WorldRemit Detailed ReviewRates, Fees, Limits, Safety and More

Last updated: January 22, 2026

What is WorldRemit? An introduction

WorldRemit company information

WorldRemit is a digital money transfer company that helps you send money (remittance) to over 150 countries worldwide. Founded in 2010, the company has continued to grow at an impressive pace, and currently handles over half a million transactions every month.

As a fast and secure online money transfer service, WorldRemit helps people to stay connected. You can use your laptop or mobile phone to send money aka remittance with WorldRemit to over 150 countries worldwide. And, depending on the country you are sending to or from, you can send mobile money, bank transfers, cash for pickup or airtime top ups.

WorldRemit services thousands of remittance corridors globally, and has a wide network of agents and partners throughout the world. WorldRemit also acquired SendWave in 2021 thereby increasing its global footprint further. In 2020, WorldRemit and SendWave combined handled 50 million transactions helping customers send over USD 10 billion overseas.

WorldRemit by the numbers

The below statistics help put WorldRemit's global scale in perspective.

- Served 5.7 million customers in the last 10 years

- Available in 70 different currencies

- Helped send money or remittance to/from 130 countries worldwide

- 95% international transfers processed within minutes

- 125,000 five star reviews

- 1000+ employees all over the world

- London office employees represent more than 30 nationalities

WorldRemit services thousands of corridors and has served millions of customers worldwide.

WorldRemit is backed by several popular venture capital firms, and has had the below rounds of funding so far.

- $100m Series B funding in February 2015 led by Technology Crossover Ventures (TCV).

- $40 million Series C funding round in 2017 led by LeapFrog Investments.

- $175 million Series D funding round in 2019 led by TCV, Accel Partners, and Leapfrog Investments.

Which countries does WorldRemit operate in?

As a global money transfer company, WorldRemit allows you to send money from and to numerous worldwide locations. Let's see which countries you and send money from and to with WorldRemit.

Where can I send money from with WorldRemit?

You can send money from over 50 countries with WorldRemit across the below geographical regions.

- Africa - Supported countries include Burkina Faso, Ivory Coast, Rwanda, Senegal, Somaliland and South Africa

- Americas - Supported countries include Brazil, Canada and United States of America

- Asia - Supported countries include Bahrain, Hong Kong, Japan, Jordan, Kuwait, Malaysia, Oman, Philippines, Qatar, Saudi Arabia, Singapore, South Korea, Taiwan and United Arab Emirates

- Australia Oceania - Supported countries include Australia, New Zealand and Guam

- Europe - Supported countries include Austria, Belgium, Bulgaria, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Gibraltar, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland and United Kingdom

- Middle East- Supported countries include Bahrain, Jordan, Kuwait, Oman, Qatar, Saudi Arabia and United Arab Emirates

In case your country is not yet supported, be sure to periodically check the supported WorldRemit source countries page to see if it gets added. WorldRemit is constantly expanding their services, so it's possible that your country will get covered in the future.

Where can I send money to with WorldRemit?

With WorldRemit, you can send money to over 130 countries worldwide. This is a pretty comprehensive coverage that lets you send money to almost all popular global destinations. Check out the below links to see if your desired destination is supported by WorldRemit or not.

Similar to sending countries, WorldRemit has a dedicated page for receiving countries in various regions worldwide as well. Be sure to check the same to see if your desired destination country is supported.

This makes the supported WorldRemit corridors to be 6500 country combinations (50 sending * 130 receiving countries)!

WorldRemit lets you send money from 50 countries to 130 countries worldwide.

What are WorldRemit's fees and currency transfer rates?

In general, the currency transfer rates offered by WorldRemit tend to be pretty good, and overall competitive as compared to those provided by other international transfer companies.

To be able to validate if WorldRemit's currency transfer rates and fees are good or not, we will pick up some case studies and run some calculations. This will help us use data to ascertain if WorldRemit's currency transfer rates are indeed good or not.

