Tax Treatment On Sale Of Property By NRI In India

Table of Contents

- How To Determine Residential Status In India For Tax Purposes?

- Do NRIs Have To Pay Tax On Property Sale In India?

- What Types Of Capital Gains Apply To NRI Property Sales In India?

- How To Calculate Capital Gains On Property Sale In India?

- What Is Cost Inflation Index And How To Use It For Capital Gains Calculation?

- Is Property Sale In India By An NRI Subject to Tax Deducted At Source (TDS)?

- Who Deducts TDS On Property Sale In India?

- What Is A TAN (Tax Deduction and Collection Account Number)?

- What Is TDS Rate For Property Sale In India?

- Can An NRI Qualify For Lower TDS Rate?

- What Is A TDS Certificate?

- Is There A Timeline For TDS Payment?

- Does An NRI Have File A Tax Return For Property Sale In India?

- What Are The Rules For Repatriation Of Sale Proceeds And Foreign Exchange Regulations?

- Useful Tips For NRIs Selling Property In India

- Conclusion

The sale of property by Non-Resident Indians (NRIs) in India is subject to subject to tax treatment and related legal considerations. Understanding the tax treatment is essential for NRIs looking to sell their property and ensure compliance with the tax obligations in India.

This article provides an overview of the tax treatment on the sale of property by NRIs in India. We will cover important topics like residential status definition and determination, capital gains tax implications, tax deductions, TDS requirements, repatriation of sale proceeds and other pertinent aspects.

By familiarizing themselves with applicable rules and regulations, NRIs can manage their tax liabilities, ensure compliance and make informed decisions when selling property in India.

How To Determine Residential Status In India For Tax Purposes?

The residential status of a person plays a crucial role in determining their tax obligations when it comes to the sale of property in India.

The tax implications differ based on whether an individual is classified as a Resident or Non-Resident for tax purposes.

It is important to note that residency for tax purposes is very different from nationality or citizenship. For example, a foreigner can be a resident and liable to pay taxes whilst an Indian citizen can be a non-resident for tax purposes. The following section will make the distinction absolutely clear.

Here is an overview of the residential status for tax purposes:

- Resident: A person is considered a resident if they meet one of the following requirements:

- Stayed in India for 182 days or more in the applicable financial year (April 01 to March 31).

- Stayed in India for 365 days or more over the past four years, and 60 days or more in the applicable financial year. This condition does not apply to Citizens of India or People of Indian Origin (PIO) who visit India, or Indians employed overseas, or Indians who are crew members of Indian ships.

- Non-Resident: A person who do not meet the above residency criteria is classified as Non-Residents for tax purposes. In general, anyone who has not stayed in India for at least 182 days in a financial year is considered a Non-Resident.

Make sure you correctly understand and determine your tax residency status in India if you wish to sell property as an NRI from overseas.

In the following sections, we will deep dive into tax implications for property sale by Non-Resident Indians (NRIs).

Do NRIs Have To Pay Tax On Property Sale In India?

If you are an NRI who wishes to sell or has sold property in India, you likely qualify as a non-resident for tax purposes. See the above section to determine your residency status.

The Indian tax law is pretty clear about taxation on property sale in India by NRIs.

Any capital gains from sale of property by non-residents in India are taxable in India. This is because the immovable property is located in India and hence capital gains from it arise in India, and therefore, are taxable in the country.

If you are an NRI and you sell immovable property in India, you will need to pay taxes on capital gains resulting from the sale.

In fact, capital gains from property sale in India are also taxable for residents. There are, however, specifics that non-residents need to be aware of. Before we get into that, let us look at the 2 types of capital gain that your property sale in India might be subject to.

What Types Of Capital Gains Apply To NRI Property Sales In India?

Non-Resident Indians (NRIs) selling property in India have to pay capital gains tax on the profit made from the sale. The capital gains are of 2 types - long-term or short-term capital gains.

Here is an overview of both types of capital gains for NRI property sales:

- Long-Term Capital Gains: If an NRI holds the property for more than two years before selling it, the resulting gains are considered long-term capital gains (LTCG). The tax rate for LTCG is 20% (plus any applicable surcharge).

