Popular Mobile Wallets In Middle East And Africa

Table of Contents

- Mobile Wallet Adoption In Middle East And Africa

- M-Pesa: Revolutionizing Mobile Payments in Africa

- Airtel Money: Driving Financial Inclusion in Africa

- MTN Mobile Money (MoMo): Bringing Mobile Money To Everyone

- Orange Money: Making A Difference In Africa

- VodaPay: Streamlining Mobile Money Within Africa

- Conclusion: Mobile Wallets Critical To Financial Inclusion In Middle East And Africa

Today's global economy has been becoming increasingly connected and cashless. There are many factors driving this change, but mobile wallets have definitely been a key contributor.

We have been embarking on a detailed deep dive into the most popular mobile wallets globally. Middle East and Africa have also seen tremendous growth in this area, and we will go deeper in this topic in this article.

Let us first look at the promising adoption of mobile wallets in Middle East and Africa. Once we see some data and statistics around wallet adoption, we will present the most popular mobile wallets in this region.

Mobile Wallet Adoption In Middle East And Africa

If there is a region of the world that has benefitted the most from the financial inclusion driven by mobile wallets, it is Middle East and Africa.

Due to a combination of historical, economic and political factors, many people living in African and Middle Eastern countries have had less access to banking and have traditionally relied on cash as the main monetary instrument.

With the rapid expansion of mobile connectivity in Middle East and Africa and around came the opportunity to advance a cashless economy by relying on the power of mobile wallets. It is, therefore, no surprise that most mobile wallets across Middle East and Africa have been developed by telecom companies - a factor that also led to massive mobile wallet adoption which came hand-in-hand with increased mobile penetration.

Mobile wallets across Middle East and Africa have been developed by telecom companies. Rapid mobile penetration has helped accelerate mobile payment adoption as well.

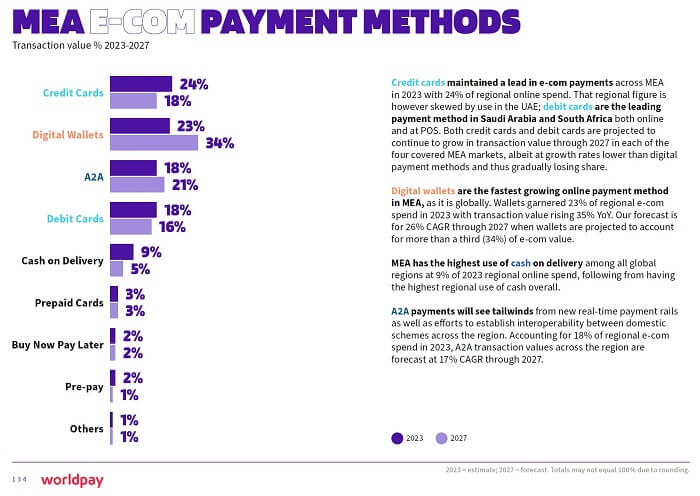

In 2023, digital wallets accounted for 23% of all e-commerce spending in Middle East and Africa, and it is projected to grow to 34% by 2027.

Market share of various payment methods in Middle East and Africa in 2023 with projections for 2027 - Source worldpay.com1

Market share of various payment methods in Middle East and Africa in 2023 with projections for 2027 - Source worldpay.com1

Check out the most popular mobile wallets in Middle East and Africa below.

M-Pesa: Revolutionizing Mobile Payments in Africa

M-Pesa is a mobile payment platform that has revolutionized mobile payments in Africa. Launched in Kenya in 2007 by Safaricom, M-Pesa allows you to perform various financial transactions using your mobile phones, even without a bank account.

With M-Pesa, you can send and receive money, pay bills, buy airtime, and even access loans and savings accounts. The platform operates through a network of agents who facilitate cash deposits and withdrawals.

M-Pesa has played a significant role in financial inclusion, empowering African individuals and businesses with access to secure and convenient digital payment services. Its success has led to its expansion into several other African countries, making M-Pesa a transformative force in the region's mobile payment landscape.

Countries served by M-Pesa include:

- Democratic Republic of Congo (DRC), Egypt, Ghana, Kenya, Lesotho, Mozambique and Tanzania

Did you know that you can send money directly from overseas into mobile wallet accounts of your loved ones in Middle East and Africa? Most money transfer companies sending money to the region support mobile payments. Make sure to compare money transfer companies to pick the best partner for your money transfers.

Airtel Money: Driving Financial Inclusion in Africa

Airtel Money is a prominent mobile money provider in Africa and is owned and operated by the Airtel Group based out of India. Launched in Kenya in 2017 by Airtel, the wallet has gained tremendous popularity and is a chosen way to conduct financial transactions by millions - as of March 2024, Airtel Money is used by 38 million customers across Africa.

Supported capabilities include making payments and purchases with Airtel Money as well as microloans, international remittances and savings. Empowered by the Airtel telecom network, millions in Africa use Airtel Money to make everyday purchases, pay bills and send and receive money.