Below is a snapshot of some numbers and calculations for sending 1000 units of currency from one country to another via WorldRemit.

| Country Pair | Transfer Amount | Exchange Rate* | Fees* | Payout | Mid-Market Rate** | FX Markup |

|---|---|---|---|---|---|---|

| USA to Jamaica | USD 1,000 | 1 USD = 148.5717 JMD | USD 3.99 | 147,978.8989 JMD | 1 USD = 153.6737 JMD | 3.71% |

| UK to Ghana | GBP 1,000 | 1 GBP = 8.9538 GHS | GBP 0.00 | 8,953.8000 GHS | 1 GBP = 9.8737 GHS | 9.32% |

| Canada to Pakistan | CAD 1,000 | 1 CAD = 155.2612 PKR | CAD 0.00 | 155,261.2000 PKR | 1 CAD = 159.4109 PKR | 2.60% |

| Italy to Bangladesh | EUR 1,000 | 1 EUR = 95.6460 BDT | EUR 21.99 | 93,542.7445 BDT | 1 EUR = 99.3853 BDT | 5.88% |

| Australia to Philippines | AUD 1,000 | 1 AUD = 37.3232 PHP | AUD 2.99 | 37,211.6036 PHP | 1 AUD = 37.9944 PHP | 2.06% |

| Denmark to India | DKK 1,000 | 1 DKK = 10.9756 INR | DKK 39.00 | 10,547.5516 INR | 1 DKK = 11.1988 INR | 5.82% |

*Remittance rates and fees as on June 08, 2022

**Mid-Market Rate from XE.com

See how we calculate FX Markup

To be able to see WorldRemit's remittance rates and fees at any time, you can use their online calculator to get a real time quote. Simply choose your from and to countries, and enter the amount you want to send to see how much money your recipient will get, and how much fee you will pay for your international transfer.

When it comes to international transfer fees charged by WorldRemit, there is a wide variation depending on corridor, amount sent and payment and delivery methods. It is best to use the online calculator to see the money transfer rates current fees for your money transfer.

WorldRemit currency transfer rates and fees have a wide variation across corridors. Make sure to get a real time quote before you decide to send money overseas.

Are WorldRemit currency transfer rates good?

There is a wide variation in WorldRemit currency rate and fee you will get across various country combinations. It is, therefore, best to use their online calculator to get a real time quote to see the latest WorldRemit money transfer rates for your intended money transfer.

As evidenced by our case studies earlier, WorldRemit has a pretty big range when it comes to currency transfer rates and transfer fees. In our analysis above, we found WorldRemit charges an FX Markup between 2.06% to 9.32%. Once again, that is a big range for their money transfer rates.

Given this, it is critical that you do your full due diligence to pick the money transfer company that is best suited for your money transfer needs. There are many providers out there with relative strengths and weaknesses, so the more you research, the better deal you will get.

Even though money transfer exchange rates matter a lot, there are other factors like transfer speed, payment and delivery methods, and safety and security that you may want to look into.

A very effective way to make your research and analysis easy is to use RemitFinder's money transfer comparison engine. We compare money transfer exchange rates from many money transfer companies and present the results to you in an easy to consume format.

When you compare WorldRemit exchange rates with those from numerous providers, you can see which option satisfies your needs best.

Is WorldRemit a cheap way to send money overseas?

It all depends on which countries you are sending money from and to, as well as the payment and delivery methods chosen.

In some cases, WorldRemit fees can be pretty high. For example, in our case studies earlier, you will have to pay a transfer fee of DKK 39.00 to send a bank transfer from Denmark to India via WorldRemit. That said, there are also numerous corridors where WorldRemit charges 0 fees.

Even if WorldRemit exchange rates are good, you may want to consider the impact of potential transfer fees on your overall payout.

In summary, you should do your due diligence and creatively use payment and delivery method combinations to minimize, if not avoid, transfer fees with WorldRemit. For example, bank transfers tend to attract lower fees compared to other delivery methods.

There is a wide variation in the transfer fees charged by WorldRemit; do your research before you send.

How do I avoid WorldRemit fees?

There are 2 ways you can try to minimize, and ideally avoid, WorldRemit money transfer fees.

- You can use coupon code 3FREE to get 0 fees on your first 3 money transfers with WorldRemit.

- After your first 3 free transfers are done, you should carefully choose the payment and delivery methods that have the lowest transfer fees. For example, bank transfers will tend to be cheaper than other payment and delivery methods.

