Best Mobile Wallets in Singapore

Table of Contents

- What Is a Mobile Wallet?

- What is the Best Mobile Wallet in Singapore?

- Mobile Wallets Powered by Banks

- Mobile Wallets from Non-Banks

- Conclusion

Singapore is a modern, vibrant city with plenty of shopping and dining options. But when it comes to paying for things, what is the best way to go? One really convenient way to do so is using a mobile wallet.

Singapore has several mobile wallets available, and each with its pros and cons. In this article, we look at some of the best mobile wallets in Singapore.

What Is a Mobile Wallet?

A mobile wallet is an electronic payment instrument that allows you to do everything you do with cash and cards but without using those payment methods. In other words, a mobile wallet is a cashless and card-less electronic payment mechanism that you carry as an app on your mobile phone.

Mobile wallets are an increasingly popular payment method because they're more convenient than ever. With a mobile wallet, you can make in-store payments without having to carry cash or physical credit cards. And since more and more stores are listed with mobile service providers, it's easy to find a place that accepts mobile wallet payments.

What are the Key Benefits of Mobile Wallets?

There are many benefits of using a mobile wallet. Here are some of the top reasons why you should consider using one:

- Increased security: Mobile wallets are generally much more secure than cash or a traditional credit or debit card. With a mobile wallet, your payment information is stored securely on your phone and can only be accessed by using your fingerprint or a PIN.

- Convenience: Mobile wallets make it easy and convenient to make payments on the go. You can use them to pay for groceries, gas, or even parking.

- Rewards and discounts: Many mobile wallets offer rewards and discounts when you use them to make payments. This can save you money on your everyday purchases.

- Easy to use: Mobile wallets are easy to use and can be set up in just a few minutes. All you need is a smartphone and an active internet connection.

- Increased privacy: Your personal and financial information remains private when you use a mobile wallet. This is because your payment information is stored on your phone, not on the merchant's servers.

Mobile wallets are cashless, secure, and easy to use, and provide numerous discounts and perks.

Are Mobile Wallets Popular in Singapore?

Are you a foreigner or expat in Singapore and not using a mobile wallet yet? You are missing out on increased security and convenience in managing your everyday purchases.

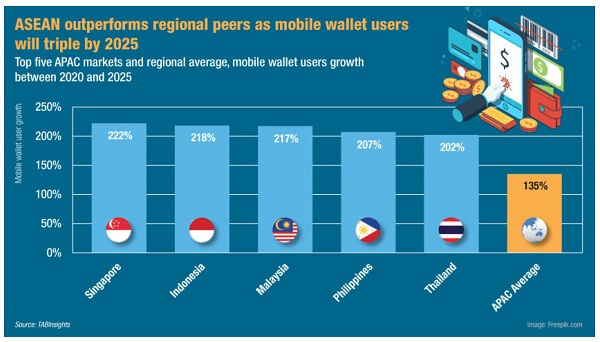

Based on an article published by The Asian Banker1, mobile wallet adoption is expected to increase to 2.6 billion by 2025. Singapore is, in fact, the leading adopter with maximum projected growth in mobile wallet adoption.

Image from an article published by The Asian Banker1

In the rest of this article, we present the top mobile wallets in Singapore below for your consideration.

What is the Best Mobile Wallet in Singapore?

If you are looking for a mobile wallet to use in Singapore, which one should you choose?

There are many good choices available, and to make the information more organized and easier to consume, we will group the best Singapore mobile wallets in 2 categories:

- Bank empowered mobile wallets

- Non-bank based mobile wallets

Popular Singapore mobile wallets are empowered by banks as well as non-bank companies.

Read on to see which are the best mobile wallets available in Singapore in both categories.

Mobile Wallets Powered by Banks

Below are the most popular bank powered mobile wallets in Singapore.

DBS PayLah!

DBS PayLah!2 is a mobile wallet developed by DBS Bank, the largest bank in Singapore. PayLah! has seen strong adoption amongst Singaporeans, and currently there are more than 2 million users using this app.

PayLah! allows users to make payments to friends and businesses, and even donate to charities, all from a mobile phone. It also comes with a handy QR code scanner, so you can quickly and easily pay for things even if the merchant doesn't have PayLah! set up.

Key benefits of DBS PayLah! include:

- Pay your friends and family easily, without having to remember their bank account number.

- Quickly pay for merchandise in shops by scanning the merchant's QR code.

- Don't have to worry about carrying cash around or losing your wallet, and make purchases at more than 180,000 accepted places throughout Singapore.