- Short-Term Capital Gains: If the property is held for two years or less before being sold, any profits earned are classified as short-term capital gains (STCG). STCG is taxable at the individual's applicable income tax slab rate.

If you are an NRI selling property in India, your gains from the sale will qualify as Long-Term Capital Gains if you have held the asset for more than 2 years. Otherwise, the gains will be Short-Term Capital Gains. Both types of capital gains attract different tax treatment.

It may seem that Long-Term Capital Gains may be more favorable due to lower tax rate applicable on them. That said, you should always consult a tax professional for expert advice for your unique situation.

How To Calculate Capital Gains On Property Sale In India?

If you are an NRI who sells property in India, you will need to calculate your capital gains on the sale. Here is how you can do the same for both types of capital gains (short-term as well as long-term).

Short-Term Capital Gains

If you have held the property for less than 2 years, the gains will be Short-Term Capital Gains and are calculated as below.

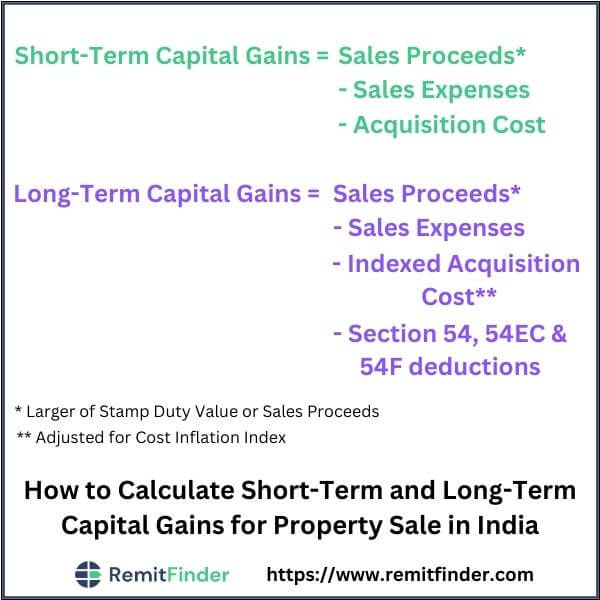

Short-Term Capital Gains = Sales Proceeds - Sales Expenses - Acquisition Cost

Here are some important points to keep in mind in regards to the above calculation for Short-Term Capital Gains:

- If the Stamp Duty Value for the sale is higher than the Sales Proceeds, then it should be used instead.

- Acquisition Cost includes purchase price of the property plus cost of improvements made to it.

- If the property was acquired via inheritance, gift, will, partition of HUF (Hindu Undivided Family) or related means, acquisition cost will be either the acquisition cost of the previous owner or FMV (fair market value) of the property as on April 1, 2001, whichever is later.

Long-Term Capital Gains

If you have owned the property for more than 2 years, any profits from the sale will be considered Long-Term Capital Gains and are calculated as below.

Long-Term Capital Gains = Sales Proceeds - Sales Expenses - Indexed Acquisition Cost - Deductions under sections 54, 54EC and 54F

All the points we mentioned above for Short-Term Capital Gains calculation also apply to Long-Term Capital Gains computation. In addition, the below apply as well:

- Indexed Acquisition Cost is a benefit provided to taxpayers by the Government of India to account for the cost of inflation. For details on Cost Inflation Index (CII), see a following section.

- You may be able to claim certain deductions under Sections 54, 54EC and 54F of the Indian Income Tax Act - we provide more details on these in a following section.

The below infographic represents the above calculations in an easy to reference pictorial format.

As you can see, it is not difficult to calculate capital gains on property sale in India as long as you know various caveats; we will continue to unravel various gotchas in sections below.

What Is Cost Inflation Index And How To Use It For Capital Gains Calculation?

If you are an NRI who has sold property in India or are thinking of doing so, and if you have had ownership of that property for more than 2 years, any gains from the sale qualify as Long-Term Capital Gains.