Choose your payment and delivery methods wisely to minimize WorldRemit transfer fees.

You should try to pay for your money transfer via a bank transfer as credit cards, for example, come with higher fees.

How much money can I send with WorldRemit?

The amount of money you can send with WorldRemit depends on the following 2 factors - the sending country and currency, and the payment method (i.e., how you pay for your money transfer).

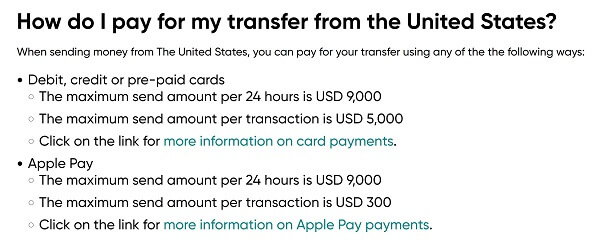

For instance, below are the sending limits for sending money from the US with WorldRemit.

- If paying with Credit Card, Debit Card or Pre-paid Cards, you can send up to USD 5,000 in a single transaction, and USD 9,000 in a 24 hour period

- The corresponding limits for Apple Pay are USD 300 per transaction and USD 9,000 per day

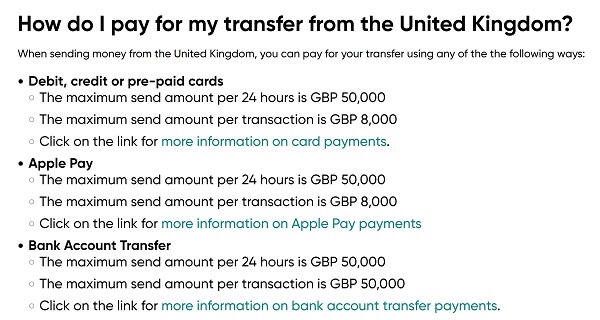

Similarly, if you are sending money from the UK, the below transfer limits are applicable.

- If you choose to pay with a Bank Account Transfer, you can send up to GBP 50,000 in a single transaction as well as in a 24 hour period

- For Apple Pay, the limits are GBP 8,000 in a single transfer, and GBP 50,000 in a day

- For Credit Card, Debit Card or Pre-paid Cards, the limits are also GBP 8,000 in a single transfer, and GBP 50,000 in a day

The amount of money you can send with WorldRemit depends on the country you send from and how you fund your money transfer.

Be sure to check the transfer limits for your country and payment method before you decide to send money with WorldRemit.

How long does it take for WorldRemit to send money overseas?

WorldRemit strives to send your money overseas as fast as possible. The actual transfer speed depends on the payout or delivery option you choose for your recipient. See below for delivery speeds for various delivery methods.

- Mobile Money is usually available instantly or within minutes of sending money.

- Cash Pickups are available instantly. Note that your recipient will have to provide identification proof when picking up the funds.

- Bank Transfers can sometimes be available instantly, else within 1-2 working days. Check with your bank to see how fast they can make funds sent from overseas available.

- Airtime Top-ups are generally available right away or within a few minutes.

- Home Delivery depends on the destination country.

WorldRemit is able to move your money overseas very quickly - usually instantly or within 1-2 business days.

How can I pay for my WorldRemit money transfer?

You can pay for your WorldRemit international money transfer in numerous ways. WorldRemit supports many global as well as local payment methods to fund your transfer.

Note that not all payment methods will be supported in every country. You should check the WorldRemit payment methods page for latest information. At this time, the supported ways to pay for your transaction are as below.

- Bank Account Transfer - You can use your bank account to pay for your WorldRemit international money transfer. At this time, back account transfer as a payment method is only available in Japan, Singapore, Somaliland, UK, South Africa and Rwanda.

- Credit Card, Debit Card or Pre-paid Card - You can use most Visa and Mastercard issues cards with WorldRemit. Note that American Express, Diner's Card and Union Pay are not supported.

- Mobile Money - If you are a resident of Senegal, Ivory Coast or Burkina Faso, you can use Mobile Money to pay for your WorldRemit international money transfer. Mobile Money is an electronic wallet service whereby your bank account is linked to your phone, and the same can be used to make payments.

