Liberalised Remittance Scheme (LRS) - All You Need To Know

Table of Contents

- What Is Liberalised Remittance Scheme (LRS)?

- How Do I Know If LRS Applies To Me?

- Which Remittance Purposes Are Allowed Under LRS?

- Which current account transactions are allowed under LRS?

- Which capital account transactions are allowed under LRS?

- Which remittance reasons are prohibited under LRS?

- Are any types of remittances by non-individuals allowed under LRS?

- What Is LRS Limit For Outward Remittances From India?

- LRS Limit - Historical Context

- Does the LRS limit only apply to US Dollars?

- Is there a limit to the frequency of remittances under LRS?

- Can non-permanent residents send more than the USD 250,000 limit?

- Are There Any Reporting Requirements For LRS?

- Are There Tax Implications Of Sending Remittances From India?

- Tax implications when sending money from India

- Tax implications on income from remittances sent from India

- What Are The Benefits Of LRS For Remittances?

- Conclusion: LRS Empowers Indian Residents To Live, Work And Study Abroad

The Liberalised Remittance Scheme (LRS) is a regulation in India that specifies the rules, limits, conditions and related enforcements in place for sending international money transfers from India.

LRS is implemented by the Reserve Bank of India (RBI) and manages the rules related to overseas remittances sent by Indian residents for various purposes. The LRS scheme was introduced in 2004 and has been revised several times since then.

Under LRS, individuals can remit up to a certain amount of money per financial year without needing any special permission or approval from the RBI. LRS aims to streamline the remittance of funds for legitimate purposes such as education, medical treatment, travel, and investment, among others.

In this article, we discuss the features of LRS in detail, including LRS rules, permissible transactions, transfer limits, reporting requirements, tax implications, and more.

What Is Liberalised Remittance Scheme (LRS)?

Liberalised Remittance Scheme (LRS) is a set of rules and regulations that govern outward remittances sent from India to other countries by Indian residents. LRS is part of the overall guidelines and regulations related to foreign exchange transactions laid down by the Foreign Exchange Management Act (FEMA) in place since 1999.

As per FEMA guidelines, when an Indian resident makes transactions that necessitate foreign currency exchange, the payment qualifies as either a capital or current account transaction. Additionally, transactions done by an Indian resident that have no impact on their assets or liabilities, including contingent liabilities, outside India are current account transactions.

LRS provides detailed guidance on various rules, transfer limits, reporting instructions, exceptions and related matters when it comes to sending money internationally from India.

Liberalised Remittance Scheme (LRS) is a specification that lays down various rules and regulations for sending outward remittances from India. This includes limits, applicability, reporting, etc., on international money transfers send from India.

We will deep dive into various aspects of LRS in the rest of this article.

How Do I Know If LRS Applies To Me?

As per Foreign Exchange Management Act (FEMA) guidelines, LRS applies to any individual who is an Indian resident for tax purposes. Thus, LRS is not applicable to Non-Resident Indians (NRIs) or Persons of Indian Origin (PIOs).

There are no age restrictions for using LRS, and even minors can use this scheme, provided that the required documentation is submitted. If a minor sends overseas remittances from India, form A2 must be signed by the minor's legal guardian.

Additionally, Indian residents must have a bank account in India that is operational for at least one year before making any remittance under LRS. The account should be maintained with a bank that the RBI authorizes to offer LRS facilities.

Any Indian resident who sends outwards remittances from India needs to abide by the rules of the LRS specification.

Note that LRS is only applicable to individuals who are Indian residents; it does not apply to corporations, partnership firms, Hindu Undivided Family (HUF), Trusts, etc.

If you are a Non-Resident Indian (NRI), LRS does not apply to you. You likely have non-resident bank accounts in India, and there are differences in how much money you can repatriate to a foreign country depending on your account type - NRE, NRO or FCNR account. In general, there is no limit to how much money you can send outside India from NRE and FCNR account; NRO accounts have a USD 1 million limit to repatriation of funds.

