popular Mobile Wallets Across The World

Table of Contents

- What Are Mobile Wallets And How Do They Work?

- What Is A Mobile Wallet?

- How Does A Mobile Wallet Work?

- How Can I Setup and Use A Mobile Wallet?

- What Are The Benefits Of A Mobile Wallet?

- Mobile Wallet Adoption and Growth Statistics

- What Are The Popular Mobile Wallets In Asia Pacific?

- What Are The Popular Mobile Wallets In North America?

- What Are The Popular Mobile Wallets In Middle East And Africa?

- What Are The Popular Mobile Wallets In Latin America?

- Pix: Empowering Cashless Payments In Brazil

- Mercado Pago: Fostering Financial Inclusion Across Latin America

- What Are The Popular Mobile Wallets In Europe?

- World's Most Popular Mobile Wallets - Summary

- Future Trends: RemitFinder's Take On What Lies Ahead For Mobile Wallets

- Digital Wallet market share will continue to increase

- Newer wallet providers will come to the horizon

- Additional focus on security and safety

- Wallet interoperability will be an area of focus

- Emerging technologies merging with wallets

- Wallets will provide additional value added services

- Conclusion: Mobile Wallets Critical To Global Cashless Economy

In today's increasingly inter-connected global digital economy, the way we handle money and make payments has undergone a significant transformation.

Mobile wallets have emerged as a convenient and secure alternative to traditional payment methods, allowing users to store their payment information digitally on their smartphones. This rise of mobile wallets can be attributed to the increasing adoption of smartphones, the growing preference for contactless transactions, and the need for greater convenience in our daily lives.

Mobile wallets offer a wide range of features, including the ability to make in-store as well as online purchases, send and receive money, pay bills, and even store rewards points and loyalty cards.

With advanced security measures such as encryption and biometric authentication, mobile wallets have gained users' trust and become an integral part of the modern financial ecosystem. As more people embrace the convenience and flexibility offered by mobile wallets, they are reshaping how we handle money and paving the way for a cashless society.

What Are Mobile Wallets And How Do They Work?

Mobile wallets have become increasingly popular as a convenient and secure digital payment method. But what exactly are mobile wallets, and how do they work?

What Is A Mobile Wallet?

A mobile wallet is a digital application, service or product that allow users to store their payment information, such as credit or debit card details, securely on their smartphones. It is a virtual wallet that can be used to make various transactions that include in-store purchases, online shopping, peer-to-peer transfers, bill payments, and more.

A mobile wallet is an electronic payment method whereby your mobile phone can be used as a virtual wallet to conduct various types of financial transactions.

How Does A Mobile Wallet Work?

Mobile wallets can work in various ways, depending on the underlying technology and infrastructure.

Some mobile wallets utilize Near Field Communication (NFC) technology, allowing users to make contactless payments by tapping their smartphones against compatible payment terminals. Others use barcode or QR code scanning for transactions.

Additionally, some mobile wallets integrate with online platforms and digital services, enabling seamless and secure online transactions.

Generally, mobile wallets are not limited to specific operating systems or brands. They are available across various platforms, including iOS and Android, and are offered by a wide range of providers, including financial institutions, technology companies, and even mobile network operators.

How Can I Setup and Use A Mobile Wallet?

Setting up and using a mobile wallet typically involves a few simple steps.

First, install your chosen mobile wallet application from a trusted source, usually from an app store. Once installed, you will be required to set up an account and securely link your preferred payment methods, such as credit or debit cards, bank accounts, or in some cases, even digital currencies.

To make a payment, you can simply open the mobile wallet app, select the desired payment method, and authenticate the transaction using a PIN, fingerprint, or facial recognition, depending on the device's capabilities. The mobile wallet then securely transmits the payment information to the merchant or recipient, completing the transaction in real time.

What Are The Benefits Of A Mobile Wallet?

One of the key advantages of mobile wallets is their convenience. They eliminate the need to carry physical wallets or cards, as all the payment information is stored securely on your smartphone.

Mobile wallets also offer useful security measures, such as multi-factor authentication (MFA) and encryption, to protect sensitive payment data and prevent unauthorized access.

