Popular Mobile Wallets In North America

Table of Contents

- Mobile Wallet Adoption In North America

- Apple Pay: The Power of Apple in Your Pocket

- Google Pay: Seamlessly Transact with Google's Mobile Wallet

- Samsung Pay: The All-In-One Solution for Samsung Users

- PayPal: The Trusted and Widely Accepted Mobile Wallet

- Venmo: The Social Payment App for Easy Money Transfers

- Cash App: Simplifying Payments for Individuals and Businesses

- Conclusion: Mobile Wallets Continue To Streamline Payments In North America

Mobile wallets have truly transformed how we spend money and make purchases in today's globally connected digital economy.

This blog post is part of a comprehensive analysis we did on the world's most popular mobile wallets. In this article, we zoom into the North American mobile wallet ecosystem and the main players.

Before we present the most popular mobile wallets in North America, let us first look at the impact and influence of mobile and digital wallets in this region.

Mobile Wallet Adoption In North America

Apple, Google and Samsung lead the way in North America given that they own a bulk of the smartphone market share in the continent. It was, therefore, a natural choice for these companies to come up with their own mobile wallets.

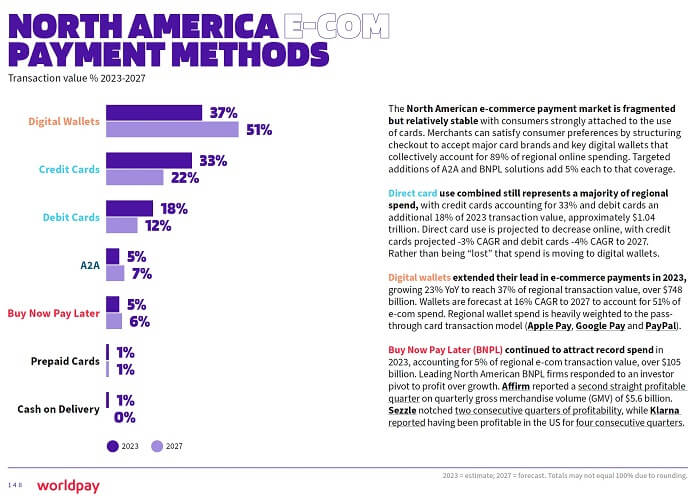

In 2023, digital wallet usage captured 37% of e-commerce market share with a promising forecast to increase up to 51% market share by 2027.

Market share of various payment methods in North America in 2023 with projections for 2027 - Source worldpay.com1

Market share of various payment methods in North America in 2023 with projections for 2027 - Source worldpay.com1

That said, PayPal continues to dominate the North American market as well as the global market to some extent. Venmo and Cash App are additional attractive choices albeit they focus more on the social aspect with streamlined peer-to-peer payments.

North American mobile wallet landscape continues to be dominated by Apple Pay, Google Pay and PayPal.

Below, we present more detailed information about the most widely used mobile wallets in North America.

Apple Pay: The Power of Apple in Your Pocket

Apple Pay is a mobile payment and digital wallet service offered by Apple Inc. that allows users to make secure and convenient payments using their Apple devices.

With Apple Pay, you can link your credit or debit cards to your Apple Wallet and make purchases in-store, online, or through supported apps with just a touch or a glance using Touch ID or Face ID.

Apple Pay utilizes Near Field Communication (NFC) technology for contactless payments, enabling you to simply hold your iPhone or Apple Watch near a compatible payment terminal to complete a transaction.

With its seamless integration with Apple devices, strong security features, and widespread acceptance at various merchants worldwide, Apple Pay has emerged as a powerful and user-friendly mobile wallet solution, putting the convenience of making payments right at the fingertips of Apple users.

Countries served by Apple Pay include:

- North America: Canada and US

- Middle East: 8 countries

- Latin America: 10 countries

- Europe: 49 countries

- Asia-Pacific: 11 countries

- Africa: Morocco and South Africa

If you are looking to send money to North America from anywhere in the world, most money transfer companies support making payments directly into mobile and digital wallets. But before you decide to send money abroad, compare money transfer companies first to see who you want to go with.

Google Pay: Seamlessly Transact with Google's Mobile Wallet

Google Pay is a mobile wallet and payment service developed by Google that allows users to make seamless and secure transactions using their Android devices.

With Google Pay, you can store your credit and debit card information, loyalty cards, and gift cards in a digital format on your smartphones. The service leverages Near Field Communication (NFC) technology, enabling you to make contactless payments by simply tapping your devices against compatible payment terminals.

In addition to in-store transactions, Google Pay can also be used for online purchases, peer-to-peer transfers, and bill payments. The service offers convenience, speed, and enhanced security, as transactions can be authenticated using biometric features like fingerprint or facial recognition.

Google Pay also integrates with other Google services, such as Google Assistant, enabling you to send money or make payments using voice commands.

With its widespread acceptance, user-friendly interface, and seamless integration with Android devices, Google Pay has become popular for individuals looking for a simple and efficient mobile wallet solution.

Countries served by Google Pay include:

- Supported countries vary by payment types that include Pay in store, Pay with smartwatch, Pay online or in apps, Pay with Chrome and Buy Google products

Samsung Pay: The All-In-One Solution for Samsung Users

Samsung Pay is a versatile mobile payment platform that offers an all-in-one solution for Samsung users, allowing them to make secure and convenient transactions with their Samsung devices.