Finally, it is important to note that LRS can only be used for permissible transactions, which we will discuss in detail in a following section.

Which Remittance Purposes Are Allowed Under LRS?

LRS allows Indian residents to remit money abroad for various permissible reasons. As per RBI guidelines1, the allowed purposes under LRS are categorized into 2 sub-categories - these are current account and capital account transactions.

Let's look at permissible transaction types for both current and capital account transactions.

Which current account transactions are allowed under LRS?

Remittances for the following current account transaction types are allowed as per LRS guidelines:

- Education-Related Payments: Payment of tuition fees, hostel fees, and other educational fees, both in India and abroad.

- Medical Treatment Abroad: Payment of medical expenses incurred abroad for self or family members.

- Employment: Making remittances towards current or capital account transactions related to employment.

- Emigration: Remittance for emigration expenses, such as visa fees, processing fees, and other related costs.

- Travel-Related Payments: Purchase of foreign currency for travel, including expenses related to overseas hotels, transportation, and tour operators for both individual as well as business purposes. Note that individual travel to Nepal and Bhutan is not part of this permissible reason.

- Gift And Donations: Making gifts and donations to organizations or individuals outside India.

- Maintenance Of Close Relatives: It is also permissible to send remittances overseas to take care of the maintenance of your close relatives living abroad.

- Other Reasons: In general, any other current account transactions that are not covered under the definition of current account in FEMA 1999 Act.

Which capital account transactions are allowed under LRS?

Remittances for the following capital account transaction types are allowed under LRS:

- Opening an account in a foreign currency with a bank or financial institution located outside of India.

- Purchase of foreign property.

- Purchase and investments in overseas assets like shares, securities, mutual funds, bonds, etc.

- Setting up wholly owned subsidiaries (WOS) or joint ventures (JV) abroad as long as stipulated terms and conditions are satisfied.

- Extending loans to Non-Resident Indians (NRIs) in Indian Rupees; eligible relatives must meet the criteria defined in the Companies Act.

There are numerous current and capital account transaction types or purposes allowed under LRS for making outwards remittances from India.

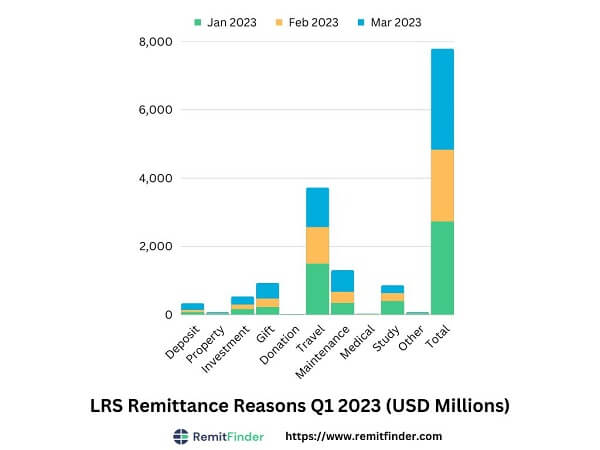

If we look at the remittances sent from India under LRS during the first 3 months of 2023, we notice that resident Indians used many different reasons2 to send money abroad; the below graph shows this data.

The "Other" category included items such as subscription to journals, maintenance of investment abroad, student loan repayments and credit card payments.

We can clearly see from this data how important the various permitted LRS purposes are to support the varied needs of Indian residents to send remittances from India.

Which remittance reasons are prohibited under LRS?

There are certain activities for which it is prohibited to send remittances overseas from India as part of LRS; these are as below:

- Reasons prohibited under Schedule-I (e.g., purchase of lottery tickets or sweepstakes, proscribed magazines, etc.) or any item restricted under Schedule II of Foreign Exchange Management (Current Account Transactions) Rules, 2000.

- Making margin calls with overseas exchanges or counterparties.

