Popular Mobile Wallets In Asia Pacific

Table of Contents

- Mobile Wallet Adoption In Asia Pacific

- Alipay: China's Leading Mobile Payment Platform

- WeChat Pay: Transforming Mobile Payments in China and Beyond

- Paytm: India's Dominant Mobile Wallet App

- PhonePe: India's Fastest-Growing Digital Wallet App

- GCash: Revolutionizing How Filipinos Participate In The Digital Economy

- GrabPay: Singapore's Leading Mobile Wallet for Everyday Payments

- AliPayHK: Alipay's Mobile Wallet Solution for Hong Kong

- KakaoPay: South Korea's Popular Mobile Payment Service by Kakao Corp.

- Conclusion: Mobile Wallets A Backbone Of Asia Pacific's Cashless Economy

Mobile and digital wallets have been instrumental in transforming how we make purchases and payments, and send and receive money.

This article is part of a series of blog posts that we are doing on the most popular mobile wallets across the world. In this piece, we deep dive into Asia Pacific's most popular mobile wallets.

Mobile wallets have contributed to tremendous economic growth and financial inclusion in Asia Pacific countries. Below, we present the most popular mobile wallets in this region.

Mobile Wallet Adoption In Asia Pacific

When we look at the mobile wallet landscape across Asia Pacific, the dominant players exist within the 2 biggest economies - China and India. It is no surprise that this is the case given that both countries present the biggest markets in the world.

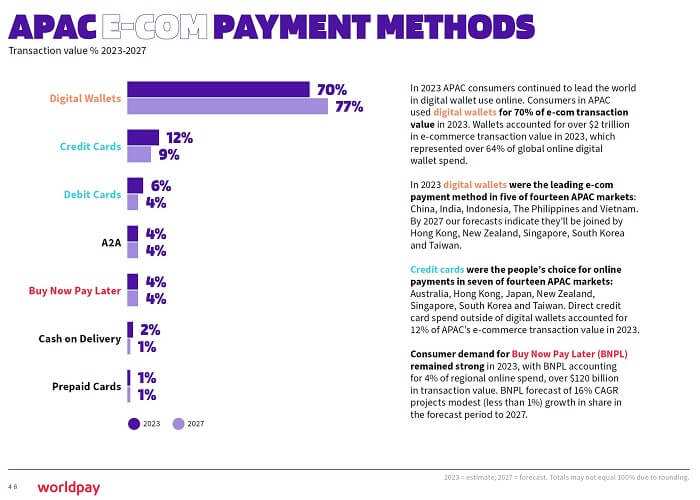

What could be a surprise though is the widespread adoption of digital wallets in APAC which stood at 70% in 2023 with a combined spending of USD 2 trillion which is 64% of global digital wallet spending.

Market share of various payment methods in Asia Pacific in 2023 with projections for 2027 - Source worldpay.com1

Market share of various payment methods in Asia Pacific in 2023 with projections for 2027 - Source worldpay.com1

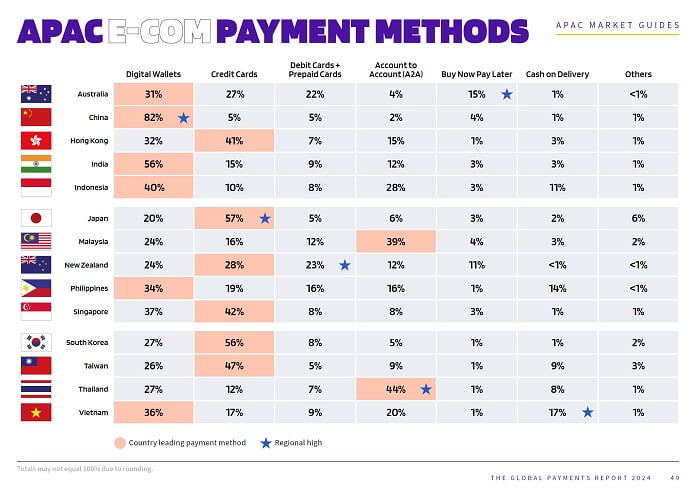

Here is the country-wise breakdown of the market share of various payment methods. Notice the widespread use of digital wallets in China and India at 82% and 56%, respectively.

Market share of various payment methods for countries in Asia Pacific in 2023 - Source worldpay.com1

Market share of various payment methods for countries in Asia Pacific in 2023 - Source worldpay.com1

Asia Pacific continues to lead the adoption and usage of digital wallets globally. China and India are major adopters, with many other countries rapidly adoption digital payment methods.

Even though China and India lead the way, many Asian economies are rapidly adopting mobile payment methods. For example, GCash in the Philippines and GrabPay in Singapore are paving the way to lead cashless purchases and digital economic inclusion in their respective countries.