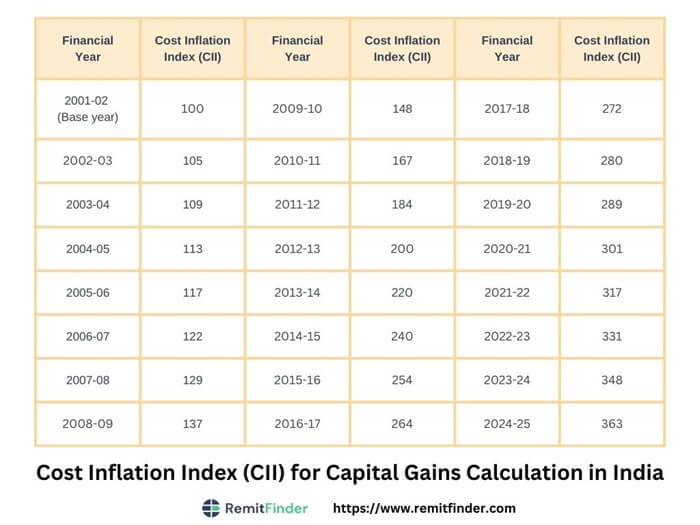

The good news is that the Government of India allows adjusting the acquisition cost of assets for the purpose of Long-Term Capital Gains calculation by accounting for inflation. This adjustment is done by applying an index called the Cost Inflation Index (CII).

Cost Inflation Index (CII) is an adjustment to account for inflation so that taxpayers can boost their acquisition cost for assets held long-term, i.e., more than 2 years.

The below graphic shows the Cost Inflation Index values for various financial years from its inception since FY 2001-2002, called the Base Year. Note that CII for the Base Year of FY 2001-2002 is 100.

How To Apply Cost Inflation Index (CII) To Asset Acquisition Cost?

Recall that if your property qualifies for Long-Term Capital Gains, you can apply indexation to adjust the acquisition cost.

Here is how to calculate the Indexed Acquisition Cost for your property by using the Cost Inflation Index (CII).

Indexed Acquisition Cost = Original acquisition cost * CII for year of sale / CII for acquisition year or for 2001-2002, whichever is later

Let us undertake a couple of case studies in to demonstrate the application of the above formula to calculate the adjusted acquisition cost of assets that qualify for Long-Term Capital Gains.

Case Study 1 - Assets acquired after FY 2001-2002

Let us assume that you acquired a property in India in FY 2004-2005 for INR 100,000 and sold it in FY 2020-2021. Below is how you can calculate your adjusted acquisition cost.

Indexed Acquisition Cost = INR 100,000 * 301 (CII for FY 2020-2021) / 113 (CII for FY 2004-2005) = INR 266,371.68

This means that you can use your Indexed Acquisition Cost of INR 266,371.68 (instead of the original acquisition cost of INR 100,000) when calculating your Long-Term Capital Gains for this property.

Case Study 2 - Assets acquired before FY 2001-2002

In this case study, we will assume that you bought a house in India in FY 1998-1999 for INR 100,000 and sold it in FY 2022-2023. Let us also assume that the FMV of your house on April 1, 2001 was INR 105,000.

Below is how you can calculate your adjusted acquisition cost.

Indexed Acquisition Cost = INR 105,000 (FMV in Base Year) * 331 (CII for FY 2022-2023) / 100 (CII for FY 2001-2002) = INR 34,755,000.

You can, therefore, use the Indexed Acquisition Cost of INR 34,755,000 (instead of the original acquisition cost of INR 100,000) when calculating your Long-Term Capital Gains for this house.

Applying the Cost Inflation Index (CII) to assets that are held long-term helps to increase their acquisition cost by accounting for inflation. This helps reduce your Long-Term Capital Gains on such assets and lowers your tax liability.

Is Property Sale In India By An NRI Subject to Tax Deducted At Source (TDS)?

If you are an NRI who sells property in India, the buyer is required to withhold Tax Deducted at Source, also called TDS for short. TDS serves as a mechanism to ensure tax compliance by NRIs and is an essential requirement in property transactions.

Below we present some key points regarding TDS requirements for NRI property sales in India.

Who Deducts TDS On Property Sale In India?

