The Top 7 Best US Banks for International Wire Transfers

Table of Contents

- 1. Bank of America

- 2. Wells Fargo

- 3. Citibank

- 4. Capital One

- 5. JPMorgan Chase

- 6. PNC Bank

- 7. U.S. Bank

- Tips to make the most of your wire transfers via banks

- Which bank has lower wire transfer fees?

- Which bank has high wire transfer limits?

- What information do I need to send wire transfers?

- How to minimize international wire transfer fees?

- Alternatives to international wire transfers

- What are the advantages of using banks for international wire transfers?

- What are the disadvantages of using banks for international wire transfers?

- What is the alternative to sending international wire transfers?

- Conclusion

When it comes to transferring money internationally, wire transfers are one of the popular means to send money overseas to a bank account. If you want to execute an international wire transfer from the United States, there are several great US banks that make it easy to wire money abroad.

In this article, we will present the top US Banks you could use to send international wire transfers. They all come with their own strengths and weaknesses, so read on to see which ones might be a better fit for your needs.

Here are the top seven best US banks for international wire transfers.

1. Bank of America

Bank of America is one of the largest banks in the United States. It offers a wide range of banking products and services, including checking and savings accounts, credit cards, loans, mortgages, and investment products. The bank also offers international wire transfer services.

Bank of America has more than 4,700 branches across the country and serves customers in more than 150 countries. The bank has a strong online presence and offers mobile banking services.

Bank of America is a member of the Federal Deposit Insurance Corporation (FDIC) and is headquartered in Charlotte, North Carolina.

You can send wire transfers with Bank of America, and we present their fees and transfer limits below.

What are Bank of America's wire transfer fees?

Bank of America domestic and international wire transfer fees1 as are below:

- Domestic wire transfers cost USD 30

- International wire transfers sent in US Dollars cost USD 45

- International wire transfers sent in foreign currency are free

What are Bank of America's wire transfer limits?

Bank of America has limits on the amount of money that can be sent via wire transfers: these are listed below.

- Domestic wire transfer limit is USD 1000 per transaction

- International wire transfer limit is USD 5000 per transaction

Bank of America also has limits on the number of international wire transfers that can be made in a given period like a day or a month. Check with your bank branch if you bank with Bank of America to find those limits as they vary based on your account type.

2. Wells Fargo

Wells Fargo is one of the oldest and largest banks in the US. They offer a variety of products and services, including international wire transfers. Wells Fargo has more than 8,000 branches across the US and in more than 70 countries around the world.

Below, we provide information about how much you can send and what fees you have to pay if you send wire transfers with Wells Fargo.

What are Wells Fargo's wire transfer fees?

Wells Fargo charges fees2 for incoming as well as outgoing domestic as well as international wire transfers as below:

- Incoming domestic wire transfer fee is USD 15

- Incoming international wire transfer fee for US Dollars is USD 16

- Incoming international wire transfer fee for foreign currencies is USD 16

- Outgoing domestic wire transfer fee is USD 30

- Outgoing international wire transfer fee for US Dollars is USD 45

- Outgoing international wire transfer fee for foreign currencies is USD 35

- Outgoing domestic wire transfer fee for repeat transfers is USD 25

- Outgoing international wire transfer fee for repeat transfers in US Dollars is USD 40

- Outgoing international wire transfer fee for repeat transfers in foreign currencies is USD 30

What are Wells Fargo's wire transfer limits?

Wells Fargo enforces limits on how much money you can send via wire transfers with them. Unfortunately, these are not disclosed as they vary based on account level and other factors. Contact your Wells Fargo branch to find out how much you can send with them for domestic or international wire transfers.

3. Citibank

Citibank is one of the largest banks in the United States and offers a variety of products and services to individuals, businesses, and governments including wire transfers.

If you need to send an international wire transfer, Citibank can be a good option. There are a few things to keep in mind, though:

- Citibank has varying fees for international wire transfers. Some account holders will have all fees waived, while others will pay USD 15 for incoming transfers and USD 25–35 for outgoing international transfers.

- You'll need to have a Citibank account to send an international wire transfer. If you don't have an account, you can apply for one online.

- Citibank doesn't offer the best exchange rates. When you send money with Citibank, you'll get the bank's standard exchange rate, which is usually much lower than the mid-market rate.