Compatible with a wide range of Samsung smartphones, smartwatches, and even some older magnetic stripe card readers, Samsung Pay allows you to make payments almost anywhere.

The unique feature that sets Samsung Pay apart is its Magnetic Secure Transmission (MST) technology, which emulates the magnetic stripe found on traditional payment cards. This enables you to make payments by hovering your Samsung device near the magnetic stripe reader, even if the merchant's terminal does not support contactless payments.

In addition to MST, Samsung Pay supports Near Field Communication (NFC) for contactless payments.

You can easily add credit or debit cards to the Samsung Pay app and authenticate transactions using your fingerprint, retina eye scan, or PIN.

With a growing list of supported banks, payment networks, and merchants, Samsung Pay offers a convenient and widely accepted mobile wallet solution for Samsung users, making it a go-to option for those seeking a seamless payment experience.

Countries served by Samsung Pay include:

- South Korea, United States, China, Spain, Australia, Singapore, Brazil, Russia, Malaysia, India, Sweden, United Arab Emirates, Switzerland, Taiwan, Hong Kong, Vietnam, South Africa, Canada, Puerto Rico, France, Italy, United Kingdom, Indonesia and Germany

PayPal: The Trusted and Widely Accepted Mobile Wallet

PayPal is a globally recognized and trusted mobile wallet that enables users to make secure online transactions and peer-to-peer payments.

As one of the earliest pioneers in the digital payment industry, PayPal has established itself as a reliable and widely accepted payment method across various e-commerce platforms and online merchants.

To use PayPal, you must create a PayPal account, link it to your bank account or credit/debit cards, and securely store your payment information. With this setup, you can make payments by logging into your PayPal account, selecting the desired funding source, and confirming the transaction.

PayPal offers strong buyer protection and safeguards sensitive financial information, making it a preferred choice for many users concerned about security.

Additionally, PayPal's wide acceptance among merchants and integration with popular e-commerce platforms provide users with a convenient and seamless payment experience.

PayPal has also expanded its services to mobile devices, allowing you to make in-store purchases by scanning QR codes or using NFC technology.

With its reputation, robust security measures, and widespread acceptance, PayPal remains a trusted and widely used mobile wallet for individuals and businesses.

Countries served by PayPal include:

- Americas: 44 countries

- Europe: 49 countries

- Asia Pacific: 55 countries

- Africa: 48 countries

Venmo: The Social Payment App for Easy Money Transfers

Venmo is a social payment app that simplifies transfers between friends and acquaintances. With Venmo, you can easily send and receive money by linking your bank accounts or cards to the app.

Venmo's social aspect sets it apart, allowing you to share payment activities, add comments, and interact with friends through a social feed-like interface. It is a convenient solution for splitting bills, sharing expenses, and making quick payments.

Note that Venmo only works in the US, so if you need to send money overseas to family and friends, there are plenty of Venmo alternatives for international money transfers.

Venmo also offers a physical debit card, the Venmo Debit Card, for spending Venmo balance at physical stores. With its user-friendly interface and social features, Venmo has become a popular choice for easy and enjoyable money transfers.

Countries served by Venmo include:

- United States

Cash App: Simplifying Payments for Individuals and Businesses

Cash App is a payment app that simplifies transactions for both individuals and businesses. The app, developed by Square Inc., allows you to send and receive money effortlessly by linking your bank accounts or cards.

Cash App offers a range of convenient features, including the ability to request and split payments, make direct deposits, and even invest in stocks and Bitcoin. For businesses, Cash App provides tools for accepting payments, managing inventory, and generating sales reports.

Like Venmo, you cannot use Cash App for international payments. If you need to send money abroad, consider Cash App alternatives for international money transfers.

With its user-friendly interface and versatile functionality, Cash App has gained popularity as a streamlined payment solution for a wide range of users.

Countries served by Cash App include:

- United States

- United Kingdom

Conclusion: Mobile Wallets Continue To Streamline Payments In North America

In conclusion, mobile wallets have become an important payment method in North America by providing a convenient way for everyone to make purchases using just their mobile phone.

As part of our analysis of the North American mobile wallet landscape, we deep dove into the main incumbents that include Apple Pay, Google Pay, Samsung Pay, PayPal, Venmo and CashApp. Of these, the first 4 constitute a lion's share of the market share.

The future of mobile payments in North America is bright, and we expect this convenient and streamlined payment method to continue to flourish.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

References:

1. Global Payments Report 2024 published by Worldpay.

Categories

Similar Articles

Tax Treatment On Sale Of Property By NRI In India

Are you a Non-Resident Indian (NRI) who needs to sell property in India? Discover the tax implications of property sale in India and ensure that you comply with all legal regulations.

The Ins And Outs Of International Mobile Money Transfers

Mobile money has become a popular way to send money overseas. From fees to security, we delve into the ins and outs of international mobile money transfers. Make the most of your mobile device to send money abroad.

Popular Mobile Wallets In Middle East And Africa

Mobile wallets have significantly improved financial inclusion for residents of Middle East and Africa. Learn about the most popular mobile wallets that people use in this region to participate in the new cashless economy.