How to Send Money into GCash from Abroad

Table of Contents

- How much remittance is sent to the Philippines every year?

- Why should I send into GCash when sending money to the Philippines from overseas?

- How can OFWs send remittance to a GCash account?

- What steps do I need to follow to send money from overseas into a GCash account?

- Is there a limit to how much money can I send from overseas into a GCash account?

- What types of GCash accounts can receive online remittances from overseas?

- Which money transfer companies support GCash as a delivery method?

- How can I receive a remittance into my GCash account?

- How can I claim a Western Union remittance through the GCash app?

- How can I claim a MoneyGram remittance through the GCash app?

- Conclusion

GCash is an incredibly popular mobile wallet in the Philippines. It has been increasingly adopted by Filipinos as a very practical and useful way to fulfill numerous financial activities in daily life. There is lots you can do with GCash – from paying bills to making purchases to buying load to sending money to others.

To be able to use GCash, the first thing you need to do is put money into your GCash account, also called Cashing In into your GCash account. You can, of course, also withdraw funds as well (also called Cashing Out of GCash) in case you need cash. But more often than not, you will likely Cash In into GCash regularly to use the money in your wallet for purchases and other spending.

There are many ways to Cash In into your GCash account. Sending online remittance from overseas to the Philippines is one of them, and in this article, we will go deeper into all you need to know to send money into GCash from overseas!

How much remittance is sent to the Philippines every year?

Philippines is a very popular destination for global remittances sent from one country to another every year. Millions of overseas Filipinos working abroad, also called Overseas Filipino Workers (OFWs) send money regularly to their home country.

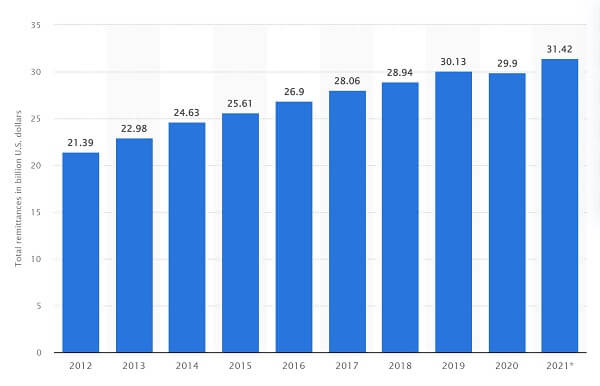

According to World Bank statistics, OFWs sent USD 31.4 billion in 2021 back home to the Philippines as remittances from overseas. This represents a sizable chunk of the GDP of the Philippines – close to 10% of Philippines GDP is driven by personal remittances from abroad!

Incoming remittances to the Philippines from OFWs contribute almost 10% of the GDP of the country.

The below graph shows the YoY increase in remittances send to the Philippines from 2012 through 2021.

As you can see, incoming remittances are a huge driver of economic growth within the Philippines. It is no wonder that GCash also supports incoming remittances, something we will discuss in detail in the sections below.

You can send remittances to the Philippines directly into the GCash account of your recipient.

Before we look into how to send money into GCash from overseas, let us first discuss why you would want to send to GCash instead of other options.

Are you looking to send money from abroad back to the Philippines, and prefer receiving the remittance amount directly in your or your recipient's GCash account? If so, there are many good choices to compare and pick from.

You can search and compare money transfer companies using our online remittance comparison engine. Simply punch in the amount you want to send and enter your country combination to see competitive options to send money to GCash from overseas.

Why should I send into GCash when sending money to the Philippines from overseas?

When you send money internationally from other countries to the Philippines, you can choose several ways to pay your recipient – the mechanism you choose to do so is called a delivery method or delivery option. For sending money to the Philippines, you can choose from any of the below delivery methods:

- Bank account transfer

- Credit into a mobile wallet like GCash

- Cash pickup

- Home delivery

Please be aware that not all money transfer companies will support each delivery option, and there may be additional fees for some services like home delivery. Check with your remittance provider to see which options they support.

Given these choices, why would you want to send money from overseas into your recipient's GCash wallet?