In the following sections, we present Citibank's wire transfer fees and limits for international as well as domestic wire transfers.

What are Citibank's wire transfer fees?

Below are Citibank's wire transfer fees3 for both domestic and international wire transfers:

- Highest incoming wire transfer fee is USD 15

- Highest outgoing domestic wire transfer fee is USD 25

- Highest outgoing international wire transfer fee is USD 35

- Fees are discounted or waived depending on Citibank account type

What are Citibank's wire transfer limits?

Citibank has pretty generous limits when it comes to sending wire transfers. This makes them a good choice if you are trying to send large amounts. Currently, the limits are as below:

- Lowest outgoing limit is USD 50,000 per day

- Some account types have a limit of USD 200,000 or USD 250,000 per day

- Some account types have no sending limits

Certain Citibank account types have lower or even 0 wire transfer fees as well as higher or unlimited sending limits. Check out Citibank account membership levels to see if you want to upgrade.

If you're looking for a bank that offers international wire transfers, Citibank can be a good option. Just keep in mind the fees and exchange rates before you make a decision.

4. Capital One

Capital One is one of the most well-known financial institutions in the United States. The bank offers a wide array of products and services, including checking and savings accounts, credit cards, auto loans, mortgages, and more. Capital One is also a popular choice for international wire transfers.

When it comes to international wire transfers, Capital One offers a few different options to send the wire depending on your account type with them. These are as below:

- By visiting a bank branch

- Over the phone

- Online via the website or mobile app

Check with your bank branch to see which options are available to you based on your Capital One account type.

Below is a summary view of Capital One's wire transfer limits and fees for various types of wire transfer transactions.

What are Capital One's wire transfer fees?

Capital One wire transfer fees vary based on your account type with them. Below is a summary of their fees:

- Incoming wire transfer fee4 is USD 15 for some Capital One account types, and waived for others

- Outgoing wire transfer fee5 is either USD 25 or USD 30 based on your Capital One account type

What are Capital One's wire transfer limits?

Just like fees, Capital One wire transfer limits vary by account types as well. These are as follows:

- For some account types, sending limit is USD 500,000 if money is being sent to a title company in the US

- For other account types, there are no limits whether sending to a title company or a linked account

Different Capital One accounts have varying fees and limits. Check to see which account type makes the most sense for you.

Make sure to check with your Capital One branch to see what your exact fees and limits are for your account type.

If you're looking for a bank that offers good rates and fees for international wire transfers, Capital One could be a good choice.

5. JPMorgan Chase

JPMorgan Chase Bank, N.A., doing business as Chase Bank, is a national bank that constitutes the consumer and commercial banking subsidiary of the multinational banking corporation JPMorgan Chase. The bank was known as Chase Manhattan Bank until it merged with J.P. Morgan & Co. in 2000.

Chase offers more than 5,100 branches and 16,000 ATMs nationwide. JPMorgan Chase & Co. has 250,355 employees (as of 2016) and operates in more than 100 countries.

Chase Bank provides several banking products and services for consumers and businesses, including checking and savings accounts, credit cards, mortgages, auto loans, investment management, small business lending, and more.

Chase Bank is one of the "big four" banks of the United States, along with Citigroup, Bank of America, and Wells Fargo. JPMorgan Chase is ranked by S&P Global as the largest bank in the United States and the sixth-largest bank in the world by total assets, with USD 2.5 trillion in assets as of 2018.

Below is information about Chase's wire transfer sending limits as well as fees.

What are Chase's wire transfer fees?

Chase wire transfer fees6 have quite a few variations depending on many factors that include how the wire was received or sent, and the transfer amount. Below is a detailed breakdown of Chase's wire fees:

- Incoming domestic wire fee is USD 0 if the wire was sent from another Chase account, else it is USD 15

- Incoming international wire fee is USD 15

- Outgoing domestic wire fee is USD 25 if sent online via the Chase website or mobile app

- Outgoing domestic wire fee is USD 35 if sent with a Chase banker's assistance

- Outgoing international wire fee is USD 40 if sent online via the Chase website or mobile app in US Dollars

- Outgoing international wire fee is USD 0 if sent online via the Chase website or mobile app in foreign currency for transfers above USD 5000

- Outgoing international wire fee is USD 5 if sent online via the Chase website or mobile app in foreign currency for transfers below USD 5000

- Outgoing international wire fee is USD 50 if sent with a Chase banker's assistance regardless of the currency (US Dollar or foreign currency) and the transfer amount

Wow, that's a lot to digest. The good news is that you can consume the above information by simply narrowing down your choices. For example, you can use the following trail - domestic vs international, then if the wire is done online or using a banker's help, then wire amount.

