5 Reasons To Avoid Sending Money Overseas With Banks

Table of Contents

- Why Are Bank Transfers Popular?

- What Are The Disadvantages Of Using Banks For International Money Transfers?

- Reason #1: High Fees And Charges

- Reason #2: Unfavorable Exchange Rates

- Reason #3: Insufficient Payment And Delivery Methods

- Reason #4: Lengthy Transfer Times

- Reason #5: Limited Accessibility

- Bank Transfers Vs Money Transfer Companies - A Case Study

- When To Use Banks For International Money Transfers?

- Conclusion: Stop Sending Money Overseas With Banks

Sending money overseas has become a common practice in today's globalized world, whether it is to support family members or to conduct business transactions.

Banks are often the first option that comes to mind for many people when it comes to sending money overseas. However, it is essential to be aware of the potential drawbacks of using banks for international money transfers.

In this article, we discuss five reasons you should avoid banks for sending money overseas, including hidden fees and charges, unfavorable exchange rates, lengthy transfer times, limited accessibility, and security risks.

By the end of this article, you will have a better understanding of the disadvantages of using banks for international money transfers and alternative options that may be more suitable for your needs.

Why Are Bank Transfers Popular?

You may be wondering if banks are not the best option to send money overseas, why are they still a popular choice for international remittances.

There are a few simple reasons why many people still rely on their bank to send money abroad; some of these include the below:

- Convenience and ease: The top most reason why banks get used for international money transfers is that it is always easier to deal with your bank. You already have an account with them, and there is no need to open a new account with another institution.

- Easy access: Another reason why you may be tempted to go with your bank for overseas funds transfers is simple and easy access to banking services. Most banks have mobile apps and online banking to help you transact online. Even if you have to stop by at your bank's local branch, it is not that hard to send money from there.

- Lack of awareness of other choices: Many people end up using their bank for money transfers as they are simply not aware of other choices. Unless you do research or seek knowledge and information, you may assume that your bank is the best and only choice to send money overseas.

- Popularity of bank to bank transfers: Often, your overseas recipient wishes to receive money directly into their bank account. Therefore, your bank may seem like a natural choice since your international money transfer is essentially a bank to bank transfer.

- Exposure to marketing: Banks often advertise their services, including international money transfer options, in their brochures, ads, posters, in-branch promotional material and via other means. This may influence you to use your bank when you need to remit funds overseas.

Convenience, easy access and popularity of bank to bank transfers are some of the primary reasons why you may be tempted to send money overseas with your bank.

Next, we will look into some of the drawbacks of sending money overseas using your bank.

What Are The Disadvantages Of Using Banks For International Money Transfers?

Whilst your bank is certainly a very valid option to send money abroad, there are many potential disadvantages of using your bank for international money transfers. Let us look at some of the top reasons to avoid banks for remittances below.

Reason #1: High Fees And Charges

One of the main reasons to avoid sending money overseas with banks is the fees and charges that can quickly add up and eat into the amount you intend to send.

Banks often charge various types of fees that include wire transfer fees, and fees charged by intermediary and correspondent bank fees. All these charges can vary depending on the amount you are sending and the destination country.

For example, when we compared various popular US banks for international wire transfers, we found that the fees for an international wire range anywhere from USD 20 to USD 50. That is a lot of money lost in fees.

Banks tend to charge high wire transfer fees for sending money internationally. Based on our research, most popular US banks charge between USD 20-50 for sending money internationally.

Reason #2: Unfavorable Exchange Rates

Another key reason to avoid sending money overseas with banks is the unfavorable exchange rates they often offer. Exchange rates refer to the value of one currency compared to another.

Banks usually add a markup, called an FX Markup, on top of the real exchange rate to increase their profits.

This markup is often hidden in the banks' exchange rate, and it can be challenging to identify it unless you compare it to the real exchange rate. This is why the FX Markup acts like a hidden fee and lowers the payout of your money transfer.

The impact of unfavorable exchange rates can be significant, especially when sending large amounts of money. For example, a 3% higher FX Markup on a USD 10,000 transfer means a difference of USD 300, which is a significant amount that you need to pay.

Based on our research and analysis, most banks charge FX Markups anywhere from 2% to 6%.

Banks often charge high FX Markups on the real exchange rate to realize a higher profit on international money transfers. Most banks will charge between 2-6% markup.

One of the reasons banks offer less favorable exchange rates than money transfer companies and remittance service providers is because they have higher overheads and operating costs, which they pass on to customers through their exchange rates.

To avoid unfavorable exchange rates, it is essential to compare exchange rates offered by different providers to get the best possible rate. If you research and compare the fees and exchange rates offered by different providers, you can avoid hidden fees and charges when sending money overseas.

One easy way to do this is to rely on RemitFinder's online international money transfer comparison engine. We do all the hard work to integrate with numerous global money transfer companies to provide you an easy to understand comparison of their services.