Furthermore, mobile wallets often provide additional features like transaction history tracking, loyalty program integration, and personalized offers and discounts, enhancing the overall payment experience for users.

Key benefits of mobile wallets include convenience, protection of sensitive payment data, enhanced security and additional features like discounts and loyalty programs.

Mobile Wallet Adoption and Growth Statistics

Mobile Wallets have enjoyed tremendous growth and adoption across the world.

This should be no surprise as mobile wallets obviate the need to share underlying payment methods like bank accounts, debit cards and credit cards, thereby making the payment experience safer and more convenient.

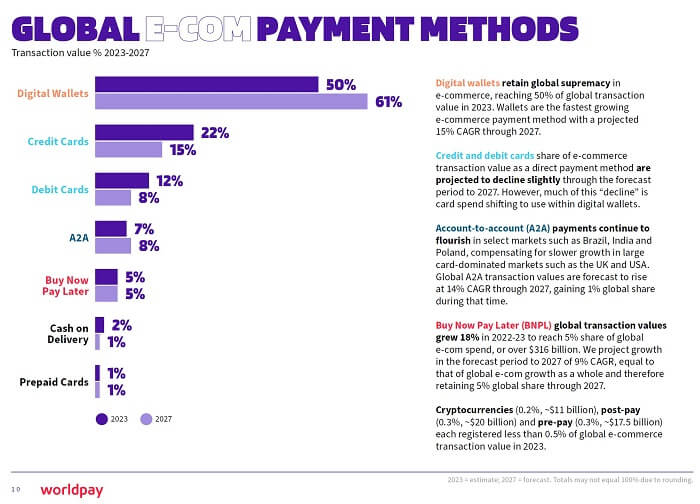

As per the Global Payments Report 20241, published by Worldpay, digital wallets led global e-commerce spending by capturing a whopping 50% market share. This represented over USD 3.1 trillion spent using digital wallets worldwide. It is projected that digital wallet share of global e-commerce will increase to 61% by 2027.

Market share of various payment methods in 2023 with projections for 2027 - Source worldpay.com1

Market share of various payment methods in 2023 with projections for 2027 - Source worldpay.com1

In 2023, digital wallets accounted for 50% of all consumer e-commerce spending across the world. This amounted to a combined transaction value of USD 3.1 trillion spent using wallets.

Now that we have established an understanding of what mobile wallets are and how they work, let us look at the world's most popular mobile wallets. We will segment them by major continents and regions of the world.

What Are The Popular Mobile Wallets In Asia Pacific?

Asia Pacific has been the global leader in mobile wallet adoption with 70% of all spending done via digital wallets1 in 2023. This is projected to grow to 77% by 2027.

Two of the world's fastest growing economies, China and India, lead the way with 82% and 56% payments handled by digital wallets, respectively. And the good news is that many other Asia Pacific countries are already far ahead in mobile wallet adoption; highlights include GCash in the Philippines and GrabPay in Singapore.

Below are some of Asia Pacific's most popular mobile wallets:

- Alipay: China's most popular mobile wallet with support for 18 foreign currencies.

- WeChat Pay: Driving payments across China and 49 other countries.

- Paytm: India's most used mobile wallet with support for 12 foreign currencies.

- PhonePe: India's popular and fastest growing mobile wallet with acceptance in 6 overseas countries.

- GCash: Driver of Philippines cashless digital economy with recently launched overseas support for 14 countries.

- GrabPay: Singapore's leader in mobile payments with support for total 8 countries.

- AliPayHK: Alipay's mobile wallet for Hong Kong with acceptance in many other Asian countries.

- KakaoPay: South Korea's most popularly used digital wallet.

What Are The Popular Mobile Wallets In North America?

North America continues to see good mobile wallet adoption with 37% market share1 captured by wallets in 2023; this is projected to grow to 51% by 2027.

Dominant players in the NorAm mobile wallet space include bit tech companies like Apple, Google and Samsung. These tech giants own both hardware and software for mobile devices, so it is organic evolution for them to enter the mobile wallet realm.

In addition, PayPal is also strong in North America as well as the rest of the world as a popular choice for digital payments and sending money to family and friends.