- Apple Pay - WorldRemit allows you to pay for your money transfer with Apple Pay in most European countries, Taiwan, UAE, UK and USA. Apple Pay is linked to your iPhone, Mac or another Apple device, and is another convenient way to pay for your remittance.

- Trustly - Trustly is another popular e-banking system in Europe that you can use to pay for your WorldRemit money transfer. Currently, WorldRemit accepts Trustly payments in Denmark, Estonia, Finland, Italy, Norway, Poland, Spain and Sweden.

- Poli - You can use Poli in Australia and New Zealand to pay for your money transfer. Poli is a digital payment service where your bank information is not shared with the payor.

- Interac - If you live in Canada, you can use Interac to pay for your WorldRemit remittance. With Interac, the money comes straight from your linked bank account.

- iDEAL - WorldRemit supports iDEAL in the Netherlands as a payment method. With iDEAL you can fund your transfer without sharing your bank details and information.

- Klarna (Sofort) - If you are sending money with WorldRemit from Germany, Austria, Belgium and the United Kingdom, you can use Klarna (or Sofort) to pay for your transfer. With Klarna (or Sofort), the funds will debit directly from your linked bank account.

With WorldRemit, you can pay for your money transfer with a variety of payment methods, including many local payment methods as well.

How can my recipient get paid with WorldRemit?

The term delivery method or payout option means the payment mode in which your recipient gets paid overseas. WorldRemit supports the below 5 delivery methods.

- Bank Transfers - In this case, the money goes straight into your recipient's bank account. All you need to provide WorldRemit is your receiver's bank details like bank name, IBAN number and SWIFT code, and the money transfer will go into their bank account.

- Cash Pickups - With a cash pickup transfer, your recipient will go to a physical pickup location in their country that is within the WorldRemit partner and agent network. Note that the recipient will have to carry identification proof to be able to collect funds.

- Mobile Money - With Mobile Money, the funds get deposited into your recipient's electronic wallet overseas. Check if Mobile Money is available for your recipient's location when you submit your WorldRemit money transfer.

- Airtime Top-ups - WorldRemit also allows you to recharge your recipient's mobile phone number if they have a pre-paid plan with a telecom network that partners with WorldRemit. By doing a mobile recharge, you are indirectly sending money to your recipient since they can use the airtime for making calls, sending SMS, use data services, etc.

- Home Delivery - In the case of Home Delivery, an agent or delivery service will physically deliver cash to your recipient's home. For Home Delivery to be successful, make sure you provide WorldRemit with completely accurate recipient name, address and identification, else the deliverer will not be able to hand over the funds to your recipient.

There are plenty of ways in which you can pay your recipient overseas when you send money with WorldRemit.

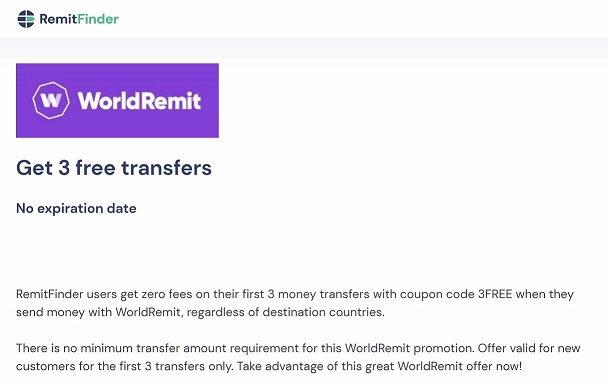

Is there any WorldRemit promo code or coupon I can use?

There is an excellent ongoing WorldRemit promo code 3FREE whereby you can send your first 3 money transfers with 0 fees. This WorldRemit coupon is applicable to all supported WorldRemit corridors, and there are no minimum transfer amount thresholds.

Below is a screenshot of the WorldRemit promo code that helps you send your first 3 money transfers for free.

WorldRemit coupon to send your first 3 money transfers for free

Make sure to use this promo code for WorldRemit on every single transfer of your first 3 transfers to avail the fee-free transfers. If you forget to apply this WorldRemit coupon on any of your first 3 transfers, that and subsequent transfers will not be free.