The buyer of the property is responsible for deducting TDS and depositing it to the Indian Government. To deduct TDS, the buyer must obtain a TAN (Tax Deduction and Collection Account Number) and mention it on the TDS certificate that is filed with the tax authorities.

What Is A TAN (Tax Deduction and Collection Account Number)?

A TAN (Tax Deduction and Collection Account Number) is a 10-digit account number issued by the Income Tax Department (ITD) of India to anyone who is required to deduct or collect tax at source. It is mandatory to list the TAN in all TDS transactions.

What Is TDS Rate For Property Sale In India?

The TDS rate applicable to NRIs selling property is generally 20% for Long-Term Capital Gains (LTCG) and 30% for Short-Term Capital Gains (STCG).

Can An NRI Qualify For Lower TDS Rate?

NRIs can apply for a lower TDS deduction rate by obtaining a Tax Residency Certificate (TRC) from the tax authorities in their resident country. The TRC serves as proof of foreign residency and helps avail lower TDS rates or claim benefits under the Double Taxation Avoidance Agreement (DTAA), if applicable.

If an NRI furnishes a valid TRC to a buyer, the latter should then deduct TDS at the lower rate as specified in the TRC.

What Is A TDS Certificate?

The TDS Certificate is filed by the buyer with the income tax authorities in India, and reflects the details of the TDS deducted; this includes the TDS amount, TAN of the buyer and other relevant information.

For property sales in India, Form 16B is the relevant TDS Certificate used to capture TDS details of the transaction.

If you are an NRI seller who sold property in India, make sure to collect your Form 16B TDS Certificate from the buyer. You will need this when you file your income tax return.

Is There A Timeline For TDS Payment?

The buyer of a property sale who deducts TDS on the transaction has to deposit the payment with the government within a specific time frame.

The due date for the TDS payment is generally the 7th day of the month following the month in which the same was made. For example, if the sale of a property is completed in the month of March, the TDS payment must be made by April 7th.

The buyer must also issue a TDS Certificate (Form 16B) to the NRI seller as proof of tax deduction.

If you are an NRI seller of property in India, make sure to familiarize yourself with TDS as it is a mandatory requirement. If in doubt, consult a qualified tax professional.

Does An NRI Have File A Tax Return For Property Sale In India?

If you sold property in India as an NRI, it is important that you file an income tax return to report the sale of property and provide details of the TDS deducted.

Filing a tax return allows NRIs to claim any eligible deductions, exemptions or refunds based on their specific circumstances. This is especially important in case deductions and exemptions lower your tax liability and you qualify for a refund of the TDS that you paid to the buyer at the time of the sale.

Also, if the sale resulted in capital losses, and you wish to carryover those losses to future years, you must file an income tax return to do so.

Next, we will look at deductions and exemptions available to NRIs who wish to sell property in India.

What Tax Deductions And Exemptions Are Available To NRIs Selling Property?

When an NRIs sells property in India, certain tax deductions and exemptions can help to reduce their tax liability.

Here are some key deductions and exemptions available to NRIs selling property in India:

- Deduction for Expenses: NRIs can claim deductions for expenses related to the sale of property, such as brokerage fees, legal fees, advertising costs and any other expenses paid in relation to the sale. These expenses can be deducted from the sale price to determine the taxable capital gains.

- Exemption under Section 54: NRIs can claim an exemption under Section 54 of the Income Tax Act if they reinvest the capital gains from the sale of a residential property into another residential property within a specified time frame. The new property must be purchases one year before or within 2 years after the sale of the original property, or constructed within 3 years of the sale. In case the cost of the new property is less than that of the original, the difference will still be taxed, else, the whole capital gains are exempt from Capital Gains Tax.

- Exemption under Section 54F: NRIs who sell assets other than properties can also use Section 54F to get an exemption from capital gains by investing the proceeds in residential property. This exemption under Section 54F is very similar to the one discussed above for Section 54 - the only difference is that it is for non-property asset sales.