Here are the top mobile wallets in North America:

- Apple Pay: Harness Apple's payment infrastructure on all iOS devices in more than 50 countries all over the world.

- Google Pay: Rely on Google Pay to make purchases in many parts of the world on any device, obviously including Android phone, wearables and tablets.

- Samsung Pay: Choose Samsung Pay for Samsung phones and wearables with flexibility to make payments across more than 25 countries.

- PayPal: The most popular mobile wallet across the globe with support in almost every country on the planet.

- Venmo: Convenient peer-to-peer (P2P) cashless payments across the US.

- Cash App: Another streamlined digital payment method that works in both the US and UK.

What Are The Popular Mobile Wallets In Middle East And Africa?

Middle East and Africa continues to be a major success story when it comes to mobile wallets. This is demonstrated by 23% digital wallet market share1 in 2023, with projections to grow to 34% by 2027.

Whilst the numbers above may not look staggering, they are highly important because mobile wallets have significantly improved financial inclusion in Middle East and Africa. Due to various historical reasons, residents of this region have had fewer financial choices, and mobile wallets have dramatically changed that.

Thanks to an ever increasing mobile penetration and usage, mobile money has taken off in Middle East and Africa in a big way. It is, thus, not a major surprise that the dominant mobile wallets in this region are owned and operated by telecom and mobile operators.

Check out the most popular mobile wallets in Middle East and Africa below.

- M-Pesa: Streamlining mobile payments in Africa since 2007 with launch in Kenya and expansion to 6 additional countries.

- Airtel Money: Used by 38 million customers in Africa and a driver of financial inclusion since its inception in 2017.

- MTN Mobile Money (MoMo): Boasting 50 million users in more than 10 African countries, MoMo helps give everyone access to mobile money.

- Orange Money: Actively used by users in more than 15 countries, Orange Money has put a lot of focus on payment interoperability to maximize its value to users.

- VodaPay: South Africa's popular mobile wallet that is owned and operated by Vodacom, with plans to launch in additional countries in the future.

What Are The Popular Mobile Wallets In Latin America?

Latin America is witnessing a similar payment revolution as witnessed in other parts of the world like Africa and Asia. Mobile and digital wallets are increasingly becoming popular with significant adoption in various countries.

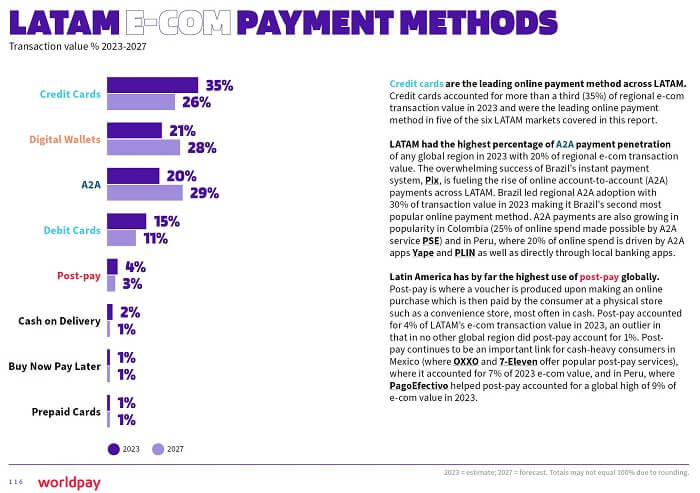

In 2023, Latin America saw a healthy growth in digital wallet usage with 21% of all e-commerce spending funded by wallets. This number is expected to grow to 28% by 2027.

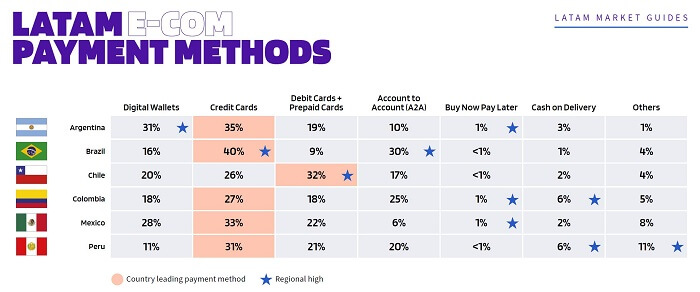

Market share of various payment methods in Latin America in 2023 with projections for 2027 - Source worldpay.com1

Market share of various payment methods in Latin America in 2023 with projections for 2027 - Source worldpay.com1

In addition to making payments and money transfers easier, more secure and seamless, mobile wallets help drive much needed financial inclusion forward in Latin America as well, enabling millions to partake in the globally connected digital economy of today.