Chase wire transfer fees are lower if you send the transaction yourself using their website or mobile app.

What are Chase's wire transfer limits?

Chase will let you send up to USD 250,000 every business day so long as you execute your wire transfer before the cut-off time of 4 PM EST. That is a pretty high sending limit, which makes Chase a good choice if you want to send higher amounts overseas using wire transfers.

6. PNC Bank

PNC Bank, National Association, doing business as PNC Bank, is a national bank that constitutes the consumer banking arm of the American financial services company PNC Financial Services.

The bank operates in 19 states and the District of Columbia with 2,459 branches and 9,051 ATMs. It offers a wide range of banking products and services for consumers and businesses, including checking and savings accounts, credit cards, mortgages, auto loans, investment management, small business lending, and more.

PNC Bank is one of the largest banks in the United States by assets and is headquartered in Pittsburgh, Pennsylvania.

You can also send domestic as well as international wire transfers with PNC Bank, and below is relevant information on fees and sending limits.

What are PNC Bank's wire transfer fees?

PNC Bank's wire transfer fees7 are fixed in nature without any dependence on account type or transfer amount, and are as below:

- Incoming domestic as well as international wire fee is USD 15

- Outgoing domestic wire fee is USD 25 if you do the transaction yourself

- Outgoing domestic wire fee is USD 30 if a PNC banker helps you do the transfer

- Outgoing international wire fee is USD 40 if you do the transaction yourself

- Outgoing international wire fee is USD 45 if a PNC banker helps you do the transfer

You will pay higher fees if you get help from a PNC banker to send wires. If possible, self-serve to save on fees.

What are PNC Bank's wire transfer limits?

PNC Bank does not enforce any maximum sending limit, so you can send as much money as you want domestically or internationally with their wire transfer service. This makes PNC Bank a good choice for high value transfers.

7. U.S. Bank

U.S. Bank is the fifth largest banking company in the United States, and is owned by U.S. Bancorp. U.S. Bank provides various financial services to both individual and business customers; these include banking, payments, loans, mortgages and investments.

U.S. Bank operates thousands of branches and ATMs across the country, with a predominance in the US West and Mid-West regions.

In addition to using other banking and financial services, you can also send and receive wire transfers with U.S. Bank with the below fee and sending limits in place.

What are U.S. Bank's wire transfer fees?

U.S. Bank shares their wire transfer fees8 for both domestic as well as international wire transfers, and these are as below:

- Incoming domestic wire fee is USD 20

- Incoming international wire fee is USD 25

- Outgoing domestic wire fee is USD 30

- Outgoing international wire fee is USD 50

What are U.S. Bank's wire transfer limits?

U.S. Bank lets you check your wire transfer limit by logging into your account and checking the applicable limits. To do so, go to the following menu options after you have signed in into your U.S. Bank account: Transfers --> External transfers and wires --> Send a wire transfer --> View all dollar limits.

Tips to make the most of your wire transfers via banks

That's a lot of information to digest, so we have compiled a few useful tips in question and answer format below.

Which bank has lower wire transfer fees?

Based on our analysis above, Capital One has lower wire transfer fees compared to other banks. Citibank also has lower fees with the possibility of further fee reductions, including absolutely 0 fees, if you upgrade your account to higher levels.

Another noteworthy bank with lower wire fees is Chase. But make sure to send your wire yourself using their website or mobile app to get lower fees. If you get help from a Chase banker, the fees will be much higher.

Capital One has lower fees compared to other banks. You can also lower your fees with Citibank and Chase by meeting certain criteria.

Which bank has high wire transfer limits?

PNC Bank has no sending limits for wire transfers, so they could be a good choice if you want to send large amounts of money abroad.

Citibank, Capital One and Chase also allow you to send higher amounts. In some cases, you may have to upgrade to elevated membership levels to avail of high limits, or even no limits.