Here are some of the key reasons why you would want to send to GCash from overseas:

- It is more secure to send money to GCash: Since the GCash mobile wallet implements many layers of security, your money is safe with GCash. The funds can only be accessed by the recipient, and there is much lesser risk of fraud or other loss.

- Funds are available instantly with GCash: Another big advantage of sending to GCash from overseas is that the international money transfer generally finishes instantly, or within minutes. This is much faster than other methods, and your recipient can access the money right away. This presents a big plus especially for situations when you need to send money quickly to your loved ones in the Philippines.

- You need very few details to send to GCash: If you are the overseas sender remitting money into a GCash account from abroad, you need very less information. Most of the time, all you need is the recipients mobile phone number to send to their GCash wallet. Another advantage of this is the reduced number of errors in the money transfer process. Typing out long bank account and routing numbers is prone to mistakes, but entering a cellphone number is less risky.

- Ease of use for both sender and recipient: It is very simple and easy for both the overseas sender as well as the recipient in the Philippines to send and receive money with GCash. We will cover the exact steps for both parties later in this article, but sending money to GCash and receiving it are much simpler than other methods to send money to the Philippines.

- Sending to GCash is often free: Most money transfer companies will let you send money from overseas to a GCash account for free. This is because the transaction is fully electronic and secure, and the remittance company therefore incurs much less cost to send your money overseas.

If is secure, easy and often free to send money directly into a GCash account. Plus, your recipient has instant access to the funds.

Given these key advantages, you may want to consider paying your recipients in the Philippines via an online remittance into their GCash account. It is cheaper, faster and easier for you, and they will have instant access to the money in their mobile wallet for immediate use.

How can OFWs send remittance to a GCash account?

As we have discussed in the previous section, sending money to a GCash account from overseas via an international money transfer is a great way to pay recipients in the Philippines. If you are an OFW residing overseas, and want to send money to your friends and family, you certainly want to consider sending directly to their GCash account.

Currently, GCash is able to receive remittances from more than 200 countries worldwide. So, the chances that you can send to GCash from your country of residence are pretty high. Check with your money transfer operator if they support sending remittance to GCash.

Important Note: Your GCash recipient in the Philippines must have a Fully Verified GCash account to be able to receive online remittances. In case they have a Basic account, please have them upgrade their account to Fully Verified if you wish to send money from overseas to their GCash wallet.

What steps do I need to follow to send money from overseas into a GCash account?

The process to send money directly to a GCash wallet from overseas is pretty straight forward.

You can follow the below steps to do so:

- Ensure that your money transfer operator supports sending to GCash. In case they do not, you may want to switch to another remittance company if sending remittance directly to your recipient's GCash account in the Philippines is a priority for you.

- Assuming your money transfer company support sending to GCash, choose mobile wallet or GCash as a delivery option.

- Enter the recipient's first and last name, as well as their GCash account number. The GCash account number is the same as your recipient's mobile phone number that they used to register their GCash account. The phone number should be in the 09XXXXXXXXX format. Note that all these details must match exactly with the corresponding details in your recipient's GCash account.

- Finish the rest of steps that your money transfer company needs to be done, and confirm your transfer.

In most cases, the funds will be available in your recipient's GCash account within just a few minutes.

Its quick and easy to send money to a GCash account from overseas. Money is available in the recipient's GCash wallet within minutes.

Note that there may be slight variations in the above steps from provider to provide, but the general flow should be the same.

Is there a limit to how much money can I send from overseas into a GCash account?

Yes, there is an upper limit of PHP 100,000 when sending money from abroad to a GCash account. This limit is the same as the wallet limit for a Fully Verified GCash account.

What types of GCash accounts can receive online remittances from overseas?

Only Fully Verified GCash accounts can receive international remittances. If your recipient in the Philippines has a Basic GCash account, you may want to have them upgrade to a Fully Verified account. Doing so is pretty easy, plus, they get access to a lot more useful GCash products and services.

Which money transfer companies support GCash as a delivery method?