When it comes to digital wallet adoption in various Latin American countries, Argentina and Mexico lead the way with wallets taking 31% and 28% market share, respectively. The popularity of Pix in Brazil has been promising and it is expected that mobile wallet usage in Brazil will continue to prosper.

Market share of various payment methods for countries in Latin America in 2023 - Source worldpay.com1

Market share of various payment methods for countries in Latin America in 2023 - Source worldpay.com1

Let us take a look at the popular mobile wallets prevalent in Latin America.

Pix: Empowering Cashless Payments In Brazil

Pix is Brazil's homegrown mobile wallet that is owned and operated by the Banco Central do Brasil (BCB) and launched as part of its endeavor to further advance the instant payment (IP) ecosystem within Brazil.

Since its launch in 2020, Pix has grown by leaps and bounds, and processes 6 billion monthly transactions as of May 2024. This amounts to a total handling of BRL 2.13 trillion in a month.

Key advantages of Pix include a Pix alias that can be any unique ID to hide revealing bank or card information, 24x7 access and transactions that finish in seconds. Pix provides support for a variety of payment needs that include purchases, bill payments, scheduled transactions and cash withdrawal.

Countries served by Pix include:

- Brazil

- Money transfers and remittances can be sent to a Pix wallet from many other countries

Mercado Pago: Fostering Financial Inclusion Across Latin America

Mercado Pago was launched by Mercado Libre, an Argentinian company that owns and operates online marketplaces that specialize in online auctions and e-commerce.

Mercado Libre has various financial products that serve hundreds of millions of Latin American users. Launching a mobile payment service like Mercado Pago was a strategic decision for Mercado Libre as the Mercado Pago wallet introduced new payment method to the overall platform, thereby making it easier for customers to pay.

Mercado Pago is a complete mobile wallet that allows you to not only make purchases offline as well as online, but also pay bills, make money transfers, receive payments and much more.

Countries served by Mercado Pago include:

- Brazil, Argentina, Mexico, Chile, Colombia, Peru and Uruguay

What Are The Popular Mobile Wallets In Europe?

The European mobile wallet landscape is dominated by PayPal, Apple Pay, Google Pay, and to some extent Samsung Pay, the big four, as we like to call them. To read more about these mobile wallets, check out our article on the most popular mobile wallets in North America.

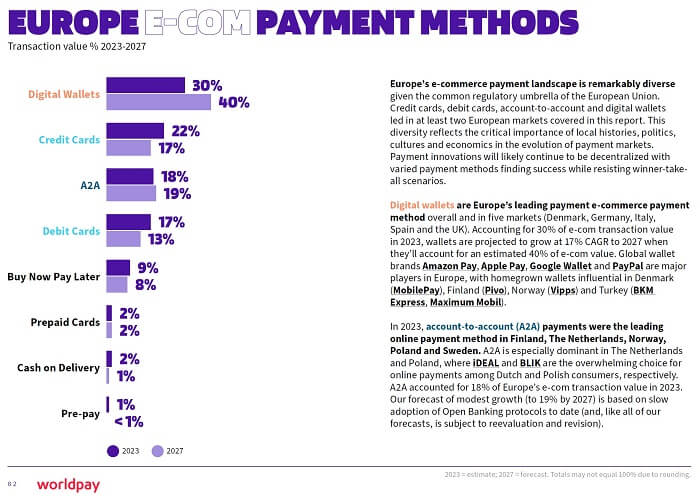

In 2023, digital wallets clocked a healthy 30% market share amongst all e-commerce spending in Europe, with projections to grow to 40% by 2027.