PNC Bank has no upper limits on how much money you can wire. Citibank, Capital One and Chase also have higher sending limits.

Bank of America has pretty low sending limits, so if you are trying to send higher amounts, you may have to either split your transaction into smaller chunks, or look for alternatives.

What information do I need to send wire transfers?

To send an international wire transfer with a bank, you will need the following information:

- The recipient's name and address as they appear on their bank account.

- The name, address and phone number of the recipient's bank.

- The recipient's account number at their bank. You may need to provide their International Bank Account Number (IBAN). Check out our article on more information about IBANs and related topics.

- The amount you want to send in US dollars.

- The reason for the transfer.

These are all good choices for sending wire transfers from the US. But as you can see, the fees involved are pretty high. For a one-time transfer, you may bite the bullet and deal with a costly wire transfer, but what if you need to send money internationally regularly?

How to minimize international wire transfer fees?

Given the high fees banks charge on international wire transfers, you want to do anything you can to minimize the impact of fees on your bottom line. Below are some tips that may help reduce wire transfer fees:

Tip #1: Compare banks

Just as we all compare any product or service from multiple companies to pick the best or most cost-effective one, do the same for wire transfers. The only complication here is that you already transact with your bank, and if another bank has lower wire fees, you will need to start banking with them as well. But if you send wire transfers frequently, it may be worth it to add the cheaper bank into your portfolio.

Tip #2: Upgrade your account

Another way to save on wire transfer fees is to upgrade your account to a higher membership level if your bank supports that. For example, Citibank has numerous account types, and many of them have lower or even 0 fees for wire transfers.

Tip #3: Consider credit unions

Credit unions generally have lower fees on everything, including wire transfers. Consider looking at your local or regional credit unions, and if they provide cheaper wire transfers, it might not be a bad idea to open an account with your local credit union. They also tend to provide cheaper loans and other services, so you may save on other services too.

Tip #4: Use local alternatives where available

There are alternatives like Zelle that may let you send money domestically in the US for free. There are limits on how much you can send, but for smaller amounts, this should not be a problem. Of course, this won't work for international money transfers as Zelle only works in the US.

Are there other options available in addition to expensive wire transfers? Yes, there are! Read on to learn how to save money on your international money transfers.

Alternatives to international wire transfers

Before we discuss the alternatives to international wire transfers, let us first see the pros and cons of using banks for sending international wires.

What are the advantages of using banks for international wire transfers?

The biggest advantages of using a bank to wire money overseas are:

- Convenience: Since you already have a bank account, and use your bank for many financial transactions, it is pretty convenient to be able to send wire transfers via them. Dealing with your bank saves you time by avoiding having to open an account with another financial institution to send money overseas.

- Safety and security: Most banks are fully secure and are backed up financial agencies as well as insurance companies. Given that, your money and information are generally safe with your bank.

- No or high transfer limits: Most banks will let you send higher amounts of money using international wires. There may be limits in place w.r.t. transaction amount and number of transfers in a week or month, so it's best to check with you bank for their limits.

Sending wire transfers with banks is convenient and safe, and you can generally send large amounts of money.

What are the disadvantages of using banks for international wire transfers?

There are quite a few potential disadvantages you face when using banks for sending international wire transfers; we list these below.

- High transfer fees: This is no surprise given what you have read earlier in this article. Most banks charge high fees for international wire transfers. The cost incurred reduces the money your overseas recipient gets.

- Non-optimal exchange rates: Banks have a tendency to provide sub-optimal exchanges rates on international wire transfers. Bad exchange rates hit your bottom line as a hidden transfer fee. In a nutshell, your final payout goes down with the double whammy of bad exchange rates and high fees.

- Slower transfer speed: Wire transfers can take a few days to complete. Plus, since they are fully dependent on banks on both sides of the transfer, any bank holidays will add to the time. So, if you wanted to send money overseas urgently, you may not like the time it takes wire transfers to finish.

- Dependent on bank accounts: Wire transfers operate from bank to bank, so your recipient must also have a bank account. If your receiver does not have a bank account, or does not want to share their bank information with you for some reason, you cannot use an international wire transfer to send them money.