We will keep this page updated with any future WorldRemit remit coupon, discount code or coupon code, so make sure to check in periodically. To automate this, you can also register for our daily exchange rate alert. It is totally free, and we will keep you updated with the latest currency transfer rates and WorldRemit discount codes as well as numerous other providers.

Is WorldRemit a safe way to send money abroad?

As a global brand established in the money transfer space for more than 10 years, WorldRemit takes the security of your money as well as confidential information seriously.

WorldRemit implements a series of measures to ensure your funds and information are safe with them at all times; some of these include the below.

- As a financial institution sending money internationally, WorldRemit has to comply with numerous international regulatory requirements. This, in turn, ensures that you are in safe hands.

- WorldRemit ensures that their mobile apps as well as website are fully secure. This protects your account against unauthorized access and malicious login attempts.

- WorldRemit implements safeguarding requirements whereby your money is kept separate from WorldRemit's money. This means that if WorldRemit were to become insolvent and cease its services, your money is still safe and can be returned to you. Bear in mind that in such a scenario, you may not get a full refund as the process may entail fees charged by third parties who handle the insolvency and refunds.

- WorldRemit follows strict KYC (Know Your Customer) guidelines whereby your identity is thoroughly verified. This ensures that only you are transacting on your behalf and not a scammer or fraudster.

- WorldRemit has fraud detection teams that continuously monitor transaction activity and alert the right teams in case any suspicious activity is detected.

- WorldRemit also ensures that privacy of your data and confidential information is paramount, and prevents any unauthorized access to sensitive information.

- To keep customers aware and updated with security best practices, WorldRemit also publishes a detailed security and fraud detection and prevention guide. You should go through this useful information as this guide has a lot of tips to ensure the security of your account.

Can I trust WorldRemit?

As a global brand that has been in the money transfer business for more than 12 years, WorldRemit implements many security measures and industry best practices to ensure they keep the focus on safety and security paramount.

Additionally, WorldRemit is registered with the Financial Conduct Authority (FCA) under the Payment Service Regulations 2017 and Electronic Money Regulations 2011 (Registration number: 900891). As such, WorldRemit is an authorized and fully FCA regulated money transfer operator. In the UK, WorldRemit is a fully registered organization with company registration number 07110878.

WorldRemit is authorized and regulated by the FCA, and implements numerous security measures. Your money and information should be safe with them.

How good is WorldRemit's service?

WorldRemit is a popular international money transfer service used by millions of customers worldwide. To see if customers like WorldRemit's products and services, we will take a look at what feedback WorldRemit gets from them.

What do users have to say about WorldRemit?

Let's take a look at what customers have to say about WorldRemit on some popular rating and review^ platforms.

- On Trustpilot, WorldRemit is rated great with a 4.1/5.0 rating and has more than 61k reviews

- On the Google Play Store, WorldRemit has a 4.4/5.0 rating with 118k reviews and more than 5 million downloads

- On the Apple App Store, WorldRemit's iOS app is rated 4.8/5.0 with more than 138k ratings

- On RemitFinder, WorldRemit is rated 4.5/5.0

^Ratings on various platforms as on June 12, 2022

WorldRemit has really good ratings across all popular review and feedback platforms. It seems like customers love their product and services.

Is WorldRemit the best choice for me?

Given our detailed inspection of WorldRemit's money transfer service, and a thorough analysis of various aspects associated with it, we are ready to discuss the strengths of WorldRemit. Below is a summary of the areas we find WorldRemit strong in when it comes to sending money internationally.

- Comprehensive corridor coverage - With WorldRemit you can send money across 6500 country combinations with support for 50 sending countries and 130 receiving countries. Given this robust support, the chances that WorldRemit operates in your desired country combination are pretty high.

- No fees on first 3 money transfers - WorldRemit has an evergreen promotion going on whereby you get your first 3 money transfers with them for free. This is a great way to avoid fees and save even more money to maximize your remittance payout.

- High transfer limits - WorldRemit lets you send a liberal amount of money in your transactions as well as on a monthly basis. For example, in the UK, you can send GBP 50,000 in a single transaction if you pay for your transaction with a bank transfer.

- Fast international money transfers - WorldRemit will move your money overseas quickly. Most transfers complete within minutes, and the rest within 1-2 business days.