Market share of various payment methods in Europe in 2023 with projections for 2027 - Source worldpay.com1

Market share of various payment methods in Europe in 2023 with projections for 2027 - Source worldpay.com1

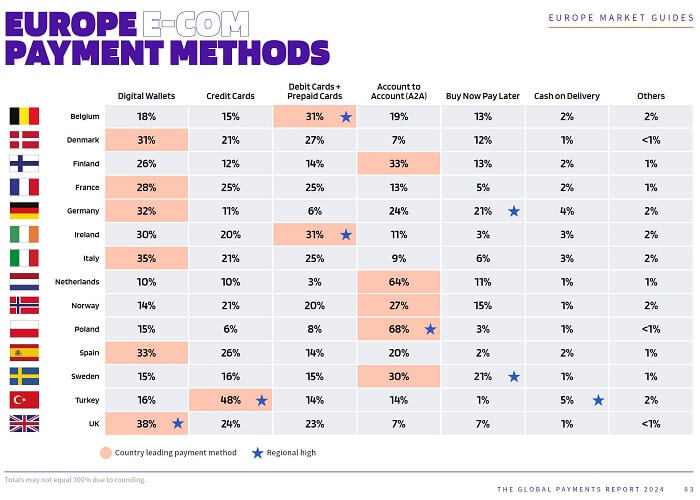

Looking at various country's market share for digital wallet usage within Europe, UK was the highest with 38% market share, closely followed by Italy with 35%, Spain with 33%, Germany with 32% and Denmark with 31%.

Market share of various payment methods for countries in Europe in 2023 - Source worldpay.com1

Market share of various payment methods for countries in Europe in 2023 - Source worldpay.com1

Europe's digital wallet market share in 2023 was 30% with UK, Italy, Spain, Germany and Denmark all enjoying e-commerce spending with digital wallets around one-third of possible payment methods.

Even through there are some local, country-specific mobile and digital wallets in various European countries, PayPal is still the most widely used digital payment method across Europe, followed by Apple Pay, Google Pay and Samsung Pay.

That said, it will be interesting to watch the European mobile wallet ecosystem in the upcoming years to see if local challengers can become big enough to grab a sizable market share from the big global players.

World's Most Popular Mobile Wallets - Summary

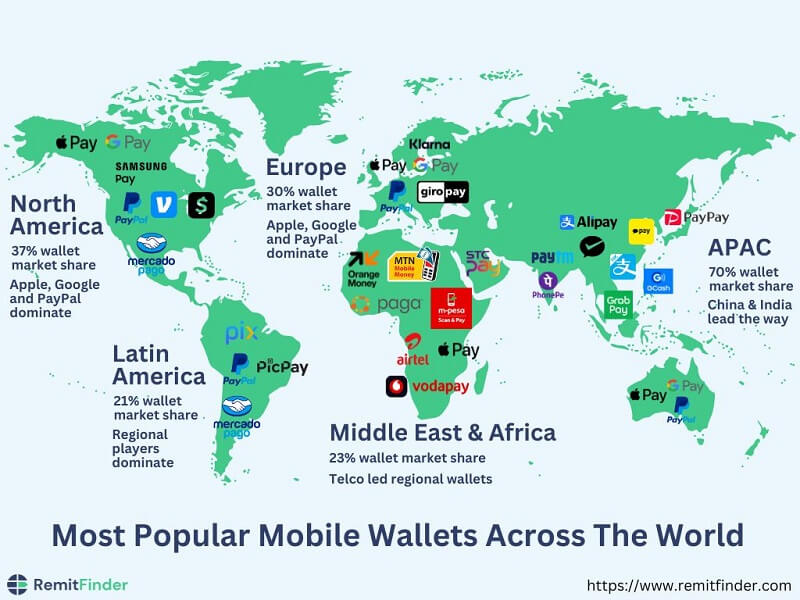

In the prior sections, we have presented comprehensive information on the most popular mobile wallets across the world with a regional focus by covering all the major continents of the world.

This is a lot of information to digest, and to make it easier to consume it in summary form, we have created an infographic that shows all the popular mobile wallets across various parts of the world.