Using specialized money transfer services or online platforms is a more cost-effective and often faster option than using banks. By being aware of hidden fees and charges, you can save your hard earned money and ensure that the intended recipient receives the maximum amount your money can get them.

Reason #3: Insufficient Payment And Delivery Methods

When you send money overseas, you will come across 2 terms - payment method and delivery method. A payment method is how you fund your international money transfer and a delivery method is how you choose to pay your overseas recipient.

Banks typically do bank to bank wire transfers, which means that your choices are very limited when it comes to payment and delivery options.

Why would you need to use additional payment and delivery methods? Here are some scenarios where a bank to bank transfer may not fulfill your needs:

- If you need to rush money for an emergency, it will be faster for you to use cash. Many money transfer companies accept cash payments and provide cash pickup overseas.

- If your recipient does not have a bank account, you will need to find other ways to send money to them. For example, you may need to send money to their mobile wallet or top up their card.

- Sometimes you may not know the recipient well and they do not want to share their bank information with you. In such cases, you will need to use alternate delivery methods.

- If you do not have a bank account yourself, or do not want to use your bank account to fund your money transfer, you will need access to alternate payment methods.

There may be other scenarios where additional delivery methods are needed, and a bank to bank transfer might not be your best bet.

Banks generally only support bank to bank transfers. If you or your recipient do not have a bank account, or do not want to use one, you will need to look for other options.

Reason #4: Lengthy Transfer Times

Another reason to avoid sending money overseas with banks is the potentially lengthy transfer time involved. Banks are known for their slow transfer times, with some transfers taking up to a week or more to be completed.

There are a few reasons why international money transfers sent with banks can be slow. These include:

- Involvement of intermediary banks: Banks often use a network of correspondent banks to facilitate international transfers, which can add further delays and costs to the process.

- Complex processes: Banks need to comply with strict regulatory requirements, such as anti-money laundering and counter-terrorism financing laws, which can lead to additional checks and documentation requirements, resulting in longer processing times.

- Cut-off times: Most banks have a cut-off time for processing international wire transfers. If you miss that time, your transfer will be on hold and will begin processing only on the next business day.

- Weekends and public holidays: Banks are subject to weekend and public holiday closures. So, if you need to send money outside of business days, you cannot rely on your bank. Moreover, even if you send money on a Friday, for example, the chances of your transfer getting picked up on the Monday of next week are really high.

The involvement of intermediary banks, complex processes, cut-off times and closures of non-business days are some of the reasons that contribute to the slowness of international bank transfers.

If you send money overseas urgently, such lengthy transfer times can be inconvenient and frustrating, and in some cases, it can be costly. For example, delays in transferring funds can mean missed payment deadlines or additional charges for late payments.

To avoid lengthy transfer times, you consider using specialized money transfer services that offer faster transfer times. These providers excel in international money transfers are able to move money internationally quickly and efficiently.

Reason #5: Limited Accessibility

Another reason to avoid sending money overseas with banks is the limited accessibility they offer. Banks may not have branches or partner banks in some cities or regions, making transferring money to certain destinations challenging.

This lack of accessibility can also lead to higher costs, as banks may need to use intermediary banks to complete the transfer, resulting in additional fees and longer processing times.

Additionally, the limited accessibility of banks can be particularly challenging for people who live in remote or rural areas. In such cases, traveling to the nearest bank branch can be time-consuming and costly and, in some cases, may not be feasible at all.

To overcome the limited accessibility of banks, you can consider using specialized money transfer services or online platforms that offer a wider range of destinations and often have partnerships with local banks and financial institutions.

RemitFinder does not recommend using banks for international money transfers due to various drawbacks. Primarily, you will pay high wire transfer fees and get poor exchange rates, both of which will put a major dent in your hard earned money. Try international money transfer companies instead.

Now that we have presented some of the main reasons why sending money internationally with banks may not be a great idea, lets embark on a case study to demonstrate the key differences between banks and money transfer companies.

Bank Transfers Vs Money Transfer Companies - A Case Study

Let us compare sending an international money transfer with a bank vs a specialist money transfer company.

For our case study, we will use a USD 1000 worth international money transfer from the US to the Philippines. Here are some assumptions that we will make to do this comparison:

- We will assume an FX Markup of 3% for the bank transfer (most banks charge a markup between 2-6%.

- We will assume a wire transfer fee of USD 25 (most banks charge wire fees that range from USD 20 to USD 50).