- Link your PayLah! wallet to your DBS Bank account and do seamless top ups straight from your DBS digibank online website or mobile app.

- Get exclusive deals and discounts when you use PayLah!

- Access numerous lifestyles services like buying movie tickets and booking rides directly from PayLah! without having to install additional apps.

DBS PayLah! is a popular mobile wallet with strong adoption and numerous useful features like seamless, cashless payments, discounts and lifestyle services.

OCBC Pay Anyone

OCBC Bank also has a mobile wallet called OCBC Pay Anyone3 which allows you to send money to anyone in Singapore, regardless of whether they have an OCBC account or not. All you need is their mobile number or email address.

You can also use OCBC Pay Anyone to pay bills and make online purchases. You also get 3% cashback when you scan and pay with your Pay Anyone mobile wallet app. The more you use, the more you earn.

OCBC Pay Anyone lets you:

- Pay merchants and business by scanning their QR code, or by making a PayNow transfer via their Unique Entity Number (UEN).

- Withdraw cash from an ATM without a card; use your QR code exclusively to withdraw money from ATMs.

- Pay bills for numerous telcos, utility, credit card and other companies directly.

- Split expenses and request payments from friends and family.

- Enjoy savings at a variety of businesses, including theaters, restaurants, and health and beauty centers.

- Enjoy 3% cashback when you pay with your mobile wallet.

OCBC Pay Anyone gives you 3% cashback for purchases, and can also be used to withdraw money from ATMs using a QR Code.

UOB TMRW

UOB Bank has their e-banking and digital wallet mobile app and it is called UOB TMRW mobile wallet. UOB TMRW is widely accepted in Singapore and stands out for its weekly deals.

The UOB TMRW app comes with all the standard internet banking activities, like making payments to merchants as well as transferring and receiving funds. In addition, it brings mobile wallet functionality in your pocket as well.

UOB TMRW benefits include:

- Use the app to control your UOB bank accounts, spending, and payments.

- Effortlessly complete transactions.

- Pay anyone using your mobile wallet within Singapore or in Thailand.

- Make cashless payments at more than 3,000 merchants in Singapore to purchase dining and lifestyle offers.

- Enjoy fresh rewards and offers each Friday.

- Transfer money to a UOB account, another bank account, or a credit card.

UOB TMRW is a mobile wallet from UOB Bank, and stands out with its weekly deals and offers.

All the above digital wallets are good products, but you will need to have a bank account with the corresponding bank to be able to effectively use their mobile wallet. So, if you already bank with any of these major Singapore banks, go ahead and give their mobile wallet app a try.

If you do not bank with the aforementioned banks, or simply want to use a non-bank mobile wallet, continue reading on.

Mobile Wallets from Non-Banks

In addition to the digital wallets offered by major banks in Singapore, you can also select from several non-bank mobile wallets. Below, we look at the most popular ones in Singapore.

GrabPay Wallet

Grab is a popular ride-hailing service in Singapore, and they also have a mobile wallet, called GrabPay Wallet4. GrabPay can be used for online and in-store payments and for making peer-to-peer payments.

One of the best features of GrabPay is that it can be linked to your Grab account, making it easy to pay for rides and other services offered by Grab.

Key benefits of GrabPay Wallet include:

- Pay bills, do online shopping and make purchases in a cashless manner.

- Pay for your Grab rides as well using your mobile wallet.

- Split bills and payments with family and friends; send and request payments.

- Earn 1.2% GrabRewards points for every dollar spent; points can be redeemed for payments and purchases.

- Many flexible payment options like QR Code, GrabPay Online, etc.; just look for the Grab logo at participating merchants.

GrabPay Wallet can be linked to your Grab account to seamlessly pay for rides. You also get 1.2% GrabRewards points for purchases.

Singtel Dash

Singtel Dash5 is one of the most popular mobile wallets in Singapore, and is owned and operated by Singtel which is Singapore's biggest telecom company.

An interesting and highly useful aspect about Dash is that you also get a 16 digit Dash Virtual Visa Card number which you can use for online purchases just like any other credit card. This eliminates the need to have a separate credit card at merchants that only accept Visa payments.

Another major advantage of Singtel Dash is that you can send money to Bangladesh, China, India, Indonesia, Malaysia, Myanmar and the Philippines. This can be a really handy option if you are a Singaporean expat with family in any of those countries.

Major benefits of Singtel Dash include:

- Make local as well as overseas purchases easily without worrying about cash and cards; simply use your Dash wallet.

- Access to various discounts and Dash rewards for online as well as in-store purchases.

- Send money to family and friends in Bangladesh, China, India, Indonesia, Malaysia, Myanmar and the Philippines.