Banks charge high fees and provide lower exchange rates on wire transfers. Plus, it may take days for the transaction to complete.

What is the alternative to sending international wire transfers?

A very good alternative to sending wire transfers via banks is to send remittances using money transfer companies.

Money transfer companies generally provide much better exchange rates than banks, and charge lower transfer fees. They also move money overseas faster, and support a variety of flexible payment methods as well as delivery options.

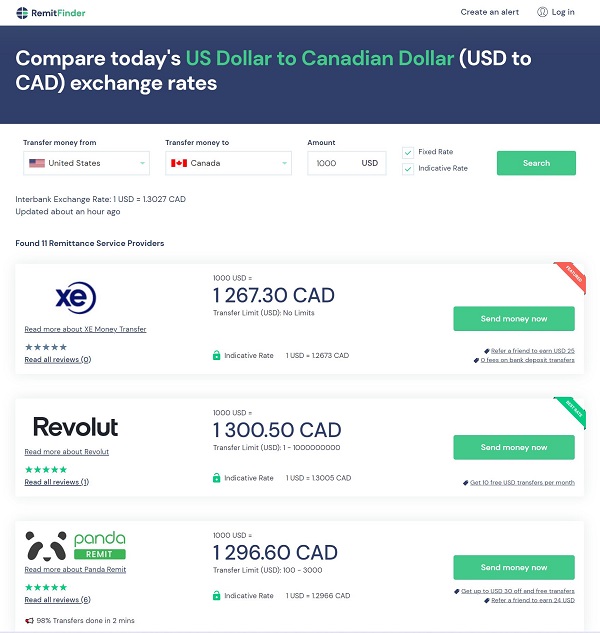

For example, below screenshot shows numerous money transfer companies available on RemitFinder for sending money internationally to Canada from the US. Notice the good exchange rates offered by many of the top providers.

Additionally, most of the time, money transfer companies are available 24x7 online via a website or mobile app, thereby allowing you to send money anytime and from anywhere.

Most money transfer companies are also regulated by global and regional financial and regulatory institutions, and implement various bank-grade security protocols to ensure safety and security of money and information.

There are numerous advantages to using money transfer companies to send money overseas instead of banks.

There are numerous money transfer operators to choose from nowadays. From established big companies to new fintech startups and financial institutions, there is a lot to choose from. The fierce competition has even motivated many banks to open up remittance lines of businesses.

One easy way to compare numerous money transfer companies is to rely on a remittance comparison platform like RemitFinder.

We compare providers in an easy to consume comparison table so you can see their exchange rates in a single view. Additional information like detailed provider reviews, customer feedback and deals and promotions can further help you see which providers might be a better fit for your needs.

Conclusion

International wire transfers via banks are a good way to send money overseas as they provide ease of use and security. Plus, you can generally send large amounts of money. In the US, there are several good banks that you can use to send wire transfers overseas.

However, there are many drawbacks that come with wire transfers. Some of these include potentially inferior exchange rates, high transfer fees, slow speed and the necessity for the recipient to have a bank account to receive money.

Money transfer companies specializing in sending international remittances are a great alternative to international wire transfers. You can generally get more return for your money with better exchange rates and lower fees.

References:

1. Bank of America Online Banking Service Agreement

2. Wells Fargo Consumer Account Fees and Information

3. Citibank Online Wire Transfer Services Guide

4. Capital One Guide on Incoming Wire Transfers

5. Capital One Guide on Outgoing Wire Transfers

6. Chase Banking Services and Fees for Personal Accounts Agreement

7. PNC Bank Service Charges and Fees for Checking Accounts

8. U.S. Bank Guide on Wire Transfer Costs

Categories

Similar Articles

CNAPS Codes Unraveled: Navigating China's Banking Landscape

Discover CNAPS Codes: China’s unique bank identifier for fast, secure transactions. Learn how CNAPS Codes simplify payments across China's banking system.

ABA Routing Numbers In The US: A Comprehensive Guide

Discover what ABA Routing Numbers are, how they work and their importance in US banking transactions like direct deposits, online transactions and wire transfers.

What Is A NUBAN Number And What Is It Used For?

Discover what NUBAN Numbers are and how they streamline bank account identification in Nigeria. Do not miss this essential guide if you transact in any way with the Nigerian banking system.