Here are some of Asia's most popular mobile wallets.

Alipay: China's Leading Mobile Payment Platform

Alipay is China's leading mobile payment platform developed by Ant Group. With over a billion users, Alipay has transformed the way transactions are conducted in China.

Alipay enables you to link your bank accounts, credit cards, or debit cards to make seamless smartphone payments. Alipay supports online and offline transactions, offers various financial services, and incorporates strong security measures to protect your information and funds.

Alipay has also expanded its reach globally, making it a preferred choice for Chinese tourists traveling abroad. Alipay's success stems from its user-friendly interface, diverse services, and widespread acceptance among merchants, making it an integral part of daily life in China.

Countries served by Alipay include:

- China

- Hundreds of overseas merchants accept Alipay in a bid to support Chinese tourists overseas

- International payments and settlement in 18 foreign currencies

WeChat Pay: Transforming Mobile Payments in China and Beyond

WeChat Pay is a mobile payment platform that has played a transformative role in mobile payments in China and beyond. Developed by Tencent, WeChat Pay is integrated into the popular messaging and social media app WeChat, allowing you to make seamless and secure payments within the app.

With a vast user base, WeChat Pay has become deeply ingrained in daily life in China, enabling you to make payments for a wide range of goods and services, transfer money to friends and family, pay bills, and even make donations.

WeChat Pay leverages QR code technology for transactions, making it accessible to both merchants and individuals. It has also expanded its services to support cross-border transactions, catering to the growing number of global Chinese tourists and businesses.

WeChat Pay's convenience, widespread acceptance, and integration with other features of the WeChat app have propelled its success and solidified its position as a transformative mobile payment platform in China and a model for mobile payment innovations worldwide.

Countries served by WeChat Pay include:

- China

- 49 overseas countries that include coverage across Asia, Europe and North America

- Settlement in 16 foreign currencies including GBP, HKD, USD, JPY, CAD, AUD, EUR, NZD, KRW, THB, SGD, RUB, DKK, SEK, CHF and NOK

Paytm: India's Dominant Mobile Wallet App

Paytm is a dominant mobile wallet app in India, revolutionizing the way people transact and manage their finances. Developed by One97 Communications, Paytm has gained widespread popularity and has become an integral part of the Indian digital payment ecosystem.

With its user-friendly interface and extensive range of services, Paytm offers you a convenient and secure platform to make payments, recharge mobile phones, pay utility bills, book tickets, and even invest in mutual funds.

You can link your bank accounts, credit cards, or debit cards to the app and seamlessly make transactions with just a few taps on your smartphones.

Paytm has also expanded its services to include Paytm Payments Bank, enabling you to open digital savings accounts, earn interest on your balances, and enjoy additional benefits.

Additionally, Paytm has embraced QR code technology, allowing you to make and receive payments by scanning QR codes at millions of offline merchants across India.

With its widespread acceptance, innovative features, and commitment to user security, Paytm has emerged as India's dominant mobile wallet app, empowering millions of users to transact conveniently in the digital age.

Countries served by Paytm include:

- India

- International payments and settlement in 12 foreign currencies including AUD, AED, CAD, CHF, CNY, EUR, GBP, JPY, QAR, SAR, SGD and USD

PhonePe: India's Fastest-Growing Digital Wallet App

PhonePe is India's fastest-growing mobile wallet app, revolutionizing the way people in India transact digitally. Developed by Flipkart, PhonePe offers you a seamless and secure platform for making payments, transferring money, and managing finances.

You can link your bank accounts, credit cards, or debit cards to the app and enjoy quick and hassle-free transactions. With PhonePe, you can pay utility bills, recharge mobile phones, book flights and hotels, order food, and shop online.

The app's user-friendly interface and innovative features, such as QR code scanning, make it easy for you to make online as well as offline payments.

PhonePe has gained immense popularity due to its convenience, reliability, and strong focus on user security. As a result, it has emerged as one of India's leading mobile wallet apps, catering to the evolving needs of millions of users and driving the country's digital payment revolution.

Countries served by PhonePe include:

- India

- QR Code payments using UPI international payments integration to foreign merchants in 6 countries that include UAE, Singapore, Bhutan, Sri Lanka, Nepal and France

GCash: Revolutionizing How Filipinos Participate In The Digital Economy

GCash is the most popular digital wallet in the Philippines, enabling everyone to participate in the modern digital economy in the country. Owned and operated by Mynt, which is a joint venture amongst 3 big players in the country, GCash has witnessed tremendous growth and adoption in the Philippines.

Once you download the GCash app on your mobile phone, you can do numerous types of digital transactions like paying bills, making purchases online as well as participating stores and merchants, sending and receiving money, including receiving money from overseas into your GCash wallet, and even investing and donating money.