- Variety of payment and delivery methods - WorldRemit lets you pay for your money transfers in multiple ways that include bank account transfer, credit, debit or pre-paid cards, mobile money, apple pay and numerous local payment methods. Similarly, you can pay your recipient in many ways as well that include bank transfers, cash pickups, mobile money, airtime top-ups and home delivery.

- Great product liked by customers - WorldRemit has really good ratings and reviews on various popular review platforms which indicates that their product works well and is liked by users.

RemitFinder likes WorldRemit for providing comprehensive corridor support, moving money overseas rapidly, supporting numerous payment and delivery methods and having a product that is well liked by customers.

What are the best reasons to use WorldRemit?

Now that you understand the strengths and weaknesses of WorldRemit's international money transfer services, we can chart some remittance scenarios where WorldRemit may be an attractive choice to send money overseas. Below, we provide some examples where you may want to rely on WorldRemit given their advantages in the respective areas.

- If you have a need to send money overseas in a hurry, WorldRemit can be a great choice as they specialize in fast money transfers. Most of WorldRemit's transfers complete within minutes, and all of them within 1-2 working days. The only exception is Home Delivery where there may be delays based on the deliverer's working hours and local holidays.

- WorldRemit supports numerous payment methods, including many local payment methods that are popular in some countries and regions. Local payment methods are often cheaper than credit cards and other ways to pay for your money transfer. This makes WorldRemit a good choice to save on fees and other expenses that you may incur with some payment methods.

- WorldRemit also support numerous flexible ways to pay your recipient. This can be a great advantage in some scenarios. For example, if your recipient does not have a bank account, you can send money with WorldRemit and choose to pay with Cash Pickup or Mobile Money.

- The service quality and ease of use of WorldRemit's website and apps is very good as demonstrated by their very good ratings and reviews across many review platforms. You will likely face no issues using WorldRemit to send money overseas.

- WorldRemit supports 6500 country combinations and can send money from 50 countries to 130 countries worldwide. Depending on where you live, and where you want to send money to, WorldRemit could be a very attractive choice.

- With WorldRemit, you get your first 3 transfers for free without paying any fees. This can be a great way to save even more money and ensure that your recipient gets maximum payout overseas.

WorldRemit offers some key advantages that make it a great choice for many international money transfer scenarios.

What type of transfers can I make with WorldRemit?

With WorldRemit, you can make 2 types of transfers when sending money overseas; these are:-

- Money transfers whereby your recipient gets funds you send

- Airtime top-up whereby your recipients gets mobile recharge and airtime on their pre-paid phone plan

If you choose to send money to your overseas recipient, there are 4 options you can have the funds delivered to them; these are as below.

- Bank Account Transfer - funds will go straight into your recipient's bank account

- Cash Pickup - the recipient will go to an agent location to pick up the money as cash

- Mobile Money - funds will be deposited into an electronic wallet in the recipient's country

- Home Delivery - a local deliverer will go to your recipient's home to hand them the funds

Depending on your needs, you can choose from any of the above flexible options when you send money with WorldRemit.

What are various ways to send money with WorldRemit?

With WorldRemit, you can send money electronically from the comfort of your home and office. There is, thus, no need to go to a physical branch or location and stand in lines. You can choose one of the 2 options below to send money with WorldRemit.

- Using the WorldRemit website

- using WorldRemit's mobile apps (available on both Google Play Store for Android devices as well as Apple App Store for iOS devices)

How to send and receive money with WorldRemit?

It is fast, convenient and easy to send money with WorldRemit, and the whole process should only take a few minutes. This is no surprise given WorldRemit's very good customer feedback - users find it easy to use WorldRemit's service to send money abroad.

Below we present a step by step guide on how to send money with WorldRemit.

Step by step guide to send money with WorldRemit

Sending money with WorldRemit is quick and easy. Follow the simple steps below to send money to your overseas recipients with WorldRemit in just a few minutes.

- Step 1 - Ascertain if WorldRemit is the right choice for your next overseas money transfer. An easy way to do this is to compare numerous money transfer companies with RemitFinder's online money transfer comparison platform. RemitFinder compares many companies and presents the results to you in an easy to understand format so you can select the best provider for your needs.