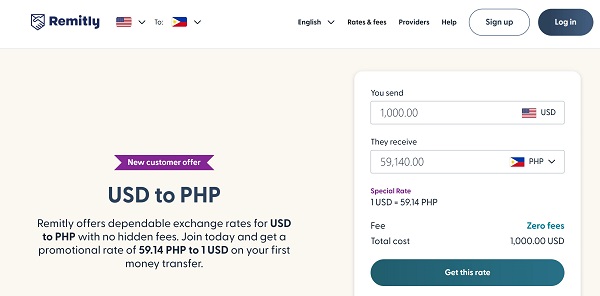

- We will use Remitly as the money transfer company to compare with and use their exchange rate and transfer fee.

Using these parameters, here is how a US bank would compare against a money transfer company like Remitly.

| Provider | Send Amount | Mid-market Exchange Rate* | Provider Exchange Rate | Provider Fee | Payout | Effective Exchange Rate |

| Bank | USD 1000 | PHP 58.5214 | PHP 56.7658 | USD 25 | PHP 55,346.66 | PHP 55.3466 |

| Remitly** | USD 1000 | PHP 58.5214 | PHP 59.1400 | USD 0 | PHP 59,140.00 | PHP 59.1400 |

* Mid-market Exchange Rate taken from xe.com as 1 USD = 58.5214 PHP on June 1, 2024

** Remitly's USD-PHP exchange rate and fees as on June 1, 2024

Below is a screenshot of Remitly's exchange rate, transfer fee and payout for a USD 1000 international money transfer sent from the US to the Philippines.

Here are some noteworthy points from our comparison above:

- If you go with the bank, you will lose PHP 3,793.34. This is equivalent to USD 64.82 (using the mid-market exchange rate).

- The hidden fee charged by the bank as part of an inferior exchange rate equals USD 39.82 (total USD 64.82 lost minus USD 25 wire fee).

- The effective exchange rate that you get with the bank (after accounting for the wire fee and the hidden fee by virtue of a lower exchange rate) is PHP 55.3466. This is PHP 3.7934 lower than Remitly's effective exchange rate.

- The exchange rate difference means that for every 1 USD that you send with the bank, you lose PHP 3.7934. If you send USD 100, you lose PHP 379.34, and if you send USD 1000, you lose PHP 2,793.40, and so on for higher transfers.

Our case study clearly demonstrates how much money you can lose with bank transfers, and just how much more profitable it can be to rely on a money transfer specialist company.

If you are looking to send money overseas, Remitly is a great choice. Check them out on RemitFinder to read more about them and compare them with other providers to see if they could be a good partner for your international money transfer needs.

When To Use Banks For International Money Transfers?

Based on our analysis, you may be considering if it is ever a good idea to use banks for international remittances.

Even though we recommend using money transfer operators instead of banks, there may be some scenarios where it might be useful to go with a bank.

One such case is when you wish to move a very large amount of money overseas. In such cases, it may be possible to negotiate with your bank to get the transfer fee waived as well as get a better exchange rate.

Another possibility where bank transfers may not be that expensive is when you have an elevated or privileged membership or account level at your bank as your account may benefit from perks like free transfers and better exchange rates.

Finally, there may be cases when you have no choice but to send or receive money via bank transfers. For example, when sending or receiving money to government agencies, or paying off your loan, etc.

Regardless of the situation, we still recommend comparing the price you get from your bank with offers from money transfer companies. Even if you decide to go with your bank, a head-to-head comparison will at least ensure that you are comfortable with your decision.

Even if you decide to go with a bank transfer for any reason, we still recommend comparing the quote you get from your bank with exchange rates and fees from money transfer companies. This will help you make a more informed decision and evaluate pros and cons better.

Conclusion: Stop Sending Money Overseas With Banks

In conclusion, while banks are a popular choice for sending money overseas, there are several drawbacks to sending money with banks.

Hidden fees and charges, unfavorable exchange rates, lengthy transfer times, lack of payment and delivery option choices and limited accessibility are all factors that contribute towards making banks a less attractive choice for international remittances.

To avoid these issues, it is important to research different providers and compare their exchange rates, transfer fees and overall service quality. Specialized money transfer services and online platforms can often offer more competitive rates, faster transfer times, and greater accessibility than banks.

Ultimately, the goal is to ensure that the intended recipient receives the full amount of money you want to send promptly and cost-effectively. By understanding the potential drawbacks of using banks for international money transfers, you can decide on the best provider for your needs.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

Categories

Similar Articles

US Big Beautiful Bill's Impact On Remittances

The Big Beautiful Bill has been passed in the US, and remittances are impacted. Learn how the Bill impacts remittances and what to do if you are affected by the new law.

Bangladesh Remittance Cash Incentive: All You Need To Know

Are you an overseas Bangladeshi resident who sends money home to your loved ones? Read on to learn how to earn an additional 2.5% cash on your international remittances sent to Bangladesh.

How Fintech Is Pushing Banks Out Of The Remittance Business

The fintech revolution is disrupting the international remittance business. Discover how innovative startups are reshaping the international money transfer industry and challenging traditional banks.