A fundamental driver of Airtel Money's rapid expansion and adoption is the development of an extensive network of Airtel Money agents, branches and kiosks that facilitate mobile payments by helping customers load money on their mobile wallet as well as withdraw cash if needed.

Having facilitated transactions worth billions of US Dollars, Airtel Money has been a significant driver of financial inclusion across multiple African countries and has become an economic lifeline for many.

Countries served by Airtel Money include:

- Kenya, Madagascar, Malawi, Niger, Nigeria, Rwanda, Seychelles, Uganda, Tanzania, Zambia, Chad, Congo Brazzaville, Democratic Republic of Congo (DRC) and Gabon

MTN Mobile Money (MoMo): Bringing Mobile Money To Everyone

MTN Mobile Money, called MoMo for short, is another popular mobile wallet in Africa boasting more than 50 million users across 16 African nations. Initially launched in Ghana in 2009 by the MTN Group, MoMo has processes over 900 million transactions monthly.

MoMo customers can use their mobile wallet to not only shop online as well as at physical locations, but they can also buy airtime, take loans, pay bills and even start savings with their MoMo account.

MoMo's success validates 2 key aspects of the mobile money revolution in Africa again. First, telecom companies have blazed the trail when it comes to digitization of African economies. Second, the advances made my mobile wallets and digital payments continue to help Africans participate in the global digital economy.

Countries served by MTN Mobile Money (MoMo) include:

- Afghanistan, Benin, Cameroon, Congo Brazzaville, Cote d'Ivoire, Eswatini, Ghana, Guinea-Conakry, Liberia, Nigeria, Rwanda, Uganda and Zambia

Orange Money: Making A Difference In Africa

Orange Money is another widely used and adopted mobile wallet in Africa. Owned and operated by the French telecom operator, Orange, it was launched in Cote d'Ivoire in December, 2008. In that sense, Orange Money is yet another telco powered African mobile wallet.

In addition to the usual mobile wallet functions of offline and online payments, Orange Money also provides services like bill pay, savings, insurance and easy movement of money between bank accounts and the Orange Money wallet.

Orange Money also strives to enable mobile money interoperability within Africa by joining forces with Telma and Airtel to ensure that mobile money services provided by all 3 companies are compatible with each other.

Countries served by Orange Money include:

- Cote d'Ivoire, Senegal, Mali, Niger, Madagascar, Botswana, Cameroon, Mauritius, Guinea Conakry, Egypt, Tunisia, Democratic Republic of the Congo, Central African Republic, Liberia, Burkina Faso, Sierra Leone, Guinea Bissau and Jordan

VodaPay: Streamlining Mobile Money Within Africa

VodaPay has become an increasingly popular mobile wallet in South Africa. VodaPay is owned and operated by Vodacom South Africa, the South African telecom subsidiary owned by the global telecom giant Vodafone. VodaPay is, thus, yet another African mobile wallet created by a major telecom company.

Like any other mobile wallet, VodaPay customers can make payments and purchases using their wallet as well as send money to family and friends. Additionally, VodaPay users can make QR code payments at supported merchants - VodaPay calls this "scan to pay".

Another advantage of VodaPay is rewards; the more the mobile wallet is used, the more the rewards that its users earn. These rewards can then be redeemed in many useful ways.

Finally, it is noteworthy that VodaPay is also available to non-Vodacom users. Anyone with a mobile phone and data connection can start using VodaPay. Of course, mobile data network usage fees will need to be paid to the mobile data provider.

Currently available only in South Africa, VodaPay does have plans to expand beyond the country. Once that happens, the adoption of this useful and popular mobile wallet will further increase.

Countries served by VodaPay include:

- South Africa

Conclusion: Mobile Wallets Critical To Financial Inclusion In Middle East And Africa

Middle East and Africa have struggled with ample financial inclusion in the past, and mobile wallets have turned this around by helping many people who did not have many financial choices before by bringing them into the heart of their national and regional economies.

With increased mobile penetration all over the world, and particularly in Middle East and Africa, there is tremendous positive momentum in increased financial participation from residents in these regions. This can only mean a good thing, not only for these residents but also for the global economy that they can now freely participate in.

Telecom providers have provided much needed leadership by creating mobile wallets in Middle East and Africa. Earlier in this article, we looked at M-Pesa, Airtel Money, MTN Mobile Money (MoMo) and Orange Money in more detail.

Looking ahead, we believe that mobile wallets will continue to be very popular in this region, and more players will enter the space to further elevate financial inclusion for one and all.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

References:

1. Global Payments Report 2024 published by Worldpay.

Categories

Similar Articles

Tax Treatment On Sale Of Property By NRI In India

Are you a Non-Resident Indian (NRI) who needs to sell property in India? Discover the tax implications of property sale in India and ensure that you comply with all legal regulations.

The Ins And Outs Of International Mobile Money Transfers

Mobile money has become a popular way to send money overseas. From fees to security, we delve into the ins and outs of international mobile money transfers. Make the most of your mobile device to send money abroad.

Popular Mobile Wallets In North America

Mobile wallet adoption in North America continues to increase. Discover the most popular mobile wallets in North America and see how you can streamline your payments and purchases using them.