- Step 2 - Register your account with WorldRemit. Create a new account with WorldRemit by signing up for their service. Registration is a seamless process and should not take much time.

- Step 3 - Enter needed information about your money transfer. Select from and to countries and currencies for your transfer, and enter the amount you want to send. Provide WorldRemit with information about your recipient, and enter banking details and other necessary information needed for transfer.

- Step 4 - Confirm your money transfer. Once you've started your new WorldRemit money transfer transaction, transfer the funds to WorldRemit (by bank transfer, card payment, or other supported payment methods) and they'll start working on your transfer.

- Step 5 - Track your money transfer. You can monitor the progress of your WorldRemit money transfer on their website or mobile apps. WorldRemit will also send you notifications as your transactions progresses to next steps.

WorldRemit makes it quick and easy to send money overseas with their website or mobile apps.

How can WorldRemit help me send money?

WorldRemit has plenty of helpful resources and guides to help you get going on your international money transfers.

First off, you can browse their very helpful getting started guide - whether you are new to sending money abroad or are a regular, WorldRemit provides some useful information and tips that you will surely benefit from.

Additionally, WorldRemit provides a lot of useful country specific information to help you understand money transfers for your country deeper. See below for some custom landing pages for some of the world's most popular remittance destinations.

- Send money to India

- Send money to the Philippines

- Send money to Nigeria

- Send money to Ghana

- Send money to Kenya

- Send money to Colombia

There are many other guides for other countries, so be sure to check the one for your recipient's country.

WorldRemit provides a lot of helpful guides and resources to get you started with your first money transfer with them.

Do I need a WorldRemit account to receive money?

WorldRemit enables you to send money overseas even if your recipient does not have a bank account. Many of the supported delivery methods like Cash Pickup, Mobile Money, Airtime Top-up and Home Delivery do not necessitate that your recipient have a bank account to receive money overseas.

In this way, WorldRemit is a great option if your recipient either does not have a bank account, or does not want to share bank details due to safety and privacy concerns.

You can send money overseas with WorldRemit even if your recipient does not have a bank account.

Does WorldRemit have a mobile app?

WorldRemit does have mobile apps that you can use to send money on the go without having to line up in stores or malls. You can use WorldRemit's mobile app on both Android and iOS devices by downloading the app from the Google Play Store or the Apple App Store, respectively.

WorldRemit mobile apps have very good ratings and reviews so it should be a good and hassle free experience to use them to send money overseas.

How do I track my WorldRemit transfer?

You can easily track the progress of your money transfer with WorldRemit by logging into your account on their website or mobile app. Simply go to the My Account area and look for your transaction in progress to get the latest status.

WorldRemit also ensure to keep you updated of transaction progress by sending you regular notifications as your money moves from the source to the destination country.

Can I use WorldRemit for international bank transfers?

You surely can use WorldRemit to make an international bank transfer. To achieve this, pay for your money transfer via a bank account transfer, and choose bank account as the delivery option to pay your recipient overseas.

In this manner, funds will come out of your local bank account, and get deposited in your recipient's bank account overseas. Your WorldRemit money transfer, thus, would produce the same outcome as an international bank account transfer.

Is WorldRemit online better than sending money in-person in stores?

WorldRemit only handles online money transfers via their website or mobile apps. There are no branches or locations you need to go to for sending money with WorldRemit.

This is a good thing as you do not need to deal with traffic or stand in lines in offices or stores. Everything that you could do in a potential branch or office can be done online via the WorldRemit website or mobile app.

Does WorldRemit have a rewards program?

WorldRemit does have a referral program whereby you can earn rewards by referring your friends to WorldRemit. See below for more details on the WorldRemit Refer a Friend program.

If you refer your friend to WorldRemit, and they send money using WorldRemit, both you and your friend get discounts on your next money transfer. Keep in mind that your friend must send a minimum threshold for you to earn the referral bonus. The minimum qualifying amount as well as the referral bonus amount vary by country, so make sure to check those out.

In addition to the referral program, WorldRemit also offers first 3 free money transfers for new customers. Take advantage of this WorldRemit promotion to save money on your first 3 transfers by paying 0 fees.