- Pay for bus and train fares seamlessly with your Dash wallet.

- Get a 16 digit Dash Visa Virtual Card number that can be used to make purchases anywhere where Visa is accepted.

Singtel Dash can be used to send money overseas to Bangladesh, China, India, Indonesia, Malaysia, Myanmar and the Philippines, and comes with a useful 16 digit Dash Visa Virtual Card number.

Google Pay

Google Pay needs no introduction. If you are looking for a simple way to spend your money online or in person, Google Pay can be a good choice for you.

You can easily link your existing payment method like your bank account, a debit card or a credit card straight to your Google Pay account. Then simply use Google Pay everywhere instead of carrying cash or cards.

Benefits of Google Pay include:

- Tap to purchase bus and Singapore Mass Rapid Transit (MRT) tickets.

- Scan PayNow QR codes to make quick and easy payments.

- Enjoy various types of rewards, savings and cashback via the Google Pay app.

- Send money to friends and family conveniently.

- Top up easily via a linked bank account or card.

Google Pay is widely accepted in Singapore and is a popular mobile wallet choice.

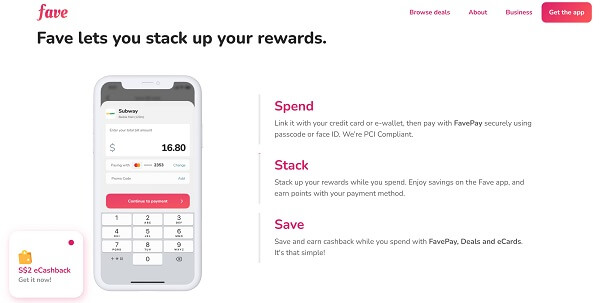

FavePay

FavePay6 is a very interesting app that basically lets you add any number of mobile wallets to it, and make cashless payments with it much like you would with a normal mobile wallet.

In that sense, FavePay is and is not a mobile wallet – it is a mobile wallet since you can make payments with it, but it is not since you do not add money directly to it. Instead, you add your existing mobile wallets to it. FavePay is, thus, an aggregator of mobile wallets.

FavePay provides all the typical advantages of a mobile wallet, such as quick and convenient contactless payment using your smartphone. The biggest advantage of FavePay is access to a tremendous number of deals, rewards and points from umpteen merchants and retailers. This helps you earn more money on your purchases.

Biggest benefits of FavePay include:

- Pay quickly and easily with your smartphone much like you would with a normal mobile wallet.

- No need to transfer money into FavePay; simply provision your existing mobile wallets in it.

- Access to tons of deals, promotions, rewards and cashback offers from thousands of merchants and brands.

- Ability to split your payments into 3 interest free smaller payments with FavePay Later.

- Seamlessly works in Singapore, Indonesia, and Malaysia – great for traveling between any of these 3 countries.

FavePay is a great way to earn rewards for every single purchase. Plus, it works in Singapore, Malaysia and Indonesia.

Apple Pay

Apple Pay is a mobile wallet that can be used with iPhones and other Apple devices. It's a great option for those already using other Apple products and services.

Apple Pay can be used for online and in-store payments, as well as for making peer-to-peer payments. One of the best features of Apple Pay is its security, as it uses Touch ID or Face ID for authentication.

Apple Pay is a very secure mobile wallet and a good choice if you already use Apple devices.

This concludes are presentation of the top mobile wallets in Singapore. Based on your needs and preferences, you can choose the most appropriate one.

Conclusion

With the ubiquity of smartphones, mobile wallets have become an increasingly popular way to pay for goods and services. In Singapore, there are a few different options available, each with its advantages and disadvantages. Which one is the best for you will depend on your individual needs and preferences.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

References:

1. The Asian Banker article on mobile wallet adoption

2. DBS PayLah!

3. OCBC Pay Anyone

4. GrabPay Wallet

5. Singtel Dash

6. FavePay

Categories

Similar Articles

Tax Treatment On Sale Of Property By NRI In India

Are you a Non-Resident Indian (NRI) who needs to sell property in India? Discover the tax implications of property sale in India and ensure that you comply with all legal regulations.

The Ins And Outs Of International Mobile Money Transfers

Mobile money has become a popular way to send money overseas. From fees to security, we delve into the ins and outs of international mobile money transfers. Make the most of your mobile device to send money abroad.

Popular Mobile Wallets In Middle East And Africa

Mobile wallets have significantly improved financial inclusion for residents of Middle East and Africa. Learn about the most popular mobile wallets that people use in this region to participate in the new cashless economy.