- Exemption under Section 54EC: NRIs can also avail an exemption under Section 54EC of the Income Tax Act which allows for capital gains exemption if the proceeds are invested in specified bonds issued by government institutions such as NHAI (National Highways Authority of India) or REC (Rural Electrification Corporation) within six months from the sale date. The maximum amount allowed to be exempted under Section 54EC is Rs 50 Lakhs (INR 5 million) and the bonds must be held for at least 5 years.

- Double Taxation Avoidance Agreements (DTAA): NRIs residing in countries with a tax treaty with India can benefit from DTAA provisions. DTAA helps prevent double taxation by allowing NRIs to claim tax credits or exemptions in their home country based on the taxes paid in India. Additionally, if the tax rate in the NRIs home country is lower than the TDS rate in India, the NRI can request TDS deduction at the lower rate by submitting a Tax Residency Certificate (TRC) from the tax authorities in their home country. NRIs should consult tax experts or professionals in their resident country to understand the specific provisions and benefits of DTAA.

NRIs selling property in India can take advantage of various deductions and exemptions to lower their capital gains tax. These include expenses related to the sale, reinvestment of proceeds into residential property under Sections 54 and 54F, purchase of eligible government bonds under Section 54EC and a potentially lower TDS rate by submitting a Tax Residency Certificate (TRC) from their home country.

This is a lot of information to digest, so if you are in doubt, always consult with your tax consultant for advice and guidance.

What Are The Rules For Repatriation Of Sale Proceeds And Foreign Exchange Regulations?

For NRIs selling property in India, repatriation of the sale proceeds is an important consideration once the same has been completed. Repatriation refers to transferring the funds earned from the sale of property back to the NRI's country of residence.

There are many ways to send money overseas, and one of the best pieces of advice we can offer is comparing money transfer companies to get the best exchange rates and deals. RemitFinder makes this easy - simply choose your source and destination countries and enter the amount to see numerous options side-by-side.

That said, there are important foreign exchange regulations and guidelines that govern the repatriation process. Here is an overview of repatriation of sale proceeds and foreign exchange regulations for NRIs:

- Property sale proceeds not freely repatriable: When you sell property in India as a non-resident, the proceeds need to be deposited into a Non-Resident Ordinary (NRO) account. Based on RBI guidelines, repatriation of funds from an NRO account is restricted and limited - repatriation is allowed only after prior RBI approval, and cannot exceed USD 1 million per year.

- Repatriation Limit: The RBI has set an overall limit on NRIs' repatriation of sale proceeds. Currently, the limit is USD 1 million per financial year for all eligible assets combined. This limit includes the sale proceeds from the property as well as other eligible investments, such as stocks, bonds and mutual funds.

- Documentary Requirements: Based on Rule 37BB specified in the Indian Income Tax Rules, an NRI wishing to repatriate funds out of India must furnish Form 15CA to the authorized dealer (bank or money transfer company) through which the transaction is processed.

Note that the Liberalized Remittance Scheme (LRS) governs outward remittances from India, but it applies to Indian residents and not to non-residents. NRIs, therefore, are not subject to LRS rules and guidelines.

If you are an NRI who sold property in India, make sure to adhere to the foreign exchange regulations and guidelines set by the RBI for the repatriation of sale proceeds.

If needed, seeking assistance from tax professional with expertise in foreign exchange regulations can help you navigate the repatriation process and ensure compliance with applicable rules and guidelines.

Useful Tips For NRIs Selling Property In India

As an NRI based out of India, it may seem complicated to manage a property sale in India. There are various rules and regulations to be aware of, and non-compliance can come with fines and penalties. If in doubt, seek the assistance of a tax professional.

That said, here are some best practices and tips that may prove helpful if you wish to sell property in India as a non-resident:

- Determine Residential Status: First and foremost, as an NRI, you should assess your residential status for tax purposes for the relevant financial year. This will help determine the applicable tax rules, rates and exemptions.

- Time Your Sale Optimally: If your financial condition permits, consider the timing of the property sale to take advantage of Long-Term Capital Gains as those are taxed lower than Short-Term Capital Gains. If you have had ownership of the property for more than two years, it qualifies for Long-Term Capital Gains.