Since GCash is the most popular mobile wallet in the Philippines, numerous money transfer companies worldwide support sending money into GCash. Below is a list of some popular remittance providers who support sending money to a GCash account:

- Western Union

- MoneyGram

- Remitly

- RemitBee (Canada)

- Azimo

- Skrill

- Wise

- WorldRemit

- XendPay

- MoneyMatch (Australia, Brunei and Malaysia)

- Alipay (Hong Kong)

- SBI Remit (Japan)

- EMQ Send (Taiwan)

- Cross Remittance (Korea)

- Instant Cash (UAE)

- Wall Street Exchange (UAE)

- PayIt (UAE)

- Denarii Cash (UAE)

- SABB (Saudi Arabia)

- Rocket Remit (Australia)

- …and many others

Many money transfer companies support sending to GCash as a delivery option to send money to the Philippines from abroad.

Check with your money transfer company to see if they allow sending remittances from overseas directly into a GCash account in the Philippines.

To maximize your international money transfers to the Philippines, we recommend you compare money transfer companies to see which one fits your needs best. RemitFinder does this for you so you can compare providers in a simple and easy to understand view. The more information you have, the better choices you can make.

How can I receive a remittance into my GCash account?

If you are a recipient of an online remittance that someone sent into your GCash account from overseas, it is very simple and easy for you to access the funds. You have 2 ways to receive the remittance amount:

- Simply ask your sender to send the money directly into your GCash account. If they do that, there is nothing additional you need to do, and you have instant access to the money once the remittance transaction is successfully completed by the money transfer company.

- Alternatively, you can claim the remittance amount using your GCash app and with a Western Union or MoneyGram reference code.

Read below if you want to know the simple steps to claim the remittance funds using a Western Union or MoneyGram reference code.

How can I claim a Western Union remittance through the GCash app?

Follow the simple steps below if you wish to claim a Western Union money transfer sent to you from abroad:

- Step 1 – Login into your GCash account.

- Step 2 – From the Cash In menu, navigate to Remittance option and click on Western Union.

- Step 3 – Enter the transfer amount and the Reference Number. For Western Union, the reference number is the 10-digit Western Union MTCN (Mobile Transfer Control Number). You can get these 2 pieces of information from your recipient.

- Step 4 – Verify all details are correct and click on Confirm. GCash will process the transaction and if all goes well, your wallet will be immediately credited with the remittance amount.

Important Note: Make sure you claim the Western Union remittance within 90 days as the MTCN may expire after that.

How can I claim a MoneyGram remittance through the GCash app?

The steps to claim a MoneyGram remittance through your GCash app are identical to the ones we listed above for claiming Western Union remittances.

The only difference is in the format of the Reference Number – MoneyGram uses an 8-digit transaction number instead of the 10-digit MTCN that Western Union uses. The rest of the steps are identical, and you should be able to easy Cash In into your GCash account for MoneyGram remittances sent to you from abroad.

If you receive an overseas remittance into your GCash account, it is quick and easy to access the funds.

We have captured all the information contained in this blog in a short video. You can use this video on how to send money into GCash from abroad as a handy reference guide for this topic.

Conclusion

Sending money to a GCash mobile wallet from overseas is a very practical way to pay someone in the Philippines. Whether you are sending money to family and friends, or making a payment to a small business, sending directly to the recipient's GCash account is convenient and easy. Plus, its fully secure and money transfers sent to GCash accounts are instant.

Likewise, if you are the recipient of an international remittance coming into your GCash account, it is super easy for you to access the money and start using it. Plus, you can do so much with GCash that having the funds available in your GCash account is highly convenient.

There are so many advantages to using GCash for remittance. If you have not relied on this useful GCash feature, we encourage you to try it. We promise you will love it!

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

Categories

Similar Articles

Tax Treatment On Sale Of Property By NRI In India

Are you a Non-Resident Indian (NRI) who needs to sell property in India? Discover the tax implications of property sale in India and ensure that you comply with all legal regulations.

The Ins And Outs Of International Mobile Money Transfers

Mobile money has become a popular way to send money overseas. From fees to security, we delve into the ins and outs of international mobile money transfers. Make the most of your mobile device to send money abroad.

Popular Mobile Wallets In Middle East And Africa

Mobile wallets have significantly improved financial inclusion for residents of Middle East and Africa. Learn about the most popular mobile wallets that people use in this region to participate in the new cashless economy.