- Purchasing Foreign Currency Convertible Bonds (FCCBs) issued by Indian companies abroad.

- Trading in foreign exchanges that are based overseas.

- Sending remittances to countries identified by the Financial Action Task Force (FATF) as "non-cooperative countries and territories". Note that the countries on the FATF list may change periodically, so make sure to check the latest list when you plan to send remittances from India.

- Sending remittances to individuals and entities identified as posing significant risk of committing acts of terrorism as advised by the RBI.

- Gifting foreign currency to another resident for purpose of later crediting the latter's foreign currency account held abroad under LRS.

Both the approved and prohibited list of remittance purposes under LRS may change at any time; make sure to check the latest LRS guidelines when you plan to send money overseas from India.

Are any types of remittances by non-individuals allowed under LRS?

So far, we have discussed the approved and prohibited reasons for individuals when it comes to sending remittances under the LRS scheme.

There are some non-individual scenarios that are permitted by the RBI that enable businesses and corporations to send remittances under LRS; these are as below:

- Donations of up to 1% of their foreign earnings during the previous three financial years or USD 5,000,000, whichever is less, for some approved scenarios.

- Real estate fees and commission to agents abroad for sale of residential flats or commercial plots in India up to USD 25,000 or five percent of the inward remittance, whichever is less.

- Consulting fees of up to USD 10 million for infrastructure projects and USD 1 million for other consultancy services procured from outside India. The limits apply on a per project basis.

- Reimbursement of pre-incorporation expenses of up to 5% of investment brought into India or USD 100,000, whichever is less, by an entity in India.

- Remittances for purposes under Para 1 of Schedule III to FEM (CAT) Amendment Rules, 2015 for up to USD 250,000.

In summary, it is important to understand that LRS can only be used for legitimate purposes, and any unauthorized use of the scheme is strictly prohibited. Additionally, there are limits on the amount that can be remitted under LRS, which we will discuss in a following section.

What Is LRS Limit For Outward Remittances From India?

The maximum amount that can be remitted under LRS is USD 250,000 per financial year for Indian residents without taking any approval from the Reserve Bank of India (RBI). Note that the Indian financial year is from April 1 to March 31 of the following year.

Note that the LRS limit of USD 250,000 per financial year applies to one individual. This means that a family can potentially club their individual limits to send more than the prescribed per person limit. If you go for this option, make sure to carefully read LRS and FEMA regulations and ensure you do not violate any rules.

An Indian resident can send up to USD 250,000 worth of outwards remittances every financial year (which is from April 1 to March 31 of next year).

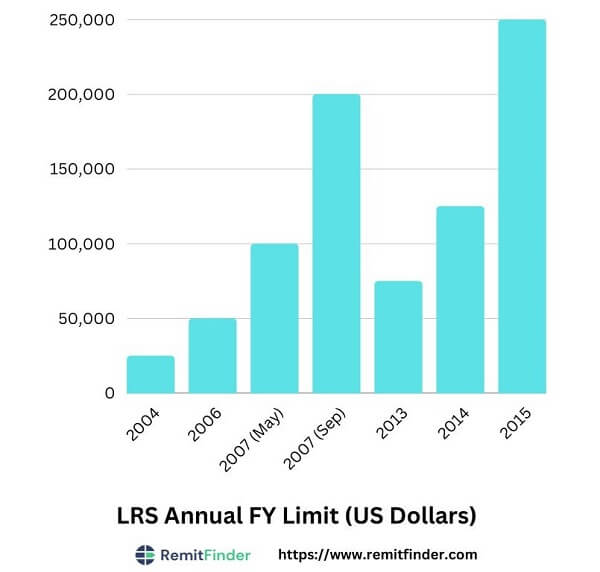

LRS Limit - Historical Context

When the LRS scheme was started in 2004, the annual limit was USD 25,000. The limit was then raised a few times till it reached USD 200,000 in September, 2007; the maximum amount stayed as is for almost 6 years.