- Avail Indexation Benefit: If your property qualifies as a long-term asset (held for more than 2 years), make sure to utilize the benefit of indexation while calculating the capital gains tax. Indexation adjusts the property's purchase cost based on inflation, reducing the taxable gain.

- Apply Indexation on Improvements: Note that indexation also applies to improvements and not just acquisition cost. Many times, sellers forget this and lose out on potential savings to reduce their Long-Term Capital Gains and, thereby, lower their tax liability.

- Use Capital Gains Exemptions: For long-term held properties, make sure to explore the available exemptions under Sections 54, 54EC, and 54F of the Income Tax Act to minimize your tax liability. These provisions provide exemptions when the sale proceeds are reinvested in specified assets such as another residential property or government bonds. By utilizing these exemptions, you can defer or reduce their tax liability on capital gains.

- Explore Possible Lower TDS Rate: Check if your resident country has a Double Taxation Avoidance Agreement (DTAA) treaty with India. If so, check if your tax rate in your home country is lower than that in India - if this is the case, you can ask for a lower TDS rate by furnishing a Tax Residency Certificate (TRC) from your home country.

- Avoid Double Taxation: Extending on the above point, if your home country has a Double Taxation Avoidance Agreement (DTAA) treaty with India, you only need to make tax in one country and not both. Check with your tax consultant to see whether it is better to pay tax on proceeds from your property sale in your home country or India.

- File Income Tax Return In India: If your property sale generated a profit, make sure to file income tax return in India for the applicable financial year. Filing your return will ensure that you are compliant with tax laws and entitled for refund if applicable. Even if your sale generated a loss, you should file your tax return to ensure that your capital loss can carry over to future years.

- Save Documents Carefully: Make sure to maintain accurate records of all property-related transactions, including purchase documents, sale deeds, expenses incurred, TDS certificate from buyer and any other pertinent documents. Having your documents in order will smoothen the whole process and help you comply with various rules and regulations easier.

- Seek Professional Guidance: If in doubt, seek professional guidance from tax consultants who specialize in cross-border taxation. They can provide personalized advice based on your unique circumstances and help you comply with the applicable tax laws and regulations in both your home country as well as in India.

The above tips and best practices can help you smoothen the end-to-end process of selling your property in India as an NRI and ensuring compliance with tax laws and related regulations.

Conclusion

Understanding the tax treatment on the sale of property by Non-Resident Indians (NRIs) in India is crucial for effective financial planning and compliance with tax regulations.

The tax treatment for NRIs selling property involves various aspects such as determining their residential status, calculating capital gains, complying with Tax Deducted at Source (TDS) requirements and understanding the repatriation of sale proceeds.

By familiarizing themselves with the relevant tax laws, NRIs can employ best practices and strategies such as timing the sale, utilizing indexation benefits, exploring capital gains exemptions and considering tax credits under Double Taxation Avoidance Agreements (DTAA) to their advantage.

Furthermore, maintaining proper documentation, seeking professional advice and staying updated with tax regulations are essential for successful tax planning.

NRIs should consult tax professionals or chartered accountants who specialize in international taxation to navigate through the complexities and ensure compliance with the applicable tax laws in both India and their resident country.

Disclaimer: The details provided in this article are for educational and informational purposes only, and are not legal or tax advice. Consult with a qualified tax professional to assess your personal situation when it comes to the legal and tax ramifications of property sale in India.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

References:

1. Indian Income Tax Department (ITD) publication on Tax Treatment of Sale of Property by Non-Residents

Categories

Similar Articles

The Ins And Outs Of International Mobile Money Transfers

Mobile money has become a popular way to send money overseas. From fees to security, we delve into the ins and outs of international mobile money transfers. Make the most of your mobile device to send money abroad.

Popular Mobile Wallets In Middle East And Africa

Mobile wallets have significantly improved financial inclusion for residents of Middle East and Africa. Learn about the most popular mobile wallets that people use in this region to participate in the new cashless economy.

Popular Mobile Wallets In North America

Mobile wallet adoption in North America continues to increase. Discover the most popular mobile wallets in North America and see how you can streamline your payments and purchases using them.