Feel free to download this summary of the world's most popular mobile wallets as a high fidelity infographic for your reference or sharing.

Future Trends: RemitFinder's Take On What Lies Ahead For Mobile Wallets

In the coming years, mobile wallets are expected to undergo significant advancements and shape the future of digital transactions. Here are some of our thoughts on what to expect from mobile wallets in the coming years.

Digital Wallet market share will continue to increase

We expect the total market share of digital wallets to continue to increase globally. According to Worldpay1, digital wallet market share is expected to increase to 61% by 2027. That means, almost 2 in 3 transactions will be empowered by digital wallets.

Digital wallets are here to stay, and they will dominate how we pay all over the world. Future projections show increased market share for digital wallet spending and purchases.

Newer wallet providers will come to the horizon

The traditional digital wallet market has been dominated by mobile manufacturers and telecom companies. This is evident in North America where Apple, Google and Samsung have dominant market shares, as well as in Middle East and Africa where telecom companies led the way to mobile penetration and hence mobile wallet adoption.

But as digital wallet adoption continues to grow, we anticipate technology companies, banks and other financial institutions to continue to enter the digital wallet market. We also expect smaller, regional digital markets to continue to improve their products and increase adoption, thereby giving stiff competition to global players.

Additional focus on security and safety

With widespread adoption comes more risk. Hackers and fraudsters will continue to find newer ways to trick, defraud and hack the digital wallet ecosystem.

To combat these nefarious activities, enhanced security features like biometric authentication will become more prevalent, ensuring secure and seamless transactions.

Wallet interoperability will be an area of focus

As the sheer number of digital wallets continue to increase, the issue of interoperability will become more prominent. For example, if you travel frequently, you would rather prefer your local mobile wallet to work internationally instead of using regional wallets in each destination.

Proliferation will lead to emergence of new standards and interoperability amongst digital wallets. Wallet providers that comply with new interoperability standards will capture more market shares, and non-interoperable wallets will slowly die out.

Emerging technologies merging with wallets

Integration with emerging technologies such as blockchain and decentralized finance (DeFi) will expand the functionalities of mobile wallets, offering access to additional financial services. Contactless payments will gain further popularity, and mobile wallets will integrate with IoT devices and wearables for a more seamless payment experience.

Wallets will provide additional value added services

Loyalty programs will be incorporated into mobile wallets, providing users with rewards and incentives. Additionally, mobile wallets will facilitate seamless cross-border transactions, simplifying international payments.

These trends collectively point to a future where mobile wallets become even more versatile, secure, and widely adopted, transforming the way we transact in the digital age.

Conclusion: Mobile Wallets Critical To Global Cashless Economy

In conclusion, mobile wallets have become an integral part of our everyday lives, offering convenience, security, and versatility in digital transactions.

In this article, we explored popular mobile wallets from across the world, each with its unique features and functionalities. From global giants like Apple Pay, Google Pay, and PayPal to regional leaders like Alipay, WeChat Pay, and Paytm, these mobile wallets have revolutionized the way we pay, transfer money, and manage our finances.

Mobile wallets have simplified transactions, eliminated the need for physical wallets, and transformed the financial landscape.

As we look ahead, the future of mobile wallets holds even more exciting possibilities, including enhanced security features, integration with emerging technologies, and seamless cross-border transactions.

With the continued advancement of technology and the growing acceptance of cashless payments, mobile wallets are poised to play an even more significant role in our digital lives, shaping the way we transact and interact with money.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

References:

1. Global Payments Report 2024 published by Worldpay.

Categories

Similar Articles

What Is PayID And How Does It Work?

If you send or receive money in Australia, say goodbye to complex bank details. Use PayID and experience hassle-free payments. PayID has revolutionized the payment experience in Australia – learn all about it.

Complete Guide To Cash App Limits

Cash App is convenient and easy to use, but there are limits you should be aware of. Our comprehensive guide to Cash App limits has all you need to know to maximize the value of your account.

Complete Guide To Cash App Fees And Charges

Ready to take control of your Cash App experience and avoid costly fees? Our complete guide to fees and charges covers everything you need to know - from transaction fees to monthly fees and more.