If you wish to receive money from overseas into your GCash wallet, or if you are an OFW (overseas Filipino worker) who wants to send money into the GCash account of your family or friends, check out various great options to send money to the Philippines from abroad.

With millions of users in the Philippines and a wide array of value added services, GCash has truly helped drive financial inclusion for Filipinos and helped one and all participate in the cashless digital economy.

Countries served by GCash include:

- Philippines

- GCash Overseas available in 14 countries that include United States, United Kingdom, Japan, Canada, Australia, Italy, United Arab Emirates, Spain, Taiwan, Germany, South Korea, Hong Kong, Qatar and Singapore

GrabPay: Singapore's Leading Mobile Wallet for Everyday Payments

GrabPay is a leading mobile wallet in Singapore, offering a convenient and secure platform for everyday payments. Developed by Grab, a prominent ride-hailing and on-demand services platform, GrabPay allows you to make cashless transactions for a variety of services, including transportation, food delivery, shopping, and more.

You can link your bank accounts, credit cards, or debit cards to the GrabPay app and effortlessly make payments with just a few taps on your smartphones. GrabPay also offers rewards and loyalty programs, providing you with additional incentives for using the platform.

With its widespread presence and integration across multiple services, GrabPay has become a popular and trusted mobile wallet for individuals in Singapore and around, transforming the way people transact and enhancing convenience in their daily lives.

Countries served by GrabPay include:

- Singapore, Cambodia, Indonesia, Malaysia, Myanmar, Philippines, Thailand and Vietnam

AliPayHK: Alipay's Mobile Wallet Solution for Hong Kong

AliPayHK is the mobile wallet solution provided by Alipay specifically designed for users in Hong Kong. Developed by Ant Group, AliPayHK offers a convenient and secure platform for digital payments in the region.

You can link your bank accounts, credit cards, or debit cards to the app and make seamless transactions for various services, including retail purchases, bill payments, transportation, and more. AliPayHK also supports peer-to-peer transfers, enabling you to send and receive money from friends and family.

The app incorporates advanced security measures, such as facial recognition and fingerprint authentication, ensuring the safety of your information and transactions.

With its wide acceptance and growing network of merchants, AliPayHK has become a popular choice for individuals in Hong Kong to embrace the ease and efficiency of mobile payments.

Countries served by AliPayHK include:

- Hong Kong

- Cross-border payments for Hong Kong residents traveling to mainland China, Macau, Japan, South Korea and Singapore

- Global ride purchases in mainland China, Japan, Thailand, United Kingdom and other locations

KakaoPay: South Korea's Popular Mobile Payment Service by Kakao Corp.

KakaoPay is a popular mobile payment service offered by Kakao Corp., a leading South Korean technology company. KakaoPay allows you to make convenient and secure digital transactions using your smartphones.

You can link your bank accounts or credit cards to the app and effortlessly make payments for a variety of services, including online and offline purchases, bill payments, money transfers, and more. KakaoPay also integrates with other Kakao services, such as KakaoTalk, allowing you to easily send and receive money within your social network.

With its widespread adoption and integration into various aspects of daily life in South Korea, KakaoPay has become a trusted and widely used mobile payment solution in the country.

Countries served by KakaoPay include:

- South Korea

Conclusion: Mobile Wallets A Backbone Of Asia Pacific's Cashless Economy

In conclusion, mobile wallets have become a highly adopted and popular payment method in Asia Pacific. They have spurred massive economic growth and contributed to elevating their countries' economies to newer levels of efficiency, inclusion and growth.

In this article, we dove deeper into Asia Pacific's most popular mobile wallets that include Alipay, WeChat Pay, Paytm, PhonePe, GCash, GrabPay, AliPayHK and KakaoPay.

Led by China and India, Asia Pacific has become a global leader in mobile wallet adoption and usage. We anticipate this dominance to continue to grow as numerous Asian economies transform into primarily digital, cashless financial ecosystems.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

References:

1. Global Payments Report 2024 published by Worldpay.

Categories

Similar Articles

Tax Treatment On Sale Of Property By NRI In India

Are you a Non-Resident Indian (NRI) who needs to sell property in India? Discover the tax implications of property sale in India and ensure that you comply with all legal regulations.

The Ins And Outs Of International Mobile Money Transfers

Mobile money has become a popular way to send money overseas. From fees to security, we delve into the ins and outs of international mobile money transfers. Make the most of your mobile device to send money abroad.

Popular Mobile Wallets In Middle East And Africa

Mobile wallets have significantly improved financial inclusion for residents of Middle East and Africa. Learn about the most popular mobile wallets that people use in this region to participate in the new cashless economy.