In 2013, the Ministry of Finance of the Government of India decreased LRS limit to USD 75,000. This was the first time that the LRS upper limit was reduced since the inception of LRS in 2004.

After a couple more changes, the limit was finally set to USD 250,000 in 2015, and it has stayed as is since then.

The below graph represents the changes in LRS upper limit over time.

The current limit proves highly beneficial to Indian residents since in today's deeply connected global world, opportunities to work, vacation and study abroad are plentiful. LRS, thus, makes it easy for Indian residents to travel, work and study abroad without having to worry about funding their overseas stay.

Does the LRS limit only apply to US Dollars?

No, LRS limits apply to any currency, but equivalent to USD 250,000 per financial year. This is because you can send outwards remittances from India to any freely convertible currency available in the FX market.

Therefore, if you send money overseas from India to another destination currency, simply calculate the amount in USD equivalent to calculate your LRS limit.

Is there a limit to the frequency of remittances under LRS?

There is no limitation on the frequency of remittances that you can send overseas from India so long as the total amount sent under a financial year stays within the limit of USD 250,000 (or currency equivalent).

Once you meet the annual limit, you cannot send any more remittances in that financial year. This is true even if you bring back some of your overseas investments to India.

Can non-permanent residents send more than the USD 250,000 limit?

If you are a foreigner or expat living or working in India, and are considered a resident for tax purposes, you may be able to send outward remittances of more than USD 250,000 in a financial year provided the below conditions are met:

- You are a non-permanent Indian resident.

- You have already exhausted the USD 250,000 annual limit.

- You have paid all due taxes, or made TDS deductions, on the additional funds above USD 250,000 that you wish to remit.

If you meet all the above conditions, you can work with your AD (Authorized Dealer) or bank to procure approval from the RBI to send more than USD 250,000 abroad in a financial year. Make sure to have all necessary documentation ready to support your case.

Are There Any Reporting Requirements For LRS?

LRS does have certain reporting requirements that must be followed by Indian residents who send outwards remittances from the country.

When you send a remittance via an Authorized Dealer (AD) and/or a bank, you will be required to fill Form A23, also called the "Application for Remittance Abroad". Form A2 serves as a declaration form to your AD or bank indicating the purpose of your remittance, the amount, and other relevant details.

Additionally, you must always specify your PAN (Permanent Account Number) - a unique identifier for every individual in India's tax system - when you send an outward remittance.

Your AD or bank may also ask for additional requirements and paperwork as needed. For example, you may be asked to show proof of the origin of funds. Note that the ultimate responsibility of compliance with FEMA laws and regulations resides with you - the AD or bank will assist you with compliance, but you must ensure that you are within the law at all times.

When you send an outward remittance, you will be asked for fill Form A2, furnish your PAN and additional documentation as needed.

Banks must also submit a monthly report to the RBI for all remittances made by them under LRS.

Are There Tax Implications Of Sending Remittances From India?

LRS is a framework of rules and regulations for sending outward remittances from India. Hence, LRS itself does not specify any tax guidance or restriction on the money you send abroad from India.

But still, there are tax related caveats that you should be aware of. Let's partition these into couple of scenarios.

Tax implications when sending money from India

In general, there are no tax implications when you want to send remittances from India as long as you can show the proof of funds.

In some cases, for example when sending money for the maintenance of someone abroad, it may be necessary for the AD (Authorized Dealer) or the bank to deduct tax (also called "Tax Deducted at Source", or TDS, for short) on the funds that are sent abroad.

Tax implications on income from remittances sent from India

If the remittances you send overseas from India earn any income, then there will be tax implications that you may want to get familiar with. For instance, if the remittance is for investment purposes, any income earned from such investments, such as dividends or interest, will be subject to income tax in India.

Similarly, suppose the remittance is for the purchase of immovable property abroad. In that case, any income earned from the property, such as rent or capital gains, will be subject to income tax in India.