What customer support options are available with WorldRemit?

In case you run into any issues or have questions regarding your WorldRemit money transfer, you can get in touch with customer support using any of the below options.

- Chat - You can use online chat to connect with someone at WorldRemit, and their customer support team will assist you.

- Phone - If you prefer to talk to someone on the phone, you can call the WorldRemit customer support number in your country to get local support.

Phone numbers to contact WorldRemit customer support team are easily available. Make sure to call the support team in your country to get the fastest service in your local region.

Finally, before you contact support, you may want to also look at the WorldRemit FAQ to see if your query is already answered in one of the help pages. This may save you valuable time by obviating the need to call customer support.

Can I cancel my WorldRemit transfer?

If you wish to cancel your WorldRemit money transfer, you should be aware of some important timelines and rules. Below, we provide more details on this important topic.

It may not be possible to cancel your money transfer if the recipient has already collected the funds. Prior to delivery of funds, it may be possible to cancel the transaction. Make sure to contact WorldRemit customer support team as soon as possible.

You can follow the below steps to initiate a money transfer cancelation request.

- Step 1 - Sign in into your WorldRemit account on the website or the mobile app

- Step 2 - Navigate to the transfer activity section

- Step 3 - Locate the transaction you want to cancel and click into it

- Step 4 - Click on the 'Request cancellation' button

From this point on, WorldRemit will try to cancel your money transfer if it is possible to do so.

When will I get my refund from a canceled WorldRemit transfer?

If you cancel your WorldRemit money transfer, you will get your money refunded to you typically within 7 business days. In some cases, it may take longer depending on how you paid for your money transfer.

Can paid out WorldRemit money transfers be recalled?

Some WorldRemit transfers may be recalled even if the funds have been paid out to the recipient. See below for more details on this as recalls depend on the delivery method you used when you started your transaction.

- Cash Pickups - If your recipient has already picked up cash, it is not possible to recall the transfer.

- Airtime Top-ups - Airtime recharge cannot be recalled once credited to the recipient's mobile account.

- Mobile Money - It may be possible to recall Mobile Money payouts. You should contact WorldRemit asap if you wish to get your funds back.

- Bank Transfer - In some cases, it may be possible to recall bank transfer as well. Once again, you should get in touch with the WorldRemit customer support team right away so they can try to help you with this.

Are WorldRemit money transfers recalls guaranteed?

Recalls are not guaranteed as there are several factors at play. For example, the recipient may not consent to return the funds, or may not have enough funds to return the original amount. WorldRemit will try to get your money recalled, but the above circumstances will eventually influence if you can get your money back or not.

How do I delete my WorldRemit account?

If you want to delete your WorldRemit account, you should contact customer support who will be able to help you with your request.

Note that account deletion will mean you will lose access to your transaction history. Hence, it may be a good idea to make a backup of your transactions before you delete your WorldRemit account.

Additional Information

Legal and Regulatory Compliance

WorldRemit is registered with and regulated by the Financial Conduct Authority (FCA) in the UK (Registration number: 900891). The FCA monitors WorldRemit as an authorized money transfer operator under the Payment Service Regulations 2017 and Electronic Money Regulations 2011. WorldRemit's company registration number in the UK is 07110878.

Helpful Links

- RemitFinder blog on top 7 best international money transfer apps

- RemitFinder blog on the best ways to send money from the United States

- How to get started with your first WorldRemit money transfer

- How does WorldRemit work

- WorldRemit blog on how to send money to someone who does not have a bank account

- Detailed guide on how to use the WorldRemit mobile app

Awards, Prizes and News

- In 2021, WorldRemit won the Canstar Outstanding Value Award for International Money Transfers

Deals

Reviews

WorldRemit authorized a fraudulent transaction in my account, withdrawing money from my debit card without my authorization to send it to a person in Kenya I did not even know. I tried to contact WorldRemit again to ask for a refund since the fraud happened in their systems and they told that was my problem and would not refund me. There are better, safer apps to send money abroad so do not use WorldRemit because they do not even care about their customers that are being defrauded.

Used this service from April till August of 2022. All of the sudden stopped working and the costumer service is abysmal.