The biggest ramification of overseas investments may be potential double taxation. This essentially means getting taxed overseas since the investment resides there as well as getting taxed in India since you are an Indian resident for tax purposes, and therefore, need to report your worldwide income to Indian tax authorities.

It is important to note that India has Double Taxation Avoidance Agreements (DTAAs) with several countries, which means that individuals can avoid paying tax on the same income in both India and the foreign country.

However, to take advantage of these agreements, individuals need to submit the required documentation and comply with the rules and regulations of both countries.

Income earned from money your remit from India may be subject to taxation in India, and potentially overseas. Research further including checking if India has a DTAA with the country where your assets earn income.

Most importantly, it is advisable to consult a tax professional before making any remittance to understand the tax implications and to ensure compliance with the regulations. Failure to comply with tax regulations can result in penalties and legal issues.

What Are The Benefits Of LRS For Remittances?

LRS offers several advantages for individuals looking to remit funds abroad from India. Here are some of the key benefits of LRS in case you need to send outward remittances from India:

- Variety Of Remittance Purposes: LRS allows individuals to remit funds abroad for various permissible transactions, including education, medical treatment, travel, investment, and gift and donations, among others. This allows individuals to meet their financial obligations abroad without any restrictions.

- Generous Limit: The LRS limit of USD 250,000 (or currency equivalent) per financial year for ordinary residents has made it easier for individuals to remit larger amounts of money abroad. The higher limit gives individuals greater flexibility and enables them to meet their financial obligations more easily.

- Simplified Process: Complying with LRS regulatory and reporting requirements is relatively simple. You simply have to fill a form through your AD (Authorized Dealer) or bank indicating the purpose of the remittance, the amount, and other relevant details.

- No Major Tax Implications When Sending Money: There are pretty much no tax obligations to fulfil when you send remittances overseas. Note that any income you earn on the money you remit may have tax implications.

- Overseas Investments And Portfolio Diversification: LRS enables individuals to diversify their investment portfolio by investing in foreign countries. This can hedge against currency and economic risks and give individuals access to a wider range of investment opportunities.

LRS provides individuals with a convenient and flexible way to remit funds abroad for various purposes, thereby letting Indian residents tap into the new globally connected economy.

Conclusion: LRS Empowers Indian Residents To Live, Work And Study Abroad

LRS is a useful tool for individuals who wish to remit funds abroad for various purposes. It offers flexibility and convenience, allowing individuals to remit up to a USD 250,000 (or currency equivalent) per financial year without prior approval from the Reserve Bank of India.

Being able to send money overseas with a streamlined and easy process like LRS, Indian residents are able to freely live, work, study and vacation overseas. This amplifies the global aspirations, exposure and impact of Indians across the world, and helps them be equal participants in the global economy.

However, it is essential to understand the eligibility criteria, permissible transactions, limits, and reporting requirements before making a remittances from India. In addition, potential tax implications need to be carefully evaluated if investing money overseas for the purposes of earning income.

In summary, LRS is a commendable initiative from the Government of India as it enables Indian residents to travel overseas for various purposes without having to worry about financing their trip and overseas stay.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

References:

1. Reserve Bank of India (RBI) FAQs on LRS

2. RBI data on LRS Remittance reasons for Q1 2023

3. Form A2 for sending a remittance from India

Categories

Similar Articles

Popular Mobile Wallets Across The World

Discover the top mobile wallets transforming how we pay globally. Explore the world of convenient and secure digital transactions. Do not miss this ultimate guide to the most popular mobile wallets across the world!

What Is PayID And How Does It Work?

If you send or receive money in Australia, say goodbye to complex bank details. Use PayID and experience hassle-free payments. PayID has revolutionized the payment experience in Australia – learn all about it.

Complete Guide To Cash App Limits

Cash App is convenient and easy to use, but there are limits you should be aware of. Our comprehensive guide to Cash App limits has all you need to know to maximize the value of your account.